Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a nonprofit coordinator who makes $43,600 per year and spends some of her money this week on an IPA.

Occupation: Coordinator

Industry: Nonprofit

Age: 41

Location: Portland, OR

Salary: $43,600

Net Worth: -$23,000 ($9,000 in 401(k) minus debt. My husband and I keep our finances separate and split bills based on earnings. He made much more than me when we first moved in together. His salary had some ups and downs over the years but he recently got a raise and makes about $7,000 more than I do. He does have a small amount of savings and any major expenses like car repair or vet bills are usually covered upfront by him and I will pay half (sometimes spread out over paychecks if needed). While we do not share any accounts, we are 100% dedicated to supporting each other in all ways and money is rarely an issue. As our earnings have been increasing over the past year, we look forward to paying off our personal debts and focusing on savings.)

Debt: $28,000 in student loans, $3,000 left on car loan, and $1,000 remaining on credit cards.

Paycheck Amount (2x/month): $1,320

Pronouns: She/her

Monthly Expenses

Rent: $550 for my share for a two-bedroom rented apartment (Husband covers the remaining $765, utilities are included.)

Car Loan: $270

Student Loans: $500 (Not paused during COVID due to status.)

Credit Card Payment: $150

Health/Vision Insurance: $71.82

401(k): $74

Phone: $152 (I cover both my husband’s and my phone.)

Internet: My husband pays

Car Insurance: My husband pays

HBO/Hulu/Shudder: $35

Spotify/NYT/NY Mag: $19

Savings: $0 right now, anything that is left over at the end of the month goes to my credit card payment.

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

My parents had me young and neither of them graduated from college, which was always a bit of a sore spot for them. Growing up, college was a nebulous idea — I knew I wanted to go but there were no savings or much discussion about how I would pay for it beyond floating the idea of community college when I was in high school. I was a good student and had a lot of ambition, but absolutely no guidance on how to further my education. Out of the blue, when I was 17, my mom took a basic service job at a local private college, which granted my sisters and me tuition benefits at a network of private universities in the area. I decided on an out-of-state school to get some distance from my family. My first semester was very difficult as I felt such a huge class divide between other students and myself, but I started to find my niche and still have a great group of friends from those years. I worked about 15 hours a week during the school year and 40 hours a week during the summer to cover rent and my meager food expenses. I also took out student loans to cover fees, books, and other living expenses, which totaled about $17,000 when I graduated. I am so grateful to my mom for the experience. I grew a lot during my time in school and really benefitted from the small classes and extra attention that you get in a private college.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

Money was a very contentious topic growing up and my parents’ relationship was definitely impacted by never having enough. My mom would have us cut coupons but we never really discussed money. When it came time for me to apply for student loans, I was really in the dark but didn’t ask for any help.

What was your first job and why did you get it?

My first taxed job was at a call center when I was 15, reserving campgrounds for people (this was the ’90s when the internet was not quite yet a thing). My dad worked for a temp agency so he always got us great summer jobs that paid a little over minimum wage. I saved my money from that summer for a used car. I worked all through high school at a coffee shop to pay for my school lunches, clothing, and any school supplies.

Did you worry about money growing up?

100% yes. Both parents worked (sometimes two jobs at a time) but we barely scraped by, using food pantries and loans from family members to cover basic needs. I knew to never ask for anything like cute clothes, new toys, etc., and could not wait to start working so I could buy my own things. My mom did her absolute best to find free and cheap activities and encouraged reading and creativity. By high school, I felt pretty responsible for a lot of my own needs, and being able to work lifted a bit of stress for me.

Do you worry about money now?

Absolutely, but I try not to let it run my life. I am nowhere near where I should be at my age with retirement and savings. I defaulted on my student loans a few years ago when I had to buy a car for work that I couldn’t afford. I have a massive amount of shame around that and feel like I will never climb out of that hole. I didn’t hit a $40,000 salary until I was nearly 40, it’s been so difficult to make up for the damage that earning low wages did to my psyche and self-worth, let alone my credit score. I do feel like I am getting to a good place with my debt besides student loans (my credit card and car will be paid off by next spring) and look forward to putting that money into savings. My lifestyle is fun without being extravagant and I know how to get by on very little.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I started covering my housing and food costs in college, so 18. My parents would occasionally visit and buy me groceries, and my mom covered my $35 phone bill a couple of times. At this point, my husband is my safety net, he’s been able to cover expenses when I’ve been laid off in the past. If my marriage ended for whatever reason, I know I could crash with one of my sisters for a month or two to save up for an apartment.

Do you or have you ever received passive or inherited income? If yes, please explain.

I feel like my tuition benefit counts for this, but I have not received any money from family members and don’t really expect to.

Day One

8:30 a.m. — My little old lady cat wakes me up for the third and final time this morning, getting me out of bed with just enough time to shower and be at my desk a little before 9. I’ve been WFH for 18 months, so at this point just put on whatever seems warm and comfortable. Quick shower, then morning skincare which involves some Evan Healy eye balm, The Ordinary squalene oil, and a light face lotion. I am not the best at routine so this may or may not happen every day for the rest of the week. A few cups of coffee while I catch up on some emails (yesterday was a recognized holiday so there’s a bit more than usual). Power through some data entry and make a fried egg with some cheese, English muffin, and sliced tomatoes from my friend’s garden.

12 p.m. — Head out to the grocery store for a thrilling change of scenery. My gas tank is about ¾ full and I get great mileage driving in the city, so won’t be filling up for at least another week or so. Pick up a baguette, butter, carrots, cocoa powder, coconut milk, olive oil, and red peppers. Get home and can’t think of anything to eat for lunch so I make a plate of more sliced tomatoes and baby carrots and tear off a hunk of baguette in a way that is much more Cave Lady than French Lady. $28.79

3 p.m. — It is absolutely freezing in my giant old apartment so I tell myself I deserve a break to get warm under the blankets and you can probably figure out what happens next…

4 p.m. — Wake up from my nap! Check my phone to see that I got zero emails during my snooze. I send some data requests to my team and close up shop around 5. During spring and summer, my days are extremely busy and I often work 10+ hour days with no additional pay. My reward is a few months of the year when things are extremely chill.

5:30 p.m. — My friend, N., is coming over for dinner so I get started on slicing and roasting tomatoes and red peppers for soup and then mix together some ingredients for brownies. We just started having friends over after no inside gatherings since March 2020. Everyone that I interact with socially this week is fully vaccinated, and I wear a mask everywhere I go.

7 p.m. — N. arrives with a lovely bottle of wine to share. Her, my husband T., and I catch up over dinner. N. and I want to watch a scary movie, which T. does not enjoy, so he takes off to the pub with his laptop to work on his personal projects. I pick the 2005 Amityville Horror and it is SO bad, we have fun judging the costumes and hairstyles that don’t fit the 1970s setting. N. leaves at 10:30. I wash my face with Derma E cleansing balm, use some Evan Healy HydroSoul, eye balm, and Alaffia night cream on top. So excited for my warm bed, which my cats immediately jump into to keep my company until T. gets home a few minutes later.

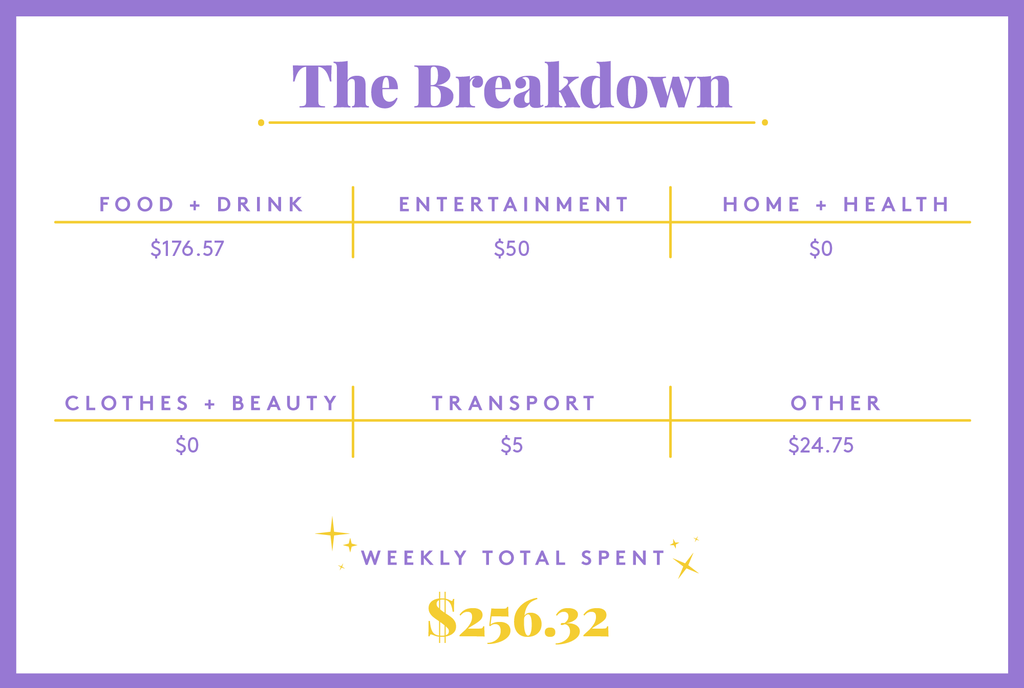

Daily Total: $28.79

Day Two

6:30 a.m. — Wake up to T.’s alarm and lovingly harass him until he turns it off. I doze off again and wake up at 8:30. I take a quick shower and then have coffee and a brownie at my desk.

10 a.m. — Department meeting gets started with our manager asking people to tell a story about a time that they faced a fear, which quickly turns into 45 minutes of people talking about when really scary things happened to them. I leave my camera off and do not participate, it’s too cringey and I don’t know why our manager will not clarify her original intentions!

12 p.m. — Meeting is finally over and I’m famished and feel sluggish, this change in weather always throws me for a loop, as much as I love it. Heat the rest of the soup up, slice the remaining baguette in half and cover with more tomatoes and a bit of Swiss cheese. Attempt a sort of open-faced grilled cheese under the stove broiler (does anyone actually know how to use these things?!). Take a few minutes to chat with R. and snuggle with the cats. Spend the next few hours on more data tracking and searching Spotify for some deep cut ’90s alternative to add to my karaoke bangers playlist.

6 p.m. — Time for a little neighborhood walk. Listen to The Vegetarian by Han Kang on Libby — it’s really dark and I love it. I only make it two and a half miles today, feeling a bit woozy and sniffly. Run into T. out on his walk we head home. Wanting something comforting, I look up open Thai places in our area and we decide on a food cart that people rave about but we’ve never been to. T. goes to pick up our order (pad kee mao for me, pad see ew for him). It is excellent, so glad we tried it! Watch The Great British Baking Show and multiple episodes of The Other Two while I work on knitting. We go to bed around midnight. $12

Daily Total: $12

Day Three

5:45 a.m. — Little old lady cat needs my attention! I can’t find any more cans of cat food, so her breakfast is a Churu cat treat squeezed onto a plate. She thinks she’s won the lottery.

8 a.m. — Coffee and a big glass of water to start the day. Browse Instagram in bed looking for new sewing patterns to save. I love to make and thrift as much clothing as I possibly can and I do my best to mend/dye/alter any items that I buy to keep them going for a couple of years at least. I can’t face sitting in my cold little corner for the day so I bring my laptop into bed and get started on some emails, make a by end-of-month goals list, and start a task list for the rest of the year.

12 p.m. — Head up to the pet food store to stock up on a variety of canned food, throw in a few fuzzy mice, silver vine sticks (a big hit!), and freeze-dried minnows ($24.75). When I get home, T. is cooking Quorn veggie nuggets and I’m glad our oven heats up half the apartment. I move to my desk in the living room where T. serves me an incredibly fancy plate of fungus nuggs with ketchup and ranch — #grownupgoals. I also add some baby carrots. The nuggets are pretty bland so I go to add some old-school seasoned salt but grab the cinnamon by mistake — would not recommend. $24.75

4 p.m. — Work happy hour! We are a tight group of coworkers and have been trying to meet up a few times since summer. As much as we all enjoy the WFH life, we do miss seeing each other. We meet up at a bar in my area that has a huge patio. I have three incredibly weak whiskey gingers and one for my coworker. I really want food but it’s slim pickings here for vegetarian options (which is not usually the case in Portland, this bar maybe sucks a little bit?). I nurse my sodas with a splash of whiskey and avoid the trap of getting shots ($24 and $6 tip). Leave with my dignity intact but feel like having another drink so I meet T. at our local spot for a beer ($6 and $2 tip). Manage to wash my face and fall into bed around 11. $39

Daily Total: $63.75

Day Four

5:45 a.m. — Same old story, but the new food must be a hit because both cats chow down.

8 a.m. — It’s a gorgeous fall Friday and I’m just a bit foggy from last night’s drinks. Coffee and a granola bar in bed while I browse Celebitchy and Girls of a Certain Age. I also finally remember to take an iron pill. I spend the morning closing out records and meeting with a new colleague to help him with some brainstorming.

10 a.m. — Urge myself to look in the fridge and find eggs, cheese, and tempeh. I make a quick scramble and find the multiple grams of protein very healing.

1 p.m. — T. suggests sandwiches from a local deli (is there anything better than grabbing lunch on a Friday?). I go for the cold tuna and Tim’s Jalapeño chips (I was vegetarian for 15 years and went pescatarian in my early-30s, usually getting sushi or poke once a week; it’s the only thing that is keeping my brain from collapsing in on itself). The sandwich is so good and huge, I eat it all but know I won’t be hungry for the rest of the day. $15

3 p.m. — Two of my coworkers mentioned going to the symphony this weekend, which I had already been considering doing by myself. I can’t get a ticket next to them but snag a great front-row seat the section over. I haven’t been to a live performance of anything in 20 months and can’t wait. The ticket is $40, plus service fees of $8.50 and $1.50 donation. $50

6 p.m. — My sister asks if I want to grab a drink at the bar next to my place. I hadn’t planned on going out but it’s beautiful outside and watching the sunset sounds really nice. She buys me a whiskey ginger (this one is good!) and an IPA. T. joins us and I grab another IPA ($7 + $2 tip). T. and I spend the rest of the evening watching I Think You Should Leave and cracking up. $9

Daily Total: $74

Day Five

8 a.m. — Happy Saturday! We are out of coffee and a few other things, so I run to the market down the street and get coffee, cream, cheese, eggs, frozen hashbrowns, kombucha, orange juice, tortillas, and veggie bacon. Make us dupes of the breakfast burritos the place down the block from us makes, don’t really save any money by not just going there, but it’s still fun. $36.78

11 a.m. — T. and I have been more intentional about housework lately, picking a corner every week to focus on. He decides to clean up behind the dresser and surrounding area (so many dust bunnies) and we sort through the random stuff that has piled up. I get some laundry going and am suddenly inspired to go through our closet and make a donate bag for anything that is in decent condition. Unfortunately, some things are just too trashed (we get a lot of closet moths) and have to be tossed. Our closet is a decent size and it feels great to see the floor again.

2 p.m. — T. leaves to meet a few friends for lunch. I graze on some sliced carrots and cucumber and dried tangerines. Work on sewing for the rest of the afternoon as I am determined to wear my new dress tonight. Listen to my audiobook while sewing and I finish it and my dress with enough time to shower and put on make-up. This dress was a real labor of love, made from fabric from T.’s grandma. It is adorable and I feel very proud of myself.

6:30 p.m. — My sister decides to tag along to the symphony so I pick her up and head downtown for the concert. We get a spot in a parking garage for $5. Meet my coworkers in the concert hall and chat for a few minutes before seats. My sister treats me to a $5 bottle of water. This venue requires proof of vaccination and our state mandate requires that masks be worn at all times when inside a public space (I would not go otherwise). $5

9 p.m. — That was amazing! I’ve picked a few other concerts I want to get tickets to for the season (I’ll go for the nosebleed $25 seats next time, though). We are both starving and head back to our neighborhood to get pizza from our favorite local spot. A drunk girl walks past us and yells at me that my dress is awesome. I had a pizza award on my account so one of my slices is free! $4 + $2 tip. Drop my sister off, get home and change into comfy clothes. Eat my pizza and watch You for the next few hours. What a fun day! $6

Daily Total: $47.78

Day Six

6:45 a.m. — The cats must be on a Sunday schedule too because they don’t wake me up until almost 7. Feed and pet them, then back to sleep.

8 a.m. — Up for good now and T. makes coffee. Breakfast is scrambled eggs and veggie bacon and I watch last night’s SNL (my tradition since middle school, when I’d set the VCR record it). Spend the morning cleaning up my sewing mess, watering my plants, and taking a bag of clothes and shoes to a donation site in our neighborhood.

1 p.m. — Our fridge is beyond bare right now, so T. goes to the grocery store to get some of our weekly regular items. We both do separate grocery trips during the week based on what we need or what we want to make. It’s very important for him to feel prepared (he’s a Virgo) so he tends to buy more of the staples, and I get more of the specialty items and plan/cook a few more meals than he does. We rarely feel the need to discuss food and household goods expenses and have no problem picking things up for each other. Any bigger expenses we split or work out who can pay for what. He preps a big salad for the week (we learned early on in quarantine that if we cut up all the vegetables at once, we will actually eat them!) as well as some pasta with lots of broccoli and veggie crumbles. I have some salad and crackers.

3 p.m. — I retreat to the bedroom with my laptop. T. has an online game with some friends and I don’t feel the need to hear about their newest adventure. Decide a bad movie and some crafting is in order. I spend the next few hours with my seam ripper and a Target dress I got from Goodwill last week — I love the material but don’t like the multi-tiered skirt and the pockets have a really strange placement. I first remove bodice from the skirt to take out the darts for a boxier shape, and will remove the top skirt tier and re-attach the skirt with just the lower two tiers and re-insert the pockets — this will give it a shorter, more baby-doll look than the original prairie maxi dress look.

6 p.m. — Head to my sister’s place for our weekly movie night. I’m not hungry but she wants Thai food, so I pick up something for her and order a rice dish for myself, which I immediately regret, I was hoping for a no spend day and it’s not very good ($24.50 + $5.50 tip). We watch The Witches of Eastwick (Cher 4eva) and my sister gives me a gorgeous pair of shoes that didn’t quite work for her but fit me perfectly. She asks if I’ll cover dinner in exchange, totally worth it. Head home around 8. T. is working on one of his projects so I finish up the deconstruction project I was working on earlier and watch Y: The Last Man. Pour a tiny whiskey for myself and the cats cuddle next to me on the couch until bed time at 11. $30

Daily Total: $30

Day Seven

6:30 a.m. — I feed both cats and get back into bed. Wake up at 8:30, quick morning routine and at my computer by 8:50. This morning’s department ice breaker involves telling everyone the meaning behind your name. I have a typical white girl name but make up a story about a great-great aunt who was a widowed homesteader who overcame adversity and my mother always admired her. Coffee, cereal, and some problem-solving about a coworker’s client round out the morning.

12 p.m. — Heat up some of the pasta that T. yesterday.

3 p.m. — The sleepies kick in so I get up and move around a little and drink some more water. I’ve been pretty busy with payroll tasks all day. I remember that I have a review on Friday so I also get started on my self-eval. I’ve felt like a bit of a wreck this year but am trying to focus on what I bring to the table and how I’d like my job duties to change a bit moving forward so I can be more successful. I also have an interview with a different organization on Friday, right before I meet with my boss. I want to move from a nonprofit to education and this position would help me reach that goal (it also pays a few grand more a year and has excellent benefits).

5 p.m. — Shut my computer down and put my sneakers on for a walk. I love the evening sky this time of year and feel so grateful for the area that I live in. My muscles are dragging and I really am not feeing it, but when I turn the corner onto a main avenue I am treated to the most beautiful full moon rise and it gives me a nice jolt of energy.

7 p.m. — Make a big salad with some crackers on the side. T. is a bit down for the count with allergies so we have a cozy night in watching The Great British Baking Show and I scout some of my favorite cooking blogs for fall vegan recipes (will only be eating in this week). My goal this week is to go to bed before 11 and force myself to read if I think I’m not tired (The Glass Hotel is at my bedside). Barely make it to 10 and it’s lights out.

Daily Total: $0

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Detroit, MI, On A $72,000 Salary

A Week In Austin, TX, On A $162,000 Salary

A Week In Seattle, WA, On A $115,000 Salary

from Refinery29 https://ift.tt/3HKqv6v

via IFTTT