Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a resident physician who has a joint income of $132,940 per year and spends some of her money this week on Teddie peanut butter.

Occupation: Resident Physician (Pediatrics)

Industry: Medicine

Age: 28

Location: Boston, MA

My Salary: $65,440

My Husband’s Salary: $67,500

Net Worth: -$282,796.28 (All medical school loans — I was extremely privileged to have my parents and grandparents pay for my undergraduate degree.)

Debt: $282,796.28 medical school debt

My Paycheck Amount (2x/month): $1,677.69

My Husband’s Paycheck Amount (1x/month): $5,625

Pronouns: She/her

Monthly Expenses

Rent: $2,200 for a two-bedroom apartment, split 50/50 between myself and my husband.

Car Loan: $255.50 (my half, split with my husband)

School Loan: $346 (10% of my take-home pay) starting in September.

Electricity/Utilities: $80-120, also split 50/50

T Pass: $58.50

Gym Membership: $22

Medical Insurance: $0 (My residency’s plan is amazing — my employer completely covers both my husband and me with no withdrawals from my paycheck.)

Dental Insurance: $67.70 for my husband and me, automatically withdrawn from my paycheck. I didn’t go to the dentist for five years (no dental insurance in med school), so I’m really happy to have dental coverage now!

Malpractice Insurance: $15.02

Retirement Savings: $345.14 (10% of my take-home pay)

Spotify: $9.99

Hulu: $4.99

Netflix, Disney+, HBO Max: My husband pays for all of these.

Cell Phone: $0 (Embarrassingly, I am still on my mom’s plan! I really should change this.)

The New York Times: $4

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes, absolutely! My dad started talking to me about colleges in middle school, which, in hindsight, is a bit crazy. My parents and grandparents paid for my undergraduate degree, as mentioned above, which is an enormous financial privilege. I paid for medical school by taking out loans and working to supplement my costs of living. However, at the end of my fourth year of medical school, after my grandmother died, my grandfather sold an apartment in New York City that they had shared and put $100,000 toward my medical school loans (they were originally $382,000). This was a huge shock — I had no idea it was coming (and probably would have been less stressed about my loans, and money in general, if I’d known). Part of the reason I want to do this Money Diary is to be transparent about how much financial privilege goes into becoming a doctor and how badly we need to reform our medical education system to make it accessible to those who don’t come from money.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

I grew up in Orange County, so while my family was solidly upper-middle-class, and I was certainly never deprived, we were surrounded by EXTREME wealth. My family lived in a condo; many of the kids I went to elementary school with lived in mansions. This, combined with the fact that my family was Jewish Democrats in a sea of blonde Republicans who mostly attended the same evangelical church, made me feel like a bit of an outsider. I remember a girl coming to my house when I was eight and being absolutely shocked that I didn’t live in a gated community — at one point, she asked me, “How do you even feel safe?” It’s crazy to think about. There was a lot of talk in my family about how excessive and gross this culture of conspicuous consumption was, and growing up surrounded by such extreme wealth definitely informed my current politics and beliefs around the massive problem of income inequality in our country.

What was your first job and why did you get it?

My first job was babysitting at the age of 12, which I did through high school. (Twelve! It reminds me of the John Mulaney bit about realizing that his babysitter as a child was 13, and how that’s like hiring a horse to watch your dog.) My first job with a paycheck was working at a coffee shop on my college campus. Both were for extra spending money.

Did you worry about money growing up?

No, I didn’t. I know now that my parents did, but they shielded us from it pretty well. They didn’t worry about covering necessities, like food, but my dad told me recently he was always worried every year about having enough money to buy Hanukkah presents. Awww, Dad!

Do you worry about money now?

No, I don’t. I did during medical school when I was living off about $30,000 a year as a student, but the mental freedom that has come with making $60,000 as a resident has been huge. I can pay for luxuries that make me happy, like yoga classes and dinners with friends, and I have the mental freedom to know that we have the cushion to pay for unexpected or emergency expenses.

At what age did you become financially responsible for yourself and do you have a financial safety net?

It was a gradual process. My family covered my cost of living during college, which is a huge privilege, but afterward, I was expected to become pretty close to financially independent. My parents also got divorced after I graduated from college, which forced me to grow up a little. In medical school, I covered almost all of my costs, but there were a couple of months where I ran out of money before my next set of loans came through and I had to ask my mom to help cover my rent. I also took out a $10,000 personal loan during medical school to cover the costs of living, which my dad co-signed. Now, I would say I’m completely financially independent except for the fact that I’m still on my mom’s cell phone plan!

Do you or have you ever received passive or inherited income? If yes, please explain.

The major one is the money I received from my family to cover the entirety of my undergrad costs and $100,000 toward my medical school loans. In addition, my husband’s parents gave us $15,000 when we got married and my dad gave us $6,000, which we used to pay off some personal loans of mine and some credit card debt of my husband’s. (The actual wedding was at a courthouse due to COVID so expenses were pretty minimal.)

Day One

6:30 a.m. — It’s my day off, yay! I normally get up around 5 a.m., so I think this counts as sleeping in. I make some coffee and do a block of practice questions to prepare for the board exam I’m taking in two weeks. During my third and fourth year of medical school, I worked as a tutor for the USMLE Step 1 and 2 (our boards), so I figure I’m going to take this next exam (Step 3) as soon as I can before I forget everything I know about adult medicine.

8 a.m. — Eat one of my go-to breakfasts, overnight oats made with milk, golden raisins, peanut butter, and cinnamon. I recently decided that since I’m almost 30, I should have a skincare routine, so I’m the kind of person who does skincare now. At least, sometimes. (Cetaphil face wash, TruSkin Vitamin C serum, First Aid Beauty Ultra Repair Cream, Cerave Eye Cream, and Neutrogena ClearFace SPF 30 sunscreen.)

9 a.m. — My husband wakes up. He’s also off work today, so we cuddle for a little bit and I fall back asleep.

10:30 a.m. — My very generous in-laws gave me a $60 L.L. Bean gift card for my birthday last week, so my husband and I hit up the outlet store. There’s a pair of navy blue Wellies rain boots on sale for $69.99, so with my gift card, I can get them for $9.99! My husband also throws in a bottle of bug and tick spray, which I pay for. $16.31

11 a.m. — Since there’s a Whole Foods next to the L.L. Bean outlet store, I pop in to grab a couple of my essentials: Teddie peanut butter, kimchi, maple RXBARS, prepackaged tikka masala, and frozen blueberries, raspberries, and blackberries. $50.87

12 p.m. — I heat up some vegetarian chili mac and cheese my husband made using a recipe from Budget Bytes. I eat the chili mac with some Harvest snap pea crisps and frozen blackberries while watching Drag Race All Stars 3.

1 p.m. — I go run some errands. I drop off a pair of FIGS scrubs that I’m exchanging for a smaller size. I realize I didn’t bring a box so I have to buy one. $4.77

1:30 p.m. — Pick up my SSRI from the pharmacy. Like many people in my profession, I’m a highly neurotic person with anxiety, depression, and some obsessive-compulsive thought patterns. I started antidepressants after a major depressive episode during my third year of medical school and I wish I’d started them so much sooner — I probably would have benefitted from being on them as early as high school! $5.45

3 p.m. — My mom bought me a FIGS gift card for my birthday and the scrubs I ordered arrived! These ones fit perfectly, so I buy two more pairs in different colors. I actually purchase clothes and shoes pretty infrequently, but I’ve been stocking up recently thanks to the double whammy of my birthday and finally having a paycheck ($172 total, $164 on the gift card). $8

4:15 p.m. — Snack on a banana and some roasted seaweed while doing some research for a podcast episode I’m doing next week. I’m super excited about this podcast — my cousin is starting a podcast focused on peer sexual education, and since I’m training to be a pediatric neurologist, I’m doing an episode on how migraines are affected by hormones, menstruation, and contraception. I love empowering young people with information about contraceptive options, so I’m stoked! (For those interested, the way pediatric neurology training works is that you do two years of pediatrics and then three years of neurology, so I just started my first pediatric year. But it’s a combined program, so luckily I don’t have to worry about applying to fellowship!)

5:50 p.m. — Head to yoga! It’s a Bikram-style flow in a room heated to 85 degrees and it’s been the perfect thing to help me relax and deal with the stresses of transitioning to being a resident. I buy 10-class-packs for $170, a habit I’ve had on and off since graduating from college. One of the other students in the class is a soon-to-be pre-med college freshman, so I give her my number and tell her to text me anytime if there’s any way I can support her.

8 p.m. — Come home, shower, heat up a Whole Foods tikka masala, and eat it while watching Wet Hot American Summer: First Day of Camp with my husband. Fall asleep at 9:30.

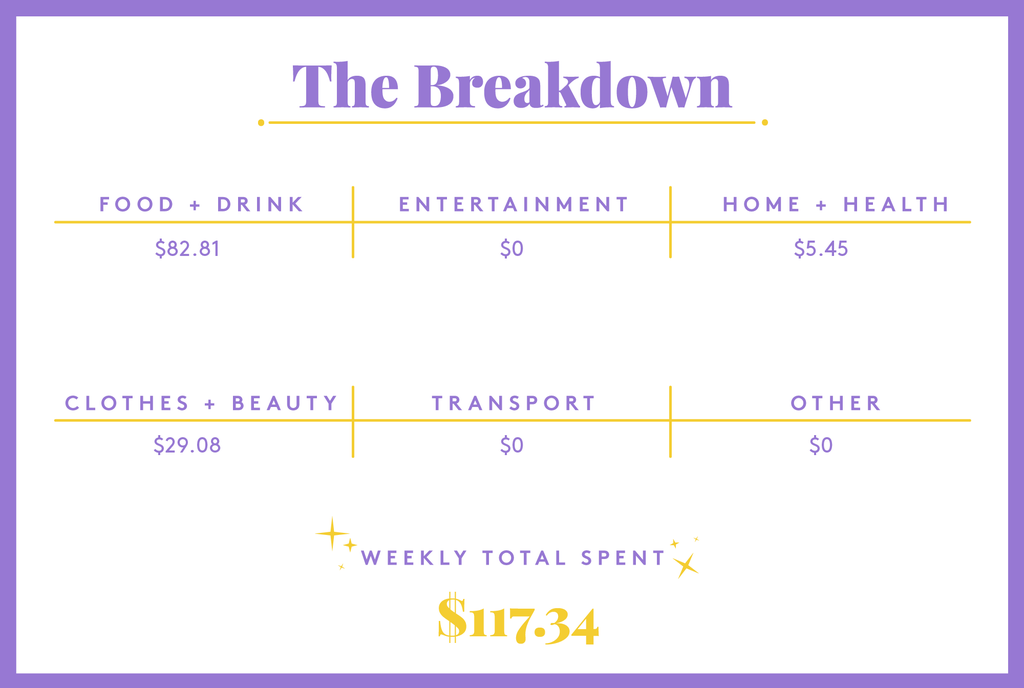

Daily Total: $85.40

Day Two

5 a.m. — Wake up before my alarm, brush teeth, skincare routine, brows and mascara, scrubs and vest on, and grab breakfast and snacks for the day (same overnight oats as yesterday and a package of mixed nuts). Listen to Glennon Doyle’s podcast We Can Do Hard Things. I have a free beverage to redeem in my Dunkin’ app, so I order a large iced green tea to pick up in the hospital. Eat oats on my walk from the train station.

6:30 a.m. — Get to the newborn nursery! Split the list with my co-interns and spend the morning checking maternal labs, examining babies, teaching new parents breastfeeding and safe sleep, and writing notes. I finish all my notes before lunch, which never happens!

11:50 a.m. — Head over to noon conference with my fellow co-interns. Today’s conference is on a neuro topic, transverse myelitis, so I’m excited about it. The residency program provides lunch for us, which is awesome, but today is pasta, which I’m not really feeling so I swing down to the cafeteria instead and buy a bowl with chicken, mushrooms, Brussels sprouts, and tater tots. YUM. In addition to the free lunches, we also have a food stipend as residents, and our cafeteria food is pretty good! ($8.47 expensed)

1:30 p.m. — We do some teaching on cardiac murmurs, which is something I’m still struggling with — they’re really common in newborns but tricky to hear because their heartbeats are so fast! Followed up by some teaching on using a breast pump.

3 p.m. — After running through our list of patients and talking through overnight to-dos, it’s a fairly slow day so I’m able to leave early! I listen to the keto episode of Maintenance Phase on the ride home — the ketogenic diet is something that’s pretty common in pediatric neurology, so I find it strange/hilarious that it’s become such a fad these days. (Of course, if it works for you, no shade!)

5:15 p.m. — Gym time! I do 30 minutes on the treadmill while watching UNHhhh on my phone. Followed by the massage beds, of course.

6:30 p.m. — Come home, shower, dinner (more Budget Bytes chili mac, carrots and hummus, and frozen raspberries) and pass out at 8:30. Lol.

Daily Total: $0

Day Three

5 a.m. — Wake up, breakfast (overnight oats and coffee), skincare (no makeup today, I’m feeling lazy), get dressed (H&M solid color T-shirt and generic hospital scrub pants), put on glasses, and go! I’m the late call intern today, so I make sure my bags are packed with everything I need.

6:20 a.m. — Get to the workroom early, and see that we have a bunch of new babies! We split up the work when my co-interns arrive, and since I speak Spanish, I take all three of the Spanish-speaking mom/baby pairs. We also have a new medical student today, which we’re all stoked about. (What can I say, pediatricians love to nurture.) Spend the morning examining the babies and making plans for them, talking to our new moms about their medical and social histories, and teaching our med student!

12:15 p.m. — The morning flies by. Head over to today’s noon conference on Pediatric EKGs. Lunch on Wednesdays is Indian food from an absolutely delicious restaurant!

1:15 p.m. — Back to the grind! More babies, more moms, more notes. I’m working at a safety net hospital, so many of our moms lack resources despite working insanely hard, and it can be a challenge to make sure they have everything they need. I wonder if anyone has started a crib or car seat donation program in the area, and mentally table that idea for later.

7:30 p.m. — Leave the hospital! Go home and shower and then eat more chili mac, carrots and hummus, frozen raspberries, and a cookie my husband made out of banana, walnuts, oats, cocoa powder, and spices. I stopped eating added sugars a few months ago so “cookie” is probably a strong word, but it gets the job done. Chat with my husband about our days. I think I make it until about 8:45 p.m. before passing out.

Daily Total: $0

Day Four

5 a.m. — Wake up, get dressed (residency program T-shirt and cargo-style scrubs), and out the door! I’m feeling extra lazy so no skincare or makeup today. Listen to an episode of Citations Needed, an amazing media criticism podcast, on the portrayal of addiction in Hollywood.

6:20 a.m. — Grab a medium hazelnut coffee with skim milk from Dunkin’ Donuts, which I drink while pre-rounding and eating a blueberry RXBAR I brought from home. $2.88

8 a.m. — Watch our case of the week conference, focused on atrial fibrillation and hyperthyroidism in adolescents, and then time to round! Hop from room to room examining babies, talking over plans with my attending, and doing discharge teaching with the moms who are going to be leaving the hospital today.

12 p.m. — Head over to today’s noon conference on anemia! For lunch, I grab an Asian-style chicken wrap and a side salad with creamy dressing. Yummm, I love food. On our way back, my co-interns and I grab seltzers from the cafeteria. I get a caffeinated mango passionfruit seltzer and use my credit to pay for it.

3:15 p.m. — After I finish talking with the mom and dad of the first baby I admitted this morning, I start the process of admitting another one. Labs look good, so I go to talk to mom and examine the baby. She says she’s hungry and would love a salad and a soda from the cafeteria, so I offer to go down and grab her one. The pickings are slim at this time of day, so I cobble together a salad of mixed greens, croutons, ham, and cheese and bring it back up to her, along with a Pepsi. I pay with my credit again.

4:30 p.m. — I sign out my patients and take the subway home, continuing the same Citations Needed episode from this morning. Debate going to yoga, but I’m feeling pretty exhausted so I clean up the kitchen a little bit and then spend an alarming amount of time on the couch slack-jawed staring at my phone.

6:30 p.m. — Eat dinner, which is beef Rice-A-Roni that my husband made, carrots and hummus, frozen raspberries, and another banana-walnut “cookie.” Thank God for my husband or I would subsist entirely off of frozen burritos. He gets home and we hang out and talk for a little bit. I make it until 9:30 p.m. today!

Daily Total: $2.88

Day Five

6:30 a.m. — Today’s a clinic day, so I can sleep in. Drink coffee and eat breakfast (overnight oats with milk, golden raisins, and walnuts) while reading Digital Minimalism by Cal Newport. We can wear scrubs to clinic, but I feel like wearing real clothes today so I go with suede pants bought on sale at Loft, a black-and-white Zara top from a friend, a blue cardigan from my mom, and the new Wellies. Say goodbye to my husband — he’s going on a trip with his friends and their wives this weekend. I’m bummed that I can’t make it because I’ll be working, but being a doctor has been my dream since I was 16 and I knew going into it that I would miss some vacations and weddings.

9:30 a.m. — Meet my preceptor who’s super nice. I try to do some Uworld questions, but fall down an Internet rabbit hole instead. Once my first patient arrives, I go and see her.

12:35 p.m. — Run down to the cafeteria for lunch. They’re doing the potato bar again today, so I go with a baked sweet potato with Texas chili, cheddar, salsa, green onions, and sour cream. A+ cafeteria food. Same deal, using my stipend.

2 p.m. — Spend the afternoon seeing urgent care visits: earaches, diarrhea, and rashes, oh my!

5:30 p.m. — Get out of work and decide to drag my butt to yoga. Make it just as the class is about to start at 6.

8 p.m. — Get home, feeling a hundred times better, mentally and physically. I love feeling like a wrung-out sponge. Shower, heat up a Whole Foods frozen tikka masala, and eat that with some roasted seaweed and frozen blackberries while watching UNHhhh and falling asleep.

Daily Total: $0

Day Six

5:15 a.m. — Up and at ’em. Do the bare minimum I need to pull myself together and am on the subway by 5:45 a.m. Read some more of Digital Minimalism and order another hazelnut coffee with skim milk from Dunkin’ from the app to pick up. Split the list with the family medicine co-intern who I’m working with this weekend. Pre-round while drinking my coffee. $2.88

8 a.m. — Our attending comes in and brings us all breakfast from a delicious little café near the hospital. I eat my mini mushroom quiche and follow it up with a package of mixed nuts that’s been in my bag all week, and then we start rounds. During the week, there are four interns, so it’s a bit of an adjustment (read: chaos) for me to get used to seeing twice as many patients, but eventually, everyone gets seen. A lot of these moms are about to be discharged, so their babies are in cute little outfits. Babies are just the most excellent patients.

12:45 p.m. — Go down to the cafeteria for lunch: BBQ chicken, rice and mixed veggies, and another caffeinated mango passionfruit seltzer, plus an apple for later. Paid for with my stipend.

1:15 p.m. — Back to seeing new moms and babies. Finish my notes by 5:30 and I’m out.

6:30 p.m. — Head to dinner at a delicious Mexican restaurant with one of my best friends from medical school and his husband. I debate getting a drink but decide against it since it’ll just make tomorrow’s 5 a.m. wake-up more painful. Feast on veggie enchiladas, chips and salsa, and a few stolen nachos off their plate. My friend’s husband pays, so I Venmo him $20 for my portion. $20

Daily Total: $22.88

Day Seven

5:15 a.m. — Last day on the newborn nursery for two weeks. Today I’m really dragging, so I decide to go for a large Dunkin’ hazelnut skim instead of my usual medium, but due to an ordering snafu on the app, I accidentally get two, so I give the other one to my co-intern. Six babies were born overnight, so it’s gonna be a busy day. Get to work frantically looking up maternal labs and delivery information, putting in orders, and getting ready to round on all these new friends. Bite into yesterday’s apple, but it’s pretty mushy, so I throw it out. (I hate to waste food but I’m weirdly picky about apple texture — anyone else?) $6.18

8 a.m. — Our attending brought breakfast again! Today I went for overnight oats with muesli, yogurt, dates, nuts, and berries. So good! Eat it while finishing up on the computer, and then off to rounds. Babies, babies, and more babies!

1:35 p.m. — My co-intern and I head down to the cafeteria for lunch. Pickings are slim on a Sunday, so I get chicken tenders, another apple, and my beloved caffeinated mango passionfruit seltzer. Tragically, this apple is also pretty mushy, so I just eat the chicken tenders. Pay with my stipend.

2 p.m. — Spend the afternoon finishing up the morning’s admission and then preparing for a new one since two more babies were born while we were on rounds. (On days like this, I have to wonder what was going on 40 weeks ago.) I go see the new baby and meet the family — it’s the sweetest family, with a 10-year-old daughter who tells me she wants to be a doctor when she grows up! Love it. I try to involve her a little bit as I’m going through the physical exam, explaining how to listen to babies’ hearts and test their reflexes.

5:30 p.m. — I’m the late call intern today, so my co-intern signs out her patients to me and heads home. Get a page from a nurse about a high bilirubin level on one of our babies, so I order a serum test to confirm. Around 7, I go to sign out our babies to the overnight resident and head home.

8:30 p.m. — My husband is home, yay! I make myself “snack dinner” (pretzels, cheddar cheese, carrots, and peanut butter) while we catch up on our weekends and watch Tim Robinson’s new sketch comedy show, I Think You Should Leave. All in all, successful week.

Daily Total: $6.18

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Madison, WI, On A $52,800 Salary

A Week In Ohio On A $30,000 Salary

A Week In Oregon On A $54,000 Salary

from Refinery29 https://ift.tt/3lIg8rv

via IFTTT