Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a marketing coordinator working in cannabis who makes $42,000 per year and spends some of her money this week on prosecco.

Occupation: Marketing Coordinator

Industry: Cannabis

Age: 33

Location: Los Angeles, CA

Salary: $42,000

Net Worth: $1,200 in savings

Debt: $40,000 in student loans

Paycheck Amount (biweekly): $1,500

Pronouns: She/her

Monthly Expenses

Rent: $1,395 (for a studio apartment)

Renter’s Insurance: $24

Utilities: $85

Loans: $0 (student loans in forbearance)

Metro Pass: $100 for unlimited travel (still using to get around locally, however also supplementing with ride-sharing. Metro pass is reimbursed in full by my employer.)

Phone: $80 (reimbursed $50 from employer)

Internet: $60 (including router rental)

Spotify: $10 (premium account)

Netflix: $13

Hulu: $1.99 (lucked up on a promotional deal!)

iCloud Storage: $0.99

Squarespace: $26 (to host blog/website)

Health, Dental, Vision Insurance: $30 (pre-tax)

Life and AD&D Insurance: $2 (pre-tax)

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Absolutely! While I didn’t have a straight forward journey with higher education, my father always drilled into me the importance of going to college, very likely because he never did. So there was very little question of if I was going — just when, where, and how exactly was I going to pay for it. Over many years, I found myself bouncing around through several colleges and institutions while I moved around the country and simultaneously tried to figure out my path, attending several in cities like New Orleans, Boston, and finally, Los Angeles. While some of my education was paid through my father’s military benefits, I spent my college career racking up some serious student loan debt along the way.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

The conversations around finances I had grown up with were dependant on which parent I was talking to but ultimately they were pretty informative and balanced. My mom, a more meticulous and detail-oriented budgeter, tended to take a bit more time to explain the nuances of a budget, show me how credits/debits worked, and show me how to balance a checkbook (wow… am I old yet?) Conversations with my dad were fiscally fruitful in the sense that he stressed… and I do mean stressed… my financial independence. He didn’t want me to rely on anyone, so he tried to instill in me a great sense of getting myself to a point financially of where if I see something I want, I can get it, no questions asked. In addition, he was the one that emphasized the importance of having a strong credit score.

What was your first job and why did you get it?

My first job was as a hostess and waitress at a local restaurant. I got the job to be able to not only pay my bills (just a phone bill.. please take me back!) but to also put a little extra spending cash in my pockets.

Did you worry about money growing up?

For the most part, my family and I didn’t worry about money growing up. While I often groan about how my father used to go on forever about my financial independence, to his credit, it’s undoubtedly because he was a self-made man. He pulled himself up from poverty in childhood and crafted a life for himself where he was able to provide nothing but the best for my family.

Do you worry about money now?

Today? No. A few years ago, I did. A few years ago, I was on much less stable ground than I am today and honestly dwelling in a mental place of scarcity. I was in another job that made me miserable. It didn’t pay me enough to actually make ends meet, so I found myself obliged to overwork myself every week with additional creative bookings and random gig work. Financially, I was a mess. I was overspending on stuff I didn’t need and trying to scrape by when it came to my necessities. And as a function of where I was, I would hold on so tight to every dollar. It took a while for me to release my grip and change how I view my relationship with money. The first part of it was facing and owning the mistakes I had made in my youth (crazy credit card spending, some charge offs on my credit report, etc), figuring out how to fix what I could, and then reteaching myself how to manage my own money. Once I did that and put myself into a routine of reviewing my finances, things started to fall into place and it became easier to remind myself that money flows to me freely as long as I’m open to receiving it and I do the work. I’m really never without, sometimes it just feels like it.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I became responsible for myself at 18 when I graduated and covered the cost of my own bills but still lived at home. Between the ages of 21-23, I grew increasingly more independent by moving out and living with friends or boyfriends. I was completely financially responsible for myself by 25. It was around then I moved out of my hometown and to NYC. While I stressed the importance of my independence to my mom, she’s made it completely clear that she’s still my mother and if I need something she can help, so I’d definitely say I’m fortunate to count her as a safety net.

Do you or have you ever received passive or inherited income? If yes, please explain.

Yes. My brother and I split an inheritance when my father passed away, including a small amount of money and ownership of our childhood home where my mom still lives.

Day One

7 a.m. — My alarm goes off, gently coaxing me awake. I hear the gentle tap, tap, tap of my dog’s nails on the floor. I open my eyes and she’s staring at me, telling me with her sweet eyes what I already know: It’s time to go outside. Since COVID’s cut my ability to use a gym, I grab her leash and strap on my sneakers, gearing up for one of my workouts for the day.

8:30 a.m. — Back home, showered, and hungry! It’s time to sneak in a quick breakfast before I have to hop on a morning touch-base call with my work team. I pull together a light breakfast from what’s in my fridge. Fruit, eggs, toast, and coffee.

12 p.m. — I finally break my flow of work for a few minutes to stand up and stretch. A snack craving hits — I can practically hear the high fructose corn syrup calling. I figure some sunshine will do me good, especially since I’m home much more these days, so I walk three blocks to the corner store and pick up a soda, a candy bar, and some chips. $5.80

3 p.m. — My dog wakes up from a nap and starts sniffing around my feet as I wrap up a call with my coworker. I giggle and grab her leash, ready to walk around the block. On our leisurely stroll, we run into our local paleta vendor. I could use a little relief from the heat so I grab an ice pop and enjoy it as we walk around the neighborhood. $2

6:30 p.m. — I wrap my work for the day and mentally make a note that I need to go into the office at some point this week. After I pull up Netflix and put on a movie to zone out to, I cuddle up with my laptop for a little online window shopping. I come across a gel manicure kit, including the light. I wonder if I should get it since nail salons aren’t open. After all, self-care is essential right now, right? I get most of the way through the process but just before I finish checking out, I see the shipping cost, second guess myself, and bail. Closing my laptop I head into the kitchen to begin cooking a chicken dinner while fantasizing about escaping quarantine and enjoying a heaping plate of pasta at my favorite restaurant.

9 p.m. — Time to settle down for the evening after I’ve finished cleaning up dinner. Typically, I try to visit my favorite Korean spa every two weeks to enjoy a good steam in the sauna but since we’ve been home, I’ve taken to curating my own spa treatments. I put on a little relaxing music and head into the bathroom to draw a bubble bath. Pulling out bags of dried lavender and roses, I crush them in my hands and toss them into the bath as well. The aroma hits my nose and my muscles begin to relax as I lower myself into a hot bath and the water envelopes my body. I light a pre-roll and settle in for a half-hour soak.

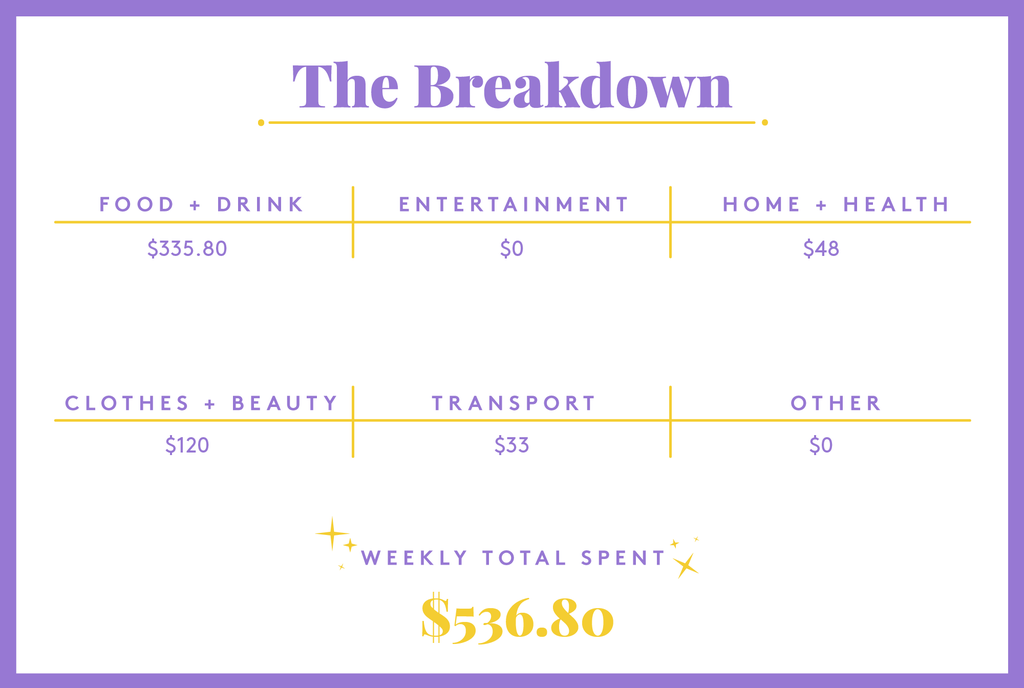

Daily Total: $7.80

Day Two

8:50 a.m. — I open my eyes, roll over, and grab my laptop just in time to make it online for our team touch-base. I feel relaxed and refreshed but still a little groggy from a good night’s sleep. Fortunately, the focus of this call isn’t on me, so I put my mic on mute and slowly begin to rise and shine while I listen to the updates from my teammates. I shuffle into my kitchen to put on a pot of coffee and we end our call. With a brief window until our weekly departmental meeting, I hightail it into the bathroom to brush my teeth and wash my face so I can quickly walk my dog. I check the fridge and notice my groceries are getting low. When we come back from our walk, I take one more peek in the fridge, before I multitask into the shower, making mental notes of what I need to get later this week.

11:45 a.m. — Feeling a little hungry so I try to grab something from the fridge before hopping on another call with the team to no success. Nothing strikes my fancy so I go into the meeting with my stomach growling.

1:15 p.m. — Out of another meeting and my stomach is still growling! I’m so hungry but what to eat? I spend a few minutes staring into the void in my refrigerator. I still have no inspiration to make anything and my patience is rapidly dwindling as I tailspin toward HANGRY, so I order a pizza. $25

5:30 p.m. — Wrap up work a bit earlier today to take a stroll to the park with my dog where she meets some of her furry friends. They play and frolic for a while until they’re tuckered out. I notice my dog’s nails are a little too overgrown and begin searching online for a local groomer. I have some more pizza when I get back.

9 p.m. — My back is a little tight today so before I get in bed, I do some yoga. I can’t get a massage right now so to activate my pressure points, I lay an acupressure mat down on my bed and lay on top. After about 30 minutes on top of this mini bed of nails, my back feels loose. I put the mat away, lay down, and within 15 minutes, I’m out like a light.

Daily Total: $25

Day Three

8 a.m. — I’m up a bit earlier today ahead of our brand building call. Not terribly hungry so no breakfast but I’m craving coffee! I guzzle down a few cups while on our call and feel full of energy which is good. I can use it because I’ve got a mission today — I’m heading into the office.

10 a.m. — Since the pandemic began, I’ve tried to limit commuting on public transit during peak hours. So to get myself to the office today, I decided to snag an Uber. The driver is friendly. The sunshine and morning air spills into the backseat with me on the ride. And as we close in on the office, I realize just how far we’ve deviated from what used to be my “normal” routine. I debate with myself the pros and cons of the “new normal” I’m in. I sigh and my thoughts are interrupted as we pull up at my office. $12

1 p.m. — I get ready to buy a quick lunch from nearby but realize I left my wallet at home. Probably for the best as I remind myself that I’m committed to cooking more. I decide to get some air. I go outside to take a break and walk around the neighborhood with my vape pen.

4:30 p.m. — After missing the off-peak bus, I cave and call another Uber. It’s busy so of course, prices surge. I take it on the chin. A small price to pay, I feel, to get me from point A to point B without a lot of other people around. $21

5:3o p.m. — Back home, I take the dog out. We’re out for a while and when we return, I lay down to watch a classic movie with a couple of the remaining slices of pizza. I drift off and wake up a few hours later with the lights on and my hand still on one of the slices. I get up and get in bed.

Daily Total: $33

Day Four

7 a.m. — My eyes pop open early today. I can hear my neighbors arguing. So if they’re up, I guess I’m up! I roll out of bed and right into the kitchen. I’m super hungry this morning for some reason. I open the fridge and am reminded I need to go grocery shopping. I check the calendar. Tomorrow is payday. Nice! That means I can pull my shopping list together today to have everything delivered tomorrow. Speaking of, I should probably schedule my laundry for pickup too. Okay, so I’ve got several other things to handle while I work from home. First things first…coffee.

9:30 a.m. — After our team check-in in the morning, I begin pulling my clothes together to be picked up to be laundered later. A silly and unnecessary expense for something I could do in a few hours? Possibly. However, folding laundry is a pain and I’d gladly pay a bit more to outsource some of my more mundane chores to release the crippling anxiety of there never being enough hours in the day. My clothes are pulled together and packed in my labeled wash bag. I log onto the website and schedule my pickup. I get the confirmation text and move on to check another task off my to-do list. $48

1 p.m. — Whoever said money can’t buy happiness probably didn’t live in a time when you could outsource your grocery shopping to get back valuable time in the day. What originally started as a function of me not having a car, has evolved into a way for me to source and stock up on my supplies easily. After I wrap another work call, I spend about 45 minutes scrolling through Instacart, price-checking, and filling my cart with items from three different stores; farm-fresh produce and grass-fed meat from Sprouts, cleaning supplies and pantry essentials from Aldi, and cases of water from Smart & Final. Before I check out, I do a double look through my cart and take out the splurge buys. Instead of being confronted with things that usually get buried in my basket, shopping via Instacart has helped me visualize what I have better and lets me loosely plan my menu for up to two weeks. $280

3 p.m. — I pop out for a quick walk around the block to stretch my legs with my dog. When we get back in, I pull together a random plate of things to eat — one slice of pizza, a handful of popcorn, three chicken tenders, a side salad, and a few grapes. I’m satisfied but can’t wait for my groceries to come tomorrow so I can get back to cooking full meals.

9 p.m. — I finish my work for the day around 6 and zone out for a few hours while on Instagram until the driver comes to pick up my laundry. I look at the clock, surprised I lost so much time scrolling on social media. I nibble on some grapes before I head to bed.

Daily Total: $328

Day Five

6:30 a.m. — Wake up early for some reason so I decide to go for a run with my dog. Come back and enjoy a light breakfast of fruit and toast. My stomach growls as I think about the bacon that’ll be on its way to me soon.

10 a.m. — I get a notice that my shopper has begun on my grocery order. A few items aren’t available so they message me to ask about possible replacements. I juggle these few requests while on a work call. Multi-tasking at its best!

2 p.m. — All of my deliveries have arrived and I spend some time cleaning out the fridge and putting them away. The feeling of a full fridge is truly unrivaled. My gaze drifts through the kitchen wondering what’s going to be for dinner tonight. I open the freezer and spot a lone steak and some shrimp. I pull them out to defrost and eye a few potatoes in the pantry. Tonight…we’re going steakhouse!

5:30 p.m. — To celebrate getting through another week working from home, it’s time for an at-home happy hour! After I get back in from walking my dog, I grab my vape pen and pump the music. I find I’m doing more working up an appetite than acing these TikTok dances, but I’m trying! Most importantly, I’m having fun.

8 p.m. — A masterpiece comes from the kitchen: a medium steak, shrimp, mashed potatoes, and a caesar side salad that I pair with the new Will Farrell and Rachel McAdams movie. Honestly, this is the epitome of self-care.

9:45 p.m. — With a belly full of steak, I promptly begin nodding off after dinner. I hear my phone — It’s a text that the driver is on the way with my fresh laundry. He arrives shortly after and delivers my labeled wash bag right to my door. I open it when I’m inside and smile at the neatly folded laundry before I sleepily saunter to bed.

Daily Total: $0

Day Six

8 a.m. — I wake up but now is not the time to get up. It’s the weekend, time to sleep in.

10 a.m. — I quickly pop out with the dog because she’s whining but honestly, I’m not sure I’m 100% awake at this point.

12 p.m. — I finally peel myself out of my bed and officially declare my weekend one of laziness. I put together a little breakfast sandwich, pull some chicken out of the freezer, and lay back down. I watch movies with my vape pen.

3 p.m. — I realize I missed a call from my mom so I call her to chat, asking her if she got the copy of Hamilton I sent her way. We spend a couple of hours catching up and giggling like old friends. She reminds me that my brother’s birthday is coming up and to start thinking about what I should get him. We spend a little longer chatting. It’s nice to connect and my heart feels so full afterward.

5 p.m. — Somehow I’ve found myself on YouTube spiraling down a rabbit hole of beauty tutorial videos. I wonder what Rihanna’s been up to so I go watch her Fenty Beauty tutorials. Somehow this leads me to Vogue’s 73 Questions series, then to Architectural Digest and travel vlogs. No complaints, I just go with it.

7 p.m. — I’m aching for something flavorful yet fresh for dinner. I stare at the chicken I took out earlier and decide on trying to make a modified chicken gyro in honor of my favorite Greek restaurant I haven’t been to in months. While it’s not exactly the same, it strikes some chords and is definitely satisfying. I jot down some notes on the spices used and plan on trying this dish again soon.

9 p.m. — Saturdays were meant for spa treatments. My muscles are a bit achy earlier, so I draw a hot bath and this time drop in several green tea bags along with some bubbles. I light several candles, put on some binaural beats, and lower the lights. After 30 minutes in the tub and a few hits of my vape pen, I feel completely carefree and ready to float to bed.

Daily Total: $0

Day Seven

7 a.m. — Up early and I’m loving it. I feel totally refreshed after last night so I wake up in an amazing mood. I put on some oldies and begin cleaning up. My apartment isn’t really dirty but could use a good tidying up. I glance around and note that I should probably sweep and mop today. I grab the trash and take it out on my way out to walk the dog.

10 a.m. — There’s something so delightful about the way your home feels when it’s got the scent of Fabuloso hanging in the air. I walk around my clean apartment, reveling in the clean laundry and the stocked fridge. I feel so incredibly grateful for my job amid a pandemic and this new apartment that I’m in that I start to cry a little as I say thank you to the universe for where I am right now.

11 a.m. — I take the pup to the park. I forget my water bottle at home so I stop in a liquor store to grab a bottle of water while out. While there, a bottle of Prosecco catches my eye and I remember the orange juice in my fridge. It honestly felt irresponsible to NOT treat myself to some mimosas on a Sunday, so I go ahead and grab a bottle then head home. $23

1 p.m. — One mimosa down and I’m feeling great. I make my way to the kitchen and start throwing down. I build out a brunch board complete with waffles, eggs, slices of bacon, strawberries, and grapes, inspired by something I saw on Pinterest. Once complete, I settle in front of my projector with it and my carafe of mimosas. I queue up How to Marry a Millionaire and start to nibble.

4 p.m. — Two classic films and a bottle of Prosecco deep, my Sunday continues to swim along nicely. I order a pair of new sneakers online, look for more jeans, and then spend most of the evening cuddled up with my pup drifting in and out of sleep while binging on films like the Grand Hotel, Sunset Boulevard, and North by Northwest, to name a few. $120

Daily Total: $143

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Louisiana On A $20,000 Salary

A Week In Mesa, AZ, On A $62,000 Salary

A Week In The Great Lakes On A $30,000 Salary

from Refinery29 https://ift.tt/3l5Smmm

via IFTTT