Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a director of patient care who has a joint income of $160,000 per year and spends some of her money this week on Nasty Woman t-shirt.

TW: This diary mentions sexual abuse and trauma.

Occupation: Director of Patient Care

Industry: Healthcare

Age: 25

Location: North Carolina

My Salary: $60,000

My Husband’s Salary: $100,000

Net Worth: $2,340,000 ($300,000 house, $2 million in a trust, $100,000 my husband D.’s 401(k), $10,000 in my 401(k), $8,000 in checking, $22,000 in savings minus $20,000 in car loans) D. and I combined finances once we got engaged — he has more in his 401(k) because he is six years older than me and further along in his career.

Debt: $20,000 in car loans

My Paycheck Amount (1x/month): $4,600 (prior to taxes)

My Husband’s Paycheck Amount (1x/month): $7,690 (prior to taxes, our combined post-tax paycheck is about $8,000 a month)

Pronouns: She/her

Monthly Expenses

Mortgage: $0 (D.’s parents and my parents graciously gave us $50,000 each as a down payment for our home. We paid for the remainder equally from our respective trusts.)

Car Loan: $2,000 (We both bought new cars last year and we are paying as much as possible.)

Streaming Services: $75 (Netflix, Amazon, Apple Music, NY Times, etc.)

Therapy: $710

House Taxes: $300

Utilities: $390 (water, electric, internet)

Cell Phones: $0 (both parents insist on keeping us on their plans and will not let us pay them)

Health Insurance: $0 (his is paid for by work, and I’m still on my parents’ — they won’t let me reimburse them)

Pet Food/Meds: $250

Car Insurance: $300 (We have four cars. Two cars we purchased last year, a 20-year-old work truck that we use for yard work, remodeling, etc., and my husband’s late brother’s rally racing truck)

Savings: Whatever is leftover

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Absolutely. There was never a question, as a first-generation immigrant, that I would go to college. I received my bachelor’s in Psychology and I plan to go to school to become a PA. I received a full-ride and worked through college for spending money. My husband got mostly scholarships and his parents paid for part of his schooling. He paid off the rest of his loans when he moved back home after his brother passed away.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My parents didn’t teach me a ton about managing finances but gave me some broad strokes. At 14, my dad supervised me writing the checks for bills and I helped my mom process payroll for the family business. I was always taught to never purchase things full price and to use coupons if I could. But my parents did spoil me a lot and I completely understand my privilege.

What was your first job and why did you get it?

My first job was at 16, working at my parents’ coffee shop. My mom insisted that I needed to start paying for any extras that I wanted outside of necessities. After they sold the business, I got a job as a hostess/server at a restaurant. I did not get a car until I went to college. My parents gave me a $3,000 down payment but it was up to me to make the monthly payments.

Did you worry about money growing up?

Yes and no. At the beginning of high school, I had a big surgery, and while we have great insurance, it didn’t cover 100%. I remember my parents really tightening down after I racked up a lot of medical bills and they made it a point to make me really conscientious about our checking account and how much I was spending. I had a debit card to their account and they made me reconcile purchases I made. I had to make sure any purchase I made didn’t exceed my allowance or leave the account with less than $1,000.

Do you worry about money now?

Sometimes. I have to make sure that I am not overspending. At times I can compensate for my depression and anxiety with too much retail therapy and I have to keep an eye on it.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I became 100% responsible when I got married. Even so, my parents keep me on their phone plan and insurance not out of need but because that is how they show love and it makes them feel like they are still taking care of me in their own way. Yes, both my husband and I know that should catastrophe hit, our trusts and our parents would help if absolutely needed. Thankfully we have never been even close and would explore any other option before asking our parents.

Do you or have you ever received passive or inherited income? If yes, please explain.

Yes. My husband and I both have trusts. He received a trust of roughly $1.5 million and I received one of $500,000 give or take. This is in addition to the $50,000 we each got as a down payment for our first home.

Day One

6 a.m. — My alarm goes off and I suddenly regret the extra 30 minutes of doomscrolling I did last night. Since COVID, I started showering at night to make mornings quicker since I care less about what I look like given that my face is covered all day. I brush my teeth, wash my face, and dry shampoo my hair. I start the Nespresso and have my daily two shots of espresso. I take them like a champ, brave 30-degree weather, and drive my 15-minute commute with my seat warmer on high.

7 a.m. — I get to work and start my morning routine of checking emails, running financial reports, and voicemails. I have a slice of banana bread I made last night and crack open a Sambazon energy drink (I’m not a morning person, please don’t come for me or my caffeine intake).

9:42 a.m. — I start a return for some FIGS scrubs that didn’t work out. I reorder a style/size I know I like. I recently sold a pair of scrub pants that I didn’t like but forgot to return. Work paid for one pair and I sold the other pair for $20 so that offsets the cost. My total ended up being $22 after my additional student discount. $22

3 p.m. — I get home and take a long hot shower since I had to jump in to assist with an emergency extraction. I heat up a small bowl of veggie noodle soup and take a nap.

6 p.m. — Clean the house and start some laundry/homework after my nap. I make a quick rigatoni for dinner and D. and I decide to watch a couple of episodes of Blacklist and go to bed around 10:30.

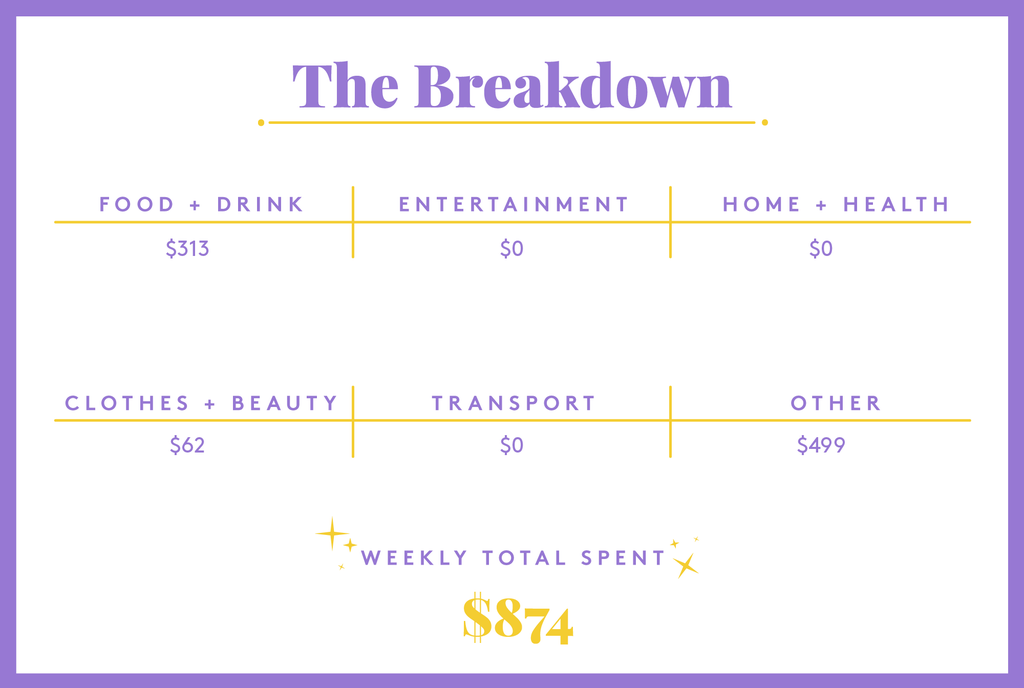

Daily Total: $22

Day Two

6 a.m. — I get up and do my usual morning routine. It’s extra cold and rainy today and it makes me happy. I’d love to live in Seattle or London but my husband went to school in Ithaca and refuses to live anywhere perpetually cold and cloudy again. I stop by Starbucks and get a cold brew and a coffee cake. $15

12 p.m. — Since the pandemic is raging we have decided to take the time to renovate our house. We did the hardwood floors, scraped the ceilings, and installed new lighting fixtures ourselves to save money. We hired a design company and a general contractor to renovate our master bathroom, guest bathroom, and install new kitchen cabinets. I receive the quote, and it looks really good. The total cost of the renovation is about $50,000. The house was purchased at $200,000 (only because the owners needed to move ASAP and sold for $50,000 less than market value) and our area rapidly grew and increased the market value to $300,000. The anticipated value after the renovations and market increase will be around $380-$390,000. We realize this is a large amount of money but we believe it’s a good investment for our future. I email him back asking for his first available date to initiate the demo.

2:30 p.m. — I pick up my grocery order curbside. Dried chiles, cilantro, black beans, and snacks for work as well as a couple of other things we need in the pantry. I get home and work on the slow cooker dinner for tonight. $62

7 p.m. — My husband dropped my pups off at the groomer four hours ago and they still aren’t ready. I’m miffed. I go to get them despite not getting a call. I get my dogs, pay for the grooming, and get them treats, toys, and new collars in turn for being a bad mom. $149

8 p.m. — I have a bowl of soup and a glass of wine and settle in for Vampire Diaries. D. comes home from putting out a fire with a client. We head to bed at 11.

Daily Total: $226

Day Three

6 a.m. — My bunny wakes me up by jumping on my face (we have two free roam bunnies, my husband jokes I’m running a petting zoo). She woke me up once last night because she and her sister were raving like there was no tomorrow, undoubtedly harassing my Christmas tree. They bit the wires one year… exactly two seconds after plugging it in. My husband fixed it and we have since protected the wires with plastic sheathing. Anyway, another day another energy drink but this time add oatmeal for #health.

2:30 p.m. — It’s the weekend (for me)! I work M-Th 7-2:30. Because of the short day, I usually eat snacks or heat up a frozen meal in between patients. I head home to heat up leftovers and a shower.

6 p.m. — I spend the afternoon binging more Vampire Diaries and the occasional TikTok. I’ve been on the prowl for comfortable jeans and heard Old Navy has some good ones and they are on sale ($25). I also order a nasty woman t-shirt off Etsy ($15). I decide I don’t want to cook, so I head to get takeout. One of my best friends owns a restaurant and I love supporting them. I try and go when they aren’t there so I can pay full price, but they pick up my check which I HATE. I tip $60. $100

10:30 p.m. — I head to bed, doing my nighttime skincare that consists of dapsone, YTP dream mask, Caudalie Vinoperfect, and Biossance eye cream. I also take my meds — I’m on an antidepressant and mood stabilizer, I have MDD and PTSD.

Daily Total: $100

Day Four

9:30 a.m. — Those extra 3.5 hours make such a huge difference! I’m feeling well-rested, yet lazy. I stay in bed for a while to do some social media scrolling for my boost of serotonin.

10:30 a.m. — I reluctantly get up to shower and then decide I could use a pick-me-up. I head to the Dunkin’ drive-thru and order an iced hazelnut coffee with almond milk and an order of hashbrowns. I use the balance on my card.

2:30 p.m. — I try to do all of my homework for the week on Fridays so I don’t have to worry about juggling work and school work during the week. I’m doing prerequisites to attend PA school. I also do some online Christmas shopping. I purchase my best friend’s present — her fiancé and I are splitting the cost of microblading her eyebrows. I know it’s a huge insecurity for her and I’d love to do it for her before the wedding next year and the place is running a sale. My half is $200. $200

7 p.m. — We decided on Thai for the night. We get Panang curry and drunken noodles. With tip, it’s $30. We settle in watching The Mandalorian and I make some coquito because why not? We head to bed around 11. $30

Daily Total: $230

Day Five

10 a.m. — I sleep in again and wake up feeling unrested. One of the many perks of MDD is that I can sleep forever. I also have multiple autoimmune disorders that can hinder day-to-day tasks. I peel myself out of bed, shower, and do my a.m. skincare that consists of dapsone, Skin FX triple lipid barrier cream, Derma-e vitamin c, and Tatcha sunscreen. Because I have bunnies, I make sure that 95% of all my cosmetics, hygiene, and household products are cruelty-free.

12 p.m. — D. makes me an iced latte from our Nespresso and we make a soba noodle soup with sauteed mushrooms and bok choy. We also make Star Wars sugar and shortbread cookies. Every year we decorate cookies with my niblings (plural for nieces and nephews). But because of the ‘rona we drop off cookies with decorating supplies for them to enjoy and they send us pictures later.

7 p.m. — My best friend comes over to do a fire pit outside with social distancing. We drink some mulled wine and order a Margherita pizza from an Italian place around the corner. She stays until 11:30 drinking, catching up, and talking wedding details (I’m the matron of honor). Lights out for me at 12:30. $24

Daily Total: $24

Day Six

10 a.m. — I get up and immediately feel like I could sleep a few more hours but instead I convince D. to cuddle for a while and talk about some upcoming decisions we need to make. I shower and eat the leftover drunken noodles from Friday.

12 p.m. — I run our robot vacuum cleaner and I and steam mop the house. Thanks to my petting zoo, I have to clean my floors often. I buy a gift card to REI for my boss’ Christmas present. Three of us are going in on it, my portion is $35. $35

2 p.m. — I’ve exhausted my beer and wine reserve and need to replenish. I’ve got enough liquor to last me a year, but I like a glass of wine or beer with dinner. I order curbside pickup from Total Wine. I get two bottles of red, a bottle of champagne, a pack of Paulaner Oktoberfest (my husband is German and Colombian so he’s a little bit of a beer snob. Sam Adams Oktoberfest will simply not suffice), and a couple of single beer bottles of ones I’d like to try ($84). On our way to get the wine, I mobile order some bubble tea for myself and D. I get the brown sugar black milk tea with boba and D gets Thai milk tea with boba ($12). $96

6:30 p.m. — Sunday scaries are in full force as I put my scrubs in the wash thinking of the early morning to come tomorrow. I’d like some comfort food so we order from a Turkish place around the corner. We split sigara börek and falafel with bulgur pilaf. We get cozy and make old fashioneds with a new Hogwarts ice mold my best friend got me (where are my Slytherins at!?). We watch an episode of Taco Chronicles. I’m Mexican so it’s always nice to see my culture displayed and appreciated! Bedtime at 11. $26

Daily Total: $157

Day Seven

6 a.m. — Another chilly and cloudy day that always softens the blow of the dreaded Monday. This week is also only a two-day workweek for me because of the holidays! I get ready and pound my espresso like nobody’s business. I get to work and heat up my usual oatmeal. My coworker gives me a Starbucks gift card, which makes me feel really good. I make a mental note to buy her a gift card to a craft store. (I’m trying my best to buy all online gift cards and print them out so I don’t go into stores as much).

11 a.m. — I heat up a lunch of portobello and goat cheese ravioli while reading The New York Times. It’s been a crazy day with so many emergency patients that I’m thankful to finally be able to eat my lunch calmly.

3 p.m. — Home sweet home! I hop online and buy the $15 Michael’s gift card along with a $100 gift card to a local spa for my sister’s Christmas present. She may not be able to use it now, but once the pandemic is over, I’m sure she’d love the chance at an hour break from her kids. $115

4 p.m. — Therapy time. I’ve been seeing my therapist for three years now and she has quite literally saved my life. As I mentioned, I suffer from MDD and PTSD that stems from six years of sexual abuse when I was younger. I had a lot of shame surrounding it but am working through it. The sexual abuse coupled with medical problems, emotionally unavailable parents, and the death of close friends lead to underage drinking, promiscuity, and dangerous behavior. It has taken me a long time to unlearn a lot of things that were ingrained in me but I am now in a place where I can say I am doing better. My therapist is not in-network so I pay $175 out of pocket and usually get reimbursed $60 from my insurance. My husband goes to her colleague and pays the same but gets no reimbursement (we are on different insurances). These are calculated into our monthly expenses.

6 p.m. — I decide to do a 15 minute VR boxing workout on our Oculus Rift. I then make a lemon couscous salad with grilled halloumi and roasted broccoli for dinner. D. and I have dinner, catch up on our days, and set up an appointment with our designer to sign our contract.

10:30 p.m. — We spend the rest of our night watching a Christmas movie and wrapping presents, which the bunnies promptly nibble on. I do my nighttime routine and go to sleep.

Daily Total: $115

If you are experiencing anxiety or depression and need support, please call the National Depressive/Manic-Depressive Association Hotline at 1-800-826-3632 or the Crisis Call Center’s 24-hour hotline at 1-775-784-8090.

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Alaskan Bush On A $60,000 Salary

Top 2020 Money Diarists — Where Are They Now?

A Week In Northern Virginia On A $115,000 Salary

from Refinery29 https://ift.tt/3nk0D6o

via IFTTT