Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

What do you do when your friend won’t pay you back? Did you escalate it legally? Did you just forgive and forget? What happened to your friendship? Tell us your experience here.

Today: a Marketing Specialist who has a joint income of $139,000 per year and spends some of her money this week on a cornhole set.

Occupation: Marketing Specialist

Industry: Non-Profit

Age: 29

Location: Seattle, WA

My Salary: $62,000

My Partner’s Salary: $77,000

Net Worth: $36,000 (I have about $10,000 in the bank; my partner has $30,000. Our home is valued at ~$630,000 (we bought it very recently for $550,000, but the housing market is exploding a bit). My car, which I bought new and paid off several years ago, is worth about $11,000. My partner’s car is probably worth about $4,000. I think we have a combined ~$50,000 in retirement savings (eek!). Total assets amount to about $735,000 but our debt is nearly $700,000. I have $95,000 in student loans (I think I initially borrowed around $70,000, but interest + income-based repayment plans have caused it to rise) and my partner has $90,000. We’re both on track for Public Service Loan Forgiveness. We also still owe $514,000 on our home.)

Debt: $699,000 (student loans and mortgage)

My Paycheck Amount (2x/month): $1,880 (after taxes + 10% goes to retirement + $25 per pay period for a transit pass)

My Partner’s Paycheck (biweekly): $1,900

Pronouns: She/her

Monthly Expenses

Mortgages: $2,800 mortgage split between us (which will decrease when our PMI goes away in two months)

Student Loans: $500 (Federal loans are currently deferred due to the pandemic, but they’ll resume in September.)

Utilities: $165 (split)

Internet: $72 (split)

Car Insurance: $65

Headspace: $14

Running Group Training: $35

Streaming Services: Thanks for your passwords, parents/friends/siblings!

Car Registration: $400/year

Ballet Subscription: $600/year

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Not all of my family went to college, but there was some sort of tacit expectation that as a kid with good grades, I’d go. My oldest sister dropped out of a commuter school, but my other older sister went to a liberal arts college that I fell in love with while visiting. My parents said it was too expensive for me to go, too, but I was sick of her getting special treatment and (like a brat) I told them I’d go anyway. I ended up hating it and working my ass off to finish in three years. At one point, I was working two part-time jobs while commuting to two internships, managing the school paper, taking 22 credits, and attempting to maintain a long-distance relationship. I did not have friends. I graduated at 20 with no idea what to do with my life, so I went to a very prestigious one-year grad school program in a big city where I learned almost nothing about the subject I was intensely studying but a lot about myself. Aside from a few scholarships, everything was paid for through federal loans. I financed my grad school apartment in the city, a 100-square-foot micro-studio filled with bugs for $650/month, with private loans that are almost paid off now (almost eight years later). My part-time jobs paid for textbooks, gas, and food, and I still had to ask my parents for grocery money every now and then. I spent a summer taking community college classes, which I was able to pay for out-of-pocket. Honestly, the education I received there was equal (if not preferable) to the classes I took at the expensive private schools. The only difference was the culture: as a poor kid from a rural town, I actually fit in better with the community college weirdos than the rich Christian kids back at the dorms. I’ve made a point not to say I regret the decision to go to private school (I met my partner at school!), but I do wish I knew then what I know now about higher education.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My dad is great with money. He’s frugal, but he knows that some experiences are worth the splurge. He has helped me a lot with my finances, especially when it comes to my student loans. My mom is good about money, too, she just loves shopping. My parents really wanted me to find a job that paid well. They loved to see my passion for journalism, but they were (rightly) worried it was a dying industry. They’re glad I was able to find work in marketing, but I sometimes wonder if I’ve made a horrible decision. I don’t find passion in what I do. I called my parents immediately when we were considering making an offer on our home. They’re appalled at the cost of houses in Seattle, but they were really proud of me for making a big and scary decision for my financial future.

What was your first job and why did you get it?

I babysat my way through high school. Most of the kids were great, but I had (and still have) severe anxiety and was constantly worried I would let them starve or die or gravely injure themselves. I got hired at a movie theater at 15 and continued working there until I was 20 through summer and winter breaks.

Did you worry about money growing up?

I remember being very poor as a kid. My parents had four kids and worked blue-collar jobs. For both of them, shame ruled their behavior around finances. I was never allowed to wear sweatpants to school, even on pajama day — my mom didn’t want me looking like “trailer trash.” Meanwhile, we were often eating egg noodles and frozen peas for dinner because we had $5 to feed six people. I felt guilty asking for money for field trips or pay-to-play sports programs. The turning point came when I was 15. My mom went back to school to move up in her field, so my dad was supporting all six of us on one income. After three years, my mom got a new job and started making a significant amount of money, but the effect of her new paycheck didn’t really set in until after I’d left for college, so my entire childhood was spent in or near poverty. My brother, who is 10 years younger than me, got a brand new car for his 16th birthday. I sometimes act jealous around him, but I think the experience of being poor taught me a lot about money.

Do you worry about money now?

I literally always worry about everything, so it’s no surprise that money is listed among those concerns. But I do think money is an extremely reasonable worry. I have never once been given a cost-of-living raise, yet I live in one of America’s most expensive cities, so I’m constantly worried about being taken advantage of in the workplace. I have friends who have never once asked for a raise; I have done it every single year since I started working. I have always worked in the non-profit industry, which is always “out of money” (despite millions of dollars just chilling in their endowment funds), so I’ve always had to put my manners aside when it comes to getting what I deserve. Now that I own a home with my partner, savings are a necessity rather than a luxury. We recently had a plumber visit to inspect our pipes and he gave us an estimate for $16,000 worth of repairs. We couldn’t afford it, so we told him to fix only what was completely necessary to continue living in this house, which was $435 to replace the toilet flange. (Thankfully, our warranty covered it.) We also have a large crack in the foundation, and one wall in our bathroom is almost definitely crumbling from mold, so we need to be prepared for extremely significant repair expenses. On the other hand, we moved to this house from a very unstable rental market. Our last home was a rented condo that had been foreclosed and was constantly on the verge of being re-purchased by the HOA while we were still renting it. Before that, we rented apartments where the rent costs increased every single year. At the very least, buying a home locks in a monthly payment that we know we’re currently capable of paying.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I’m not sure when I became financially responsible for myself, but I haven’t asked my parents for money since I was 19. The only exception is I am still on my parents’ cell phone plan, which they say is cheaper because I’m on it (they might just be saying that, but I don’t fight it). In my relationship, my partner and I keep completely separate bank accounts and Venmo each other for shared expenses. I think I pay a little bit more than my fair share, even though he makes more than me, but I really don’t want to ask for $10 from him for some dog treats I bought on an impulse. I’d rather eat the cost myself.

Do you or have you ever received passive or inherited income? If yes, please explain.

Nope. My family’s poor. My dad’s mom died young and my dad’s dad retired early and lived off his firefighter pension for several decades. My mom’s parents were also blue-collar workers with no college education. My partner’s dad’s mom recently passed away and left us some power tools and gardening supplies, which was very sweet and generous.

Day One

8 a.m. — My partner (R.) and I wake up on a Sunday morning. He plays video games with friends online while I make a grocery list and walk the dog. We eat bagels with cream cheese for breakfast, and he makes coffee from beans that I order from my favorite local coffee shop every month — three bags for $35.

12 p.m. — We go to a thrift store for the first time since the pandemic! I’m excited to look for furniture or outdoor games, but there isn’t much to see. I guess thrift stores haven’t been collecting as many items as they did pre-pandemic. We head down the street to Fred Meyer to see if we can scratch that same itch. We find a cornhole set for $30! There’s also a cute outdoor side table for $15. We grab both of those and some gallon-sized storage bags that were on our list and head to check out. For some reason, the cornhole set is ringing up at $45. I want to just say, “screw it, let’s pay $45,” but I know I should ask for help. 15 minutes and two frazzled Fred Meyer employees later, it finally rings up at $30. We go home and play cornhole. $50

5 p.m. — I pick up the week’s groceries at Sprouts Farmers Market. I am obsessed with digital coupons and I clip about 30 of them before going to the store, so I’m able to get a few items completely free and many more at deep discounts. I am also growing lots of salad greens and a few vegetables in my backyard garden, so I can supplement my groceries with freshly grown food. The bill is about $20 under budget, and it should feed both of us for the entire week. $80

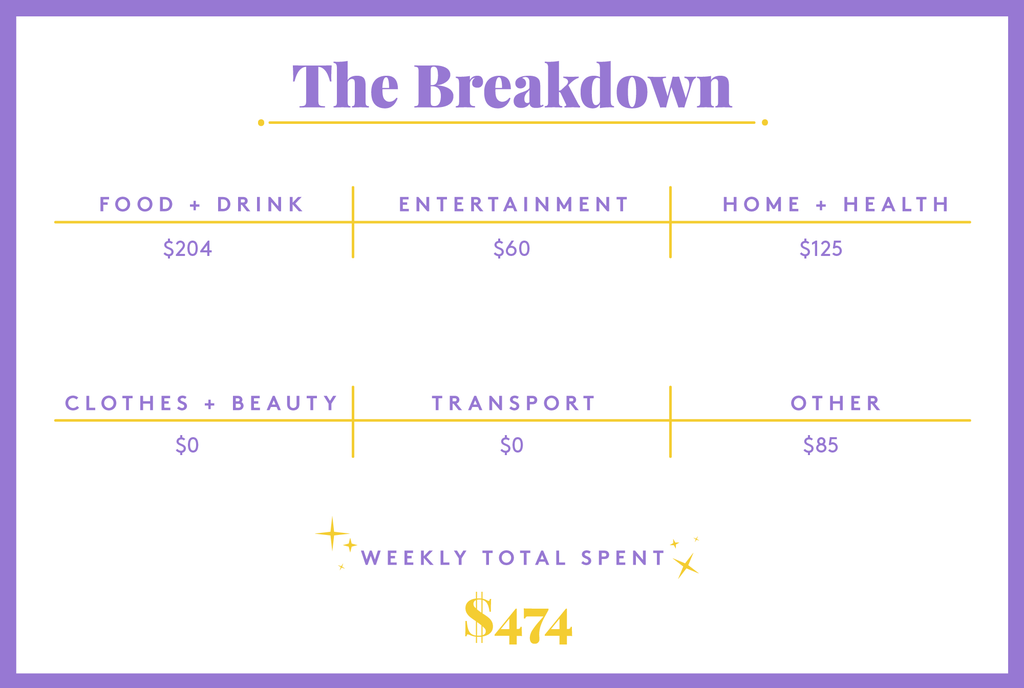

Daily Total: $130

Day Two

7 a.m. — R. goes to work in person a few days per week, including today. I’m still working from home full-time. I made him enough overnight oats to last all week, so he takes a serving with him for breakfast and makes a K-cup of coffee to drink before his five-mile bike ride to the hospital where he works. (Don’t worry, we only use compostable or reusable K-cups.) I also eat some overnight oats and log into the virtual conference I’m attending all week.

12:30 p.m. — I still have work to do between conference sessions, so at lunchtime, I turn my camera off and make a sandwich. Over the weekend, I marinated and baked a block of tofu, so I slice that up today and combine it with some homegrown lettuce and store-bought tomatoes on whole wheat bread with mustard and pickles. I’ve been a vegetarian for 15 years, and last year I convinced R. to join me. I’m a little concerned we eat too much “fake meat,” which is just a few molecules away from plastic or whatever, so I want to try to find more natural replacements for meat that he’s still used to eating. The tofu is a quick fix, but it’s still very processed.

6:30 p.m. — After the conference is over, I browse social media. I see a post in a trail running Facebook group about liquid nutrition. I love endurance running, but anything over 17 miles starts to make me nauseous, so I have tried LOTS of liquid nutrition brands. Someone suggests a brand I’ve never heard of called Gnarly Nutrition. I order their sample pack, which is $15 with free shipping! I’m looking forward to trying their performance fuel as well as their vegan protein supplements. $15

Daily Total: $15

Day Three

6:30 a.m. — I wake up early to go on a “sunrise” run with two close friends. (We call it a sunrise run, but in the summer in Seattle, the sun actually rises at like 5:15, and there’s no way I am waking up at 5 to catch the sunrise.) After the run, we always grab coffee at a local shop and talk. I order an oat milk latte and tip $2. I don’t love their drip coffee and some stingy part of me hates ordering things I can make better at home, but I end up spending so much money on lattes! I am the millennial the boomers warned you about. $8

12:30 p.m. — Another day of conference sessions, another tofu sandwich. Today’s afternoon session is extremely participatory, which is a little bit exhausting. We’re in breakout rooms every 10 minutes going through scenarios where hypothetical microaggressions have happened and we have to hypothetically respond to them. I appreciate the practice, but as an individual contributor, I wish SOMEONE would talk about power dynamics in these hypotheticals. How am I supposed to confront someone with twice as much power as me without risking my job?

6:30 p.m. — I make rice and vegetables for dinner and we watch The X-Files. I love this show but sometimes it’s not what I want to watch after a heavy day of work! Last week, we watched an episode where a bunch of zoo animals died and I cried a lot. Sometimes I just want to watch The Nanny or RuPaul’s Drag Race and pretend we all live in a perfect little world where nannies can afford designer clothes and drag queens don’t face discrimination for being queer, just for runs in their tights. Anyway, again, shoutout to my friends who let me use their Hulu and HBO Max accounts.

Daily Total: $8

Day Four

11 a.m. — R. is petsitting for a friend whose wife just gave birth, so I am unfortunately home alone when a plumber visits. He’s wearing some type of thin blue line shirt and we have leftist propaganda posters all over the house, so I already know this is going to be weird. For the next two hours, I’m asking him if he wants me to run the washing machine or let him into the crawlspace while he tells me stories about selling drugs and almost getting fired from the plumbing company. He finds no issues with our pipes, I guess, and awkwardly relays my credit card number over the phone for the $75 service fee. I’ve missed two hours of work, so I have a lot to make up. $75

6:30 p.m. — My day was so stressful that I take a nap instead of biking or going on the group run I had planned. I feel super guilty about this and can’t shake it off. R. comes home and feels sorry for leaving me alone with the weird plumber, but of course, I don’t blame him — I’m glad we didn’t have to share that experience. If it were a year ago, I’d ask if he wanted to go out for a drink, but even though we’re vaccinated, I don’t feel totally comfortable going out yet, and also I’ve taken a hiatus from drinking to try and sort out my anxiety on my own. So I eat ice cream and we watch The Nanny. At least we didn’t spend money on drinks!

Daily Total: $75

Day Five

7 a.m. — Day four of the five-day virtual conference. It’s energizing but draining at the same time. R.’s home today and we share a pot of coffee (and overnight oats) then make another almost immediately. We used to buy a bag of coffee every month or two, but the lack of office coffee means we’re making much more at home. I’m not complaining, I’d rather brew a fresh Chemex every morning than dilute the free extra-dark roast percolator coffee with hot water. I’m not a coffee snob! I just know what I like. It’s okay to have preferences.

6 p.m. — I pick up my biweekly $40 CSA box from a gigantic house near Green Lake. I walk my dog around the neighborhood and ogle at the homes. Our house is a teeny 685 square feet, though we have a pretty decent yard, which our pup enjoys. Some of these homes must be nearly 3,000 square feet. Income inequality in Seattle is baffling, but it’s almost not surprising after five years of living here. I count my blessings, though. My first job in Seattle paid $19/hour, which was a $2 raise from my previous job in the midwest. Turns out rent costs more than twice as much here. I’m very fortunate to have worked my way up to nearly $30 per hour, but looking at these houses, it doesn’t seem like much. $40

7 p.m. — I reeeeeally want takeout. I pass by Wayward Vegan Cafe on the way back home, but I know there’s plenty of food at home, so I make pasta and watch My Best Friend’s Wedding while R. plays video games with friends. The pasta’s really good. No regrets. The movie’s not so great. We’ve come a long way with rom coms since 1997.

Daily Total: $40

Day Six

11 a.m. — It’s the final day of attending a conference while still working my normal job! FedEx delivers my dog’s auto shipment of Purina ProPlan, which costs $45 every four-ish months. She’s a very cheap eater. I sometimes wonder if I should sign her up for one of those fancy dog food subscription plans, but she does really well with kibble and her vet says it’s a safe bet for ensuring she gets all of her nutrients in one meal. I’m also interested in raw food diets for dogs, but I’m very squeamish around meat. So it’s $45 bags of Purina ProPlan for now. $45

7 p.m. — I give into the Friday night takeout craving and we head to Rain City Burgers in Roosevelt. The veggie burgers and fries are $26. It’s a 15-minute wait, so I head across the street to grab ice cream and bagels at Whole Foods. (I like to have a bagel before long runs on Saturday mornings.) I still have time to kill, so I stop by Mud Bay to grab styptic powder for cutting my dog’s nails. While I’m there, I talk to the associate about basket muzzles, and she talks me into getting one for my pup who has a tendency to snap at dogs when she’s nervous. We’re meeting my parents’ dog for the first time this summer and I want my dog to make a good impression! We go home to watch a movie for free on Kanopy (thanks, Seattle Public Library!) and enjoy the burgers and ice cream. $66

Daily Total: $111

Day Seven

6 a.m. — I wake up bright and early for a bagel and a 13-mile run with my training group. We’re tapering; last week was a 21-mile run, but this week is fun and easy in comparison. Afterward, we head to a local bakery and I grab an iced coffee and a muffin. I’m about to leave when the artistic director of the non-profit I used to work for calls my name and says hello. I’m so touched that he remembers me since we didn’t work very closely and it’s been two years. I get in the car and cry a little. I loved that job, but I didn’t make enough money there to live comfortably in Seattle. $10

1 p.m. — After a shower, I head to the zoo with R. We wanted to go last weekend when we had friends in town, but timed entry tickets were sold out. This time, we get $25 walkup tickets very easily and we’re ecstatic. We spend four hours walking through every exhibit, including the robotic dinosaur display (which cost an extra $5 each but is worth it). Lunch involves MORE veggie burgers (there aren’t a lot of vegetarian options at the zoo), which costs another $25 total. R. and I have been together for five years. We went to the zoo together back in 2017 and it’s fun to compare the visits and notice that we are even more in love now than we were then. $85

7 p.m. — We’re exhausted and some friends want to hang out, so we tell them they’ll have to come to us. They bring takeout but I feel like we haven’t eaten enough vegetables lately (after all the veggie burgers and fries) so I make a kitchen-sink-salad (spinach, carrots, tofu, tomatoes, cucumber, sunflower seeds, goat cheese, and a fig balsamic dressing) and I force everyone to eat a serving of the ice cream I bought on Friday. We play cornhole but it starts to rain, so we go inside to play cards and share music recommendations. I notice nobody is drinking, which reminds me that I don’t need alcohol to hang out with friends. It’s a lovely end to a long week.

Daily Total: $95

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Ohio On A $30,000 Salary

A Week In Oregon On A $54,000 Salary

A Week In Austin, TX, On A $87,400 Joint Income

from Refinery29 https://ift.tt/3ygy7IP

via IFTTT