Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: an attorney who makes $350,000 per year and spends some of her money this week on Tiger sneakers.

Occupation: Attorney

Industry: Law

Age: 33

Location: San Francisco, CA

Salary: $350,000 + $100,000 bonus (but I don’t count on this).

Net Worth: $487,000 (savings: $50,000, 401(k): $100,000, Roth: $12,000, investment account: $65,000, LP investments: $10,000, home value: $1.3 million (or $650,000 for my half) minus debt. I co-own a house with my partner and we each owe $400,000. We split all of our expenses using a joint credit card but we don’t have shared accounts. We each pay our half of mortgage, property taxes, expenses on our credit card, utilities etc. Our rule of thumb is we split everything that we both need but pay individually for things that only one of us needs (clothes, lunch with coworkers etc.)).

Debt: $400,000 mortgage.

Paycheck Amount (2x/month): $7,500

Pronouns: She/her

Monthly Expenses

Mortgage: $2,500 including property taxes.

Barry’s Bootcamp: $250

Utilities: $40 for my half.

Pet Insurance: $30 for my half.

Hulu + Peacock: $15 (I share subscriptions with my sisters, who have Netflix, Spotify and HBO).

Financial Times Subscription: $40 (I share with my siblings in exchange for the NYT and the LA Times).

Internet: $0 (my work reimburses me each month).

Phone Bill: $0 (my work reimburses me each month).

Parents’ Phone Bill: $60

Parents’ Savings/Investments Accounts: $1,000

My Savings: I transfer any remaining amounts to my HYSA and/or my brokerage account at the end of each month.

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes. My parents immigrated from Mexico before they were 18 and both were forced to drop out of middle school. They expected me to attend a four-year university but anything beyond that was beyond their wildest dreams. I received grants and scholarships that covered my undergrad degree and took out law school loans. My law school actually gave me a significant scholarship but I took out loans to cover the rest of tuition/cost of living.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

Yes, my parents always talked about living within your means, saving all of your money and having a budget. My parents made $22,000 a year, living in a high-cost-of-living city with five of us in a one-bedroom apartment. We were all aware of what everything cost.

What was your first job and why did you get it?

I started working as a hostess at a restaurant when I was 15 to help pay for my own expenses. My parents paid for all of the essentials but if I wanted something nice I had to pay for it.

Did you worry about money growing up?

No, not at all. My parents were so financially responsible that I never thought about our socioeconomic status. I attended public schools in LA and a lot of my friends were also first-generation so it was normal to live in a cramped apartment, everyone got free lunches and we all walked or took the bus around the city.

Do you worry about money now?

Yes, I constantly feel like I might lose my job one day and everything will fall apart. I help manage my parents’ finances and I also worry about them having enough retirement savings.

At what age did you become financially responsible for yourself and do you have a financial safety net?

At age 17, when I went off to college and had multiple jobs to cover expenses and rent. I don’t have a financial safety net. As mentioned above, I’m first-generation in all things including trying to create generational wealth.

Do you or have you ever received passive or inherited income? If yes, please explain.

No.

Day One

7 a.m. — I wake up and take my dog on a walk around my neighborhood. I forgo brushing my teeth, taking off my pimple dots or brushing my hair. Everyone in my neighborhood knows us and is fully aware that we have a puppy that we’re training. After our walk, I get ready and then head to the office while listening to a podcast.

9 a.m. — Our office kitchen is fully stocked with snacks and there’s catered breakfast. I chat with people while I make myself a coffee and grab a banana and scrambled eggs. I’m working on a new deal that’s going to involve a lot of due diligence so I start working on a diligence request list to send to opposing counsel.

12 p.m. — My work bestie is in the office today so we walk down the street to a Mediterranean restaurant across from our office. I order a falafel wrap. No time to sit down for lunch but it’s nice to catch up with my coworker. We talk about work and our dogs. After lunch, I have calls with clients and I catch up on emails. $14

6 p.m. — I head to Barry’s for a workout, which kicks my ass and helps me destress between the loud music and the intensity. I pay for a monthly package to attend twice a week so I’ve already paid for this class. I walk home and take my dog out for a walk.

8 p.m. — I make chicken, sesame potatoes and caramelized carrots. I order five to six meals from Blue Apron every Monday so after I eat, I put in my Blue Apron order and then do some more work. I’m in a senior role so I have more flexibility with work but I try my best to answer all of my emails every night. $120

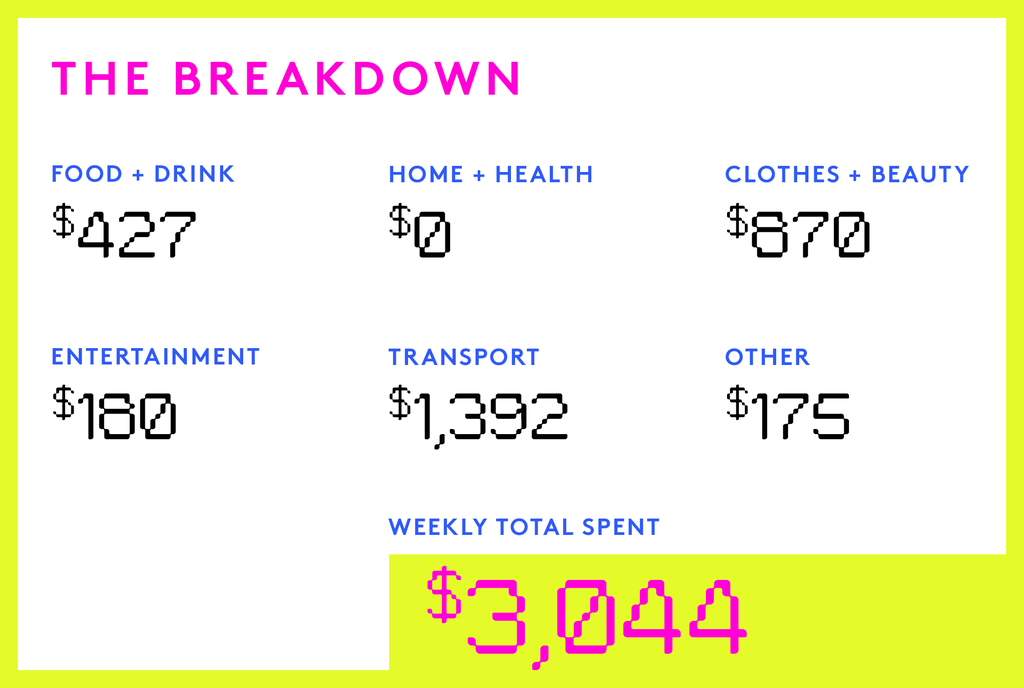

Daily Total: $134

Day Two

6 a.m. — I wake up early today because I have a 7 a.m. call. My partner takes our dog out for a walk and I get ready with a Real Housewives episode. I pick up coffee and a morning bun from my neighborhood bakery and walk to the office. My sister bought us tickets to see Beyoncé this summer so I’m listening to my favorite album, Renaissance. I arrive at the office and immediately have to start sending out emails to ask for status checks from the junior attorneys. $10

11 a.m. — I have a break between calls and decide to buy a pair of sneakers for walking around the city. I decide on a pair of Tigers. $120

3 p.m. — My friends and I are planning a trip to Japan. A friend books my flight for me so that we can all fly together and sends me options to choose from for cities to visit. She and I have the same travel style: we book flights and hotels and serendipitously find cool things to do once we’re there. But since it’s a group trip, we start to book hotels, dinner reservations and day trips. I venmo her for my trip and promise her I will research more. $1,200

6 p.m. — We have a cocktail reception in my office for visiting attorneys. I introduce myself to a few people and meet some people working on my deals. I grab champagne and cheeses to pair with the documents I have to review tonight.

9 p.m. — I wrap up work and take an Uber home, which is reimbursed by my company. I stop to get pints of ice cream from my neighborhood store. My partner loves chunky ice cream so I always have fun picking the wackiest flavors I can find. I walk my dog with my partner and we catch up on our days. $10

Daily Total: $1,340

Day Three

7 a.m. — Today’s my birthday! I treat myself to a latte and Danish from a coffee shop on the way to the office. I listen to a podcast from The Economist. $10

8 a.m. — There’s catered breakfast again. I get a veggie scramble and a second coffee. I’m working on a presentation for a client so I have a few meetings to go over slides with different teams. More meetings and more agreements.

11 a.m. — My secretary sends out an email for lunch orders. I order a miso salad. More emails and more agreements.

4 p.m. — My friend texts the group chat about a weekend trip to celebrate defending her dissertation. We decide on Portland because we’re all spread out on the West Coast. I just donated coats and boots so I order a new coat and two pairs of boots that were waiting for me in my cart. It took me a decade to find my style so now I stick to a handful of stores that I’m always browsing. $300

6 p.m. — I have a meeting for a nonprofit board I’m on so I get an Uber and order a delivery of wine to our meeting. $55

8:45 p.m. — I meet my partner for dinner. He made reservations at a tapas restaurant and he brings me roses. We order 12 tapas, wine and dessert. $90

Daily Total: $455

Day Four

6 a.m. — I wake up at 6 a.m. for a 7 a.m. call on an East Coast deal. After the call, I walk to work and grab a coffee and banana from the office kitchen.

1 p.m. — I surface from back-to-back calls. I find leftover salad and remnants of a charcuterie board from an event in our kitchen. I eat at my desk because a lot of my deals are going haywire. I love the chaos but it also means I have to be at my desk all day today.

7 p.m. — I take an Uber to meet some friends for a musical. I order a slushie rosé and hang with my girls before the show. We see Six, about King Henry VIII’s wives (I venmo my friend $100 for the ticket). I uber home and walk my dog before going to bed. $160

Daily Total: $160

Day Five

8 a.m. — No meetings today and I expect a chill day. My partner and I always plan something fun for Friday night. We observe Shabbat so on Friday evenings my phone goes on silent. My partner really wants to do something artsy with me so we book a pottery class. I walk to work and listen to The Daily. Coffee and a banana for breakfast from our kitchen. $80

12 p.m. — I go out for lunch with my coworkers. I order a burger and fries and I decide to get a boba after to drink back in the office. $15

2 p.m. — I have several pro bono cases that I’m working on. I have a few status calls with the nonprofits that refer the cases to us.

6 p.m. — I walk home and meet my partner at a Neapolitan-style pizzeria in our neighborhood. We order two pizzas and two beers. $25

7 p.m. — We take an Uber to our pottery class and learn about wheel throwing. It’s a fun class and super intimate. $12

Daily Total: $132

Day Six

7 a.m. — I take my dog on a long walk because we’re going to be in a car for a few hours today. I pick up two croissants from our neighborhood bakery. $10

10:30 a.m. — I have an appointment for a facial this morning. I call my parents on my walk to my appointment and we talk about work and weekend plans. They ask if I have any plans to visit them. We pick a weekend when I’m free and I book a flight home for next month. I try to visit my parents every two to three months. I love going home because it means I get delicious home-cooked meals, we take trips to the hardware store for my home projects and we ride bikes around their neighborhood. My parents also give me perspective on work and life because we’ve all come a long way from their farmworker days in Mexico. $120

12 p.m. — I pay for my facial and add a tip. I’ve had the same facialist for almost a year and she has done wonders for my skin. I try to be frugal about spending unless it’s for my skin, health or spending time with family and friends. $300

1 p.m. — We are on the road for an overnight trip to our favorite small town. We pick up In-N-Out and decide to eat on the road because it’s raining. $6

3 p.m. — We see a cute coffee shop and stop for a snack and to walk our dog. I order a green smoothie and my partner orders a coffee. $12

6 p.m. — We arrive at our hotel and pay for our room. $175

7 p.m. — We find a seafood shack where we can eat with our dog outside. Most of our decisions these days are based on whether our dog can come or not, including staying at a pet-friendly hotel. We order clam chowder bowls. $15

8:30 p.m. — We head to the sauna at the hotel for a while then go back to the room and go to sleep.

Daily Total: $638

Day Seven

8 a.m. — Our stay includes breakfast at the restaurant inside the hotel. I order coffee, granola and a side of fruit.

12 p.m. — We check out of our room and head to a pizza shop that’s located inside a garden that I read about online. We share a vegetarian pizza and beet salad. My partner pays.

2 p.m. — We walk around town and then head out for a long hike.

7 p.m. — We are on the road back home after our hike. We decide to stop at a deli that we saw the last time we were in the area. We order latkes, matzo ball soup and a pastrami sandwich. I pay. $35

10 p.m. — Home. I order the vitamin C serum, niacinamide serum, retinol serum and tranexamic acid my facialist recommended. I read a chapter from Ben Bernanke’s memoir and call it a night. $150

Daily Total: $185

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more Money Diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In San Francisco, CA, On A $68,000 Salary

A Week In California On A $145,000 Joint Income

A Week In Central Mississippi On A $42,000 Salary

from Refinery29 https://ift.tt/otsPjvB

via IFTTT