Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a pastry chef who makes $65,000 per year and spends some of her money this week on bourbon.

Editor’s Note: This is a follow-up Money Diary. You can read the original diary here.

Occupation: Pastry chef

Industry: Hospitality

Age: 43

Location: Los Angeles, CA

Salary: $65,000

My Husband’s Salary: $85,000 (but we keep our finances completely separate)

Net Worth: $146,000 (This includes approximately $110,000 in an IRA, $15,000 in savings, $18,000 in a mutual fund, and $3,000 in checking.)

Debt: $0

Paycheck Amount (2x/month): $2,185

Pronouns: She/her

Monthly Expenses

Rent: $661 for my half of a rent-controlled apartment

Car Payment: $300

Netflix/Hulu: $0 (husband’s mom’s account)

Apple Music: $9.99

Cable/Internet: $0 (paid by husband)

Utilities: $52 for my half

Car Insurance: $101

Health Insurance: $172

Renter’s Insurance: $14

Cell Phone: $75

Vanguard IRA: $500

New York Times: $4

LA Times: $16

NPR: $10

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes, there was. I was a valedictorian at a humanities magnet school but I was NOT interested in college. I was, however, very into photography so I ended up attending a good art school. I dropped out after two years because it felt too stupid and didn’t seem like it was worth the money ($19,000 at the time). My parents paid for the schooling. They also paid for culinary school several years later, and let me tell you, I do NOT recommend culinary school. Just go get a job in a kitchen, you’ll learn just as much. My husband works for a university and as of this year will start getting free education for a spouse and I’ve thought about going back and finishing school, seeking a degree in business. I would like to be able to still work in food but pivot away from actual cooking (which is a pain in the ass and I’m unsure of how many more years I can physically do it), and so many food manufacturing businesses require a business degree. I’m also unsure of whether I could make it through two econ classes and statistics, so, we’ll see. I can’t even make it through a whole NYT article at this point.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

We didn’t really have any conversations about it except my mother always repeating that you shouldn’t borrow or lend money. I also saw my dad get years behind on his taxes (and yes, the government did eventually show up on our doorstep). My parents made more money once I was a teenager. We didn’t get allowances, they just bought us what we wanted when they could, within reason (seeing The Cure three times was within reason).

What was your first job and why did you get it?

I was a barista at a local coffee shop at 16. I honestly don’t remember why I felt I needed to work because it wasn’t necessary, but I continued at other barista jobs through college for spending money.

Did you worry about money growing up?

When we were younger, my parents made less money, so I would get upset I couldn’t have the name brand clothing the other kids in sixth grade had. But I never worried that we could pay the rent or put food on the table, ever. My parents owned apartment buildings that my dad bought in the ’60s which have since sold and are the source of my family’s wealth now.

Do you worry about money now?

No, not anymore. I was worried about it when I wrote my first Money Diary because I was only making $25/hour, and then I was VERY worried about it from August-December 2021 because I left my job without having another job and was living off my savings. Right after I left my job, I got married (online via the county!), so my husband was chipping in more each month to help me out. We have NOT combined our finances — he still gives me money each month for rent, groceries, etc. We take turns paying for things like pizza night and fancy meals and figure it just evens out. I now make $5,000 more than my last job, which is nice (after I wrote my Money Diary, my last job did finally stop paying me hourly and gave me my $60,000 salary back but it took a lot of cajoling).

At what age did you become financially responsible for yourself and do you have a financial safety net?

At 25, when I moved out of my parents’ house. My safety net is both my savings and my husband’s savings. If something REALLY went wrong, we could count on both my mom and his mom. We both stand to inherit quite a bit of money when our mothers pass, but here’s hoping that doesn’t happen for a very long time.

Do you or have you ever received passive or inherited income? If yes, please explain.

My mom gave me $10,000 several years ago after the sale of an apartment building. I put it in a mutual fund and have occasionally taken money out of it for travel, then let it regrow.

Day One

6:30 a.m. — My first Money Diary had me waking up at 4:15 a.m. to open the restaurant and let me tell you, waking up at 6:30 instead is a real windfall. One of my requirements in looking for a new job was finding something that was NOT an all-day restaurant with a bakery that required early hours (I was offered several of these). I skip coffee at home because the coffee at work is freaking delicious and I brew a pot as soon as I get in. I shower, grab a chef’s coat, and I’m off!

7:15 a.m. — Since I am in the throes of becoming my mother, I take the streets all the way to work instead of driving on the freeway. I find it too stressful first thing in the morning, and I’m not even certain it’s faster.

8 a.m. — Arrive at work, and I am the only one there, which is nice. I make coffee, set up my station, and turn the ovens on. The first thing I do is bake some chocolate chip cookies for family meal breakfast.

12 p.m. — The other thing I am unwilling to do this time around and at my age is to eat for three minutes standing over a trash can (this is classic kitchen behavior). I insist on making time for a sit-down lunch. I eat a Trader Joe’s salad that I brought from home. They actually make lunch family meal now, but it’s not always dependable in timing and quality (and often includes an inordinate amount of fries), so I’d rather depend on my own lunch. After lunch, I finish prepping for dinner service. Because of COVID cutbacks, I am the entire pastry department, which means I not only make the desserts but all the crackers and various doughs the restaurant requires. This sounds like a lot of work, and sometimes it is, but the joy of not having to manage anyone or wonder if your employees will show up for their shifts cannot be overstated. It is frankly the easiest job I have had in years. People management is the hardest part of cooking.

4 p.m. — Quitting time. I basically work only eight hours a day at this point, instead of the 10-12 hours I have been used to for years. Again, this is blissful.

5 p.m. — Home. I quickly change into my jammies, pour us some bourbons, and start prepping dinner. I am making a cream of broccoli soup with grilled cheeses and will take the leftover soup into work for a nice lunch.

7 p.m. — Because we are old, we watch Jeopardy! with dinner. Wheel Of Fortune follows and my husband, S., insists I turn it off because he thinks it’s too stupid (like, how is a trip to Florida valued at $9,000??). We instead watch an episode of Curb Your Enthusiasm. I get into bed after to continue watching Archive 81 on Netflix (pretty good, like a cross between Rosemary’s Baby and Videodrome) until I eventually fall asleep.

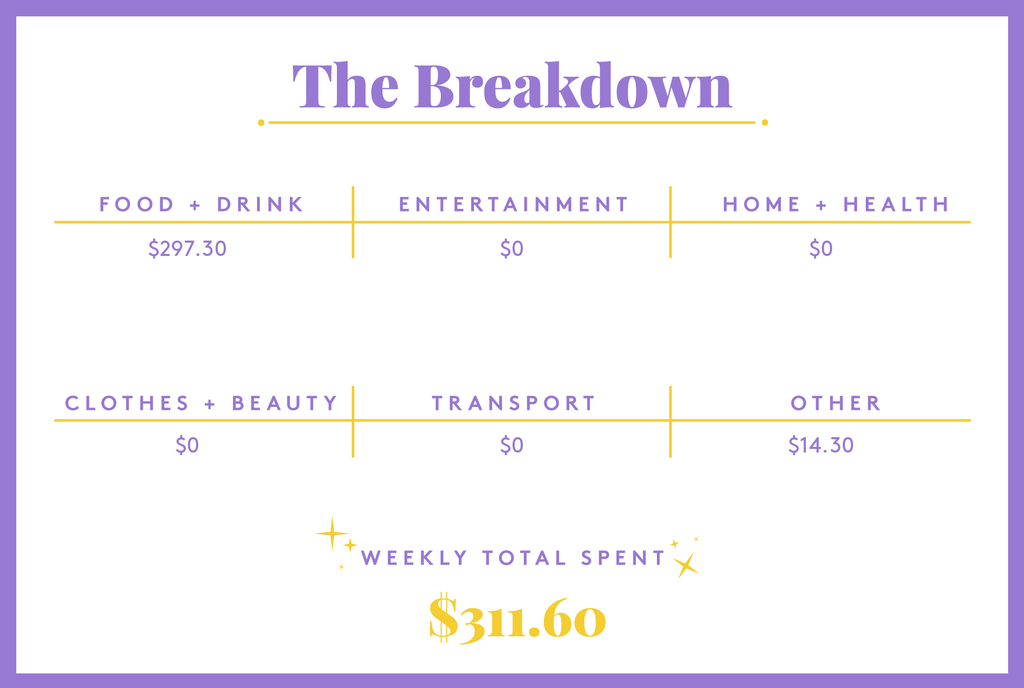

Daily Total: $0

Day Two

6:30 a.m. — Wake up, read emails, scroll Instagram, shower, and think about the new dessert I’m putting on today!

8 a.m. — My favorite thing about drinking coffee at work is that we drink it out of delicate china cups and I get to put straight heavy cream in it. Set up station, turn on ovens, and bake peanut butter cookies for a grateful staff.

2 p.m. — Assemble a tester of my new dessert. I’ve only worked here a few weeks and I’m still adding things to the menu. I present it to our chef, and aside from a small adjustment, he loves it and we plan to put it on the menu tomorrow. My last restaurant was more broadly general and American in concept, so I could basically put anything I wanted on the menu, which makes things surprisingly difficult. This is a high-end restaurant of a specific cuisine and I actually find it easier to come up with desserts when there is a framework and a style.

5:15 p.m. — I arrive home and find S. at our neighbor’s apartment, assembling a coat rack for her. I change my clothes and head over there. She calls him her apartment husband, and he really is the go-to in the building for problems. While working, S. asks me if I want to go to Kauai for five days next month, on him. Um, what? Yes? Wait, this doesn’t affect my summer vacation does it? No? Then YESSSSSS. Can I take the extra three days off of work? Yes? Maybe? WHO CARES, SPRING BREAK!!!

7 p.m. — Dinner is pasta and a salad, something I keep in my back pocket for easy meals (I make big batches of tomato sauce and freeze it in deli cups in the exact portion I need for two people). Jeopardy! and Curb, then in bed to watch Archive 81. This show will later give me a screaming nightmare, so take that as you will.

Daily Total: $0

Day Three

6 a.m. — Get up a half-hour early because I want to use a machine upstairs at work before the prep guys get in.

7:15 a.m. — Hustle upstairs to make the crackers before the guys get in to use the upstairs prep area. The crackers use an electric pasta sheeting machine to achieve maximum thinness, and I’ve only used it once. The first dough ball sheets perfectly. The second sticks and clogs the machine. I unclog it and run through the third dough ball, which also sticks. Now I have to scrape the sticky dough off the rollers. NO PROBLEM.

7:30 a.m. — I take a very thin paring knife and start scraping off the rollers. As I scrape, I am leaning on the machine with my other hand and accidentally switch the machine on, which proceeds to suck the paring knife into the rollers. The machine shuts itself off and now my paring knife is stuck in the rollers, which are obviously on the thinnest setting. OMFG. I start trying to pry out the knife and it ain’t going nowhere. I start to panic. I spray some pan spray in there to try to grease it like WD-40. After 10 minutes, I manage to squeak it out. Miraculously, the stupid machine actually turns back on. OMFG.

12 p.m. — Lunch is family meal which is actually quite delicious today, a kind of spicy beef stew over fregola. I eat with my favorite line cook, who I end up telling the cracker story to, and who I swear to secrecy under threat of never getting any breakfast treats again.

4 p.m. — Time for line up, which is the pre-shift meeting of chefs, managers, and servers that happens before dinner service. Today I am there to taste and talk about my new dessert. To my delight, the manager has spelled everything right on the dessert menu. I love talking about my food and teaching people about unusual ingredients and techniques.

5:45 p.m. — I get home and check the mail because I have been waiting for the final check from my last job. It was for a very corporate restaurant group and it just was not the right fit for me, so I only worked there a few weeks. They were dragging their feet on my final check and after much back and forth they admitted they owed it, and that it would include penalties for late payment, which I figured could only be a small percentage of my pay. As it turns out, the check I received was THREE times the amount they owed me because of penalties (the penalty is apparently one day’s pay for every day late, up to 30 days) and I am over the moon after not working for so many months.

7 p.m. — Tonight is a personal favorite, chilaquiles night! I fry the chips myself and make a green sauce along with guacamole and eggs to top them. We take a long walk around the neighborhood after Jeopardy! then it’s Netflix and bedtime.

Daily Total: $0

Day Four

6:30 a.m. — Sleeping til 6:30 is truly bliss. Then I step in cat vomit.

8 a.m. — Coffee machine isn’t working, so I make myself an espresso and resign myself to probably making espressos for the next four people that come in. I also bake blueberry muffins for the guys. I say “the guys” because I am literally the only woman that works in the back of house and yes, it is exhausting sometimes. Male cooks are classic bullshitters and they NEVER shut up.

12:30 p.m. — Family meal lunch is wings, as it often is, and I pass and eat a soup. Why do men like wings so much? It’s like a lot of mess for so little reward and then also some gristle.

2:30 p.m. — I have one of my favorite things to make on the menu right now, a swiss roll. I execute a PERFECT unbroken swirl, every single time, and every time, I think of the poor bastards on The Great British Baking Show that flub it. I quietly award myself a Hollywood Handshake.

4 p.m. — I attend line up again to talk about the new dessert. Everyone loves it.

6 p.m. — I get home after stopping for Thai food ($45.98) and go online to buy S. a card I saw an Instagram ad for ($14.30; yes I was influenced). It’s a pop-up card with an old fashioned inside, his favorite cocktail. I’m shaky about spending $14 on a card, but, here we are. $60.28

7 p.m. — Eat Thai food and watch Jeopardy! S. tells me he finalized all the details for our trip to Kauai; it will be short but sweet! I get into bed and start researching where to eat while we are there, then finish up Archive 81. It was pretty good overall. No nightmares tonight!

Daily Total: $60.28

Day Five

6 a.m. — I get up earlier on brunch days because there are some doughs at work that need extra time to proof. Also, today is my Friday!

7:30 a.m. — Thankfully the coffee machine is working again. I pull all the dough that needs to proof and start getting things ready for brunch service. It’s stressful but it’s less stressful than my last restaurant because my station picks up fewer items.

10:30 a.m. — I take a quick break before brunch service starts to eat instant ramen because I can’t eat during brunch. Instant ramen has saved me many times at work. If I have time, I add a soft boiled egg and it is *chef’s kiss*.

4 p.m. — Brunch is finally over and I feed the staff the leftover pastries, to everyone’s delight, drowning them in extra nuts and sauce. I snag a few for S. and head home for a nice dinner reservation and the weekend!

5:30 p.m. — Get home for a quick shower before dinner. Tonight we are eating at a restaurant where two friends are the pastry chef and pastry cook. I finally get to wear a new jumpsuit I got for Christmas!

7 p.m. — We arrive and they ask to see our vaccine cards, which I find odd because we made a reservation for outdoor dining. They go to seat us inside and we ask what’s going on and they say they closed outdoor dining because it was windy earlier. S. is VERY upset and considers leaving; he does not eat inside. I convince him to stay but it casts a pall over the evening. All the food is meticulous and delicious, and my friend comps us ALLLL the desserts, with cookies to go! S. pays for the meal.

Daily Total: $0

Day Six

7:30 a.m. — Desert day! We are headed to Palm Desert for one night, as we like to do a few times a year. It’s nice to get away, even for just one night. S. booked someplace different than where we usually stay, because that place was wildly expensive for this weekend. I’m not thrilled because it’s a condo, not a resort, so no one will bring me Bloody Marys by the pool. I pack beers, homemade Bloody Mary mix, vodka, and chips and resign myself to being my own cocktail waitress.

12 p.m. — Since there’s no restaurant at the condo, we stop for sandwiches ($25.80). I’ll pay for all the food this weekend since S. got the condo. $25.80

12:30 p.m. — We get to the condo and they tell us the room won’t be ready until 4, which means no ice for my Bloody Marys and warm beer for S. They do let us use the changing room and pool, so we enjoy the pool and hot tub until 4. When we check in, we enjoy the waning light and the fireplace on the patio.

6 p.m. — I call our favorite sushi place to place a to-go order. Repeatedly. They are not answering, which is not a good sign. So we figure fine, we’ll just drive over there. She tells me it will be an HOUR AND A HALF for takeout. No way. We head to our Thai place across the parking lot. One hour for takeout. Okay, no problem, let’s just go to that In ‘n’ Out across the street. The line is wrapped around the parking lot twice and bleeding onto the street. Okaaaaaay. Defeated, we settle on fast food and find a Carl’s Jr across the street and get western bacon cheeseburgers and fries and Jesus, why is it $24.95?? The burgers are TERRIBLE and I am very sad for my tiny vacation. $24.95

Daily Total: $50.75

Day Seven

8 a.m. — I wake up early so that I can wring out as much vacation as possible. S. gets up and makes coffee and I ask if it is too early for a Bloody Mary. Apparently, it is. It also feels too early to put on a bikini but I am determined. I head out to the pool in my romper.

10 a.m. — Finally Bloody Mary o’clock! S. joins me in the hot tub as we have deemed the pool too cold. Soon after, we pack up and leave.

12 p.m. — We make our traditional stop at Baker’s, a local Inland Empire chain, for the best crunchy shell ground beef tacos. I start to feel slightly redeemed from last night’s dinner disaster. I sleep the rest of the way home because Bloody Marys. $14.90

1:30 p.m. — Home, and nap time!

4:30 p.m. — I wish I could keep lounging around but I HAVE to go to the grocery store or I’ll never get there this week. I meal plan for the week, plotting out specific meals instead of just buying stuff and coming up with ideas later. In addition to a few household items, bourbon, vitamins, and cat food, I buy the prep for tomato risotto, quesadillas, and pozole ($100.39). In a classic move, I refuse to cook after toiling over grocery shopping, so I plan on getting sushi to further placate myself for that terrible vacation dinner. $100.39

7 p.m. — I go to pick up the sushi ($85.28) because I’m too cheap to pay for Postmates and sushi is already so expensive. And I’m still mad about the $25 I spent at Carl’s Jr. The sushi hits the freakin’ spot and we go to bed very happy. $85.28

Daily Total: $200.57

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In San Francisco, CA, On A $200,000 Salary

A Week In San Bernardino, CA On A $79,000 Salary

A Week In Chicago, IL, On A $67,000 Salary

from Refinery29 https://ift.tt/nBd4oL8

via IFTTT