Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a paralegal who makes $54,000 per year and spends some of her money this week on a Mac Paint Pot.

Occupation: Paralegal

Industry: Legal

Age: 40

Location: Oregon

Salary: $54,000 (I also receive $575/month for alimony and $343/month for child support. The alimony will end if I get married or move in with a partner.)

Net Worth: $372,000 ($120,000 equity in my house, $143,000 in IRA, $73,000 in Roth IRA, $14,000 in 401(k), $22,000 in the bank)

Debt: $206,000 mortgage

Paycheck Amount (2x/month): $1,715

Pronouns: She/her

Monthly Expenses

Mortgage: $1,222.84

Utilities: $195

Internet: $45

Cell Phone: $42

Car Insurance: $65

Life Insurance: $41

Roth IRA: $500

Travel Savings: $200

Spotify: $14.99

Google Storage: $1.99

Netflix: $13.99

Hulu: $11.99

HBOMax: $7.50 (split the cost with my sister),

401(k): $200 taken out pre-tax (my employer does profit sharing, not a match, and I’ve only been vested for about a year)

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes, there was a strong expectation that I would go to college. My dad has a master’s degree and my mom never finished college and that was a sensitive topic for her. I started college at 16 by attending a local community college (and living at home obviously) and then transferring to a university in another state at age 18. My parents paid for all tuition and living expenses, and I didn’t take out any student loans.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

When I was little, I know we didn’t have a lot of disposable income, though my dad made enough that my mom was a stay-at-home mom for my entire life. As my father rose in the ranks of the corporate world, his income greatly increased, but my parents ultimately had six children, so I shudder to think of their grocery bill when we were all teens. Both of my parents use spending money on themselves as a coping mechanism. My mom spends hundreds of dollars a month on wacky health products. My dad has every tech tool and toy that exists. My dad gives my mom an allowance each month in her own separate account because otherwise, she would spend as much as is in the joint account. A few days before I got married at age 20 (spoiler alert, I am now divorced), my dad told me getting married is the biggest financial decision of your life. My parents are now retired and still have a sizeable mortgage and a huge monthly payment for the RV they barely use. I have sort of used my parents as an example of “what not to do” with money. My parents did not teach me how to budget, save for retirement, or anything like that.

What was your first job and why did you get it?

I babysat for my mom’s friends and people from church starting around age 12. At 16, I got my first official job at the city library, which was perfect for my nerdy self because I was then exempt from library fines. The minimum wage was $5.15 at the time, so my paychecks were tiny and I used the money to buy cute clothes.

Did you worry about money growing up?

Not really. I knew my dad made good money, especially by the time I was a teen. We had a big house with a three-car garage, but my parents would take us to Walmart and Goodwill when we needed clothes (thus my motivation to get a job).

Do you worry about money now?

A little bit. I only have myself to rely on. Sometimes I worry about what would happen if I lost my job, but I remind myself that’s fairly unlikely because I’m good at my job and work in a very steady sector of law. To ease that anxiety, I set a goal when I got divorced to save up six months of bare-bones living expenses, and I’m on track to meet that goal before the end of the year. My day-to-day money situation actually improved when I got divorced. When I was married, we were living paycheck to paycheck despite having so much more money. Now that it’s just me, turns out I’m good at budgeting and I’ve been able to save a lot of money for my emergency fund, a new car fund, travel, and fun things like books and nice clothes. Budgeting has allowed me to spend money on fun things guilt-free because I know all my financial goals are on track. Each month, I am actually spending last month’s income, and the security from knowing I’m a month ahead is really nice.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I became financially responsible for myself at 20 when I got married. I worked as a paralegal before I had children, then I was a stay-at-home parent for nine years when my kids were small, and I’ve been back in the workforce for seven years. I’ve been dating my boyfriend for a year, and we plan to eventually move in together when our kids are a little older. I suppose if things really hit the fan, I could move in with my parents, but I would exhaust EVERY other option first.

Do you or have you ever received passive or inherited income? If yes, please explain.

I currently get alimony and child support from my ex each month, don’t know if that counts as passive income. Feels more like I earned that alimony via my pain and suffering, lol.

Day One

8 a.m. — Get up and start getting ready for the day. Do my typical morning skincare routine: innisfree balancing serum, Wander Vitamin C concentrate, and Thank You Farmer sunscreen SPF 50. My cat is desperate for love and very vocal about it this morning. I put on a hunter green tank blouse, gray leggings, a black blazer, and some black flats. Grab salad bowls, oatmeal cups, and a milk tea to replenish my stock at work.

10:30 a.m. — I have half a milk tea and eat the oatmeal cup while I work up the motivation to issue ten subpoenas. They take forever.

2 p.m. — Eat some almond butter-covered almonds from Trader Joe’s, a southwest salad bowl, and a La Croix for lunch (my firm provides sodas and La Croix). My daughter K.’s boyfriend and two best friends text me they’ll be coming over to hang out tomorrow for K.’s birthday. K. is turning 15!

4:15 p.m. — I finally finish the subpoenas and eat a snack pack of almonds, craisins, and cheese in celebration. I get an email from Venmo that you can get crypto through it, so I impulsively decide to buy a teeny tiny fraction of a Bitcoin. I’m not a gambler, so I only spend what I won’t care if I lose ($10 + 50 cent fee). $10.50

5 p.m. — Leave work and head to my ex’s house to pick up K. My two younger kids, N. (13) and D. (9), are on a 50/50 custody plan, but K. lives with me eight days out of 14. When my ex and I split a couple of years ago, we agreed the kids had to abide by the 50/50 custody arrangement until they were 16. Let’s just say K. is eagerly awaiting their 16th birthday and the extra days spent with me were a compromise we all eventually agreed upon.

5:30 p.m. — When we get home, I see my Imperfect Foods box arrived and I’ve been charged (bell peppers, candy, energy bar, onions, paneer, ghee, cottage cheese, blueberry muffins, quiche Lorraine, naan, shower oil, and face moisturizer – $62.37: $41.39 groceries, $20.98 household), but it’s infested with ants! Most of the food escapes unscathed, but sadly the naan has to go in the bin (guess it’s good I bought some at Costco earlier this week). I leave the box outside to deal with later because K. has a band concert. I change my clothes and we head to the high school. $62.37

6 p.m. — The concert is on the football field so everyone can socially distance. I spot K.’s boyfriend, J., in the stands and chat with them while we wait for the concert to begin. The band sounds great and it feels nice to have some semblance of normal after the crazy COVID year of distance learning and hybrid learning.

7:30 p.m. — K. requests a dozen donuts just for them for their birthday tomorrow ($11.99 + $1 tip). My ex will split this expense with me, as we share some kid expenses like birthdays, medical expenses, and school supplies. We get Wendy’s drive-thru on the way home ($12.79). We watch an episode of Cruel Summer and an episode of Arrested Development while we eat. K. dismisses Arrested Development as “millennial humor” and I am dismayed. $25.78

9 p.m. — K. decides to bleach their roots and then dye them to match the rest of their hair (bright red) and I assist as needed. Then, I do a couple of Spanish lessons (Duolingo), listen to podcasts (The Liturgists and The Scathing Atheist, lol what can I say, my relationship with religion is complicated), and play on my phone.

10 p.m. — I give K. an early birthday present of rose quartz earrings and they love them. I shower and do my normal nighttime skincare routine: Shiseido oil cleanser (holy grail cleanser for my dry skin!), innisfree Intensive hydrating serum, Wander Sight C-er Vitamin C concentrate, Cosrx Propolis Light Ampule, Philosophy Purity Made Simple moisturizer, and Belif moisturizing eye bomb cream. I scrunch my hair with Marc Anthony Curl Defining Lotion. I have half an edible and a melatonin to encourage good sleep, read some of Morning Star by Pierce Brown, and lights out around midnight.

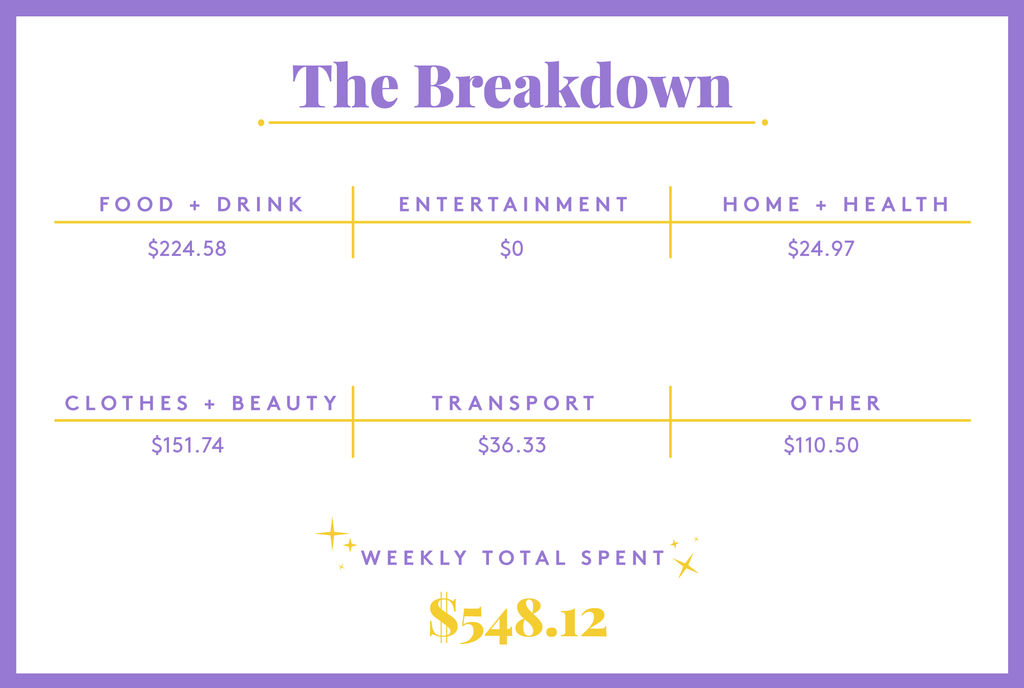

Daily Total: $98.65

Day Two

8 a.m. — I text K. happy birthday and start my morning skincare. It’s casual Friday, so I put on a ruffled black tank, a cheetah print cardigan, jeans, and Adidas sneakers. My hair turned out great (never guaranteed) and I spray in some Oribe Après Beach and scrunch a bit. On the days my kids have in-person school (2x/week), I go in late to work so I can get them all off to their various schools. My employer has been awesome and understanding about kids in COVID times. They’ve allowed me a lot of flexibility in my schedule. I worked partially at home for most of the school year when the kids were all on full-time online learning, but the kids started doing some in-person school this spring. I prefer to be in office, especially now that almost all of us at the firm are vaccinated and can therefore go mask-free.

9 a.m. — I give K. another present, a skull bracelet from my sister-in-law’s Etsy shop, and they immediately put it on. I pack a bag with a blueberry muffin, cottage cheese, and freezer meals to replenish my work supply. K. graciously allows me to take a donut as well.

9:15 a.m. — I drop K. at the high school and am at work by 9:30. I drink the rest of the milk tea and eat the donut. The two combined are really frickin’ sweet.

10:30 a.m. — I get an email from Penzey’s that they have temporarily reduced their spending requirement to get free shipping. This is timely because I used the last of my curry powder two days ago, so I place an order for curry powder, cumin, kosher flake salt, chili powder, and Muskego Ave seasoning blend (good on scrambled eggs). $29.32

12:30 p.m. — I place an order for three pizzas. My ex will split this expense with me. $41.97

2 p.m. — I have a southwest salad bowl and a La Croix for lunch.

5:10 p.m. — I drive to my ex’s house to pick up N. and D. They just got two kittens a few weeks ago, so I spend some time petting the kitties. We swing by the pizza place to pick up the order.

6 p.m. — It’s quite the crew at my house, with my three kids and three bonus kids. (Feel how you want about it, but I decided mid-pandemic to prioritize K.’s mental health over maintaining a strict bubble. They have a history that’s not mine to disclose. Almost all of the adults in our lives are fully vaccinated, and my two teens are half vaxxed.) My ex comes over for a while and everyone eats pizza crammed in the kitchen, laughing and talking. After my ex leaves, the teens and I watch the Bo Burnham special with my boyfriend, V., and his daughter.

9 p.m. — I ordered a new couch six weeks ago that arrived in five huge boxes earlier this week. Those boxes have been waiting patiently in my garage for the right time (i.e., people strong enough to carry out the old couch). V. and J. carry the old couch into the garage and then V. and I put together the new one. It’s a gorgeous green velvet. We all take turns trying it out.

10:30 p.m. — The big kids pile into the car for rides home (J. is spending the night) and N. watches the little ones. We stop by Dutch Bros so K. can get their free birthday drink. Two teens want drinks too; V. graciously pays.

11:30 p.m. — Back home, the grownups are pooped. I fall asleep without washing my face.

Daily Total: $71.29

Day Three

8:30 a.m. — I wake up to find V. just returning from a coffee run. He brought me a chai! We have very quiet morning sex.

10 a.m. — I put on pink leggings, a gray linen tank, and a gray hoodie. All the teens are still asleep, so we discuss plans for the day — we’re going to go to the outlets. The girls eat blueberry muffins and I drink my chai.

12 p.m. — At the outlets, D. decides to finally get her ears pierced. She’s been back and forth on this for years. V.’s daughter reassures her it’s not that bad and I give my ex a heads-up text (we’ll share this expense). Her eyes barely water. What a trooper! $51.99

1 p.m. — On the way home, I eat a Payday from my purse. My meals on the weekends are always kind of erratic.

1:30 p.m. — K. has an appointment for a septum piercing at a tattoo shop. This is the only gift they asked for specifically for their birthday ($51 + $10.20 tip, shared expense with ex). J. comes with us but had to wait outside due to COVID restrictions. The septum piercing looks super cute! Back at home, I clean, do laundry, and motivate each child to do their Saturday chores. I break down all the boxes in the yard and stash them in the garage to slowly dispose of in the recycling bin as I have room. $61.20

6 p.m. — I give J. a ride home (K. comes with) and we get gas on the way. $36.33

6:30 p.m. — We stop at the cheap grocery store on the way home. I am grocery shopping hungry. I get conchas, La Croix, spinach, salad mix, Vitamin Water (for V.), crackers, pizza rolls (K. chose dinner), strawberries, a jalapeno, bananas, apples, bread, salsa, and a lot of candy. $61.79

7:30 p.m. — I make the pizza rolls for K. and N. D. is a flexitarian (lol, she just doesn’t care much for meat), so she eats leftover cheese pizza from last night. I eat chips and salsa and have a couple of pizza rolls. N. and I watch Point Break. I grew up super religious, so I am slowly making my way through old movies that I couldn’t watch before. The movie is fun and silly. The kids and I shoot the breeze for a while. They crack me up and it’s fun to see the people they are becoming.

11 p.m. — I shower and am too tired by the time I’m done to put any product in my hair.

11:30 p.m. — I eat some candy while I read a little of Morning Star and turn the lights out around midnight.

Daily Total: $211.31

Day Four

9:45 a.m. — I slept in, how glorious! I eat the last blueberry muffin and play on my phone until D. wanders in to say good morning.

11:30 a.m. — I video chat with my sister-in-law while I do my skincare and makeup. I bemoan my lack of haircare last night — my hair is pretty flat today. My outfit is a white tee, taupe hemp-cotton sweater, light wash jeans, and Adidas sneakers. I put Après Beach in my hair, but it has minimal effect.

12 p.m. — I wake K. up because K., D., and I are going up to spend the day with my boyfriend and his daughter. I do the dishes and eat a concha.

1 p.m. — We head out. I warn N. we will be back late, and he assures me he will make mac and cheese for himself. We stop by Starbucks, where D. cries over having too many options. I get a peach green tea, K. gets a Frappuccino, D. eventually decides on a strawberry acai drink, and I get a couple of cake pops for us to share. I pay with the app, so no charge today.

2:30 p.m. — We listen to This Podcast Will Kill You on the drive (brain-eating amoebas are as terrifying as they sound). There are multiple crashes/slowdowns en route, so it takes extra long to reach V.’s house. Once there, K. asks to go to a crystal shop of some sort. We pile into V.’s car and drive there, only to find it’s closed today. I find a shop that’s open, though on the other side of town. I pop a Dramamine so I can navigate.

3:45 p.m. — The crystal shop is totally overpriced, but there’s a promising vintage clothing shop just down the street. We spend a long time perusing the racks. K. asks for a shirt and D. finds a pair of earrings ($12 + $4). $16

5:30 p.m. — We’re all famished and a nearby pizza place smells amazing. We get breadsticks, cheese pizza, and pepperoni pizza. Everyone but me gets root beer. And yes, I am aware this is the third day in a row I’ve eaten a pizza product. V. pays.

6:30 p.m. — Back at V.’s house, the kids play and V. and I grab a little adult alone time in the bedroom.

8:20 p.m. — When we leave, K. reminds me we wanted to go to the Asian grocery store near V.’s house. It’s much bigger than the tiny Asian grocery in our city. We wander the aisles and add several unneeded items to our bag. The ramen aisle alone is a delight. We get Hello Panda cookies, ramen, vanilla ice cream sparkling water, spicy ramen noodle snack, black rice vinegar (the one thing that was actually on my list), and mini moon cakes. We listen to This Podcast Will Kill You and Lexicon Valley on the drive home. $23.83

9:50 p.m. — N. reveals he couldn’t remember how to turn on the stovetop, and thus hasn’t eaten dinner yet. I walk him through the process as he makes mac and cheese for himself. I have a tiny bowl of mac and a black razzberry La Croix.

10:30 p.m. — By the time I’ve washed my face, I am exhausted. I barely convince myself to do my Spanish lessons. The e-book of Morning Star went back to the library before I finished it, so I start Still Life by Louise Penny. I read two pages before my eyes are closing. Lights out by 11.

Daily Total: $39.83

Day Five

7:30 a.m. — My alarm goes off and I hit snooze repeatedly.

8 a.m. — I start getting ready for work. I am dragging. Today’s outfit is a colorful striped tee, blue trousers, a blue cardigan, and heels. My hair is hopeless today; I throw it in a scrunchie.

9 a.m. — My ex paid this month’s alimony via Venmo and I transfer it into my bank account. I’m super hungry, so I eat a snack pack of almonds, craisins, and cheese, and a pack of Belvita blueberry crackers.

10:45 a.m. — Still hungry, so I have some pistachios, pretzel snack mix, and Sweet n Spicy tea. I get back on the library list for Morning Star. Five weeks wait. I correlate my budget and enter the weekend’s purchases in my budgeting software (YNAB, worth every penny imo!!), and upload the grocery receipt to Fetch. My grocery spending for the month thus far is already high due to a Costco run last week. I’m hoping the Costco snacks last the entire month. I’ve noticed N.’s appetite increasing lately and I know it’s only going to continue to increase. I’ll probably need to recalibrate my spending categories soon, to allocate more money to groceries each month.

3:15 p.m. — My morning snacking means I’m just now hungry again. I have cottage cheese and a La Croix for a late lunch. I select items for the upcoming Imperfect Foods delivery — broccoli, carrots, scallions, bone-in chicken thighs, and cottage cheese; I’ll be charged when it’s delivered in a few days. I text back and forth with my friend, B., and we make plans to have family dinner together in two days.

5:30 p.m. — Upon arriving home from work, I change my clothes and start making palak paneer for dinner. Bets on if any of my kids will actually eat it or just eat naan? In between cooking, I do laundry, tidy the kitchen, take out the garbage and recycling, and do the dishes.

7:30 p.m. — Dinner turns out delicious, but this was too much work for a weeknight dinner. None of my kids even try it, because it “looks healthy” (quote from N.).

8 p.m. — I’m exhausted after working all day and then two hours of housework and cooking. N. asks me to play Plants vs. Zombies on the Xbox with him and I want to cry at how badly I want to say no. I say yes and play with him. Eventually, I convince him to play while I watch (I am comically bad at video games as they were forbidden in my house growing up) and make funny comments to make him laugh.

9 p.m. — I get N. and D. started on their chores and listen to Not Your Grandmother’s Book Club podcast and play on my phone a bit. Once N.’s done with his chores, he wanders into my bedroom and starts chatting. D. comes in and asks if we can go to the grocery store tomorrow. I ask what for and she says she wants to buy a bunch of snacks. N. and I laugh because the pantry is full of snacks. Not the right snacks apparently. I do my Spanish lessons.

10 p.m. — Shower and a Shea Moisture protein treatment on my hair, nighttime skincare and haircare. I didn’t see K. all evening; they have to finish a 400+ page book before the end of the school year and it’s crunch time. I read a little of my book and lights out around 11:30.

Daily Total: $0

Day Six

7:50 a.m. — I do my morning skincare. I put on a blue tee, gray leggings, a bright pink sweater, and black flats. My hair is pretty good today and a little Après Beach helps the waves. I listen to Across the Ages (new to me, and I’m still deciding if I like it) and the Duolingo Spanish podcast as I get ready for work.

9:30 a.m. — I eat a banana and an oatmeal crumble bar and have a cup of Sweet n Spicy tea. I churn out pleadings and cover letters.

10 a.m. — V. texts asking if he can drive down to hang tonight. The answer is absolutely!

12 p.m. — I eat some bold flavor Chex mix and some almonds.

2 p.m. — For lunch, I have a La Croix, almond butter-covered almonds, and an Amy’s broccoli cheddar pasta bowl.

4:30 p.m. — I get a notification that the Mac Paint Pots are on sale at Nordstrom (they’re on my wishlist). I already have Vintage Selection (frosted dirty peach) and love it. I decide to buy the Tailor Grey (cool taupe) shade. Already in my cart is Le Labo Santal 33, to replace the empty bottle at home. The total is $102.55 but I use $80 of Notes that I’ve been accumulating over several months. $22.55

5:20 p.m. — When I get home, I discover my period has started SIX DAYS EARLY. Not cool. This does explain the fatigue and desire for candy over the past couple of days. I lay on my bed and feel sorry for myself for a while. I almost fall asleep a couple of times, but D. keeps coming in to chat.

6:35 p.m. — My ex picks D. up for a kitty visit.

7 p.m. — Finally rouse myself and start cleaning the kitchen. I decide dinner will be grilled cheese for everyone and start churning out sandwiches. Miraculously, I don’t burn a single one. V. arrives. D. gets back from her kitten fix. V. tells me that this is the best grilled cheese sandwich he’s ever had.

7:45 p.m. — V. and I finalize dates for our upcoming trip to Maui. We previously agreed he will use miles to buy the tickets and I’ll contribute $600 towards the Airbnb. He makes about double what I do (and has one kid vs three) and pays for more of our activities — we’ve settled on a division that feels fair for both of us. Over the past several months I’ve set aside $1,500 for this trip — thanks stimulus money — which will cover my portion of the Airbnb, a pet sitter, food, activities, souvenirs for the kids, etc. Anything leftover at the end will get rolled into my savings category “Universal Trip 2022.” V. and I want to take all the kids down to Universal next year, and I’ve just started saving for it.

8 p.m. — We all settle on the sofa to watch an animated show called Invincible. The first episode is kind of dragging until suddenly there is a graphically violent scene that introduces a twist that has us all engaged. We watch the second episode too.

9:30 p.m. — V. and I sit down on my bed and everyone follows us. I’m really glad my kids all like V. We’ve been dating for a year and he is the only guy I’ve introduced to my children post-divorce. D. asks for masks like mine and I discover they’re on final sale at Athleta, so I order a set for her (free shipping by using my Gap credit card). Who knows how long she’ll have to keep masking. $3.99

11:15 p.m. — V. heads home. The big kids wander off and D. chats with me as I tidy the kitchen a bit. I do my Spanish lessons and read more of Still Life. Melatonin and lights out at midnight.

Daily Total: $26.54

Day Seven

7:30 a.m. — I slept really well and only hit snooze once! I throw on some workout clothes to walk D. to her school a few blocks away. We discuss her birthday in a couple of months.

7:45 a.m. — On the way home, I spontaneously decide to go for a little jog. I’m more of a yoga girl and haven’t run for like two years, so this must be period-induced insanity. I soon feel like I’m going to die.

8:05 a.m. — I breathe heavily on the couch until my heart rate returns to normal. N. laughs at me.

8:10 a.m. — N. leaves for the bus stop. I wash yesterday’s makeup off and use a face scrub (Tonymoly). Do my morning skincare while listening to the Duolingo Spanish podcast and an episode of Oh No Ross and Carrie. Carrie talks about having scrupulosity (religious OCD) in her teen years and it mirrors my experience pretty closely.

8:45 a.m. — K. comes into my bathroom to clean their septum piercing and chat. Today’s outfit is burgundy leggings, a black tee, and a striped sweater. K. helps me choose shoes — ivory suede booties.

9:20 a.m. — I drop K. at the high school and then go to the coffee shop drive-thru for a chai. I have a full punch card, so there’s no charge. I have no dollar bills for a tip, so I dump all my change in the tip jar (I’ll leave extra next time). When I get into work, my coworker tells me about some drama that happened earlier. I’m super bummed I missed it as I love drama that doesn’t involve me in any way. I eat half a banana and drink my chai. $0.50

12 p.m. — I eat an oatmeal crumble bar and transfer $100 to a mutual fund account that is functioning as my “Eventual New Car” fund. Right now I budget $100 a month toward the new car fund and $200 a month for my emergency fund, and any money left over at the end of the month also goes into the emergency fund (usually about $100). Once I hit my target for the emergency fund, I plan to start shoving all that money into my new car fund ($300-$400 each month). My car is 13 years old, and I have a feeling its end is approaching, though I intend to make it last as long as possible. $100

1:30 p.m. — Eat an Amy’s chili mac bowl. I head over to the eye doctor for a quick visit — I just got fitted for new contact lenses and my left lens isn’t quite right. The doctor sorts out the issue and orders a trial lens in the new prescription. There is no charge for this visit.

3 p.m. — I neglected my inbox yesterday and it’s now approaching disaster status. I drink a passionfruit La Croix and eat some candy as I prioritize my emails, tackling the biggest fires first.

5:30 p.m. — I load up a bag of food (chips and salsa, blueberries, naan, salad mix & toppings) and get a read on which kids want to go to family dinner at B.’s. N. elects to stay home and have mac n cheese. The rest of us go to my friend, B.’s, where she and her husband pull out bacon-wrapped filets and ribeyes for dinner. We eat well and have a great evening. D. plays with B.’s daughter in the kiddie pool. K. talks with B.’s husband about privilege. B. and I bask in being able to hang out again.

9 p.m. — We head home and I persuade all the kids to do their chores. We all feel snacky, so I heat up naan and brush it with melted butter. N. continues his recent hobby of hanging out in my room making me laugh with funny anecdotes until I kick him out at 11 so I can go to bed. I wash my face, do my Spanish lessons, read Still Life, and turn the lights out around midnight.

Daily Total: $100.50

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In St. Petersburg, FL, On A $57,500 Salary

A Week In Washington, D.C., On A $77,602 Salary

A Week In Provo, UT, On A $46,000 Salary

from Refinery29 https://ift.tt/2UVMR17

via IFTTT