Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a grant writer who makes $63,500 per year and spends some of her money this week on a coupe glass.

Occupation: Grant Writer

Industry: Nonprofit

Age: 31

Location: Rural Kansas

My Salary: $63,500

My Husband’s Salary: $44,337

Net Worth: $21,447 ($8,947 across our checking accounts, $7,700 in savings, and $4,800 across our retirement investments. We also own a tiny house that is completely paid for, though I have no idea what its resale value would be. My husband and I combine all our money, with both of us getting “allowances” for extras and paying for things that jointly benefit us out of the main pot.)

Debt: $0

My Paycheck Amount (1x/month): $2,509

My Husband’s Paycheck (1x/month): $2,771.09

Pronouns: She/her

Monthly Expenses

Housing: $0 (We built a tiny house together (yes, literally, we did all the labor) in 2020 and paid for it in cash.)

Loans: $0 (We finished paying off our student loans in 2019.)

Netflix: $8.99

Apple Music: $4.99

Phone: $60.95

Tithe: $484

Savings: $1,000

Roth IRA: $350

Car Insurance: $46

Life Insurance: $14

AAA: $17

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes, there was definitely an expectation for me to go to college. It was something that my dad always regretted not doing and I was the first person in my family to complete a bachelor’s degree. Fortunately, I loved school so college was always something I wanted to do anyway. I went to a crazy expensive private college and while I had a great experience, I don’t know that I would sign up for that again knowing what I do now. I’m an only child so I was very fortunate to have my parents pay for my college, but my husband footed all his own bills for his degree and even with him working all throughout college he still had about $100,000 in student loan debt when we got married, which we paid off together. It took us eight years to do it and for two of those years, we actually lived in a converted van so we could put our rent money towards paying off loans.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

Oh lord no. I mean, they tried sometimes, but my family put way more emphasis on teaching me to be a somewhat decent human and on completing my formal education than they did on money. My mom was a big saver, but only when it came to herself. She would buy me anything I liked but had a hard time splurging on anything for herself. My dad’s philosophy towards money was very much about the now and his planning for the future with money has always been very vague. I grew up with a gauge for what my family considered “reasonable spending” and never really questioned it much past that.

What was your first job and why did you get it?

My first job was working for my dad, cleaning at his store after school. I got it because he wanted me to and I showed up when he asked me to, even though there was zero financial compulsion for me because if I wanted some spending money, all I had to do was ask (I told you, SPOILED).

Did you worry about money growing up?

Nope, never. I don’t think I even thought about money growing up.

Do you worry about money now?

Oh yes. Especially now that I’m an adult and can see where my parents are at financially, I really don’t want to be in the same boat. I worry about making enough now to be able to take care of them in the future if they need it, especially considering everything they did for me growing up. I’d like to give them some years where they don’t have to worry about money just like they did for me.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I’d say 21 when I got married. I didn’t know much about money but I had a STRONG opinion about never using credit cards and always having at least $5,000 in savings because you never know what might happen. My husband is an absolute rock when it comes to money and we have tried really hard to build up our own safety net. If a major catastrophe happened, we have about 17 immediate family members who could help us out.

Do you or have you ever received passive or inherited income? If yes, please explain.

My parents sporadically gave me what they called an allowance, but it was never regular. Mostly it was an “ask if you need it” basis, and “need” was defined very broadly. But no, never an inheritance or anything like that.

Day One

9:40 a.m. — I wake up out of a dream where I’m trapped in a rearranged version of my best friend’s parents’ house. My dogs are still sleeping beside me (they always crawl into my husband’s spot after he gets up for work in the morning) so I grab my phone and check the IRS website for our stimulus payment status and our tax refund status. No progress on either, at this point, I’m trying to tell myself that it’s just monopoly money and it isn’t real. We’ve been talking about doing an endless brunch date for Easter, so I check the restaurant’s website to see if they’ve posted the menu yet. Also no dice, so I drag myself out of bed and head outside with the dogs.

10 a.m. — This morning is my weekly coffee date with my mother-in-law, so I walk down to her house and start the Moka pot going. We sit down at the kitchen table, drink our coffee, and talk about what we’ve been thinking about this week. Turns out she’s been feeling like she wants to have fewer animals (and less responsibility), and I want to spend less time traveling and more time at home with my husband, so we talk about how to shrink those things — and also how we want to buy a milk cow eventually.

11:30 a.m. — I walk the half-mile to the mailbox and collect the mail, then start my laundry down at the big house. My nieces and sister-in-law (K.) are outside playing on the dirt pile, so I say hi to them on my way through. I grab the Instant Pot from the big house and go back up to our tiny house to start charro beans cooking for dinner.

1 p.m. — I get an email invite to apply for a grant that I’ve been working towards for three years. Feels good. Feels real good. I check on some other work-related projects and then start baking gooey butter bars for dropping off in town later.

2 p.m. — Laundry switching, afternoon snack (dates, swiss cheese, cashews, raspberries, fig crackers, and some fancy goat cheese) and some book reading (currently for work it’s Out of Poverty by Paul Polak and for pleasure, it’s Joe Abercrombie’s The Blade Itself).

3 p.m. — Laundry folding quickly turns into going through all my clothes, packing away winter items, and bringing in my summer stuff. Fortunately, since we live in a tiny house, it takes about 20 minutes to go through every single item of clothing I own.

4:30 p.m. — My husband, D., comes home and we end up chatting about Easter. I check the restaurant’s website again and BEHOLD they have posted their brunch menu! We take it to my in-laws who get really excited and I call and book us reservations for Sunday.

5 p.m. — My mother-in-law picked up some stress relief capsules for D. while she was in town today, so we pay her back for that ($26.96), our propane ($32.50), and our electricity for March ($26.07). Our house is set up to run off of a mid-size propane tank that we refill off of their humongous tank, and our electricity is split off of the cable that runs to their shop, so we have a meter that tracks our electric usage and we pay for the propane by weight every time we refill our bottles. $85.53

7 p.m. — D. and I go for a mile run and then come back and have salad, baked potatoes, ham, and charro beans for supper.

10:30 p.m. — D. conks out and I stay up and read. I have trouble winding down and end up staying awake until 4 a.m. reading The Atlantic and my book and getting probably three hours total of real sleep.

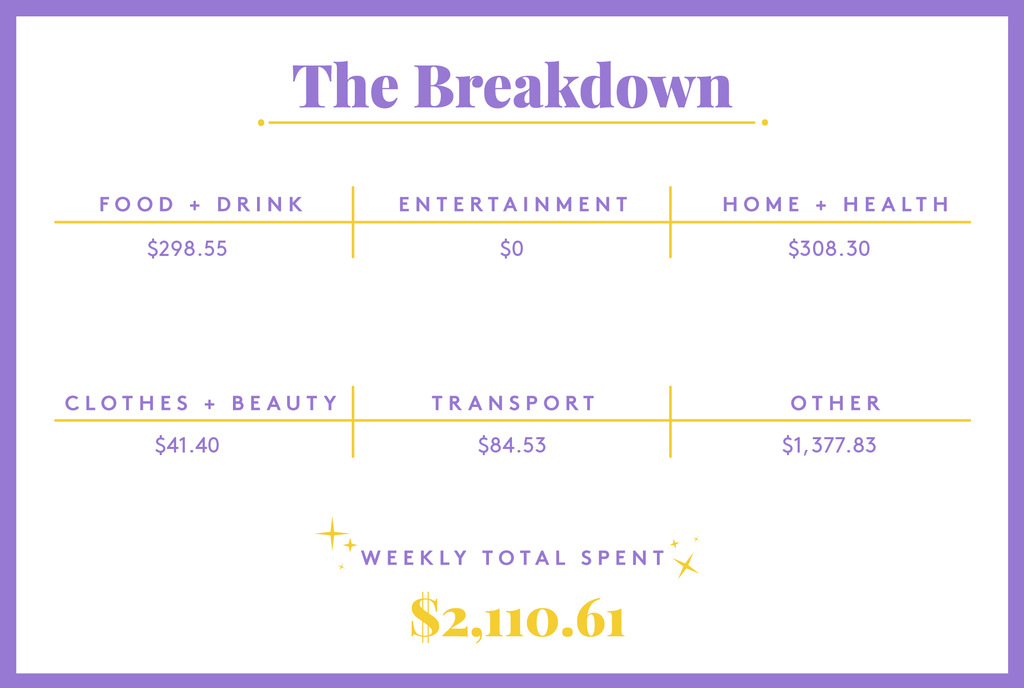

Daily Total: $85.53

Day Two

9:40 a.m. — I wake up with a dog nose in my face. I check the accounts — my paycheck came so it’s time to do monthly money chores. I walk the dogs then make my coffee and spend some time reading and praying.

10:30 a.m. — I total up our last month’s spending, saving, and investing and then look at this month’s upcoming expenses. I pay my quarterly estimated taxes (Hooray for being an independent contractor. Gag. ($1,330)), order a tile cutter and subway tile for above the shower ($203.29), and write a check to move money into my personal account. $1,533.29

12 p.m. — I make a veggie smoothie for lunch — spinach, carrots, a banana, frozen blueberries, chia seeds, cinnamon, and coconut water. Then, I load up the car for errands. I pick up the mail, drop off the gooey butter bars, drive 45 minutes to the nearest Walmart, go grocery shopping ($34.56), drop off my give away bags at the second-hand store, and finally end up at my best friend L.’s house for tea and quality time. She’s 35-weeks pregnant with her sixth child, so we talk a lot about how she is feeling, what she’s worried about, and what she’s looking forward to with the new arrival. $34.56

4:30 p.m. — When I leave L.’s house, I am hungry, so I stop by a taco place. I get two very cheesy, very melty comfort food items and head back up the road ($4.47). On my way home, I stop and get gas in preparation for my drive to Denver on Friday ($20.71). $25.18

6 p.m. — I am exhausted when I get home from lack of sleep, so I take a 20-minute nap and then get to work on finishing the laundry folding, washing the Mount Vesuvius of dishes that appeared overnight, and getting the house back in order. It’s times like these that I love my tiny house most — it takes me less than an hour to get the whole thing clean. D. has a late night helping out with the youth group in town, so I heat up some leftovers, chop a pineapple that’s been sitting on our countertop, and sit down to catch up receipts and read till he comes home.

9:30 p.m. — D. comes home and we decide to eat chocolate and watch the latest episode of Temptation Island. I have a very hard time believing that Kendal is a real person. After it’s over, we both turn in.

Daily Total: $1,593.03

Day Three

9:30 a.m. — I wake up and my ear is killing me. I’ve had an earache on and off for the past few weeks, but it’s been really hurting every day for about a week now, so I make an appointment to go to the clinic in town and get it checked out.

11 a.m. — Today is pretty much just grant writing and collecting statistics.

3 p.m. — D. is leaving tonight to go see his grandpa in Colorado so I go ahead and run on my own.

5 p.m. — I head in for my appointment, the verdict is no infection but I do have fluid trapped in my middle ear. The doctor said he’d like to avoid giving me antibiotics unless I need them (thank the Lord) so I’m supposed to try some over-the-counter allergy medicine and see if that does the trick. While he was checking over my ears, nose, and throat, he actually got distracted by this bump I have on the back of my throat. That thing has been there forever, but he was really interested in it and was using a lot of gross-sounding words like “polyp” and “stalk” and saying I might want to have it looked at if it starts changing. This is the moment where I realize I’m not much of a hypochondriac — if it’s an anomaly on my body that’s been there for as long as I can remember, why start worrying about it now? Bodies are just like fruit, there are tons of imperfections and weird things on all of them and most of those things are not worth getting worried about.

5:45 p.m. — D. is sitting in the waiting room when I get out of the doctor’s office, waiting to take me to dinner (the sweetie). I ask about payment but they say they will just mail us the bill. I haven’t been to a doctor’s office in so long, it will be interesting to see what they charge here, especially because we are cash customers. We decide to go to our local bar, where they make the best hamburgers on the planet (I have lived in four states and visited 24 of them, and I have never had a better burger). $20.36

6:30 p.m. — While we’re eating, D. tells me about a spot nearby where you can get homemade pie slices, and after we have dinner, we drive over for one. $3.27

7:30 p.m. — Home again and D. is packing up to leave. I hate it so much when he’s gone, especially sleeping apart. We’ve been married 10 years and it still never gets easier. I’m grateful to be with someone who prioritizes his family, though, especially his parents and grandparents who did so much for him while he was growing up. He says goodbye and heads out and I call my dad and talk for a couple of hours. I work on a Harry Potter cross stitch while we talk.

12 a.m. — Read for a bit, then set my alarm for 6:15 so I can get up and drive to Denver in the morning.

Daily Total: $23.63

Day Four

6:15 a.m. — My alarm goes off and predictably, I decide I can leave at 7:15 and still make my first meeting.

6:45 a.m. — Convince myself to roll out of bed for real this time, pull on my clothes, make some coffee, slap some war paint on my face, put the collars on the dogs, and then walk them down to my in-laws before hopping in the car for my three-hour drive (there’s a time change between where I live and Denver so I leave an hour later than normal).

9:10 a.m. — I roll into town just about when I was supposed to. My first meeting is breakfast with a friend who is leaving the company at the end of the month. We have a good chat about life and money. $26.51

10:45 a.m. — I have a staff meeting at noon, but I need to run some errands before then, so I am BOOKING IT across town to hit my stops in time. I go to Crumbl Cookies first, where I pick up a four-pack for my meeting with the executive staff later that afternoon. I also grab a $10 gift card for one of my office mates who has a birthday next week ($23.37). After Crumbl, I swing by Target to get a puzzle for my mom’s birthday and some self-tanning face drops ($41.40). $64.77

12 p.m. — Staff meeting! It is so good to get to see some of my favorite people and we have a great time eating Chick-fil-A and laughing together. It turns out to be my three-year anniversary with the organization. I am really lucky to work for a place where I believe in the good we’re doing and I get to accomplish it with some really good people.

2:30 p.m. — I meet with the executive team and give them cookies so they’ll like me (haha). We discuss the plan for my new position (I just took on a new role) and try to figure out if there’s anything they need to add to what’s coming this year.

4 p.m. — I leave the meeting and scoot over to CB2 to pick up some sweet coupe glasses that have been on my wish list for about a month. L. and I do a weekly “cocktails and cinema” night where we pair a cocktail with a movie and I wanted a martini glass for some of our creations. $19.48

5 p.m. — I meet my friend for dinner. We get incredible tacos and queso dip. God, good food just makes everything so worthwhile. My friend decides to be incredibly nice and treat me for dinner, which is so sweet and unexpected.

7:30 p.m. — I go to Kung Fu Tea before leaving the city. I get a huge peach black tea with mango popping bubbles in it and half the sweetness — heaven. $6.97

8:20 p.m. — I stop at the grocery store to grab some sliced turkey and a kombucha ($8.84) then fill up my very thirsty car with gas before hitting the long, flat drive home ($31.41). Once again, I am grateful for my husband getting me an Apple Music subscription because it makes these drives fly by. I get home around midnight, grab my dogs from my in-laws, unload my car, and fall into bed. $40.25

Daily Total: $157.98

Day Five

10:15 a.m. — I wake up feeling like I’ve been hit by a truck. Yesterday was very long and I feel like I have a lot to think about and plan for from the meeting, but it’s Saturday so all that can wait. I walk the dogs, make some coffee, and lay in bed reading for a while.

12 p.m. — It is a picture-perfect day outside with very little wind (a minor miracle in rural Kansas) so I decide to go on a bike ride. I ride 14 miles and am really enjoying being outside in the sun on my bike again. My husband and I rode a century last summer, and I’d like to do that again this year if we get a good day for it.

2 p.m. — I decide it’s time to do the self-tanning routine, so I go take a bath, say hi to everyone at the big house, then go back up to my house to put the dang stuff on. You have to basically be naked for an hour, so I figure it’s a good time to catch up on my receipts and some other things I need to do that won’t make me sweat and won’t require clothing. K. is cooking our Easter dinner for everyone tonight since half of us are going to brunch tomorrow, so I am looking forward to eating with everyone this evening AND most especially to D. being home again.

6 p.m. — K. gets ahold of me and says that dinner is running behind, so I go down to the big house to see what I can do. She has made roast, deviled eggs, fresh green beans, and carrot cake for everyone, so while she’s trying to pull the last few things together, I mix up some cream cheese frosting for the cake and then clean the kitchen. We chat about what’s been going on in our lives lately and then try and get everyone rounded up for dinner. D. has arrived at this point and I am SO GLAD! Once all eight of us are assembled, we pray and then dig into some seriously good food.

11 p.m. — Up at our tiny house with D., we are winding down for bed and looking forward to brunch tomorrow. I read my book until I fall asleep — Joe Abercrombie is a freakin’ genius.

Daily Total: $0

Day Six

10:15 a.m. — D. and I drag ourselves out of bed and get dressed to go to brunch. Whenever we go out together, we like to pick each other’s outfits. I just bought a black pencil skirt and haven’t had a chance to wear it yet, so he picks that with a red bodysuit and a grey sweater, and I put him in a waffle shirt that always makes me want to hug him and we head down to meet his parents.

12 p.m. — We arrive at brunch and IT. IS. SO. GOOD. Between the four of us, we try 23 items off the menu (and most of them twice). I try a Southern Sunrise cocktail, which I’ve never had before, but it quickly becomes one I’ll have again. We see some friends of ours who have also come in to eat and we chat with them and generally just enjoy ourselves for a couple of hours. $75

3 p.m. — After we finish our food, we drive 20 minutes to the nearest Walmart to pick up some groceries and allergy medicine for me. I don’t know why, but I have been dragging tired all day, and on the way home, I actually fall asleep in the back seat. We get back to the house and I lay down for a nap and sleep for four hours. $42.68

9 p.m. — After I wake up, D. and I watch some movies and generally chill together. I am thinking of my trip to Denver tomorrow and hoping I can keep track of all the different things that are swirling in my to-do bowl right now.

12:30 a.m. — After reading for a while, I finally put my book down and go to sleep.

Daily Total: $117.68

Day Seven

9 a.m. — I get up, make myself coffee, and hang out with D. and the dogs for a bit. I don’t have to leave for Denver until 10:30 so I enjoy seeing them while I can.

10:30 a.m. — I hit the road for Denver and play music the whole way. I’ve been stuck on smrtdeath for the past few weeks and am really hoping to get to see a show of his once COVID restrictions are less intense.

12:30 p.m. — Make the switch into mountain time and am running a few minutes early before meeting my friend for lunch. I wander around Ulta for a bit, marveling at the sheer volume of beauty products there are in that store (I’m an eyeliner and mascara only kind of girl). I get bored and go back to my car, where I read for a bit and then order my mom some flowers for Mother’s Day. $47.83

1:10 p.m. — I meet my friend for lunch. I have the best cobb salad on the planet with sweet tea and she has a Margherita pizza. We hang out until I have to leave to make my first meeting. $14.98

3:30 p.m. — I meet with my boss on our strategic plan and we sift through it for an hour and a half. He’s really used to hearing my unfiltered opinion at all times, so he very nicely asks me to take it easy on him at the board meeting tonight. I tell him I do have the tiniest radar for that kind of thing and promise not to shred him in front of the board. He laughs nervously.

5:15 p.m. — I meet my friend T. for dinner downtown. I park on the street and go to pay my meter and there is a sticker on my meter that is literally just an anus. I laugh so hard I have trouble focusing on actually paying the thing ($1), then I snap a picture and send it to D., who is highly unimpressed. Once inside, T. and I order two different sandwiches and then swap halves so we get to try more things — she is my soulmate when it comes to food ($13.88). We talk about work, new things we’re trying out, and we end up exchanging opinions on why we both are glad the other one is there. It’s super sappy and I love it, and it’s over way too soon because I have to get to this board meeting on time. $14.88

6:20 p.m. — I luck out and drive right past a Safeway on my way to the board meeting, so I stop and pick up kettle corn, salt and vinegar chips, and two kinds of Haagen Dasz ice cream for us to consume as we hammer out the details of our strategic plan. $17.58

6:35 p.m. — I get to my boss’ house and walk in at the same time as another committee member, so everything seems to be on schedule. We all squash into the living room and start going through the notes and it’s a really good dialogue. I realize that I like our board president a LOT and I hope she stays in that position for a good long time.

9:15 p.m. — The meeting lets out and I need to fill my car with gas and head back to Kansas. I decide to get another Kung Fu Tea ($6.08). Tea in hand, gas pumped ($31.41), I hit the road back and fall straight into a hot shower as soon as I get home. Then it’s bed and, amazingly, the end of a whole week. $37.49

Daily Total: $132.76

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Central New Jersey On A $61,800 Salary

A Week In Detroit, MI, On A $37,500 Salary

A Week In Providence, RI, On A $54,300 Salary

from Refinery29 https://ift.tt/2SOe9FM

via IFTTT