Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

What do you do when your friend owes you money but isn’t paying you back? How do you approach the convo? Have you ever just forgiven your friend’s debt? What happened to your friendship? Tell us your experiences here.

Today: a retired foreign service officer who has a joint income of $201,000 per year and spends some of her money this week on hanging Boston ferns.

Occupation: Retired Foreign Service Officer

Industry: Federal government

Age: 50

Location: Pittsburgh, PA

My Pension: $68,616

My Husband’s Salary: $133,026

Net Worth: $3,239,111 ($1,366,580 in my 401(k) and Roth IRA; $906,322 in husband’s 401(k) and Roth IRA; $320,932 in Vanguard stock mutual fund (house fund); $564,798 house estimated worth; $22,664 in checking; $55,322 in savings. When my husband retires in five years, his pension will be roughly the same as mine. We merged all our accounts and assets when we got married 12 years ago.

Debt: $0

My Pension Check (1x/month): $4,710.99

Husband’s Paycheck (biweekly): $5,966.28

Pronouns: she/her

Monthly Expenses

Housing Costs: $880 to savings for annual real estate taxes. We purchased the house for $440,000 in 2019 and paid for it in full with no mortgage. I live in our house with my husband, F., our cat, and two dogs.

Loans: None. We have one car that we paid cash for in 2013.

Vanguard Mutual Fund: $3,000 (House fund for when F. retires. Location TBD.)

Travel Savings: $1,000

Utilities: $600-$1,000

Donations: $550 (Monthly contribution to various local charities/animal rescues. We increase this amount by $5 each month. Our goal is to get to $1,000/month by the time I can access my retirement funds in nine years.)

Husband’s IRA: $500

Home/Auto/Personal Property Insurance: $213

Long Term Care Insurance: $143

Income Tax Savings: $108 (not automatically deducted from husband’s paycheck)

Pest Control: $44

Netflix, Spotify, New York Times, PBS Thirteen, iPhone Storage: $41

Violin Rental: $18

Annual Expenses:

The Washington Post: $100

Ancestry: $199

The Atlantic: $50

Amazon Prime: $119

Dropbox: $199

Calm Meditation App: $65

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

I think my parents more anticipated I would want to go to college than had an expectation that I should. They paid for my living expenses (about $500/month for rent and grocery money) when I was an undergraduate, and I paid for tuition with scholarships and by working part-time during the school year and full-time during the summers. For my master’s degree, I got a full-tuition research assistantship and took out student loans to pay for living expenses. When I went back to school part-time for my doctorate in my 30s (I didn’t finish), I had a full-tuition teaching/research assistantship. I was already working for the federal government, so living expenses weren’t an issue.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My parents didn’t talk to my brother and me about money as much as teach us by example. They both grew up in poor farming families and thought of themselves as relatively poor, even though they were middle class. They generally bought less expensive brands, made or repaired things themselves, and had little debt outside of modest mortgages or car payments. One of the biggest challenges I had when working overseas, coming from the background I did, was getting used to hiring and managing household help. I’ve also spent decades un-learning the lesson that the cheapest thing is the best thing.

What was your first job and why did you get it?

I had a full roster of babysitting clients by the time I was 12 and even babysat full-time during summers. (This was back in the days when parents would confidently leave small children with a 12-year-old babysitter.) I also had a paper route from about the same age. Although I had a small savings account, I didn’t save for college expenses until I was in high school and working at the mall. Most of my early earnings were spent on books and clothes.

Did you worry about money growing up?

I don’t remember ever worrying about having a roof over my head or food to eat, but there were many things I wanted to do (ballet classes, study abroad in high school) that were off the table because my parents believed they were too expensive and/or not something people of our income level did. My closest friends growing up all had wealthy parents, so I was very aware of not having the same things (vacation homes, college funds, overseas travel).

Do you worry about money now?

In terms of having enough to live on, no, but I’ve always spent a lot of time thinking about and managing our money to ensure we stayed within a budget that would allow us to retire at our first eligibility (age 50). One big worry exception is the pretty awful financial decision we made in buying a house at our current domestic assignment. The “completely renovated” 120-year-old place we thought we were purchasing turned out to be a badly-flipped money pit into which we have sunk more than $50,000 in repairs with no end in sight.

At what age did you become financially responsible for yourself and do you have a financial safety net?

When I graduated from college at age 21, I lost my parents’ health insurance coverage and stopped receiving monthly rent money from them. I married my high school boyfriend at 23 and my parents loaned us money for our wedding and to pay off our college credit cards. A few years later, they loaned me money for a divorce lawyer when the marriage fell apart. I owed them about $5,500, half of which they forgave and half of which I paid back before I was 30. I haven’t received any support since. F. lived with his parents for six months in his late 20s during a health crisis but hasn’t received any support since then either. However, both sets of parents and our brothers are financially comfortable now and would help if we needed it (and vice versa).

Do you or have you ever received passive or inherited income? If yes, please explain.

No. My grandparents had very little money when they died. I received a few heirlooms — an old family bible, my grandmother’s dishes — but no income. Same for F.

Day One

4:55 a.m. — I wake up without an alarm thanks to a combination of bad genes (everyone in my family is an early bird) and not yet being used to my new, retired life. I brush my teeth and go to the kitchen to mix medication with a little food for our 16-year-old dog. She and I have been together since I found her as a very young street pup in Africa. I do some stretching then send messages to my two dearest friends. They are both posted overseas, and though we only talk by phone every few weeks, we message each other continuously most days.

6 a.m. — My husband, F., loves his morning sleep, so I keep the lights on low while I shower. Once he’s up, we begin our usual routine — he gets ready for work while I walk the dogs then we have breakfast together. Like most mornings, it’s oatmeal with oat milk, chia, ground flaxseeds, and blueberries for me. For him, it’s cereal with sliced banana and some cranberry juice.

8 a.m. — After F. leaves, I go to the third floor to exercise. During our last overseas assignment, I had a trainer who created workouts for me that I’ve adapted for home. (We canceled our Planet Fitness membership last spring during COVID.) Afterward, I update our finances. I’ve been tracking all my expenses since before I got married and still balance against our bank accounts most days. I get an email from the attorney we hired for our real estate tax appeal (on the grounds we overpaid for a house needing massive repairs). We lost the first round, but the attorney promises we’ll win the second. Completely falling for the sunk cost fallacy since we’ve already paid a $1,000 flat charge to the law firm, I send the $139.31 filing fee to continue. $139.31

10 a.m. — I settle on the couch to start a book I found in one of the many Little Free Libraries in our neighborhood — Ron Chernow’s Titan (biography of John D. Rockefeller). I have a morning snack of grapes, gouda slices, and almonds. I turn on the electric throw blanket, and like magic, our cat appears and curls up next to me. I finish about half the reading before I get drowsy and join him in a nap.

11:30 a.m. — Every day around lunch I take our dogs to one of Pittsburgh’s huge city parks with acres of trails near our house. Back at home, I heat up the leftover shrimp, pasta, and tomatoes from last night’s dinner.

2 p.m. — The first new thing I did in retirement was signing up for violin lessons. My teacher, who lives a few blocks away, is a young musician with the local opera. Since it’s our first lesson of the month, I bring her a check for $80 ($20 each for four 30-minute lessons). The rest of the afternoon is spent working on a grant proposal for an animal rescue in the Democratic Republic of Congo where I’m a volunteer. It’s slow-going as we message each other in French — it’s been a decade since I used the language regularly. $80

5:30 p.m. — F. gets home a little late after swinging by a local shop to pick up a pound of honey ($54) for brewing mead, a hobby he took up during this mostly-at-home year. He starts dinner — salmon and lentils — while I feed the pets. After dinner, we curl up on the couch for the rest of the evening. I show F. an ad for The Peach Truck, where you can preorder 25 pounds of Georgia peaches for delivery in July. This sounds like a perfect summer idea, so we schedule ($45). Then F. reads the news while I try to make sense of the latest installment of a Christmas gift he got me — weekly letters from Sherlock Holmes enlisting me to solve a mystery. So far I’m zero for two in figuring them out. $99

8:30 p.m. — It was perhaps not the best decision to put a TV in our bedroom as we’re now in the habit of going to bed early to watch a series. Right now we’re obsessed with The Last Kingdom on Netflix. When it’s over, I read Titan for a few minutes before falling asleep.

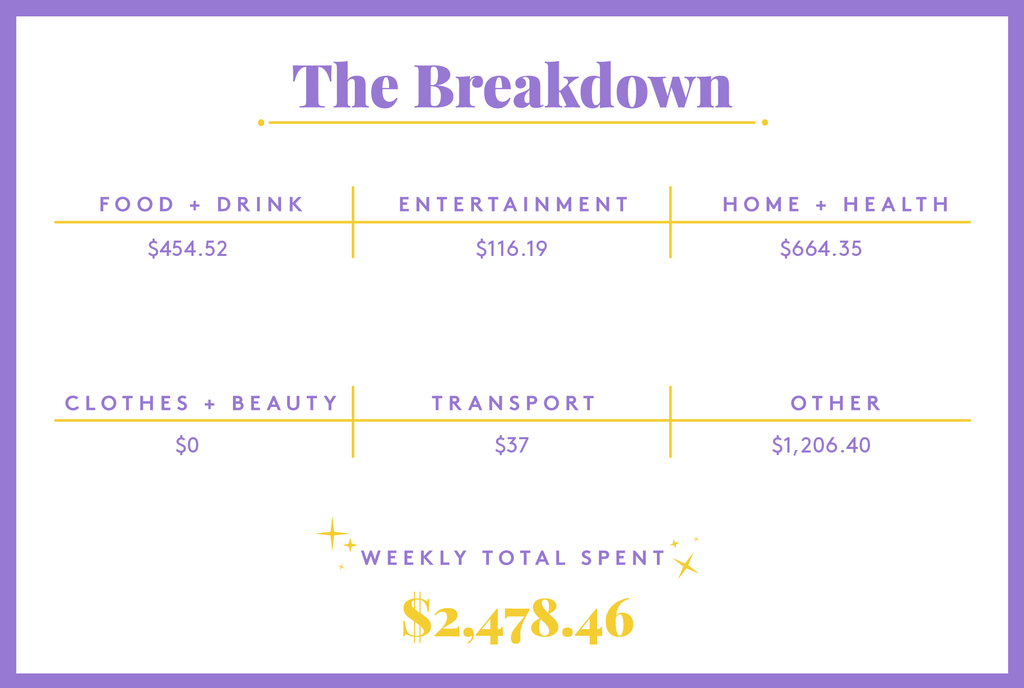

Daily Total: $318.31

Day Two

6:15 a.m. —I sleep delightfully late (for me). I get dressed, wake up F., and head out to walk the dogs before breakfast.

8:30 a.m. — It’s a beautiful, spring morning, so I go for a 5k run around the neighborhood and report my pace to my dad and brother when I get home. My brother is a serious obstacle course racer and my 75-year-old father took up running a few years ago. For the past year, we’ve been sending updates with our speed/distance every time we run to encourage each other. Lots of stretching and several handfuls of grapes later, I shower while listening to the History of English podcast on Spotify. I’m on episode 49 (out of 146) after almost a year.

10:30 a.m. — I catch up on messages. During COVID, I began a regular email correspondence with a historian ex-colleague in which we discuss books, culture, and politics. (Okay, mostly politics.) Then I switch to WhatsApp and Facebook Messenger for other conversations. Because I’ve moved every few years for the past few decades, I have friends scattered all over. I spend a lot of time staying in touch with people. While I’m online, I get a message from an old neighbor who now lives on the West Coast. We reconnected this past year and walk our individual dogs as we chat on the phone.

2 p.m. — Lunch is last night’s leftovers, which F. took to work as well, eaten while I doomscroll Twitter (I’m trying to quit). The afternoon’s project is painting. I convinced F. we should refinish my light oak bookcases during the long winter evenings, but spring is here, and we aren’t quite finished. F. has done the bulk of the work — repairing, sanding, assembling beadboard backing, but my job is to paint them black and apply several coats of polyurethane. His basement workshop is too cold, so I spread out a drop cloth on the office floor, stream Schitt’s Creek on Netflix, and spend the afternoon more or less successfully not making a mess.

4:45 p.m. — F. gets home a little early so we do a longer-to-prepare dinner — butternut squash and leek casserole. While it bakes, F. fills up the bird feeders and cleans the birdbath and I practice violin.

6:30 p.m. — One of the things I like about the house (and I try to remind myself there are many things I like) is our garden. We put in a little pathway and a garden shed and planted all kinds of native plants and trees last year. F. and I make a map of open spots and brainstorm plants to buy at the Audubon Society sale in a few weeks. We also text the guy who mows our lawn (without a garage, we have nowhere to store a lawnmower) and okay his price to do all the mulching (without a truck, we can’t pick up mulch). It will be about $750 and we schedule for the week after the plant sale.

9:30 p.m. — After our nightly viewing, I leaf through the BBC History Magazine that came in the mail today. I make it halfway through one essay before I’m asleep.

Daily Total: $0

Day Three

5 a.m. — I wake up to my alarm so I can drive F. to work, so I can have the car for the day. Surviving with one car was easier overseas, but we have somewhat stubbornly stuck with it back in the States, despite the occasional need to coordinate our days. I quickly do my third-floor workout and shower so I’ll be ready to leave at 7:45.

8:15 a.m. — After dropping off F., I drive to my yearly dermatology appointment. One of my close friends has been battling stage-four melanoma for the past five years, so I’m religious about getting a yearly skin check (paid for by insurance, with co-pay billed later). I get the all-clear, then drive to the eye doctor to pick up the year’s supply of contacts I ordered last month. $504

10 a.m. — F. usually does the grocery shopping, but since I have the car today, I take over. I stock up on everything: grapes, blueberries, bananas, mandarins, mushrooms, onions, kale, squash, peppers, tomatoes, almonds, vegetable broth, gnocchi, yogurt, cereal, oatmeal, barley, almond milk, tofu, frozen cod fillets, blackberry jam, Triscuits, good bread, soba noodles, cranberry juice, and strawberry popsicles (we’re trying to quit sugar, and this is our nightly treat). Although we’re mostly vegetarian, I buy four bags of frozen chicken breasts for our dogs. I donate $10 to a local charity at check out. $227.07

2 p.m. — Once the groceries are put away and I’ve reheated last night’s leftovers for lunch, I take the dogs for a walk, then come home and practice violin. Then it’s time to face the latest house problem. One of our 80-year-old box gutters is leaking, and I’ve been calling companies for three weeks trying to find someone reputable to fix it. The first company that looked at the gutters gave us two options: rebuild for $50,000 or replace with modern gutters for $30,000. Ugh. Today I find a very well-reviewed company on Angie’s List that says they have a third option: relining the gutters for $8,000-$10,000. Still a depressing amount of money for a house we plan to sell in 18 months. I schedule an appointment for an official quote.

4:15 p.m. — I pick up F. from work and tell him the latest gutter news. We know we can’t afford to fix everything the flipper did wrong, but we also don’t want to con the people who buy this house from us like we were conned. F. looks on Amazon for a wiring kit for an antique lamp we bought last fall. He adds a rain gauge to replace the one in our garden that cracked in the last ice storm. $27.35

6 p.m. — Even before COVID, we only ate out once or twice a month, but we’ve still missed getting out. Tonight we decide to each get a slice of pizza and a scoop of ice cream at a neighborhood shop with a walk-up window and outside benches. We get a little soaked on the way home, so we change into our pajamas and watch the two final episodes of The Last Kingdom before bed around 9. $15.40

Daily Total: $773.82

Day Four

5:15 a.m. — I’m up. It’s still too dark to run, so I catch up on finances and messages. When I wake up F., it’s almost sunrise, and I leave for my 5k.

7:30 a.m. — F. leaves for an early meeting. I brew a cup of black tea to make up for my lack of sleep, drink it while I shower, then tackle house cleaning. We used to have a cleaning team that came every other week, but I took over the housework when I retired. I’ve tried various approaches, but just devoting two to three hours one weekday morning or afternoon seems to work best.

11 a.m. — Done, except for the loads of laundry I’m still running. I practice the violin for 30 minutes then go for a walk with the dogs. Lunch is a microwaved black bean burger with avocado.

1 p.m. — The dogs are running low on medications, so I make a list for ordering. They have 11 prescriptions between the two of them. I compare prices and place multiple orders for six of their meds. These should last for about 90 days. $429.93

1:30 p.m. — For a while now, I’ve been thinking about how to create something positive out of the experience we’ve had with the house. One idea was to write an article about surviving a flipper. So this afternoon, I make some toast and jam and spend a few hours brainstorming what I would tell someone in our shoes, and it actually makes me feel a lot better about where we are.

4 p.m. — My neighbor arrives with her two young dogs. My younger dog and I join them on a brisk walk to the park. We compare old house problems (which also makes me feel a little less alone in our home repair nightmare). I offer her several of the anemones from our garden, which are spreading wildly and taking over. When we get back from the park, F. is home and already cooking my new favorite dinner — Thai curry noodle soup.

6:30 p.m. — Tonight we’re planning travel! When we lived abroad, we scheduled a whole year of adventures at a time. But when we returned to the U.S., I was commuting to D.C. for work a few days a week and was too exhausted for much of anything else. Then COVID. Mostly we want to see our families again, so we slot in trips to our parents and brothers and a niece’s wedding. Then we plan a week in New England in the fall to scout possible places to retire plus five days at the ocean in August. This leaves December. I really want to convince my parents to travel with us to Austria and Germany for the Christmas markets this year. However, getting them to spend money can be like pulling teeth, even though they have more than enough to travel.

8 p.m. — I call my Mom to pitch the travel idea, but she thinks 2021 is too early for overseas again, so they plan to come to Pittsburgh to visit us instead. While I talk to her, F. finds a bed and breakfast for our August trip and we book it, paying half the total now ($538). I’m too tired to watch anything and fall asleep listening to a nature documentary F. has on. $538

Daily Total: $967.93

Day Five

6 a.m. — I get up and take a quick shower. We’re a little slow getting going, so I walk the dogs after breakfast and F.’s departure, instead of before. After our walk, I do my morning workout while listening to a podcast, Nice White Parents, recommended by a friend.

10 a.m. — I’ve been taking classes through the University of Pittsburgh since I retired. It’s only $225 for as many classes as I want all year. (I paid last summer.) They’re for senior citizens, which makes me giggle since I’m only 50, but the topics are fascinating. I took one on problematic presidential elections, another on famous 19th-century trials, and this term, I have one on bird watching. After, I heat up last night’s noodles for lunch.

12:30 p.m. — F. takes the afternoon off. We haul the dogs for much-needed baths at the pet supply store. We buy a $25 punch card for the self-service washes and once we’re done, stock up with 20 cans of dog food, a box of litter, and some cat kibble. $99.16

6 p.m. — Friday night! We miss going to the movies, so after a quick dinner of black bean and corn quesadillas, we rent the latest Tom Hanks film, News of the World, on Amazon Prime. It’s pretty expensive for a rental, but we figure we’d pay more than that in the actual theater. We make some kettle corn and dim the lights. $21.19

Daily Total: $120.35

Day Six

6 a.m. — One of my favorite things about spring and summer is going for a long run at sunrise. After, the dogs and I walk a few blocks to a little neighborhood dog park and cross paths with F., who is running early too. At home, I make batter for waffles for when he gets back.

10 a.m. — By the time we’ve showered and dressed, it’s already mid-morning and we decide to take care of a few errands before lunch. We visit a local greenhouse for hanging Boston ferns for our big covered front porch ($75) then stop at Target for what seems like a never-ending list of miscellaneous items that we generally buy there: nuts, May birthday cards, oat milk we like but can’t find at our grocery store anymore, kitchen washcloths, and Annie’s mac and cheese ($102.14). Probably because it’s already lunchtime, we make an impulse stop at Panera and each buy a cookie to tide us over until we get home ($6.35). $183.49

2 p.m. — At home, we heat up the remaining leftovers from the week and give the dogs Busy Bones to eat on the front porch. They lounge on the rug while F. reads and I make my weekly call to my parents.

5:15 p.m. — F. starts a mushroom risotto bake. I reply to messages on my phone and break my promise to stay away from Twitter. F. realizes we’re short on mushrooms, so I make an unplanned run to the grocery store for another pound and pick up bananas as well. $4.56

7:30 p.m. — I do a quick last walk of the day with the dogs, followed by violin practice. Then we surf for a new show and settle on Ted Lasso, figuring we can watch the whole first season during the free trial period of Apple TV+.

Daily Total: $188.05

Day Seven

7 a.m. — I am making progress on this sleeping later goal! F. and I take quick showers, get everyone breakfast, then pack some snacks and water for us and the dogs. We’re taking them north of the city for a hike.

8:45 a.m. — Almost no one is out, so we let the dogs off-leash to explore a little. We find a bench in a meadow and sit for a while with two content pups, enjoying the breeze. On the way home, we stop to get gas. $37

11:30 a.m. — Last night’s risotto awaits for lunch, then we head back out of town to go for a drive around. On the loop back to Pittsburgh, we stop at an antique mall. This is our happy place (and usually pretty empty so a nice outlet during COVID times). We aren’t really avid collectors, but we do like old books. Today we find three Modern Libraries, a budget classics imprint from the 1930s and 40s that I started collecting in college because they’re slightly challenging to find in good condition and rarely cost more than $10. We have about 100-150 volumes, but not these titles. F. also discovers a working, mid-century, oscillating fan for our guest room. $58

4:30 p.m. — Back home and I quickly text my mom a picture of our fan. (She was my first antiquing partner, and we still show off our finds to each other.) F. makes barley and snap peas for dinner while I feed the pets.

6 p.m. — We try to do no-electronics Sunday nights. Instead, we read or do puzzles while listening to old-timey radio shows or classical music. Tonight we use my iPad only to access a Pittsburgh Symphony streaming concert ($15). F. looks through our new books and I get back into my Rockefeller biography. The cat is blissed out on the heated blanket between us. $15

8:45 p.m. — We turn on the outside lights, close the blinds, and let the dogs out one last time. Then it’s time for the next episode of Ted Lasso and we’re dead asleep by 9:30.

Daily Total: $110

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Ohio On A $30,000 Salary

A Week In Oregon On A $54,000 Salary

A Week In Western Georgia On A $47,500 Salary

from Refinery29 https://ift.tt/3ih1y83

via IFTTT