Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a sales operating manager with a joint income of $210,000 per year who spends some of her money this week on Warby Parker glasses.

Occupation: Sales Operations Manager

Industry: Engineering

Age: 34

Location: Chicago Suburbs, IL

My Salary: $125,000 + 20% Bonus

My Husband’s Salary: $85,000 (He works in sales and his total OTE is $170,000 but he will likely only get his base this year)

Net Worth: ~$413,000 (We have about ~$250,000 in 401(k)/IRA/brokerage accounts for retirement, ~$180,000 in our Money Market account which is MUCH higher than usual. This includes the money from the sale of our house last month and it will be used for our down payment next month. Minus ~$17,000 car loan)

Debt: ~$17,000 car loan

My Paycheck Amount (2x/month): $3,437.60

My Husband’s Paycheck Amount (2x/month): $2,254.52

Pronouns: She/Her

Monthly Expenses

Housing: $0 at the moment. We sold our house last month and don’t close on our new house until next month. The housing market is INSANE here right now because of COVID and we determined with working from home indefinitely, both my husband and I need our own office spaces. Our house sold without hitting the market and we bought our new home without it being listed as well. The seller asked for a long close and we love the house so we agreed. My parents (dad and stepmom) have a second home that they have spent most of the last year in and my childhood home has been pretty much empty during that time. My parents are letting us stay at the house expense-free while we are between the two houses and it is only 10 minutes away from our old house. They already had everything set up for my kids which was an added bonus. In return, I cook for them when they are in town and keep wine on hand at all times for my stepmom.

Car Loan: $390.65

Daycare: $3,769 (full-time daycare for two kids. Yes, this number sends me into a panic every time I see it but when our center closed down last March because of COVID, I vowed to stop complaining about how much of our income goes to this because it’s truly worth every penny. They also get breakfast, lunch, and a snack that we don’t have to prepare)

Cell Phone: ~$198

Peloton: ~$80 (bike payment and monthly subscription)

Streaming Services: ~$40 (Our phone company pays for our Netflix, we pay for Hulu, Peacock, and Spotify)

Storage Units: ~$170 (Once we move next month we will not be paying this)

Lease Payment: $526.45 (We have two cars. I am looking forward to getting the lease over with next summer. With working from home, we will hopefully be able to get rid of the leased car and just live with one.)

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

100%. I am the oldest in my family (and extended family) and my parents and aunts and uncles are all well-educated. We grew up near my paternal grandparents and they were VERY higher education-focused for all of the grandkids. They started contributing to our college educations from the time we were born. What my grandparents didn’t contribute, my dad paid for, with the exception of a small, $5,000 loan I had to take out for my study abroad program. The mantra growing up was that we could go to the best school we got into without worrying about paying. I know how incredibly lucky I was and am where I am today because of the overall privilege I had growing up the way I did.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

Money was always on my mind growing up. I grew up in a very affluent area and kids getting a new BMW or Jeep for their 16th birthday was pretty common. I worried about fitting in (teenage girls are mean) and this was because my parents did not have the same “keeping up with the Joneses” mentality as many of the others in our community. My mom grew up very poor and was pretty frugal, whereas my dad believed in spending money on quality that would last. This lead me to appreciate money and understand the importance of it while also having fun.

What was your first job and why did you get it?

I babysat as a teenager but my first job at 16 was answering phones at a local pizza place. I got it because my parents would not pay for the “designer” items I wanted in high school. They would contribute (a very reasonable amount) to items, but if I wanted something more expensive, the difference would need to come from me.

Did you worry about money growing up?

Yes and no. My parents have been divorced since I was 5 and put me in the middle of a lot of their money disputes, which really wore on me growing up. My dad was always commenting that my mom never paid for my sports, school stuff, clothes, etc., despite him paying her child support (which is true). Ultimately, my brother and I ended up moving in with my dad (and amazing stepmom and step-siblings), which was the best situation for us. I don’t have a relationship with my mom currently.

Do you worry about money now?

Yes and no. I know we make a really comfortable income, but our daycare costs really stretch us. I know this is an expense with an expiration date (come on, kindergarten!!) and once we get my son into public school this fall, we will feel a lot more comfortable and be able to start really building our savings and strategically investing outside of our retirement accounts.

At what age did you become financially responsible for yourself and do you have a financial safety net?

At age 22, when I got my first full-time job. I paid for my own health insurance, rent, cell phone, etc. — but my dad did co-sign for my first apartment and helped me furnish it. If things had ever gotten really tough, I know my dad would have helped. At this point in our lives, if we really needed anything, my parents or my in-laws would likely step in and help us (mostly for the kids’ sake). We know how lucky we are to have them and how privileged we are. Additionally, my husband has a chronic illness and his parents continue to pay for his medical needs/supplies. We meet our annual deductible pretty early every year.

Do you or have you ever received passive or inherited income? If yes, please explain.

Yes. My dad and grandparents paid for my education and my in-laws paid for my husband’s undergrad and MBA. My grandmother has given us very generous birthday and holiday gifts totaling around ~$50,000 over the last few years and when my husband and I got married, my in-laws gave us money to contribute to a down payment of ~$75,000. We both realize how fortunate we are to have this safety net.

Day One

7 a.m. — My alarm wakes me up, which is a 50/50 occurrence these days. Usually one of the kids is insisting we get up anytime between 5:30 and 7, but my husband must have given older kiddo his iPad as he is happily and quietly watching it in our room while we both snooze until our alarms go off again.

7:55 a.m. — Everyone is dressed and heading out the door to daycare when I get a notification that I have a meeting in five minutes. Someone must have put a meeting on my schedule last night that I somehow missed. I work for a global company so 6 a.m. and 8 p.m. meetings are not uncommon so we can capture all time zones. My husband takes the kids to daycare alone.

10:30 a.m. — We are running out of milk, so I place a grocery order for pickup. I love placing the order online and doing pickup. Prior to COVID, I enjoyed going to the store for inspiration but honestly, I don’t think I will ever go back to shopping in person. I order milk, a bunch of fresh fruit and veggies (I usually buy what is in season and on sale), and snacks for the kids (cheese, yogurt smoothies, pretzels). The total will be around $70 when I pick them up later tonight.

12 p.m. — I get a very short window for lunch, so I heat up a Daily Harvest Bowl and throw two eggs on top. I add in a little too much liquid but it still ends up being really good. Every few months I treat myself to a box so we have some quick, easy, and relatively nutritious freezer meals that my husband and I make when we don’t have leftovers. I eat at my desk while on a call. We have a big training this evening for our colleagues in Asua and one of my team members is freaking out about us not being ready. My boss is AMAZING at talking people off the ledge and we will be able to proceed this evening.

2:30 p.m. — I clean out the fridge and start dinner. I accidentally smack my engagement ring on the fridge and I notice the center stone is now loose. Losing the diamond is one of my greatest fears. I take it off and will need to find someone who can fix it. We are eating at my in-laws and I offered to cook dinner for everyone. I am a huge fan of simmer sauces, mix in a protein and some veggies, cover, and three hours later you have a meal! I add in extra onion, shallot, and garlic because they make everything taste that much better… try and tell me you don’t agree!

4:30 p.m. — Shut down work for now and pick up the kids from daycare (the dog comes too). I get a call from the grocery store that they need us to pick up our order early so my husband goes to pick it up. All goes as planned except when he gets home he realized the store way overcharged us for the wrong order (the giveaway to my husband was the 12 peach Red Bulls on the receipt). I call, they sort it out, and ask us to come back to reverse the charge. After dinner, my husband goes back and pays the correct amount and picks up some wine (my stepmom is unexpectedly home tonight!) and a bottle of bourbon for himself. $105.87

7:30 p.m. — Get home, kids to bed, unload groceries, and have our work training which ends up being way more talking for me than I originally anticipated. After the call my husband, stepmom, and I grab a glass of wine and catch up.

10:30 p.m. — Today was long… brush my teeth and pass out watching Parks and Rec.

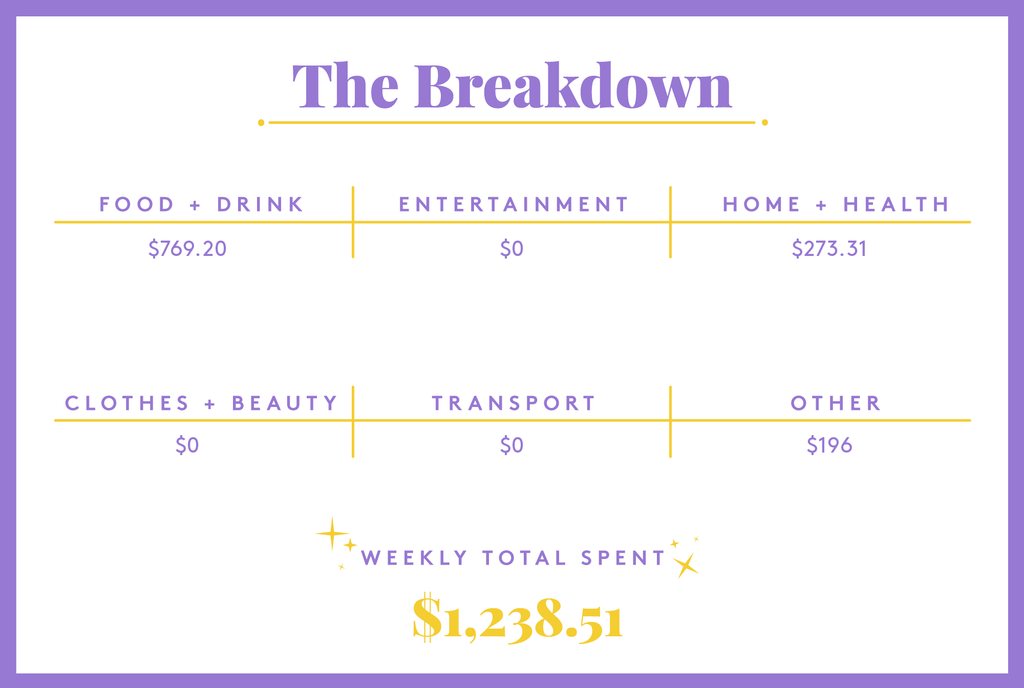

Daily Total: $105.87

Day Two

4:30 a.m. — Ugh. Anyone else wake up in the middle of the night unable to fall back asleep? I am up and can’t get back to sleep for at least an hour. I watch more Parks and Rec and eventually wake up to my alarm at 7 a.m.

7 a.m. — Older kiddo is up, my husband gave him an iPad again and he is peacefully watching it in his bedroom. My mom and I exit our rooms at the same time and both go and chat with him. He is loving all of the extra grandma time he is getting by staying at my parents’ place. We didn’t see much of them last year with daycare travel restrictions, but we are making up for lost time. Kiddos dressed, given snacks, and backpacks packed. My husband takes the kids to daycare alone again while I get ready for the Americas/Europe training with my team.

11:30 a.m. — This morning has been LONG. I only had time for two cups of coffee so I finally break and make myself a piece of peanut butter toast. Crumbs on the bottom of the toaster oven light on fire and I panic momentarily but put it out and eat my singed toast. Despite being responsible for two humans and having a good job, I in no way feel like a real adult most days. This last year has had me surviving, definitely not thriving.

1:15 p.m. — Eat another DH bowl with two scrambled eggs into it. I compliment it with some dark chocolate. Our mortgage broker asks for our homeowner’s insurance policy for the new house, so I work on getting them the information they need. We then take the dog on a walk.

4 p.m. — Pick up the kids from daycare, then head to my in-laws to drop off the kids. My husband and I are having our first date night since COVID hit last March!! We have taken precautions very seriously because daycare has been our lifeline during this time and my kids’ lives have been relatively uninterrupted because they go. I have been nervous eating inside anywhere so we have just done take out or delivery, but I feel with both of us well beyond two weeks out from our vaccines, we deserve this.

7 p.m. — Dinner is amazing. I am wearing jeans for the first time in months. We had edamame, a caterpillar roll, and steamed crab legs, and my husband has a steak. I have been tipping servers aggressively because I really appreciate them taking the risk to serve the public during this time ($190). Head back to my in-laws. The older kiddo has started having sleepovers at my in-laws house on Friday nights which is amazing for us. He is the early riser and it is nice to be able to sleep in. The younger one still sleeps in a crib and will sleep until 9 if we let her. It is also nice to have alone time with her without her brother. $190

11 p.m. — Crawl into bed and watch an episode of Girls5Eva on Peacock. This show is funny and I recommend it.

Daily Total: $190

Day Three

7:30 a.m. — I am awake and feel very well rested! One of my good friends is graduating from graduate school today and they are streaming the commencement so I hop on my iPad at 8 and watch. Congrats to all of the 2021 grads!

9 a.m. — We have a tradition of bringing over breakfast from our favorite place on Saturday mornings as a way to say thank you to my in-laws for sacrificing a night of sleep. My husband and I each get a breakfast skillet with potatoes, chorizo, onions, jalapeño, and two sunny side eggs on top, the kids split a meal (pancakes, scrambled eggs, bacon), and we get my in-laws Swedish pancakes and corned beef hash. $56.12

11 a.m. — The older kiddo has been watching way too much TV today and is starting to get really crabby. We head home for lunch. A huge meltdown ensues.

12 p.m. — I make the kids tomato soup and grilled cheese sandwiches. The little one goes down for her nap and we let the older one know there will be no TV for the rest of the afternoon. He is very unhappy but we play with him and all is well again. My husband orders a new pair of glasses from Warby Parker from a try-on box he got earlier this week. $196.95

5 p.m. — Order a pizza and wings for dinner. I am realizing we have been eating out a ton this week but I have just been so exhausted with work, our moves, and being a mom that I forgive myself. $35

8 p.m. — Both kids down, my husband and I settle in for the night and watch a few episodes of The Big Bang Theory before turning on SNL with some wine.

12 a.m. — The episode is not worth staying up so late to finish it. Bedtime.

Daily Total: $288.07

Day Four

8 a.m. — Wake up, lounge around, make the kids breakfast (mini pancakes, yogurt, and raspberries), and I scramble some eggs and make breakfast tacos for myself. My husband and I talk about taking the kids on a nature hike. We both want to shower so we take turns playing outside with the kids while they run through bubbles and ride bikes.

11 a.m. — We lounged for too long and now it is a little late to go on an actual hike. The younger kiddo still naps and the kids will need lunch soon so we opt to take a walk around a lake that is near my parents’ house. We make a fun game of it and the older one is pretending he is on a scavenger hunt.

12 p.m. — We call my mother-in-law and see what she is up to. We decide to bring lunch over and all agree on Italian. My husband and I have Italian beef sandwiches (with hot peppers and cheese) and fries, the kids split chicken fingers, my MIL has a hamburger, and my FIL an Italian sausage sandwich. The total is $45 and they pay.

1 p.m. — The younger kiddo goes down for her nap at my in-laws. My husband and FIL take the older one to a nearby nature preserve and then the park. I relax and screw around on my phone and chat with my MIL.

4:30 p.m. — Leave my in-laws and head to Target. I placed a drive-up order yesterday that I need to pick up. The kids are out of bubble bath and it is the only way the younger one will take a bath without protest. Pick up two things of bubble bath and a spot treatment for my face (stress breakouts suck) ($20.56), but realize I need to run inside to grab some additional items. I go into the store with the older one since he is having another meltdown (four-year-old’s, am I right?) and get some food (Twizzlers, cereal, chicken broth) a bottle of wine, and a toilet brush because my parents don’t have one and we want to leave their house cleaner than we found it ($33.81). We get home, I start dinner, and my husband plays soccer in the backyard with the kids. My mom got home just before we did and the kids are very excited to see her. $54.37

8 p.m. — The kids are bathed and in bed. We got my stepmom into The Marvelous Mrs. Maisel and watch a couple of episodes with her.

10:30 p.m. — Bedtime!

Daily Total: $54.37

Day Five

4 a.m. — The little one is up screaming her head off. My husband takes the first crack at getting her back down but is unsuccessful. I grab her a snack, we snuggle for a few minutes, and she lets me put her back to bed. I hate waking up at this time because I don’t always fall back to sleep. I take some CBD, put on an episode of Superstore, and fall back to sleep.

7 a.m. — Alarm goes off. Nope, not yet, snoozed.

8 a.m. — I had previously set a calendar reminder to sign the kids up for summer swim lessons. It has been well over a year for my older kiddo and the little one has never done lessons. I sign up through our park district and snag two of the last spots for their age groups. Classes are limited this summer so I knew I had to jump on this ($196). I then check my email and see that my Butcher Box has been processed ($212.61). I started using ButcherBox last summer and I love it. The meat has been really high quality and I appreciate not having to think about protein. I am getting filets, NY strips, salmon burgers, chicken breasts, ground turkey and beef, Italian sausage, burgers, hot dogs, and ribs in this box. $408.61

12 p.m. — We were supposed to meet a flooring contractor at our new house but my husband never confirmed the final time with him. We get a call from the contractor apologizing that since he (my husband) didn’t confirm, he wasn’t sure if we wanted him to come. The contractor is able to come an hour later but I have a work call at that time so we run some errands (dropping off Nespresso pods at UPS to be recycled and picking something up from our old house which ends up being a check for $77) and my husband drops me back off at my parents. With this time change, my stepmom will be able to go with my husband and see the house for the first time! We coordinate with the seller and she gives us the green light to come back.

3:30 p.m. — Walk the dog around the pond. It is really nice to get outside and have some alone time with my husband. After our walk, I do a few more work things, we go pick up the kids, and they play outside until dinner.

6 p.m. — Dinner for the kids is mac and cheese, strawberries, and veggies. I am not inspired to cook so we are ordering out again. (I swear we never order out this much and I think I need to be better about meal prep in the upcoming weeks). I also order a desk calendar for me and a few books for my son about getting ready for kindergarten! I have an Amazon gift card that covers the entire balance.

7 p.m. — My husband goes and picks up sushi for all of us. My stepmom gets a soft shell crab app and some nigiri, my husband gets gyoza and katsu and I get two sushi rolls. The total is $120.19 including a tip. We eat, both kids are in bed, and we watch a few more episodes of Mrs. Maisel. I am so happy that my mom likes this show as much as we do. I am in bed around 10 and fall asleep almost immediately. $120.19

Daily Total: $528.80

Day Six

4 a.m. — Younger kiddo is up crying again. We usually let her cry for a few minutes to see if she will settle back down. Luckily, today she does go back to sleep so no intervention needed! I fall back to sleep pretty quickly.

6:40 a.m. — Older kiddo is in our room. He gets my iPad and we snuggle for a bit while he watches a show on Netflix.

7:30 a.m. — Up, everyone is dressed, my husband takes the kids to daycare, and I make an iced coffee and head to my computer.

9:30 a.m. — I am hungry so I toast a piece of bread and make a piece of avocado toast. I like to add a few drops of good olive oil, flakey salt, pepper, and crushed red pepper. So good and filling.

12:30 p.m. — Take the dog around the pond on a walk with my husband since it is supposed to rain later today. Over the last year, all of the togetherness has really solidified our relationship. There have been a lot of ups and downs but he is a true partner, amazing dad, and my best friend. We have known each other since middle school (he was my middle school crush), reconnected after college, started officially dating a few years after, and I guess the rest is history. When we get back, I preheat the oven for a Daily Harvest Tomato and Basil flatbread (unfortunately with all of the eating out there haven’t been leftovers so I am going through my DH stash).

4:30 p.m. — Head to get the kiddos with my husband and the dog. We are going to have dinner at my in-laws tonight because my stepmom has a Zoom meeting and we want to give her quiet time with no screaming kiddos in the back. I get a note from daycare that the kids need new sunscreen for their cubbies, so I place another Target drive-up order for sunscreen, apple sauce, and smoothies (yes, more kids snacks).

7 p.m. — Dinner is burgers and brats, then the kids take a bubble bath and we head to Target to pick up the order ($21.99). When we get home, I remember to defrost something for tomorrow’s dinner. I play roulette with what I pull out of the freezer. My parents’ second home is in a rural location where you can buy pigs/cows directly from farms and then have them butchered locally. They usually order a cow and a pig a year and have a ton of meat and not enough storage so we are gifted a lot. There are some unlabeled bags of ground something (either beef, pork, or venison) and I take one out for tomorrow’s dinner. $21.99

9 p.m. — Mom is done with her call. We turn on Mrs. Maisel, watch a few episodes, and are in bed around 10:30.

Daily Total: $21.99

Day Seven

7 a.m. — Alarm goes off! I have an early call this morning so I get the older kiddo dressed and snacked and dad takes him to daycare. My daughter has a speech pathologist appointment so she gets to sleep in while I take my call.

8 a.m. — Speech for the little one. My daughter has a slight speech delay and her pediatrician recommended we engage with an SLP more as a proactive measure. We have been working with a therapist for about a month and we have already noticed a big difference in her sentence creation and the number of words she is using. After her session, my husband takes her to daycare because I am still on calls.

9:30 a.m. — I am hungry and remember I have half an avocado waiting for me in the fridge. Toast two slices of bread, slice avocado, olive oil, flaky salt, pepper, and crushed red pepper again!

1 p.m. — Break for lunch. We order Potbelly’s sandwiches (a steakhouse for my husband and tuna for me, which I regret as soon as I start eating it), chips (salt and vinegar ALWAYS), and my husband gets a milkshake. ($26.14). We watch the newest episode of Handmaid’s Tale (OMG). My mom goes to Costco and gets us a box of applesauce pouches and yogurt pouches for the kids. She doesn’t ask us to pay. $26.14

3:30 p.m. — Start dinner. I am making a slow-simmered ragu served over creamy polenta. I have decided I think the ground meat I defrosted is venison and it smells delicious and it all cooks together.

4:30 p.m. — Pick up the kids. When we get home, they play outside with a young boy who lives next door. They play with bubbles and ride bikes while I finish dinner. I roast some zucchini and finish the polenta for the adults, and heat up some leftover mac and cheese for the kids with strawberries and carrots on the side. One day I will stop making two meals, but for now, I do it because I don’t want the fight after a long day of work.

7:30 p.m. — Kiddos are in bed. I have been putting off buying a new charging cable for my Foreo face brush in hopes I would find it in the mess of our move, but I haven’t yet and I am experiencing breakouts. I also need some coffee creamer and order a four-pack of Caramel Nutpods. $23.27

10 p.m. — A couple of glasses of wine, a couple of episodes of Mrs. Maisel, and then its lights out!

Daily Total: $49.41

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Austin, TX, On A $37,440 Salary

A Week In St. Louis, MO, On A $40,000 Salary

A Week In Pittsburgh, PA, On A $224,000 Income

from Refinery29 https://ift.tt/2UQcD77

via IFTTT