Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

How are your 2021 New Year’s resolutions going? What are some resolutions that you’ve failed to keep in past years? Do you have any tips for how to set achievable financial goals? Tell us your thoughts here.

Today: a pharmacist who makes $140,000 per year and spends some of her money this week on Dr. Martens.

Occupation: Pharmacist

Industry: Retail

Age: 36

Location: Upstate New York

Salary: $140,000

Net Worth: $353,700 including 401(k) ($163,000), traditional IRA ($29,300), investments ($63,000), savings/cash, and equity in my home.

Debt: $0, my parents paid for undergrad, I paid off $200,000 in pharmacy school loans in 2018 after seven years

Paycheck Amount (1x/week): $1,682

Pronouns: She/her

Monthly Expenses

Mortgage: $1,125 for a three-bed, 1.5-bath home ($550 goes to principal/interest, $575 goes to an escrow account to pay taxes/insurance — taxes in NY are outrageous!)

Savings/Investments: $700 to 401(k) direct from paycheck (my company matches up to 6%, but due to our corporate structure, I cannot contribute the max of 17% so I contribute 6%) and $1000 to a brokerage account — I make too much to utilize much else in the way of deferred tax retirement savings. Whatever is left over after monthly spending goes into a high-yield checking account for savings and/or major expenses and I move lump sums into my investment accounts when my cash balances are above a certain limit. I’ve been keeping more cash on hand lately since COVID.

Snow/Lawn Services: $150

Internet/TV: $135

Utilities: ~$150

Spotify/Netflix: $25

Cell Phone: $105 (My mother is on my plan)

Health Insurance, HSA: $260 deducted from payback — I contribute the maximum allotted to my HSA as additional retirement savings

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

It was just kind of a given that I’d go to college, it was never really discussed by either myself or my parents. I went to four years of undergrad, paid for by my parents. They flat out told me my first choice was not an option after seeing the (lack of) financial aid package. They said it had to be a SUNY school. It never occurred to me that I could get loans and go somewhere else. In the end, I went to a private Jesuit college because after scholarships, the cost was the same as a state school. Best decision I ever made. I worked two years before going to pharmacy school, which I paid for entirely with my small savings and student loans — stupidest decision I ever made.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

We didn’t explicitly talk about money. There were definitely conversations between my parents about whether they should be spending money on certain things but always more in terms of luxuries or extras than needs. It was also instilled in me that if you wanted things, you had to work for them and that you don’t spend money you don’t have.

What was your first job and why did you get it?

I worked summers starting around age 15 at a souvenir shop. Again, I don’t remember it being discussed necessarily, it was just a given that I would work when I was old enough. I did a lot of extracurriculars in high school and therefore was not required to work during the school year. Had I not had those activities, I would have been expected to have a job.

Did you worry about money growing up?

No. We always had everything we needed and a lot of the things we wanted. When I was nine, my dad sold his business and we moved from NJ to NY to start the business again. I think things were tighter than I realized at that age, but by the time I was old enough to understand, we were well-established.

Do you worry about money now?

Yes. I constantly worry about money. I’m not sure where that comes from given that I’ve never struggled financially but I think a lot of it has to do with being single and knowing I have no one to fall back on. I am the only one I can count on to support myself and it’s harder and more expensive to do it on your own. Job stability is also a concern in my industry so that adds an extra level of concern for the future both near and long term.

At what age did you become financially responsible for yourself and do you have a financial safety net?

After I graduated from college at 21, I was financially responsible for myself. I don’t have a financial safety net per se. My family is not wealthy, but we do alright. I know if I am in trouble they will always have my back.

Do you or have you ever received passive or inherited income? If yes, please explain.

Yes, my grandmother passed away in 2015, and I inherited about $35,000, most of which I put towards my student loans.

Day One

7:30 a.m. — I don’t have to be to work until 1 so I get to wake up without an alarm. I go downstairs to make coffee and let the dog out. The sun still isn’t up. I sit on the couch drinking my coffee and reading the news, catching up on social media, etc. I also check my budget app, Mint, every morning. I check to make sure new transactions are assigned to the right categories, if any return refunds have been issued, and where I’m at with spending for the month. I go upstairs to change and do a quick workout. I have an elliptical machine that I don’t love, but I haven’t been motivated to run outside so it’ll have to do. Afterward, I have more coffee and make breakfast — Egg and Taylor Ham sandwich (if you’re from NJ, you know!).

12 p.m. — I hop in the shower. I don’t blow-dry my hair partially because I can’t be bothered and partially because I’m not very good at it. It’ll be dry by the time I get to work anyway. I also haven’t really worn makeup in about seven months — with a mask on all the time, what’s the point? I also don’t worry too much about what I wear to work because I just put a lab coat on over it anyway. I apply translucent powder and some mascara, get dressed in black pants, a sweater, and sneakers, and head to work.

1 p.m. — This is the first business day of the new year and it’s crazy busy at work. I break for lunch at 3:30 to have some leftover meatballs that I pulled out of my freezer. I only cook about once or twice a week but I always make enough to freeze the leftovers so I always have something reasonably health to eat.

9 p.m. — We are so busy the second pharmacist ends up staying an hour and a half late to help get caught up. Thankfully, by the time 9 p.m. finally rolls around, we are in good shape but I’m exhausted. I get home, let the dog out, and have a quick dinner — cheese and crackers and some fruit — before calling it a night. I never sleep well on nights I close but I try to get to bed early anyway. I drag myself upstairs, wash my face with Cetaphil, brush my teeth, and am in bed by 11.

Daily Total: $0

Day Two

6 a.m. — Opening the morning after closing is always rough but it’s so much worse with these dark mornings. I have some coffee and try to wake up before getting ready. I take a shower but don’t wash my hair. I just put in some dry shampoo and throw it in a ponytail. I go to a different store every day and this one is notoriously freezing so I throw on a tank, a long sleeve, and company polo. I grab a granola bar to eat in the car and a yogurt for later and I’m off.

1 p.m. — All the talk at work is about who has signed up for the first COVID vaccine. There’s been a lot of confusion as to whether pharmacists are considered healthcare workers (we are!) and whether or not we’re eligible to get the vaccine in the first round. Appointments opened up over the weekend but I didn’t want to risk showing up and being turned away so I didn’t sign up. It turns out most of the pharmacists have signed up and are getting their vaccines without issue so I check the webpage obsessively until more appointments are loaded. An appointment for tomorrow opens up and I jump at it. I didn’t pack anything for lunch so around 1:30, I pick up a sandwich and some chips. $6.50

6 p.m. — The rest of the day passes uneventfully and I leave at 6. I call my mom to catch up and then have more leftovers for dinner. I spend the rest of the night texting with my friends in the group chat and watching reruns of Brooklyn Nine-Nine (99!). I head upstairs to get ready for bed at 9:30.

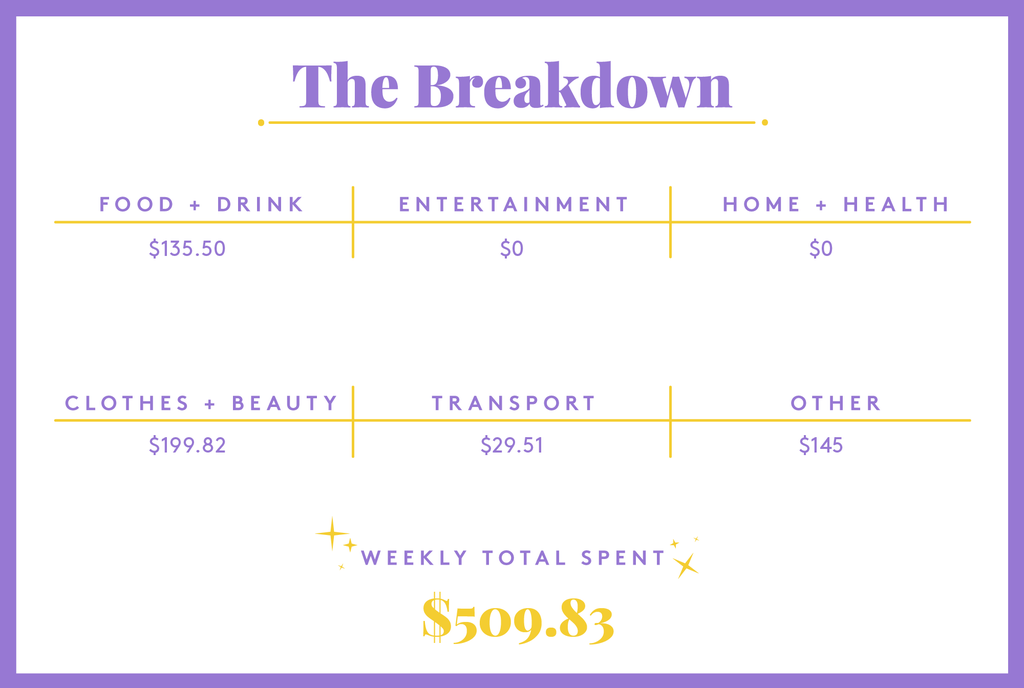

Daily Total: $6.50

Day Three

6:45 a.m. — Today I’m working out of the office, so I get up early before showering and heading to work by 9. Working out of the office is kind of boring because it’s monotonous but the plus side is that you don’t have to wear a mask(!) and therefore can drink coffee all day long! You also get to listen to music. So, all in all, not so bad. I bring cream of wheat and some yogurt for breakfast and get to it. I stop for lunch around noon. I brought cheese and crackers but I also buy an apple and some Doritos. $2.50

3 p.m. — I leave work a few minutes early because I’m nervous about being able to find the vaccine site downtown. I stop at Dunkin’ on the way to grab a small Duncaccino. I figure if I’m getting a shot I deserve a treat. I get to the vaccine site about 15 minutes before my appointment and walk around the building at least once before I figure out where I’m supposed to go in. There is already a line of people but the whole thing runs pretty smoothly. I check-in and show proof that I am a pharmacist and am therefore eligible to receive the vaccine, fill out a form, and then wait my turn. It takes about 30 minutes from the time I walk in to the time I sit down for my shot. I am a huge baby when it comes to needles, which is pretty ironic given how many vaccines I give in a year, but I think I hold it together pretty well. I wait my 15-minute observation period then I’m on my way. $2.50

5 p.m. — I get home and call to let my mother know I survived the shot. My sister, a nurse, got hers two weeks ago without any issues but mothers worry. Again, because I’m a big baby about shots I reward myself with a frozen pizza for dinner. My arm is starting to feel a little sore but otherwise, I feel fine. I fold and put away some laundry, play with the dog, and watch a leftover cheesy Christmas movie before heading to bed at 9:30.

Daily Total: $5

Day Four

7:30 a.m. — Well damn, my arm really started to hurt last night and I slept terribly. Every time I moved it hurt and woke me up. This was definitely more sore than a flu shot, but not really unexpected so all things considered, I’ll call it a win. I get up but I’m still super tired so I skip my planned workout. I just veg on the couch with the dog, drinking coffee for a while. I make some cream of wheat with cashew butter for breakfast. I hop in the shower at 9 and leave for work by 9:45. We spend the day talking about who’s gotten their shot and how it went. Thankfully most of the pharmacists have gotten their shots or are scheduled and so far no one has had any issues. I’m not at all concerned about the safety of this vaccine, but it’s nice that we will be able to tell the public, “Hey, we did it and we’re all fine.”

2 p.m. — I break for lunch, freezer leftovers again, this time it’s rotisserie chicken and rice. I also run over to Kohl’s on my lunch break to hand in some Amazon returns. I canceled Prime awhile ago because 1. I was spending way too much money and 2. I think Amazon is an awful, awful company and I’m trying to be more mindful of where I spend my money, but with Christmas and COVID, a few purchases made their way through. I get $65 back for a phone case and a game I had bought my nephew for Christmas that turned out to be a duplicate. I’ve already sent him a replacement gift card so this is a net refund of about $35.

5 p.m. — I finish up the rest of my shift at work and head out at 6. Thankfully my arm is starting to loosen up so I should be able to get some good rest tonight. I stop at the gas station on my way home and fill up. $29.51

6 p.m. — I was feeling so sorry for myself last night that I didn’t clean up the kitchen so I take care of that while I reheat what’s left of last night’s pizza. I ordered two pairs of Dr. Martens last week and they arrive today (they were $300, paid last week). I usually wear custom insoles at work since my feet are wrecked from a decade of standing on concrete floors for 8-12 hours at a time and the pair I like best doesn’t have a removable insole, but the other one does so I’m not sure what to do. I set them aside to reevaluate later. I chat with my friends a bit while watching TV and head to bed around 10.

Daily Total: $29.51

Day Five

6 a.m. — I have to be at work at 8 so I’m up by 6. Thankfully I slept better last night and am feeling good. I shower, get ready for work, head out with a granola bar. I forgot my water bottle in the car so I just buy a new one. I get to work and check the email to find out the staffing moves that had been planned have been postponed. That’s a disappointment since I was hoping to get a permanent posting. But when does anything go according to plan in COVID times? $2

1 p.m. — I have a coupon for a free sub so I pick that up for lunch. I spend the rest of my break coming up with a meal plan and grocery list for the next few days. The rest of the day is uneventful and I leave work at 4.

4 p.m. — I pick up groceries on my way home including chicken breasts, chuck roast, spinach for green smoothies, celery, carrots, and onions for the soup I want to make this weekend. It’s been a long week and I’m super tired so I clean up the house, make some eggs and toast for dinner, and spend the rest of the night reading my book. $122

Daily Total: $124

Day Six

7:30 a.m. — Wake up with no alarm! I have some coffee and relax before heading upstairs for another elliptical workout. Afterward, I make a green smoothie — spinach, coconut water, avocado, cashew butter, protein powder, and chia seeds. I drink that while I look for a used pair of AirPods Pro on eBay and finally settle on one I like. I don’t want to commit to new ones because I really don’t know if they will fit my ears. It’s an auction listing so I set an alarm for a few minutes before the end and swoop in to win. With taxes and shipping, it’s $145. I also go on Amazon ( I know) to order some foam earbuds in hopes that the damn things will stay in my ears. Of course, I’m $0.01 from free shipping so I also order a pair of smart wool socks I don’t need. See, this is one of the many reasons I canceled Prime. $194.82

1 p.m. — The Buffalo Bills are in the playoffs for the first time in basically a million years so obviously, I have to watch that game. I’m not a Bills fan necessarily, but since my team sucks and is done for the season, I’m rooting for them. Plus, it’s all anyone will be talking about Monday and I need to be informed. In non-pandemic times, I’d get together with some friends to watch but since things are pretty bad here, I settle for doing some serious live texting. There are shirt changes and rally caps involved.

6 p.m. — After the game, I force myself upstairs to change my sheets (my most hated chore) and then feeling accomplished, start to brine my chicken for dinner. Once that’s done, I bake the chicken with some bbq sauce and pair it with frozen french fries. I swear I’m usually better at eating than this but between COVID and the holidays I’m having a hard time getting back into the swing of things. I talk to my mom again after dinner and spend the rest of the night reading a new book.

Daily Total: $194.82

Day Seven

7:30 a.m. — I downloaded the Peloton app free trial after the new year and I haven’t gotten around to using it yet. Some friends have the bike and swear by it but it seems a bit trendy for me. I do a strength/stretching workout. I have eggs and toast for breakfast and veg out with some coffee while I stare at my phone. I go to Zappos and buy a third pair of Dr. Martens in the hope that they’ll be the style I like and have removable insoles. $150

4 p.m. — I spend the rest of the morning/afternoon cleaning bathrooms, the kitchen, doing laundry, etc. Typical Sunday stuff. I remember I need to pack up a few returns to Macy’s and American Eagle. I have another green smoothie for lunch and then get to making my soup. I round out the day with some vacuuming, reading, and dinner before I take the garbage out and call it a night. Another busy week at work tomorrow.

Daily Total: $150

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Washington, D.C. On A $45,000 Salary

A Week In San Jose, CA, On A $72,000 Salary

A Week In Brooklyn, NY, On A $58,500 Salary

from Refinery29 https://ift.tt/2KQkUTQ

via IFTTT