Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a recreational therapist who has a joint income of $51,000 per year and spends some of her money this week on an Old Navy T-shirt.

Occupation: Recreational Therapist

Industry: Healthcare

Age: 33

Location: Southern Michigan

My Salary: Unemployed (laid off in January 2022)

My Husband’s Salary: $51,000

Net Worth: ~$180,000 combined (Our assets include our house ($57,000 left on the mortgage, house worth $130,000+), our trailer (valued at $10,000), our car (valued at $10,000), our 401(k)s ($40,000 in mine, $53,000 in husband’s), joint savings of $10,000, and our daughters’ 529 account: $4,700, minus debt.)

Debt: husband’s student loans: $17,650, mortgage: $57,000

My Paycheck Amount (biweekly): Currently $0 (Prior to losing job my net paycheck was $1,185.)

My Husband’s Paycheck Amount (biweekly): $1,615

Pronouns: She/her

Monthly Expenses

Mortgage: $580

Husband’s Car Payment: $218

Husband’s Student Loan Payment: On hold, but $200 when payments resume.

Energy: $150-$250

Gas: $50

Internet/Streaming Services: $125

Cell Phone: $130

Car Insurance: $250

529 Contribution: $100

Husband’s 401(k): $254

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes, I think my generation has always been expected to attend higher education. It wasn’t so much my parents that pushed it, though. My dad worked in the trades and my mom was a stay-at-home mom for all of my childhood, so I know they would have supported me through any decision I made. I ended up going to university and received a bachelor’s degree. My parents paid for my undergrad, which I was grateful for, however, it was because my dad’s longtime employer paid him a retirement buyout of $100,000 (to split among three kids).

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My parents didn’t talk too openly about finances, but I knew there was stress, especially around 2008 when everything crashed. My mom had a lot of stocks that took a hit and my dad was forced into retirement. It was a hard time for them but they still provided and made sure we didn’t have to worry. They are much more open now that we are older and asking for more advice.

What was your first job and why did you get it?

My first job was as a camp counselor at a summer camp for individuals with disabilities. I wanted the experience of working in that setting since that was related to my major. I worked part-time since I was lucky enough that I was living at home and had support from my parents.

Did you worry about money growing up?

We worried when it came time to go to college. Our parents said they would pay for undergrad, but we still applied for every scholarship we could to ease the burden.

Do you worry about money now?

Yes, especially now that I just lost my job as a recreational therapist. It’s scary not knowing when my next paycheck will show up or when I will find another job. We’ve always been comfortable, but we would love to bring in a little more so we don’t have to worry as much.

At what age did you become financially responsible for yourself and do you have a financial safety net?

After I graduated college I moved into my own apartment and started two part-time jobs. I haven’t asked for assistance from my parents since and have offered to pay them back for my schooling, but they won’t let me. Over the past two years while student loans have been on hold, I told my husband we should throw extra money into our savings instead. I’m grateful we did because we have a small safety net if I’m not able to find a new job right away.

Do you or have you ever received passive or inherited income? If yes, please explain.

No.

Day One

9:30 a.m. — I sleep in and have a late breakfast (French toast made by my husband, my favorite). I’m grateful my husband enjoys cooking! Our two daughters play around me while I drink coffee.

11 a.m. — We attend virtual church since we are finishing up our quarantine after my daughter had COVID. I’m grateful to still be able to stay connected even if we can’t attend in person. We try to give $50 a week to our church (online donation). $50

2 p.m. — The girls are napping/having quiet time so I take advantage of some free time and apply for jobs. I was unexpectedly let go from my job of over 10 years because of budget cuts so I’m still a little shocked, but I know I need to start applying ASAP. While I’m applying to jobs, my husband buys a CBD oil product recommended by his sister (I think he’s hoping this will help with my stress?). $48

7:30 p.m. — We do bedtime routine for kids then spend the rest of the evening applying for more jobs and reading before bed. In bed by 10:30.

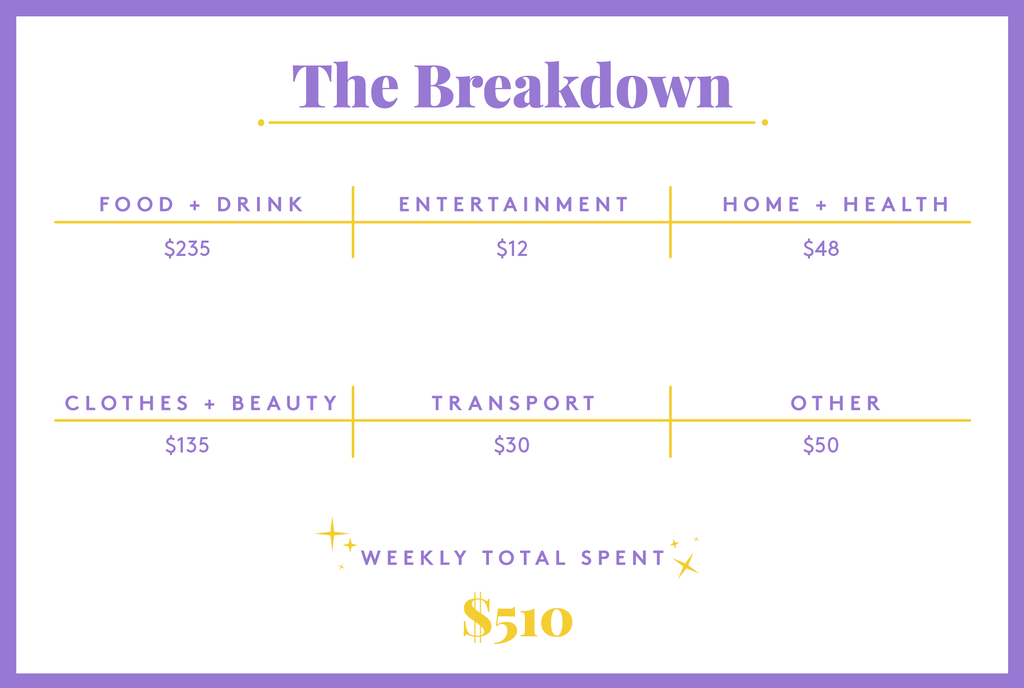

Daily Total: $98

Day Two

6:30 a.m. — Up early to wake up before the kids get up. Exercising is so important for my mental health and it’s something I try to prioritize. After my workout, I spend time making the girls’ breakfast and enjoying our downtime.

12 p.m. — Lunch for the girls and myself (deli meat, cheese, crackers, fruits, and veggies — basically a homemade Lunchable). Girls are off to nap and quiet time and I apply for more jobs. I also spend this time writing notes to all of my clients since I have to say goodbye tomorrow. I am going to be a mess!

2:30 p.m. — DSW is my weakness. They email me with a coupon and I have rewards to use, so I make an impulsive purchase and buy two pairs of shoes. I know I will wear them often and they will work for job interviews, so I try not to feel guilty about it. $95

5:30 p.m. — My daughter needs a negative COVID test to return to school tomorrow but unfortunately it came back positive. She had symptoms over a week ago but it stays in your system for a while. She’ll be home from school until Thursday.

8:30 p.m. — Kids are in bed and job applications are finished. Relaxing with a book until going to sleep at 11.

Daily Total: $95

Day Three

9 a.m. — I head to work to pack up my office and say goodbye to my clients and coworkers. I stop by Starbucks to pick up coffee and breakfast for myself and my office buddies. After 10 years of working here, it’s very hard for me to say goodbye. I spend so much time crying, but I’m letting myself grieve and be sad today. $25

11 a.m.— Since my mom is watching the girls, I take an hour wandering aimlessly around Target. I know I need to watch my spending so I try to limit my purchases to things that are on our grocery list (kids’ vitamins, granola bars, hair cream), but it’s Target, so I end up buying a blanket and a sweater for my daughter too. $75

5 p.m. — Make a quick dinner and get the girls ready for dance. My husband takes them so I can go to the grocery store and finish buying what is on our list. I get fruit and produce, applesauce, bread and buns, crackers, cheese, rice, hot dogs, burger patties, pork chops, protein shakes, milk, and chocolate bars. $53

8:30 p.m. — I relax with some wine and greasy food after the kids go to bed. In bed by 10:30.

Daily Total: $153

Day Four

8 a.m. — Lazy morning with my girls. After breakfast of toast, eggs, and fruit we go outside because it’s sunny and somewhat warm (for winter in Michigan). Feels good to be in the sun!

12 p.m. — I have two interviews set up! One is for tomorrow morning (in person) and the other is a Zoom interview on Friday afternoon. It feels good to get some responses to my applications so quickly.

6 p.m. — We’ve had an uneventful day, which is just what we needed. Spending the evening getting my daughter’s school stuff together, packing her lunch, and preparing for my interview in the morning. In bed before 10.

Daily Total: $0

Day Five

5 a.m. — Even though I have a busy morning I still fit in my workout. I know I’ll feel better than if I skip it. After showering and getting ready, I get my daughter up, make her breakfast, let my mom in to watch the kids, and get out the door by 7:30.

9 a.m. — The interview is at a local coffee shop in Ann Arbor. I pay $5 for parking but my coffee is paid for by the interviewer. The interview gies well and I’m excited to have some options! $5

3 p.m. — I grab the youngest from home (grateful my mom is close enough to watch my kids) and head to pick up my oldest from school. Once home I start prepping breakfast for dinner for the kids — my favorite simple dinner.

7 p.m. — My husband leaves to get a haircut while I do bedtime with the kids. The rest of the night is laid back and we’re both in bed by 9:30. $25

Daily Total: $30

Day Six

8 a.m. — I wake up early, exercise, and then get myself and my daughter ready. After dropping her off at school, I got to the hospital for a mammogram and diagnostic ultrasound. Unfortunately, they find some areas of concern so I have to return in two to three months to make sure it’s nothing serious. Did I mention this year is off to a rocky start??

2:30 p.m. — My mom picks up my youngest so I can have an empty house for my Zoom interview. The interview itself goes well, but I already know it’s not one I want. It’s too far away and it’s a big pay cut.

5:30 p.m. — My husband and I are able to have a date night tonight at our favorite local restaurant. Sangria for me, beer for him, Mediterranean entrees, and desserts for both. It’s rare that we ever get or spend this much on a date night but after a rough couple of weeks, we are happy to treat ourselves. $82

7:30 p.m. — We pick up the girls from my parents and head home. In bed before 10.

Daily Total: $82

Day Seven

8 a.m. — I sleep in and it is glorious! I quickly fit in a workout while my husband makes breakfast (the kids joined me which is always fun to watch). Then, we quickly get ready to meet my sisters in Detroit. We fill up my husband’s car on the way. $25

10:30 a.m. — Meet my sisters at a cafe for breakfast and coffee. Afterward, we head to a King Tut exhibit at a local museum. It’s a great exhibit and it’s always fun spending time with my sisters. $12

6 p.m. — Spaghetti night, which means a definite bath night for my kids. My parents stop by to drop off some food and things for the girls (they have a Costco membership and they always buy too much of everything). The kids are super hyper but still manage to fall asleep at their normal time.

11 p.m. — I can’t fall asleep because I have way too much on my mind. I decide to do a little browsing on Old Navy’s website and notice my favorite basic tees are on sale for $3. I promise myself I will cut back on unnecessary shopping tomorrow… $15

Daily Total: $52

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Chicago, IL, On A $67,000 Salary

A Week In Jacksonville, FL, On A $497,000 Income

A Week In San Bernardino, CA On A $79,000 Salary

from Refinery29 https://ift.tt/xNVS9Aw

via IFTTT