Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a naval officer who makes $60,000 per year and spends some of her money this week on ramen.

Occupation: Naval Officer

Industry: Military

Age: 25

Location: Yokosuka, Japan

Salary: $60,000

Net Worth: ~$86,000 (Checking: $2,985, savings: $19,933, share certificate: $4,923, roth IRA: $19,609, Government Thrift Savings Plan: $39,022)

Debt: $0 (I pay my full credit card statement at the end of the month)

Paycheck Amount (2x/month): $2,270

Pronouns: She/her

Monthly Expenses

Rent: $1,912 (I live alone in a rented apartment off-base. I get an Overseas Housing Allowance as part of my salary, which covers about $1,800 a month of my rent bill. I pay the rest out of pocket. Most people who get the same allowance as me choose to rent and not spend over the allowance, but I decided the extra money per month was worth the beautiful apartment in a neighborhood I love.)

CAUSEBOX: $250/year

YouTube Premium: $11.99

Cell Phone: $73.32

Amazon Prime: $9.92

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Definitely. When I graduated from high school, I didn’t feel ready to go to college. I didn’t want to “waste” a lot of money earning a degree I wasn’t sure about, but my parents told me it was go to college or leave their house and support myself. I knew I couldn’t afford to rent my own apartment or car payments making minimum wage, so I earned an ROTC scholarship that took care of my tuition and applied to colleges. My dad paid for my room and board, which I paid back after I graduated. I worked part-time in college to pay for groceries and gas.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My dad always took me to the bank with him when he needed to run errands. He explained to me how he put everything in savings except for the money he was okay spending, and how he figured out what percentage of his paycheck should go into the spending category. The idea of interest compounding the sooner you put your money into the bank stuck with me even when I was little. I knew that I could put money away when I didn’t need it and it would turn into more money in the future. A guy I dated in college explained I should open an IRA even before I started working, so I started mine when I was 19.

What was your first job and why did you get it?

My dad didn’t want me to work when I was in high school. He grew up supporting younger siblings (his younger siblings were orphaned when he was 21 and they were minors) and I think he didn’t want me to feel stressed or burdened about financial hardship. I also think he didn’t have the money to help me get a car or the time to drive me to work anyway, so my first job was working in a cafeteria when I was in college after I left home. This money was what I used for groceries and going out.

Did you worry about money growing up?

No. I know my mother clipped coupons and planned our meals based on what was on sale or in season, and that my parents would carpool to save gas, and that we didn’t have cable because it was expensive. We also didn’t take family vacations. However, my parents definitely spent money, investing in my sister and me and supporting us in different hobbies and activities. There was always money for me to get a musical instrument or my sister to get new running shoes for track, but we didn’t get fancy electronics as holiday gifts like a lot of my friends did.

Do you worry about money now?

Not really. I don’t travel much right now due to COVID and I don’t have any “expensive” hobbies that require me to buy equipment and gear. My biggest expense is food. I barely buy anything else, and I know that I could even cut down on the snacks and eating out if I had to.

At what age did you become financially responsible for yourself and do you have a financial safety net?

22. I wasn’t paying for my own rent when I was in college — I paid for about half my living expenses. My safety net was my parents. Now I’m on my own, and I think if I absolutely needed help, I could ask, but I am very resistant to that idea. I’d have to have less than $1,000 in the bank to go to them for something like rent or food.

Do you or have you ever received passive or inherited income? If yes, please explain.

Nope!

Day One

6 a.m. — I wake up early, at 5:20. It’s still dark outside but I’m excited because it’s a Friday and I’m planning on making today a half-day. I hit snooze for ten minutes, getting out of bed at 5:30. I rush through getting ready and catch a train at 5:50 ($2 to swipe my train pass). I respond to Facebook Messenger and texts as I ride the train in. I usually wake up to some messages because while I sleep, my friends in the States are still awake and send me things. $2

12 p.m. — After a busy morning at work, I go on a run during my lunch hour. The weather is beautiful, sunny, and mid-60s and it’s too nice to resist. I drink a chocolate milk box I have at the office.

3:30 p.m. — I walk to the Pizza Hut that is next to the pier that my ship is on and buy some breadsticks ($3.50). I am not sure when I’ll be getting dinner because I’m supposed to leave around 4 for a spontaneous road trip this weekend. It’s the second weekend I’ve been allowed to do something besides be at home or work (COVID-19 precautions), and some friends booked an Airbnb over the weekend at the base of Mt. Fuji. I Venmo a friend ($90) for my two-night stay. $93.50

5 p.m. — The trip is off to a semi-late start. My friend and I are driving together and we stop to get gas. I run into the mini-mart and get gum, granola, and candy ($17.48). When I get back to the car, my friend and I realize we don’t have an exact address to go to, just the city we’re planning to visit. While we wait to receive the Airbnb address from the friend who made the booking, I run back inside to pick up some hard cider and lemonade for the evening’s festivities ($34.35). Since I didn’t pay for gas on the trip, I offer to pay the tolls ($12.40). $64.23

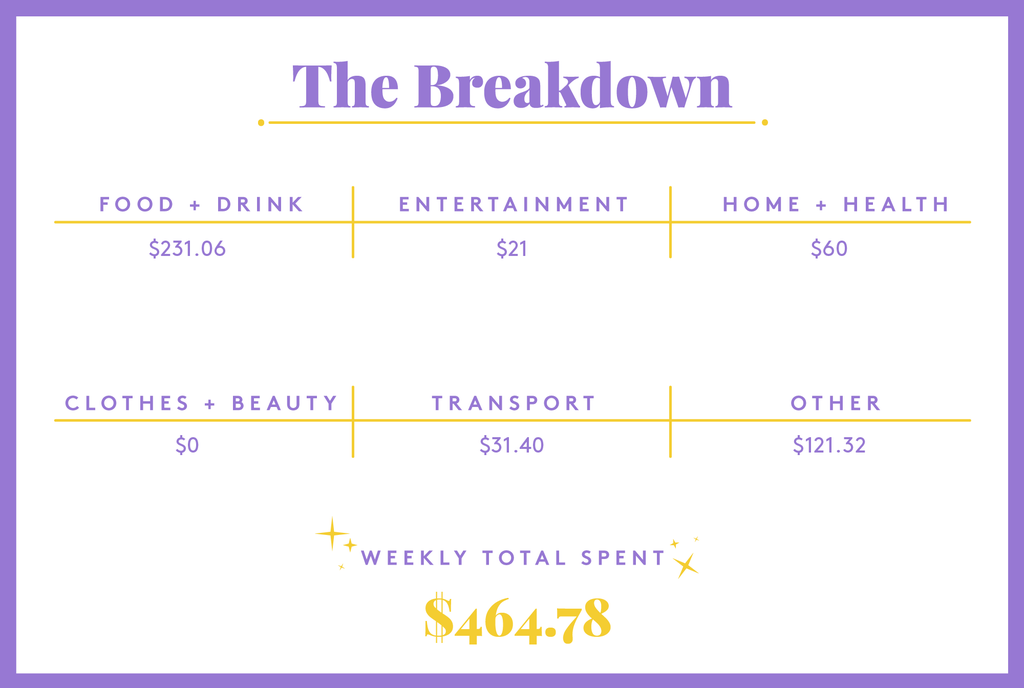

Daily Total: $159.73

Day Two

9 a.m. — After a night celebrating the fact that the group could actually go on this trip (we’re all vaccinated with some restrictions lifted), I’m the first to wake up in the Airbnb. I make a mug of tea and look through a magazine on the coffee table. It has an ad for a breakfast spot nearby and I convince everyone that waffles are the way to go for breakfast. One of my friends picks up the bill, so waffles are on him!

12:30 p.m. — Japan is famous for its onsens and I’m determined to go and relax at one since I haven’t been allowed to in over a year. My friends and I drive to one that is accepting of guests with tattoos (usually a taboo) and I break off from my friends to go alone into the women-only bath. I pay cash for my entrance fee. Later when I get out of the baths, I realize I should’ve brought or purchased a towel. Oh well. I drip dry before changing into clean clothes. $8

6:15 p.m. — After the relaxing onsen, we decide we want to get massages. I pay $60 for a 30-minute foot and calf massage and a 60-minute body massage. I can hear another person so relaxed that they have fallen asleep and are snoring on the massage bed next to mine. $60

8 p.m. — After a full day driving around and relaxing, my friends and I stop at a ramen place for dinner. We all try different types of ramen (I opt for pork and vegetables) and I end up paying for the group. $72

Daily Total: $140

Day Three

9 a.m. — My friends and I get up and decide to visit a gem museum. I pay cash for the entrance tickets for myself and two friends. $18

10:15 a.m. — We are back at the waffle place for brunch! This time I order a basil and tomato sandwich and it’s amazing. The tomatoes are piping hot, so I go with a brownie and ice cream for dessert. I pick up the bill for this breakfast for my friends. $54.45

12:30 p.m. — After eating, we take a gondola up a mountain with amazing views of Lake Kawaguchi and Mt. Fuji. I pay for my ticket ($5) and enjoy the short ride. I do not mind heights. At the top, I pay for a small fortune at the shrine ($1). It’s a good one! I pick up some souvenirs at the top to send to friends before we hike down ($22.32). $28.32

3 p.m.— After the natural beauty of the mountain and lake, we go to the Aokigawahara Forest for a short hike. While walking, we decide to see some famous caves formed from lava tubes. I pay my entrance fee ($3) and prepare to duck through a lot of small spaces. $3

5 p.m. — Everyone is tired and ready to head home from the weekend. I wanted to find a smaller restaurant, but the group votes for a well-known sushi chain. I eat and stack my plates. We pay and hit the road home, opting for a scenic and toll-free route. $15.25

Daily Total: $119.02

Day Four

5:50 a.m. — Another early train ride to work ($2). I definitely stayed up too late the night before, video calling a friend. I’ll be on the ship all day today. I skip breakfast and munch on chips for lunch. Not the healthiest, but it’s my duty day so I cannot leave the ship to pick up something else food-wise. I stay on the ship working all day long. $2

6 p.m. — I eat a cup of Annie’s mac and cheese for dinner before my evening workout. I buy 12 packs of these cups on Amazon whenever I run out. I work out and then go to bed on the ship.

Daily Total: $2

Day Five

6 a.m. — I wake up on the ship today and skip breakfast per my usual routine.

12 p.m. — At lunch, I’m really hungry so I walk to an on-base cafeteria and order Japanese curry and rice. $5

5 p.m. — Now that we are allowed to eat in restaurants again, I take two friends to an udon restaurant they’ve never been to before. Since I treated him to a few meals over the weekend, one of my friends pays for my dinner.

6:30 p.m. — We aren’t allowed to go to bars, so after dinner, my friends and I go to a convenience store to buy a drink ($1.51), which we (classily) drink in a park before our 8 p.m. curfew. Canned chuhais come in different “strengths” (alcohol content) and flavors and are pretty cheap. I take the train home ($2). $3.51

Daily Total: $8.51

Day Six

6 a.m. — The usual morning train to base ($2). I made a 2021 resolution to buy no drinks in plastic bottles, so as tempting as a morning coffee or tea from the vending machine at the train station looks, I ignore them. $2

5 p.m. — After my Clif Bar breakfast and running through my lunch break, I’m SO ready for dinner. I have spent the whole day thinking about going to my favorite cafe. The woman who runs it has a changing menu board based on what she feels like cooking that day. Today, I decide on her roasted chicken. The meal set includes soup, salad, fresh-baked bread, and tea at the end of the meal, and it’s phenomenal. I could eat here every night. The quality of food is miles above what I could make. If I wasn’t so full, I would stay for dessert too. $16.51

7 p.m. — After that delicious meal, I wish I could stay outside and walk around. Unfortunately, the curfew is still in effect and I take an early train home. $2

Daily Total: $20.51

Day Seven

6:20 a.m. — I wake up to a dead phone which means I slept through my alarm. I change in literally two minutes and run for the train station, catching the last train I can take without being late ($2). I have to run from the train station to the ship, so I roll into work sweaty and holding nothing but my ID card, a credit card, and some cash rubber-banded together in my pocket. It’s easier to run when everything you carry is lightweight. $2

5 p.m. — I ate a Cliff Bar and some pistachios from my snack drawer at work throughout the day, so I take the train home ($2) and get to dinner hungry again. I order ramen at my favorite spot in my neighborhood. I choose curry ramen with an extra egg and yuzu juice to celebrate the end of the week ($11.01). I accidentally thought it was Friday the whole day, and I’m going to keep up the end-of-week mindset. $13.01

Daily Total: $15.01

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Queens, NY, On A $220,000 Salary

A Week In San Francisco, CA, On A $104,000 Salary

A Week In Northern New Jersey On A $76,686 Salary

from Refinery29 https://ift.tt/3eGsaxx

via IFTTT