Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: an art director who has a joint income of $270,000 and spends some of her money this week on Yankees tickets.

Occupation: Art Director

Industry: Advertising

Age: 30

Location: Hoboken, NJ

My Salary: $145,000

My Fiancé’s Salary: $125,000

Net Worth: $242,000 (Investments: $210,000 (joint between my fiancé and me), Savings account: $15,000 in mine, $35,000 in his, minus debt. My fiancé and I have a joint bank account as well as our own separate accounts. We use the joint account for bills, meals, groceries, trips, and anything else we do/spend on together. We use our own accounts for personal purchases — shopping, outings with friends, gifts for each other, etc.)

Debt: $15,000 left in student loans (mine, not his)

My Paycheck Amount (Biweekly): $3,230

Pronouns: She/her

Monthly Expenses

Rent: $3,498 for a two-bed, two-bath

Student Loans: $307 (currently on hold due to COVID)

Netflix: $20

Electric: 120

Internet: $75 (my work reimburses $50)

Spotify: $12

Cell Phones: $112

Savings: $800

Investments: $600

Health Insurance: $170

401(k): 11% of my paycheck

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Oh yes. The question was not if but where I would go to college. The high school I went to prepped everyone for college, and I had to take the ACT/SAT four times to try to get the highest scores possible. Growing up it was mandatory that we always participated in at least one sport, one extra-curricular activity, and did all of our homework before we could ever make plans with friends. My parents paid for the majority of school but did require me to take on about 25% of the total. And to be clear, I don’t regret the loans! The education I received was well worth every penny, and the friendships I made are still my closest ones nine years after graduating.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My siblings and I joke that our view of money growing up was pretty warped. My dad is as frugal as can be even though he made six figures. He was always cutting coupons, buying things on sale, and wearing the same clothes until they had holes in them. Anytime we wanted to buy something, he would ask if we really needed it. My mom would lecture us about saving and was always donating to charity, but also would take us out shopping. We took at least one nice family vacation every year and never worried about having food on the table or anything we needed. My parents each had a nice car and we had a beautiful home. I didn’t see the bills behind any of this and it’s only now as an adult paying for things myself that I realize how much it all costs. In terms of educating us as kids, my dad always said to pay yourself first and put money into a savings account or 401(k) before spending. My mom always taught us to give to charity or those less fortunate before buying something for ourselves. That being said, I graduated college not understanding how credit cards, bank accounts, or even a checkbook worked.

What was your first job and why did you get it?

My first job was probably babysitting. I babysat a ton in high school, at least once per weekend. Senior year I also started working at an ice cream shop. In both cases, I only worked because I wanted extra spending money for clothes or to go to the movies with my friends. I don’t think I saved a penny until after college.

Did you worry about money growing up?

Never. I knew my parents thought about it, but I never personally felt any responsibility to contribute or understand how much money our family had. I understood that things cost money and that I had a weekly allowance, but beyond that, it wasn’t something I really thought about.

Do you worry about money now?

Sometimes. When I graduated college, my parents completely cut me off which came as a huge shock. They had paid for essentially everything I touched up until that point, and at graduation, when I told them I wanted to move to NYC for an internship that would pay $10 an hour, my dad looked at me and asked how I was planning to pay rent. I was flabbergasted and beyond angry that they were cutting me off with zero notice or time to prepare. (I’m the oldest so the precedent was set with my siblings that when you graduated, you were cut off, and they both worked/saved throughout college.) I moved to NYC with about $800 and some clothes. My best friend and I subletted one room in an apartment with bunk beds and both took internships that paid $10 an hour. We drank $3 Trader Joe’s wine, ate dollar slice pizza or whatever food was leftover in the work kitchen, and honestly had the time of our lives. I worried about money every week in those days, but I was also so excited to be in the city that I didn’t let it scare me off. I never knew if I would be able to pay rent or my student loans, and just tried to live week by week the best I could. It wasn’t until I was about 26 that I had a job with a decent enough salary where I could afford some wiggle room and actually save. I’ll never forget the first time I bought a coffee before work and didn’t worry or write the price down on my phone. My fiancé and I have both worked really hard since graduating and are now very comfortable. Because we’ve had to work to get to where we are now, we do not take our current financial situation for granted. We save, invest, and plan for the future, but we also spend money and let ourselves enjoy life without guilting every purchase. I wouldn’t say I worry about money now, but I do actively think about it. If I’m at the grocery store, I’ll buy produce that’s on sale instead of just getting whatever we want. We cook most nights so we can enjoy eating out. We set a budget before we plan a trip and then on the trip live however we want to within the limit.

At what age did you become financially responsible for yourself and do you have a financial safety net?

21, the day I graduated college. Zero safety net, just a girl with a dream of living in NYC and drive to make it happen. Writing that sounds a little show tunes-y, but it’s true. I wanted to stay here, so I made it happen.

Do you or have you ever received passive or inherited income? If yes, please explain.

No.

Day One

8:30 a.m. — My alarm goes off and I’m up within minutes. I try to never let myself hit snooze because if I do I’ll be late for work. I do some yoga before work so I head into our second bedroom which is an office/art studio. I work here most days so I fire up my computer and log into work email as well.

11 a.m. — I’ve finished yoga and my morning meetings, and emerge for coffee. My fiance, L., makes a pot every morning and I never take it for granted. It’s so nice to have caffeine ready and waiting 🙂 I grab a mug and a second cup of water, scramble some eggs with veggies, and head back into the studio for some heads-down work time.

2:30 p.m. — I take a quick work break to make a big salad for lunch and use whatever veggies are about to go bad in the fridge. I notice that L. hasn’t moved from his workstation at the kitchen table, so I decide to double up the batch and make one for him too.

6:45 p.m. — L. and I walk over to our friends’ apartment for dinner, drinks, and games. We’ve kept our circle pretty small the past year and this is about as wild a night out as we have. They’ve made homemade pizzas and have beers, which we all enjoy while playing gin rummy. At some point, I convince everyone to take a walk and get ice cream, so we mask up and head over to a little shop down the street. Everyone gets something and we treat since they made dinner. $21.79

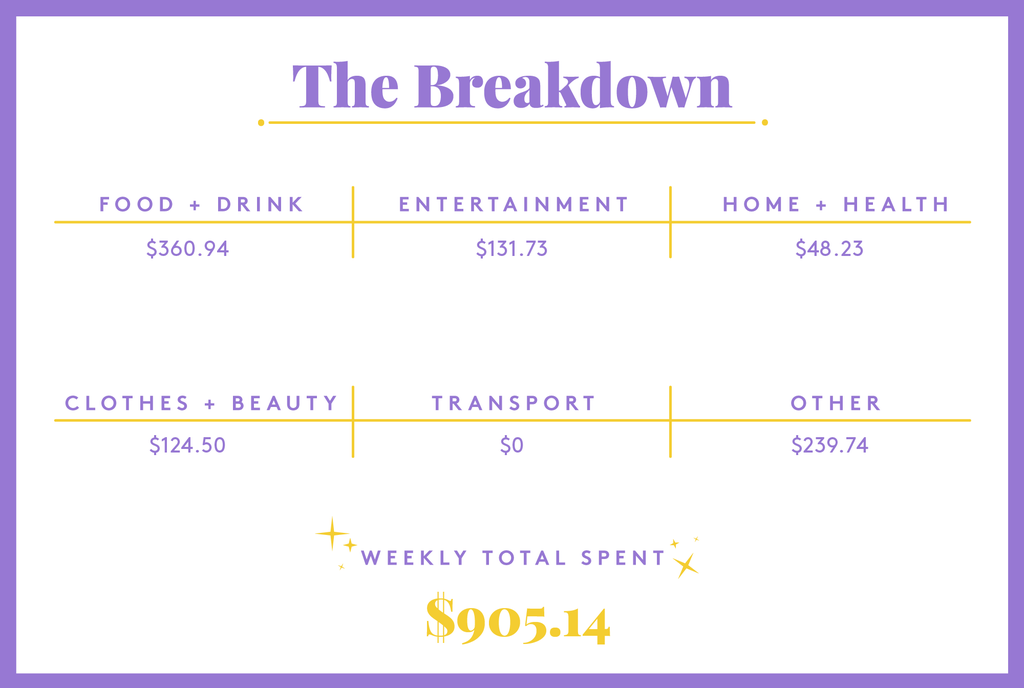

Daily Total: $21.79

Day Two

6:45 a.m. — Woof. I’m up early because I signed up for a pilates class at 7:30. They just started holding semi-private classes again and I’m beyond thrilled to be back. I regret the early alarm but know it will be worth it. $33

9 a.m. — After class, I stop by the grocery store. I love shopping in the morning because the store is completely empty. I decide to make salmon for dinner and spring for wild-caught because it’s still cheaper than eating out. We’ve decided to take a weekend off from drinking so we might as well have some good eats! I pick up a few other items at the store as well before heading home for the workday. $37.80

2:30 p.m. — This day is flying by, which feels nice for a Friday. I make avocado toast with a big salad for lunch.

6 p.m. — Work is done and salmon is in the oven! We’re eating early tonight because L. has conjured up some apartment Olympics for the evening. Since we’re breaking from booze and don’t want to fall into a total TV rut all weekend, he made up a bunch of games we can play around the house and a big poster score sheet. My favorite is a timed test to see who can roll an M&M across the kitchen counter the fastest with their nose. It’s hilarious and weird and we definitely don’t play five rounds. Other highlights include “hide a large object, see how fast the other person can find it,” and a version of Around The World with socks and our laundry basket.

Daily Total: $70.80

Day Three

10 a.m. — I’ve slept in and I am thrilled. The older I get, the harder it is to actually sleep in on the weekends so I bask in it when I can. I walk into the living room to find a note from L., he’s gone to his parents’ house for the day to hang out and give me the place to myself. A goal for us in 2021 is to give the other alone time in the apartment at least once a week. It’s done wonders for both of us individually as well as our relationship. I give him a mental hug and kiss, text him a thank you, and make myself a big breakfast spread. Coffee, fruit, eggs, toast, and bacon. Hallelujah!

4 p.m. — I’ve spent most of the day in the studio painting but it looks lovely out, so I text L. to see when he’ll be home and if he wants to break the “no drinking” weekend and have a cocktail in the sun. He agrees as long as we keep it to just one drink, and says he’ll be home in about an hour.

5:30 p.m. — We head out to an outdoor bar along the waterfront and order drinks. While sitting there, we call around to see if any restaurants have outdoor seating. Lucky for us, one of our favorites has a 7:30 opening and we take it. Since we’re not really drinking, we decide to splurge on two appetizers and a dessert at the restaurant. Isn’t it crazy how much alcohol adds to the bill? Even with the extra courses, our bill is still less than it would have been if we’d had drinks. $172.45

Daily Total: $172.45

Day Four

8 a.m. — No luck sleeping in today, but that’s showbiz baby. I’m super comfy in bed so I pick up my Kindle and decide to read until L. wakes up.

10:30 a.m. — He’s up and hungry. We make pancakes and then tackle cleaning the apartment. We’ve let it go a few days too long and she really needs some TLC. While L. cleans up from breakfast, I go to CVS to get a few supplies we need. $15.23

1:30 p.m. — Cleaning is done and we are pooped. Scrubbing the shower is a serious workout! We decide to chill for the rest of the day, and I order salads from a local place. We always joke about how overpriced it is to order in salads, but neither of us has the motivation to chop or mess up our sparkly kitchen. $23.06

7 p.m. — We go for a walk and debate what to have for dinner. L. wants Chinese and I want pasta, so we decide to both have our own meals but time it so we can eat together. We have leftover homemade sauce in the fridge, so he orders and I throw it on the stove. After dinner, we snuggle up to watch Homeland, which we’ve been slowly working our way through. As usual, we fall into the rabbit hole of one episode that turns into four and are up until 1 a.m. watching. $17.18

Daily Total: $55.47

Day Five

8 a.m. — I wake up and go for a short run before my morning status meeting. I finish up and still have time to spare, so I head to the grocery store to restock our kitchen for the week. I pick up the ingredients to make soup, fajitas, and stir fry for dinners, salads for lunches, and oatmeal, yogurt, and bread for breakfasts. I also get some chocolate milk, goldfish, and chocolate chip cookies because there’s a soccer mom inside of me dying to break out. $73.47

12 p.m. — With the morning meetings done, I start to make the soup. I chop veggies, throw them into a pot with chicken, and set it to simmer for the day. I’m already excited to eat it later. For now, I make a big bowl of oatmeal with fruit, nuts, and seeds and settle into work for a few hours.

4 p.m. — The endless string of meetings won’t end, so I start shopping online during the last one. I buy two new sundresses and a bathing suit because I’m excited for summer and they’re on sale! $124.50

7 p.m. — Soup is hot and so comforting. L. picks up a fresh baguette from the French bakery across the street. We enjoy the meal and settle in for some Homeland before bed. $3.19

Daily Total: $201.16

Day Six

10 a.m. — I’m up, showered, and ready for the day. I sit down for my first meeting with a bowl of fruit and yogurt and a coffee.

2:30 p.m. — I’m hungry so I make a big lunch bowl with some chicken, rice, and veggies leftover from dinners this week. I watch Pretend It’s A City with Fran Lebowitz while I eat. I love her humor and I very much miss New York. I mention this to L. as I’m cleaning up from lunch, and we decide to buy Yankee tickets. By that point, we’ll both be vaccinated and able to go in person. We debate cheap bleacher seats versus actually getting nice tickets and decide to go somewhere in the middle. $131.73

5 p.m. — Done with work for the day and switch to tackle some wedding tasks. We’re getting married this fall so we’re at that stage of planning where most of the bigger stuff is done and I’m trying to check off whatever minor items I can so it doesn’t all hit at the last minute. I buy stamps for the invitations, RSVP cards, and thank you notes, and print a shipping label for a rehearsal dinner dress I ordered and need to return. I start browsing tie colors for the groomsmen and realize I have no idea what I’m doing, so I make dinner instead. $151.03

7:30 p.m. — I made shrimp stir fry and we sit down together to eat. Even though we spend all day working from home in the same apartment, sometimes L. and I don’t talk much since we’re so busy with work. We catch up, talk about the week ahead, and decide that we want to have our own nights tonight. L. opts to watch Godzilla and I FaceTime the girls and paint my nails. Yes, I realize how stereotypically gendered these nights.

Daily Total: $282.76

Day Seven

9 a.m. — I mask up and meet a friend for a coffee walk before work. We try to meet for coffee twice a month or so. I treat since she paid last time. I get an americano and she gets an oat milk latte and we both get a slice of banana bread. $12

12 p.m. — I heat up some leftover turkey meatballs for lunch and throw them over a mixed green salad. I brainstorm what night next week I can give L. the apartment to himself and text a friend to make outdoor dinner plans for the following Thursday.

3 p.m. — I check my personal email and see that an Etsy seller emailed back about a sign I wanted to order for the wedding. I’m trying to support small makers wherever I can and I love his work. I place the order and tell L., who is also excited. Instead of a traditional welcome sign, we’re having him paint an old Irish saying and plan to keep it for our future first home together. $88.71

8:30 p.m. — I work later than I intended to today and have zero energy to cook. I pull Bubba burgers out of the freezer and throw them on the grill pan. While they cook, I throw some potatoes in the oven and green beans on the stove. In 20 minutes, dinner is on the table and I’m proud of myself.

10 p.m. — I’ve stayed up far too late painting and realize it’s time for bed. As I close down the studio for the night, it dawns on me that my credit card payment is due tomorrow, so I open the banking app and pay it from my phone. We’re trying to rack up as many credit card points as possible to use towards honeymoon flights, so I’ve done my best to stay on top of the bills. I don’t have any outstanding credit card debt, this is just purchases from the last few weeks.

Daily Total: $100.71

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Detroit, MI, On A $37,500 Salary

A Week In Providence, RI, On A $54,300 Salary

A Week In New York, NY, On A $70,000 Salary

from Refinery29 https://ift.tt/3oKYzX7

via IFTTT