Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: an AmeriCorps Volunteer who makes $18,000 per year and spends some of her money this week on a bird feeder.

Occupation: AmeriCorps Volunteer

Industry: Sustainability

Age: 23

Location: Rural Iowa

Salary: $18,000

Net Worth: -$15,000 (Debt: $30,000)

Paycheck Amount (1x/month): $1,100

Pronouns: She/they

Monthly Expenses

Rent: $450 for my half of an apartment shared with a roommate ($900 total)

Student Loans: $0, currently frozen

Phone Bill: $100 (I pay for my family bill, and they pay my car insurance in exchange)

Spotify: $13 (my roommate and I share an account)

Google Storage: $3

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

As an only child and a first-generation college student, I was always heavily encouraged to go to college. I worked extremely hard in school to get good grades and great scholarships, and chose a college that would offer me ample financial aid as well as opportunities for work-study. I had a small amount of financial assistance semester to semester from my family, but took on the bulk of my initial college payments and am responsible for my student loan debt. My family gave me all the help and support that they could afford during my college experience and I am exceptionally grateful for that, but I left college with a hefty amount of debt that many of my peers haven’t had to deal with. I took the past year and a half to volunteer with AmeriCorps in part because of its education award benefits — once I leave the program, I will have a small education stipend that I can put toward my schooling and AmeriCorps pays the accrued interest on my federal loans while I am in the program. I am lucky to only have one non-federal loan and I have learned a lot about my student loans in the past few years so that I can make the best possible decision on how to pay them swiftly.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

The conversations about money growing up centered around how I could be better at saving than my family. My single mom worked extremely hard to have enough money to keep us happy and healthy growing up, but she spent a lot of money each month on material goods. Because I grew up with a single mom, I had many informal guardians in my upbringing, and I was privileged to spend time with many family members, all of whom had drastically different approaches to money. That being said, I received very little guidance financially.

What was your first job and why did you get it?

I can’t remember a time in my childhood when I wasn’t babysitting. I babysat for all of my middle school and high school years. I got a job working at a gym when I was 14.

Did you worry about money growing up?

Growing up in a single-parent household, money was something I stressed about early and often. My mother ensured us that we were taken care of, but our money barely stretched beyond that. We were privileged to take trips growing up and my classmates never knew I was financially insecure, but I knew. My mom worked at least two jobs most of my growing up and her spending habits occasionally left us with cramped finances. I remember loaning money to her on a few occasions when I was in elementary school and again when I was in college. Her spending style pushed me to see money in an incredibly different way; from an early age, I tried to save away as much money as possible.

Do you worry about money now?

I work full-time as a volunteer, so of course I worry about money! In all honesty, I am in a super financially sound place right now (for my own comfort levels), but I can’t feel comfortable in that because I will always feel like the poor kid. I also worry about being able to afford a house one day.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I think that my financial self-sufficiency was a gradual transition, but I know that I was thinking seriously about money from a young age, and I started paying for my own needs when I got a job at 14. This was all prompted by my interest in being financially independent.

Do you or have you ever received passive or inherited income? If yes, please explain.

I was lucky to get an old (but reliable) car from my mother when my car stopped working. I also had a small education fund from my aunt and uncle (around $3,000) that made it possible for me to get a laptop after college so that I could start working from home during the pandemic. These pieces of equity have given me a small head start on life as an adult, and I am really grateful.

Day One

7 a.m. — I groggily get out of bed. If I wasn’t in COVID quarantine, I would have moved much quicker today. I finally get up around 7:15 and head downstairs to start my morning routine — making my coffee while listening to The Daily. My girlfriend bought me a wonderful coffee setup for my birthday (the whole nine yards: a hand-crank grinder, milk frother, and a pour-over carafe), and it makes it easy for me to want to make a coffee at home, as long as I’ve cleaned out the filter before the morning. I use locally roasted beans, oat milk, and local maple syrup to sweeten.

11 a.m. — I spend my entire unpaid lunch break on the phone with the loan holders for my student loans because I learned this week that a student loan I didn’t know about has gone to collections. I feel really horrible about this oversight and I want to get it figured out as quickly as possible. I end up calling a family member to see if I can access the rest of my education money that they had set aside for me. I am so grateful that they say yes, which cuts my payment in half. I am nervous because my education funding from my AmeriCorps service is up in the air now that my loan has gone to collections. I say thank you to my family member (a million thank yous won’t be enough) and I take a deep breath.

2 p.m. — I stop by a local kitchen store in my small town to pick up an accessory for my dehydrator. It’s a little more expensive than ordering online, but I prefer to buy local and shop small whenever possible. My girlfriend surprised me with a dehydrator after a particularly busy Earth Month and I have been foraging and drying to my heart’s content ever since. I spend the afternoon drying dandelion roots that were a free forage find from my girlfriend’s farm job. $18

6 p.m. — I spend the evening making food for the week, planting and planning my garden, and adding $250 worth of IKEA goods to my cart, trying to not stress myself out. I have needed a home office setup for months and I have made this cart over and over again in my head. I’ll be ordering these items for pick up this week, but not without wringing my hands a few more times over the cost.

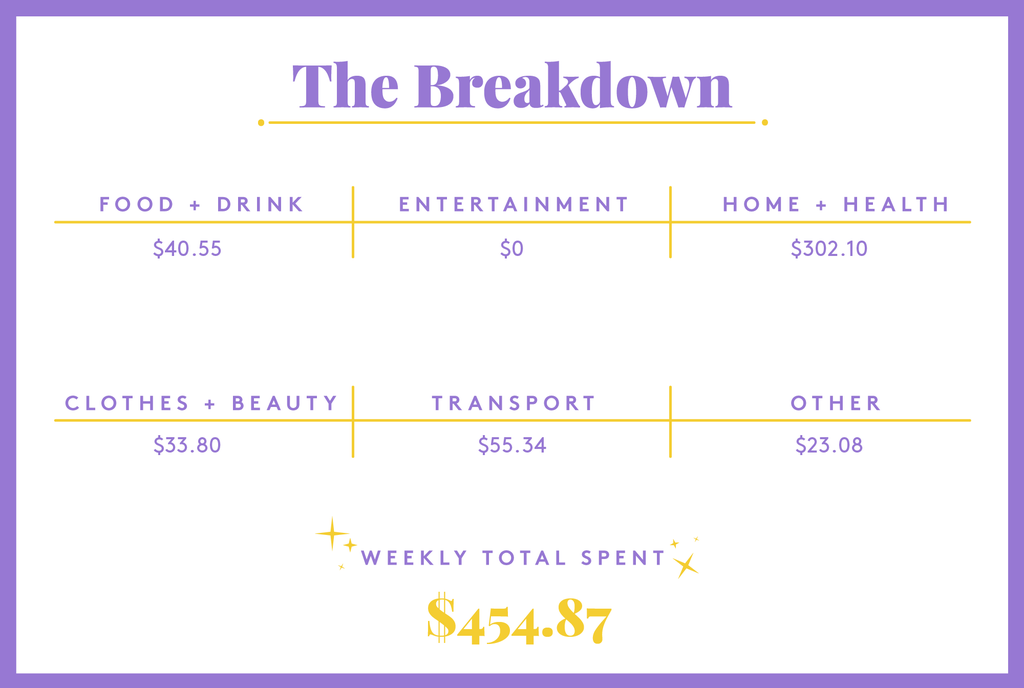

Daily Total: $18

Day Two

10 a.m. — I have a telehealth therapy appointment. I receive healthcare from AmeriCorps, which keeps my co-pay low. $10

5 p.m. — I drive out to my girlfriend’s house to enjoy dinner together. We started dating in the throes of the pandemic, so luckily for us, we prefer staying home and making dinner together. We cook pasta with a pea shoot pesto. We sit on the back deck and listen to the birds singing. Life is sweet.

9 p.m. — I lay in bed and read a library ebook on my phone. I have a Kindle from childhood that I have just started using again, but I lost the charger and I am too frugal to buy a new one when I can just borrow my girlfriend’s. I am having an ebook renaissance right now because I can’t go to my library and peruse like I usually do. I read up on some different budgeting styles and head to bed.

Daily Total: $10

Day Three

8 a.m. — I pick up coffee for my roommate and me, now that I am officially in the clear on COVID quarantine. She isn’t out of the woods yet and we are both working from home, making us a little stir-crazy. I pay for both of our coffees and I know she’ll get me back later. We sit on the stoop of our house and dream about the garden. We have a beautiful corner lot and a landlord that loves flowers, so we have full control. The birds are singing again. I don’t think I’ll tire of that sound anytime soon. $8.25

4:30 p.m. — I swing by the co-op and the farmers market. I grab food for date night tomorrow and pick up some kombucha and fancy cold brew for the rest of the week so that my roommate and I can have a little treat. I use my SNAP/EBT money, which sometimes feels like monopoly money… I want to be more diligent about making my grocery spending more intentional because I won’t be on food assistance forever ($37.80 via SNAP).

6 p.m. — I put a few more things in my IKEA cart, but still don’t click purchase.

10:30 p.m. — I take time to peruse the Parachute website in preparation for their upcoming sale. I have been setting some money aside for the past few months so that buying a new sheet set won’t be a total blow to my bank account.

Daily Total: $8.25

Day Four

11:30 a.m. — I run to the hardware store before work to grab a bird feeder and birdseed that they have on sale. I have just recently taken an interest in birds and I am excited to attract more to my yard. I didn’t know that birdseed was so expensive, though! $17.10

8 p.m. — My girlfriend and I enjoy a nice meal at home together, using ingredients that I bought at the co-op. We spend a lot of our money on cooking ingredients because that is what is most important to us. Since the beginning of the pandemic, we haven’t had a lot of meals out because we feel safer eating at home, so it feels like a good use of money.

Daily Total: $17.10

Day Five

8 a.m. — My girlfriend and I stop at the farmers’ market before we head out of town for the weekend, and while we are there, I buy a t-shirt from a new vendor. Working as a local food advocate, I try to give as much of my money to local producers as I can and I love their logo. I plan to wear their shirt during my next shift at our local food hub. $33.80

8:30 a.m. — I spend a mix of cash and SNAP money at the farmers’ market buying treats to eat on our road trip drive, fern fronds (one of my favorite specialty market finds in the spring!), and a few early spring veggies to put in the fridge. My girlfriend has to pry me away from the market so that we can actually get on the road. $15

12 p.m. — I finally buy my IKEA goods! After eyeing a work-from-home set for months, I decided to upgrade from sitting on my couch to working at a standing desk. The trip to IKEA takes a lot of time and most of my patience, but I am so happy to finally have a work-from-home setup that I am happy with. This IKEA purchase is the first of a few house purchases that I have planned out for the year, and now that its out of the way, I feel a little less stressed about letting the money go. $275

3 p.m. — We drop off my IKEA goods and then head to my partner’s parents’ house. We eat dinner and have a calm night in once we get there.

Daily Total: $323.80

Day Six

9:30 a.m. — We take a hike around the state park that is right by my partner’s parents’ house. It is a nice reminder that there are so many free activities that we can enjoy together. On our walk, we hear a few new birds and go on a hunt for mushrooms to forage, but come up empty-handed.

12 p.m. — We have lunch and hang out with my girlfriend’s parents for most of the day.

7 p.m. — On the drive back from my girlfriend’s parents’ house, we stop to grab fast food. We get Cane’s chicken, a personal favorite, and my girlfriend buys us some drinks at Caribou to keep us awake for the rest of our drive. We listen to my moon-themed playlist as we head home, the Full Flower Moon shining over us. $17.30

Daily Total: $17.30

Day Seven

7 a.m. — I try to get back into my weekday routine after a weekend out of town. I make a coffee to go and throw some random odds and ends in a bag to take for my lunch. I eat a small breakfast of toast and bone broth. I get on the road and fill up my tank before I drive to work. I groan as I watch the numbers crawl into the fifties — I wish that I was in a position to get an electric car, but I think I’ll have to endure high gas prices for a few more years before my car will be out of commission and I will be able to justify getting a new car. I hope there will be a more affordable option by then, too. $55.34

2 p.m. — During my lunch break, I order my cat’s food for the month since I have a coupon that expires today. After I ordered her medication the other week, they send me a gift card to use in their online store; the coupon, plus the gift card makes my order of a month’s worth of cat food, a toy, and shipping only about $5. I think this is the closest I have ever been to understanding the draw of extreme couponing. $5.08

Daily Total: $60.42

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Boise, ID, On A $126,000 Salary

A Week In Brooklyn, NY, On A $105,000 Salary

A Week In St. Louis, MO, On A $300,000 Income

from Refinery29 https://ift.tt/fm5Svn6

via IFTTT