Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a senior analyst who has a joint income of $203,500 per year and spends some of her money this week on Adidas volleyball shorts.

Occupation: Senior Analyst

Industry: HR

Age: 26

Location: Minneapolis, MN

My Salary: $83,500 + 10% bonus

My Husband’s Salary: $120,000 + $7,500 bonus (We were both promoted this year so our salaries for the year will be prorated.)

Net Worth: ~$380,000 ($350,000 in 401(k)/IRA, car, HSA, other savings combined between the two of us plus $50,000 home equity minus debt. We have a joint account currently for combined expenses and separate accounts for personal expenses. Reoccurring costs are split ~40/60 and we take turns with other costs (entertainment, travel, food).)

Debt: ~$200,000 left on our mortgage and $20,000 car loan on my car (husband’s car is paid off).

My Paycheck Amount (2x/month): $3,200 pretax

My Husband’s Paycheck Amount (2x/month) $4,600 pretax

Pronouns: She/her

Monthly Expenses

Mortgage $1,200

HOA: $350 (includes cable and lawn services)

Utilities: $250

Car Loan: $341

Student Loans: $0 (My parents paid mine and my husband paid off his two degrees)

Health Insurance: $120 (separate health insurance plans from our employers, cheaper than if we were to go on a family plan)

Gym Membership: $145 ($20 for a normal gym that is fully reimbursed by my husband’s company and $145 that I’m currently paying for F45 that I will cancel after the wedding)

Kombucha Subscription: $40

Wax Pass: $60

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

The expectation was that I become a doctor, which is common culturally. They were disappointed but not surprised when I decided to get a business admin degree. I am the first in my family (first-generation American) to get a degree. My parents paid for my degree and I will always be grateful for that. They wanted both my brother and I to focus on our studies instead of having to work to pay off debt during school and after graduation. There wasn’t a focus on what school I attended, so I tried to go to the cheapest school possible to save my parents money. I completed two years at a community college and two years at a state college. I also did a pre-college program during my senior year of high school, which allowed me to take college courses on campus. Tuition and books were paid by my high school so I saved my parents a year of tuition costs.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My parents rarely talked to me and my brother about money. We had an allowance for doing chores around the house. They also helped us open a checking and savings account in high school and even put charges on our credit card to pay it off to build our credit early.

What was your first job and why did you get it?

My first job was at a clothing store when I was a senior in high school. Even though my parents didn’t want me to work, I had always loved the idea of working and doing something for myself, so I knew I wanted a job the second I could have one (when I had transportation). I was referred to the job by one of my best friends who was already working there and loved it. My first job out of college was luckily in my degree, as I had experience working in HR before I graduated.

Did you worry about money growing up?

My mom and dad have different spending habits; my mom is a saver and my dad is a spender, which led to many arguments. My mom was constantly worried about money and every argument was about money. My dad has a gambling addiction and my mom told me that he had gambled away our college money (~$100,000) in middle school. I think that was the same time that she decided she needed to control all the money and expenses so now everything is in her name. He continues to gamble without her knowledge and then when he’s in too much debt, he tells her and they have to figure out a way to pay it off. This last time, they had to sell their business of 20 years for a discounted price so they could get a lump sum to pay it off. I begged them not to get divorced when I was in middle school, but when I look back now, I was being selfish. This most recent time that he lost money, I begged her to divorce him and she still refused to do it because culturally, divorce is not an option.

Do you worry about money now?

It’s always in the back of my mind, but thankfully, my husband is really financially responsible and I’ve been slowly adopting his methods. I definitely don’t have the best habits. I view money as valuable when it saves time, as time is not something you will ever get back but my husband would rather DIY than pay someone to do something he could do. We don’t plan on having children ever so that helps us not worry about the future.

At what age did you become financially responsible for yourself and do you have a financial safety net?

At 25, I would consider myself mostly financially responsible for myself. By 18, I had employer-paid health insurance. When I was 20, I started paying for my car loan that my dad co-signed. I didn’t start paying for housing until I was 22 when my husband and I bought our first place together. He paid the down payment and then we split the mortgage and HOA costs. By 23, I quit my job due to being burned out, without another job lined up. I had to borrow $1,000 from my parents to pay for bills as it took me three months to find another job. Regardless of how much money my parents have/don’t have, they never want me to worry about money so they always offer to pay for things. I’ve been slowly trying to not rely on them but currently, they pay for my phone bill (family plan) and family vacations (usually once a year). As of today, I have three different savings account (long-term expenses, short-term expenses, and a joint expenses).

Do you or have you ever received passive or inherited income? If yes, please explain.

I do not receive passive or and have never received inherited income. However, my parents did receive inherited income when my grandma passed away, which they used for the down payment of their current home/my childhood home.

Day One

6 a.m. — We naturally wake up early since we normally are up by 5 a.m. on the weekday for the gym. I start my morning with green tea with a teaspoon of Starbucks Vanilla sweetener and my husband makes a pot of coffee for himself. He spends an hour playing games and I catch up on my shows.

7:30 a.m. — I shower early since I know I have a lot to do this morning before we go tubing down the river that afternoon. I drop off our dog at daycare because we won’t be home all day. When I arrive back home, we start packing for the cooler and other beach items.

12:30 p.m. — We arrive at a friend’s house and then we all carpool to the river, which is an hour away.

1:30 p.m. — We arrive at the river and it takes an hour to get through the line. The tube rental is $15 per tube (we get two tubes) and we also get two water bottles ($2). We eat the ham and cheese sandwiches I brought for lunch. $32

6:30 p.m. — Our tubing accidentally takes much longer than we expected. We thought we signed up for the one-hour float, but we end up floating for four hours. As we drive back home, I frantically call the dog daycare and they said they had to board her overnight since we are so late, so we won’t be able to pick her up until tomorrow.

8 p.m. — We stop by Chick-fil-A on the way home to get a light dinner. I order 12 chicken nuggets and a large iced sweet tea ($10). I don’t get the hype with Chick-fil-A, but my husband likes it. We get home, share the nuggets, and go to bed by 9 p.m. $10

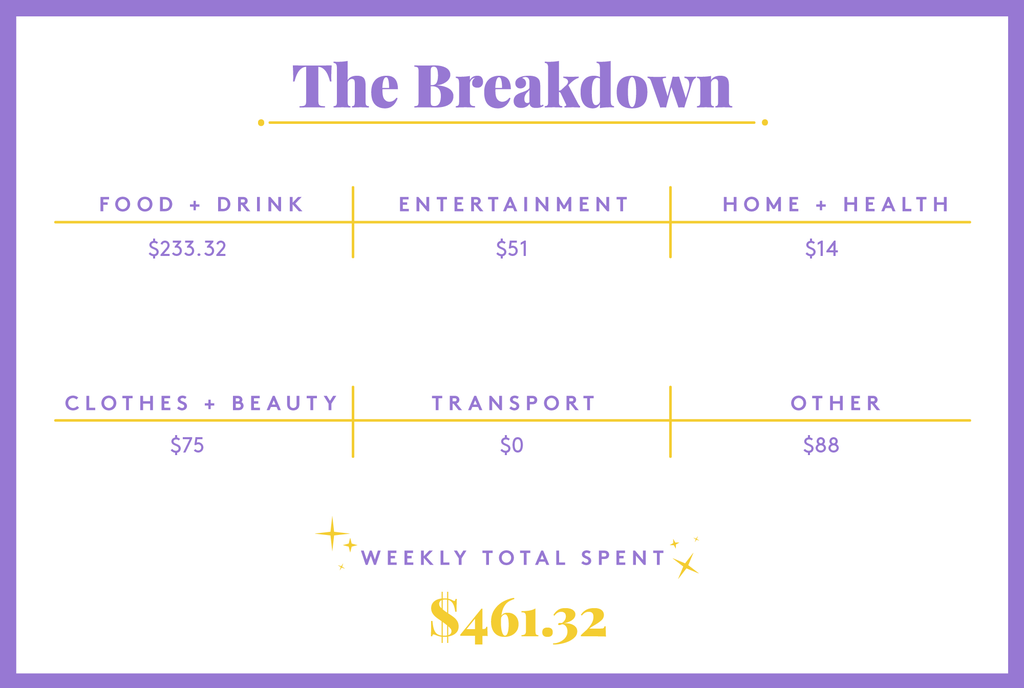

Daily Total: $42

Day Two

4:40 a.m. — Our first alarm goes off. I hit snooze a couple of times and finally wake up at 4:55. We fill up our water bottles, take pre-workout, and head to the gym. There are more people at the gym today than normal, but we find two benches next to each other so that we can work out together. Our gym membership is for one person but it has unlimited guest passes. We both get to go to the same gym for $20, all of which is fully reimbursed if my husband attends at least 12 times a month. We go to the gym five times a week so we don’t have any issue meeting that requirement. The only catch is that I can only go to this gym when he’s with me, because the membership is under his name.

7:30 a.m. — We both start work early as we are currently working from home. He makes his usual coffee, I make my green tea, and then at 9, I make a protein shake and drink half a kombucha. The morning is filled with meetings and I keep delaying high priorities items to later in the week.

6:30 p.m. — My husband picks up our dog from daycare. She got two full days of play (normally $30 per day) but we only have to pay for boarding ($45), which includes both days. I work four ten-hour days (instead of five eight-hour days), so I get off later than my husband. We make chicken bowls for meal prep and dinner (Asian marinated chicken thighs, carrots, rice, red cabbage, green onions, cilantro, kimchi, and spicy mayo). After we eat we order groceries. We spend $100 on groceries (Capri Sun, steak, chicken, 7UP, salmon, bell peppers, coffee, ham, carrots, lemon, gum, yogurt, and bread) and set it for pick up tomorrow. It’s only $2 for pick up, compared to the $15 in fees we used to spend on delivery, service, and tip. The $2 is a steal and still saves us hours of grocery shopping. $145

7:30 p.m. — I spend the night making a couple of playlists for our joint bachelor party in September in Vegas. We eloped earlier this year after having to change our wedding plans numerous times. We realized that the only thing we wanted out of a wedding was photos, a bachelor party, and a honeymoon.

9 p.m. — We’re pretty in routine so we go to bed every night at 9 p.m. unless we’re going out for the night. I put in my retainers that I always forget to put in, and it hurts for a few minutes before I fall asleep.

Daily Total: $145

Day Three

4:40 a.m. — We go through the same morning routine with the gym. I spend the 10-minute drive to the gym looking at my saved workouts on Instagram to plan out my session. My workout consists of hip thrusts, squats, donkey kicks, dumbbell Romanian deadlifts, and back extensions. I don’t work out my arms; I focus on my lower body five times a week.

6:30 a.m. — My husband drinks his protein shake and I head for the shower. I deep condition my hair with a sample of Moroccanoil to see if I want to purchase the full size. I bleach my hair pretty often, so it takes a lot to keep it moisturized and to my surprise, it works really well. We feed our dog and let her out. She spends most of the day napping because she’s still exhausted from daycare.

12 p.m. — I have a reoccurring meeting every Tuesday during lunch, so today I eat an hour later than I normally do. For lunch, we both have sandwiches with chips, Hershey’s chocolates, and a Capri Sun. I take my dog on a walk after I finish eating.

8 p.m. — I have a meal-prepped chicken bowl for dinner while working and a Blue Bunny mini ice cream cone afterward to satisfy my sweet tooth. I lose track of time at work trying to solve a problem and end up signing off late.

9 p.m. — An hour before bed, I catch an episode of my current favorite show, Rizzoli & Isles, on HBO Max before my six-month subscription expires.

Daily Total: $0

Day Four

4:40 a.m. — We wake up for the gym, but today I am also going to F45, which is a 45-minute circuit workout. My husband and I drive separately to the first gym, then 25 minutes into my workout, I refill my water and head to F45. F45’s workout today is cardio-based. To be honest, it’s hard to justify the cost here ($145 monthly), but I figure if I can at least go 12 times a month, the class is about $12 per session.

8 a.m. — I try to keep my Wednesdays meeting-free so I can block the whole day for project work without distractions. But today I have a last-minute meeting, so I hop on that when I get home.

11 a.m. — I eat while I work so that I can use my breaks to run errands or do tasks around the house. Today, I use my break time to put a load of clothes in the washer, then go to my Brazilian wax appointment, where I tip my esthetician $15. I have an unlimited wax pass, so I only have to pay for tip today. $15

5:30 p.m. — I decided to sign off early today because I worked late yesterday. My boss is all about work-life balance and for only working 40-hour weeks. Ten-hour days can go by pretty slow, so I try to take mini-breaks throughout my day. The time I get off work varies from day-to-day, but I don’t mind it — it actually allows me to flex my time and work when it makes sense for me, as long as I work 40 hours.

9 p.m. — I spend the rest of the night watching recorded shows (Hell’s Kitchen, MasterChef, The Hills: New Beginnings, and Restaurant Impossible). My dog falls asleep on me and I don’t want to move and wake her up. It’s time for bed; before I turn in, I take probiotics and hair, skin, and nail gummies.

Daily Total: $15

Day Five

6 a.m. — Normally we go to the gym today, but we are both so exhausted this week that we decide to skip it. I’m also starting to work in the office once a week and with back-to-back meetings today, I wouldn’t be able to work out and get ready in time. My husband drops our dog off at daycare. We try to have her go to daycare once a week for socialization and so we can focus without distractions, since when she gets bored, she wants to go outside every hour.

7:30 a.m. — I spend the morning packing my backpack with everything I think I’ll need. I head to the office and catch up with a few colleagues I haven’t seen in over a year.

11 a.m. — It was my colleague’s birthday earlier in the week so I suggest we go out for lunch to celebrate. Most of my coworkers have kids, so it’s hard to convince them to do happy hours. We get Mediterranean food and since I don’t want to cook tonight, I get two double chicken shawarma bowls and plan to have the leftovers for dinner. $30

4 p.m. — I purposely scheduled all my meetings today so I could have them in person, but now I hardly have time to go to the bathroom. I have an important meeting that doesn’t go as well as I want to and I feel bummed. I think I’m going to try to do half-days in the office going forward because 10 hours in a physical office is mentally exhausting. I leave work at 4 so that I can finish my day at home.

7:30 p.m. — I finish my chicken shawarma for dinner and get stuck trying to solve a problem that might not even be possible. My husband picks up the dog from daycare. $30

9 p.m. — I spend a couple hours planning our joint bach party. My world revolves around food so I bookmark a bunch of restaurants near where we are staying. Then it’s time for bed.

Daily Total: $60

Day Six

4:40 a.m. — We wake up and I go to two gyms. I don’t work Friday, so it feels good to not be rushed to get home. F45’s workout today is hybrid, meaning it’s cardio and resistance-based. I normally don’t sweat — but these circuit sets leave me drenched.

9 a.m. — It’s payday so I put some money towards my credit card bill and venmo rent to my husband for the mortgage. I usually pay my credit card off every month but I find it easier to break up the payments depending on when I get paid, instead of one large lump sum payment once a month.

12 p.m. — We ran out of chicken for our chicken bowls so we make teriyaki steak to supplement the protein and switch up the meal. I have some errands to run, so I go to the jewelry store to get my bi-annual warranty check and ring cleaning. Then I go to Sephora to return the Christopher Robin Cleansing Mask with Lemon deep conditioner and end up exchanging it for a different deep conditioner (the Moroccanoil Intense Hydrating Mask) and a Paula’s Choice Mini Skin Perfecting 2% BHA Liquid Exfoliant. I end up with $4 in store credit.

5 p.m. — We try to only go out to eat once a week but that isn’t the case this week. We have a planned dinner with a few friends at a restaurant that is known for seasonal tasting menus. It is French-inspired and 10 courses. It includes two drinks, charcuterie, oysters, ratatouille, salmon, palette cleanser, duck, ribeye, and two desserts. I also have two additional drinks. The whole experience is only one and a half hours, which is pretty quick for 10 courses. We had to prepay for the meal when we made the reservation weeks ago ($140 per person) so when the bill comes, we only have to pay for the additional drinks. The bill is on one check so I venmo my friend $28 for our drinks. $28

7 p.m. — We get home and I research wigs the rest of the night. I got a wig recently for the bachelor party (one of the themes) but I’m not crazy about how it looks on me. I watch a lot of videos and read articles on how to wear a cheap wig and end up finding a bunch on Shein ($20) to try. It’s 9 p.m. so it’s time for bed. $20

Daily Total: $48

Day Seven

6 a.m. — We don’t have plans today so I spend the day cleaning the house. When we’re not watching TV, I play music throughout the house. I’m currently listening to our bachelor party playlist so I can make sure my husband and I agree on the songs. We met at a concert, and music is a huge part of our lives. I scroll through my Instagram and see these Adidas volleyball shorts that I need. There is free shipping and returns so I decide to get two sizes to try them out (it’s $60 for both). I also do some research on a book to improve my communication at work. I find a book called People Skills for Analytical Thinkers ($19) but have to spend over $25 for free shipping. I ask my husband if he need anything on Amazon and he adds a golf tool ($13) and I add resistance bands ($14). $106

11 a.m. — Lunch rolls around and we have sandwiches and chips. Our friend texts us and invites us to the beach so we pack up and head out. We hang out for a while with our dog and friends and then head home once we’re fully sun-exhausted.

4 p.m. — We are too tired to cook again so we order from a local cafe. We get quiche with rosemary potatoes ($14.95) and a wrap ($14.37) with coleslaw, plus $8 fees and an $8 tip. The food ends up being cold and desperately in need of salt and pepper. $45.32

6 p.m. — I spend the rest of the night researching future travel plans as we will be visiting my family in California early next year. I split up our California trip so that we can spend a day in San Francisco and the rest of the trip in Sonoma County. I book a hotel for SF and an Airbnb in Sonoma. We wanted to stay at the new casino that was recently built, but it isn’t available for next year’s dates — and it’s ~$500 per night. We enjoy gambling but view it as a social activity, rather than a means to win money. That way, we don’t tie as much emotion when we lose and attempt to win it back by putting more money in. There is no payment for the hotel required until check out and the Airbnb payment required is only half ($194). My parents sent me money for the Airbnb and the hotel I will plan to pay ourselves since it was our idea to stay in SF.

Daily Total: $151.32

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Twin Cities, MN, On A $69,700 Salary

A Week In South Florida On A $65,000 Joint Income

A Week In Rochester, NY, On A $82,348 Salary

from Refinery29 https://ift.tt/38XtyII

via IFTTT