Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: an analyst who makes $69,700 per year and spends some of her money this week on European Wax Center Ingrown Hair Serum.

Occupation: Analyst

Industry: Health & Human Services

Age: 26

Location: Twin Cities, MN

Salary: $69,700

Net Worth: -$18,781.30 (savings: $18,598.28; checking: $1,868.58; 401(k): $7,561.84) minus debt.

Debt: Student loans: $46,810

Paycheck Amount (2x/month): $1,852

Pronouns: She/her

Monthly Expenses

Rent: $816.50 for my half of the rent, including a storage unit; split equally with my partner.

Student Loans: $390 (suspended due to COVID-19 but still paying)

Utilities: $50

Phone Bill: $75

Health/Dental/Disability/Life Insurance (pre-tax): $348

Spotify: $9.99

Apple Storage: $2.99

Pet Insurance: $22

Savings: $500 in savings every month but I’ve been buying lots of things lately (e.g., Lasik eye surgery) so I haven’t been contributing as much the past few months.

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes! I grew up pretty low income with a single mother and she always emphasized that we needed to go to college. I didn’t have any “free” summers and was always in a camp or pre-college program. Apart from that, I was a first-generation college student, so I didn’t have a ton of guidance. I ended up going to a very expensive liberal arts college on a full scholarship. I also worked part-time in an on-campus job and did summer internships for spending money. I also obtained my Master’s degree and got a full-tuition scholarship but had to pay for the cost of living through student loans.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My mom says she educated me about finances, but in reality, that was just hearing her talk about how she had no money and clipped coupons. We were okay when I was younger as my mom had a lot of social support and we received social security survivor’s benefits after my dad passed away. But once those benefits dried up and the recession hit, we nearly lost our house, I filed bankruptcy (while in high school) for my mom and signed us up for food stamps and anything else I could find. We didn’t have a great financial foundation so I really learned what not to do by watching my mom and sisters.

What was your first job and why did you get it?

I worked at a fast-food restaurant starting when I was 15 and then started working as a cashier at a drug store when I was 17. All of this money was used to help pay bills, pay for my own food, any school fees that came up, and spending money. I saved a few thousand dollars for college as well so that I didn’t have to work the first semester.

Did you worry about money growing up?

Absolutely! After we almost lost the house and didn’t have a lot of food — cemented by the fact that my mom seemingly didn’t have any desire to do anything about it — I had to make a lot of financial decisions at a young age, which brought me a ton of stress and also strained our relationship.

Do you worry about money now?

Yes and no! I feel like I’ve made pretty good financial decisions thus far. My savings make me feel fairly comfortable and I think the amount of student loans I have is semi-feasible to pay off (although I’m still hoping Joe cancels those). My partner and I don’t really want kids so I don’t worry too much about that, either. However, I know that my sisters and I are my mom’s retirement plan and I don’t know how that’s going to work, considering my own financial goals!

At what age did you become financially responsible for yourself and do you have a financial safety net?

Even though I’ve been responsible for myself since high school, I’d say I became financially responsible when I graduated at 21. I don’t have much of a financial safety net. I have my savings and in a pinch, I have my partner (who is now unemployed, more on that later) or family and friends, but no one is particularly well-off.

Do you or have you ever received passive or inherited income? If yes, please explain.

Nope!

Day One

10 a.m. — Brush my teeth when I hop out of bed and give my puppy some much-needed attention. My partner, F., is finally awake a bit later so I feel better about using my very loud blender. Make a smoothie with frozen banana, spinach, soy milk, mixed berries, mango, and flaxseed.

11 a.m. — Start working on the second part of an Ikea dresser I bought a few days ago. We moved almost a year ago but since I didn’t know if we’d be staying, I didn’t do a ton of decorating and organizing at the time. Now that we’ll for sure be here a while, I’m trying to be more intentional about the space. It takes me almost two hours to finish the dresser, but it’s done and I begin organizing the avalanche of clothes that I pulled out of plastic drawers yesterday. My partner walks the puppy and leaves to run some errands for his grandma.

1 p.m. — I eat some leftovers for lunch — homemade pizza with spinach, olives, peppers, and onions. I made it in the cast iron so the crust is still really good after being in the microwave. Yum! I finish eating and realize that I never did my skincare routine this morning so I wash my face with CeraVe and use some Natural Mystic Zen Hydration Jelly moisturizer along with some Black Girl Sunscreen. I then unload the dishwasher and watch a YouTube video.

2 p.m. — Head out for my Brazilian wax appointment. I should note now that I am fully vaccinated and wear a mask when I leave the house; with my background in public health and my arguably weak immune system, this is the best option for me. I have a wax pass so I only pay for the $10 tip in cash and $31.82 for some ingrown hair serum. I make a mental note to buy this serum when it’s on sale because I definitely only paid $22 for it last time. I head across the street and grab a green tea latte from Starbucks. I use my card that already has money loaded on it. $41.82

3 p.m. — I stop by Trader Joe’s to grab a few things that I forgot to put on the list when F. went a few days ago. I pick up some walnuts, rainier cherries, nectarines, dates, seltzer water, a candle, body scrub, and a cute reusable bag with waffles on it. My partner and I typically split groceries, but since I know he won’t use any of this, I don’t Venmo request him. $31.62

3:15 p.m. — Back home, I wipe down my groceries and put everything away. I get started on some work and turn on my “on repeat” playlist on Spotify. I work for about two hours. I’m not super hungry but I grab a date with peanut butter before turning on an audiobook and taking the dog on a walk. My audiobook of choice (and feel free to drag me) is New Moon. I just started listening to audiobooks, and since I read this so many times in middle school, it’s really easy to get into it and not feel like I have to pay super close attention.

5:45 p.m. — After our walk, I give the pup a treat and wash my hands before getting started on dinner. I make spaghetti and meatballs and a Caesar salad. I can tell my partner wants to talk about his feelings because I can see him staring at me while I cook, so we chat while I finish up dinner and talk about things we can work on.

7 p.m. — We sit on the couch and watch the basketball game.

8:15 p.m. — Hop in the shower! No need to wash my hair or shave today because I did it last night (thank god).

8:45 p.m. — I turn on my audiobook and wipe down the kitchen. F. already washed the dishes so I’m just tidying up after him. Our rule is that whoever cooks doesn’t have to clean, but since he cleaned the bathroom, I’m happy to finish up the kitchen.

10 p.m. — Eat some Tillamook ice cream straight out of the carton because it tastes better that way. Put some whitening strips on and do my nighttime skincare routine. It’s the same as the morning, but I add in Sunday Riley Luna Night Oil. After those are on for 15 minutes, I brush my teeth and chug some water. I get the puppy ready for bed and head to bed myself around 11.

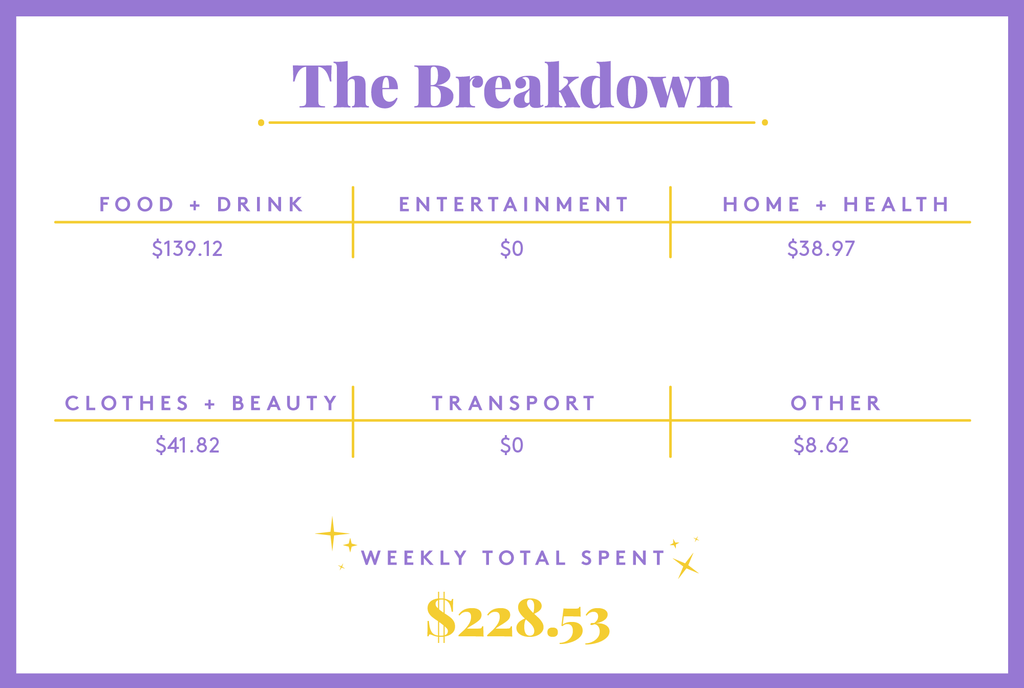

Daily Total: $73.44

Day Two

5:30 a.m. — The dog is crying in his crate so I take him out to go potty. Then, I go back to bed.

8:30 a.m. — Up for work! F. gets up to take care of the dog and says he’ll take him for a walk after his meetings. We’re both working from home, but F. is quitting his job on Friday because he wants some time off before going back to school full-time. I make myself oatmeal with blueberries, bananas, and peanut butter and drink water before starting on emails.

10:15 a.m. — I pop into the bathroom to put in eyedrops. I had Lasik a few weeks ago, and for anyone who is curious, I paid $4,200 out of my savings. No regrets whatsoever. I grab my AirPods while I’m up and some coffee.

12 p.m. — Feed the dog and eat Trader Joe’s gluten-free macaroni for lunch along with the rest of my banana from breakfast and a few walnuts. After eating, I go back to work where I’ll mostly be pre-programming a big, national survey. I say pre-programming because I’m just writing out the specifications for actual programmers.

5 p.m. — I log out of work and log directly onto Zoom for therapy. My therapist tells me he’s leaving his practice, so here’s hoping his new practice is in-network! I pay $25 for the copay. $25

6 p.m. — Take the dog for a walk and then come home and chat with F. about our days while I start on dinner. I’m turning the leftover meatballs into meatball subs and making another Caesar salad. We eat dinner and turn on old episodes of Insecure to watch (and debate).

8 p.m. — I was really frustrated with my job today so I spend some time looking through LinkedIn. I’m fairly qualified and competent (if I do say so myself) but I’m so picky that I have a hard time looking at anything. F. says I’m psyching myself out. I end up giving up and do some more organizing in my room while listening to my audiobook.

10 p.m. — Shower and do my nighttime routine (no Luna Night Oil but I do use my Natural Mystic Rose Quartz Serum). I use my Oral B Genius X toothbrush while watching reviews of cars on YouTube since I’m in the market for one. Head to bed around 12.

Daily Total: $25

Day Three

8 a.m. — Wake up and do a quick morning routine since I’m a bit behind. Take the dog for a walk then throw on a pot of coffee and log into work for a morning meeting.

10:30 a.m. — Meeting done and I grab a piece of cheesecake Kringle for breakfast. Back to work!

1 p.m. — Break for lunch and heat up a frozen pizza. I bought this for nostalgia’s sake and I should have left it in the past, lol.

5:15 p.m. — Log off from work, catch up with F., load and turn on the dishwasher, and take the dog for a walk. F. runs some errands for his grandparents and picks me up some of the good Sudafed (behind the counter) since my allergies are pretty bad. I Venmo him. $13.97

7:30 p.m. — While on my walk, I realize that we miscounted our meals for the week and are a bit short. I call F. and tell him to swing by Chipotle. I order in the app and grab us two burrito bowls and use a coupon for free chips and guac. Once he’s back, we eat and trade memes back and forth on Twitter. F. gets in the shower and I do some more car research. $16.50

8:45 p.m. — FaceTime with my sister a bit before I hop in the shower. Do my nighttime routine and brush my teeth. I also chat with my cousin who sells cars about some of the cars I’m interested in, and he confirms my thoughts that the market is horrible because of COVID-19 (no used cars being returned and fewer new cars being made).

10:15 p.m. — Do the dog’s nighttime routine! And I’m not kidding, haha. I don’t do it every day, but I wash his face (small dogs’ eyes get so gunky), brush his teeth, and add dog mouth wash to his water. I pop on my audiobook in bed while F. reads Dune. Fall asleep around 11.

Daily Total: $30.47

Day Four

8:15 a.m. — Wake up and throw on sweats and a t-shirt. I have to sit in on an interview today but since I won’t be turning my camera on, no need to look cute. I Venmo F. $75 for the phone bill (covered in monthly expenses). We split everything. If it’s really close together, we might consider something a wash, but ultimately, it’s easier for us both to manage our budgets this way. I log into work, do some quick documentation tasks, and make myself breakfast (same oatmeal situation from the other day) while listening to this interview.

1:30 p.m. — Pop out of my room to chat with F. before he heads out. I eat leftover Chipotle for lunch and make some coffee. I play with the pup and do some training with him before heading back to my desk.

5:30 p.m. — Done with work for now. Throw on some jeans and a sweatshirt and head to Petco. I stop and get two hot chocolates from Starbucks on the way and I still have enough money on my card to cover it. The pup gets all of the attention at Petco and I buy him a bully stick to chew on since these are lifesavers at keeping him occupied during the day while I work ($8.62). $8.62

6:45 p.m. — Back home and F. starts on dinner while I shower. He pulls together some sort of teriyaki chicken with basmati rice and roasted broccoli. We sit down to eat about an hour later and dinner is really good! He comes from a family of great cooks but the gene kind of missed him so it’s really fun to see him grow and become more comfortable in the kitchen. I wash the pots and pans, load the dishwasher, and wipe down the counter before logging on to work. I finish up some products for a client. One of the papers I need is nowhere to be found so I shoot my project lead an email and log off after two hours of work.

10:30 p.m. — I join F. who is watching basketball. I do my nighttime routine and head to bed around 11:30.

Daily Total: $8.62

Day Five

8:45 a.m. — Do my morning routine while F. takes the dog on a walk. Log onto work and get started. This includes sitting through three separate conversations with researchers about changing a survey item that we ultimately don’t end up changing (which was my initial suggestion). I grab a Trader Joe’s PB&J Duo Snack since I don’t have time to make breakfast. I sprinkle in some cinnamon to the coffee grounds and when I tell you this LEVELED up the coffee?! I think I saw this suggestion on YouTube somewhere (maybe Jaclyn Forbes?).

1 p.m. — Break for lunch and throw some frozen cod in the oven while I heat up some leftover macaroni. I snack on some cherries and carrots while I wait for the food to finish. I also chat with my sister about my mom’s newest financial drama.

2 p.m. — Catching up on emails! I swear this is the bulk of what I do.

5 p.m. — Log off from work and FaceTime with my best friend for about an hour. Then, my close friend (and now co-worker) calls and we chat a bit about work. It seems like no one is pleased with their job right now! I get ready to go visit F.’s aunt in the burbs.

8 p.m. — We get home around 8, and as I prep dinner, F. takes the dog on a walk. I make chicken wings in the air fryer and cover about half of them in the sriracha garlic barbecue sauce from Trader Joe’s. I also air fry some waffle fries. Then, unrelated, I throw some biscuits in the oven for quick breakfasts/snacks and sprinkle them with cinnamon sugar to pair with apple cider jam that is going to go bad soon.

10 p.m. — Shower, nighttime routine, audiobook, and sleep around 11.

Daily Total: $0

Day Six

5 a.m. — We wake up to a gagging puppy. We tag-team cleaning up the mess and getting him back to sleep. The wannabe doctor in me examines the throw-up and doesn’t see anything incriminating, so I’m not concerned at this point.

8:30 a.m. — Wake up at a much more reasonable time! My allergies are horrible and it looks like I’m crying on video, but thank God it’s Friday! I take a bunch of allergy meds, use nasal sprays, eat a biscuit, and log on to work.

11 a.m. — Work is a mess, honestly. I grab an Alani Nu energy drink because I need more than what coffee can provide. The piña colada flavor is not as bad as I expected!

1 p.m. — My allergies are getting worse but I don’t have time to nap. I eat a few bites of macaroni I had left, a handful of granola, and a handful of cherries and call it lunch. I go back to my desk to do some quality assurance on a co-worker’s task and get extremely confused by some state policies. Documentation in this country is horrible.

3 p.m. — Grab another handful of granola and check on the pup. He’s just chilling on the couch so I go back to my desk to work.

4:45 p.m. — Honestly, I didn’t get everything done that I needed to but my head is killing me so I make a to-do list for Monday and log off. I think the headache is a mix of allergies and hunger, so I make myself a smoothie with soy milk, spinach, mango, mixed berries, dates, and peanut butter. If you need extra greens in your life but don’t like the strong spinach taste, add peanut butter because it can mask the flavor. I get out a treat and the pup’s favorite toy and try to play with him but he starts exhibiting some guarding behavior. I use this moment to try to train but it doesn’t go so well. I let him cool off and thank the lucky stars that I scheduled a behaviorist appointment for next month.

7:30 p.m. — I FaceTime with my sister as we head out to grab takeout from our favorite Thai place! I get veggie pad see ew, F. gets beef pad see ew, and we get an order of veggie egg rolls to share. The total comes to $51 including tip, but F. covers it since I got the last couple meals.

8 p.m. — We get home, feed the dog, and immediately eat because we’re starving. After dinner, we turn on White Chicks (it is my turn to choose the movie and I’m feeling nostalgic again), and man, this movie didn’t age well. Still some funny parts, though. I eat some ice cream while we watch.

11:30 p.m. — We do our nighttime routines and head to bed since we have a long day ahead of us tomorrow.

Daily Total: $0

Day Seven

7:30 a.m. — I wake up with F.’s alarm since he’s getting together with some friends, but since I don’t need to be up for a while, I head back to sleep. I get out of bed at 8:30 and get the dog some water. I don’t take him for a walk because he’ll be going to daycare. I FaceTime two of my closest friends from college at 9 and we catch up.

10:30 a.m. — After FaceTiming, I hop in the shower and get ready for the day. We’re going to the city’s food truck festival and I’m so excited to eat! F. gets home (and he brought me a coffee!!), showers quickly, and gets ready. Then, we head out to drop the dog off at doggy daycare. We have a package of five, so we don’t pay anything, but the cost for a half-day is around $22. This is not currently in my monthly expenses since this is our first package and I’m not sure what the plan will be for daycare moving forward.

1 p.m. — First stop is the car dealership. I want to see some of the stock they have in person and test drive the car I want. The issue with the market right now is that everything is overpriced and no one will budge. I drive a 2021 Honda Civic and it’s really nice, but since the 2022 is already out and is priced exactly the same but none are available, I opt to not purchase because I’d rather wait a few months if I’m going to buy new. Hopefully, in that time, some used cars will come in (but right now, because of COVID-19, newer used cars are scarce).

1:30 p.m. — We make it to the food truck festival (F. pays $6 for parking) and we buy all the things! First, since it’s 90 degrees outside and I’m sweating, we split a frozen yogurt topped with gummy bears, sprinkles, and M&M’s ($6). After walking around a bit, we settle on trying a chicken shawarma wrap and it is SO good ($13). Then, we walk around in the sun more and drink lots of water because it’s way too hot. F. sees a donut truck that I’ve always wanted to try so we get a Coca-Cola cold brew, a coffee donut, and a bottle of water (F. pays). After some time, we get a few empanadas. We get one cheese and spinach for me and two beef empanadas for F. ($12). I am not a fan. We have to pick up the dog so we head out. $31

6 p.m. — We pick up the pup with a few minutes to spare! We stop at Costco for gas (F. pays) and stop at the grocery store. We get steak, broccoli, pizza dough, pasta sauce, bell peppers, onions, bread, croissants, various fruits, frozen meals for quick lunches, tortillas, orange juice, ice cream, eggs, non-dairy milk, and many other food items. This should last us just over a week and we spend around $120 ($60 for my half). $60

8 p.m. — Now that we’re home, we put away the groceries, feed the dog, and F. turns on basketball. We eat our Thai leftovers for dinner and I chug water and head to our room to lay down. I think I got too much sun and am feeling exhausted. After a few hours of laying in the dark and listening to my audiobook, I still have a headache but feel much better. F. watches Better Call Saul while I play with the dog, listen to my book, and stretch.

12:30 a.m. — Do my nighttime routine — including adding extra moisturizer to my shoulders since it has aloe and I think my skin is slightly sunburned — chug water, and head to bed!

Daily Total: $91

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Orange County, CA On A $175,000 Salary

A Week In San Bernardino, CA, On A $43,800 Salary

A Week In Portland, OR, On A $62,500 Salary

from Refinery29 https://ift.tt/3t2mZxI

via IFTTT