Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a marketing associate who has a joint income of $230,000 per year and spends some of her money this week on Badgers sweatshirt.

Occupation: Marketing

Industry: Tech

Age: 35

Location: Northeast Wisconsin

My Salary: $163,000 ($125,000 base + 15% bonus + ~$20,000 RSUs)

My Husband’s Salary: $67,000 (But he was just laid off so he is currently living on severance.)

Net Worth: $661,000 (Home equity: $210,000 (home valued at $550,000 conservatively, we owe $340,000), joint savings: $40,000, personal savings: $4,000, Ellevest fund: $9,000, stocks & RSUs: $75,000, 401(k): $210,000, husband’s personal savings: $32,000, husband’s 401(k): $67,000, my car: ~$5,000, boat: $35,000 minus debt.)

Debt: $26,000 for my husband’s truck + $340,000 left on mortgage

My Paycheck Amount (2x/month): $3,250 + $100/month for healthy activity reimbursement

My Husband’s Paycheck Amount (2x/month): $1,983

Pronouns: She/her

Monthly Expenses

Mortgage: $3,500 (The minimum is $2,120, but we pay more so we can pay it off in ~10 years. I contribute $2,500 and my husband contributes $1,000.)

Truck Payment: $750 (The loan is actually through his parents and will be paid off in less than three years.)

Joint Savings: $1,000 (We each contribute the same amount each month.)

Ellevest: $1,000 (Started when I finally paid off student loans, this is earmarked for early retirement, not to be touched unless it’s an extreme emergency.)

Health Insurance: $105 (Deducted from paycheck for vision, dental, and excellent health coverage.)

Electric and Gas: $80 (My half.)

Sewer: $14 (My half, this is so cheap because we have a well for water.)

Cable and Internet: $50 (My half, I also expense $50 for internet through work.)

Spotify: $7.83 (My half.)

Medium: $5

Gym: $51 (Expensed.)

Phone: $40

Annual Expenses:

Car Insurance: $340 (My half.)

Boat Insurance: $180 (My half.)

Beachbody Fitness Classes: $109 ($100 expensed through work.)

Amazon: $60 (My half.)

Financial Donations: We donate sporadically, mostly to local causes and sometimes GoFundMe initiatives. Last month we sent $150 to a local women’s shelter (which was doubled with employer match) and $25 to a nature photographer on GoFundMe. We donate sporadically to optimize employer match.

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Going to college is just what I thought everyone did. At least in my family, all of my cousins and my two siblings went to four-year universities, so I did too. My parents are divorced and couldn’t afford to contribute but my mom is a SAINT who helped figure out all things FAFSA and student loans. My dad purchased each of us a laptop for school which was a big deal back then — I was one of the few in my dorm who had my own. About six years into my career, I also pursued an MBA which was financed through student loans and a generous $20,000 lump sum paid by my employer at the time with a two-year employment commitment after I graduated.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

Woof. We didn’t talk about money at all growing up and I don’t think I realized until I was in college or even later that there was trouble. I suspect when I was younger things were okay, we always had nice things and we went on a few vacations in my childhood, though not every year. My parents fought a lot and I don’t know how much of that was around finances. At some point after they got divorced, my mom filed for chapter 13 bankruptcy, which meant we didn’t lose anything. I know she still struggles financially and it annoys me that my dad is retired and seemingly okay financially, but I don’t know how it all played out.

What was your first job and why did you get it?

I started working when I was 15. My mom had a side gig as a banquet server and my sister and I both worked with her on Saturdays as servers for weddings. My parents paid for nearly everything, so I used it for extra spending money. When I got my driver’s license, I got a job as a lifeguard to earn more.

Did you worry about money growing up?

Not really, I was pretty oblivious. I knew other families had more than us and that we had more than others, too. We were somewhere in the middle. Also, as mentioned, my mom was a saint and always found a way for us to go on field trips, have new sports gear, etc.

Do you worry about money now?

Yes and no. We recently relocated from Seattle to Wisconsin to lower our cost of living and while I did take a minor pay cut (10%), we’ve also dramatically reduced our mortgage and were able to cash in some major equity on our last home to give us a nice cushion. I love my job and the company I work for and feel very stable. However, my husband’s role was just outsourced to another country so he is currently living on a generous severance package (six months of pay) while he finds new work. We knew this was coming when we relocated so we were sure to stick within our means. Further, I’m pregnant with our first child… ha! so I have no idea what to expect with that financially, but I do feel fairly comfortable that I can handle it and have been making plans for reallocating my income to baby savings, daycare, etc.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I was fully responsible for myself when I started college at 18. I worked three jobs to support myself throughout the four years and I saved for a semester abroad (and also stupidly went into major credit card debt from that, which took years to pay off!). As mentioned previously, I also had student loans to cover room and board, which I aggressively paid off when I started earning six figures. When I first moved from Wisconsin to Seattle at 22, I was SUPER poor and learned to just deal with it, which meant living frugally, including no car for the first four years. I’m not sure how much of a safety net we have now in addition to our savings — definitely not with my parents. And while my husband’s parents are not extremely wealthy, they might be able to help us if ABSOLUTELY necessary, though I would be horrified to ask them. Last year when my husband bought his truck we put 25% down and took out a loan at 3.5%. When he told his mom about this she offered to help us with a “private” loan through her at only 1%. It makes me laugh that she charges us interest, but it was a super nice and generous thing for her to do for her son… she also just recently took $500 off instead of giving us a Christmas present, which to me was WAY better than any junk we don’t need!

Do you or have you ever received passive or inherited income? If yes, please explain.

Yes, kind of. My dad gave us $7,500 toward our wedding (which SHOCKED me) and my husband’s parents gave us $5,000.

Day One

9 a.m. — I sleep in for once and wake up starving! We got home pretty late last night due to a flight change on our way home from Mexico and because of all the chaos we never actually ate any dinner. I stumble to the kitchen to make a pot of coffee, which is a splurge since I’m pregnant and I’ve given up caffeine. I also take some bacon out of the freezer and defrost it for a nice big breakfast with eggs and hash browns. My husband, L., and I enjoy breakfast in bed and lounge for the morning.

2 p.m. — After unpacking and starting laundry, I’m feeling restless and decide to take back a few returns from the holidays. First stop is the UPS store to return a wine book from Amazon that I ended up not gifting. And then Target to return a pair of shoes I bought online because they were a steal on clearance, but unfortunately they were too small. I browse around Target for a bit, but nothing strikes me so I leave empty-handed.

3 p.m. — Next I hit up Goodwill because it is super close by and I’m in need of a new book to read. I find a book by an author I love and two clearance snowman holiday mugs that I’ll use to make a craft/gift for my sister and sister-in-law. $7.72

3:30 p.m. — On my way home I stop to pick up two large take-and-bake pizzas from a local place I love and have been craving. The cashier lets me know I also have a $2 reward that is going to expire, which brings the total to $21.29 ($10.65 for my half). Not bad at all considering my husband will pay for his half and we’ll have leftovers! I make the pizzas as soon as I get home and we call it “dunch.” $10.65

7 p.m. — After being gone for a week we stay home and just chill for the night. I feel slightly guilty that we were traveling during this new Omicron surge but we’re both vaxxed and boosted and already had a breakthrough case in late September. There’s no way to justify it, we just did what we were comfortable with. I want a sweet treat and remember I threw some extra holiday cookies in the freezer before we left…even slightly frozen, the peanut butter blossoms are delicious.

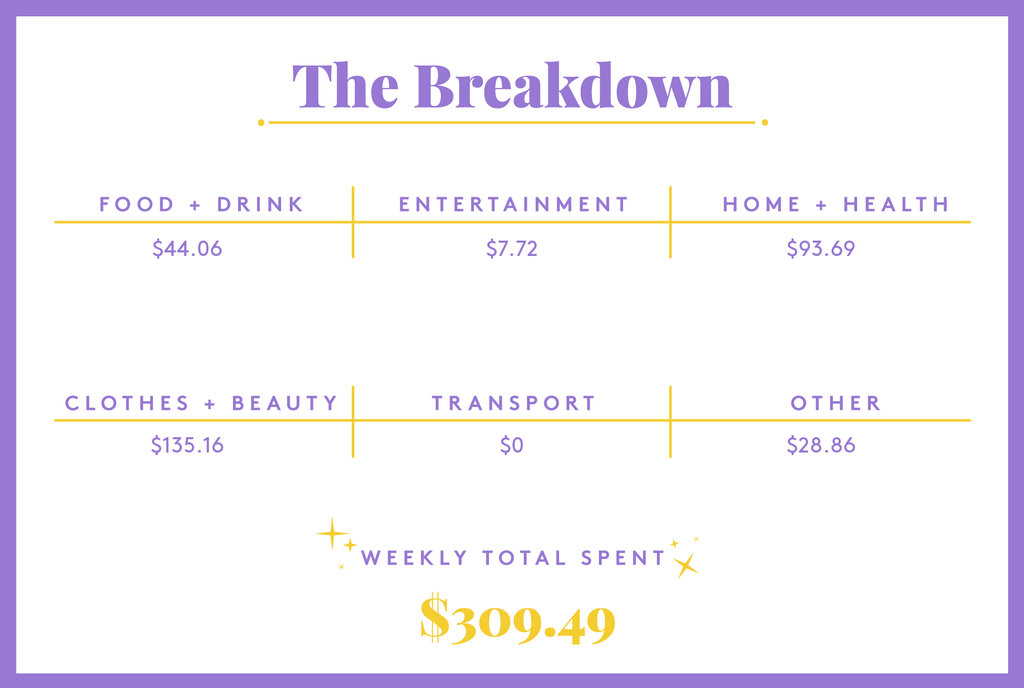

Daily Total: $18.37

Day Two

7:30 a.m. — I wake up a little earlier today despite having been up past midnight for two nights in a row. I’m pretty hungry, so I make sausage (breakfast) balls. I make a pot of coffee “for my husband” and sneak a cup for the second day in a row, vowing after today I’ll be done again. (The reason I’m not drinking coffee right now is because I had a blood pressure scare early in my pregnancy. Even though I seem to be fine, it’s just best to avoid caffeine.) I take the sausage balls and coffee back to bed and chill with L. for a few hours.

11 a.m. — My mom comes down to hang out for the day. We go to Goodwill together and I end up getting a framed map for the baby’s nursery. This is the first purchase I’ve made for the nursery and it feels so weird yet exciting! Total $26.24, which my husband and I will split. He offered to split smaller things like this and for bigger purchase like crib, stroller, etc. we’ll just take money out of our joint-savings. Things are slowly getting more real and I can’t wait for my appointment next week to see the full scan. We already know we’re having a boy thanks to genetic testing! $13.12

12 p.m. — Our next stop is Michaels for some post-holiday clearance scores. I get some nice fake holiday-looking greenery and flowers. $33.23

1 p.m. — Onward to Plato’s Closet! This particular store has a baby store attached and we check it out to get ideas of what I might be able to buy second-hand. I’m also looking for a spare bouncy seat for the boat. Of course he will wear an infant life jacket and I will probably hold him most of the time, but I’ve also been told babies love the feel of the water. On the adult side, I end up finding a really cute hooded flannel jacket that has Wisconsin Badgers on it. $14.77

2 p.m. — One more stop before we go home because I’m hungry and have a craving for Panda Express drive-thru. I get orange chicken and lo mein and my mom orders some spring rolls. $9.92

7 p.m. — L. eats leftover pizza for lunch/dinner and I’m satisfied with my Panda Express and a few leftover holiday peppermint Hershey’s kisses. I log in to our bank account because I realize I got paid yesterday and I always pay off the credit card balance at the end of the month. We use our credit card for everything and split the charges that are combined and pay our own in full. The balance is higher than normal because last month I charged a whole week in NYC for work, which still needs to be reimbursed. We also took that vacation to Mexico and I need to pay for my half. My husband has already paid his portion and I pay the $3,800 balance knowing I’ll get reimbursed eventually for work.

Daily Total: $71.04

Day Three

7 a.m. — Wake up hungry, what’s new. No coffee today. Proud of myself for this, but I do bake chocolate croissants for breakfast.

11 a.m. — I decide to get on the treadmill and go for the world’s slowest walk for about 35 minutes. When I’m done I turn on a BeachBody prenatal 25 minute workout.

12 p.m. — By now I’m really hungry because obviously that chocolate croissant didn’t get me far. I make L. and myself ham, egg, and cheese breakfast sandwiches on Dave’s Killer Bread and pair it with some orange slices.

4 p.m. — I’m trying to do less online shopping as a resolution but with baby on the way, I always seem to have an excuse to buy something. I see Costco is having a sale on sweats so I pull the trigger and get a pair of pants and a pullover. Most of my pants don’t fit right now and wearing leggings feels HORRIBLE as my belly expands. $26.23

6 p.m. — We haven’t grocery shopped since we’ve been back from our vacation so food options for dinner are limited. We have some sirloin burger patties and tater tots in the freezer from Costco. I make the tots in the air fryer and grill-pan the burgers and call it dinner. Then I get lost reading my new book for the rest of the night, trying to avoid the fact that tomorrow I actually have to get back to work.

Daily Total: $26.23

Day Four

7 a.m. — Wake up and eat a leftover chocolate croissant. Chill in bed until 8:30 and then decide I should probably start working. I left some projects on hold before our trip to Mexico, so I dive back into those first.

12 p.m. — I’m hungry for lunch and need a break. I find some yogurt that thankfully isn’t expired and some random veggies that still look good and make myself a little veggie plate consisting of carrots, cucumbers, red pepper, and pickles with dill dip. While I’m thinking of it, I throw some chicken with coconut milk and spices in the crockpot for dinner later.

4 p.m. — Call it quits and head to the gym to swim some laps. I do a solid 1,000 yards, shower, and head to the grocery store before heading home. Thankfully I packed some cashews to snack on between the gym and shopping and I only stray from my list on a few things. I pick up some jasmine rice to make with dinner, milk and cereal for the hubs, hummus, lettuce, kale, zucchini, avocados, tomatoes, bananas, pineapple, lemon, lime, shredded cheese, yogurt, and a few splurges off the list including Ben & Jerry’s, orange juice, a box of shells and cheese, and shredded cheese! Total is $46.98 which we will split. $23.49

6:30 p.m. — I’m tired by the time I get home and glad dinner is at least half-prepped! I make the rice I just bought, roast a head of cauliflower we already had tossed with EVOO and curry powder, and microwave a package of paleek paneer I have in the freezer from Trader Joe’s. Dinner is fantastic and we have a lot of leftovers for lunches.

8 p.m. — A girl I’ve been following on Instagram started an Amazon Deal of the Day group and I can tell this might become a problem… I can’t resist a good deal! I end up buying two new hair towels for $4.19, which are so handy for after swimming laps. I also get a diaper bag that is half-off for $28.86 and a pair of maternity leggings that are half-off for $7.56. Oops. Not a great start to my year of “buying less,” but I somehow justify all of it. $40.61

Daily Total: $64.10

Day Five

7 a.m. — Yesterday when I was digging around in the freezer, I found sausage patties and English muffins. I’m excited to wake up and make breakfast sandwiches to start the day! I enjoy mine with some orange juice I bought yesterday and get to work. Lots to do again but it seems like it will all be manageable this week.

10 a.m. — In between meetings I remember I’m running low on shampoo after my swim yesterday and hop on Amazon to get a new bottle. I lost crazy amounts of hair at the beginning of my pregnancy and switched to Derma E shampoo which seems to have helped, so I snag another bottle for $10.49. I also decide to splurge on a new swimsuit because holy hell, getting my current one over my pregnant belly was NOT fun yesterday. I have tons of “cute” suits for the beach that fit fine, but I spend $34.64 for a new athletic suit that will make my lap swimming just a tad more enjoyable. $45.13

1 p.m. — After a few more meetings and getting some work done I stop for a quick lunch break and make myself some leftover rice and chicken curry with leftover roasted cauliflower. It’s seriously so good. While I’m eating, I see a 10% off email offer on Etsy for some prints I’ve been eyeing for the nursery. Before hitting buy on those, I hop on Amazon to find some frames and order those first to make sure I like the size ($37.79, which we will split). Once I get them and decide they look right I’ll also order the prints (which will be ~$70). While I’m taking a break I defrost some chicken wings from the freezer and toss them with some dry rub to have for dinner later. We typically do a big Costco run to fill our freezer every six to eight weeks and it usually costs us around $400 to $600, but it is so nice having stuff in the freezer and doing minimal grocery shopping for fresh stuff each week. $18.90

4 p.m. — Done working for the day! Hop on the treadmill for another 35-minute walk. We make big garden salads for dinner with lettuce, tomato, avocado, sunflower seeds, and balsamic + EVOO and pair with chicken wings.

8 p.m. — I take a quick shower and then head to bed to read my book and fall asleep.

Daily Total: $64.03

Day Six

3 a.m. — Oof. I’m back to being hungry in the middle of the night. I’ve been up for a half-hour trying to will myself back to sleep but I can’t, so I get up and eat some hummus with pretzel crisps. It’s not an every-night habit but definitely not something that happened pre-pregnancy. I read more of my book and go back to bed around 4:30.

8:30 a.m. — I wake up. It has been snowing all night and looks like it will continue to snow all day. Definitely a day to stay cozy. I lounge in bed before deciding I need to get up and start working. I make an English muffin with peanut butter and banana and get to work.

1 p.m. — I’ve been in virtual meetings all day and I’m hungry so I turn my camera off and mute myself while I heat up a bowl of leftover rice and chicken curry and cauliflower during a call. I scarf it down before my next meeting starts and I actually need to be on camera again.

3:30 p.m. — Husband returns from running errands and surprises me with flowers, which is rare! He has been super helpful doing things around the house and taking care of moving-related stuff since his job ended five weeks ago. He has already interviewed with multiple companies, but I’m also glad he is enjoying time off. He informs me he is sick of not having a printer and I agree. We have a gift card for Amazon but there aren’t any good deals and even with Prime the soonest we can get one delivered is a month from now!? I end up buying one on Walmart.com that will be delivered in a few days for $67.20 which we will split. I peel some oranges and we have a little snack before I get back to work. $33.60

6 p.m. — I work until 5 and then relax for a bit. I make Italian sausage-stuffed zucchini boats for dinner. So good and a much healthier alternative than lasagna. After dinner, I have a few bites of the Ben and Jerry’s I bought earlier this week…Peanut Butter Half-Baked is so good!

Daily Total: $33.60

Day Seven

7 a.m. — Wake-up after a rough night of sleep. I head to the kitchen and make both my husband and myself sausage, egg, and cheese breakfast sandwiches and a pot of coffee for him. I have orange juice.

8:30 a.m. — Grab my laptop and get to work. It’s been a productive week back, lots of things swirling with the Omicron variant putting a strain on an event my team has been working on that was supposed to be in NYC, but is now moving to virtual. I was in NYC for work in early December just before the surge really exploded and I’m so glad I’m not going again and that my company is pulling out. Thursdays are always nuts with meetings because we have a no-meeting Friday rule, which I don’t mind because I absolutely LOVE being open on Fridays.

11 a.m. — Break from meetings means snack time! I defrost berries in the microwave and add Greek yogurt and nuts. Check bank account and see reimbursements from work. $3,522 which will sit in my checking since I drained it earlier this week to pay off the credit card. I keep around the amount of one paycheck in my checking and each payday I move money around to various savings, mortgage, payments, etc. For work charges, I’m supposed to use my company card but I prefer using my personal card for points. This delays reimbursement but I don’t mind. We travel a lot on rewards. We’re planning to go south again soon and have ~$1,100 banked in points that we’ll use. We try to maximize these and travel modestly, though we do splurge on nice restaurants here and there. Speaking of, one thing I miss about moving from Seattle are the great restaurants. We eat out here once a week, usually on weekends, but it’s not the same so far.

1:30 p.m. — Snack on a half of a leftover stuffed zucchini. carrots, pretzel crisps, and hummus and an orange for lunch and realize I’ve been having a lot of sausage this week. Not normal, wonder if it’s a pregnancy craving!? Decide to thaw some fish for dinner later.

2 p.m. — We see a bunch of packages have been delivered. Yay! My Costco joggers and pullover have arrived and they are SO comfortable! I also get the hair towels, shampoo, new swimsuit, and the 10-pack of frames. Take the frames into the nursery to check them out. They look super cute where we imagine they will go over the crib so I head to Etsy and order the prints for the frames. It’s a set of nine safari-themed animal prints with cute sayings which totals $64.24 with free shipping and the 10% coupon code I had. Again, we’ll split this charge. $32.12

4 p.m. — Done working! L. clears the driveway with his new toy (snowblower) and the roads seem fine so I head to the gym for a swim. One adjustment from moving out of Seattle to a more rural area is how far I have to drive for this sort of thing. It’s about a 20-minute drive each way, which is double what it took me when I lived in the city but truly not that bad. We were ready to leave city life after almost 13 years and as a huge perk, we bought a house on a lake here in Wisconsin… and a boat (paid in full with cash)! I’m pretty excited for this summer when we will have our boat docked right in our own backyard. Of course, I realize with a newborn things will be a LOT different but it’s still exciting. Being closer to my family I can’t wait to host summer gatherings at our house.

6 p.m. — Home and hungry. I broil cod with butter, old bay, and cajun seasoning and make some creamed kale with onion, lemon, and tomato and baked potatoes for sides. L. reminds me my clothes have been in the dryer for almost a week since we got home. Ha, oops. I tell him I’ll take care of it tomorrow when I don’t have any meetings. Tonight I’m too tired and we settle in to watch a few episodes of Money Heist on Netflix before I head to bed.

Daily Total: $32.12

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Jacksonville, FL, On A $95,000 Salary

A Week In Portland, OR, On A Joint $388,000 Income

A Week In Knoxville, TN, On A $78,750 Salary

from Refinery29 https://ift.tt/kNH2bY3

via IFTTT