Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a data analyst who has a joint income of $201,000 and spends some of her money this week on Brooklyn Tweed yarn skeins.

Trigger Warning: This Money Diary mentions miscarriage.

Occupation: Data Analyst

Industry: Software

Age: 35

Location: Minneapolis, MN

My Salary: $71,000

My Husband’s Salary: $130,000

Net Worth: $90,100 not including our house (Personal savings: $2,000, joint checking and savings: $30,000, personal 401(k): $80,000 (3% match), personal HSA: $2,300 minus debt)

Debt: $24,000 in student loans, $200 in credit card debt. Mortgage is $450,000.

My Paycheck Amount (biweekly): $2,038

Husband’s Paycheck Amount (biweekly): $3,600

Pronouns: She/her

Monthly Expenses

Mortgage: $2,900

Student Loans: $300 paid from my salary (not joint)

Personal HSA: $100

Personal Savings: $100

Streaming Services and Internet (Netflix, Crunchyroll, Peloton, Kindle, Sling): $200

Patreon: $15

Cleaners: $200

Car Insurance: $165

YMCA: $36-$79, depending on insurance/corporate discount

Utilities: $600

Phone Bill: $140, split between me, my mom, and my sister (I manage the account so it comes out of my bank. My husband pays for a plan for himself and his father)

Dog Daycare: $150

Joint Savings: $2,000-$3,000

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

There wasn’t really an expectation in my family for higher education. None of my grandparents or my dad got a Bachelor’s degree, and my mother went back later in life for a nursing degree. My parents vaguely disapproved of my liberal arts education because they valued college only so long as it related directly to a profession. I graduated from a local university with a Bachelor’s in Anthropology and then went to a tech school in my late-20s for an associate’s degree in software development. My parents covered about 25% of my student loans and I took out federal loans and worked through college to pay for loans and living expenses.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

The main conversations around finances as a kid were mostly about what not to do — no credit cards, buy used, brand names aren’t important. My parents gave me $20 a month as an allowance, and my main memories of money are my parents being angry with me over late library fees.

What was your first job and why did you get it?

I started babysitting for neighborhood families at about age 13 during the summers and on weekends. Once I turned 16, I got my first “official” job at a fast-food chain. I worked there about 20 hours a week until I graduated from high school. Money from my part-time jobs went to paying for my social and school activities, like band trips, movie outings, gas, sports fees, and my hobbies (mostly books).

Did you worry about money growing up?

I was vaguely aware we didn’t have a lot of money, since we drove used cars and I had to get a job for spending cash. But my parents owned our house, we’d been to Disneyworld twice, and we never lacked necessities. I felt comfortably middle class. I’ve become more aware of my parents’ struggle as I’ve grown up and learned more about finances, and I’m amazed how effortlessly they pulled everything off.

Do you worry about money now?

I worry about money a lot now; I could win a million dollars, and I’d probably still be concerned I don’t have enough in case of emergencies. Every time I read a financial article about where my 401(k) or emergency savings should be for my age, I have a small panic attack. But I also struggle with how much I enjoy spending the money I earn on frivolities. I’m trying to find the balance between being prepared, and that you can’t take it with you. It’s an everyday battle.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I’m not sure when I became completely financially responsible, as my parents always helped out when they could. They took on a portion of my student loans and paid for my dinner once or twice a semester when we’d go out to a restaurant; I paid for all other living expenses as soon as I started college. Twice I bought my parents’ used cars at a reduced price, and they lent me $1,000 once after an accident that totaled my vehicle (insurance wouldn’t cover due to the age of the car).

Do you or have you ever received passive or inherited income? If yes, please explain.

My parents gave me $5,000 in 2019 for my wedding, and I inherited $5,000 last winter after my father passed that went towards my down payment.

Day One

7:30 a.m. — I wake up to my “gentle” alarm, daydream, and check Twitter. Half an hour later, I drag myself into a shower. I take my thyroid medication, wash my face with PanOxyl acne wash, and rush through my skincare routine — The Ordinary toning solution with reusable cotton pads, Drunk Elephant vitamin C serum, and Clinique moisturizer. I also put on some Bath & Body Works Vanilla Bean body lotion. I feed my dog and walk her for about 15 minutes around the block.

9 a.m. — Mondays at this point in the season are nice and slow. My coworker isn’t too smug about the Packers game yesterday, which is more than I deserve after making fun of her for the Vikings all season. I start working on documentation for an internal training on databases I’m co-hosting next month. I quickly buy some Bumble and Bumble value shampoo with my credit card from the Sephora website before I forget. $60

11 a.m. — One of the big perks of my job was free lunch, and even after nearly a year of WFH, I’m still pretty lazy about making my own lunch. I warm up leftover chili and add shredded cheddar and plain Greek yogurt. My husband (R.), who is also WFH, and I discuss our dinners for the week and we put together a grocery list. My husband has Celiac disease, so I do all of the grocery shopping and general errand-running so he can avoid COVID exposure as much as possible.

1 p.m. — The doctor bills for my “fertility roller coaster” week have hit, and they’re about as painful as I expected, even after insurance. I had my first positive pregnancy test after Christmas with bleeding and cramps. A few weeks, two OBGYN visits, and two ultrasounds later, it seemed that I had a blighted ovum. A few days later, I ended up in the ER with stomach pains, and it turned out I had a rare situation where I had miscarried in my uterus but also had an ectopic pregnancy. They rushed me into laparoscopic surgery and removed the tube. I don’t have enough to cover the latest OBGYN visit, ER visit, both ultrasounds, and emergency surgery. My husband offers to pay the majority out of his HSA. I’m yet again grateful for his patience and generosity, but I feel so much shame over how expensive my desire for a kid is ending up. (My husband wants a kid as well but is less concerned about how long it takes, while I’m staring down the fertility clock.) $5,100

3 p.m. — My client status calls are done for the day — we’re early into our projects, so the meetings are thankfully short. R. and I take our dog on a mile walk on the trails around our house every day. There are miles and miles of winding, connected trails around here, which was a huge blessing for my running when the Y closed. It wiped out most of my savings to pay for my portion of the down payment, but I absolutely love our house and where we live. (My husband took on a larger portion of the down payment with a small inheritance, and the sale of his old house, which I inhabited with him but did not co-own.)

6 p.m. — I wrap up my cases for the day. I’ll need to check back in tonight on a few automated scripts I’m running to make sure the data looks good before everyone logs back in tomorrow. I change into exercise leggings I got from Target, an Under Armour high impact bra, an Athleta tank top under a long sleeve top, and Smartwool socks. I kiss R. goodbye and prepare myself for the Minnesota winter with Sorel boots, a Columbia long jacket, and my favorite Merino wool shawl (I might have, like…. eight of them, with another one on my needles right now). I am a freeze baby, so going anywhere requires a lot of layers.

6:30 p.m. — I stop by the Subway drive-through on my way to the gym. I order a turkey spinach salad with extra protein, tomatoes, cucumbers, banana peppers, and ranch, a bag of chips, and a drink. I tip an extra $2 on my debit card and eat in my car. I check the Y’s website to see how their capacity is. MN law says gyms can only be at 25% capacity, and the Y has a neat counter on all their locations that shows how much of that capacity is currently filled. I try to go half an hour or so before closing when it’s the least crowded, and only if capacity is under 20%. Tonight I’m lucky at only 15% capacity. $15.50

7 p.m. — I put on my Under Armour mask, as masks are required everywhere in the Y now except the pool. I haven’t lifted in over two months, so I start with bodyweight squats, military standing press, and dumbbell chest flies with light weights. I’ve missed this so much; lifting is the only form of exercise that actually makes me feel comfortable in my body. I’m really glad for the mask and that the weight area is deserted because I’m crying right now from the relief.

8 p.m. — I stop by Target on my way home for groceries. This is my favorite time to shop for groceries, as Monday nights here are usually pretty empty. Unfortunately, they have surprisingly low stock tonight, so I will need to stop by another grocery store as well this week. It’s a huge blessing that more and more stores are carrying gluten-free alternatives, so my husband can mostly eat normally, but the inventory can be very uneven. It’s a rare week where I don’t end up shopping at two stores. I only get a few groceries: yogurt packs, sharp cheese, Colby Jack blocks, tomatoes, onions, lemons, Diet Pepsi, dog food, and envelopes. $48.39

9 p.m. — R. has fed the pup once I get home. After I knit my cardigan for a bit, I do a very slow (like 15 min/mile) jog on our Peloton Tread. After months of research and agonizing over getting a treadmill, we finally broke down and bought the Tread+ in November with our year-end bonuses. I was so psyched when it was delivered right after Christmas.

10 p.m. — We walk the pup around the block before bedtime and I take a 30-minute bath when we get home. I finish one of the romance novels by Alyssa Cole I’ve been devouring on my Kindle, and immediately buy her latest one on Amazon. After the bath, I brush my teeth and put on some Olay Retinol night serum. My husband is a night owl and stays up two to three hours after me, so he cuddles me in bed while we scroll through dog Instagram accounts until I fall asleep. $5.99

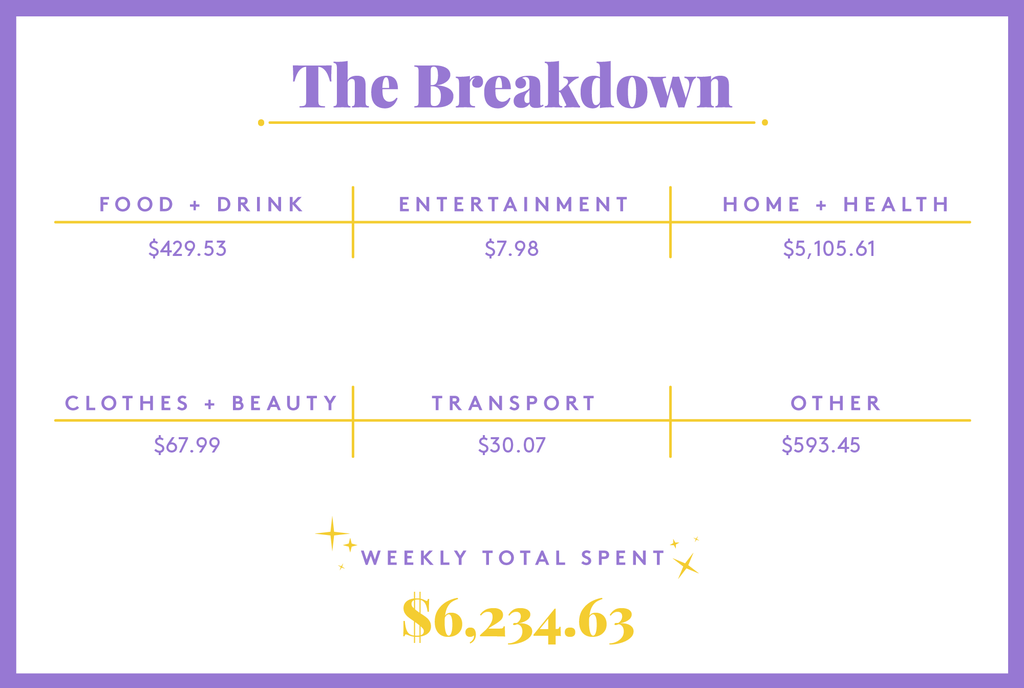

Daily Total: $5,229.88

Day Two

8 a.m. — I make it into the shower 15 minutes after my alarm; this is a PR for this month. I am very rarely on camera during client or internal meetings (insert joke about never letting developers talk to regular humans), so I dress in my “uniform” of Lucky skinny jeans, a cami, and a long sleeve solid color crew neck or Henley shirt from Duluth Trading Company. I feed my dog and walk her; she’s particularly sniffy today.

9 a.m. — I sign into Mint.com to see how my budget is for this month. I desperately need new jeans. I browse Madewell and Lucky, but it’s a bad idea for me to buy jeans without trying them on. As usual, they are out of my size. Maybe I can just live in yoga pants and exercise leggings until the world is sane again?

2 p.m. — Stacked impromptu meetings means a Perfect peanut bar and some turkey with a buttermilk biscuit for lunch. I scroll Instagram as I eat, which is a mistake, as I see that one of my favorite dyers has a yarn kit with my favorite color combos for a popular new knitting pattern. FOMO is one of my biggest struggles with yarn purchases; skeins or kits from independent dyers are usually very limited and exclusive. They’re also usually half my monthly shopping budget at least.

3 p.m. — On our walk bundled up against the cold. R. is as bad as I am about buying jeans (I’ve patched all of his as well), and we debate driving down to the Mall of America and trying on jeans in person at both Madewell and Lucky. Masks are required everywhere indoors here, but the risk still makes my husband nervous. I joke about actually sewing us some pairs; jeans are an intense project, and I’ve never drafted a man’s pants pattern, but maybe I’m bored enough?

6 p.m. — Project scope change means I’ve still got work to do, but my mushy brain needs a break. While R. makes jambalaya with quinoa, chicken, and andouille sausage for dinner, I do a 30-minute walk/run class on the Tread. I swear I’m last on the leaderboard, but I finished! We watch an episode of The Mandalorian as we eat.

8 p.m. — I take a work break to feed the pup and browse MoodFabrics.com for stretch denim. I try to buy fabric locally as much as possible, but denim for jeans has to be *so* specific. I order swatches of three different medium-weight stretch cotton denim. R. surprises me by cleaning the entire kitchen so I don’t have to do that on top of work as well; sometimes I can’t believe my good luck in marrying him. $7.99

Daily Total: $7.99

Day Three

7 a.m. — I’m out of bed and in the shower extra early today as our dog has her annual vet appointment. She’s still snoozing cuddled up against R. on the bed when I come out dressed and ready to go, but perks right up at the mention of breakfast. I feed her, walk her around the block, and then strap her into her dog seat belt in the backseat of my car.

8:30 a.m. — I’m pretty lucky in that my dog LOVES the vet; more people to pet her! She’s adorable but embarrassing in her enthusiasm. They update her shots, do some standard blood work, and she gets tons of treats and love from the whole office. I still have a few months worth of heartworm and flea tick medication, so the bill isn’t quite as much as usual. I pay with the joint credit card. $299

9 a.m. — I stop at the Caribou Coffee drive-through on the way home and get a medium iced matcha tea latte, and a plain bagel. I’m almost always cold, and yet the ironic thing about me is I dislike hot drinks; I contain multitudes. Pup of course gets a treat from them (and half my bagel) for being so friendly. I pay with my debit card. $6.65

10 a.m. — I look at our gas, water, and electric bills for this month. Everything is set to autopay, but I like to track charges. R. has always lived very frugally but with a good salary, so he doesn’t budget his personal account and rarely looks at our joint budget unless we’re making a large purchase. I live entirely in the confines of a personal budget, as I am really not frugal, and the habit of tracking every dollar even in our joint is still engrained.

11 a.m. — I get a notification that the Kindle book I have on hold at the library (Invisible Women by Caroline Criado Perez) is available, yay! The vast majority of my reading comes from renting out Kindle books from Hennepin County Library. I used to waste SO much money on late book fees and paperbacks, so e-books have been a huge blessing for my budget.

12 p.m. — I head to Cub Foods for whatever I couldn’t get at Target; the store is usually less crowded at lunchtime. I get two boxes of gluten-free elbow pasta, heavy cream, eggs, andouille sausage, two packets of chicken breasts, two packets of ground beef, zucchini, green onions, cilantro, feta cheese, frozen French fries, three gluten-free pepperoni pizzas, cat food, and cat litter. All of it goes on the joint credit card. $108.66

12:30 p.m. — I’m also naughty and am craving carbs, so I stop by Raising Cane’s drive-through for chicken fingers, a coleslaw, and a Diet Coke. $9.42

4 p.m. — R. and I discuss adding $25 a pay period to my HSA contribution on our walk. It’ll lower my paycheck amount to the joint account, but he’s all right with that while I try to boost my HSA back up. When we get back, I have an email reminding me about registration for a September Virtual to Live half marathon. I register through Race Roster with my credit card, and since I did the same half marathon virtually last summer, I get a discount. $15.50

6:30 p.m. — I pull out the rice cooker (like the Midwestern Scandinavian I am) and make pork tonkatsu. We’re trying out a new brand for gluten-free panko, and it’s pretty darn good! My only regret is that I didn’t have time to run to United Noodles for some Kewpie mayonnaise. R. indulges me in finishing an episode of Bargain Mansions. After dinner, we both clean the kitchen and generally straighten up the house in preparation for the cleaners tomorrow.

10 p.m. — After dinner and wrapping up work, R. does a 20-minute glutes/legs bootcamp on the Tread; I join him for the strength training, and my abs are still completely dead. R. dropped his gym membership back in March when the Y initially closed, and I’ve missed working out together, so it feels fantastic to get back into the routine. Pup’s hindquarters seem a bit sore as we walk around the block. I practice a short Japanese vocab lesson on Duolingo before bed.

Daily Total: $439.23

Day Four

7 a.m. — We’re both up early so we’re ready in time for the cleaner to arrive. I use Aveda dry shampoo, wash my face in the sink, and finish off my skincare routine, then do last-minute tidying. While R. is showering, I feed the dog and let her outside. Usually, on days like today, I take her into daycare for the day, but she seems to be having some side effects from her shots yesterday. I leave a message for the vet and decide to keep her home with me.

9 a.m. — The cleaner arrives. R. hired them back in his bachelor days as a rare indulgence, and they’ve been absolutely spectacular. Given COVID, we usually try to be out of the house so they don’t need to wear masks, but I’ve got back-to-back meetings I can’t miss, and sadly nowhere to go with an Internet connection (miss you, coffee shops.) R. leaves for the morning and I shut myself and the pup up in my office with a mask on so they can clean in peace.

1 p.m. — The cleaner is done and R. picked up lunch for both of us on his way home; gluten-free grilled bourbon chicken with brown rice. He has a coupon for a free entrée! I add two pieces of Dove dark chocolate for dessert. I feel a little guilty eating out again, but the kitchen is so beautiful after the cleaners I don’t want to ruin it! I put chicken breasts, black beans, corn, tomatoes, and cream cheese in the crockpot for dinner tonight. $8.56

3 p.m. — Pup has been worrying me with her symptoms, so we’re back at the vet. Luckily she doesn’t have a fever and her blood work looks good, so our theory is she’s just having a reaction to the vaccines yesterday. R. texts that the pup is family, so of course use the joint credit card, and then gently teases me about what an anxious mom I am. $214.45

4:30 p.m. — Back home and feeling a bit emotionally wrung out. Pup and I lay down for a nap and end up crashing for over an hour.

6 p.m. — We dish up dinner and start the next episode of Bridgerton. Oh, it’s *this* episode that I’ve heard so much about! It’s enough to distract me from my knitting, ha. After the episode is finished, I get dressed in my exercise leggings, Shefit sports bra, an Athleta tank top, and long sleeve top and head out for the gym. It’s a slightly higher capacity at 20% tonight, but the weight area is less crowded. I’m still lifting light, so I do deadlifts with dumbbells, curls, tricep dips, and incline push-ups (that last one was maybe pushing it as my abdomen feels tender as I drive home.)

9:30 p.m. — I feed pup and give her her medication when I get home as R. is wrapped up in a video game with friends, and then head straight to the Tread for a three-mile run. I feel so wonderful and spoiled for finally having my own treadmill; it feels worth every penny. My best friend T. and I have an online watch party for Bridgerton as I knit my cardigan and get into a fun discussion about corsets. Based on the vet’s recommendations, we let pup outside instead of walking her, and R. tucks us both in for the night.

Daily Total: $223.01

Day Five

8 a.m. — Up and at ‘em. I’ve got a lot to get done today since I took a half-day yesterday for the vet. I switch up my Bath & Body Works lotion to the Strawberry Pound Cake scent I got last week and R. wonders why all my candles and lotions have to smell like food. I feed pup and let her outside and she seems to be doing better today.

12 p.m. — One of those busy technical brick wall days where I bug my senior developer a lot. I take a break to heat up jambalaya leftovers with two oatmeal chocolate squares. After I’m done eating, I take 20 minutes to read a book through the Amazon desktop app and knit the simple part of a shawl I’m working on. I’m trying to teach myself how to knit by “feel” more so I can be more productive with my hobbies.

3 p.m. — I take a small break from tasks to update my HSA contributions through our HR website. I panic a little over the idea of having another ectopic pregnancy and/or other expensive infertility complications after seeing my HSA halved this year even before surgery.

3:30 p.m. — Now I’ve made myself sad, so I sign up for another 10k virtual race for February; the anniversary of my dad’s passing is coming up and it’ll be a good distraction. I also add a Tracksmith sweatshirt from Mill City Running to my Purchase Wish List spreadsheet. In the spreadsheet, I lay out my purchases for each month, and try to budget in future shopping. Documenting future purchases has been a good way to ward off the temptation to buy something now when my budget can’t take it. $35.50

6 p.m. — We walk the pup just around the block and then R. gets started on dinner; homemade cheeseburgers and French fries! I lay down for a quick nap while he cooks and we watch an episode of WandaVision as we eat. Afterward, he heads off to play some video games with his friends and I have a quiet night on the couch trying to hydrate, rewatching Crash Landing on You, and making good headway on my cardigan.

10 p.m. — After taking care of pup, I go into my office to poke a bit more at work and do my Friday night ritual; looking up therapists I can’t afford, as my health insurance doesn’t cover therapy, and I’ve always made too much for a sliding scale fee. With everything that’s happened in the past year, I should probably try harder to see someone, but I just can’t figure out how I could afford it straight out of pocket. I buy a song I’ve listened to a thousand times on Spotify off the iTunes store and add it to my running playlist. After we walk the pup, I collapse into bed. It feels like I’ve barely done anything today but I feel fried. I turn on a short Peloton sleep meditation session on my phone and drift off. $1.99

Daily Total: $37.49

Day Six

7:30 a.m. — I feel surprisingly alert this morning and am out of bed without hitting snooze. I put on my running leggings, Shefit high impact bra, Under Armour tank top, a long sleeve shirt I got from one of my races (best perk), running socks, and my latest pair of ASICS. I feed the dog and let her out into the backyard. She’s straight-up romping through the snow, so it seems she’s back to normal! On my drive out of the neighborhood, I stop by the gas station to fill up my tank. $30.07

8:30 a.m. — The local sports dome has restricted the track to reservations, and I was so lucky to snag a Saturday morning spot. I always try to do my long runs on actual ground for my joints, but the trails are way harder in the winter and I’m still a bit shy about road running. Last summer during a long run session, a group of teenage boys in a pickup truck followed me around honking and yelling until I lost them behind the high school. I get a lot less judgment as a plus-sized runner at the dome or on trails where it’s just other runners around. I put on my Under Armour mask (masks required for everyone) and start my run.

10 a.m. — Run turns into jog turns into a walk and my body says I’m done after just two miles; seems I might have pushed a little too hard this week. I head over to the nearby Costco. R. is a Costco devotee, so I usually go to stock up every other week or so. I pick up chicken breasts, turkey breasts, a package of chicken sausage, a tub of spinach, artichoke and parmesan dip, a container of guacamole packs, two bags of oatmeal chocolate chip squares, a box of gluten-free saltine crackers, and a few boxes of protein bars. $161.68

11 a.m. — R. has ordered us lunch online, as is our tradition, so I swing by the restaurant to pick up our salads and head home. $34.30

12 p.m. — I plant myself on the couch with a heating pad for the foreseeable future and eat my delicious salad and some Dove dark chocolate.

3:30 p.m. — I finally finish the last episode of Mr. Sunshine and text about it a bit with my mom; we decide to do The King: Eternal Monarch for our next K-drama virtual watch-along. I also finish my cardigan!! R. and I take the dog for a very slow mile walk so I can shuffle along. He was a sweetheart and stopped at Target for cotton balls and Tylenol, as my mom advised me to lay off ibuprofen after a recent inflammation flare-up. $5.61

10 p.m. — After an epic nap for everyone, I’m back on the couch while R. makes dinner; instant pot mac’ n cheese with sharp cheddar, Colby jack, gluten-free noodles, andouille sausage, and heavy cream. We watch a League game and an episode of Bargain Mansions. After we feed pup, I do a very slow walk on the Tread watching the latest video from Philosophy Tube on my phone (congrats, Abigail!). R. takes pup for a walk by himself while I soak in a hot bath.

Daily Total: $231.66

Day Seven

9 a.m. — I shower and get dressed in my “laundry day Sunday” attire: yoga pants and a Henley shirt. My abdomen is still tender, but the pain is a lot more manageable than yesterday! After I let pup outside and feed her, I keep working on a colorwork cowl I’m doing for a virtual knitting class. I’m still a beginner at colorwork, and it’s taking a while for me to adjust to looser tension.

10 a.m. — I get a text alert from Digit that they’ve pulled $3.24 into my “rainy day” savings. I’ve been using Digit for over three years now, and it’s been really nice having an “out of sight, out of mind” way to save money. I check my account, and I have nearly $150 saved up, woo!

12 p.m. — I get sucked into a new project it seems everyone on Instagram is doing; the Feel the Bern sweater by Boyland Knits, based on Bernie Sanders’ mittens! I’m not usually a fan of cropped sweaters, but I bet I could adjust the body. I start browsing Brooklyn Tweed colors on the Yarnery website while I eat my turkey salad; one or two skeins should be fine for my budget! (Maybe I’ll use my Digit savings as a treat.) $29

2:30 p.m. — I toss all our towels into the laundry and R. and I clean the kitchen. We take pup for a mile walk, being very careful of the ice, and then settle in for an afternoon of League of Legends games (it’s like football, but for nerds). I start ripping the seams apart on an old pair of his jeans; I’ll use the cheater method and instead of drafting a pattern, copy the pieces from this. So.Much.Ripping.

6:30 p.m. — We order dinner from a local restaurant that does great gluten-free food (and actually worries about cross-contamination!); a gourmet salad with grilled chicken and avocado Ranch dressing for me and a pizza for him. Since we’ve spent way too much on Doordash this month, I drive to pick it up curbside. I eat at my desk as I have a few scripts to run in preparation for tomorrow and R. watches an episode of Forged In Fire with dinner. $36.37

9 p.m. — The night passes quietly with lounging, knitting, and more League. I do a 20-minute scenic walk on the Tread and decide my abs feel okay enough to risk a walk around the block. R. and I both pass out after some Instagram and some cuddles (actual cuddles, not a euphemism, still on surgery restrictions!). Slowly but surely, we will get back into our routine!

Daily Total: $65.37

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In New Zealand On A $54,000 Salary

A Week In Ohio On A $150,000 Salary

A Week In The Bronx, NY, On A $100,700 Salary

from Refinery29 https://ift.tt/3rCdsM9

via IFTTT