Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Editor’s Note: Just a head’s up, we’ll be pausing Money Diaries the week off 12/27 so your trusty Money Diaries editor can have a little R&R. We’ll be back in the new year – see you then!

Today: a store manager who has a joint income of $190,000 per year and spends some of her money this week on Christmas pants.

Editor’s Note: This diary is from October 2021.

Occupation: Store Manager

Industry: Retail

Age: 37

Location: Newburyport, MA

Salary: $125,000 + bonus (Last year was $60,000.)

My Husband’s Salary: $65,000 + bonus (Not sure what it will be yet.)

Net Worth: A little north of $1.1 million (Retirement savings: about $550,000 between myself and my husband; home equity: $400,000-$500,000; stocks: $60,000 mostly in my company (with another $80,000 unvested); travel savings: $20,000; emergency fund: $50,000; house project savings: $60,000; cars: $25,000; son’s savings/529: $11,000. I feel it is important to note that pretty much all of our savings (and some of our current home equity) is because we sold our first condo in Boston a few years ago. We struggled to buy the condo but felt strongly it would be a smart investment vs. paying crazy high rent. We did silly things like take out two mortgages on it and take a loan from my 401(k) so we could buy it, but it paid off for us.)

Debt: About $430,000 left on our mortgage

My Paycheck Amount (biweekly): $2,527 (Family health insurance, healthcare HSA, and daycare FSA are all taken out of my paycheck.)

My Husband’s Paycheck Amount (biweekly): $1,879

Pronouns: She/her

Monthly Expenses

Mortgage: $3,800 (We took out a 10 year to get the best interest rate, so our mortgage is high.)

Utilities: $400

Daycare: $576 (Mostly reimbursed through my daycare FSA account.)

Husband’s Phone: $70 (My company pays for my phone.)

Internet: $60

YouTubeTV: $49

Netflix: $13

SimpliSafe: $25

Ring: $3

Hulu: $2 (Promo offer, will cancel once promo ends.)

Savings: We don’t currently make any regular contributions to our savings accounts. If we get above $10,000 in our checking account, we will transfer money into savings and we also put all of my bonus and whatever we receive back in taxes into savings every year.

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes. I did well in school so the expectation that I would attend college was always there. I attended a private college that I had no business attending because I absolutely could not afford it. I received some financial aid and scholarships, but still graduated roughly $90,000 in student loan debt. My parents paid for about $15,000 (bless them) and I paid for the rest (along with my husband who also had about $30,000 in students loan debt left when we combined finances. I think at that time I had about $45,000 left).

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My parents always struggled financially. Looking back now, I know it’s because they didn’t talk about money with each other, so they definitely didn’t talk about it with my brother or me. I learned mostly from my aunt, who worked at a bank and handled my grandparents’ finances for them.

What was your first job and why did you get it?

I worked at an ice rink snack bar at 14. Most of my friends got jobs around 14 so we could have spending money, but I also wanted to save up so I could buy a car when I was able to drive. I think this was my first true lesson in saving and budgets. I bought a brand new car when I was 17, putting down over 70% of the cost of the car. As soon as my bill arrived every month, I would pay it right away and make notes in my checkbook.

Did you worry about money growing up?

Not until I was a little older because my parents did a really good job of making sure I had everything I wanted and I don’t think I will ever understand the depth of what they went through to make sure my brother and I were taken care of. My uncle (father figure, long story) worked full time + OT and was a golf caddy on the weekends, and my mother worked at night.

Do you worry about money now?

Not anymore. For many years (as we were paying off students loans, cars, stupid credit card debt from our early 20s, etc), I worried a lot. My husband comes from a very similar financial background, where money wasn’t discussed, but as we got older we both sensed the financial stress our parents were under. This is why we talk so openly about money (it took us a long time to get there, including both of us hiding debt from each other for awhile pre-marriage). When we finally got on the same page we went crazy into the debt snowball (extra jobs, rented out our condo on Airbnb and stayed at my parents’ house, etc), which is what allowed us to live a life where we don’t have to worry about money anymore. It also helps that we don’t spend frivolously (a lesson learned from having to pay off all the stupid debt we racked up when we were younger).

At what age did you become financially responsible for yourself and do you have a financial safety net?

By the end of high school, I was paying for everything myself, but I lived at home for free. My financial safety net now is our emergency fund. When I was younger, my safety net was knowing I could always move home and my parents would welcome me without expecting me to pay anything.

Do you or have you ever received passive or inherited income? If yes, please explain.

I received $2,000 from my grandmother and $1,000 from my uncle when they passed away. As mentioned above my parents paid for about $15,000 of my student loan debt, and they also paid for most of my wedding (I didn’t want them to but they are stubborn and prideful so there was no talking them out of it).

Day One

4 a.m. — Ugh. My alarm goes off for the third time and this time I really need to get up. It’s Halloween and I’m getting to work early so I can leave early to trick-or-treat with my son. Shower/get ready/eat breakfast (cereal), pour coffee in a to-go cup (I pre-program the machine every night), and I’m out the door by 4:45.

9:30 a.m. — Time for a second coffee. I go to the Starbucks next door and grab a tall iced coffee with one pump of Cinnamon Dolce, as well as a turkey bacon breakfast sandwich, and two fancy coffees for employees who worked overnight to say thank you. $16.76

3:15 p.m. — It has been a stressful workday and as I am leaving I realize I haven’t eaten since 9:30. I grab a box of Wheat Thins to munch on for my ~50 min commute home. $2.99

4:30 p.m. — Get home and am welcomed with a “MAMA!” and a massive hug from my two-year-old, D. I absolutely devour leftovers, then my husband, S., and I get D. ready to trick-or-treat and put a bowl of candy out with a “help yourself” sign. When we bought this house we both said “this seems like a great trick-or-treat neighborhood” and we were 100% right, it also helps that it is 60 degrees out. Maybe it’s lame to say, but this is so much fun. D. becomes an expert right away and is so polite it makes my heart melt. We also finally meet a lot of our neighbors, one guy who it seems like we could be friends with (we need local friends) has a little party going on in his driveway with a firepit and great music. He offers us beers and we want to say yes, but D. keeps running towards the firepit so we say definitely another time.

6:30 p.m. — Get home and in a great mood and then when I walk in the house, I step in dog poop. Seems our 14-year-old dog was probably nervous with all the kids coming up to our door. We let him out then tag-team clean up. Because we are both in a great mood it doesn’t get to us. S. cracks a Bud Light seltzer, and I open one of the last of our summer beers to enjoy while raiding our son’s pumpkin pail. We let D. have one piece of chocolate and have a mini dance party in the living room.

8 p.m. — After putting D. to bed, S. and I hang out on the couch. He watches TV and I mindlessly scroll on my phone. I go to bed pretty early but have a bowl of Cheerios before bed (I do this every night, I am a creature of habit).

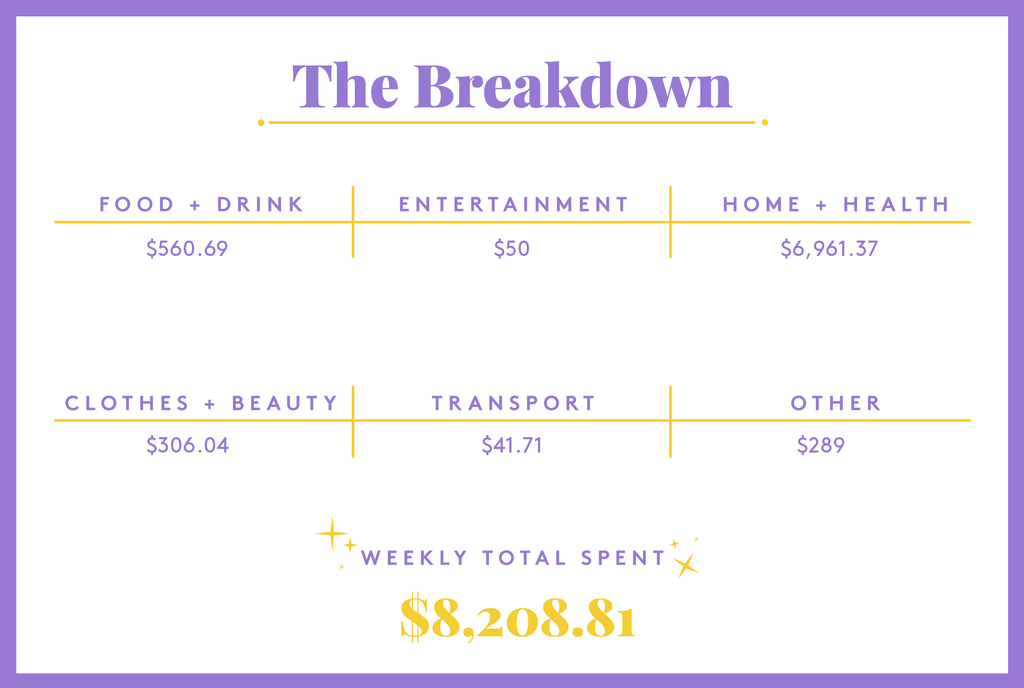

Daily Total: $19.75

Day Two

4 a.m. — Again with the third alarm. Day after a holiday is just about as important as the day of a holiday, so it is an early day for work for me again. Same routine — shower/get ready/cereal/coffee to go, and out the door by 4:45. On Monday nights, our son stays at my parents’ house (I know, I am extremely lucky) so I peek in while he is sleeping to say goodbye (obviously being very careful not to wake him up).

10 a.m. — Second coffee, same as yesterday. A few people I work with have also started ordering acai bowls and I get one today. We take turns paying and it’s not my turn. I get a bowl with granola, honey, strawberries, bananas, peanut butter, and cocoa nibs. It’s nice to have time to sit and eat with part of my team, which honestly we don’t do often enough. $3.05

4 p.m. — The day has passed by fast as always, but I force myself to leave on time since S. and I have a kid-free night and plan to go out to dinner. I grab a few things at the store on my way home (dog food, water, snacks) and am home by 5. $45.31

6:30 p.m. — Who knew so many restaurants were closed on Monday nights now that “tourist season” is over? Not me until tonight. We wanted to try a new place but as they are all closed, we end up at a pub/tavern we haven’t been to in a while. We sit at a high top near the bar and I am once again thankful my parents keep my son one night a week, as I know many parents don’t get to do this often. I order a glass of wine and a sweet potato/black bean burrito and S. gets some sort of fancy cocktail and steak tips. We also split a salad. I stick to the one drink, but S. also gets a Coors Light. When we are done, we walk around downtown. $81.68

8:30 p.m. — Hang on the couch and have another glass of wine. We watch TV for a bit and I again go to bed early.

Daily Total: $130.04

Day Three

5 a.m. — I get to “sleep in” today until 5 (insert sarcastic voice here). When I wake up, I notice we have an Amazon charge for $99.49, which I am assuming is the air compressor my husband ordered (turns out I am correct). Same routine and out the door by 5:45 today. $99.49

6 a.m. — Partway to work my gas light comes on. Yes, I am that person who never fills the tank until the light comes on. I stop at a gas station and then I call my mother because she is always awake at the crack of dawn and talk to her the rest of the way to work. $41.71

8 a.m. — We get a credit back on our card from the tile store where we purchased tiles for our master bath renovation because we accidentally ordered too much, yay for $211 back!

1 p.m. — I am exhausted. I have been on Zoom all day for a quarterly meeting and haven’t even had time for a second coffee. I don’t like having coffee in the afternoon, so I decide to power through the day. I can at least finally get up and walk around/work on the floor, which energizes me. I could complain about my hours, but truth is, I don’t think I could ever have an office job. I am so used to at least some level of physical work that I go crazy sitting for more than an hour at a time.

3 p.m. — S. must have paid that pediatrician bill that has been on the counter for several weeks, thanks hubs! $20.52

5 p.m. — I totally forgot to pick up milk and I finished ours this morning. Because I refuse to go into a grocery store just for milk I pay the “stupid tax” of a half-gallon for $3.99 at a gas station. $3.99

5:30 p.m. — My mom drops my son off and brings us food because she is an angel (and a great cook). A salad and soup for me and turkey, rice, and stuffing for S. and D. She hangs out for a bit and I am happy to actually see her (we talk on the phone every day, but I’m typically not home when she drops D. off).

6 p.m. — Dinner/family time until D. goes to bed at 8. After, I grab a glass of wine and park myself on the couch. S. and I start talking about getting away again (now that travel is a thing again, we are actually excited to travel). We look at tickets to see our friends in California (they came out to us in August so we want to go to them in the spring) but don’t take the plunge on tickets yet. I do, however, book a weekend away in New Hampshire in February at a resort that has an indoor water park and is near the ice castles. I am charged for one night immediately, and we will pay the rest when we check-in. $289

9:45 p.m. — I actually made it up until almost 10! Have my bowl of cereal, get ready for bed, and actually go to bed the same time as S. for the first time this week. We get to cuddle and fall asleep together.

Daily Total: $454.71

Day Four

8 a.m. — Yay, it’s my day off! I have every Wednesday off since I work rotating weekends. My son loves to sleep so he doesn’t wake up until 8:30-9 most mornings which means I get to sleep until 8 today. The contractor for our bathroom remodel arrives at 8:15 and will be there all day, but I don’t stay home much on my day off anyway. Coffee/cereal/let the dog out and then get D. up for the day.

9:30 a.m. — Stop to get a coffee for me and two donut holes for D., then hit the playground. It is just warm enough to be outside. We have an awesome playground in town that has beautiful views, but since it is right on the water it’s a little chilly. We stay until 11, then head to D.’s swim lessons. $5.72

12 p.m. — Home from swimming, I give D. lunch, snack on some Wheat Thins and hummus, and put him down for a nap. I take a nice, long shower. Afterward, I have leftover salad for lunch, munch on more snacks, and order makeup/moisturizer from Sephora since I am almost out. $89.92

2:30 p.m. — I end up ordering a bunch of stuff from Target (started out with a Christmas book for D. and ended up with seven books for me (they are all on sale today so I am saving money?? maybe??), a hat and gloves for D., and family Christmas pajama pants. $191.12

3:30 p.m. — He is up and we are back at the playground. I chat with a few other parents and think “maybe this is the time I actually make real friends!” but it just turns out to be small talk. It is downright gorgeous out for early November in New England, so we walk towards downtown. We stop for ice cream and get two baby cones and a bottle of water, plus tip. $4.50

5 p.m. — Stop at the grocery store to get supplies for chicken parm for dinner tonight. D. grabs a bag of Goldfish so we end up with those too. For someone who hates the grocery store, I come here a lot. $21.54

6:30 p.m. — S. finishes work and we have a salad and chicken parm/pasta for dinner. I actually love to cook but don’t get to often because kid/work/long commute, so it makes me happy when I can.

8 p.m. — D. is in bed. S. and I close our eyes a little and pay our contractor bill for the bathroom. It is paid in four installments and this one is due tomorrow. This is actually the third bathroom we have remodeled in the last six years so we know it isn’t cheap, yet every time the cost is still a little jarring. We joke that maybe our next house will have a bathroom I approve of (this is a joke because we really don’t plan on moving again). Paying our bill gets us on the train of listing the house projects we want to do and mapping out when we can actually afford to do them. We have also been considering buying a small house/condo on the beach in southern Maine that we could rent out for a few years to pay it off, but that would put a hold on our house projects. We spend several hours (and a few drinks) having these conversations, ending with how lucky we are to even have these options. We go to bed around 11 and I pass out immediately. $6,798

Daily Total: $7,110.80

Day Five

4 a.m. — I am reminded why I do not stay up until 11 on work nights when I roll my butt out of bed at 4. Same routine as always, and out the door by 4:45, at work by 5:30.

9 a.m. — I actually have enough time to go to my favorite coffee shop/breakfast place, yay! I get a large hot coffee, half-French vanilla, half-cinnamon sticky bun flavor (New England coffee is the best coffee — I will fight anyone on this, they have the best flavors and no syrup) and an egg white, green pepper, and cheese sandwich on an English muffin. I lived right down the street from this place when I first moved to the city with my friends after college and we became regulars. It is a family-run place where you walk in and they just know your order even if you haven’t been there in a month or two. $9.76

2:30 p.m. — I leave the store to head to our warehouse for a quick visit before heading home. Again, I realize I have not eaten lunch (this is the problem with eating two breakfasts every day) so I buy a bag of pretzels to snack on. I am at the warehouse for an hour or so and leave to head home by 3:45. Miraculously, I hit no traffic and am home by 4:20. I fold laundry and talk to my boss on the phone when I get home. $3.69

6 p.m. — Leftover chicken parm for dinner, which D. has now decided is “yucky” (he loved it last night, toddlers are fun). We microwave chicken nuggets for him and he is in his glory. Right after dinner, we realize we’re out of diapers. S. goes to Market Basket to grab a pack while I stay home and watch Vivo for the 500th time. $19.99

9 p.m. — S. gets an email invite for his stepfather’s family’s holiday party. Despite the fact that his mother didn’t remarry until S. was in college, we have become really close to her husband and his family. It helps that once of his sons is exactly our age, his wife and I are a ton alike, and they have a daughter only three months older than D. The holiday party every year is a blast and includes a lot of booze, live music, and tons of food. This year they finally started to charge a fee to RSVP which they really should have been doing for years. This year it will be at our brother and sister in-law’s house which is amazing for us because it means we have somewhere to crash! $50

9:30 p.m. — I place an order for pick-up at Target tomorrow. We are apparently also almost out of baby wipes and D.’s snack selection is dwindling down (he is either going through a growth spurt or just being a toddler jerk because he says “I’m hungry” like 100 times a day). S. is watching the Celtics game so I go to the bedroom and try, for the fourth time, to get into Maid on Netflix. Everyone swears I will love this, but I just end up super emotional and cry and turn it off every time. I end up putting on The Office (for the 900th time) and fall asleep. $23.37

Daily Total: $106.81

Day Six

5:30 a.m. — Yay, it’s Friday! I promised my team I wouldn’t go in until 7 today because they had a big project last night overnight and apparently I am more of a nuisance than I am worth when I try to help (this is honestly true). Normal routine and out the door by 6:15/at work by 7:20 because I forget how bad traffic sucks after 6. I spend most of the morning in my office messaging applicants because my HR manager is off today. I eat half a protein bar before leaving the office.

9 a.m. — Finally leave my office and am on the floor for literally six minutes before someone calls me back to the office area. Fortunately, it is to order acai bowls, not because of some sort of drama. Unfortunately, it is my turn to pay. I order the same thing as always and head back to the floor because I have a virtual visit with my boss’s boss at 10:15. The visit goes off without a hitch (because I have a great team) and I excitedly run back to grab my acai bowl. Of course, the time I pay for it they totally mess up my order and leave off all the extras I paid for. Out of principal, I call to see if I can get a new bowl delivered, but the kid on the phone is definitely high and doesn’t understand what I am saying. I give up fighting and just break up the other half of my protein bar (with chocolate and PB) onto the bowl and it is still very good, but I miss my strawberries. $79.90

1 p.m. — Well, not to get political but the fact that the Biden administration just announced the vaccine deadline for large corporations for January 4th just screwed up my day. TBH I voted for Biden because I was not going to stand by and let Trump have another four years in office. Also, I am fully vaccinated and believe everyone who can be should be, and I wear my mask when I am supposed to (which is all day every day at work), but this vaccine mandate is just going to be tough for me at work. Luckily being in MA, I don’t have it nearly as hard as other parts of the country, but I still have a handful of employees who do not want to be vaccinated and who may refuse to be tested weekly and I am nervous about how to handle this. I try my best not to worry about it, but it does stay in the back of my mind all afternoon.

2:30 p.m. — Realizing I am not going to get out early today, I run over to Starbucks for an egg white, turkey bacon breakfast sandwich. I also drink an entire liter of water because I realize I have not had any water since I got to work (I normally drink a ton of water so dehydration hits me really hard when I don’t). $3.97

5:30 p.m. — Text my husband to see if we need anything and he tells me we are already out of milk again, so I buy a gallon when I go to pick up my Target order. It takes me almost an hour and a half to get home, but I talk to my mother for most of my drive. I also call S. to see if he wants pizza and his answer is a resounding yes. I call in an order to be there shortly after I get home. $32.54

7:05 p.m. — Pizza is here! The three of us split the pizza and leave two slices for leftovers. My time with D. passes quickly since I got home late and soon we are putting him to bed. I get sad for a few minutes and think for the millionth time about changing my career so I can be home more. I actually had a call recently about an opportunity to stay with my company but work remotely for headquarters… it’s something I am still considering. As I mentioned before though, I love moving around and think I might struggle with a more typical desk job. S. and I talk about this for a little bit, then settle in and watch an SNL episode from a few weeks ago. I have a glass of wine and S. has a Bud Light seltzer and we are in bed by 10:30.

Daily Total: $116.41

Day Seven

6:40 a.m. — It’s Saturday and I am off and somehow I am wide awake. Slightly annoyed, I try to go back to sleep but it’s not happening. I get up, make some coffee, and have cereal. I am excited for a lazy Saturday morning.

8:30 a.m. — The rest of the household is awake. I make pancakes for breakfast. I shower after another cup of coffee. When I am done showering, S. goes for a run on the treadmill (gotta take turns at alone time when you have a toddler). I look up yoga classes and consider signing up for one for tomorrow but decide not to commit yet.

10:45 a.m. — I head out to my eyebrow wax appointment. It goes great. $25

11:15 a.m. — When I get home, S. hops in the shower. Because it is nice out, I take D. for a walk to the coffee shop close to our house. It’s kind of bougie (aka pricey) but the coffee is pretty good and I like having somewhere to walk. Definitely the biggest adjustment leaving Boston and moving to the ‘burbs has been having to drive everywhere, so when I can walk, I do. It should be a 10-minute walk each way but it is closer to 30 with a toddler. I get two medium iced coffees (mine with a pump of sugar-free vanilla and skim milk, S.’s with three pumps of caramel and 2% milk) and a blueberry donut for D. We sit on the Adirondack chairs in the back and enjoy the sun for about 15 minutes before heading back. When we get home, I eat a leftover slice of cold pizza. $11.16

1 p.m. — D. is down for a nap and I have nothing to do. I folded the laundry earlier and S. made the bed, so the house is relatively in order. I want to make turkey chili tonight but again, hate the grocery store, and realize I have enough time to make a solo Target run where I can also get all the stuff needed for chili. Ask any mom and she will tell you a solo Target run is heaven. I go just over the border to one in NH to avoid paying sales tax. I spend over an hour in the store and while I consider buying even more than I do, I leave with a very full cart and apologize to the cashier for everything I have. I end up with an insane amount of groceries and other household supplies, as well as a few shirts and a pair of gloves for me, a few more books for D., and a few cute Christmas ornaments. I get home before D. wakes up so we are able to unload everything quickly. $226.81

5 p.m. — I get started on turkey chili! I love making this and haven’t made it in close to a year. About 10 minutes into cooking I realize I don’t have cumin. S. offers to head to the store to grab it. About 15 minutes later, I call him because I realize I also don’t have chili powder either (I’m a mess). He stops at a second store and grabs that too. $7.32

7 p.m. — Chili and cornbread are finally done. S. says this is the best chili I’ve ever made and he’s not wrong, it’s delicious. We decide against giving D. any and instead just heat up mac and cheese and give him a piece of cornbread (terrible mistake, it breaks apart too easily and ends up everywhere). We put D. to bed at 8 and decide to have a few drinks and play some games. A few games somehow turns into reorganizing our living room but we play music and have fun with it. We are exhausted by the end and hit the bed by 11. It has been a good day and I fall asleep happy (and slightly tipsy).

Daily Total: $270.29

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Philadelphia, PA, On A $78,000 Salary

A Week In Austin, TX, On A $45,000 Salary

A Week In Minnesota On A $97,392 Joint Income

from Refinery29 https://ift.tt/33GSrc0

via IFTTT