Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a marketing manager who makes $102,000 per year and spends some of her money this week on Revolve platform heels.

Occupation: Marketing Manager

Industry: Tech

Age: 25

Location: Hartford, CT

Salary: $102,000

Net Worth: $99,300 ($2,300 in checking, $28,800 in savings, $34,100 in investment accounts, $20,600 in Roth IRA, $13,500 in my 401(k). I live with my partner and we split all expenses 50/50.)

Debt: $4,500 student debt (if I get approved for loan forgiveness, this will be completely forgiven)

Paycheck Amount (biweekly): $2,737

Pronouns: She/her

Monthly Expenses

Rent: $1,100 (my half of the rent I split with my partner for our one-bedroom rental. We were actually able to afford a two-bedroom and strongly considered it but decided to make the short-term sacrifice for long-term gain and savings.)

Utilities: $100

Gas: $20 to my partner (I rely on my partner and his car to get us around for errands and entertainment. I help by sending him money for gas monthly.)

Cell Phone: $30 to my family for my portion

Internet: covered by my company

Yoga Classes: $50 covered by my company’s monthly benefit reimbursement

Hulu, Netflix, Peacock, Paramount, HBOMax, Disney: $0 (shared accounts with my partner’s family)

401(k): 8% of my salary, 5% match covered by my employer

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Definitely! My parents are immigrants so I’m first-generation American. My mom received her bachelor’s degree while my dad has his master’s. I was raised to be very academics-oriented and I was constantly trying to make them proud. While I didn’t attend an Ivy League like I originally dreamed of when I was younger, I’ve now realized that the “name” and perceived clout of where I attended college had no impact on my current career — my hard work and ambition have. I actually transferred a few times: I did one year abroad, another year in community college to knock the basic classes out of the way, and then another at a nearby school. I contributed maybe $1,000 to my total tuition and I’m lucky to have parents who were able to cover the rest of the costs. I was involved in an accident as an infant and my parents were given funds for my education as part of a settlement so they used that money to pay for college.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My parents came to the US with close to nothing and have done very well for themselves. I grew up middle class and very comfortable and I’m really grateful looking back — we were better off than a lot of those in my social circle at the time. It has only motivated me to do even better than them since I don’t face a language or cultural barrier like they did. They’re largely self-taught when it comes to finances and they regret not learning concepts earlier, though I think it’s understandable. They’ve taught me a lot about establishing credit, passive income, stocks, and the importance of having a Roth IRA and an emergency fund. I began taking finances more seriously in my early 20s, and now read a lot of blogs and watch a lot of YouTube videos on different financial topics. I still have a lot to learn.

What was your first job and why did you get it?

I took my first job when I was 16 at a local restaurant. I wanted to build working experience as well as earn pocket money. I’ve been working ever since.

Did you worry about money growing up?

I didn’t and I’m very lucky to be able to say that. I wouldn’t consider myself spoiled as I worked many jobs to help pay for my expenses, but I had experiences that I know others didn’t (multiple vacations abroad, tutoring, nice clothing and things, a spacious house). However, my dad was the breadwinner while my mom was a full-time parent and I saw the complications of this dynamic — my mom instilled in me at a very early age to never rely on a partner and to be financially independent (something I’m proud to say I’ve achieved and want to further maintain).

Do you worry about money now?

Facing inflation and a recession and having graduated during a pandemic, yes! However, I’ve always been innately frugal and constantly need to remind myself to loosen up a bit when it comes to finances. Having a stringent mindset about finances 24/7 won’t always save you money, especially if it comes at the expense of your time, energy, and mental health. My current role came with a huge pay jump compared to my last position, and having a partner to share expenses with definitely has helped me save compared to if I was single. I’m proud to live below my means.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I moved back home with my parents during the pandemic, so I didn’t have many monthly expenses at the time. I moved out at 24 to get a place with my partner (fully paid for on our own). I never want to have to ask my parents for money, as they’re getting older and prepping for retirement, and will only have larger medical bills later on. However, I know they’d be able to help if I needed it. I want to get to a financial position where I can offer them money instead of the other way around. My partner and I are also generous with each other when it comes to expenses.

Do you or have you ever received passive or inherited income? If yes, please explain.

No trust funds or inheritances here! I freelanced for a while in addition to a full-time job, but later stopped, and I’m thinking of picking it up again. I also sell secondhand items on marketplace apps, but that isn’t consistent monthly income. My parents did add me and my sibling’s names to one of their homes for our future benefit.

Day One

9 a.m. — It’s a Friday so I’m already looking forward to the weekend. I wake up at 9 and lay in bed for a little while longer (anyone else do this?) while checking Slack from my phone. My team is in various time zones so I have slightly more flexibility in the mornings.

11 a.m. — Typically I have no meetings on Fridays, but today I have three. I make an early lunch for myself, cooking up some leftovers from last night. I wish I was a meal prepper, but I’m typically too lazy on weekends. On the rare occasion I do order food delivery, it’s always for dinner and never lunch. Cooking takes up a lot of my lunch break, regrettably.

5:30 p.m. — I sign off work early and my partner and I head to a local food hall that we’ve been meaning to check out. I opt not to buy anything but enjoy the ambiance and sit with my partner as he eats a bowl. I don’t think it’s a big deal to go somewhere with a friend or whoever and not eat or drink even if they decide to (but some people care!).

6:30 p.m. — Nearby, there’s a quirky Halloween-type store that’s been on my bucket list. It’s eerie, set up like a haunted house, and I look at some paintings for a while and consider buying one for our mostly undecorated apartment. I eventually decide not to (I usually think about purchases overnight before pulling the trigger). Maybe I’ll visit the website later.

7:30 p.m. — We get back home and I whip up some potatoes and veggies for dinner. I feel accomplished knowing that I explored new places in my area! After settling in, I buy a ticket for an upcoming meditation class. My work offers a wellness reimbursement and I’ve been wanting to prioritize this more. Wellness apps just don’t do it for me — I have to do things in person. ($27 expensed)

11 p.m. — My partner and I find something to stream after we get into bed. We have many streaming services, but it can be a curse because it’s like dating apps — too many options! After watching for a while, we get to sleep.

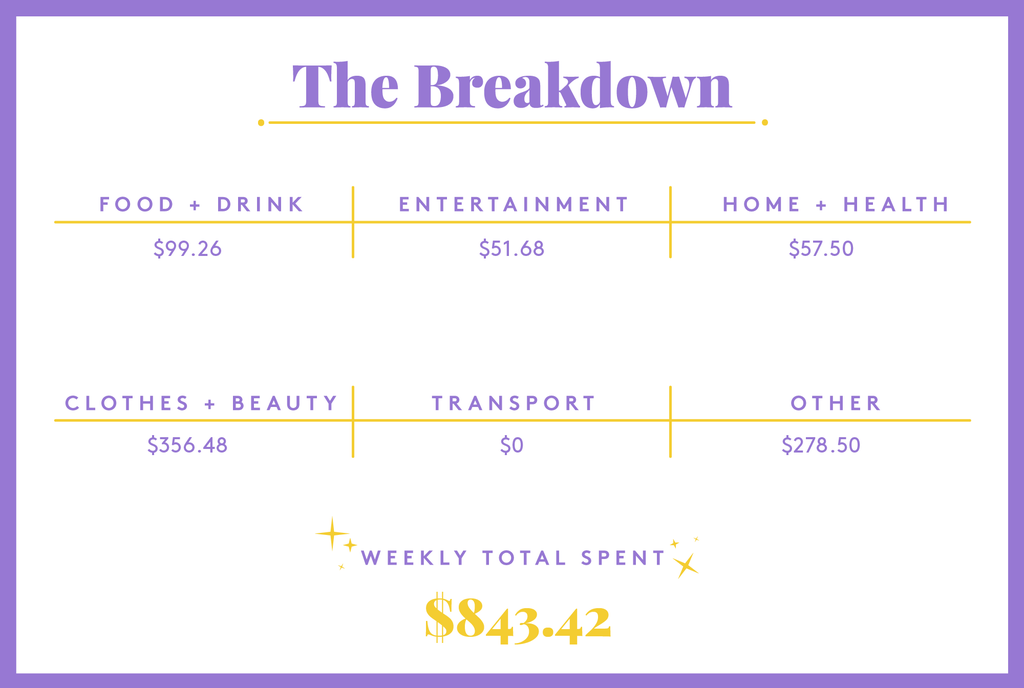

Daily Total: $0

Day Two

9 a.m. — Weekend mornings are typically lazy for me. I stay in bed for a few hours (sue me!) and edit some photos to post on Instagram. I ponder taking social media more seriously.

12 p.m. — Still in bed, I buy my partner and me tickets for a mansion tour (my treat!) for an upcoming trip to another state. I love exploring, especially house tours where I can admire architecture and see how the top 5% lived. $51.68

12:30 p.m. — We have another trip planned next month and I realize we should add on another night since the destination’s a couple hours away. I browse Airbnbs for a while, but there aren’t a lot of options left for my time frame. I settle on one that is a bit expensive and I offer to split it 60/40 with my partner since I bought it without asking him first (I was worried about someone else snatching up the reservation). Since I’m already on Airbnb, I book a last-minute reservation for an upcoming wedding. This one’s a lot cheaper since it’s a shared space, and my partner and I split this one 50/50. I’ve always preferred buying experiences over material things. $278.50

1 p.m. — I’m finally out of bed and take my vitamins and do my skin-care routine. I make lunch, keeping it simple with frozen berries and maple syrup. I realize I’m in dire need of new underwear (I’m still wearing some from high school). I go on Calvin Klein, my preferred site, and buy a thong pack on sale. $36.48

8 p.m. — It’s been a chill day. I checked emails, did laundry, and caught up with my mom on the phone. I’m not too hungry tonight, so we settle on eating snacks. After, I shower and decide to get into bed early.

Daily Total: $366.66

Day Three

9 a.m. — I wake up at my normal time. I realize we need some groceries so I make an order on Thrive Market (snacks, tea, spices, maple syrup). I use Rakuten so I can get some cash back. $64.26

1 p.m. — It’s another lazy day and we once again decide not to leave the house. After a light brunch, I go to the gym in our building and walk on the treadmill and do some light work on the elliptical. There are days when I prefer the gym over a walk outside — I typically try to do two miles total. I’m lucky to not have to buy a monthly gym membership.

7 p.m. — I’m a little tired of cooking and propose getting a DoorDash order. We put in an order with a local Mediterranean restaurant we love. We spend about 40 minutes doing this as the app keeps giving us a lot of error messages as I try to plug in different promo codes. I end up getting frustrated and so we pay full price. The meal is worth it though! I get a plate of mixed protein, rice, and veggies. Typically I avoid food delivery orders since there are so many additional fees tacked on. $35

9 p.m. — It’s a Sunday night, so I decide to get into bed early and watch House of the Dragon. To get myself ready for sleep, I scroll on Reddit for a bit before calling it a day.

Daily Total: $99.26

Day Four

9 a.m. — It’s a start of a new week and I get out of bed early to send a bunch of emails for a new project. I only have one meeting today.

2:30 p.m. — The day flies by without me noticing. I have a late lunch, and have myself spend it away from my computer for my sanity! I’m a huge advocate of not working through lunch (or any meal for that matter). I have some leftovers of my DoorDash dinner.

6 p.m. — I’m signed off for the day and I end up calling a friend who recently moved to the West Coast. We catch up for a while, reminiscing about our college days and all of the new life changes we’ve had in the past year.

7 p.m. — My partner and I take a walk around town and through a local park. After we get back home, we make dinner — tonight it’s scallops and asparagus. We get into bed early once again but I’m feeling restless (there are nights when my mind won’t shut off) so I scroll on Reddit and look at the news longer than I should.

Daily Total: $0

Day Five

9 a.m. — Up and at ’em, it’s another work day. I have a one-on-one meeting today so I put on some light makeup to be more presentable on Zoom. After my meeting, I’m head-down for the rest of the day.

5:30 p.m. — I sign off early because I’m finally pulling the trigger on a furniture purchase. I’ve been wanting a better TV stand for a while (we’ve used a coffee table since we moved in). I find one on Raymour and Flanigan Outlet (my partner likes it more than me) and after some price hunting (a must), I actually find it for cheaper on Amazon. I also have a $15 discount for it being my first in-app purchase. We split it 50/50 and I hope that it fits in our place! While I would like higher-quality furniture, I’d rather invest more in a new couch, and save for when I own a place. $57.50

Daily Total: $57.50

Day Six

9 a.m. — It’s a meeting-less day (yay!) so I don’t feel the need to put on any makeup today and can just be head-down buried in my to-do list. I handle Slack requests from colleagues and spend most of the workday writing.

12 p.m. — On my lunch break, I check the mailbox and get a surprise. I recently had an urge for magazines (both to read and I like the aesthetic of stacking them up on my table) so I signed up for Vogue, GQ, and Architectural Digest. I get Vogue‘s September issue with Serena Williams on the cover and spend the rest of my break reading it.

1:30 p.m. — I recently bought a coffee table from a secondhand marketplace website. It’s finally being delivered and I get notifications that the delivery workers are nearby. They arrive with it and quickly leave. Upon further inspecting, I find that there are flaws which isn’t how it was described. I open a case with customer support and they investigate. Later on, they end up giving us a partial refund, score! This is a mindset I always have — just make the ask. This applies whether you’re negotiating, talking to customer service, or dealing with your personal circle. My partner is once again grateful that I help save us so much money. But oops this is taking up time and I need to get back to work.

6 p.m. — I finally log off, eat leftovers for dinner, and go to bed early.

Daily Total: $0

Day Seven

9 a.m. — I wake up at my normal time and put on more makeup than usual. I have about three hours worth of meetings today and I’ve found that just a little bit of eyeshadow, liner, and mascara goes a long way on Zoom. My meetings are a nice break from my head-down work but I also start feeling a bit behind on my to-do list.

2:30 p.m. — My meetings are finally done for the day so I have time to make a late lunch. I microwave leftover wild-caught salmon and pair it with some olive oil chips. Some days, I stream a show on my lunch break but today I make progress on the Vogue September issue. I feel a bit antsy for it to be the weekend.

6 p.m. — Finally, I’m off for the day! It’s been a heavy online shopping week (way more than I usually do), but there’s one more thing I have to buy. For an upcoming wedding (as a guest), I need new heels. My usual pair is far away at my parent’s house, and have also been featured in too many of my Instagram photos already (call me vain). I always go for platform heels thanks to my thick calves so I pick out a pair from Revolve and a pair from Nordstrom. I’m not sure if they’ll fit or if I’ll like them in person, but I can always make a return. $320

Daily Total: $320

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Twin Cities, MN, On A $110,000 Salary

A Week In Bay Area, CA, On A $120,000 Joint Income

A Week In Charlotte, NC, On A $45,000 Salary

from Refinery29 https://ift.tt/K6VyLHR

via IFTTT