Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Have you ever spent more than 30% of your income on rent? How much of your paycheck goes to rent? How much of a financial burden was it? Share your experiences here for an upcoming Refinery29 story.

Today: a UX/UI manager who makes $160,000 per year and spends some of her money this week on a hanging plant.

Occupation: UX/UI Manager

Industry: Technology

Age: 31

Location: New York, NY

Salary: $160,000

Net Worth: ~$479,000 ($137,000 in retirement accounts; $184,000 in investments; $110,000 in various checking and savings accounts; $48,243 equity in one bedroom co-op apartment.)

Debt: $203,757 left on my mortgage

Paycheck Amount (biweekly): $3,438 + (varying $1,000-$2,000/month for freelance gig)

Pronouns: She/her

Monthly Expenses

Mortgage + HOA: $2,035

Home Insurance: $25

Utilities (Gas, Electricity, and Internet): $115

Cell Phone: $40

Car Insurance: $50

HSA: max out

401(k): max out

Health Insurance: $45

Dental/Vision Insurance: $25

Amazon Prime: $119 annually

Netflix: $0 (covered by cellphone provider)

Donations: $40 to various causes

Investments: $500

Savings: Whatever is left over after all variable expenses.

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes, but my parents were the type where as long as I got a B-, they were happy. I attended a city college because I didn’t want to spend a fortune on education. I got a few scholarships and grants and my parents helped pay the remaining balance. Fortunately, I graduated with no student debt.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

Yes and no. When I was younger, my mom helped me open up a savings account. I was stingy AF growing up because I was addicted to seeing that number grow, so I saved every penny that I received as a gift and added it to the account. When my bank went out of business, I withdrew all the money and had a stash of cash underneath my pillow. When I turned 18, I opened up a checkings account, savings account, and a low-limit credit card. At this point, I didn’t even know how to write a check. I learned everything on my own.

What was your first job and why did you get it?

My first job was at a skincare clinic as an admin while I was in school. I got a job to sustain my shopping habits and barely saved any of it. Growing up I had an unhealthy relationship with shopping. The moment I got a credit card, I started to rack up some debt that rolled over every month. I practically hit rock bottom because I was borrowing money from friends to pay off bills that I didn’t have the means to pay. I was pretty embarrassed and I guess that was my turning point.

Did you worry about money growing up?

Yes. We weren’t rich at all growing up, but I never felt like we were poor-poor. My parents were immigrants and came to America as teenagers. My dad had a gambling problem, so money was tight, but my mom did her best to shield the money problems from me. I kinda figured it out anyways since my parents argued about money pretty regularly. I hated him growing up, and I feel like that caused my love-hate relationship with money.

Do you worry about money now?

Sadly, yes. Even though I am considered a high earner now (new job, salary bump), my anxiety around money still persists. It’s always like “I’ll feel better when I ___ [finish paying off my mortgage, save enough for retirement, reach FIRE, etc…].”

At what age did you become financially responsible for yourself and do you have a financial safety net?

I would say by the time I was 24 when I moved out on my own. I started to pay for my own health insurance and cell phone bill. I have a healthy emergency stash that could cover both my family and me for a year.

Do you or have you ever received passive or inherited income? If yes, please explain.

Yes, about $5,000. My uncle consistently invested in an index fund under my name. The moment I turned 18, I withdrew all the money. Looking back I wish I had kept it in there.

Day One

7:30 a.m. — My first alarm rings at 7:30 and I’m dreading that sound. There are days I snooze and there are days I just force myself to wake up — today I win. The moment I’m up I try to chug a glass of water to wake up my body while my mind slowly catches up. I instinctively do a couple of yoga poses and stretches and then choose a quick morning meditation from Insight Timer. When my mind is fully awake, I indulge in my bad habit of scrolling through my emails and social media.

8 a.m. — I am up and in my bathroom getting ready. I brush my teeth and wash my face with plain water. Then I spray on some facial mist, put on Krave Beauty moisturizer, and a light dab of eye cream and Vaseline for my lips. I take my multi-vitamins and B12. I get out of bed and water my plants.

8:30 a.m. — I log in to work, check a couple of emails and all my unread Slack threads. I work for a few hours before my stomach starts growling.

11:45 a.m. — I start preparing my lunch. Today is a quick wrap with grilled chicken from Trader Joe’s, sweet potato, butter lettuce, avocado, and a dash of salt and pepper. I’m still hungry after I eat, so I cut up a kiwi for dessert.

3 p.m. — I start to get the midday slump, so I start munching on a bag of PopCorners. While I’m snacking, I open up my Yesstyle tab and start window shopping again. I like to add stuff to my cart imagining all the stuff I could buy, but don’t actually pull the trigger then and there. This way I have the chance to talk my way out of buying stuff that is impulse versus stuff that I actually need. I switch back to work.

6 p.m. — I’m always uninspired when it comes to dinner, so I make instant ramen and watch a bunch of YouTube videos while I’m eating.

8 p.m. — I turn on Netflix and catch a few episodes of Squid Game. I’m craving something in my mouth again, so I reach for the PopCorners.

10:50 p.m. — Time to get ready for bed. I take a quick shower and begin my nighttime routine. I started using the ATOI soothing line, and love how luxurious it makes me feel about my routine. After two rounds of cleansing, I pat on a small amount of toner. I have a sample of La Mer cream, so I attempt to smear a thin layer all over my face. It’s really heavy, but I want to use it up. I add a light dab of eye cream and I’m ready for bed.

11:20 p.m. — I check my social media feeds and get sucked in for 30 minutes before my eyes got tired. I lay my phone next to me and knock out.

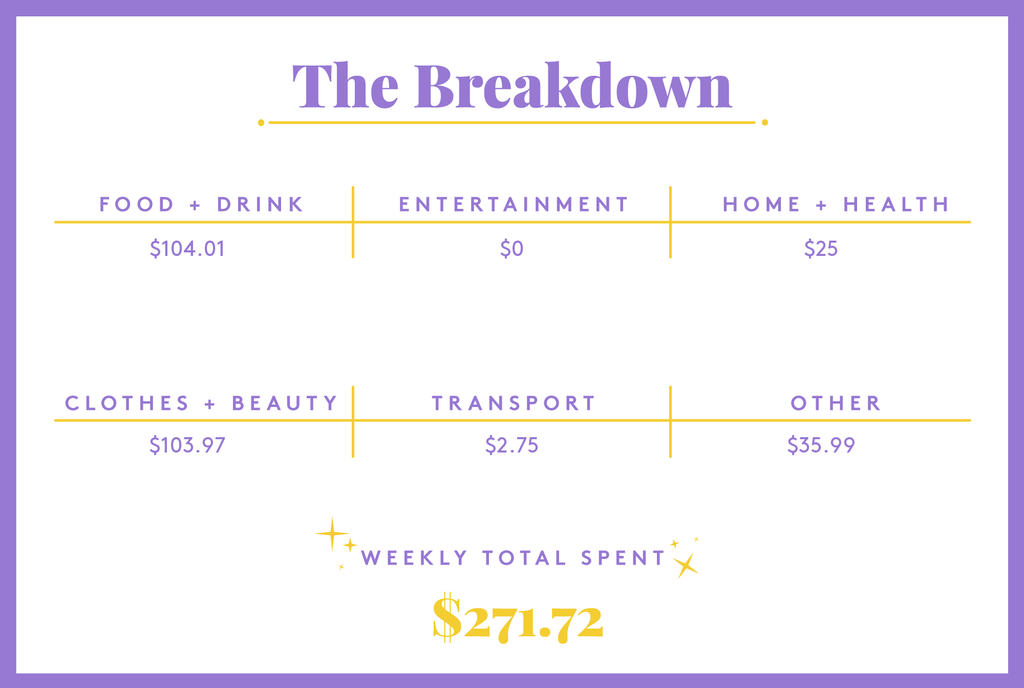

Daily Total: $0

Day Two

7:30 a.m. — Snooze today, so I do my morning routine and skip social media. I have T-Mobile and on T-Mobile Tuesday there is always some type of perk. Today it’s $2 off Dunkin’, so I quickly saved that to my account.

8:30 a.m. — I’m hungry this morning, so I make a quick smoothie with half of a frozen banana, frozen strawberries, blueberries, and pineapple with almond milk. I nurse the drink until 11 a.m. because I have back-to-back meetings, so my butt is in my seat until 1.

1:15 p.m. — I get hungry, so I quickly fix the same lunch as yesterday. Meetings slow down and I actually get to have some heads-down time and catch up on work.

5:15 p.m. — My eyes get dry and my head feels heavy, so I set my boundary and log off from work.

6:15 p.m. — I have a quick intro call with a connection of a friend who wanted some career advice. I offer my advice and talk about my experience in this field.

7 p.m. — Craving pho tonight, so I get a large order of pho and a short ribs appetizer. It definitely hit the spot. The portions were very large, so I have leftovers. $16.50

8 p.m. — Same nightly routine of Netflix, shower, and ready for bed by 11.

Daily Total: $16.50

Day Three

7:50 a.m. — Snooze again. It’s been getting colder, which makes it harder to wake up. Today I have a few working sessions with clients, which means I have to be on camera. I lightly fill in my brows, curl my lashes, put on some blush, and lipstick. Put on a nice “work” top and I’m ready to work.

12 p.m. — Meetings are done! For lunch, I make a bowl of noodles with the leftover pho soup from yesterday.

1 p.m. — It’s my friend’s son’s fourth birthday, so I quickly log on to Amazon and find a nice explorer kit to arrive tomorrow ($15.99). Finish the day with a few more hours of emails and work. $15.99

5 p.m. — Haven’t left my house for three days, so I make an effort to take a walk outside while listening to my borrowed audiobooks.

7 p.m. — For dinner, I boil some frozen udon noodles from my freezer and eat them with two soft-boiled eggs and imitation crab sticks. I catch up on some YouTube videos.

9 p.m. — Jump on a quick meeting with a freelance client who lives on the West Coast. We walk through a few upcoming requests and I tell them I will get back to them about the ETA.

9:45 p.m. — Time to relax, so I do my normal nightly routine, but also put on a sheet mask, and turn on my back massager.

11 p.m. — Ready for bed. I do some social media scrolling before I drift off to sleep.

Daily Total: $15.99

Day Four

7:30 a.m. — Same morning routine until I’m ready to get up.

8:30 a.m. — Another packed day of back-to-back meetings. People have got to learn that some meetings can be done through emails!

11 a.m. — I finally pulled the trigger on my Yesstyle order ($103.97). I mentally prepare myself to hit the buy button after double-checking all the items over and over again. The final push is me telling myself I can treat myself here and there. I can’t take my money with me when I die. I close the tab and continue to work. $103.97

12 p.m. — For lunch, it’s another wrap with eggs, avocado, leftover short ribs, and a squeeze of hoisin and sriracha sauces.

2 p.m. — Today I am redeeming my Dunkin’ $2 code, so I pick up a strawberry donut as midday treat. It’s covered by the coupon.

7 p.m. — Time to put my laptop to sleep. For dinner, I use whatever is left in my fridge. I make scrambled eggs with truffle salt, mashed avocados, and grilled chicken with teriyaki sauce.

8:30 p.m. — Watch a few more episodes of Squid Game (holy moly, the suspense).

11:30 p.m. — I’m ready for bed and drift off to a guided sleep meditation.

Daily Total: $103.97

Day Five

7:30 a.m. — It’s finally Friday! For some reason, I wake up refreshed and just get up.

9 a.m. — Makee myself a cup of non-dairy matcha latte. I work through lunch without even realizing it.

3 p.m. — I snack on PopCorners and a kiwi. I decide to check up on my stock portfolio (lots of red, eek, so I quickly close the app). Back to work.

5 p.m. — Can’t decide on what I want to eat, so I just make a big batch of pasta with spaghetti sauce.

7 p.m. — I have a few freelance projects to work on so I spend my Friday night just grinding away.

10 p.m. — Late-night sweet tooth and I’m craving ice cream so I open up the box of non-dairy Haagen-Daaz coconut caramel dark chocolate ice cream bars. It’s actually really good!

12 a.m. — Time to get ready for bed. I’m so glad tomorrow I can sleep in.

Daily Total: $0

Day Six

8:30 a.m. — Rise and shine. I check my messages and social media feeds. I get out of bed two hours later.

11 a.m. — Time to head to my local farmers market to see what they have. I get a large bag of kale, one cucumber, a bag of apples, and cherry tomatoes. $15

12:30 p.m. — Wash and prep all the produce that I got and fix myself a simple kale-apple-cucumber salad with a cup of matcha.

6 p.m. — I’m going to a poker night tonight with some of my close friends. I take public transportation to my friend’s home ($2.75). I’m definitely a newbie to this game, so I’d like to think of my buy-in as my tuition to learn. At the end of the night, I’m down $20, but I learn something new every time. We end the night with a platter of sushi and wine. My friend gets the sushi and I get the wine ($34.50). $57.25

1 a.m. — In bed and ready to snooze.

Daily Total: $72.25

Day Seven

9:30 a.m. — Sleep in today. I roll around bed and go through my social media feeds.

11 a.m. — Stop by the local plant shop and get a new hanging plant ($20). I’ve been eyeing hanging plants for a while and finally decided to pull the trigger. I also stop by Home Depot to grab some soil for my plants ($5). $25

12 p.m. — I go to Traders Joe’s to restock on some grocery items: bread, eggs, almond milk, onion, sweet potato, teeny tiny avocados, bananas, strawberries, blueberries, turkey meatballs, and naan ($32.01). For lunch, I decide to heat up the spaghetti and add turkey meatballs. $32.01

3 p.m. — Time to tidy up the house a bit. I wipe down the kitchen, scrub my bathroom, and vacuum all the floors.

5 p.m. — I head out for a short bike ride around my neighborhood park and then head to a park bench to catch the beautiful sunset.

7 p.m. — On my way home, I pick up two slices of pizza with sausage and pepperoni. The night ends with the last few episodes of Squid Game (highly recommended!). $6

11 p.m. — Wash up and ready for bed. I can’t believe the weekend flew by! Am I the only one who wishes we had a four-day workweek?!

Daily Total: $63.01

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Boston, MA, On A $95,000 Salary

A Week In New York, NY, On A $75,000 Salary

A Week In Detroit, MI, On A $72,000 Salary

from Refinery29 https://ift.tt/3posBkr

via IFTTT