Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: an office administrator who makes $37,440 per year and spends some of her money this week on succulents.

Occupation: Office Administrator

Industry: Childcare

Age: 28

Location: Austin, TX

Salary: $37,440

Net Worth: -$8,700 (I have two savings accounts totaling to $5,525, an Acorns account with $195, and about $4,200 in a piggy bank. This is including my car and student loan debt. My SO and I have a joint bank account exclusively for bills, but I don’t view that as an asset. He and I contribute about 50% or more of our paychecks to it.)

Debt: Car debt: $8,300, student loans: $10,300

Paycheck Amount (biweekly ): $1,100

Pronouns: She/her

Monthly Expenses

Rent: $1,445 (For a two-bedroom and includes water utilities. We need the two rooms since we have a nine-year-old boy. My boyfriend helps me with about $650, and I pay the rest since I have a higher salary. )

Car Loan: $300

Student Loans: deferred due to COVID

Electric: $100

After School Care: $264

Car Insurance: $80 (boyfriend pays other half)

Streaming Services: boyfriend pays

Acorns: $6

Son’s Orthodontist: $300

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

There was always an expectation for me to attend university. My parents never graduated high school and wanted me to continue my studies to increase my job opportunities. However, I got pregnant at 17 and that limited my choices. I got a full ride to my local university. I was not super excited, since I felt a lot of pressure to choose a career that would be lucrative. I ended up graduating with a Bachelor of Science in Nursing. That ended up not working out. I was very disappointed with the field and healthcare system in general. I’ve since started my studies for a master’s in library science.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

I had zero knowledge of finances. It wasn’t until I moved out of my parents’ house after graduation that I learned how to create a budget. My parents were always worried about finances and I believe that’s the reason they never really talked about it. Ignorance is bliss, I guess!

What was your first job and why did you get it?

I got my first job in my freshman year of university. I was determined to be as financially independent as possible from my parents. I felt like it was not their place to help me since they were already letting my son and I live with them. As soon as I began making money, I was able to pay for gas, food, and childcare. Sometimes I used my excess scholarship money to buy my mom airplane tickets. I felt accomplished.

Did you worry about money growing up?

I didn’t really worry about money. My parents did a great job keeping their struggles under wraps. We were definitely lower class, but my parents provided me with the basics and many comforts. I’m grateful for that, but I do wish I had asked more questions before moving out.

Do you worry about money now?

I don’t really worry too much, but I’m not carefree. I struggled so much after I moved out of my parent’s house. I made horrible financial decisions and spent about two years trying to correct them. I had to cut my losses and file for bankruptcy in 2020. I feel like I’m finally getting back on my feet, but I’m definitely being more careful.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I became financially responsible for myself at 22. I moved out of my parent’s house and began living with my boyfriend and son. Thankfully, I know my parents will always be a pillar of support in case things go south.

Do you or have you ever received passive or inherited income? If yes, please explain.

I wish!

Day One

6 a.m. — I’m seriously struggling to get up for work. I’m definitely not a morning person, but I have no choice since the other admin goes in at noon. I mindlessly pack some yogurt and granola for breakfast. I share the car with my boyfriend and we agree to get some coffee at the gas station before work. I pay. I get to work a couple of minutes late, but my boss is aware of my carpooling situation, so it’s not a big issue. $3

12 p.m. — It’s lunchtime and I’m so close to clocking out for the day! I’m taking my son to his orthodontist appointment today. I clock out and eat the yogurt and granola I forgot to eat earlier while watching some plant videos on YouTube. Makes me want to buy some plants…

4 p.m. — I had hoped my son’s orthodontist appointment would’ve been longer. The office only allows entry to the patient, so I doze off in the car. He knocks on the car window about 15 minutes after being let into the office. Oh well! We have time to stop by Lowes before heading home, to my son’s displeasure. I buy two cute succulents and three terracotta pots for some of my plants at home. Yay! $18

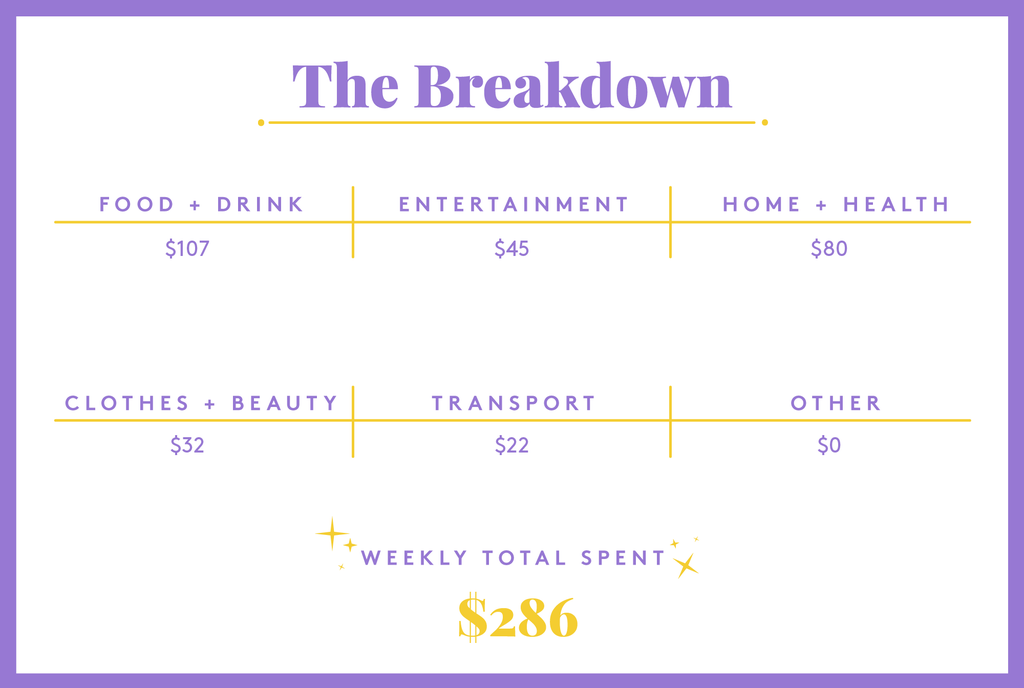

Daily Total: $21

Day Two

8:30 a.m. — I’m in a much better mood this morning. I decide to splurge on myself and order a cinnamon dolce latte and a breakfast sandwich from Starbucks. I don’t have enough on my app, so I add $15. $15

12 p.m. — It’s lunchtime, but I’m not super hungry. I run across to HEB and buy some plantain chips, a fruit cup, and some cheese sticks. After work, I go home and do some yoga. $21

9 p.m. — I wind down watching YouTube and scrolling Instagram. I come across an ad for sandals. I’ve been looking for a pair of sandals with a thicker sole to no avail. These look super cute and comfy. I order a pair of Muk Luks after consulting with my boyfriend. He then asks me if he can buy a game. It’s been really helpful being open about our expenses and we’ve really helped each other moderate our spending. $32

Daily Total: $68

Day Three

7:20 a.m. — I’m in a very bad mood since I have to rush into work. I dislike when multiple staff members call out and I have to regroup for the morning. My mind is already working on a new plan for the day as I’m getting ready. My boyfriend is groggy since he wasn’t prepared to get up early. We decide to buy some kolaches from the gas station to perk ourselves up. $6

12:30 p.m. — I rush to HEB since my lunch will be short today. I buy a fruit cup and juice to go with my plantain chips and cheese. I scarf them down and get back to work. $4

5 p.m. — After a horrible day at work, my boyfriend and I decide on some fast food for dinner. My son is excited for burgers and seeing him happy makes me feel better. We get some burgers and life is good again. I struggle during yoga afterward, but I don’t care much. $26

Daily Total: $36

Day Four

2 a.m. — My son wakes up at 2 a.m. to tell me he needs to vomit. Then he proceeds to vomit. After cleaning him up, I check his temperature and call out sick. I get up around 7 to work from home and do as much as I can from my laptop. I cook breakfast.

1 p.m. — My son is doing better and we heat up some soup. I’m not feeling so great as allergies are attacking my sinuses. I take a nap after making sure my son tolerates his food well.

6 p.m. — After my boyfriend comes home, I decide to go to the gas station to buy some allergy medication. They have none, but I see that we need gas so I fill up the tank. $22

Daily Total: $22

Day Five

9 a.m. — It’s been a horrible morning at work with two no-shows and two call-outs. I really wish the sub company had staff to send to us. Luckily, a parent brings in donuts and that brings me back to life.

12 p.m. — I thank the universe for a short day today. After the horrible morning, I consult with my boyfriend to see if I can buy some Chick-fil-A. He agrees and asks for a milkshake. My son is so excited since Chick-fil-A is his favorite. This makes my day and I forget about work. $32

7:30 p.m. — I’m really loving HBO Max. We all sit down to watch Mortal Kombat and I am thrilled from start to finish. (Don’t worry, my son didn’t really watch it.) We snack on some ice cream and go to bed. My boyfriend and I have sex. It’s pretty hot and afterward, he realizes he may have finished inside me. I’m not too concerned, but he tends to overthink things. We talk for a while and he confesses he wants to start trying for a child in about a year. My heart pounds with excitement! We decide that it will be for the best to wait and I will buy the Plan B pill in the morning.

Daily Total: $32

Day Six

9 a.m. — I get up and out of bed early to pick up supplies for our learning center. Once I’m already out, I find out everything was already picked up yesterday. I text my boss and she apologizes for wasting my time on a Saturday morning. I head to Walmart to buy the emergency contraceptive. I also buy some allergy medicine since my sinuses are really kicking my butt. $62

1:30 p.m. — My son and I decide to go on a hike. He is not too pleased and spends the whole time complaining and getting startled by pollinators. I spend this time talking to him and trying to educate him about insects, but it’s futile. He is only excited about the creepy bridges and manholes.

6 p.m. — We have another movie night, but this time at Alamo Drafthouse. My boyfriend and I are so excited to watch the new Demon Slayer movie. My son has shown interest but is not as excited as we are. We give him a quick synopsis of the show. He’s never been to Alamo Drafthouse and is excited to hear they serve actual food. My boyfriend pays for the food and drinks and I buy the tickets. $45

Daily Total: $107

Day Seven

8 a.m. — My allergies are still winning the battle against my immune system. Once all the medication kicks in, I’m ready to begin my Sunday chores. My son and I cook up some eggs and sausage for breakfast. Yum!

12 p.m. — My boyfriend has the car today, so I make my son and myself sandwiches with cantaloupe on the side. We watch cartoons until my boyfriend comes home.

1 p.m. — My boyfriend is back and now I can go window shopping. I stop by Lowes to see what indoor plants they have available. I am (thankfully) not impressed. I skip out on buying anything, even though shopping wasn’t even my intention. When I come home empty-handed, my boyfriend and son sigh with relief. Ha!

4 p.m. — Spend the rest of the day hanging out with the family and then head to bed.

Daily Total: $0

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Austin TX, On A $76,000 Salary

A Week In Central New Jersey On A $61,800 Salary

A Week In Detroit, MI, On A $37,500 Salary

from Refinery29 https://ift.tt/2TKifPw

via IFTTT