Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: an administrative assistant who makes $48,000 per year and spends some of her money this week on vet bills for her horse.

Occupation: Administrative Assistant

Industry: Substance Abuse Rehabilitation

Age: 26

Location: Richmond, VA

Salary: $48,000

Net Worth: ~$20,000 (I have $15,000 in an HYSA and my car is probably worth $5,000ish. My partner and I do not share finances (he has some financial habits that I do not agree with). I make more than he does, so while we split the big expenses (rent, car insurance, daycare) evenly, I tend to cover the grocery bills, diapers/wipes for our daughter, and the higher monthly bills (I pay gas/electric & my partner pays internet).)

Debt: $0

Paycheck Amount (2x/month): $1,320

Pronouns: She/her

Monthly Expenses

Rent: $658 (I live with a partner, who pays the other half of the rent. Our rent will go up to $740 each at the end of this year, though.)

Loans: $0 (I own my car outright and I don’t have any student loans.)

Daycare: $466 (my half)

Car/Renters’ Insurance: $85 (my half)

Horse Boarding: $320 (I have an elderly horse that I board about 45 minutes from where I live. I’ve had her for 10 years and I love her deeply, but her care puts a real strain on my budget. She’s also shod by the farrier every six weeks, which is $110.)

Gas: ~$100

Electric: ~$100

401(k): I contribute 3% of my pre-tax salary, which usually ends up working out to roughly $60 a paycheck.

Health/Dental Insurance: $80

Hulu: $7.99 (My partner pays for Netflix.)

Annual Expenses

Amazon Prime: $120

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes, definitely. I got a BA. My dad did not graduate college and felt that it limited his career opportunities. My parents set up 529s for me and my sister, so I didn’t have to take out any student loans for school. Additionally, my mom was an employee at my school, so I received six free credit hours per semester. I used the extra money from those free hours to pay for rent.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

We didn’t talk about money much. My parents were (and still are) frugal, but we had all of our needs met and went on yearly vacations. As an adult now, I can see that my parents are very well-paid and upper middle class, but likely were putting all of their money into retirement and college funds.

What was your first job and why did you get it?

I was a hostess at a restaurant when I was 16. I used my earnings for spending money and gas money. With the exception of my first semester of college, I’ve consistently held a job since I was 16.

Did you worry about money growing up?

Sort of, but not really. I was involved in an expensive sport (horseback riding), and my parents were not willing to sink as much money into it as many of my peers’ families were. I still was given many opportunities to ride competitively, and my parents ultimately bought me my horse when I was 16.

Do you worry about money now?

Absolutely. I have a well-paying job but my partner does not, and toddlers and horses are expensive. I wouldn’t say we live paycheck to paycheck, but things are tight more often than not. My daughter was an unplanned pregnancy and I was not financially stable when I got pregnant. I’ve had to grow up and learn a lot in terms of financial literacy in the past three years.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I became financially independent in bits and pieces as I graduated high school and went to college — first I was responsible for my own clothes, then my own food, then utilities, and so on. My parents also paid my horse’s board until I was 24 because they paid my sister’s rent for the two years she was in grad school, but I didn’t go to grad school. I’m beyond grateful to have parents that were so generous. I definitely have a financial safety net in my parents. They would never let anything happen to me, my daughter, or my partner. I don’t ask them for money, but they provide a lot for my daughter and would give us a place to stay if we lost housing.

Do you or have you ever received passive or inherited income? If yes, please explain.

Yes. My parents gave me $8,000 to pay off a car before my daughter was born. I believe the money was part of an inheritance from my grandparents that I might receive in the future, but I’m not positive.

Day One

5:45 a.m. — I wake up to my two-year-old kicking me and sticking her fingers in my mouth in her sleep. Sigh. This is how I wake up pretty much every morning. I quietly slip out of bed. My dog, who is asleep under the covers, does not budge. She’s not a morning person. I set up my coffee to brew on a timer, so it’s ready for me when I get downstairs. My partner is out on a walk with our other dog. I take a few minutes to sip my hot coffee in silence before I cut up a mango for my lunch and throw a waffle in the oven for my daughter.

7 a.m. — Out the door! I drop my daughter, G., off at daycare and then drive to work.

12:45 p.m. — Because I work at a residential treatment facility, my job provides us with lunch and snacks. I usually pack myself something small, just in case I don’t like what’s for lunch, but I’m really grateful for a job that feeds me. Today’s lunch is a French dip sandwich, which I don’t like, so I have a side salad with nuts, my mango from home, and crackers.

2:15 p.m. — Work has had a lot of drama recently, so my officemates and I discuss what’s been happening. I think that companies that say “we’re a family!” are toxic, but I’ve really found that my boss and colleagues at this job are truly like a family.

4:30 p.m. — Quitting time! I pick up my daughter and start the long commute home. There’s traffic, of course. When we get home, I take the dogs out, throw some dinner (homemade falafel from the freezer) in the air fryer, and change into shorts.

7:15 p.m. — Dinner time with a toddler is… exhausting. I clean up the dinner mess, bribe G. into her stroller with raspberries and Hershey’s Kisses, harness up the dogs, and we’re off for a walk. We do three miles.

9 p.m. — G. is finally asleep. I set up the coffee for tomorrow morning, have a quick chat with my partner (he works 12-hour shifts, so he’s gone a lot) and then head upstairs. My horse was seen by the vet today, so I’m expecting an invoice and some advice from the vet on her visit. My horse is elderly (26!) and is struggling with skin problems and low weight. The vet recommended bumping up her feed and left me some medicated shampoos and antibiotics. I pay the invoice while internally groaning. This is outside my budget but I won’t deny my horse the care that she needs in her old age. I make a mental note to Venmo the barn manager a holding fee (you have to pay when they hold your horse for the vet) in the morning. $251

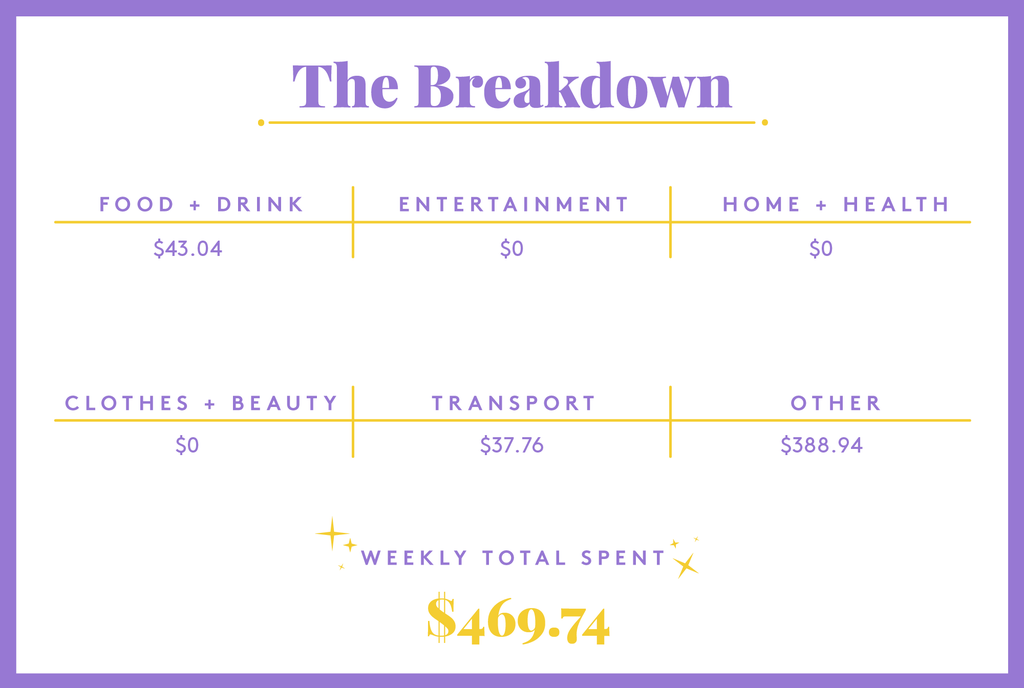

Daily Total: $251

Day Two

6 a.m. — Finally Friday! G. is going to the pool with her dad and cousin today, so I have an easy morning. I drag my grumbling dog out of the bed and we go on a quick walk.

12:30 p.m. — A busy day at work again. I have a quick lunch of vegetarian pot pie.

3:30 p.m. — I Venmo the barn manager money for holding my horse during her vet visit. $50

4:30 p.m. — I shut everything down for the weekend and head home. I have a long commute (about 35 minutes with no traffic), but it’s often the only alone time I get in a day, so I cherish it.

5:30 p.m. — I get home before my partner and G., so I take the dogs for a quick spin around the block. It’s nice outside and we’re all happy to be moving after spending the day cooped up.

6 p.m. — My partner, R., and G. get home from the pool. G. skipped her nap today because she was having so much fun with her cousin and she’s that cranky level of tired that’s terrifying. I manage to get her to eat a small dinner of cheese and crackers but I can’t push off bedtime any longer. She’s asleep in her crib by 7:15 — an hour and a half earlier than usual!

8 p.m. — My partner and I sit outside with the dogs for a few minutes, then we go inside to watch Criminal Minds for the millionth time.

10 p.m. — I head upstairs, brush my teeth, take my contacts out, and settle in bed with a new book. It’s lights out by 11.

Daily Total: $50

Day Three

6:35 a.m. — Toddlers don’t understand the concept of sleeping in on the weekends. R. is working, so it’s just me and G. today. We take the dogs for a walk. G. eats her breakfast (waffles and blueberries) in the stroller while we walk.

9:15 a.m. — G. and I take our puppy over to my boss’s house. We’re going on vacation and my boss will be pet sitting, so we want to make sure our dogs get along, which they do!

11:30 a.m. — Back home. I make G. a quick lunch of cheese, crackers, yogurt, and an apple. She asks to take a nap afterward, so I rock her to sleep and then sneak out of her room. I take the dogs out, then throw a veggie chicken patty in the oven for my lunch. Juuuuust as I’m taking my food out of the oven, I hear G. wake up. I swear I haven’t had a meal alone in two years.

2 p.m. — After some couch snuggles and a snack, G. and I leave to go to the feed store. My horse is on senior feed, which is pricey, but I don’t have the upfront money to buy her feed in bulk, so I end up at the feed store every few weeks. I buy three bags of feed. While we’re there, I bump into an old friend from when I used to ride horses competitively. I haven’t seen her since before I had my daughter, so it was nice to see her and for her to briefly meet G. $66.75

3:30 p.m. — G. and I stop at Kroger before meeting a friend at the park. We get some cases of sparkling water, mangoes, one banana, Goldfish, Pop Chips, and a small slab of fancy cheddar cheese to snack on. $38.95

4 p.m. — We meet my friend, J., at the park. We chat about life and work while we push G. on the swing. Between COVID and new parenthood, I’ve lost a lot of my old friendships and I’ve found it hard to form friendships with other parents as I seem to be younger than most parents in my area. I’m so incredibly thankful for J. and her friendship. We’ve been friends for nearly a decade and hardly go more than a few days without talking.

5:30 p.m. — At home, I make a quick dinner of tortellini, tomatoes, mozzarella balls, and balsamic glaze. Of course, G. takes two bites before declaring, “Don’t like it, mommy!” Ugh.

6:30 p.m. — After cleaning up from dinner, we pack out for another walk with the dogs.

8 p.m. — G. has her bath, pajamas, books, snuggles, and sleep. R. is finally home and hungry. He’s not a vegetarian like I am and I refuse to cook multiple meals, so we rarely eat the same thing. Also, he just has an odd diet. He says he’s gonna order a pizza and asks if I want anything. I remember I have a coupon for a free pizza from the place down the road, so we use that and I get an order of breadsticks. We pay with my card ($15.19) but R. Venmos me the money right back. We eat our food, watch New Girl, and snuggle with the pups.

10:30 p.m. — Contacts out, teeth brushed, in bed with a book. I don’t wear makeup, so it’s a pretty quick morning and nighttime routine for me. Lights out by 11.

Daily Total: $105.70

Day Four

6:30 a.m. — Up and at ‘em again. G. wants yogurt, the puppy wants to go out to play, and our older dog still hasn’t dragged herself out of bed. R. is working another 12-hour shift, so I’m solo again. I’m dropping G. off at my parents’ this morning so I can have some alone time at the barn with my horse.

8:30 a.m. — I get everyone fed and we go for a walk. The weather is so amazing, especially for Virginia — I actually need to wear a flannel!

10:30 a.m. — I drop G. off with my dad (who she is obsessed with!). I get gas ($37.76) and run inside the store to get a seltzer water and some popcorn ($4.09). It’s nearly an hour drive to the barn and I haven’t eaten yet today, so I’m feeling snacky. $41.85

2:30 p.m. — I spend about an hour giving my horse a bath, then I let her hang out in the sun and graze for a while. I hate that I can’t see my horse as much now that I’m a parent, and I miss riding. I got her when I was 16, so we’ve been together for a decade, and we used to show competitively. Unfortunately, my biggest financial stressor is also my horse. 16-year-old me had NO concept of the cost of owning a horse because my parents were bankrolling it at the time. I was lucky to have them continue to cover the cost until I was 24. I’m also lucky to have a barn manager that gives me 50% off on board because she knows my situation and knows how much I care for my horse. So, I’m lucky in a lot of ways, but I am also cognizant of the fact that I am spending beyond my budget a lot of months, due to my horse and the care that she requires as she ages.

4 p.m. — G. and I play in my parents’ yard for a while. My biggest financial goal is to buy a house, so I can give G. and my dogs a yard to play in.

5 p.m. — My mom offers to feed G. dinner while we’re over and I won’t turn that offer down. She has macaroni and cheese and carrots for dinner. I nibble at her food when she offers me bites, but I’m not really hungry, so I don’t eat.

6:30 p.m. — We get home, feed the dogs, take them out, and then I plop down on the couch. I’m tired. R. will be home in about an hour and I’m counting down the minutes until I have a co-parent. I used to feel guilty asking R. to help with G. after he’d worked a long shift, but I’ve started reminding myself that parenting is work, too, and I deserve a break as much as he does.

9 p.m. — Ugh. G. did not want to go to bed tonight. I need to shower and I have a mountain of dishes to wash. I just want to collapse on the couch. No matter. I set my laptop up to watch Netflix while I wash dishes. I scrub through them in no time, set the coffee up for the morning, and head upstairs to shower.

10:30 p.m. — Shower, contacts out, teeth brushed, in bed with a book! Pretty much the nightly routine. I’m asleep by 10:30.

Daily Total: $41.85

Day Five

6 a.m. — Monday. Need I say more? R. is working yet another 12-hour shift, so he’s already up and walking the dogs. He picks up a lot of shifts because his job is low-paying, despite being a healthcare provider. He’s an extremely hard worker, and I’m proud of him, but I hate seeing him work 50-60 hours a week and miss out on so much time with his daughter and family.

7:30 p.m. — Somehow we all managed to get out of the door in one piece. I drop G. off at daycare and head to work.

11:30 a.m. — Work is busy and I’m tired. My job takes a lot out of me emotionally so I take a short walk out to the dumpster to get some fresh air and sunlight. Lunch is a veggie burger and a side salad. Again, I’m so grateful for the free lunches and snacks at work. It drastically cuts down my grocery bill.

4:30 p.m. — I made it through Monday! My boss and I walk out together, and I head to daycare to pick up G. When we get home, it’s the normal routine — take the dogs out to the bathroom and make dinner.

7 p.m. — It’s super hot outside, so our walk this evening is short and sweaty. When we get home, I see a package on our front stoop. We’re going to the beach for vacation next week and G. needed a bed to sleep in. My mom was kind enough to order her an inflatable child-sized air mattress with bumpers on the side. There’s no way R. or I could have afforded this right now. I blow the bed up and G. wants to test it out. She lays down with one of her dolls and asks me to cover them up with a blanket. We play “fake night-night” for a while and then I put G. to bed.

9:30 p.m. — I wash dishes, set up the coffee for the morning, shower, and then R. and I hang out and cuddle with the dogs for a little bit before I head upstairs. Lights out around 10:45 p.m.

11:30 p.m. — I wake up, tossing and turning for about an hour. I’m stressed about money, stressed about vacation next week (vacation is never as fun when you don’t have any money to spend), and stressed about G.’s upcoming birthday. Bleh.

Daily Total: $0

Day Six

5:30 a.m. — G. wakes up and gets in bed with us so I’m up early. I slip out of bed, pour a cup of coffee, and take the puppy out for a loop around the block.

7:35 a.m. — I drop G. off at daycare and now I’m headed to work. I’ll be a few minutes early, and I’m hoping no one else is in the office yet so I can sit down and work out a quick budget. I’m stressed about money because of all the medical expenses for my horse. I’ve had to transfer money out of my savings several times in the past six weeks and I’m not sure when I’ll be able to replenish what I used.

12:30 p.m. — I’m not a fan of today’s lunch offering at work, so I end up eating a hodge-podge of things — a side salad, Greek yogurt, and some crackers. Hopefully, that’ll hold me over until dinner.

5:30 p.m. — G. and I are home. R. was off of work today, so the dogs don’t need a walk or bathroom break yet. I make breakfast for dinner and G. loves it.

7 p.m. — We go for our nightly walk. G. insists that R. pushes her stroller, so I hold the dogs.

9 p.m. — G. is asleep, the dogs are asleep, and the TV is calling my name. I forgo dishes for the night (I know I shouldn’t do that, but it’s only a few and I honestly just do not feel like doing them). I want to relax, so R. and I watch the latest episode of Only Murders in the Building.

10:15 p.m. — I put on moisturizer, brush my teeth, and take out my contacts. R. and I fight for space on the bathroom counter, throwing elbows instead of maturely waiting for the other to finish. We get in bed around 10:45.

Daily Total: $0

Day Seven

6 a.m. — Same routine, different day.

12:30 p.m. — Wednesdays at work are breakfast for lunch, so lunch is eggs, fruit, and French toast casserole. I didn’t consider that I’d be having breakfast for lunch today when I made breakfast for dinner last night. Feels a bit excessive, but I’ll survive.

4:30 p.m. — I pick up G. from daycare and make a quick stop at the pet store to get dog food. When I get to the pet store, they have a sign on the door saying they’re closed except for grooming and training. Great. It’s a pain to run errands with a toddler and now G. is screaming because I hauled her out of the car and she didn’t get to go shopping. Luckily we’re only five minutes from home.

6 p.m. — We have a quick dinner of taco bowls (and R. actually eats the vegan “meat”!) and then I head back out to the pet store again.

6:45 p.m. — I am striking out. I get to the second pet store and they’re closed. I hop back in the car and head to a different chain of stores across the road. This store doesn’t carry the brand of food we use. Par for the course, I guess. I buy a small bag of a different brand to hold the dogs over while I order their usual food. Hopefully we don’t end up with a week of stomach problems due to my poor planning. $21.19

7:30 p.m. — R. is giving G. a bath when I get home and I can hear lots of splashing and laughing. I decide to feed the dogs and clean up from dinner while they’re playing, so I don’t have to do that once G. goes to bed. I clean the kitchen, set up tomorrow’s coffee, and take the dogs out before I head upstairs to put G. to bed.

9 p.m. — I’m tired. I don’t like leaving the house after I get home from work (evenings are stressful and rushed with a toddler!), so this evening’s run around town for dog food has made me kinda grumpy. I get my planner (custom from Personal Planner) and flip to the budget section. I’m about to make myself even more grumpy. In the past two months, I’ve transferred over $600 from my savings to cover expenses for the dogs and my horse. I’m stressed about the amount of money that I’ve had to spend, but I love my animals so much and I can’t deny them care. G.’s second birthday is next week and I don’t have the money for a gift. She doesn’t want/need anything and is too young to know the difference, but the mom guilt is real. I make a budget for the next two weeks, having to cut a lot of my grocery budget and only pay partial bills.

11:30 p.m. — I go to bed stressed and a little grumpy. R. and I let the puppy sleep in the bed with us tonight because I could use the extra cuddles. I know things will improve financially at some point (daycare costs will go down, I’ll get a raise, R. will move up in the medical world), but I’m impatient. I can’t wait for the day that I don’t have to stress over money so much.

Daily Total: $21.19

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Birmingham, AL, On A $50,000 Salary

A Week In Coastal Virginia On A $88,000 Salary

A Week In North Florida On A $370,000 Joint Income

from Refinery29 https://ift.tt/sHz6XNt

via IFTTT