Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a barista/mental health intern who has a joint income of $47,380 and spends some of her money this week on a Caesar salad.

Occupation: Barista/Mental Health Therapy Intern

Industry: Coffee/Human Services

Age: 32

Location: Bucks County, PA

My Salary: $10/hr at my barista job (it is roughly $15,000 a year, I work 24.5 hours a week), my internship is unpaid

My Husband’s Salary: $32,380

Net Worth: Roughly -$23,500. (We have $5,500 saved but have a good amount of student loan debt left and are almost done paying off my husband’s car. We are consumer debt-free. We have approximately $24,000 in our combined 401(k)s.)

Debt: $50,000 in school loans combined. $3,000 for my husband’s car.

My Paycheck Amount (biweekly): ~$380

My Husband’s Paycheck Amount (biweekly): $1,080 for my spouse

Pronouns: She/her

Monthly Expenses

Rent: $995

Student Loans: $200 for my student loans (husband’s are deferred)

Husband’s Car: $197

Health/Dental/Vision Insurance: $280 (pre-tax from my husband’s paycheck)

Utilities: $85

Husband’s 401(k): $72 (5% of his paycheck)

Hulu: $0.99

Netflix: $9.99

Sling: $14.99

Cell Phones: $87

World Vision: $35

Car Insurance: $500 (2x/year)

Annual Expenses:

Renters Insurance: $110

Amazon Prime: $59 (student rate)

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Both my parents have their master’s degrees and my mom ultimately went back to school for her nursing degree at 52. It was always an unspoken expectation that I would go to college. I am currently finishing up my master’s in Mental Health Counseling and I always said I wouldn’t go to grad school unless I knew 100% what I wanted to do. I am currently an unpaid intern at a community mental health facility and work as a barista three days a week.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My parents never really had any direct conversations with us about money, however, I always knew that we struggled. It was more that they never wanted us to worry about money as much as they did, but I don’t remember learning any actual financial skills from them.

What was your first job and why did you get it?

My first job was babysitting. I started at probably 13 and babysat for kids in the neighborhood and at my church. I wanted to work so I could have spending money.

Did you worry about money growing up?

We never went without, but it was always tight. My dad always valued jobs he cared about vs. jobs that would provide (and they never aligned ;)). I could always tell there was tension as my mom grew up in a very financially stable household but my dad did not value money and always valued experiences. This dichotomy made it challenging, however, we always went on at least one vacation a year and were able to get nice thrifted or consigned clothes. I appreciate that I learned the value of a dollar and did not grow up spoiled, but I certainly wished when I was younger that I could have had nicer toys or name brand clothes.

Do you worry about money now?

Yes and no. Those looking at my current financial situation would probably be stressed, but my husband and I are on the same page about this being a step-back year for us. We have a relatively small amount of debt (we recently moved to the area from Denver where we lived for four years and made more money than ever before; we paid off $70,000 in debt while out there so we are nearly out of the red at this point). Our expenses are very low and we don’t need a lot. Once I get a job in my field, we hope to buy a house and start our family but for now, we are in a healthy and good spot with our finances.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I moved home for a week after college and then packed up and moved to another state to live with my best friend. I have been living on my own, fully financially independently since that time (so since I was 21 years old). If we lost our housing or income, we would most likely have to move in with his parents or relocate to where mine live.

Do you or have you ever received passive or inherited income? If yes, please explain.

Yes. My husband’s parents recently gifted us $10,000 which we used to pay off debt. They gave us part of an inheritance from their parents.

Day One

7:45 a.m. — I’m stirring and want to sleep more but I can’t. I get up and throw a breakfast casserole in the oven that I made yesterday and then cook beef and saute peppers and onions for chili in the crockpot. We will be out all day and the weather is supposed to be perfect for a Sunday Funday so I want to have our dinner all ready. I run out to Dunkin’ and get an iced coffee for me and a hot coffee for my husband, D. (I have a giftcard).

9:35 a.m. — I eat breakfast, have some caffeine, and get in my running clothes. D. gets his bike in the car and we head out. We drive over to a trail so he can bike and I can run. We meet up with our friend, N. at the trail. They head out for a 30-mile ride and I grab D.’s car keys so I can do homework while they are still out.

11 a.m. — I head out for my run. It is 70 and sunny, which absolutely unheard of weather for November in Eastern Pennsylvania. I run a 10k faster than I have in months! I grab my computer bag from the car and head to a local diner. I order a coffee, Greek salad, and water and work there for two hours ($36 with tip). $36

2:42 p.m. — I meet D. and N. at the brewery next door where there are only outdoor, socially distanced tables. Our friends and their baby randomly walk up to us and of course we have them join us! We hang out for a few hours and then head home for the evening. $42

6:45 p.m. — We are home and showered! I scoop up chili with some cheese and sour cream and we relax for the rest of the night. We end up FaceTiming our best friends from Colorado for an hour and a half and watch football. We are both sore and slightly sunburned but it was worth it for such a great day!

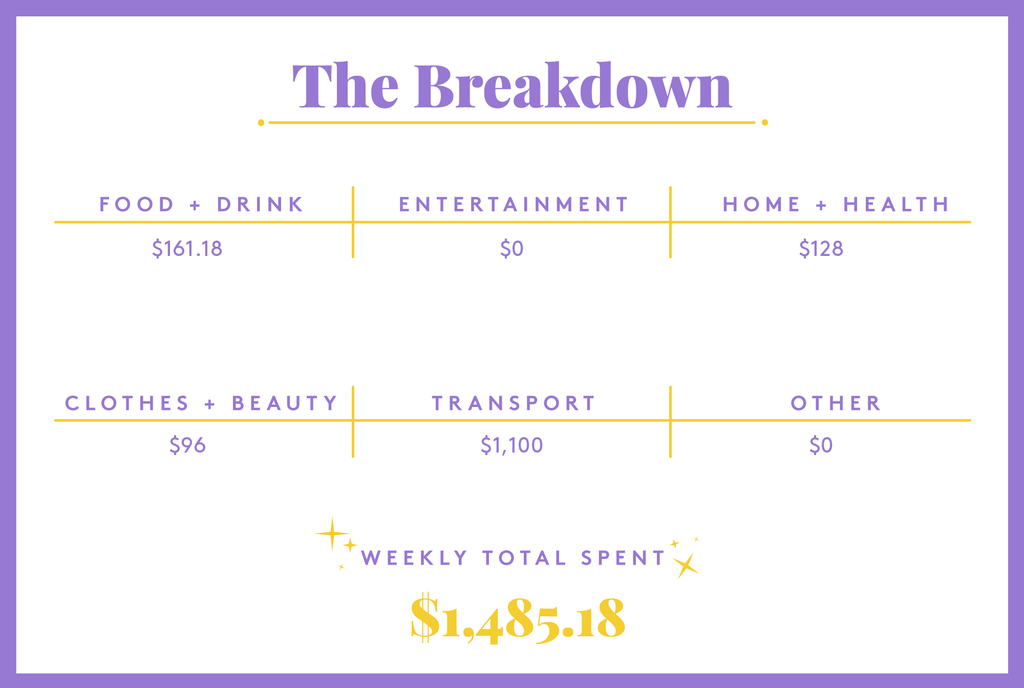

Daily Total: $78

Day Two

7:15 a.m. — Up for my barista job today. I work every other day at a local cafe and I work as a therapist on the other days. I love that I split my days as two days in a row in either of these capacities would be a lot less enjoyable. D. continues to work remotely. He gets to sleep in on the days he doesn’t do a morning run. I open up the cafe and heat up some breakfast casserole. I get free coffee all day and I drink a lot of it.

4 p.m. — I eat a salad from home for lunch and bought a bowl of soup and a cookie ($8). I finish the day with $94 in tips, which is amazing since I already make a livable wage. I do not count my tips in my salary or budget for them, but I put money in savings or towards our baby or travel fund. It ends up being about $500 a month. D. went to the store to get lunch supplies during the day and spent $6.90. $14.90

6:50 p.m. — I mail some packages after work, do laundry at my in-laws, and go for a two-mile run. I put my clothes away and cook some chicken sausage and spaghetti with sauce for dinner. D. gets home around 7:10 and we eat together. We chat for a bit and watch Operation Christmas Drop on Netflix followed by SNL. The movie is an 8.5/10 and the Dave Chappell episode of SNL I give a 9/10. We head to bed around 11.

Daily Total: $14.90

Day Three

8 a.m. — I’ve been stirring for a bit but finally get up. I didn’t fall asleep until 2 a.m. so I’m groggy today. D. slept great because he always does. I have my internship today and I WFH on Tuesdays. I wipe down the bathroom, shower, and warm up some egg casserole while D. heads out for a run. After my 90-minute morning meeting, I drive to Dunkin’ and get a coffee (gift card still) and then stop in a local consignment store. I buy a sweater that is finally half off that I have been eyeing ($8). I grab an avocado and lettuce for my salad for lunch at Giant ($5). $13

12 p.m. — I’ve had back to back sessions with clients and I’m already drained. I boil some eggs for my salad for lunch and eat in three minutes in between client sessions. I have four more sessions today followed by a 90-minute class tonight so I should probably drink some more coffee but I resist. D. pays an outstanding bill for his hand surgery earlier this year. $128

5:50 p.m. — I’m wrapping up my last client session and send out a quick blurb to our team about my sessions today. I have one call to make at 8 after my class but other than that I’m done for the day. I chill for a few minutes and watch Cold Case Files on Netflix while I warm up some shepherd’s pie from the weekend. I grab water and turn on Zoom at 6:30 for my class.

8:30 p.m. — Last email of the day sent, class finished, and I will finish my documentation later this week because my brain is fried. D. unloaded the dishwasher and reloaded it while I was in class (do we lead an exciting life together or what?! Also, it’s the little things!). D. and I watch/finish Schitt’s Creek (bawling!!) and then some Unsolved Mysteries. We head to bed around 10:30.

Daily Total: $141

Day Four

7 a.m. — Up and showering/getting ready for another day at the cafe. I pack a lunch and some breakfast to bring with me again today. I’m already thinking about what latte I’m going to make when I get there…

4 p.m. — Finish the day with $90 in tips! I’m getting my hair done this weekend so this week, all of my tips are going to that. I ended up buying some protein bites at the cafe ($4.28). I stop by Giant on my way home for a bag of Caesar salad ($4.22). At home, I change into running clothes to run before it gets dark and I end up running four miles. I then shower and start on schoolwork as I have assignments due on Wednesday nights and I still haven’t read the chapter for it yet. We alternate doing dinner with D.’s parents each Wednesday and it’s our turn to host. Around 7, I throw in tortellini and make the salad, and they all arrive at 7:15. We have a pretty good time. They leave at 8:30, so I can finish work. I wrap up around 9:15 and unwind by watching some Cold Case Files while D. watches something else in the living room. We go to bed around 10:30. $8.50

Daily Total: $8.50

Day Five

7:45 a.m. — Today is the one day a week I go into my internship. I warm up the egg bake for one last portion and head out to the office. I see one client in person and then see clients virtually from the office the rest of the day.

5 p.m. — I wrap up my day around 5 and send out my clinicals. I still need to finish up notes but I can do that later when I get home. I stop by my favorite thrift store in this area and buy a couple of tops. I call a friend on the drive home and catch up. $8

7:15 p.m. — I finish up a journal entry for my other class and turn it in. I warm up chili and have it all ready for when D. gets home at 7:15. Thursdays are exhausting for me and we don’t do much in the evening. We just cuddle, have sex, and go to bed after watching some Netflix.

Daily Total: $8

Day Six

7:15 a.m. — Last day of the week at the cafe! As far as food service jobs go, I hit the jackpot. I work by myself two days a week and with one person on Fridays. It’s an 8-hour long shift but I’m done at 8. It’s a great gig and a small town, woman-owned cafe, and I love the customers. I order an avocado toast with eggs and feta and later in the day buy more protein balls but I eat leftover chili for lunch. I end up making $58 in tips split with my coworker. $9.78

4:10 p.m. — I’m home and changing into my running clothes. It works out well to run on my cafe days since I need to shower after work anyway. I run 3.1 miles and then shower and settle in to do more homework. I am normally not this disciplined with my schoolwork but I am so sick of scrambling on Sundays to get it all done. When D. gets home I warm up leftovers yet again (I’ve been cooking two meals a week and having leftovers, and it’s so helpful for this season in my life right now). We watch Netflix for the rest of the night and I make some tea before bed. We head to bed around 11 because we have an early car appointment.

Daily Total: $9.78

Day Seven

7 a.m. — We are up early because we both have car repairs to get today. A low spend week is officially out the window! We take turns showering and then drive both of our cars to drop them off in tandem at the shop. We grab breakfast at a favorite diner (sitting outside). $30

11:30 a.m. — We leave Midas with both of our cars repaired. It hurts. $1,100

2:30 p.m. — I’m done with my hair appointment. I get partial highlights (I have thick hair so I have to pay for regular highlights). They look great. It’s $50 and I tip $30. $80

4:30 p.m. — We grab a six-pack from our favorite local brewery and head to our friends’ house. They are making pad thai! We end up staying there for a few hours and are home and in bed at 11:30. I pass out the second my head hits the pillow! It was a busy but good week overall. $15

Daily Total: $1,225

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Los Angeles, CA On A $80,000 Salary

A Week In Portland, OR, On A $34,000 Salary

A Week In Central Valley, CA On A $216,100 Income

from Refinery29 https://ift.tt/3b5Hjpj

via IFTTT