Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: an operations specialist who makes $67,000 per year and spends some of her money this week on Ferrari Carano Fume Blanc.

Editor’s Note: This diary is from December 2021.

Occupation: Operations Specialist

Industry: Beauty

Age: 25

Location: Los Angeles, CA

Salary: $67,000

Net Worth: $26,034 ($14,259 in a savings account, $3,660 in a checking account, $8,115 in a 401(k))

Debt: $0

Paycheck Amount (2x/month): $1,883

Pronouns: She/her

Monthly Expenses

Rent: $1,496 for my bedroom in a three-bed/three-bath townhouse I share with two friends

Utilities: $75-$90

Apple Storage: $0.99

Peloton App: $12.99

ClassPass: $79

401(k): $250, employer matches up to 3%

Savings: $300

Cell Phone: I’m still on my family’s plan

Netflix/Spotify/Amazon Prime/Youtube TV: I use my parents’ accounts

Apple TV/HBO Max: Roomies have accounts that are hooked up to my TV in our place

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes. Both of my parents have bachelor’s degrees and it never crossed my mind that I wouldn’t go to college. I don’t remember ever discussing if I wanted to go to college or not, it was just something that was always expected. My parents paid for my undergrad education. I’m extremely fortunate to have graduated without any loans. I don’t think I realized how lucky I was that my parents could provide that for me, but the older I get and realize how expensive life is, the more and more appreciative I become.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

I don’t remember having many conversations about money. I never wanted for anything. When I was in elementary school my mom would take my sister and I shopping for new clothes four times a year (once a quarter). We were each given a budget of $300 and could get whatever we wanted as long as it was within our budget. My parents helped me set up a savings account after I graduated from eighth grade. I put most of the money I received as gifts for graduation into that account. When I went off to college, my parents made me an authorized user on their credit card account and I used that for certain purchases in school. As I got older, my parents kept progressing in their careers and our financial situation kept getting better and better. Now that I’m an adult, I ask my parents many things about finances. Lately, I’ve been asking a lot of questions about their financial advisers and how they have their finances set up for retirement.

What was your first job and why did you get it?

My first job was a summer job as a lifeguard at the waterpark in my hometown when I was 16. I got it to have spending money to do things with friends. I was given a car when I turned 16, extremely lucky, and my parents made it very clear that I would have to pay for my own gas. I would say that was the main reason I got a job. I continued working as a lifeguard at the indoor pool during the school year, and I also was a hostess at a local restaurant one or two nights a week. I had a part-time job three out of my four years in college.

Did you worry about money growing up?

Never.

Do you worry about money now?

Yes. I have plenty of money to survive and live off of currently, but thinking about how much money I’ll need for retirement really stresses me out. I feel like I’m behind. I haven’t gotten into investing yet because I think it’s very overwhelming and I don’t know where to start.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I became financially responsible for myself at 22 when I moved to LA after graduating from college. I didn’t have a job lined up when I moved. It was agreed that my parents would pay my first month’s rent, we would spilt my second month’s rent 50/50, and then it was all on me. I found a job after a few weeks of being in LA and stuck to that plan. After about a year of living in LA, my parents told me it was time for me to start paying for my car insurance. They slowly eased me into adulthood expenses, which was so, so generous of them. In terms of financial safety net, my parents would help me with anything I needed if something went wrong, or I could easily move back in with them. If I ever did need to rely on them for money, they would give me what I needed, but they would look at it as a loan and I would be expected to pay them back over time.

Do you or have you ever received passive or inherited income? If yes, please explain.

I have not received any passive income.

Day One

6 a.m. — Wake up and scroll through Instagram while cuddling with my cat. I bookmark a Goop podcast that Tinx recommended for my drive home later today. I’ve been at my parents’ house for the holiday but now it’s time to go home.

6:30 a.m. — Get out of bed and get coffee. One of the best things about being at my parents’ place is that my dad always has the coffee made in the morning. It’s the little things! I log on to work to help our team make some urgent updates.

7 a.m. — I sit down to read some of my book while work updates are being made by the team. I just started Maybe You Should Talk To Someone yesterday after I saw it on The Nudge’s list of book recommendations. I am already really enjoying it!

8 a.m. — My birth control alarm goes off and I realize I never took it yesterday, whoops. That’s the second time I’ve forgotten to take it while at my parents’. Not being home really throws me off my routine. I toast an English muffin and eat it with cream cheese, avocado, and garlic salt and sit down with my mom to review my health insurance options. I turn 26 in early 2022, so this will be the first time I will have my own health insurance plan. I knew this was coming, but I’m still shocked with how little I know about health insurance. Why don’t they teach these things in school?

9:30 a.m. — Pack up my car and leave my parents to head back to LA. Listen to two Call Her Daddy episodes and the Goop podcast I saved earlier. I fill up on gas on my way out of town. $33.14

1 p.m. — I finally get home after being stuck in traffic. I grew up in the Midwest and my parents just moved from my childhood town to California earlier this year. So even though my drive is an hour or two longer than it should be, it still beats the holiday chaos at airports this time of year! Unpack my car, heat up some leftover chili I brought back from my parents, and scroll through my phone.

2:30 p.m. — Make a grocery list and go to Trader Joe’s. I get tomatoes, shredded carrots, basil, apples, avocados, lemons, bananas, salmon, mozzarella, cream cheese, frozen dumplings, Everything But the Bagel seasoning, a bottle of Ferrari Carano Fumé Blanc, and a La Colombe oat milk latte. $54.87

4 p.m. — I do a 45-minute Peloton strength class on my balcony. I started using the Peloton app over the summer for strength and cardio/HIIT classes and I’m really liking it. I love that I can choose to do any class on my own schedule. Hop in the shower after.

5:30 p.m. — Heat up some more leftover chili for dinner and sit down to do some work so I’m not drowning tomorrow morning.

6:30 p.m. — Close my laptop and turn on the TV to watch the Jonas Brothers Family Roast on Netflix. Light a candle and eat a Trader Joe’s chocolate and peanut butter Joe-Joe’s cookie — if you haven’t tried these, run don’t walk.

8:30 p.m. — Get in bed to read more of my book, but fall asleep after a few pages.

10:30 p.m. — I wake up super confused, lights are still on, candle still burning. Stumble out of bed to brush my teeth, turn the lights off, blow the candle out, and now we’re going to bed for real.

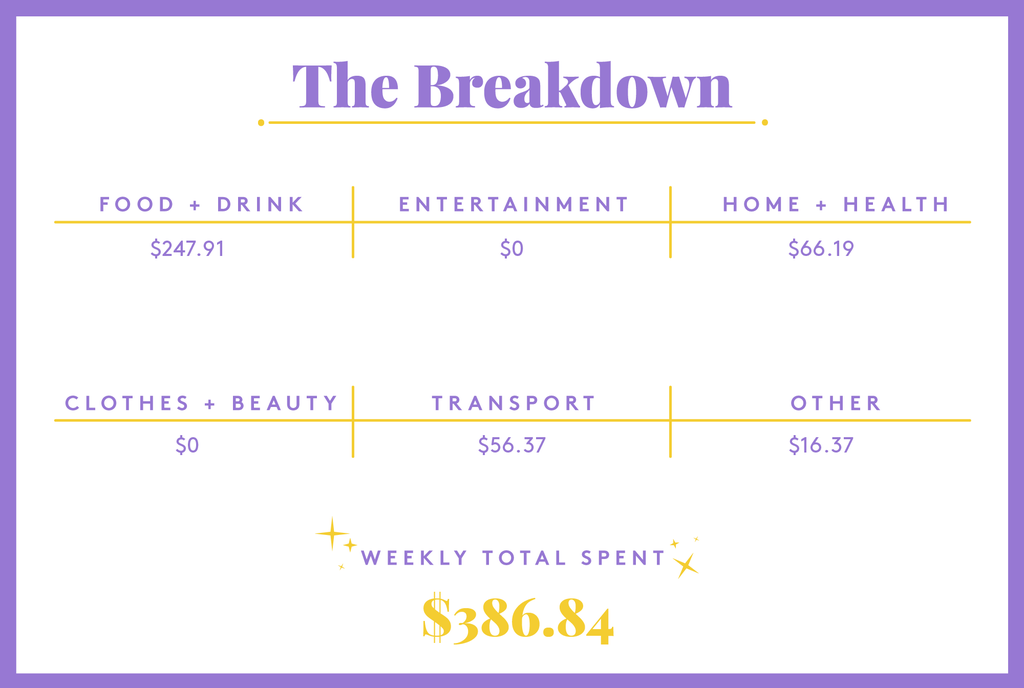

Daily Total: $88.01

Day Two

5 a.m. — Wake up, check my phone, snooze. I’m a morning person and usually always wake up between 5:30-6 without an alarm. Today is a little earlier because I fell asleep so early last night.

5:45 a.m. — Get up to brush my teeth and put on some Clinique Moisture Surge moisturizer. I get lots of free skincare and makeup products through my job so I don’t really have a skincare routine because I am constantly trying different products. This Clinique moisturizer is one of my favorites and one of the few things I still buy when I run out.

6:15 a.m. — Go downstairs to feed the cats and make myself an English muffin with cream cheese, avocado, and Everything But the Bagel seasoning. Head out to drive to the beach to go on a morning walk. I listen to the Armchair Expert podcast as I walk. When I get home I make a pot of coffee, go upstairs to curl my hair, and finish listening to the podcast.

8:15 a.m. — Walk around the block to a local bakery and buy a loaf of sourdough to eat this week. I started buying fresh loaves from this bakery a few weeks ago and love it. For some reason it makes me feel very mature. $10

9 a.m. — Dentist appointment! Everything is looking good. Appointment is covered by insurance.

10 a.m. — Home and jump into my morning meetings.

12:30 p.m. — Break for lunch. I toast a piece of my sourdough loaf and eat it with mozzarella cheese, tomato, basil, and a balsamic glaze drizzle.

1 p.m. — Back to work.

6 p.m. — Done with work for the day. Make myself some dinner while I talk to my roommate, R., about potential travel plans. For dinner I make a bowl with quinoa, salmon, cucumber slices, shredded carrots, Soyaki sauce, and a squeeze of lemon.

7 p.m. — Talk to my BFF, B. on the phone for a while.

8 p.m. — Watch an episode of MTV’s The Challenge and eat a TJ’s chocolate and peanut butter Joe-Joe. I got hooked on this show in the 2000s and have been a loyal fan ever since. A guy from Hinge texts to plan a date we’re going on Wednesday night!

9:20 p.m. — I place an Amazon order for plain white gift boxes for my remaining gifts. $16.37

9:30 p.m. — Brush my teeth and do tonight’s skincare: Sunday Riley CEO Cleansing Oil, The Nue Co. The Pill All-in-One Serum, Charlotte Tilbury Magic Cream, and Blistex. This Charlotte Tilbury cream is pretty amazing. I wanted to not like because it’s expensive but it’s too good to not like. It is on the heavier side, but my skin has felt very dry lately so it’s perfect for me right now. Read a few chapters of my book and scroll through my phone.

10:30 p.m. — Lights out.

Daily Total: $26.37

Day Three

5:30 a.m. — Up before my alarm. I see that I got paid so I pay my rent then read theSkimm. I log onto the Mint app to see how my budget panned out last month. It’s looking much better than I expected, which is great. I thought it would be rough because of all the presents I bought. I did spend a good amount of time with my family this month though, so that definitely offset my expenses since my parents pay for most things when I’m with them.

5:45 a.m. — Brush my teeth, put on leggings and a sports bra, and head out for my 6:15 Barry’s class. I am expecting to be a little slower in class this morning since it’s a leg-focused workout and my legs are pretty sore from the Peloton workout I did on Sunday. This should be fun.

7:15 a.m. — Feeling on top of the world! I PR’ed with a 6:58 on my mile time! I’m so excited, I leave my sweatshirt at the studio. I book Barry’s classes through ClassPass and I take either three or four classes a month. Barry’s memberships are stupid expensive, but I love the classes.

8 a.m. — I shower and put on my morning moisturizer of the day — today it’s Murad Clarifying Oil-Free Water Gel. I make scrambled eggs and chicken sausage and eat it with some avocado. And of course coffee, always coffee.

8:40 a.m. — I open my laptop and start working. Lots of meetings this morning.

12:30 p.m. — I take a break and heat up some leftover turkey and green bean casserole. Talk with my roommates R. and C. about food, boys, plans — all the normal things.

1 p.m. — Call with my team while I snack on Fritos.

3 p.m. — Throw in a load of laundry and cut up an apple for a snack.

5 p.m. — I heat up some TJ’s frozen black bean taquitos and eat them with salsa and avocado.

5:45 p.m. — Drive to the bank to get cash to buy a Christmas tree later tonight, but when I get to the bank it’s no longer there? They closed that location I guess, so I have to drive to another one. I take $120 out at the ATM. I grew up with fake trees but my roommate C. loves getting a real tree. So for the past few years, I’ve been paying for a real Christmas tree to make her happy.

6 p.m. — I go to the store on my way back from the bank and get oat milk, coffee, peanut butter, Haagen-Dazs ice cream bars, a frozen pizza, and parchment paper ($39.95). On my way home, my best friend from high school calls me. Her fiancé bought them tickets to come out to LA for our birthday weekend and she just found out/received them. I’m so excited! $39.95

7 p.m. — C. gets home from her workout class and we go to the Christmas tree lot to pick out our tree. We choose one, get it all bundled up in the car, and blast Christmas music on the drive home. The tree ends up being $110.19. I’ll Venmo charge both my roommates for this, so I end up paying $38.19. We also swing by Barry’s to pick up my forgotten sweatshirt. $38.19

8 p.m. — C. and I pour ourselves some wine, blast Christmas music once again, and decorate the tree. Love when the house starts to feel super festive! I eat one of my ice cream bars.

9:15 p.m. — Brush teeth, and do tonight’s nighttime skincare. Tonight that is Hey Honey Tone It Up Herbal Toner and Youth to the People Superberry Hydrate + Glow Dream Mask. Youth to the People is one of my favorite brands that I discovered through my job.

9:30 p.m. — Scroll through my phone and read a few chapters in my book.

10:45 p.m. — Lights out.

Daily Total: $78.14

Day Four

6 a.m. — I wake up to a less than ideal work email and see that my team has a meeting later today to discuss how it will affect us. I stress apply to like 10 jobs because I’m nervous. I eat an English muffin with banana and peanut butter and have some coffee.

8 a.m. — Put on some Clinique Moisture Surge and start working.

8:30 a.m. — Open Spotify to start a podcast and see that their “2021 Wrapped” has come out, I love these! My top artist for the year was Justin Bieber — 13-year-old me would be so proud. Start listening to the new Call Her Daddy episode.

10:50 a.m. — Feeling anxious, I log into my BetterHelp account to choose a new therapist. I’ve been toying with the idea of starting therapy for a few months now but didn’t really know where to start. I was talking to my friend a week or so ago and she mentioned she recently started therapy through BetterHelp and forwarded me a voucher code to try it out. I answered their questionnaire and got paired with a therapist, but from looking at her profile I didn’t get a good vibe from her. I’ve been ignoring her emails to set up a call for a few days now, but now that I’m feeling even more anxious about work I’m driven to set it up. I browse through some other options and choose one that feels like a better fit.

12:30 p.m. — The team meeting goes better than expected! I toast a piece of sourdough and eat it with mozz, tomato, basil, and balsamic glaze.

3:30 p.m. — I have a call with my manager. I feel like I haven’t moved enough today so I turn this call into a walk and talk. It’s pretty eerie out today weather-wise, but it still feels great to get some fresh air.

6 p.m. — I shower and eat dinner. Tonight it’s salmon, brown rice, cucumber, carrots, sliced almonds, and Soyaki sauce. I go upstairs and blow-dry my hair using my blowout brush. I watch a quick tutorial video on IG and I actually like how it turns out!

8:30 p.m. — I’m meeting a new guy for drinks tonight. We meet at a speakeasy bar. We both get gin and tonics and talk about work, traveling, and concerts. I’d say it was a successful date! We make tentative plans to get together this weekend. He pays for the drinks.

11 p.m. — Home, brush teeth, put on Sunday Riley Good Genes, lights out.

Daily Total: $0

Day Five

6:30 a.m. — I get out of bed, put on my Murad moisturizer, feed the cats, make coffee, and toast an English muffin. I eat it with cream cheese, avocado, and Everything But the Bagel seasoning. Get back into bed and read some of my book.

7:45 a.m. — Through work, I get a few products every month, and this morning I find out that I’m getting a Kate Somerville moisturizer that I had my eyes on. Can’t wait for that to arrive! I deal with a minor work crisis, nothing for me to do but I forward it along to the correct team members. Then, I schedule my first therapy session for next week through BetterHelp.

8 a.m. — Go for a quick morning walk around the block.

8:30 a.m. — I pour some more coffee and start working.

9 a.m. — We have an all-company call, and I paint my nails as I listen.

10:30 a.m. — Eat a banana with peanut butter. Thursdays are my most meeting-heavy day, so I jump from meeting to meeting all morning, trying to get some work done where I can.

12:45 p.m. — I make the same Caprese toast situation for lunch and add turkey today.

2 p.m. — I book an Orangetheory class for next Friday. The drop-in rate is $28. $28

4 p.m. — My rooomate made lemon poppyseed muffins and I eat one fresh out of the oven, they’re bomb!

6:15 p.m. — I eat salmon with brown rice, carrots, Soyaki, and sliced almonds for dinner again tonight. I watch the new episode of Selling Sunset and it’s pretty cringey. My dad texts me that T-Mobile is offering the iPhone 13 for free, say whaaaat?!? I tell him to look into it and see if I can get it. Thirty minutes later I get a text from my dad saying a new phone is ordered and should be to me within a week. What a happy surprise! Read some more of my book while all this is happening.

8 p.m. — R. gets home from work and we take a gummy together. We watch the new episode of The Challenge.

9:45 p.m. — Lights outs.

Daily Total: $28

Day Six

6:30 a.m. — I get out of bed and do two 15-minute workouts on the Peloton app.

7:15 a.m. — I shower and put on some Dr. Eve Ryouth Vitamin C moisturizer. I also put on some gold under-eye masks this morning. I toast a piece of sourdough and eat it with cream cheese, avo, and Everything but the Bagel seasoning.

8:30 a.m. — Start working, should be a pretty calm Friday.

11:45 a.m. — I’m getting pretty sick of my lunch options at home, so I run out to get a kale caesar from Sweetgreen, my fave. $14.73

3 p.m. — I eat some Fritos and open a ginger ale.

4:40 p.m. — I get everything I need to get done wrapped up, so I log off for the week. The weekend is finally here!!

6 p.m. — I watch music videos on YouTube with R. I put a frozen pizza in the oven for dinner. It’s a cauliflower crust veggie pizza and it’s shockingly very good.

7:30 p.m. — I make the three of us espresso martinis at home. They’re a house fave.

8 p.m. — I’m going out with both my roommates tonight. I call us an Uber there that is $15.98. I open a tab at the bar and get all of us drinks, a beer for me, gin and tonic for R., and vodka soda for C. Two of our friends meet us at the bar, we chat about dating and all of our first impressions of each other. I get another round of drinks for some of us, I switch to a gin and tonic this time. After a little bit, we decide we’re ready to head to the next place. I close my tab, which ends up being $69 with tip. I’ll Venmo request everyone for their drinks tomorrow. $84.98

9:15 p.m. — I call us all another Uber to the next place. $10.14

10 p.m. — I get a round of drinks at the next bar. Get home at some point and pass out. $35

Daily Total: $144.85

Day Seven

8 a.m. — Birth control alarm goes off and wakes me up. I never sleep this late so I’m clearly hungover. I chug some water, go downstairs to a mess in the kitchen from whatever we decided to eat when we got home last night. Talk with R. about our night. Eat a piece of toast with cream cheese, avo, and Everything but the Bagel and have some coffee.

10 a.m. — Drive to the beach to go for a run, but then end up just walking instead of running. I don’t have it in me this morning. I listen to an Armchair Expert episode as I walk.

11:15 a.m. — I get home and Venmo request my friends for the drinks and Ubers from last night. Don’t really remember who bought what drinks at the second place so I only charge for the drinks from the first bar. I get $55 from them.

12:30 p.m. — Hop in the shower. Put on some Charlotte Tilbury Magic Cream when I get out. Eat the rest of my pizza from last night.

1 p.m. — I complete a Venmo charge for our Uber home last night. $7.25

1:15 p.m. — I’m going on a date with the same guy from the other night this afternoon. We’re having a picnic at a park, and he said he’d bring the food if I brought something to drink. Go to the store and pick up a bottle of Ferrari Carano Fume Blanc. $14.22

3 p.m. — Meet my date at the park for a picnic. We have cheese and crackers and some grapes. It’s a really nice afternoon out, perfect day for the park!

6 p.m. — Home from the date, catch up with the roomies.

7:15 p.m. — Eat a piece of toast with cream cheese. Go over to my friend’s new apartment that they just moved into today. Their new place is so cute and put together already, I’m so happy for them! We catch up on life and I have a strawberry White Claw.

9:45 p.m. — Home. I watch two episodes of Selling Sunset and put on some Kate Somerville Goat Milk moisturizer.

12 a.m. — I have a really hard time falling asleep tonight. Dose off sometime after midnight.

Daily Total: $21.47

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Chicago, IL, On A $120,000 Salary

A Week In Raleigh, NC, On A $87,000 Salary

A Week In Brooklyn, NY, On A $173,760 Salary

from Refinery29 https://ift.tt/33aGU4M

via IFTTT