Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a content manager who has a joint income of $160,000 per year and spends some of her money this week on brie.

Occupation: Content Manager

Industry: Tech

Age: 35

Location: Boise, ID

My Salary: $75,000 + $8,000 bonus

My Wife’s Salary: $77,000

Net Worth: $794,000 combined ($320,000 in home equity, $145,000 and $21,000 in wife’s TSP and Roth IRA, $95,000 and $30,000 in my 401(k) and Roth IRA, $24,000 cash ($12,000 each) in HYSA emergency funds, $98,000 (her) and $30,000 (me) in taxable brokerage accounts, $25,000 worth of cars, and $6,000 in checking. My wife, Y., has a leg up on savings partially due to selling her house for a sweet, sweet six-figure profit when we moved in together. We’re permanently child-free and working towards FI/RE, both saving more than half our income.)

Debt: $115,000 mortgage, accounted for in home equity above.

My Paycheck Amount (2x/month): $1,650 (take-home pay after all deductions)

Pronouns: She/her

Monthly Expenses

Mortgage: $1,050

Cell Phones: $100

Internet: $50

Housekeeping: $100, paid by Y. — a recent anniversary gift that keeps on giving.

Utilities: $200

Pets: $200

Streaming/Subscriptions: $170 (Amazon, Netflix, Hulu, Showtime, HBO, MasterClass, Pandora, Idaho Statesman newspaper, New Yorker, Skylar Scent Club)

Car Insurance/Registration: $80

Charitable Donations: $150, plus we’ve both been donating a chunk of each stimulus check. My employer matches all my donations.

Roth IRA: We both max out our IRAs at the beginning of the year so that works out to $500/month each.

401(k): $1,600

ESPP: $100

Health/Dental/Vision Insurance: $160

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Going to college was the path of least resistance for me. I was extremely fortunate that my parents paid all my college expenses.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My family didn’t directly talk about money very often. I got the sense that it was taboo, or at least gauche to talk about. My parents imparted healthy money habits and values through positive role-modeling, such as, pay the higher upfront cost for quality goods, buy secondhand when it makes sense, and take good care of your possessions to save money later on. They also taught me to live below my means and be frugal where I can, but also don’t wait for retirement to enjoy my money; and don’t buy anything I can’t afford to pay cash for (other than a house).

What was your first job and why did you get it?

Teenage babysitting gigs earned me a few bucks, but my first real job was at a craft store when I was 20. I worked part-time while going to school full-time. My starting wage was $6.50/hour and I spent a good chunk of it on yarn and fabric to feed my knitting and sewing addictions.

Did you worry about money growing up?

Yes, but in hindsight, I recognize that was silly. We were solidly upper middle class, with my mom pulling a healthy six-figure income and my dad staying home to take care of me. They bought a second home in a nearby resort town, and we took annual vacations to Hawaii and to the east coast to visit family. They paid off both their mortgages early and built their wealth with smart investments. Growing up, though, there was a lot of mystery and misunderstanding about money on my part. For instance, once when I was little I asked if we could go to a fancy seafood restaurant for dinner, and my mom made some off-handed remark, like, “We can’t afford to eat there every night.” I made a few over-simplified calculations and became convinced that we were on the edge of poverty.

Do you worry about money now?

Yes, I worry, probably irrationally. Graduating college during the Great Recession and struggling to find employment right out of the gate instilled in me a scarcity and insecurity mindset that I can’t seem to shake. I know that my wife and I are in a privileged and stable situation money-wise, but it feels tenuous, fraught with uncertainty like it could all collapse at any moment.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I started paying for my own phone, clothes, gas, etc. in my late teens, but I relied on my parents for housing, food, and insurance until I landed my first full-time job at age 26. Now, my parents would provide a safety net if needed, but my wife and I would have to fall through our own safety nets before hitting theirs.

Do you or have you ever received passive or inherited income? If yes, please explain.

I inherited $10,000 from my grandparents’ estate when I was in my late teens. My parents gave me an allowance as a kid and bought me my first car (which I still drive nearly 20 years later).

Day One

8:45 a.m. — I wake up longing to sleep later, but our dogs and my bladder are all having none of it. I let the dogs out, bring fresh water to our chickens, and give everyone their morning treats. I cook fried egg poutine with local cheese curds for breakfast (it’s Superbowl Sunday, and I’m here for the snacks).

11 a.m. — My wife, Y., shuts herself in the office to lead an Alcoholics Anonymous meeting via Zoom. She’s been sober for years and I’m incredibly proud of her. While she’s busy I enjoy alone time on the couch, cuddling with the pups, drinking coffee, and reading the paper.

1 p.m. —Y. picks up veggie sub sandwiches for lunch, plus a sadly undrinkable iced coffee that tastes like someone incinerated a pile of espresso beans and soaked them overnight in skim milk. $25.79

4:30 p.m. — Time for sports ball. Go sports! We initially root for the team with the non-racist name, but switch allegiances upon finding out their star quarterback is a Trump supporter.

6 p.m. — “Our” team is having a rough day. Y. tries to tell me what’s happening in the game and I invariably react the wrong way, exasperating her.

8 p.m. — The game is almost over and we’re finally hungry for snacks. I make a mound o’ nachos for dinner and we stuff our faces.

11 p.m. — Glance at my email and check my Outlook calendar for Monday morning meetings. I work on a global team with coworkers on the other side of the planet, so sometimes meetings start at 7 a.m. (or, god forbid, 6). Luckily my calendar is clear until 10. The dogs and I pile into bed with Y. who is beset with cramps. I fetch her some ibuprofen and water.

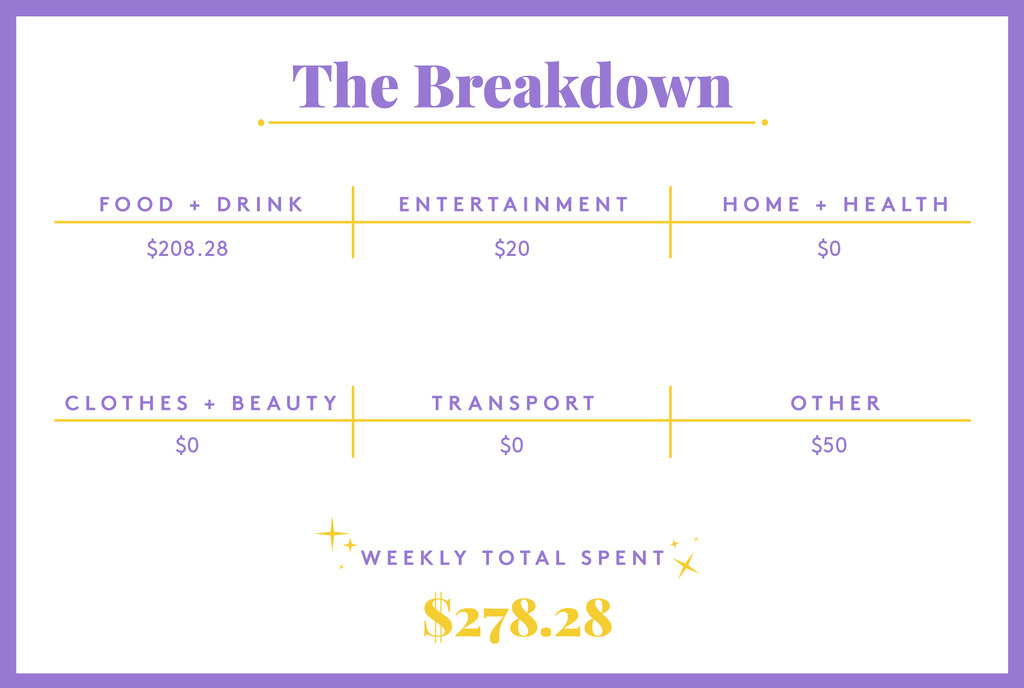

Daily Total: $25.79

Day Two

7:45 a.m. — Our dueling alarm clocks start going off. We both repeatedly hit snooze for a full hour. I groggily commence my morning phone business: catching up on a group chat, reading the NYT morning briefing email, checking my gambling stocks. I have a small brokerage account separate from my real investments where I swing trade using money I’d be comfortable losing. It scratches the itch for active, risky trading. I’m up 142% on my initial $1,000 after seven months.

9 a.m. — Finally make it to the (home) office after brewing coffee and tending to the animals. I start reading emails and figuring out priorities for the week. Y. leaves for work. She worked from home alongside me through most of the pandemic, but has to go in for the next few weeks. I miss having her with me, but it is nice to get a break from coordinating our meeting schedules and taking turns relocating to a different room when there’s a conflict.

10 a.m. — Realize I haven’t eaten breakfast, but I’m still full from nachos the night before, so I munch a mandarin and call it good. Join my first meeting of the day. Our smallest and neediest dog takes his position on my lap.

11 a.m. — The burnout is real. Over the last couple of weeks, I’ve hit a productivity wall. The stress that once powered me through work tasks has transformed into paralyzing guilt and shame and exhaustion. At least I’m not alone — my closest coworker friends are in the same boat. Instead of taking any action to remedy the situation, we trade memes about it throughout the day like responsible adults.

12 p.m. — I make a sandwich for lunch and scroll through Instagram. I check my investment accounts and find that I’ve hit a milestone: $150,000. My company’s stock is at an all-time high, so I sell a long-held chunk of my ESPP that I scored over 60% gains on, freeing up $5,000 to move to more diversified holdings.

1 p.m. — Meeting where I’m notified about a confidential, earth-shatteringly huge upcoming project that literally nobody needs on their plate right now. The dogs sense that I’m having an important conversation and serenade me with their barking accordingly. I get a text from my mom saying she got the first vaccine shot. Both my parents are super healthy, but they’re over 65, so I’ve been very worried about them catching the virus. My dad is scheduled to get his first shot on Thursday.

6 p.m. — Y. comes home with groceries: avocados, milk, frozen meals (for office lunches), diet soda, and an excessive amount of Valentine’s candy ($52.84). We sit on the couch to chat about our days. She plays a game on her PS5 while I make dinner — big salads topped with avocado and vegetarian chicken strips. We start watching season three of The Sinner on Netflix. $52.84

10 p.m. — I lock into revenge bedtime procrastination on my phone and snack on a couple of slices of toast and a mandarin before finally joining Y. in bed at 11:30.

Daily Total: $52.84

Day Three

7:45 a.m. — My 7 a.m. meeting was canceled, but I still have an ugly back-to-back Zoom block from 8-11, followed by a rush to publish a bunch of high-priority articles at precisely 11 a.m. One meeting ends 10 minutes early, so I use that pocket of time to make scrambled eggs for breakfast. Y. stops by my desk for a smooch and leaves for work.

10 a.m. — They’ve brought in a consultant for a teambuilding exercise, which is basically teaching us how to interact with other humans. Webcams are mandatory. Every new breakout room is an awkward, forced exchange with strangers, while salty IMs are flying behind the scenes. Coach repeatedly tells us to smile. I message some friends the iconic photo of Abbi and Ilana using their middle fingers to prop up the corners of their mouths.

11 a.m. — The technology gods smile upon me as I’m able to get all my urgent publications out the door on time with no system issues. I send some emails, closeout some tickets, and then step away to heat up lunch: veggie spring rolls with sweet chili sauce and a Coke Zero.

1 p.m. — Another block of meetings, but at least they’re productive? It’s been a busy day and I’m getting a lot done. Later in the afternoon, I have a weekly fun Zoom call with coworker friends.

6 p.m. — Y. comes home and we cuddle up in bed to debrief about our days.

6:30 p.m. — I slice up a couple of homegrown onions to caramelize. Last season we urban farmed like our lives depended on it; Y. rebuilt all the garden beds in our backyard plus two new raised beds out front, and she rototilled a huge new patch of land to grow corn, melons, pumpkins, beans, and squash. The raised beds were bursting with salad greens, root veggies, and sugar snap peas, and the backyard garden was full of tomatoes, cabbage, peppers, eggplants, herbs, raspberries, and an entire 4×14 bed of sweet onions. Our homegrown produce and chicken eggs helped us minimize trips to the grocery store in pandemic times. By now we’ve used up everything except for a few cubes of frozen basil, a pie pumpkin, and two sacks of cured onions hanging in the basement.

7:30 p.m. — Dinner is finally ready. I’ve been trying to replicate a vegetarian Philly cheesesteak sandwich that Y. fell in love with in San Diego. I load up a couple of hoagie rolls with onions, Impossible beef, chanterelle mushrooms, and melted American cheese, and it’s not quite restaurant quality, but it’s tasty.

9 p.m. — I spend a few hours working through a Diversity, Equity & Inclusion prework packet for a training session tomorrow. Included are a couple of excellent YouTube videos about our system of white supremacist capitalist patriarchy: “How Can We Win” by Kimberly L. Jones and “People, Systems, and the Game of Monopoly” by Allan G. Johnson. I come away with a deeper understanding and appreciation for some of the more vilified actions of fringe BLM activists.

Daily Total: $0

Day Four

7 a.m. — Wake up, do my hair and makeup, put on a real shirt, plant myself in front of my computer and adapt to the glare of my ring light and the strain of proper posture. I’ll be on camera all day, so I need to dampen the scoliotic swamp-witch vibes I exude when I’m comfortably hidden behind a closed webcam cover.

7:45 a.m. — Join my Zoom session. I’m in a two-year leadership program with monthly sessions on local healthcare, education, government, etc., plus volunteer service projects and a monthly featured nonprofit. Like my brief stint in grad school, I applied for this program during a fleeting spell of ambition and later regretted it due to my commitment to laziness and free time. The program is actually awesome, it’s just a bummer to miss out on the in-person experience. Nine solid hours on Zoom is draining. Today’s session topic is business, and the featured nonprofit is a catering company that hires and trains opportunity youths. I chip in $50 and submit a donation match request through work. $50

10:30 a.m. — I’m excited for the DE&I session, ready to discuss whether it’s reasonable to think we can sufficiently change the game while we (a group of mostly white, affluent, fine young capitalists) actively play and benefit from it. Conversation in the Zoom chat turns to complaints of “reverse discrimination” and worries over cancel culture. Yep, I’m still in Idaho. I suppress my auto-snark and offer gentle dissent instead. The speaker prompts stimulating breakout group conversations about our backgrounds, culture, and the concept of otherness.

12 p.m. — I make stir-fried veggies and rice for lunch. Y. is working from home and takes a break to eat with me. After lunch, the rest of the Zoom lineup includes experts on smart growth, startup incubation, the SCARF model, driving effective teams, and preparing for the future of work. We end with a social hour, breaking out into groups to design fake companies and job descriptions around fanciful job titles. My group of overachievers makes a detailed slide deck for our presentation.

6 p.m. — I’m wiped out and I have a headache from wearing a headset nonstop. I want to make something more interesting for dinner, but I need fast comfort food, so I make grilled cheese sandwiches and edamame. I had grand plans to catch up on work this evening, but it’s not happening. I’m a husk with nothing left to offer the world. Netflix instead.

Daily Total: $50

Day Five

6:15 a.m. — I’m hosting a meeting at 7, so I get up, get ready, and make coffee. After the meeting, I take a break to cook breakfast and then clean the house for half an hour. Y. leaves for the office.

11 a.m. — I make vegan chicken nuggets for lunch and sit on the couch reading articles about the Fourth Industrial Revolution. I’m taking a short break from worrying about climate change, and instead am fretting about widening economic disparity and social unrest as a result of technological advancement. I hope our future robot overlords are generous enough to develop a San Junipero and archive my consciousness in perpetual digital utopia.

12 p.m. — I’m very snacky all day. Our Girl Scout cookie order was delivered today, so I dig into those, mini mozzarella balls, mandarins, and a protein bar.

1 p.m. — Weekly one-on-one meeting with my boss. I ramble on about some content innovation ideas that popped into my head during the leadership session. She seems interested. I have an ulterior motive of lessening the impact of the confidential mega-project. My group is already resource-constrained, and on top of barely having enough writers for our current projects, I’ve become a bottleneck in the review process.

5 p.m. — Y. comes home excited about hanging out with her sister the next day. They both took Friday off and her sister is driving in from the small town where she lives an hour away. We haven’t seen much of her for the past year due to COVID. She’s a teacher and is frequently exposed to small-town anti-maskers. Y.’s excitement turns to grumpiness when she’s having trouble finding a restaurant with a covered patio. It’s supposed to snow tomorrow, and they need to sit outside for COVID safety. Frustrated with Google results, she drives downtown to location-scout in person.

6 p.m. — I do some couponing then pry myself off the couch to go grocery shopping. I pick up a bunch of fruit, veggies, salad mix, eggs (our chickens don’t lay in winter), crackers, various cheeses (the store is sold out of feta, thanks to a TikTok video, but I get brie and sharp cheddar for Valentine’s charcuterie), bread, sour cream, and chips. $75.65

7 p.m. — I unload groceries then make buffalo cauliflower wings and quinoa for dinner. We watch more of The Sinner while we eat. Later, Y. goes to read in bed and I stay up with my favorite hate-watch TV show: MTV’s Catfish. Their COVID format is kinda boring. There’s still plenty to hate, though.

Daily Total: $75.65

Day Six

8:30 a.m. — Y. couldn’t get to sleep last night and moved out to the living room couch, which meant I could starfish across the entire bed. I planned to wake up early and have a slow, leisurely morning, but instead, I wake up late and then have a leisurely morning anyway. It snowed a bunch overnight.

9 a.m. — Sister-in-law arrives. She and Y. go sit together out on the back porch. One of my handy wife’s summer projects was remodeling our covered patio; we added comfy outdoor sectional furniture, but never got around to installing a radiant heating system for winter, so it’s ultra-chilly out there. They load up with blankets and coffee and chat for a couple of hours before leaving for lunch.

9:30 a.m. — I work on reinvesting the funds I freed up from my ESPP. After researching megatrends over my holiday break, I’ve been building positions in a variety of specialized ETFs focused on clean energy, AI, robotics, genomics, cybersecurity, infrastructure, fintech, weed, and esports. I move about $4,000 into my favorites.

12:30 p.m. — Stress-eat my lunch (sandwich) while untangling an urgent request that seems difficult but turns out not to be too bad. A winter storm warning pops up on my phone promising an additional four to six inches of snow the next day. Y. and I had planned to drive an hour away to bring our nephew gifts for his sixth birthday on Saturday, but driving is supposed to be “difficult to impossible,” so we reschedule for Monday (which we all have off for President’s Day).

3 p.m. — My co-workers nominate me to be profiled as a “woman of inspiration” for International Women’s Week. Impostor syndrome kicks in to question if this nomination is ironic — lately, I feel like more of a Bartleby the Scrivener than a Sheryl Sandberg, but I’m flattered regardless and I submit the requested info.

5 p.m. — Got a notice in the mail that our mortgage payments are increasing to cover escrow. It’s happened every year. Our house has nearly tripled in value since I bought it in 2013; in today’s market, you would be lucky to find an empty lot in a sketchy part of town at the price I paid for this three-bedroom on a double lot. The annual property tax increase is something I didn’t anticipate as a homebuyer — I thought as long as I had a fixed-rate APR, my mortgage payments would stay roughly the same.

6 p.m. — I bake a pasta dish for dinner, with spinach, herbs, veggie crumbles, and a blend of cheeses. I think it’s delicious but Y. isn’t into it. I tell her she should fire her personal chef. We eat Girl Scout cookies for dessert and watch The Dead Don’t Die, a zombie apocalypse comedy that got mostly bad reviews…but it hits me just right, I think it’s hilarious. After the movie, we bundle up and take a walk. The neighborhood is silent, bright with snow, and it feels like Christmastime. My glasses fog up every time we pause to kiss.

10 p.m. — Y. goes to bed, and I stay up listening to ASMR and reading ARK Fund’s Big Ideas 2021 innovation research. ARK manages three of the ETFs in my investment portfolio. Their research and predictions are fascinating, and I love that their Fortune Teller in Chief is a woman.

12:45 a.m. — After dozing off on the couch I finally get ready for bed, let the dogs out to potty, then relocate to the bedroom. Unfortunately, now I am wide awake and restless, so two of the dogs and I move back to the couch for more ASMR and scrolling Reddit into the wee hours of the morning.

Daily Total: $0

Day Seven

10 a.m. — More snow accumulated, about eight inches deep and growing. I step into snow boots and wade out to tend the chickens and bring them treats. I’m glad Y. covered their run this year so they have more than just the coop to stretch out in on snow days.

10:30 a.m. — Warm up with coffee, the newspaper, and a living weighted blanket made of dogs. Send Galentine’s Day messages to a few of my favorite land mermaids. After Y. wakes up, I make breakfast: eggs and avocado toast with veggie bacon. We decide to open our Valentine’s Day gifts a day early. She got me a bottle of Cult + King Tonik (a root spray that does wonderful things for my hair), and I got her a kit for growing mushrooms, a handmade bar of soap, and some artisan chocolates.

2 p.m. — I make salads with tomato and mozzarella for lunch. We find out that the senate acquitted Trump in his impeachment hearing. Not surprised, but certainly disappointed. Can’t wait for history to judge those complicit senators.

3 p.m. — We suit up in snow gear and set out to make a snowman. The snow is not cooperating, it just crumbles. We make the tiniest, saddest snowman, with gravel eyes and a twig mouth, then take a short neighborhood walk in the snow.

6:15 p.m. — Stop by a coffee shop to pick up a couple of peppermint mochas ($10) on our way to a day-before-Valentine’s date night. We buy tickets ($20) to a drive-in movie special: a punk puppet zombie musical projected on the side of a truck in a vacant lot down by the river. Pinnacle of romance, no? Our local zero-waste market distributes pre-ordered appetizer boxes ($30 with tip). This is our first date out in the real world since last fall when the weather was mild enough that we could dine al fresco. We’ve had some extremely creative and fun lockdown date nights, but damn, it feels good to get proper dressed and leave the house. $60

6:45 p.m. — I spot a friend sitting in her car behind us. I send her some creepy texts and zombie emojis. She and her friend pop out for a masked chat before the movie.

7:30 p.m. — The movie is so great. We’re getting really into the audience participation — flashing brake lights for blood splatter, hazard lights for booze, etc. The snack box is awesome, too: a coffin-shaped chunk of brie, heart-shaped housemade crackers, chevre with blood orange marmalade, deviled eggs with pimiento olives (made to look like eyeballs), movie popcorn cookies, and “sweet brains” raspberry treats.

8:45 p.m. — We stop at a drive-thru to pick up Beyond Meat tacos and churros ($14). The dogs are beside themselves with joy when we return to our hermitage. We eat dinner, Y. watches Netflix, and I scroll Instagram. We go to bed early, around 10:30. $14

Daily Total: $74

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Pennsylvania On A $106,000 Salary

A Week In Westchester, NY On A $525,000 Income

A Week In Minneapolis, MN, On A $201,000 Income

from Refinery29 https://ift.tt/3fpagQE

via IFTTT