Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a global public relations manager who makes $55,378 per year and spends some of her money this week on a puppy.

Editor’s Note: All currency has been converted to USD.

Occupation: Global Public Relations Manager

Industry: Tech & Software

Age: 26

Location: Tel Aviv, Israel

Salary: $55,378.44

Net Worth: `~$13,000 (I have $13,000 in my savings account. I am enrolled in my company’s ESPP (Employee Stock Purchase Plan), where they take out 12% of my salary to buy stocks over six months, this comes out to roughly $663.39/month. This will be $60,000 vested over four years, but currently I don’t have access to this money.)

Debt: $0

Paycheck Amount (1x/month): $2,735

Pronouns: She/her

Monthly Expenses

Rent: $901 (I live with my boyfriend and we split the rent of our apartment equally, the total is $1,802).

Streaming Services: $0 (I’m on my mom’s accounts).

Phone Plan: $0 (Work covers my international phone plan).

Workout Studio: $86.53

Gym Membership: $0 (My mom covers this, I literally just go for the treadmill to do 12/3/30).

Healthcare: $23.15 for the premium healthcare plan through the government (Israel has universal healthcare, but I pay a little extra for a higher package. I’m considering getting private insurance since wait times are so long).

Wells Fargo: $10 (I pay this to keep my American bank account open).

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes, my parents didn’t really talk about options outside of going to university. My mom has an MBA, but my dad didn’t go to college. He ran his own construction business, but we were always told it wasn’t what he wanted to do and he was limited due to his education. There was always an expectation that we put part of our birthday money or holiday money into a savings account for school. In the end, that savings account didn’t have enough money to pay for my private school degree, but it was important to my parents that I graduate with no debt, so they took on the debt themselves. I am very privileged in that sense. I was a nanny while in college to pay for my day-to-day expenses, but my parents covered tuition and rent.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My parents always tried to educate us about money. We were taught about savings but also always about giving back. If we were given money, we always put some in savings and gave some to charity. Once I was in middle school, my parents would try to have me pay for smaller things myself (like clothes I wanted that weren’t a necessity). I was never educated about taxes or bills and never knew how much my parents earned.

What was your first job and why did you get it?

I started babysitting when I was 13 or 14 years old. I also worked weekends at a local consignment shop. In high school, I was expected to pay for all my ‘fun’ stuff. Anything with friends, clothes I wanted, my car, gas, etc. I worked really hard to have enough money to buy a used car when I turned 16. My parents would pay for all the maintenance but I was responsible for gas.

Did you worry about money growing up?

No. I knew we weren’t rich, but my parents never made me or my siblings worry about money. In high school, my parents moved us to a more affluent neighborhood so we would be in a district with a better public high school (in the US where I grew up). I felt the socioeconomic difference there, but I never worried we didn’t have money.

Do you worry about money now?

A little. I really think about everything I’m buying. I don’t feel as though I am living paycheck to paycheck, and in Israel my salary (my combined salary with my boyfriend) puts us in the upper middle class, but I still get nervous spending money.

At what age did you become financially responsible for yourself and do you have a financial safety net?

24. I am fortunate that my parents supported me all through university and even a little bit after. When I first moved from the United States to Israel, I lived with my grandma and had a really low-paying entry job. My grandma covered food and rent and my parents still gave me money so I could go out and enjoy my new life in Tel Aviv. They also would pay for my tickets home. At 24, I moved into an apartment with roommates and my parents told me that if I decided to do that, all the financial burden of rent and bills would be on me. My grandma would still drop off groceries for me (because she wanted to, not because she needed to), but I was responsible for everything. I live with my boyfriend now, but if anything were to happen, my parents would step in financially. If I wanted to leave Israel, I know my parents would support me while I got my footing in the US.

Do you or have you ever received passive or inherited income? If yes, please explain.

No.

Day One

8:15 a.m. — Alarm goes off and it’s time to get up and get ready for work. P., my boyfriend, wakes up with me and we get ready, make a coffee (Nespresso cappuccino for me), and take our foster dog, N., out for a morning walk together and feed him.

9:15 a.m. — I decide to test out taking our foster dog to the office to see how he does (I work at a dog-friendly office) and P. offers to drive us. Once at work, I get breakfast. My work provides a free breakfast that consists of fresh pastries, salads, cheeses, fruits, and veggies. A few hours later, I eat lunch which is a salad I brought from home and a small can of tuna on the side.

4:20 p.m. — N. did great! P. comes to pick us up.

6 p.m. — Go to Pilates at my workout studio (in monthly expenses).

7:30 p.m. — Grab a beer from the fridge and take N. out for a walk with P. We discuss taking the next step with N. to adopt him (we’ve been fostering him for a week now). On the walk, we stop at the pet store to buy dog bones ($27.98/$13.99 for my half). $13.99

8:30 p.m. — P. and I both deposit money into our joint account ($432.64 for my half). P. and I have a shared account that we deposit money into monthly. This card is used for home expenses, when we go out for drinks/dinner, and now for expenses related to N. On the walk we decide to adopt N. and P. sends the payment to the organization to adopt it (it’s an adoption package that covers his vaccinations and his neutering surgery). I Bit (Israel’s version of Venmo) P. for half ($116.09). We throw together a quick dinner (couscous, veggies, and tilapia), drink some white wine, and watch The Crown. We go to bed around 11:30. $548.73

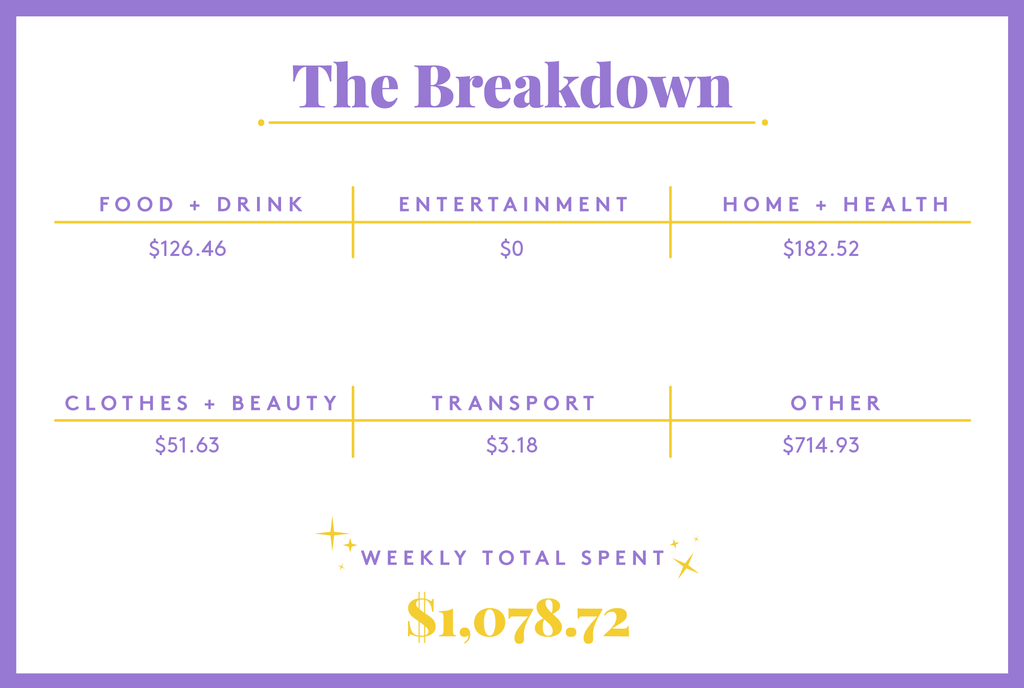

Daily Total: $562.72

Day Two

7:20 a.m. — Wake up, snooze, feed N., and head to work. I take the shuttle to the office, which is free. I eat my usual breakfast of random salads, cheese, and veggies.

3 p.m. — I eat lunch I brought from home (leftover couscous and veggies). P. is WFH and has a light workload today. He goes out and buys groceries, alcohol, and other things we need for the apartment. He uses a food card my work gives me for part of the groceries ($40.28 goes on the food card and we pay $137.04/$68.50 for my half). In Israel, food stipends are a common workplace benefit. $68.50

7 p.m. — Home after a long day! Lay in bed and scroll TikTok for a bit. P. comes home from his walk with N. and we open a bottle of wine. P. makes me my favorite dinner of schnitzel and fries and we watch The Crown.

10 p.m. — Take N. on one last loop before bed. We’re asleep by 11:30.

Daily Total: $68.50

Day Three

7:45 a.m. — P. and I both wake up. N. is getting neutered today and can’t eat breakfast (doctor’s orders), so we get ready, make coffee, take him for a walk, load him in the car, and head to the vet.

9:30 a.m. — N, is dropped off at the vet and P. is able to drive me to my therapy appointment so I don’t have to take the bus. I’m a few minutes early to the appointment so I stop into a hair products store and grab a Moroccan Oil conditioner since I just ran out. $25.67

11 a.m. — My therapy appointment ends and I pay ($129.79). This was my second session. I decided on my 26th birthday (late last month) that I wanted to address some underlying issues and try out therapy. I’ve been putting off trying therapy for years due to the expense of it (it’s really hard to find an English-speaking therapist in Israel that is covered by insurance, and the ones that are available have a very long waitlist). I learn about CBT and leave with something to try out in the next two weeks before my next appointment (I’m doing biweekly since it’s what I can afford at this point). I head home, eat a Greek yogurt with granola, cinnamon, and honey. I work from home until N. is ready for pickup. $129.79

3 p.m. — N. is done! P. was able to get out of work a little early and we drive over together to pick him up so one person can go in and the other person can circle with the car. The garage is expensive and there’s no street parking so this is the best solution. The surgery is covered by the adoption package but we pay $74.99 ($37.50 for my half) for blood tests. When I get home I make a large chicken salad. $37.50

5:30 p.m. — I go to a reformer Pilates class (part of a three-class introduction package I bought for $54.51 at a local pilates studio, so I don’t pay today). This is pretty expensive for Israel prices, so I won’t be continuing with reformer Pilates once I use up this introduction package.

7:00 p.m. — Home. I’m in a baking mood so I make us brookies (brownies on the bottom, cookie on top) while P. makes us dinner (leftover couscous, fresh veggies, and salmon). We put in a big Amazon order for stuff for N. The local pet stores are almost double the price so it’s worth ordering online and waiting the two weeks it takes for it to come to Israel. We buy a big bed for him, toys, a dog bowl, a brush, and some other small things ($132.84/$66.42 for my half). We do our boring routine of eating, watching The Crown, dog walk, and bed around 11:30. $66.42

Daily Total: $259.38

Day Four

7:30 a.m. — Alarm goes off for me to go to an 8 a.m. workout. No thanks. Set my alarm for 9 and go back to sleep.

9:30 a.m. — Up, have a coffee, shower, and start work. P. is also WFH and handles feeding N. and taking him for a walk. When he gets back from the walk, P. makes us breakfast “crunch wrap supremes” (basically a fancy folded tortilla with eggs and veggies) and a side salad.

2 p.m. — I make a big veggie salad with canned tuna for lunch for P. and me.

5 p.m. — Wrap up work and head out for a manicure. I do a neutral color with white waves/squiggly lines ($1.59 for the public bus and $25.96 for gel nails with a design + gel removal, a steal for Tel Aviv prices). $27.55

7:40 p.m. — I take the bus home ($1.59). P. is at a workout but fed N. before he left. I play with N. and watch TikToks on the couch. P. gets home around 8:15 and makes us chicken wings and fries. We watch The Crown, eat, walk N., and then get in bed. $1.59

Daily Total: $29.14

Day Five

6:30 a.m. — Alarm goes off for me to go to a 7 a.m. workout. N. was really upset having to sleep with a cone on and kept us up all night thrashing around the apartment (bumping into things and knocking them over). Not happening. I didn’t sign up for the class in case this happened, so nothing is lost. Reset my alarm and back to sleep.

7:30 a.m. — Time to actually get up. We get our electric bill so we pay it immediately ($96.24/$48.12 for my half). In Israel, the bill comes every three months instead of monthly so this will keep us covered for a while. I feed N., take him for a walk, get ready, then catch the shuttle to work. $48.12

10 a.m. — I get to the office and grab breakfast (plate with veggies, cheese and some egg salad) and my second coffee of the day.

11:30 a.m. — P. picks up hypoallergenic dog food. N. has been a little itchy and sneezy and P. is convinced he’s allergic to something. My brother is a dog trainer in Los Angeles and suggested we try grain-free, salmon-based food ($43.26/$21.63 for my half). I use this time to grab a third coffee of the day. $21.63

4 p.m.— I take the shuttle home, change into workout clothes, and then head out to a workout class.

6:45 p.m. — Home, shower, feed N., watch Handmaid’s Tale, and eat cheese and crackers.

8:15 p.m. — P. comes home and we take N. on a 30-minute loop then go out for dinner. It’s the start of the weekend here and all the bars are packed. We get burgers, fries, and beers. The total comes out to $34.03, but I use my food card from work so it’s technically free.

10 p.m. — We get home and I make a Lillet spritz, play with N., have some couple time, and by midnight we’re both asleep.

Daily Total: $69.75

Day Six

6:45 a.m. — P.’s alarm goes off for him to get ready to head to his part-time grad school classes. I hear him feed N. and fall back asleep.

9:30 a.m. — I want to sleep more, but I’m awake. I get out of bed and N. is FULL of energy. I can’t even sit to drink a coffee so I brush my teeth, wash my face, throw on leggings, and make coffee in a reusable to-go cup, and immediately take him on a walk.

10:20 a.m. — We are back from a nice 45-minute loop. I make myself Greek yogurt with cinnamon, a drizzle of honey, and granola. I eat and quickly change. Then, I go meet my friend, D.

11 a.m. — Meet my friend, D., for coffee. It’s so nice to catch up with her! $6.92

12:30 p.m. — Errands time. P. needs a soft bristle toothbrush so I pick that up for him ($9.23/$4.61 my half). At the grocery store, I stock up on veggies, eggs, dairy products, and cleaning supplies ($33.75 total — I pay $28.84 with my work voucher and $4.90 from our joint account, so my half comes out to $2.45). I also stop for fruit ($5.19 total/$2.60 my half). I also stop for a bottle of wine ($10.38) and pay for that with my card. $20.04

1:15 p.m. — Home. I feel like I got a workout from all the walking around and carrying the groceries. Give N. some love, open the wine, and start tidying the apartment. (P. and I evenly split chores but he’s literally in school ALL day and has done the majority of the housework this week so I’m happy to do it all today.) D. texts me if I still have energy and want to do a doggy playdate. I invite her over.

2:15 p.m. — P. arrives home at the same time D. and her dog arrive. D. brought a bottle of wine so we crack it open and the dogs play. While we drink, I make us tofu spring rolls and P. makes homemade corn tortillas for us to freeze. D. stays for a while then we clean up and P. and I nap.

9 p.m. — P. and I make burrito bowls for dinner and then get ready to go out.

10 p.m. — We walk to a nearby bar. We get two pitchers of beer and some shots ($46.44/$23.22 for my half). $23.22

1:30 a.m. — Home and straight to bed.

Daily Total: $50.18

Day Seven

10:30 a.m. — Wake up, make coffee, and feed N. P. wakes up a little after me and we walk N. and decide to take him for a fun hike today since it’s 78 degrees. We pack up the car, find a hike, and head out.

1 p.m. — Wow things could not have gone worse today. N. is still getting used to the car and threw up twice, we thought we’d find breakfast but forgot outside of Tel Aviv everything is pretty much closed (we ended up finding a jachnun, a Yemenite Jewish pastry you eat for breakfast, stand, $22.50/$11.25 for my half), and ultimately turn around and just go home. On the drive home, I order a backseat car cover for dogs, a muzzle to take N. on public transit (a law in Israel), and a salt and pepper bowl ($53.32/$26.66 for my half). $37.91

1:30 p.m. — We spend the next hour cleaning the car and then decide to not let the bad morning ruin the day. I chug a glass of rosé, open a beer, and we walk down to the beach. We walk along the boardwalk and eventually make our way home. We stop and grab oranges from a market on the way back. $1.14

6:30 p.m. — P. makes orange chicken for dinner while I watch TikToks on the couch. We eat dinner and watch two episodes of The Crown.

8:45 p.m. — P. and I take N. for his evening walk. Get home, shower, and get ready for the start of the week tomorrow. In bed by 10:45 and fall asleep before P. goes to bed.

Daily Total: $39.05

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Chicago, IL, On A $65,000 Salary

A Week In New York, NY, On A $180,000 Joint Income

A Week In Boston, MA, On A $202,000 Joint Income

from Refinery29 https://ift.tt/IAF8Tqn

via IFTTT