Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: A senior account manager working in consumer packaged goods who has a $279,000 joint income and spends some of her money this week on photos with Santa.

Friendly reminder: We won’t be publishing a Money Diary on January 1st. Happy New Year!

Occupation: Senior account manager

Industry: Consumer packaged goods

Age: 31

Location: Chicago suburbs

My Salary: $139,000, plus a $20,000 bonus target

My Husband’s Salary: $100,000, plus a $20,000 bonus target

Net Worth: $537,000 ($165,000 in my 401(k); $140,000 in my husband’s 401(k); $90,000 in a brokerage account; $25,000 in liquid savings; ~$25,000 for the value of one car we’ve paid off; $22,000 for the value of another car we’re still paying off; $560,000 in home value, plus $12,000 in my son’s 529 that I don’t count in the above total.)

Debt: $490,000 ($480,000 left on the mortgage and $10,000 owing on our second car at 0% interest)

My Paycheck Amount (1x/month): $7,600

My Husband’s Paycheck Amount (biweekly): $2,900

Pronouns: She/her

Monthly Expenses

Mortgage: $3,900

Gas: $90

Water, Trash & Electricity: $150

Car: $636 (0% interest for 48 months)

Car Insurance: $187 (for both cars)

Daycare: $1,440 (for our toddler, L.)

Health & Dental Insurance: $380 (This is for all three of us. It’s deducted from my pay.)

Phones: $80 (My employer reimburses me $60 per month.)

Gym: $140

Netflix, Disney+, Apple TV+, Spotify & HBO Max: $62

YouTube TV: $60

Wall Street Journal & The New York Times Student Memberships: $15

Investments: $1,500

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes. I went to a Big Ten college on an academic scholarship with some help for rent from my parents. I had a $5,000 student loan that my parents agreed to pay off, but I always worked to afford food and my car.

Growing up, what kind of conversations did you have about money? Did your parent(s)/guardian(s) educate you about finances?

My mom had a lot of issues, and my parents divorced when I was young. My father was always worried about money and not great at saving, so I grew up with a lot of financial anxiety that still manifests today.

What was your first job and why did you get it?

I was a cashier at a grocery store, mostly because that’s what my older sister did!

Did you worry about money growing up?

Absolutely. My dad was constantly talking about how we couldn’t afford things, and then spending on things we didn’t need, like DVDs. It always made me feel out of control. Now control is a big aspect of my relationship with money. It took me a long time to feel comfortable investing in the stock market outside of my 401(k).

Do you worry about money now?

Not usually. I definitely have moments of anxiety that I will lose my job or have to dip into savings, or that the larger US stock market will fail, but I try to tamp down those fears because I’m in a really great place.

At what age did you become financially responsible for yourself and do you have a financial safety net?

At 22, I was off all the insurance and phone bills and getting a regular paycheck from a full-time job. My husband, B., and I definitely have more money now than most people in our family, but there are definitely those who would help if something came up.

Do you or have you ever received passive or inherited income? If yes, please explain.

B.’s father gave us $10,000 to invest in the stock market.

Day One

7:30 a.m. — I help B. get my son dressed, and then he takes him to daycare. I get dressed for work and head in. There’s hardly anyone in the office, but we have a happy hour for our client tonight nearby, so I’m there and drinking an absurd amount of green tea. There’s a role transition in our group, so we spend most of the day gossiping and not working. I have to roll my eyes at a coworker complaining about making $133,000 at age 26.

11:45 a.m. — Our office isn’t near any good food options, so I get DoorDash more than I’d care to admit. Today, I order shrimp tacos from a great local place. They’re always so fast and come right to our suite. My husband also buys lunch at his office cafeteria. $32.89

3 p.m. — I get a call from daycare that L. has been coughing so much it’s disrupting his nap. He doesn’t have to go home because he doesn’t have a fever, but the cough is getting a lot worse, and he has a rash on his cheeks. I call the pediatrician and make an appointment for tomorrow morning. My husband will get him from daycare because I have a work function tonight.

5 p.m. — We’re taking our clients out to an end-of-year happy hour. We’ve had a great year, and the relationship is in a really good place, but it’s a lot of work talk. I have an awful margarita and a glass of wine, and we share appetizers across the whole table. I feel bad staying so late because of my son’s cough, but I’m paying the bill and can’t leave early. $350 (expensed).

7 p.m. — I get home just in time to give my son a bath, turn on his humidifier, and put Vicks on his chest. He’s coughing so much that my husband and I have a hard time falling asleep, listening to him cough on the baby monitor. Around 11 p.m., he seems to settle in for the night.

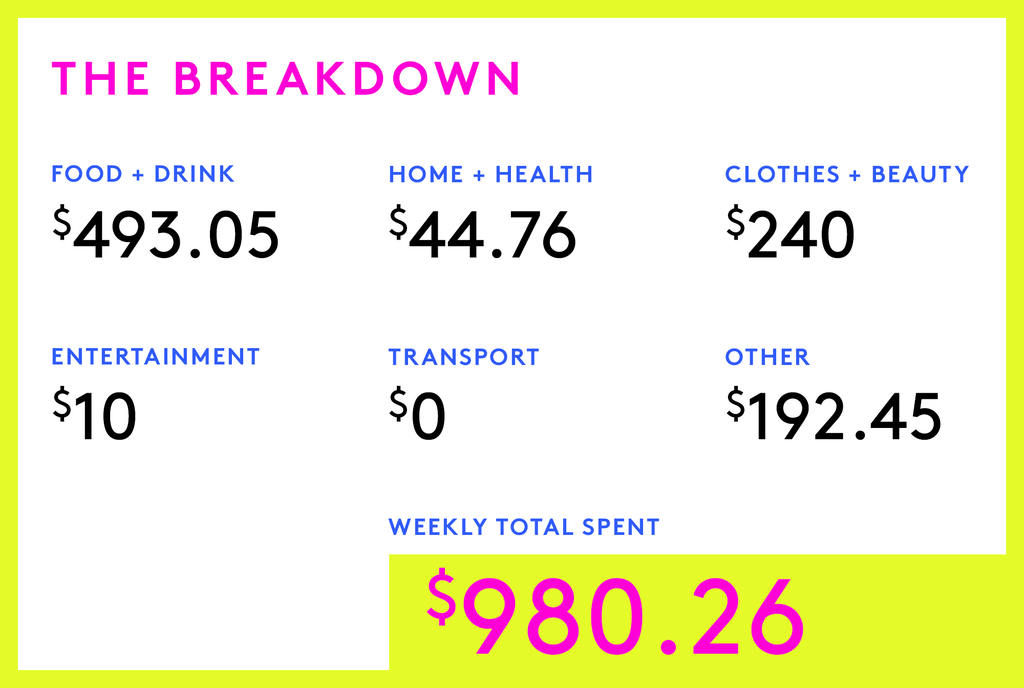

Daily Total: $32.89

Day Two

8:40 a.m. — I’m on sick-kid duty this morning. I take L. to the doctor. The doctor prescribes a steroid for his wheezing cough and gives him a dose in the office, so I can take him right to school. I love our pediatrician ($30 co-pay). I pick up the prescription ($4) and some Christmas cards ($12) from the drugstore. I’m not going to make it to the office in time for my in-person meeting, so I also grab a breakfast sandwich ($8.34) on the way home and take the call from there. $54.34

12 p.m. — There’s not a lot happening at work today. I contemplate going to my workout class over lunch, but I walk on the treadmill in our basement instead. I have a spinach smoothie and air-fried chicken for lunch. When I get an afternoon break, I work on boxing and wrapping presents for my niece and nephew: a custom apron for my niece and a pair of Nike dunks for my nephew. Neither one is old enough to really understand what presents are, along with my son. My son and my niece were born only three weeks apart! This is the only gift giving we do on my side of the family, which is a big relief, because I’m a terrible gift giver. My husband buys lunch and snacks at work. $16

5:45 p.m. — Usually, we take L. to dinner on Thursday night, but since he’s sick, we stay home and have shrimp tacos. Yes, that’s shrimp tacos twice in as many days! They’re fairly healthy and VERY easy, so they are a common meal here. I buy silicone liners for our air fryer on Amazon after dinner. $10.76

Daily Total: $81.10

Day Three

7 a.m. — I’m up with my son at 6:30 a.m., and he’s off to daycare with dad. Work has been dead lately, but I have a few follow-ups this morning and manage to crank out work before an important meeting at 10 a.m. We crush the meeting and there’s talk of us winning Team of the Year! I never win anything at work so I don’t count on it, but this is a new company to me and I’m off to a great start.

11:45 a.m. — Lunch hour is stressful because we’re trying for another kid, so we fit that in and then go to Costco to grab food for our dinner party tonight. One of my best friends flew in for the weekend and is landing now. We’re hosting her and two other local couples. We get filets and salmon for surf ‘n’ turf, wine, prepared sandwiches for lunch, and vitamins and supplements for my husband. Then we both rush back for afternoon meetings. $119

6:30 p.m. — Our friends come over. I prepare a cheese board and make mashed potatoes and Brussel sprouts while my husband handles the proteins. Dinner goes over pretty well, despite not having enough steak knives. We stay up way too late playing games, and I know I’ll regret this when my son wakes up in the morning. I don’t drink a lot anymore, but I get caught up and have almost four glasses of wine over the course of the night and have so much fun.

Daily Total: $119

Day Four

5:45 a.m. — Yep, my son is up at 5:45 a.m., and I’m hungover. My husband usually gets all the other days to wake up with my son besides Saturday, so it’s my turn. I’m struggling this morning. When my husband gets up, I leave to get bagels and grab a canned latte, too. $15.45

9 a.m. — I reeaallllly need to get my husband a Christmas present, and he’s the one person I’m the worst at shopping for because he buys the things he wants. I browse online before committing to a pair of army green Converse high tops with a brown rubber sole. They seem like something he would wear, but I won’t take offense if he returns them. I then order Bocuse by Paul Bocuse, a $50 cookbook he knows he’s getting. $106.45

11 a.m. — My mother-in-law arrives. She’s watching L. while we go out with our friends from last night. I’m pretty sure L. likes grandma more than me, and they’re together often, so it’s not hard to leave him. We go to a local Christmas market and drink mulled wine ($28), have a crepe ($14), and buy some fudge ($25). Then we get lunch at a local brewery. I don’t have any drinks, but we share apps in addition to mains, and my husband has two beers. He pays $63 for our portion of the bill and tips. (My husband is a high tipper. He recently told me he tips $20 on a $35 hair cut.) $130

3 p.m. — We go back to our house to decompress before happy hour, and I take a short nap while my husband plays with L. I get a call from our local friends who are hosting the out-of-town guests. They want to skip happy hour and chill at their place. We go over and play Mario Party on Switch and then head out to dinner.

7 p.m. — We have dinner with our four friends at a local farm-to-table place. We all share a mussels dish, then I have scallops and risotto, plus a dirty martini. Then we go to a lights display followed by one more drink at a bar. B. has a light beer, and I have a seltzer. Afterward, we go back to our friend’s house to play Jackbox. TV. We go home around 11 a.m. $155

Daily Total: $406.90

Day Five

9 a.m. — Praise Jesus, I sleep in. There is definitely some disrupted sleep from toddler shrieking, though. My mother-in-law will still be here until noon, so after playing with L. for a bit, I go say goodbye to my friend who is leaving. When L. goes down for his two-hour nap, I leave for my book club. I bring cookies, and we discuss Fourth Wing. This is my first time at the club, and I can’t stay for more than 90 minutes, but I already know a few of the women and have a great time.

3 p.m. — We take my son to a Santa visit through our parks department. He is predictably not that into it. We pay $10 for the slot and get some decent photos, but I hold him the entire time and there is a chair next to Santa for us to sit in, which is a great move. When we’re done, L. insists on going to the park, but it’s freezing so we don’t stay long. $10

5 p.m. — We consider picking up food, but neither of us wants to go out again, so we make Trader Joe’s frozen orange chicken with rice and frozen broccoli. We try watching May December after L. goes to bed, but it’s not holding my attention.

Daily Total: $10

Day Six

3 a.m. — My son is a pretty good sleeper, but he’s up at 3 a.m. and 3:30 a.m. this morning and doesn’t want to go back to sleep. Eventually, I bring him into the guest room and sleep with him, and he falls into a deep sleep. I have a hard time going back to bed. I would go back to sleep after he goes to daycare, but I have a workout class at 7:15 a.m. I go to a HIIT class usually three times a week, but I’ve been slacking lately with illness and holiday plans.

12 p.m. — This day is slow! Mondays usually are, plus they’re work-from-home days. I have a spinach smoothie and leftover orange chicken for lunch and look into how to get my emissions test for my car. This is my third state in about five years, and every state has a slightly different procedure. My husband buys lunch and a snack at work. $12

3 p.m. — I go to my hair appointment. I have dark, warm-blonde hair that I’ve been highlighting blonder and cooler in tone since I was 17. I’m moving toward grown-in baby lights and showing more of my natural color because it will require less maintenance. I’m also getting a cut today. While talking to my hairstylist about presents, I do some ordering from my phone for other family members on my husband’s side: a Pyrex glass container set for my MIL and a book and earrings for my SIL ($74). My hair is done ($240), and I don’t love the outcome, but I know it’s because more of my natural warm color is showing. $314

5:30 p.m. — My husband is making pasta and meat sauce at home but calls to tell me that we don’t have red sauce. I stop and get it on the way home, and then eat and play with my son and put him to bed at 7:30 p.m. $4.37

Daily Total: $330.37

Day Seven

6 a.m. — L. is up early, so I play with him and give him breakfast while B. gets ready for work. When he’s showered, and they’re both out the door, I grab a coffee and settle in to answer emails.

7 a.m. — I have to go to downtown Chicago later today for a company party, so I buy and expense parking on SpotHero. I have a few calls in the morning and then get ready to go. $20 (expensed)

12 p.m. — We have our holiday lunch at a pizza place, followed by some meetings and a happy hour. I really want to leave by 2 p.m. to beat traffic, but I have to speak to one of my leaders in person, and this will be my last chance before the holiday. At happy hour, I ask her to send an email on my behalf to help my team win Team of the Year. I get in my car around 3:15 p.m., and make it to my son’s daycare by 4:45 for pickup.

5:30 p.m. — My husband grills chicken thighs and I make rice and beans for dinner. L. actually eats a lot of it but refuses to sit in his regular high chair and insists on sitting in his travel chair. Toddler life. After L. goes to bed, we hear mice or a squirrel crawling above our family room that goes directly to the roof. Mice are super common and really bad this time of year in this area. We call pest control to come out tomorrow. This is part of life, but it makes me feel gross. B. decides to get another quote for siding, since ours is old and full of holes. Then I head to bed.

Daily Total: $0

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more Money Diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Chicago On A $210,000 Joint Income

A Week In Seattle On A $109,200 Salary

A Week In Los Angeles On A $53,131 Salary

from Refinery29 https://ift.tt/fjAdx7P

via IFTTT