Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: an IT Specialist who has a joint income of $87,400 per year and spends some of their money this week on a pineapple.

Occupation: IT Specialist

Industry: Finance

Age: 27

Location: Austin, TX

My Salary: $55,000

My Husband’s Salary: He gets paid hourly and makes $2,700-$3,000 a month (or roughly $32,400 a year)

Net Worth: -$35,000 ($60,000 in assets (cars/electronics/$200 in savings total between my husband and me) minus $95,000 in debt)

Debt: $30,000 in student loans, $25,000 left on our cars, $40,000 in credit card debt

My Paycheck Amount (Biweekly): $1,800

My Husband’s Paycheck Amount (1x/month): $2,700-$3,000

Pronouns: They/them

Monthly Expenses

Rent: $1,250

Student Loans: $305

Car Payments: $760

Electricity: $70

Heat/Gas: $30

Internet: $60

Netflix: $18

Crunchyroll: $6

Spotify: $15

My Health/Dental/Vision Insurance: $240

My Husband’s Health/Dental/Vision Insurance: $140

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

I went to a local state college for my four-year degree in Industrial Psychology. Growing up I was expected to go to school, and with the help of my jobs, parents, and grandparents, I was able to get my Bachelor’s without any debt on graduation. I was also expected to go to graduate school and had to take out loans to pay for that.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My family always had money troubles. We were a family of minimal generational wealth. My parents frequently talked to me about money from the time I was a kid. We had to work hard to put food on the table and clothes were to be bought once a year.

What was your first job and why did you get it?

My first job was at the local mall at a teen clothing store. When I turned 15, on my birthday, my dad took me to the mall and taught me how to ask for applications and ask to speak to managers about positions and the industry. Within two months, I had my first job. I was there for two years. I’ve been working full-time along with school and other activities since I was 17.

Did you worry about money growing up?

We filed for bankruptcy when I was in middle school and my parents were open with me and my brother about it. We had our car repossessed and couldn’t afford surgery to save our dog at the time. This was due to the 2008 recession and my parents losing their jobs. We were always stressed about money, but my parents did everything they could to give us a normal childhood. We grew up in a low-income suburb outside of a medium-sized city.

Do you worry about money now?

Yes, my husband and I moved to Austin to get involved with the tech scene. He has a stable job in a lab, but it is about 60+ hours a week and we wish he made more. We do our best to budget, but if something breaks or we need cat food for our three cats, we have to use credit cards and figure out a plan to pay it back.

At what age did you become financially responsible for yourself and do you have a financial safety net?

On my 15th birthday, I became financially responsible for everything besides food. Just before my 17th birthday, I announced I was moving out to rent a house with a friend. My parents made me present a budget plan because they refused to offer me any money once I moved out. I started working full-time at a gas station at that point while still in high school. I have never asked my parents for money in the 10 years since.

Do you or have you ever received passive or inherited income? If yes, please explain.

No, I have not.

Day One

7 a.m. — I wake up to my alarm straight away. My husband has been gone, he works about 12-14 hour days and leaves at 3 a.m. I feed my three cats and head to the bathroom. I take about five different medications for both mental and physical illness, as well as a multivitamin. I wash my face and put on acne cream. I run to the kitchen, grab a Clif bar and a glass of water, and sit down to do my IT job. My desk is located next to my bed in my small Austin apartment.

2 p.m. — I get up from my busy workday and feed the cats again. I play with them a bit, take mid-day medication, and grab a snack. I read the news on my phone while I eat.

6 p.m. — After I log off work, I play with the cats and hop on the Nintendo Switch for an hour. My husband runs to Walmart after work and comes home with food for the next few days, cat food, and our prescriptions. We make tuna salad sandwiches for dinner and watch Bo Burnham’s new special on Netflix. We talk about fixing things in our marriage, the weather, and some PlayStation games, which we both enjoy playing. These are daily conversations. My husband goes to bed at 9. $105.60

11:30 p.m. — At night I enjoy writing fiction and I play a lot of D&D, so I do some character work. I spend the night watching Critical Role, playing with the cats, and eating a bag of popcorn. I take my nighttime medication, take a five-minute shower, and lay down to sleep. I fall asleep fast, but it’s hard to stay asleep most nights. I wake my husband up to kiss him goodnight and pass out with the cats cuddled around me.

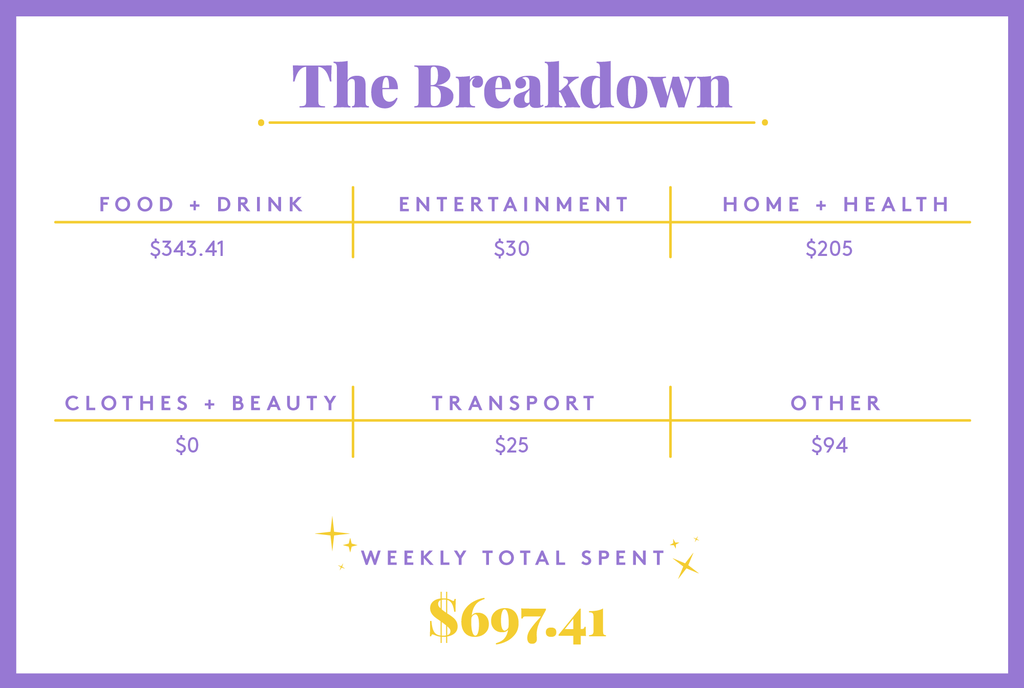

Daily Total: $105.60

Day Two

7 a.m. — I wake up like usual and hop on to work. I have to log on to a virtual doctor’s appointment at 9:30 for a half-hour to discuss mental health — depression and anxiety have been issues all my life. Luckily, I have insurance that covers this. $60

4 p.m. — My husband and I are texting back and forth about things we need for the house. The cats also need flea treatment and a few cheap toys. I hop on Chewy.com to get some supplies for them. $94

7 p.m. — My husband comes home late, so he picks up two Jimmy John’s subs on the way home from work. His work is about 30 minutes outside of Austin so he spends quite a bit on gas. We sit down and eat while we watch anime. I tell him about my funny clients, he tells me about his plans for a promotion at work. We are always talking about getting ahead. We also talk about how Austin is coming back from the pandemic. We’re excited to get out and do things again. He goes to bed and I read. $16.35

1:00 a.m. — I can’t sleep after taking my five-minute shower and taking my meds, so I grab my Switch and play Animal Crossing for about an hour. Once 2 a.m. rolls around, I realize I have five hours to sleep and my husband will be awake soon. I take a sleeping pill and try not to think about how groggy I will be tomorrow.

Daily Total: $170.35

Day Three

7:45 a.m. — I snooze my alarm a few times. I am exhausted. I feed the cats, take my meds, and make coffee at home to try to get through the morning since I took that pill last night. Sometimes I think pulling all-nighters would be more productive. I have ADHD, so sleeping and working schedules are hard for me. But a Clif bar and a banana help me make it through to lunch.

2:30 p.m. — I’m hungry and I realize we don’t have a lot of food in the house, but I don’t have time to sit in traffic to get groceries. I run up to 7-Eleven and grab a slice of pizza, a candy bar, and an electrolyte drink. I make it back just in time to clock back in after my 30-minute break. Every single activity we do is timed. $10

5 p.m. — My husband comes home from work early today, so I get him for an extra hour. Our coffee table that also serves as a dinner table is completely broken. We decide we need to buy a new one from Amazon. I open the Chewy order and play with the cats who are overjoyed at their new laser pointer and catnip sticks. My husband cooks us penne in alfredo sauce for dinner. $145

6 p.m. — We eat dinner and talk about work. We discuss new video game updates and how the oldest cat needs to get dental work done. We take the time to budget it out until his bedtime and my quiet time. At 8:30, I kiss him good night and I start watching YouTube videos about D&D. I buy a D&D book online for $30 and work on a campaign I’m doing, getting lost in Pinterest art and maps. I think about painting my own mini characters and wonder if I still have those paints. I go to sleep at 11:30. $30

Daily Total: $185

Day Four

6:30 a.m. — I wake up early this morning, already stressed about a work project. I get up, feed the cats, grab a bagel with butter and a glass of water, and sit on the porch for a bit. I play with the cats and head inside to log on for work at 7:45 to work on my project. Getting more of it done calms me down. I’m a perfectionist and I get stressed easily when it comes to work.

12:15 p.m. — I remember wanting to paint last night, so I text a D&D friend to ask if he will teach me how to paint and he agrees. I spend my 30-minute break eating leftovers and searching through our closet for my old paints. I find them and a box of other art supplies. I’m excited to paint with friends again. I haven’t hung out in person with a friend since early 2020. I sit back down to finish my busy day at work.

6:15 p.m. — My husband and I run to HEB to get supplies for tuna tacos and HEB has the best homemade corn tortillas. We stop to get gas as well, which runs about $25/week for my husband. We get back and make our tuna tacos. We eat quickly and play with the cats for a little while. I tell my husband how excited I am to paint. He knows I haven’t gotten any opportunities to socialize outside of my computer, so he is excited for me. Summer is looking up. $51.50

Daily Total: $51.50

Day Five

7 a.m. — I wake up straight away to my alarm. I grab a bottle of water from the fridge, take my medication, and get to work. It takes me until about 10 to realize I forgot to eat breakfast. I eat two slices of toast with jelly and continue chatting with clients until my break.

2 p.m. — I’m still not very hungry, but I am tired, so I take a 15-minute power nap on my break. I wake up feeling slightly better. I read the local news until my 30-minute break is over.

5 p.m. — My husband’s work provides lunches for the employees, so he often brings home leftover salads, BBQ, and sandwiches for us to enjoy for dinner. He gets home a little early which is nice. We do the laundry, eat our salads, and watch a show on Netflix. I tell him I want to start walking during the evenings and he agrees it’s a good idea to help me sleep. My exercise has been sporadic since the pandemic, so I think about walking by myself, but I sit down and play PlayStation to unwind instead.

11 p.m. — I play No Man’s Sky on PS4 until my 11 p.m. bedtime alarm. I hop in bed, fall asleep, and wake up at 12:30 a.m. I put on some meditation music on Spotify through my headphones, and I think I get to sleep by 1 a.m.

Daily Total: $0

Day Six

9:45 a.m. — It’s the weekend! My husband works six days a week, but I’m off, so I wake up and splurge on an iced coffee and a bagel. I get home and the new coffee table arrives, which I will put together with my husband that afternoon. I eat my bagel with cream cheese and drink a water bottle on the porch while budgeting and going through our bank accounts/credit cards. It’s 90 degrees outside already, summer is here to stay in Austin. $4.95

2:30 p.m. — My husband gets home from work and we take forever deciding what we want for lunch. We settle on P. Terry’s cheeseburgers and fries. We get home, eat lunch while watching anime, and then put together the new coffee table. $9.31

7 p.m. — Once the sun starts to set and it gets cooler, we decide to walk around the block. We’ve lived on the same block the entire six years we’ve been in Austin, in different complexes, so it’s all very familiar. A block in South Austin is about six city blocks, however, so our walk takes almost an hour. We talk about work and he fills me in on his promotion that will come one day. We also talk about visiting family for the holidays, and how we will have to start budgeting now if we want to save up for Christmas. We agree it’s a good idea to start saving.

12:30 a.m. — My husband and I play a fighting game on PS4 together and play with the cats. I finish my book and tell my husband about it while he continues playing a game on the PlayStation. I’m feeling tired from the walk and a busy productive day, which is probably a good thing. By the time 12:30 rolls around, I’m actually ready for my bedtime routine. We plan the next day’s activities (a day off work? no way!) and go to sleep.

Daily Total: $14.26

Day Seven

8:30 a.m. — We wake up early to get to Walmart to do our grocery shopping before the crowds get there. We buy food for the week including tater tots, salad, taco and sandwich supplies, fruit, Clif bars, and a pineapple. We also have to do our weekly cleaning so we buy some Mrs. Meyers cleaning supplies. By the time we get back, traffic is already picking up in our area. $135.70

1 p.m. — We vacuum, wipe up, run the dishwasher, sweep the porch, and do general cleaning for a few hours. A comedy special plays on Netflix in the background, I’m listening to some Led Zeppelin while mopping, and he’s working hard on deep cleaning.

4:30 p.m. — We finish up cleaning and celebrate our hard work with some sushi. We get two fancy rolls, salad, and a Coke to celebrate (we don’t drink alcohol). We eat up and talk about our little life and how every day is about hard work and enjoying our hard work. My husband wishes he could invest or we could have passive income and we talk about it. Money is always central to our lives, unfortunately. $35

10:30 p.m. — Since I have to work in the morning and I’m a little anxious, I go to bed early to try to get a good night’s sleep. I text my parents and ask if they want to chat soon, we talk maybe once per month, just on the phone for an hour or two. My husband is already in bed by 9. I play on my Switch until I pass out with the cats cuddled around me.

Daily Total: $17.70

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In St. Petersburg, FL, On A $57,500 Salary

A Week In Washington, D.C., On A $77,602 Salary

A Week In Provo, UT, On A $46,000 Salary

from Refinery29 https://ift.tt/2UWSDj0

via IFTTT