Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: an unemployed MA student who spends some of her money this week on salmon cat treats.

Editor’s Note: All currency has been converted to USD.

Occupation: Unemployed MA student

Industry: Higher Education

Age: 24

Location: Jerusalem

Salary: $0

Net Worth: $-14,680 (savings minus debt)

Debt: $2,135 in student loan debt + $14,380 in credit card debt

Paycheck Amount (1x/month): The only income I receive regularly is a $125 monthly government rent subsidy for recent immigrants

Pronouns: She/her

Monthly Expenses

Rent: $0 (I am currently crashing with my boyfriend)

Loans: $0 (I took out a $5,000 loan to pay for Semester at Sea when I was in college and my dad pays the minimum on it each month (about $50))

National Healthcare: $32.50

National Insurance: $23 (this is the Israeli equivalent of Social Security)

Medication: $11.56 (two medications for depression and anxiety)

Cell Phone: $8.50

Spotify: $9.99

New York Times Subscription: $12

Patreon: $1 (subscription to The Freelance Beat, a weekly newsletter that curates freelance journalism gigs)

Democratic Socialists of America Monthly Dues: $5

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

There was always an expectation for me to obtain an undergraduate degree and my parents made it clear that as long as I attended a relatively affordable institution, they would pay for it. None of the universities in-state had a strong program in the area I wanted to study (journalism), so we agreed that I would work hard to get scholarships if I was to go out-of-state. I ended up going to a private art school in a large city. Tuition and fees were about $22,000 per year and half of my tuition was covered by merit scholarships from my university. I am extremely privileged that my parents made it a priority to create and contribute to a college fund for me, which had accumulated about $35,000 by the time I started college. I also entered college with nearly a year’s worth of AP and Dual Enrollment credits and was able to graduate in three years. Throughout those three years, I worked and paid half of my rent while my dad sent me money to cover the other half, as well as groceries. I studied abroad through Semester at Sea during my last year, which was extremely expensive, but I received scholarships and a work-study fellowship through the program and only owed $5,000 for the semester abroad (instead of the $24,000 ticket price). Since it was part of my undergraduate education and I was on track to graduate in three years, my father offered to take out a loan and pay the minimum payments to cover the deficit.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

I figured we were solidly middle class, but I had no idea how much my parents made until I had to fill out FAFSA. Money was a bit of a taboo topic because it was the main source of my parents’ marital issues. My parents are on opposite ends of the financial spectrum — my dad saves everything while my mom is a big spender. I had separate conversations with both of them about money growing up, but it was honestly confusing because they told me completely different things. As I’ve reached adulthood and things like credit scores and loans have become relevant, I tend to go to my dad for advice.

What was your first job and why did you get it?

My first experience being paid for work was as a contributing reporter for a local newspaper. I was 12 and wasn’t motivated by money. I never expected payment, I just wanted experience as a journalist so I cold-called the editor and begged for a chance to write. After about a year and a half, they offered to start paying me for each story and I happily obliged. When I was 15, I wanted a more steady source of income for spending money, so I got a job as a stocker at a grocery store.

Did you worry about money growing up?

I worried about money in the sense that I knew it was a tense topic in my household and I was nervous to bring it up, but I never worried about where my next meal would come from or if we would be evicted. I always procrastinated on asking for money for field trips, book fairs, and sports because it stressed my parents out. Once I got older, I realized there were a lot of instances where they sacrificed things they wanted or needed so that my brother and I could have access to sports and other extracurriculars.

Do you worry about money now?

I didn’t before the pandemic, but I lost my full-time job in March and have been struggling since then. Like everywhere else in the world, the job market plummeted, and it was already hard enough to find a job as an immigrant with mediocre Hebrew before the pandemic. I didn’t have any savings so I relied heavily on credit cards and my parents to help. When my lease ended in August, I moved back to my parents’ house in the U.S. for a few months and worked in retail to pay off some debts and try to build up savings. I suddenly had to return to Israel in late November and feel less concerned now, thanks to some assistance I received from the immigrant absorption ministry, the stimulus, and some leads I have on prospective jobs.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I’m still not truthfully financially responsible for myself. I finished undergrad when I was 20 and was immediately offered a full-time position at a magazine that paid $39,000/year, which was definitely enough to live. I took over paying all of my expenses except for health insurance and my cell phone, but my dad has sent me $50-$300 each month since I graduated. My parents thankfully still serve as a safety net, which I utilized last year when I moved home for a bit and received major assistance from them with my rent. They are very conscious of the fact that the economy is completely fucked compared to when they were young adults and have done everything they can to help me.

Do you or have you ever received passive or inherited income? If yes, please explain.

I haven’t received any inheritence and I don’t think I ever will. I do receive some money from my dad as stated above.

Day One

7:20 a.m. — I wake up full of dread for the rest of the day. For the last four weeks, I have been doing a work exchange on a pomegranate farm in the desert. I worked five to seven hours a day, five days a week, in exchange for free room and board. I had planned to stay at the farm for a few more months, but I didn’t feel safe staying at the farm anymore due to how some conflicts were handled by the farm owner and the other volunteers. I make a vegan breakfast scramble from tofu, potatoes, onions, and cabbage and think about how this is the last free filling meal I’ll have in the foreseeable future.

10:30 a.m. — I’m packed and ready to go. The owner offers to drive me to the nearest bus stop, as the farm is pretty remote. I realize I have 40 minutes to kill, so I walk to a gas station nearby and purchase peach juice, a nut mix, and a package of cookies. $8.05

12:05 p.m. — I am on the first of two buses that I need to take to get back to Jerusalem. The country is currently in lockdown and buses are supposed to be operating at 50 percent capacity, but every seat is full and a few people are sitting on the ground. I load my RavKav (the national transportation pass) to ensure I have enough money for the next bus. $9.36

1:20 p.m. — I make it to the Central Bus Station in Beersheva, a city in Southern Israel. I scratched my eye while pruning trees at the farm yesterday and my eye is killing me. I buy a box of eye bandages so I can take my contact lens out and keep my eye closed and covered. I board yet another packed bus to Jerusalem and kill time by doodling in my sketchbook. $2.50

2:45 p.m. — I arrive in Jerusalem and my boyfriend meets me at the Central Bus Station. We have been together for nearly two years and actually shared an apartment last year. We only moved out because the lease ended and we couldn’t afford rent anymore. He is currently an undergrad, so he moved into the university’s dormitories to save money for our next place. I know he will have no edible food at his dorm, so I stop and buy two family-size bags of chips for us to snack on over the next few days while we binge Shameless together. $7.80

10:45 p.m. — My boyfriend, D., and I watch an episode of Shameless and accidentally end up having a long conversation about our future before we fall asleep around one. We plan on getting married at some point, but neither of us feel like we will be ready to take that step any time soon. We are both ambitious and want to achieve some semblance of financial stability and land decent jobs in our fields (journalism for me, computer science/machine learning for him) before getting married. Halfway through our conversation, we realize it’s New Year’s Eve. We listen to his hallmates count down to midnight, but it’s not that exciting for either of us. We’re both Jewish and agree that Rosh Hashanah is way more lit.

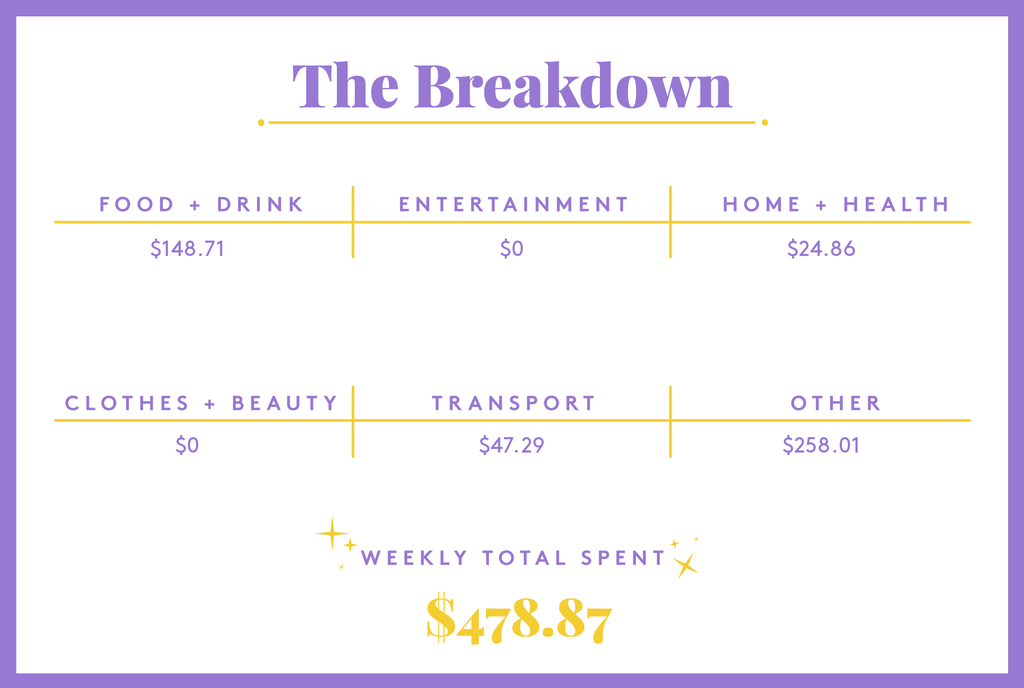

Daily Total: $27.71

Day Two

9:30 a.m. — D. and I wake up. He’s a caffeine addict and realizes he’s out of coffee. I offer to run to the vending machine to buy him an energy drink so he can jump-start his day. I end up buying him two (one for later!) and a package of chocolate wafer cookies to share for breakfast. After we lounge around and recover from sleep, we head into the city to do some grocery shopping. $7.54

12:30 p.m. — We arrive at Jerusalem’s famous Shuk Machane Yehuda. It’s an open-air market where vendors sell all sorts of fresh food, as well as housewares, clothing, and random junk. Our old apartment was right around the corner, so we became accustomed to shopping here. The weekend in Israel is on Friday and Saturday, and most people do their shopping on Friday mornings to prepare for Shabbat, the Jewish day of rest. The market is absolutely packed and seems like a good place to catch COVID, so we opt to go to a smaller store around the corner. D. buys vegan schnitzel, milk, and coffee. I buy us spaghetti, tomato sauce, two bags of ramen, and a big bottle of peach tea ($8.77). When we leave, I notice a new hummus joint has opened and ask D. if he wants to give it a shot. We order a bowl of hummus with lots of toppings to share, as well as a vegetable pancake. I offer to pay because D. receives no financial help from his family and never eats out ($12.48). $21.25

2 p.m. — After we put away groceries, D. goes to study. I open Netflix and watch a few episodes of Friends for the millionth time before deciding to try something new. Netflix recommends Atypical. I’m instantly hooked (mostly by the scenes with Brigette Lundy-Paine, because they are amazing) and watch until D. comes back around 9. We cook some schnitzels and couscous for dinner.

1 a.m. — While I’ve made significant progress in managing my anxiety disorder in the last year, I’ve started having panic attacks again in the last few days. I’m laying in bed with D. (and all of my existential thoughts) when I started experiencing one, but this time, I lose control of my body’s reflexes and can barely talk. I manage to let D. know that this isn’t normal for me. He calls the national insurance’s hotline to ask for medical advice. They advise that we go to an ER. The ER is nearby, but Shabbat started at sundown and there’s no public transportation on Shabbat (or Uber/Lyft at all!) in Israel, so D. uses my phone to order a taxi. $14.40

1:15 a.m. — We arrive at the ER and D. takes care of the paperwork and checking in for me. He was advised to take me to a private ER because it’s closer and is less chaotic than the hospital. The only downside is that there is a 23 shekel co-pay for the visit, whereas thanks to Israel’s nationalized healthcare, the public hospital would’ve been free. $7.18

4 a.m. — The doctor gives me a muscle relaxer and keeps me for observation for a few hours before discharging me around 4 a.m. I feel extra grateful that D. sat by my bed for three hours, texted my mom to keep her in the loop, helped me navigate the language barrier with the doctor, and advocated for me. We order a taxi back to campus and go to sleep. $13.35

Daily Total: $63.72

Day Three

11:30 a.m. — D.’s alarm goes off and I wake up too. I thank him again for taking care of me last night and apologize for keeping him up all night because I know he will be tired. We both have assignments to work on, so we head to an empty study space inside one of the academic buildings. I’m pursuing a master’s in Israel Studies, mostly because the government offers immigrants free degrees and I felt pressure to do something productive while riding the pandemic out. I know the degree is hella niche and likely useless, but I want to work as a journalist who covers Israel/Palestine and figure the extra credential couldn’t hurt.

12:15 p.m. — D. and I stop at a vending machine to buy sandwiches. There is only one vegan option, so I choose that, while D. opts for some sort of contraption with eggs and veggies. We try to figure out how old the sandwiches are by studying how wilted the lettuce is, but we decide we are too hungry to care. $12.18

3:40 p.m. — I am supposed to be working on a final paper for my Israeli Law class, but I’ve never taken a law course and the Latin jargon is making my head hurt. I decide to head outside and do some stretching and yoga poses to try and get my blood flowing and my head cleared. A black cat follows me to the patio and watches me the entire time. I give the cat some love and apologize for not having any food to share before heading back inside to chip away at my paper.

7:30 p.m. — I push myself to finish a page about Ottoman influences on the contemporary Israeli legal system before giving up and heading back to D.’s room. I heat up schnitzel and couscous before turning on Atypical and continuing to drool over Brigette Lundy-Paine. At some point, D. returns so I turn on an episode of Shameless for us to watch before we head to sleep.

Daily Total: $12.18

Day Four

10:45 a.m. — D.’s alarm wakes me up. He doesn’t have class until noon, so we spend the morning hanging out. I’m tired and desperately want an iced coffee, but until I figure out what caused the ER trip, I figure I should stay away from caffeine. On the bright side, I check my bank account and realize the $600 stimulus came through direct deposit. I don’t have any immediate debts to allocate that to, so I plan to use it as a cushion for food and transportation until I figure out a more permanent housing situation beyond crashing illegally in my boyfriend’s all-male dorm.

3:30 p.m. — I make significant headway on my final paper for law class. My friend, S., texts me and asks if I want to go to the pet store together. When I had to relocate temporarily back to America and D. moved into the dorm, S. offered to take our cat in until we got another apartment. We agree to meet around 4:30.

5:30 p.m. — I take a bus the wrong way and end up waiting at the wrong bus stop for a very long time. I start to feel panicked and decide to order a cab instead of waiting another 30 minutes for the bus. I get to S.’s and she lets the cat out into her front yard so I can play with him without coming inside. After a few minutes of belly rubs and watching my impressive son scale a tree, S. and I set off to the pet store. $10.18

6:15 p.m. — At the pet store, S. and I both agree that a mesh harness would be most comfortable. I also buy a new leash and a bag of salmon cat treats for my little man. The cashier informs me that I’ll ultimately save on my purchase if I sign up for their membership club, which only costs a one-time fee of 10 shekels ($3.14). I decide to sign up. $54.05

6:50 p.m. — S. and I decide to go for a walk on the Mesila, a path in Jerusalem constructed on top of old railroad tracks. The railway used to connect Jerusalem to Jaffa, Cairo, Damascus, and Istanbul, but now it’s a boardwalk and biking path. We pass a pharmacy chain on the way there, so I stop to buy shampoo and body wash. $15.18

7:20 p.m. — At the end of the train tracks is the old station, which has since been converted into a pavilion with a bunch of cafes, restaurants, and shops. We walk past my favorite smoothie chain and I resist stopping. As we begin to walk back to S.’s apartment, I am filled with regret. I offer to treat S. since she has taken such amazing care of our cat. She says it’s unnecessary but I sway her by reminding her that it’s the U.S. government’s money and the least they could do is buy us smoothies. $12.52

8:10 p.m. — On my way back to D.’s dorm, I stop to buy us some snacks to power through finals. I buy him his favorite cereal, a can of Pringles, and disposable coffee cups and I buy myself cookies, crackers, grape iced tea, peanut butter, and jelly. D. meets me back at his room shortly after I arrive and our nightly ritual of watching Shameless commences. $42.18

Daily Total: $134.11

Day Five

2:10 p.m. — I wake up and can’t believe how long I slept. I don’t feel refreshed and decide to lay in bed and watch a few more episodes of Atypical before buckling down on my final paper.

6 p.m. — My therapist calls for our weekly session. I’ve been talking to the same therapist off and on since I was 19 and thankfully he’s allowed our sessions to continue while I am in Israel. I’m still on my dad’s health insurance, which covers most of our sessions, aside from a $20 co-pay (which my dad pays). I talk for nearly 30 minutes straight before it becomes more of a conversation because I have so much to process, but when the call ends, I feel a lot better. I’m supposed to have class on Zoom right after therapy, but the teacher cancels it, thankfully, so I go back to working on my final.

10:15 p.m. — I finish the first half of my final paper and finally let myself look at my phone again, where I see an invoice from my Hebrew tutor. I was previously doing private lessons to work on my conversational skills, and I could afford it when I was working in America. Since I moved back to Israel, I had to cut it out of my budget. We stopped lessons more than a month ago, but she never invoiced me and I didn’t really think to set the money aside. I owe her for eight sessions and decide to send it through TransferWise from my American account because that’s where my stimulus was deposited. (Note for any other ex-pats — TransferWise is def the easiest for sending money back and forth!) I feel tired and head to sleep pretty quickly. $202.16

Daily Total: $202.16

Day Six

9 a.m. — D.’s alarm goes off. He has class at 10. I don’t have class until 12:30 but I know I should get out of bed with him and go do some homework. We shower and head to an academic building for a change of scenery. I’m craving a boureka — a savory, stuffed Middle Eastern/Mediterranean pastry — so I stop by a cafe on campus and buy a potato one and a bottle of mint lemonade. D. asks me to pick him up a boureka and Coke and I happily oblige because he’s been so nice about me crashing in his dorm. $11.87

12:30 p.m. — My Israeli history class starts so I log in to Zoom. Today, we are talking about the Yom Kippur War. I am confident that everything the lecturer will note is available on Wikipedia, so I spend most of the class on Pinterest and Twitter. I check my bank account and see that my grandma sent me $100 for Chanukah and a $20 reimbursement from a doctor came through. Woo!

2:45 p.m. — My Israeli sociology/anthropology course starts. The topic today is immigration to Israel. I spend the first few minutes attentive, but I quickly find the material that we are reviewing to be really redundant. I am overly familiar with immigration in Israel because, well, I immigrated. I decide not to return to class after the break and to go check out an apartment that’s being shown instead.

4:15 p.m. — I get to the apartment showing early and while I’m waiting, my boyfriend’s sister video chats me with her baby. The baby is super cute and I love them both. I don’t have any family in Israel, and they have definitely gone out of their way to make sure I feel welcome and included in theirs. The current tenant arrives and shows me around the apartment. It’s quirky and I’m absolutely in love with it, but I know D. will require some convincing because it’s small and there isn’t a bedroom door.

5:15 p.m. — It turns out the harness that S. and I picked out for the cat doesn’t fit, so I meet S. at the pet store to exchange it. The new harness we pick out is two shekels ($0.63) more than the one we bought before. It feels dumb to put two shekels on a debit card, so I ask Rachel for the change. We part ways quickly because I have a doctor’s appointment shortly.

6:37 p.m. — I arrive at the doctor’s office late because the entrance is super hard to find. I apologize in English when I walk in, and the doctor tells me it’s okay, but in Hebrew. I ask him if he speaks English and he says no. I immediately feel like crying — his website said he spoke English and I don’t know how to say “I had a panic attack but lost complete control of my body and want to know if that’s really bad” in Hebrew. D.’s native language is Hebrew so I call him and put him on speakerphone to be our translator.

7:20 p.m. — I leave the doctor’s office feeling frustrated. He wrote me a referral for a psychiatrist. I love the Israeli healthcare system and I’m so grateful to live in a country with socialized and accessible healthcare, but I know it can take weeks to get an appointment with an English-speaking psychiatrist, and I’m not sure how urgent this all is. I make the executive decision to eat ice cream for dinner and head to a nearby grocery store. I pick up a carton of non-dairy Ben & Jerry’s, a loaf of bread, and an Arizona iced tea. $19.06

8:30 p.m. — D. is still studying elsewhere when I get back to his room, so I enjoy some much-needed alone time and watch more Atypical. I try to find Brigette Lundy-Paine on Instagram but it looks like they deleted their account. Bummer.

11:20 p.m. — D. gets back relatively late. We only talk for a bit before heading to sleep.

Daily Total: $30.93

Day Seven

9:45 a.m. — D.’s alarm wakes me up, again. I lay in bed too long and miss the chance to shower before my 10:30 a.m. appointment slot for a COVID-19 test. The university that D. and I both attend has made testing on campus frequent, free, and easy. I don’t have any symptoms, but I’m planning to crash with S. in her roommate’s empty room for a week or two until I find out if I have any job offers or decide to find another work exchange program. S.’s roommate’s parents are rich and pay her rent, so she said I don’t have to pay anything to sublet, but S. encouraged me to get tested before moving in because I have been on packed buses recently. This is my third COVID test and for the first time, it’s painless. They tell me I can expect results by midnight. I’m craving iced coffee so I stop and buy one at a cafe, as well as a chocolate croissant for D. $6.26

12:10 p.m. — I am killing time before my 12:30 class and see on Twitter that someone I follow has started a Patreon where she posts a queer interpretation of the Shulchan Aruch (a book containing Jewish law) every day. Learning traditional Jewish texts is a hobby of mine and I’ve been coming to terms with being attracted to all genders recently. Like many religious laws and the texts they’re derived from, Jewish laws and customs can be really sexist, xenophobic, homophobic, transphobic, and all-around horrible, but there is an amazing generation of rabbis working now to find the light in our traditions and texts, and it’s definitely a priority of mine to help accelerate that in any way that I can. I pick the lowest tier and make a mental note to upgrade as soon as I get a job. $1.80

4 p.m. — I make some instant noodles and trudge through the rest of my Israeli politics class. Today, she mentions that she used to work in journalism. I ask the professor to stay for a moment on Zoom after the lecture ends, and ask if she knows of any opportunities for master’s students in journalism. She says she will reach out to a colleague and see if there are any internships available. She also recommends another professor who could help me as well. I thank her profusely and feel grateful that Zoom hasn’t completely eliminated the chance to get to know my professors.

6:15 p.m. — I check my email and see two messages from PayPal. One is a notification that my Democratic Socialists of America monthly due was paid today, and another is a money request for co-pays from my therapist. I text my dad and ask if he can send me money for it. He replies yes instantly. I have the money but my dad started paying my co-pays when I was in college and still dependent on him, and he hasn’t told me to bug off yet, so I keep the tradition going.

10:15 p.m. — I work on my final until my eyes physically hurt from staring at my screen all day. I don’t have anything else urgent to do tomorrow, so I let myself stop. It’s due tomorrow at 11:59 p.m., but I work well under pressure and am confident that I can finish in a few hours’ time. I spend some time doodling in my sketchbook and trying to process some things. I have no idea where I’ll be living two weeks from now or when I’ll finally get hired or why I had such a bad physical reaction during that panic attack the other day, but drawing cacti and writing down random thoughts helps me feel like I’ll survive.

Daily Total: $8.06

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In San Jose, CA, On A $72,000 Salary

A Week In Brooklyn, NY, On A $58,500 Salary

A Week In Ski Town, CO, On A $165,000 Salary

from Refinery29 https://ift.tt/3sy54y6

via IFTTT