Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a registered nurse who makes $52,000 per year and spends some of her money this week on a Christmas sign.

Occupation: Registered Nurse

Industry: Healthcare

Age: 21

Location: Wisconsin

Salary: $52,000

Net Worth: $7,000

Debt: $0

Paycheck Amount (2x/month): $1,300

Pronouns: She/her

Monthly Expenses

Rent: $600 (split with my boyfriend, M.)

Loans: $0

Health Insurance: $75 (taken out of paycheck)

Car Insurance: $120

YMCA: $25

Netflix: $9

Amazon Prime: $6

Hulu: $9

HSA: $75 (taken out of paycheck)

IPSY: $12

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Neither of my parents graduated from college and both went back for GEDs later in life. I knew that my parents always wanted me to attend college, but it was not a priority for my family. I was able to take college classes in my junior and senior years of high school, which were free through a program at our local technical college. Once I graduated, I was able to continue my education at that same college for a fraction of what a university would have cost. I graduated in April of 2020 with my associates degree in nursing. Financial aid was not an option for me due to some interesting family dynamics, so I paid for college out of pocket, which equated to about $3,000 a semester. I was able to graduate college debt-free!

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My parents would never talk directly to me about finances, but I knew that we struggled. They owned a family business and handled all of their own finances. They never educated me, which led to a mild credit card issue when I turned 18, which I have since got back under control.

What was your first job and why did you get it?

My first job was as a table busser at a local bar. I was 14 and used this money to save up for my first vehicle. After about a year I was able to progress to waitressing, which helped me save even faster.

Did you worry about money growing up?

Absolutely. I was a nervous kid, too, so I never wanted to ask my parents for anything extra for fear it would leave us less stable than we already were. My parents did everything they could to help me succeed, even if they couldn’t support me financially. In some ways, that way of life was a blessing because it made me more conscious of my spending habits now.

Do you worry about money now?

I wouldn’t say that I am free of worry, but the burden is definitely becoming less. I am finally in a place with a steady paycheck that doesn’t have to go towards schooling, which takes a huge weight off of my shoulders.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I became financially responsible for myself the day I graduated high school. I have no sort of financial safety net besides my (very small) savings account.

Do you or have you ever received passive or inherited income? If yes, please explain.

No, I have not.

Day One

5:40 a.m. — My boyfriend, M.’s, alarm goes off. He rolls over to snuggle me for a couple of minutes after snoozing it. When it goes off again, we both get up to get him ready for work. I make him pancakes while he packs leftovers from the night before and a couple of other odds and ends in his lunch bag. He makes a pot of coffee and we watch a little bit of local news before he leaves around 6:15 and I go back to bed.

12 p.m. — I wake up to the garbage truck outside screeching and check the time. I decide to shut the windows and turn on the fan for some more calming noise. I check my phone and drift back to sleep.

2 p.m. — Alarm goes off. Wake up and browse the internet before hauling myself out of bed. I take a shower and put on some comfy clothes before deciding what to make for dinner. Tonight will be oven-baked chicken breasts with mashed potatoes, corn on the cob, and stuffing. It’s finally starting to feel like fall here, so I’ve totally embraced it.

4:30 p.m. — Dinner is ready and I’ve started to get ready for work. I use tinted moisturizer since foundation is frowned upon with our N-95 masks, a little brow gel, and some mascara. I quick braid my hair so it’s out of my face and sit down for about 10 minutes before M. gets home at 5. We eat together and I’m out the door by 6.

6:15 p.m. — Stop to fill up my car at the gas station. I only fill up about once a week because my commute is only about 15 minutes. I also grab a couple of energy drinks and some pretzels to snack on at work tonight. $35.16

6:30 p.m. — Clock into work. It looks pretty busy tonight so I snack on some olives I keep in my locker before getting report.

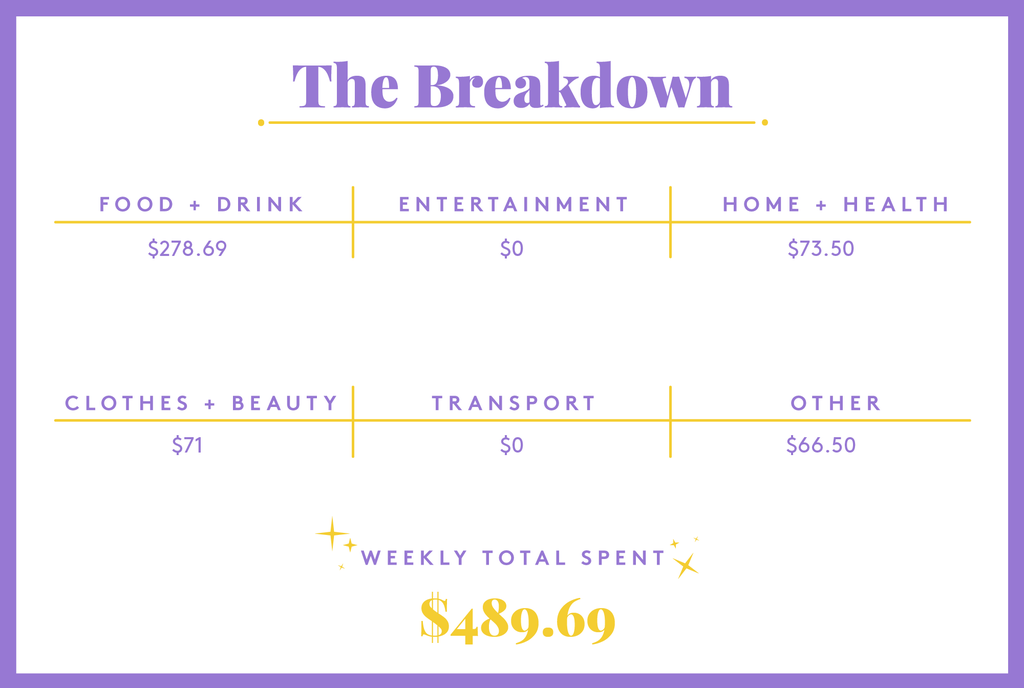

Daily Total: $35.16

Day Two

1 a.m. — I finally get a chance to sit down and eat my lunch. I packed a sandwich to eat with my pretzels and peanut butter. I also grab some M&Ms out of the vending machine to hold me over for later. $1.25

7:30 a.m. — I stop by my favorite coffee place on the way home. I’m so glad they’re still doing the drive-through during COVID, or I don’t know if I’d survive. $5.30

8 a.m. — Get home, brush my teeth, take a shower, and pass out. Also, make sure I set my alarm or I’ll sleep the whole day.

2 p.m. — Wake up and scroll through the internet for a little bit. I order a birthday card for M. off of Etsy and get up to make plans for dinner. I decide on chicken fajitas and start preparing them. $8.68

5 p.m. — M. gets home and we eat while watching House Hunters. We’ve been looking for a house for the last year and can’t seem to find one that fits our needs, so watching will suffice for now. I throw my hair into a bun and put on my normal makeup for work and am out the door by 6.

6:15 p.m. — I stop by the gas station again to grab a couple of energy drinks, a cheese stick, and a yogurt before heading to work. $9.60

6:30 p.m. — I clock into work and it looks like I’m being floated to a different unit. I never know what to expect from these days, but sometimes it can be a nice break. I grab my stash of snacks from my locker and head out.

Daily Total: $24.83

Day Three

2 a.m. — I browse through my snacks quick to find my cheese, yogurt, and pretzels. I sit down for a little bit and scroll through Facebook before getting back to work.

8 a.m. — Back to my favorite coffee shop! I get through the drive-thru line super quick and I am on my way home. $5.30

8:30 a.m. — I get home and get ready to sleep just as our monthly meeting goes live on Google Meet. I log on and listen for a little bit before getting distracted with my phone. I end up scrolling on Facebook and see my friend shared a fundraiser for her birthday. I donate $10 because it’s for a good cause and pass out immediately, meeting still playing in the background. $10

12 p.m. — Wake up to my alarm blaring. I snooze it for 10 minutes and play on my phone. When it goes off, I reluctantly drag myself out of bed.

1 p.m. — I decide to run to Walmart for a few groceries. I stock up on the normal stuff: chicken breasts, ground beef, peppers, onions, mushrooms, potatoes, pasta, oats, vegetable oil, tea, bananas, deli meat/cheese, bread, butter, eggs, bacon, and a box of brownie mix. I can’t wait to get home and get my mask off. $165.43

3 p.m. — Make it home to unload the groceries. I decide that I’m way too tired to figure out what to make for dinner tonight and text M. to see if he wants to order from somewhere. I put away groceries and pass out on the couch watching Netflix.

5 p.m. — M. gets home and wakes me up. He takes a shower while I get ready to eat. We end up settling on a bar just down the road that has fantastic weekly specials. I get a burger with fries and a PBR and he gets wings and a Mountain Dew. I pay. $31.50

8 p.m. — We get home and watch some Netflix before heading to bed around 9:30.

Daily Total: $212.23

Day Four

5:40 a.m. — M.’s alarm goes off. We get up and do our morning routines. Pancakes for him, coffee for me. I give him a kiss goodbye around 6:15 as he heads for work and I head to the gym.

8:30 a.m. — Done with the gym and showered, I head to my favorite coffee shop. They have fresh baked cookies some days, so I grab one of those too. $7.40

9 a.m. — Stop and get my eyebrows waxed and schedule a hair appointment. I am in desperate need after this pandemic. $15

10 a.m. — Get home and decide to do a little online shopping. I have M.’s main birthday present, but I want to get him a couple more things. I end up picking out a cookbook and some new hunting stuff for him. Thank goodness for prime shipping! It’ll be here in a couple of days. $47.82

2 p.m.— Take a short nap after doing some laundry and realize I need to start thinking about dinner. I eat a few crackers while I browse on Pinterest looking for recipes. I finally settle on making chili with cornbread because I have all the ingredients. I also start some sweet tea to set out on the porch for when M. gets home. After dinner gets rolling, I pick up around the house and clean up the kitchen.

5 p.m. — M. gets home. He showers, we eat and then drive to town to grab a Redbox movie and get ice cream. His treat! We go home and watch the movie while simultaneously looking at floor plans for a house. We’ve been kicking around the idea of maybe just building instead of buying, but we’re not settled on the idea yet.

9 p.m. — After our movie is done and the house is cleaned, we head to bed. Tomorrow is Friday, but it’s also my weekend to work, so while M. sleeps I stay up reading for a little while.

Daily Total: $70.22

Day Five

5:40 a.m. — You guessed it! Morning routine. I head back to bed after throwing a roast in the crockpot for dinner.

2 p.m. — Alarm goes off, I wake up. I spend some time on Amazon getting some basic house supplies, plus a super cute sign for Christmas. I check on dinner and then take a shower and start getting ready for work. $73.50

5 p.m. — M. gets home and showers. We eat quickly before I go to work. I pack a lunch of the roast I made and a couple of other snacks along with my water bottle. I’ve been trying to drink more water at work and less caffeine, but I was not built for night shift. I leave around 6:10.

6:30 p.m. — Clock into work. I love my weekend crew, we all work really well together so I’m always happy to be here when they are. I get my assignment and head to get report by 7.

Daily Total: $73.50

Day Six

1 a.m. — We all pitched in for pizza right before delivery closes at midnight. I finally sit down to eat mine and Venmo my coworker for my share ($8). I can’t wait for this night to be over, I am in serious need of a nap. $8

8:30 a.m. — I finally clock out and head home where M. has breakfast waiting for me. We eat eggs and bacon and toast before I get ready for bed.

1 p.m. — I wake up to M. and one of his friends making noise in the living room. His friend and girlfriend came over to visit and didn’t realize I had to work again tonight. I did get a nap in though, so I decide to stay up with them for a little bit. We go on a walk and then come back to eat some carryout his friend picked up. I’m just glad I’m not in charge of dinner tonight. I fall back asleep around 4 for an hour.

5 p.m. — I wake up and get ready for work. M. brings me a cup of coffee. I pack a lunch of leftovers and leave for the hospital around 6, stopping on the way for my usual energy drink and yogurt. $9.75

6:30 p.m. — I clock in and notice that the patient census is low. They give me the option to go home at 11 if it stays low and I happily agree. I work until about 11:30 and then make my way home to be on call for the rest of the night.

Daily Total: $17.75

Day Seven

3 a.m. — I can’t sleep because I slept all day yesterday. I scroll on social media until I am finally able to fall asleep at about 5.

10 a.m. — M. wakes us both up and asks if I want to go to town to look around. We’ve both felt pretty cooped up since the safer-at-home order started and sometimes just going to town is an adventure. I call my friend to catch up while getting ready and we talk about how things are even more restricted where she lives in a bigger city. After hanging up with her, M. and I decide to go look for new work shoes for me. I settle on a pair with memory foam because my feet always hurt and they seem comfortable. $56

12 p.m. — Back at home, I take a shower and fall asleep while M. preps dinner for tonight.

5 p.m. — Wake up, get ready for work. M. makes chicken and rice with asparagus and it’s delicious. I pack some for lunch later and head out the door by 6:10.

6:30 p.m. — Clock into work, get my assignment, and receive report. One of my other coworkers brought in donuts so I snag one before starting my day.

Daily Total: $56

It’s a cliche, but this year was supposed to be our year — full of independence, opportunity, or at least a few weekend afternoons spent with more than 10 friends with fewer than six feet between us. But with COVID-necessary social distancing, a shitty job market, closed campuses, 2020 hasn’t given us much to work with. Past generations have had to deal with a recession, social upheaval, and changing norms: We’ve had to deal with all of it at once.

So, what now? What do we do with our careers, our relationships, and our lives? How do we move forward when we’re still stuck in our high school bedrooms? These stories are for us — filled with the resources, blueprints, and people who are finding ways to turn all this garbage into something like lemonade.

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Saudi Arabia On A $22,400 Salary

A Week In Silicon Valley, CA, On A $145,000 Salary

A Week In New York On A $355,000 Salary

from Refinery29 https://ift.tt/3jCXLQ7

via IFTTT