Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a content design manager who makes $295,000 per year and spends some of her money this week on stackable washer and dryer.

Occupation: Content Design Manager

Industry: Technology

Age: 42

Location: Seattle, WA

Salary: $295,000 including my bonuses and annual stock grants

Net Worth: ~$275,000 (I have $250,000 in stock grants from my company, $100,000 in 401(k)/investment accounts, a home worth $750,000, a car worth $25,000, and $5,000 in a savings account for emergencies. I contribute 20% of my salary and bonuses to my 401(k) and as my stock vests, I convert that to investments. Minus debt.)

Debt: $275,000 in student loans, $580,000 mortgage

Paycheck Amount (2x/month): $4,500

Pronouns: She/her

Monthly Expenses

Mortgage: $3,619 (I live alone with my kids in a newly built townhome, which is all I could afford in Seattle without compromising my retirement and savings goals.)

HOA: $300

Student Loans: $550

Car Insurance: $445 for car insurance (I insure my adult kids and they reimburse their share)

Health Insurance: $30

Cell Phone: $490 for cell phone

Cable/Internet: $240

House Cleaning: $300

Spotify: $16

Hulu: $13

Peloton: $42

Netflix: $10

Credit Monitoring: $42

BarkBox: $25

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

My parents always wanted me to go to college when I was a kid. My mom was a high school dropout and my dad worked at a welding supply store so neither of them had a degree. I started going to college in high school as part of a program that gives juniors and seniors free tuition at local community colleges. I transferred to a four-year college when I was 18 but got pregnant and left college soon after. I was briefly married to the father of my kids, but we split up a few years later, I was 21 with three kids, no degree, and no real work experience outside of my college newspaper. I started working for websites at a salary that was lower than childcare costs and relied on state childcare assistance for three years to barely scrape by. I was lucky and was able to transition into higher-paying content jobs in tech and by the time I was 25, I was making just shy of $100,000. I completed my degree while working full-time and eventually went to grad school, which I graduated from last year. I paid for all of my college myself, which is why I have so much student loan debt. My parents were never in a position to help me financially at any point since I became an adult.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

None, really. I had no idea how to build credit, save, or invest, and because my parents wouldn’t let me get a job as a teenager, I had no access to spending money or experience managing money until I was on my own in college.

What was your first job and why did you get it?

My first job was working on the student newspaper in college. I loved to write so I tried to find ways to make money that built those skills. I also worked on student government, for the women’s studies program, and in the college bookstore. I couldn’t get enough aid to cover living or food costs so I worked multiple jobs to try to cover those expenses.

Did you worry about money growing up?

Not really. I never thought about finances growing up, largely because we lived in a pretty poor California town where everyone seemed to be in the same boat. We shopped at K-Mart and ate Hamburger Helper and Kraft mac and cheese. I went to Disneyland once and the only other vacations we took were camping trips or very rare visits with family in other states.

Do you worry about money now?

As a single parent living in a high cost of living area, I’ve been through a number of periods of pretty dire financial straits. I’m in a good place now, largely because my kids are old enough not to need childcare anymore. I have been so broke, I’ve had to look for change to buy food and spent years juggling shut-off notices to try to keep everything on. At one point, my credit score was 450 and I had creditors garnishing my wages. It took me a long time to dig out of that hole so even though now I’m financially stable, I don’t feel safe and probably won’t until I have enough money saved to cover my expected expenses through the end of my life.

At what age did you become financially responsible for yourself and do you have a financial safety net?

18. I’ve been responsible for myself and my kids ever since.

Do you or have you ever received passive or inherited income? If yes, please explain.

I received $5,000 when one of my grandparents died, which I used to pay off a debt to my college so I could return to school and finish my degree. When my father died, I received $20,000 from the sale of the land his mobile home sat on. I used that to help my oldest child buy their first home.

Day One

9 a.m. — I usually start my workday between 8:30-9. Right now, I’m working from home so I pretty much roll out of bed, put on joggers and a hoodie, put my hair in a ponytail, and get to work. I eat a protein bar and start reading my email and preparing for a day full of meetings. My son texts me to see if I want coffee. He has my Starbucks card on his phone so he grabs me an almond milk mocha and drops it off between errands. I usually make my own coffee but I’m always up for more. $6

12 p.m. — One downside of working from home is back-to-back meetings. I used to make time to grab food from the cafeteria once or twice a week, but now I eat leftovers during meetings. Today I have leftover Swedish meatballs, mashed potatoes, and peas from last night’s dinner. Yum!

8 p.m. — I love to watch the Food Network and recreate my faves with my kids. I want to try to make Oreo macarons but I don’t have a food processor. I find one on Amazon for $230 and use some of my Amazon credit card reward points so it’s only $93. I do all of my grocery and household shopping on Amazon with their credit card so I have $200-$250 in rewards points to use every month on something fun. $93

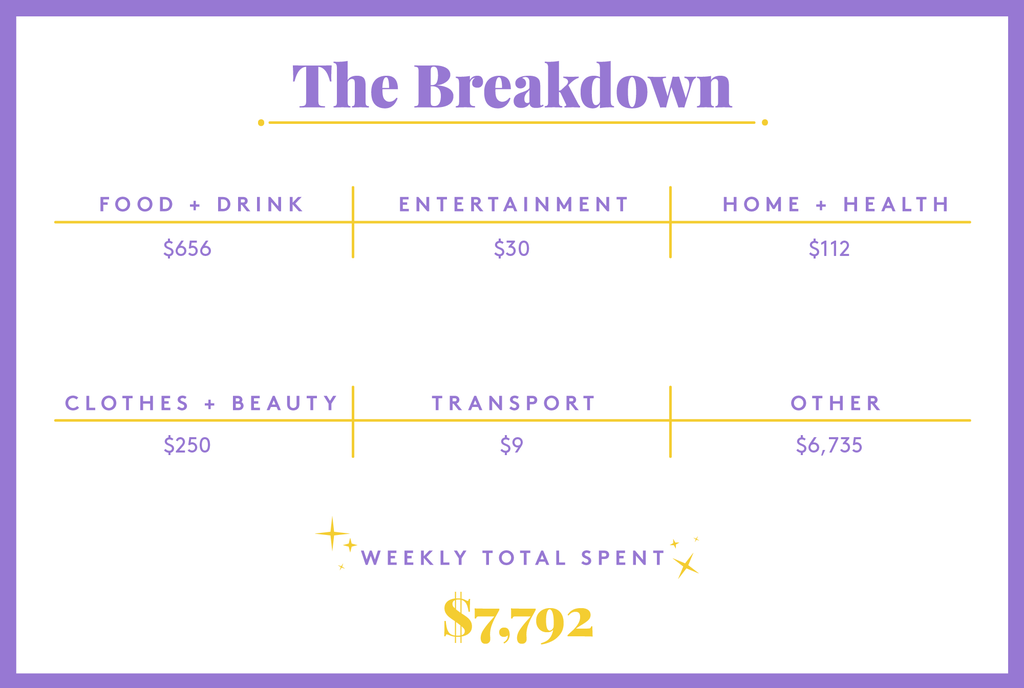

Daily Total: $99

Day Two

10 a.m. — It’s Saturday! I sleep in and do my grocery shopping from the couch. I load up my cart while my kids play and there’s enough to fill two Whole Foods orders and one from Amazon. Combined, they’re $456 plus $20 tips. I used to go to three grocery stores to get everything we needed at the absolute lowest price, but these days, I’m all about freeing up time even if it costs more. I spend the afternoon reading a book. $456

5 p.m. — Pre-pandemic, my family ate out… a lot. These days, we’ve cut back to once a week. This week, we decide to try a new Asian-Mexican fusion place that just opened up in the neighborhood and is offering pickup. My kids get sandwiches and fries, and I try the loaded spicy pork fries with Mexican roasted corn. DELICIOUS! It was absolutely worth the $108 (with tip) and I post pics of our meal to social media to let my local friends know how good it is. $108

6 p.m. — The kids have been begging for a movie night so I make popcorn and dig up some candy for the theater experience. They settle on a new Disney release on Disney+, which is $30 plus the cost of Disney+ itself, but that’s a bargain compared to seeing it in the theater for my crew. $30

Daily Total: $594

Day Three

9 a.m. — I got a Peloton early in the pandemic and promised myself I’d use it four to five days a week. These days, I’m lucky if I work out more than once a week. Exercise has never been my friend but I’m determined to get some use out of this thing. I work out for a grueling 45 minutes and have to admit that I feel great afterward.

6 p.m. — After a quiet day at home, cleaning and organizing, I settle in to catch up on Instagram. As usual, they get me with a targeted ad, this time for a lint roller for rugs and furniture. Who knows if it’ll work but as a pet owner, I’m willing to try anything! $19

Daily Total: $19

Day Four

9 a.m. — Get up and start working.

2 p.m. — I manage to snag a COVID vaccine appointment, which is covered by my insurance. I log out of work and head to my appointment. The only parking available is paid so I swing into the lot. The vaccine clinic is run out of a large hospital and it works like clockwork. I’m in and out in 15 minutes, but still owe $9 for parking. I run through the Starbucks drive-thru on my way home and get my afternoon usual, a venti iced peach green tea with two stevias. $15

8 p.m. — I’m starting to feel a bit under the weather so I spend the evening watching Ginny & Georgia on the couch and shopping for raincoats for my dog. I find a cute one for $25 and use my Amazon points to snag it for free.

10 p.m. — My oldest kid is buying a house and texts to see if he can use my Home Depot credit card to buy a washer and dryer. He promises to pay me back after the house closes. I agree but decide to gift him the set as a housewarming gift. We text back and forth from the store until he chooses a stacking set with a three-year warranty. I didn’t have help from my family when I was his age so it’s important to me to be able to do things like this for my kids. $2,500

Daily Total: $2,515

Day Five

11 a.m. — Now that I have my first vaccine, I realize I can finally go back to the salon! I haven’t had a haircut or color since quarantine began and things are looking ROUGH. I text my favorite salon and it’s a good thing I did because she moved to a new location. I book an appointment for after my second vaccine and pre-pay for the service. $250

2 p.m. — A friend tells me about a board and train program her dog is going to so I start looking into them for one of my dogs who is very anxious. After reading all about them, I’m feeling super excited about enrolling my pup. I’m able to connect with them quickly so after discussing my dog and her needs, we agree to a four-week program for her. I put 50% down to hold her spot. $2,500

8 p.m. — I’m feeling restless after being cooped up at home for a year and have plane ticket credits to burn after having to cancel a trip to Disney World last year. I’m able to rebook the tickets without any fees because of the pandemic and I settle on a week in Kauai in late November when it seems safe. I spend the night looking for the perfect Airbnb for the whole fam and settle on a large house with a pool and hot tub for $8,000. I put down a $1,700 deposit and add my PTO to my work calendar. $1,700

Daily Total: $4,450

Day Six

10 a.m. — I’m really lucky to have medical care that’s almost entirely covered by my employer. I pay a few bucks for prescriptions, $10 co-pays for office visits, and have free mental health care. I take advantage of the mental health benefit to schedule a visit with my therapist. I’ve been struggling with depression for most of my life but the pandemic has made it harder to cope. I’m feeling overwhelmed and exhausted, but meeting with her helps me to feel more in control. I log into my next meeting feeling ready to tackle my workday.

6 p.m. — I forgot some things in my weekly grocery order so I hop back onto the Amazon app to order a few essentials. I’m obsessed with REBBL protein shakes lately so I load up on those, plus add more Zevia (a sad replacement for my beloved Diet Coke), and my fave non-dairy ice cream. $80

10 p.m. — Instagram ads get me again with a hand-lettering journal. I took a hand-lettering workshop at work a few months ago and found it oddly relaxing. I’m always trying to find ways to decompress so I’m excited for it to arrive. Before bed, I write in my daily mood journal, drink a glass of water, and meditate on the Peloton app. $35

Daily Total: $115

Day Seven

10 a.m. — It’s been a long work week already and I take advantage of a break between meetings by looking at real estate. I’ve been thinking about moving to a warmer, sunnier state if my company continues to let us work from home after COVID, and looking at cheap real estate is my new favorite hobby. It’s pouring outside so sunny states with nice homes with pools for way less than my mortgage feels like perfection.

3 p.m. — BarkBox arrives and it’s the best part of my month (how sad is that?). My dogs are super excited about their new toys and I snap a few pics and post them to their Instagram account. I never saw myself as a dog mom but here I am. (In monthly expenses above.)

12 p.m. — It’s cleaning day! I started treating myself to house cleaning twice a month a few years ago and it’s a total lifesaver. While they clean, I continue my meetings but have to keep my camera off so it’s not weird. I Zelle my cleaning lady $130 plus a $20 tip when she’s done and enjoy my pristine house until the kids mess it up! (In monthly expenses above.)

10 p.m. — Before bed, I check in on my investments. The market has been crazy lately so I often gain or lose $1,000 or more per day. I am new to investing and saving but I am taking a long view of my investments. I have another 20+ years until retirement so I try not to stress out when my balance is down. Today it’s up $1,100 and I’m overwhelmed with gratitude for the ability to save for my future.

Daily Total: $0

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Queens, NY, On A $220,000 Salary

A Week In San Francisco, CA, On A $104,000 Salary

A Week In Northern New Jersey On A $76,686 Salary

from Refinery29 https://ift.tt/3o2gBE9

via IFTTT