Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a developer who has a joint income of $135,000 and spends some of their money this week on Nespresso pods.

Trigger Warning: This Money Diary mentions an eating disorder.

Occupation: Developer

Industry: Tech

Age: 27

Location: Indianapolis, IN

My Salary: $65,000

My Husband’s Salary: $70,000

Net Worth: $-139,500 ($155,000 home value, $10,300 savings, $13,500 in 401(k) between both of us, and car values minus debt)

Debt: $298,300 ($148,000 mortgage, $140,000 combined student loan debt, $10,3000 loan for foundation work we got in December)

My Paycheck Amount (2x/month): $1,895

My Husband’s Paycheck (biweekly): $1,900

Pronouns: She/they

Monthly Expenses

Mortgage: $978

Student Loans: $925

Utilities: ~$300 for gas, electric, and recycling

Phone Bill: $250 but my husband gets reimbursed for $50 of this from work

Internet: $60

Car Payments: $945 for both

Myx Fitness Membership: $29

Savings: $2,650 in anticipation of filing our taxes (this normally goes toward debt repayment as we are avalanching our student debt!)

Allowances/Fun Money: $600 ($150 for each of us biweekly)

Netflix/Hulu/Amazon Prime: $25

Health Insurance: $110 (for both of us)

Southwest Credit Card: $138 (annual fee)

Car/Motorcycle Insurance: $801 every 6 months

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes, it wasn’t an option. Neither of my parents went to college and were adamant about us getting some sort of higher education. My brother ended up going into the military instead, but my agreement with my parents was that they would pay for my loans once I graduated. That didn’t work out because my dad passed when I was 20, so my husband and I are aggressively paying down our student loan debt.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My parents didn’t teach me anything about money, which I’m a little bitter about now. My parents observed pretty traditional gender roles; my mom was a stay-at-home mom and my dad was the primary breadwinner and took care of all the finances. Turns out my dad was awful with money and they were in a ton of debt that no one knew about until he died, and my mom and I had to learn how to handle money together. We always had the best and the newest of everything: cars, technology, clothes, etc… so I guess, if anything, they taught me that it’s much better to be financially stable with less of a focus on material things than it is to be drowning in debt with no transparency about finances in your relationship.

What was your first job and why did you get it?

I worked as a server for cash at a pizza place that my dad’s friend owned when I was 14. It was a fun, after-school and weekend job, but my first legal job was at Kmart (lmao midwest life).

Did you worry about money growing up?

Not really. Even when my dad wasn’t working due to surgeries, I wasn’t aware of any issues.

Do you worry about money now?

A lot more than I probably should. We’re doing okay, but my parents’ situation kind of traumatized me, so I’m always hyper-aware of our finances. I think once we have our student debt paid off, I’ll feel much better.

At what age did you become financially responsible for yourself and do you have a financial safety net?

When I moved out at 23. I was working full time and going to school full time (yes, it was as exhausting as it sounds), so my mom kept me on her health insurance which was amazing, but I was responsible for paying for everything other than that. We don’t have a safety net other than ourselves because while we could ask either of our families for help if we needed it, no one is in a situation that makes it really feasible.

Do you or have you ever received passive or inherited income? If yes, please explain.

I haven’t. My dad committed suicide, and we only got $25,000 from the life insurance company. It went toward funeral expenses and getting my mom back on her feet. While I haven’t received passive or inherited income, my brother and SIL did let my mom and I live with them for a couple of years after my dad passed. My grandma also cosigned on my private student loans because my parents’ credit wasn’t good enough and I wouldn’t have been able to continue my education without that. Without the help from my family in these regards, I wouldn’t be where I am, and I think it’s important to acknowledge that!

Day One

6:30 a.m. — Wake up and lay in bed for an hour instead of working out like I intended to do, oops. After a shower, I make a brown sugar shaken espresso with oat milk because I keep seeing people talk about the Starbucks one. I get screamed at by our three cats to be fed and then feed myself some oats while starting my workday.

12 p.m. — It’s been one of those days. I mean, it’s Wednesday, so it makes sense, but I’m ready for it to be over. While I’m making my lunch (read: heating up a leftover baked potato and peeling an orange), I make soft boiled eggs in the instant pot. They’ll be marinated in some soy sauce and mirin to go in our ramen for dinner tonight. I got diagnosed with binge eating disorder last month and I’m working with my therapist to recognize unhealthy thoughts around food, so I jot down some notes to talk to her about this week.

3 p.m. — My friend, A., comes over to do a mock therapy session for one of her social work classes. She’s one of the few people I trust is as careful as my husband and I are about COVID, and she’s vaccinated which is comforting too. We finish up our session and then chat for an hour or so.

6 p.m. — M. (my husband) and I hang out in the kitchen while prepping dinner. It’s nothing fancy, just ramen packets that we’re prettying up with enoki and shitake mushrooms, the eggs I made earlier, and some bok choy! We went vegetarian in early December and have been having a really fun time cooking together. Once our bowls are assembled, we walk right past our beautiful dining room table to eat on the couch and watch a couple of episodes of The Blacklist.

9:30 p.m. — Time for bed! M. is a night owl and I require nine hours to function, so he goes into our shared office to play PC games while I start a sleep meditation on the Calm app and beckon my favorite cat to come snuggle me.

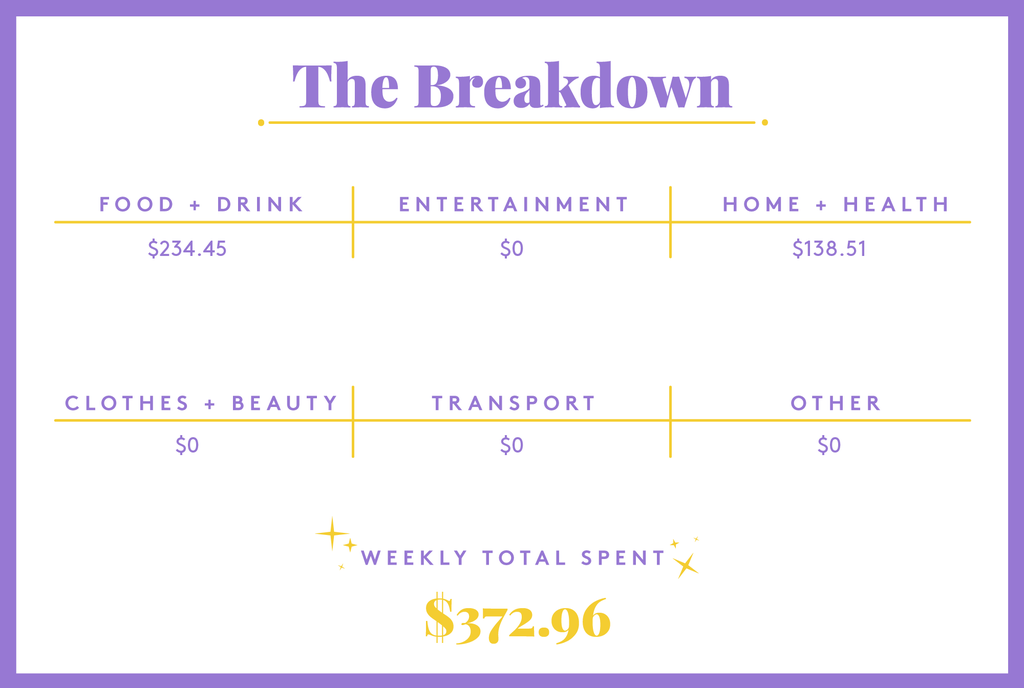

Daily Total: $0

Day Two

8 a.m. — My morning goes about the same as yesterday. I lay in bed instead of working out because I’m exhausted despite getting nine hours… turns out my period is looming so I make a mental note to sanitize my menstrual cup. M. got a vasectomy in August because we are happily childfree and intend to stay that way, so I got my IUD removed once he got the all-clear that his procedure worked. I’ve had PCOS since I was 15 and got put on birth control immediately, so before October 2020, I had only had a couple of natural periods in my life and they were irregular. It’s a huge PCOS win to have natural, regular periods without medication so we celebrate menstruation in this house (typically with donuts).

12 p.m. — Wrap up a morning of work and make lunch. I have another pack of ramen with the leftover bok choy and the last marinated egg. There’s something so comforting about packaged ramen and I’m willing to die on that hill. When I’m done eating, I feed my sourdough starter.

4 p.m. — Log off for the day and start a sourdough focaccia dough. My sourdough starter is nice and bubbly and it makes me feel nostalgic for the bread-making/dalgona coffee/Tiger King part of quarantine. M. convinces me to run to Home Depot with him. We need to build some sort of shelter for our seedlings or our cats will absolutely eat them, so we get chicken wire, wood, hinges, and other things I don’t pay attention to because I have to be dragged away from the plant section. $64.05

6 p.m. — We grab Taco Bell on the way home and complain about how bleak being a vegetarian and eating here has become. Soon, we will be reunited with our precious potatoes. When we get home, we turn on The Blacklist while eating and end up watching three episodes. I get my focaccia dough shaped, put it in the fridge, and head to bed. M. has the day off tomorrow so he heads to our office to play games. $13.45

Daily Total: $77.50

Day Three

8 a.m. — M. gets paid today so I look at our budget spreadsheet and pay the expenses allocated to his check. We set up our cart yesterday with groceries for the next week, so all I have to do this morning is checkout and schedule the delivery from Aldi via Instacart ($79.59). Before I jump into work, I gather up M.’s request for pods and place a Nespresso order ($88). I also get a recycling bag because one of the main reasons we were comfortable getting a Nespresso (we have the Next model) was their robust recycling program! $167.59

12 p.m. — After emerging from meetings, I find M. in the garage building the seedling cage so we can figure out lunch. I have no patience for cooking and I’m going to be in meetings again soon, so we order Chipotle. We really have a tendency to ball out on paydays and then live pretty frugally otherwise, but we’re both fine with it! $33.41

6:30 p.m. — After laying on the couch for a bit, I decide to eat the rest of my Chipotle bowl for dinner while M. plays online games with his friends. We’re both introverts, so we fully embrace and appreciate the “alone together” time that we get while doing our own things in the house.

Daily Total: $201

Day Four

7:20 a.m. — I’m immediately annoyed that I’m awake this early on a Saturday, but here we are. After flopping around for a bit, I take a bath. A maple iced latte is the bathtub drink of choice today and our smallest cat lovingly dips her paw into it right before nearly falling in the tub.

11 a.m. — Our groceries get here so we put them away and share a snack of chips and dip. Now feels like a good time to start planting, so we start our herbs and peppers. We’re a big spreadsheet household, so I made a sheet a couple weeks ago to track what needs to be started or transplanted and when. The rest of our garden is set to be sown next weekend. While we’re in a gardening mood, I convince M. to come out and turn the compost with me. Some of the soil is still frozen, so we take turns breaking it up in hopes that the nice weather will get our box nice and hot!

6:30 p.m. — I’ve been on a hunt for vegan protein powder that isn’t disgusting or $100 a tub for what feels like hours, but I give up to make breakfast for dinner. Eggs, MorningStar sausage, and fried potatoes while we watch… you guessed it, Blacklist.

9:40 p.m. — We have not moved from the couch and I’m here for it. Still putting in work on our show and multitasking by researching protein powder again. I end up deciding to order some sample packs of Orgain because they’re on sale on Amazon and we canceled our membership, so it feels like a solid last purchase. $20

Daily Total: $20

Day Five

8:30 a.m. — Wake up to a cat screaming in my face, so I laze around in bed while scrolling on my phone. I check our banking app and see that my check came through, so I force myself out of bed to make another brown sugar shaken espresso with oat milk (I know how douchey that sounds, I promise) and head to our office to pay bills. M. is already hanging out in here, so we chat about our current financial situation over coffee. Our “allowances” are part of this check, so we each get $150 transferred to our “fun” accounts that give us carte blanche spending money. It’s eliminated nearly every issue we had re: money and gives us both freedom to not have to clear purchases with the other!

11:15 a.m. — I convince myself to do a 15-minute HIIT ride on our Myx bike, and it kicks my ass. I did CrossFit pre-pandemic so the shift from lifting heavy to doing mostly cardio and moderate strength training has been interesting. That being said, I’ve really enjoyed it and I can do it at home and feel safe which is most important to me right now. M. is in the garage when I come back upstairs, so I jump in the shower. I think I’m more hungry than I am, so I make french toast sticks and MorningStar sausage in the air fryer, but only eat half. This makes me appear to be a great wife when M. comes in and I tell him I “saved” the rest for him.

6:30 p.m. — We convene in the kitchen to make barbecue tofu and baked potatoes. Once everything is done, we head to the couch like the disgusting creatures of habit we are to cram as many episodes of Blacklist as we can into our eyeballs before I go to bed around 9:45.

Daily Total: $0

Day Six

8:45 a.m. — My company has flexible hours, so I lay in bed a little bit longer this morning by negotiating with myself that I can log into work later as long as I work out. I take a banana to my desk with me and eat it while catching up on emails and the never-ending Slack notifications. Still hungry after my banana, so I make some toast with butter.

11:45 a.m. — I chop up a carrot and bell pepper that are going to go bad and cook them with some Boca crumbles while boiling some udon. The last of the peanut butter jar gets shaken with chili garlic sauce, soy sauce, rice vinegar, and sesame oil for a quick peanut sauce. Toss everything together and top with green onions before heading back to my desk. I don’t eat all my noodles so I pack up the rest and put them in the fridge. One of my things I’m trying to focus on re: binge eating recovery is that I *can* have things later. I don’t have to eat it all because it’s in front of me, which is a new concept for someone who grew up in a huge portion and clean plate club household.

6 p.m. — M. sits on the kitchen counter while I shape falafel from a mix and put them into the air fryer. I made some tzatziki earlier today so once the falafel is done, all we have to do is heat up some pita and dress our salads! We chat about the garden and start a to-do list of things we can start getting ready this week since it’s supposed to be gorgeous. Eat dinner while we watch Blacklist, the usual. I go to bed around 9 but don’t end up actually falling asleep until 11, oops.

Daily Total: $0

Day Seven

8:15 a.m. — Sit down at my desk with a chocolate fudge coffee (my least favorite Nespresso pod, but we have four pods left and they are all this flavor lol).

10 a.m. — I throw together a quick egg sandwich with sriracha and MorningStar bacon on it and head back to my desk. Today is a little chaotic because tomorrow we have a sprint day, so my sandwich comes with a side of code.

12:15 p.m. — I needed a mental break and that involves physically stepping away from my desk so I can come back with fresh eyes. I decide to hop on the bike for a 30-minute interval ride and I absolutely LOVE it. I normally struggle with hard rides in the morning so maybe that’s a sign to stop trying to force myself to work out at specific times and be more flexible! I take a quick shower and make my way back to my desk.

4 p.m. — Log off for the day and chat with M. while we unload and reload the dishwasher. He talked to my brother today about borrowing a ladder, so once we’re done with the dishes and some other chores (cleaning litter boxes, taking the trash out, and picking up the house), we go grab the ladder.

6:30 p.m. — We’re both tired so we settle on pasta with meatless meatballs for dinner. I throw a couple of slices of garlic bread in the air fryer while M. makes dinner. When we’re done eating, M. places an order for the rest of the garden tools we’ll need. We should be able to get the raised beds put together this weekend and I am so so excited! $74.46

Daily Total: $74.46

If you are struggling with an eating disorder and are in need of support, please call the National EatingDisorders Association Helpline at 1-800-931-2237. For a 24-hour crisis line, text “NEDA” to 741741.

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Brooklyn, NY, On A $116,000 Salary

A Week In Philadelphia, PA, On A $54,000 Salary

A Week In Gainesville, FL, On A $56,500 Income

from Refinery29 https://ift.tt/3g9ElUJ

via IFTTT