Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a program specialist who has a joint income of $108,000 per year and spends some of her money this week on a microwave.

Editor’s Note: This Money Diary was written in November 2022.

Occupation: Program Specialist

Industry: Local government

Age: 27

Location: Portland, OR

Salary: $68,000

My Husband’s Salary: $40,000

Net Worth: $32,800 (Savings: $22,000, investments: $25,500, retirement savings: $13,100 minus debt. My husband and I typically split bills equitably from a joint account. We put almost all of our spending on a credit card which we also pay in full every month from the joint account. We usually put 20% each into private savings accounts, but haven’t maintained that structure for a few months since he took a pay cut and we’re in the middle of buying a home.)

Debt: $12,100 in student loans, $15,700 left of my car loan. My full student loan balance will hopefully be erased by Biden’s forgiveness plan.

My Paycheck Amount (2x/month): ~$2,100

My Husband’s Paycheck Amount (2x/month): ~$1,100

Pronouns: She/her

Monthly Expenses

Rent: $2,000 (includes water and trash)

Car Payment: $240

Student Loans: still paused

Electric: ~$100

Wi-Fi: $80

Gas: ~$20

Car Insurance: $80

Hulu: $14

Husband’s Cell Phone: $90 (I’m still on my family’s plan)

Streaming Services: We use family’s Netflix, Amazon Prime, and any other streaming needed.

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

I never felt majorly pressured to pursue higher education, but it always seemed inevitable to me. My parents were both very low-income for most of my childhood, so it was understood that college would only be doable if I maintained good grades and got scholarships. I did receive several scholarships but eventually lost some of those scholarships because I was in the wrong field and failing courses. I had a patchwork of scholarships, work-study, and student loans covering my last two years of college after I switched majors and started keeping better grades.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My mom was my model for finances and she was always very open. She taught me how to balance a checkbook, find coupons, and stay on a tight budget. I always knew she had multiple jobs, government assistance, and help from family members. She’s always shared her salary with me and would be honest about how much things cost.

What was your first job and why did you get it?

My first job wasn’t until I got into work-study in college. My scholarships actually fully covered my costs and then some, so my work-study funds were just for spending money and sorority dues. That was until I lost some scholarships and started using the money for school costs.

Did you worry about money growing up?

Absolutely. I was born when my mom was in high school, so it was never going to be easy. My parents divorced when I was seven and I always knew finances were extremely tight for both of them because my mom received a mix of government and family support. She eventually got her bachelor’s degree and landed a decent-paying permanent job, but my sister and I still caused a lot of pressure since we were dedicated to our sports and extracurriculars. We were also probably pretty bratty about having nice things because our friends’ families were definitely not in the same financial situation, so jealousy was natural. We always knew we were straining my mom financially, but she still managed somehow.

Do you worry about money now?

Yes, it’s a daily stressor for me. My husband and I had a lot of learning to do about each other’s relationship with money and it was a big strain on our relationship when we first started living together about five years ago. We’re finally comfortable now, but we did take a big hit when he switched careers this year. It was absolutely necessary for his sanity, but the financial adjustment has been pretty stressful.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I have paid for my own rent, living costs, and daily spending since getting an apartment in college, but I did have family support in terms of health insurance, car payments, and other small bills through the end of college. I have several months of living costs in emergency savings and other readily available assets, but I know I could always move back home with my mom and have a lot of support if I really got in an emergency.

Do you or have you ever received passive or inherited income? If yes, please explain.

No.

Day One

8 a.m. — I wake up with no missed calls or texts from my realtor or mortgage loan consultant, so I’m considering this a win. I do my morning scrolling routine which lately has included Zillow, Betterment, Instagram, and TikTok, in that order. I eventually get up, do skin care, and take my dog out for a walk.

10 a.m. — After my only meeting of the day, I grab a nutritious bowl of Frosted Flakes. I give my escrow people a call to make sure my earnest money (around $3,400) was received from my mobile transfer a couple of days ago, but they’re closed.

1:30 p.m. — My husband, H., and I both have leftovers for lunch. I get an email that my mortgage application has finally moved into underwriting — can’t wait for complete strangers to pore over all of my finances from the past year!

6 p.m. — After stressing over a list of things we need to buy for a new home, we decide to make a Lowe’s run. We get a manual push mower on clearance, moving boxes, and a dog door ($95). We dream about appliances we’ll never be able to afford. We grab Taco Bell for dinner, which we immediately regret since we still have leftovers in the fridge ($23). We stay up late watching Lost since it’s a Friday and head to bed around 1 a.m. $118

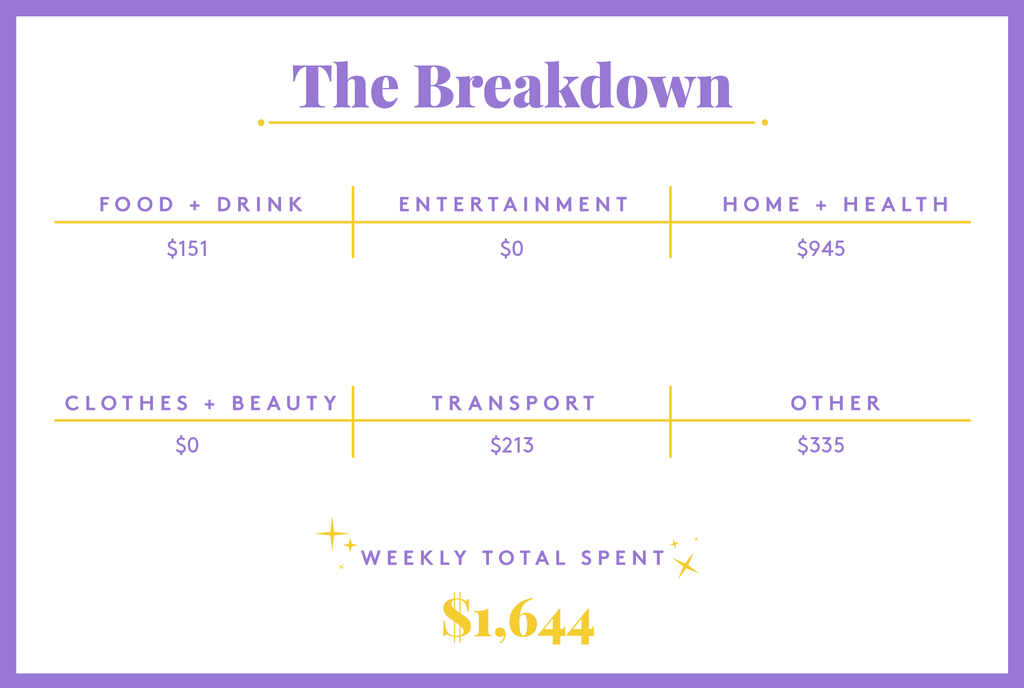

Daily Total: $118

Day Two

11 a.m. — I begrudgingly roll out of bed and find H. making pancakes for breakfast. I spend a couple of hours trying to figure out Christmas gifts for family members. I decide on a phone photo printer and photo album for my brother- and sister-in-law ($115) and digital photo frames that we can send pictures to for both my mom and mother-in-law ($94 each, $205 total). I also order myself one of the photo albums to hold all the tiny polaroids I have laying around ($15). $335

2 p.m. — We head out to run some errands. First, we drop off our bottle recycling bags — there’s a program in Oregon where you can be refunded your bottle tax for recycling bottles and cans at special drop sites. This adds up over time, so we let it accumulate for a few months until it can cover a grocery bill. Next, we stop in some antique stores to look for holiday decor and H. wants a special cornbread pan. We find both! Now we’re behind schedule for cooking for Friendsgiving, so we rush home and get started. $39

6 p.m. — Finally heading out for Friendsgiving, we bring deviled eggs, Brussels sprouts gratin, and beer. We stop for gas on the way there. $30

12:30 a.m. — We definitely didn’t expect to stay out this late! We get home full of good food and gratitude for great friends.

Daily Total: $404

Day Three

11 a.m. — Another late weekend wake-up call. I get up to walk the dog and have my Frosted Flakes. We’re out of cat food, so I send H. on a quick grocery run to grab a few things while I get the house cleaned up. $25

2 p.m. — Today is my favorite holiday: Christmas Tree Picking Day. We stop by the hardware store on our way to the farm to grab a new blade for our little power saw. I also grab packing tape ($22). We get to the cute little farm and do our searching before landing on the perfect tree. I am absolutely baffled when we get the bill: $120!! Apparently, we picked the most expensive kind of tree. How am I supposed to know what kind of tree I’m looking at? I’m so annoyed with myself, but still decide to check out the farm store anyways. I exercise extreme willpower and do not buy all the cute decor and garlands, but I do give in and buy some dilly beans ($8) since they’re my favorite snack. $150

5 p.m. — We spend the rest of the night decorating our tree, eating the last batch of Thanksgiving leftovers, and watching Lost before heading to bed around 11. My definition of a perfect night!

Daily Total: $175

Day Four

8 a.m. — Back to reality, my morning starts with a missed call from my escrow people confirming that they’ve received my earnest money payment. I walk the dog, have breakfast, and spend a couple of hours working before I log off to head to our home inspection — eeeek!!

1 p.m. — The inspection goes pretty well. No major surprises, but there are some needed improvements that we didn’t have on our radar. The house is such a good price that we’ll still have cash for repairs and upgrades. Now we patiently wait for the official report to come back. I rush home after the inspection and hop on a meeting. I heat up the last bit of pecan pie and call it lunch.

5:30 p.m. — H. gets home from work and I give him the rundown on house stuff. We make a prioritized list of repairs and improvements, which eases my stress a bit. The list of things we need to buy and pay for just keeps growing. We make a grocery run to grab some food for the week. We get sandwich things, coffee, breakfast pastries, snacks, veggies, and a few other essentials. $54

7:30 p.m. — I have boxed mac and cheese for dinner (my go-to stress meal) before getting ready to head out for volleyball. I play in a rec league every Monday and this week’s game is at the insane time of 9:30 p.m. We play valiantly, but we lose just as we have every other game. I get home around 11 and promptly take a shower and go to bed.

Daily Total: $54

Day Five

8 a.m. — I’m up, doing my morning scrolling, and walking the dog before logging on for back to back to back meetings.

1 p.m. — Break for lunch — I’m having a sandwich today. I take some time to review my credit card balance and make a payment. We put all of our expenses on our credit card and pay it off fully each month, but I’m afraid we might actually end up carrying a balance this month for the first time ever because of all of our spending on the new house. When talking to my therapist about my financial anxiety, she said any interest I accrue could just be considered a convenience fee for my sanity.

4 p.m. — I get some requests from my lender that prompt a bit of a mental breakdown. I chat it out with my realtor and feel a little better. I have one more meeting before logging off around 6. My lender calls to chat things out. I’m exhausted.

6:30 p.m. — I work late then go out to pick up a microwave from Facebook Marketplace because the new house doesn’t have one ($40). Afterward, I head home to make chicken salad and pickled red onions for lunch this week and chicken noodle soup for dinner. $40

9 p.m. — It’s travel Tuesday, so I knock out the return flights for a trip home to the southeast in January. We’re flying into one city and out of another, so I booked our flight there with credit card points a few weeks ago. I realize that I have $200 in United credit so I only end up paying $183 out of pocket for $800 in flights! $183

Daily Total: $223

Day Six

9 a.m. — I get a late start since I worked late yesterday. I have my usual bowl of cereal with an iced coffee. In my inbox, I’ve got my home inspection report and invoice, which I pay right away. I spend the rest of the morning reading the report and sharing it with family members to get their opinion. $400

1 p.m. — It’s a slow work day today. I have a sandwich for lunch and spend most of the afternoon dividing my attention between emails and catching up on The White Lotus.

4:30 p.m. — After work, I’ve arranged for someone from my neighborhood Buy Nothing group to pick up a chair. We’ll have plenty of things that we don’t want to move with us, so I’m trying to get started early. Afterward, I convince H. to make a HomeGoods run with me. I have a whole list of things I want, but we only end up finding a blanket basket. We get back home and have whatever is in the fridge after begrudgingly holding ourselves back from getting fast food on the way home. I spend the rest of the night posting a few pieces of furniture on Facebook Marketplace. $25

Daily Total: $425

Day Seven

8:30 a.m. — I’m up and taking care of the dog. H. is off work today and offers to pick up Chick-fil-A for breakfast. He gets extras for lunch, too. $26

12:30 p.m. — After my morning meetings, I quickly have my leftovers and head out to my weekly therapy appointment. Actually, it’s biweekly until the new year due to a lapse in coverage that started a few weeks ago. As per usual, we spend a few minutes lamenting over the nonsensical health insurance industry. I’m paying out of pocket until the beginning of the year, so they’ve slashed their rate in half for me for a few sessions. Afterward, I run by the FedEx store to ship a laptop back to my old employer. It’s been over a year and I found it while starting to pack for the move… oops. I use their shipping account, so it’s no cost to me. $75

5:30 p.m. — I log off for the evening and after two days of building a cart on IKEA’s website, I talk H. into making a trip with me. We split a classic meatball dinner to fuel up ($15). We get everything I had put in my cart (mostly small rugs and curtain rods) and I find a nice light fixture for the bathroom in the sale section. Very proud to not go overboard ($121)! We also swing by the HomeGoods in this part of town, but don’t find anything else on my list. H. gets some kind of accessory for the bar cart ($8). $144

Daily Total: $245`

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In New York, NY, On A $58,000 Salary

A Week In Chicago, IL, On A $65,000 Salary

A Week In New York, NY, On A $180,000 Joint Income

from Refinery29 https://ift.tt/lgBQNRn

via IFTTT