Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Have a sexual fantasy you’re not sure how to talk to your partner about? Share your story here to be featured in an upcoming Refinery29 article (can be anonymous).

Today: a laid-off tech employee who is living on a severance check of $150,000 and spends some of her money this week on sushi.

Occupation: Laid off

Industry: Tech

Age: 30

Location: Brooklyn, NY

Salary: Living off $150,000 severance, I previously made $570,000.

Net Worth: My net worth minus debt is over $1 million. My partner also has personal savings but our finances are not joint. Before being laid off, I was making $550-$600,000 ($250,000 base salary and the rest in RSUs and bonus) and our household income was over $1 million joint. We co-own our home and keep most of our finances separate. I have $100,000 in a high-yield savings account. I also have $600,000 in my non-retirement brokerage account and $150,000 in retirement accounts. I also have $5,000 in an HSA and $5,000 in a 529 account. If I run out of cash before I go back to work, I will sell some stock from my brokerage. I use a robo-advisor and don’t invest in individual stocks or crypto. We have one joint checking account with $10,000 in it and we list each other as beneficiaries for all our personal accounts. We have $700,000 in home equity.

Debt: $900,000 left on mortgage.

Severance Check Amount (2x/month over three months): $13,800

Pronouns: She/her

Monthly Expenses

Mortgage: $2,500 for my half (this includes mortgage, property taxes and utilities. We split housing costs proportionate to our income. In the past, I paid more when I was making more. I’m currently still paying half since I am still receiving my full salary through my severance and our salaries were about the same this year).

Family Cell Phone Bill: $300 (I cover six people in my family).

Spotify: $15

Internet: $22.50

Gym: $75

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes, my parents didn’t attend high school and my siblings and I going to college was their American Dream. We paid for college through financial aid, loans and work-study. I went to a private college that had a big endowment and a decent financial aid program. Tuition came out to $5,000/year. I owed $20,000 in student loans, which I paid off five years after I graduated. I’m older, so I also helped pay for my sister’s college.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My parents were frugal but knew very little about finances. I helped translate and manage bills growing up. When they came to the US they worked service jobs with no healthcare or benefits. They wanted me to get a stable job and told me I should be a teacher or work a government job; they didn’t aspire for me to be a high earner. They don’t have a 401(k) since they were paid under the table. Like many immigrants, they saw social mobility through homeownership and never thought about retirement accounts. They bought a home before 2008 and lived paycheck to paycheck paying the mortgage. They don’t have much in liquid assets and I help with their finances. I learned about investing and personal finance by reading up on it on my own. I tell them how much I make and how much I have saved so that they feel comfortable coming to me when they need help.

What was your first job and why did you get it?

I started working in high school. I made $5 an hour pushing stretchers at the local hospital after school and on the weekends. I liked working and feeling useful. My first job after college was an office job that paid $40,000.

Did you worry about money growing up?

Money was always in the back of my mind growing up. My parents cut things pretty close and had to do some dangerous things for work. They worked all the time, 12-hour days, six days a week, manual labor. I would hear them working through the night and sometimes helped them with sewing and cleaning when I was very young. They were stressed about being paid under the table. We were on Medicaid because they didn’t have insurance through their jobs.

Do you worry about money now?

I have enough saved so I’m not worried about money as much anymore. Despite the recent tech layoffs, I benefited from a very good job market for the last few years. I saved enough to not worry and have built enough financial literacy to understand how to support my parents and my family. Even though I lost my job, I hit several major financial and career milestones so I can afford to take some time off. My partner and I have only been making our current salaries for the last two years and I’ve been saving up, thinking tech salaries might come down. I’ve been working for a while so this is not the first time I’ve lost my job. The first time I lost my job a few years back, I changed my mindset on work and money. I had $15,000, enough saved to float myself for a few months while I looked for a new job. But shortly after, my mom got sick and I started thinking about supporting my family long-term. I realized I needed to make significantly more money. My male friends told me I was underpaid. I worked my way to a job offer at a tech company and finally broke $100,000 in salary and savings. I learned about investing and personal finance. I’ve survived layoffs making much less, so I’m not as worried about money these days.

At what age did you become financially responsible for yourself and do you have a financial safety net?

In college, work-study covered food and housing but I lived at home during long breaks. I became fully financially responsible for my own food and housing after college. My parents own their home so I do have a safety net in that I would have a place to stay if I needed one. However, it’s highly unlikely I’ll ever need to and it’s more likely that I will end up helping them with their bills, especially as they get older. I’m lucky to be in a dual-income household and I feel relieved either one of us could pay the mortgage alone if we needed.

Do you or have you ever received passive or inherited income? If yes, please explain.

No, my grandparents passed away without a will or any savings. We paid our downpayment on our own.

Day One

8 a.m. — My alarm goes off and I hit snooze but my partner, G., makes me get out of bed. We get ready and take the train to City Hall (I use a prepaid Metrocard). We’re getting a domestic partnership so that I can get health insurance. The train ride takes 20 minutes and we get there early. We take a number and wait to be called. Our number is called and the clerk asks for our IDs at the window. The whole process takes less than 10 minutes and they print out our certificate. It costs $35 ($17.50 for my half). Now I’ll have insurance after my benefits end. We take a selfie with the license and head out of the building. I say “goodbye domestic partner!” and G. heads to the office while I go look for food. I don’t really care for marriage as an institution but it feels nice to do something to commemorate five years together. $17.50

9:30 a.m. — I stop into a bakery in Chinatown and order takeout dim sum and tea. I walk around Chinatown and continue to snack. I buy some pastries to bring home for G. I grab a bench at the park to take a call. Some of my coworkers are going through interviews so I’ve been doing reference calls for my former team. The person doing the call asks me about my working relationship with my former direct report and I give them glowing praise. I like doing reference calls since it makes me feel like I have more control over this layoff situation. I feel a bit of guilt for not being able to protect my team. $10

3 p.m. — I’m done exploring and head home. I still have a lot of money left on my Metrocard from when work used to pay.

6:30 p.m. — G. gets home from work and dumps snacks on the table. Before being laid off, I would also bring snacks home and we would have a snacks exchange from our offices. It became a fun tradition but I no longer have office snacks so we snack on the pastries I got instead. We head to one of our regular spots for dinner. I’m not very hungry so I get two appetizers as my meal but G. orders more. G. pays since I’m ahead in Splitwise and it’s $10 for my share. We use the app as a ledger for our shared expenses and try to keep it even. We walk home, watch some TV, shower and go to bed around midnight. I feel really satisfied from the day.

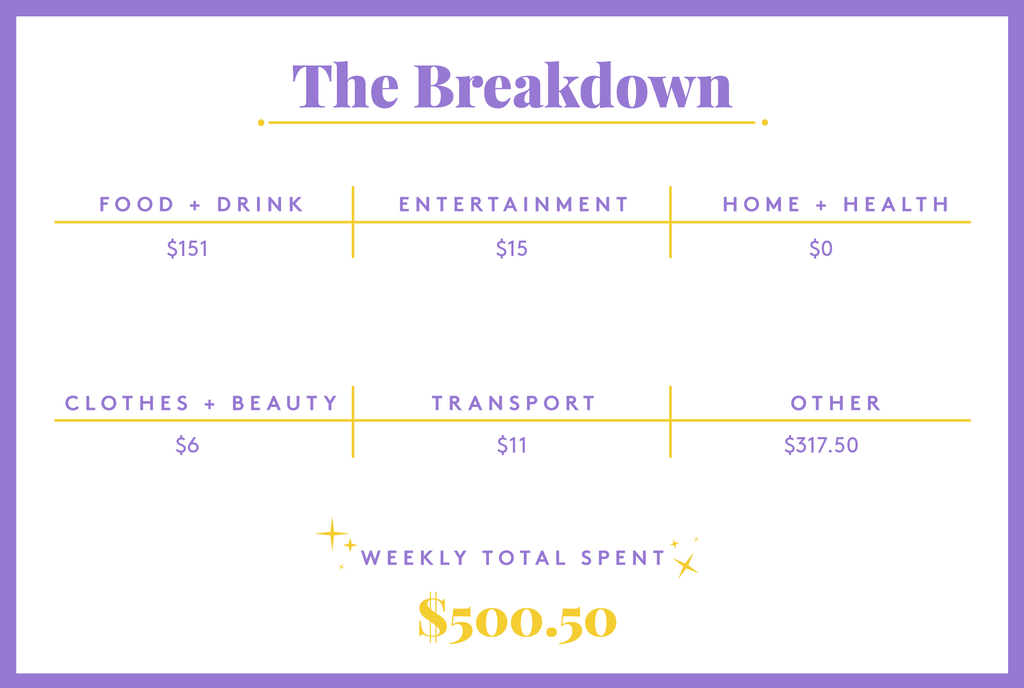

Daily Total: $27.50

Day Two

10:30 a.m. — Check my emails out of habit before remembering I don’t have work! Checking work emails in bed first thing in the morning is a habit I picked up over the last few months of my job. As a manager, I got urgent messages in the middle of the night. I didn’t feel comfortable missing out on critical information and putting my team in danger. Right before layoffs, I got a message at 10 p.m. asking me to justify saving my team from layoffs. I did what I could but it wasn’t enough and I still get triggered by email ping sounds. I get up and wash my face. My cat dramatically cries at me for food. Text G. in case he forgot to feed him before he left for work. He says he already fed the cat. My cat is such a liar but I love him anyway.

11:30 a.m. — Virtual therapy. We talk about how I’m adjusting to not working. It’s a lot of time alone with my thoughts and insecurities. I feel pretty happy most days but sometimes I still feel uncertain about the future. Financially I feel very lucky. I’m worried about switching therapists when my insurance ends and maybe having to switch again when I get a new job. Change is stressful. The session is covered by my insurance (which will end soon).

12:30 p.m. — Throw together some leftovers for lunch and text a few friends.

5 p.m. — I head out for dinner with a friend. We haven’t seen each other in a while so she asks me a bunch of questions about the layoffs. I’m getting a little tired of recapping it but it’s okay. Walk home, shower, catch up with my partner on our days and then go to sleep. $16

Daily Total: $16

Day Three

9:30 a.m. — My mom calls. My dad’s tooth fell out but he has been delaying going to the dentist. I can’t believe it. I send them money to cover it. It really bothers me that my parents don’t always take care of themselves. I try to remove the financial barrier but I can’t force them to do anything. $300

10:30 a.m. — I browse through some real estate listings in nearby neighborhoods. I’m trying to convince my parents to downsize and move to a senior-friendly apartment closer to us. It’ll be more accessible as they get older and I want to keep an eye on them. My mom can’t drive and as immigrants, there are only a few neighborhoods they feel comfortable in. I bookmark some places that would be within budget and send them to my partner. I walk over to the bodega and get an egg and cheese. The walk is short but going outside helps with the stress. I make some coffee and have it in the backyard. $3

1 p.m. — I call a sushi place nearby for a pickup order. They have a decent lunch special ($12 for three rolls plus a side). My body is still getting used to eating earlier in the day. When I was working, most of my coworkers were on the west coast so I got used to eating lunch around 3 or 4 and dinner around 8 or 9. I spend the afternoon looking up hotels for a trip I’m taking with my partner next month. We have a lot of credit card points so the hotel is fully covered. I spend the rest of my afternoon trip planning. We don’t have a vacation budget but I spent about $10,000 last year on travel and will likely spend about the same this year. We’re trying to travel more while we don’t have kids. Looking up activities gets me excited and in funemployment mode. $14

5 p.m. — I leave the house and go on a long walk in the park. The sunset is really beautiful! On my way home, I stop by a discount fruit store. I buy a bag of 10 apples, three cartons of berries, two bunches of veggies, carrots, cherry tomatoes, potatoes and onions. I cook dinner with groceries I bought and some stuff in the fridge. G. has plans so I’m eating alone today. G. gets home after a few hours, we catch up and then go to sleep. $15

Daily Total: $332

Day Four

11 a.m. — I wake up late after a nice long sleep.

12:30 p.m. — I eat leftovers for lunch before I have a recruiter call today. It’s the first interview I’ve taken in a while. The role sounds interesting and the pay is similar to what I was making before. The recruiter covers the interview process and what types of questions I should expect. I take notes and check it against information I’ve gotten from other companies to get a sense of the job market. The range for similar roles to my last job is generally between $500,000-$600,000. NYC recently started listing base salaries in job listings, which helps me get a sense of my market value. For-profit tech companies offer $200,000 and up for base salaries. I’m also looking at some nonprofit companies, which offer less but still around $200,000, which is enough for my lifestyle. I’ve also talked to some rare companies that offer close to $1 million. I’m taking time to be open and explore.

1:30 p.m. — I impulsively check LinkedIn after my call. Tech hiring has slowed down so there aren’t many new job postings. Before layoffs, I used to get 10 recruiter messages per week from the same companies that did layoffs. Now I don’t get any messages. I’ve also taken a few interviews that were then canceled after the company lost headcount. It’s hard not to doomscroll and feel dejected. I check my bank account as a reminder that nothing bad is actually going to happen if I don’t start work right away. Despite being laid off, I haven’t made a dent in my savings yet. Still, it’s hard to shake the feeling of insecurity today.

5 p.m. — Somehow I waste four hours of my life on LinkedIn and now it is almost dark with nothing to show for it. I delete the app from my phone and try not to think about it. I leave the house and go for a walk. Walking and moving my body always makes me feel better. I text an old coworker during my walk and we make plans for tomorrow. He is also taking some time off and we bond over the shared experience.

7:30 p.m. — Text my partner to see what we’re doing for dinner. We decide to go out since it’s getting late. We order two entrees. Our bill is $36 and G. pays. Our cat is waiting by the door and meows angrily at us for coming home late. We open a can of food and he scarfs it down. He rubs against my leg so I guess all is well. We watch some TV, cuddle and go to bed at midnight.

Daily Total: $0

Day Five

10 a.m. — Wake up to more tech layoffs news. After the rabbit hole I fell into yesterday, it’s hard not to get pulled into the negativity. I text my friends at the company that did layoffs to let them know I’m thinking about them. I go to a yoga class to clear my head. There are several studios near me but I like the one that’s a 20-minute walk since it’s queer-owned. I don’t typically do yoga but I’ve started going a few times a month since being laid off. The class is prepaid through a class pack I bought previously.

1 p.m. — I meet up with my old coworker at a café and get a coffee and a pastry. My coworker pays since I paid for drinks last time. We talk about how we’ve been spending our time. Most days are good but some days it is hard not to overthink things and think too far ahead. I feel fortunate I’m not on a visa like many of our former coworkers. We had coworkers who had to find a job in 30 days or risk being deported with their families. We talk about the coworkers we’ve checked in on recently and how they’re doing. I’m really hoping everyone lands on their feet. We agree the recent tech layoffs make us wary of going back to work.

3 p.m. — I get home and try to read but I can’t concentrate so I turn on the TV instead. I pull up the IRS calculator to estimate my taxes while I’m watching TV. So far I owe an additional $35,000 in taxes since my company can only legally withhold 22% from my RSUs and bonus and I’m in a higher tax bracket. In total, I’ll pay over $200,000 in federal and state taxes. I can’t finalize it until I have my W2, 1099s and donation forms but it’s useful to know so I can put that money aside.

4 p.m. — I go to the gym. On my way, I pick up some eyebrow gel at the drugstore since I lost mine. $6

6 p.m. — Stop by the grocery store and pick up a whole rotisserie chicken and some sides for dinner. We do this maybe once or twice a month. It’s quick and easy. My mom texts me to say my dad booked an appointment. I feel relieved. $20

Daily Total: $26

Day Six

11 a.m. — My partner has some work to catch up on so I’m glad I have plans with friends today. It’s an extra social weekend and I have two birthday parties today. We go to a Mexican diner nearby for breakfast. I order huevos con poblanos and we talk about our upcoming trip. The bill is $25 and G. pays.

2 p.m. — I walk over to the park and read a book until it’s time for a friend’s birthday picnic. It ends up drizzling so we go to a bar for late lunch and drinks. I get a burger, beer and my friend’s drink since it is her birthday. It’s a bigger group with people I don’t know well so I’m glad no one asks me about work and my job search. $35

9 p.m. — I go home to change into something different for the other party. G. made salmon and saved me a filet. Even though I already ate, I scarf it down. I convince G. to come out. The cover is $15 and the band is great. We get home at 1 a.m. I wash my face and rinse my body off and then go to sleep. $15

Daily Total: $50

Day Seven

10:30 a.m. — Make some coffee. I’m out of beans so I walk over to the coffee shop for more. I’ve earned enough points for a free pastry and I choose the almond croissant. $14

11:30 a.m. — We place a call and order two breakfast burritos from one of our regular spots. It’s ready in 15 minutes and I walk over to pick up our order. We watch TV while we eat. $24

2 p.m. — Leave for the gym. I typically work out four to five days a week but I’m not as good about it in the winter. I rotate through different activities depending on the season. While I’m out, my friend texts me to ask if they can come over with their dog so I head home. I love spontaneous hangouts. We catch up for a bit then decide to go on a walk with the dog.

6 p.m. — I walk my friend to the train station and walk home. Our place is kind of messy right now so we do some tidying. Decide to clean out my closet and put aside a bag of clothes to bring to the thrift store. One of the nice parts of not working is I can now go on a weekday when it’s less busy. They’re pretty picky but I have some good items I figure they’ll take. We pick up takeout from the bodega. I get falafel over rice with red and white sauce. G. pays. As we eat we talk about our upcoming trip. We also talk about a home repair we’ve been putting off. I make a note on my calendar to call around for price quotes from contractors this week so I don’t forget.

10 p.m. — We book one of the flights we’ve been looking at for a trip next month. We use points and pay $11 in taxes. I get back into funemployment mode, thinking about the trip. Shower, catch up on email, text friends to make plans for the week and go to bed around midnight. $11

Daily Total: $49

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Boston, MA, On A $60,000 Salary

A Week In Los Angeles, CA, On A $217,920 Salary

A Week In Orange County, CA, On A $326,000 Income

from Refinery29 https://ift.tt/l7f98z5

via IFTTT