Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

This week: a senior resource navigator who makes $58,000 per year and spends some of her money this week on a new rug.

Content Warning: This diary contains reference to miscarriage.

Occupation: Senior resource navigator

Industry: Non-profit

Age: 31

Location: Grand Rapids, MI

Salary: $58,000

Assets: Our house: $280,000 (minus what we owe); 403(b)s: $6,006; my husband B.’s retirement accounts: $8,230; CD: $4,000; savings: $4,354; B.’s savings: $2,856. B. and I are married but have chosen to keep our finances separate. We split bills and household costs 50/50.

Debt: Mortgage: $162,091; car: $16,937.84; private student loan: $5,441.31; public student loans: $62,669; medical debt: $969.90

Paycheck Amount (every two weeks): $1,689

Pronouns: She/her

Monthly Expenses

Monthly Housing Costs: $622.50 (my half of the mortgage)

Monthly Loan Payments: Car loan: $284.34; private student loan: $366.77; public student loan: $82.15; medical debt: $200

All Other Monthly Expenses:

Childcare: $530 (my half)

Orangetheory Fitness: $99

Internet/Cable: $75 (my half)

Hulu: $7.99

Kindle Unlimited: $9.99

Utilities: $60-100 (my half)

Prescriptions: $30

Car Insurance: $0 (thanks, mom)

Phone Bill: $0 (thanks, dad)

Swim Class: $57.50 (for our daughter; this is my half)

Gymnastics Class: $31 (for our daughter; this is my half)

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes, my parents both got degrees when I was a child and expected my sister and I to go to school, especially through to a graduate degree. I have a bachelor’s and master’s. I worked through both — and full time with my master’s program. I paid with public and private student loans.

Growing up, what kind of conversations did you have about money? Did your parent(s)/guardian(s) educate you about finances?

My parents didn’t talk much about money until they divorced. My mom’s career has been in accounting so she was a penny pincher, more so than my dad. Even after they divorced, they would argue about money and who paid for what for my sister and me.

What was your first job and why did you get it?

I worked for my uncle cleaning his polishing and buffing shop in high school. It was dirty work but he paid well. I used the money to visit my boyfriend in college. This was around 2008-2009 and I couldn’t find even a teenage job in the area I grew up in. So I worked for my uncle and babysat.

Did you worry about money growing up?

Yes, my mom stressed out about it a lot so I thought we were poor. Now looking back, we lived in a very middle class way. My parents were able to buy my sister and I cars when we turned 16 and my dad always had a boat. We went on vacations. We always had food in our home.

Do you worry about money now?

Yes, paying for childcare is a huge expense and something we could afford for one child. But B. and I both want more children, so he switched jobs and I got a raise and now we are able to afford childcare for another child (hopefully soon). I still stress about unexpected car repairs and medical bills. I feel a level of financial anxiety that isn’t always based in reality. I am working on paying off accelerated debts like my private student loan to have more spending money. I also work at a non-profit so part of my public student loans will be forgiven in four years.

At what age did you become financially responsible for yourself and do you have a financial safety net?

My parents still pay for my car insurance and phone bill. I have offered to pay it but they always say no. My parents also helped pay part of my rent in college. After college, I paid all other bills myself though. My parents are well off and offer to help with big bills. They also helped pay for my wedding. I know they would be able to help if we ever needed it. Same with my in-laws. We could always get assistance from them in a pinch.

Do you or have you ever received passive or inherited income? If yes, please explain.

Yes, I received $5,000 after my grandpa passed away in 2023. I have kept it in savings and intend to use it for a doula and hospital bill for my next child.

Day One

6:20 a.m. — I set my alarm early because I have an appointment right at 8 a.m. My daughter M. came into bed at like 5:30 a.m. after going potty. We both get up. She begrudgingly gets dressed and drinks her oat milk. I make coffee and grab a banana for the road.

8 a.m. — Right on time for physical therapy. I have had some severe back pain on and off since February so my doctor put in for PT. I have a weak left side and weak hips, so I have exercises to do every night and get to see my PT once a week. He puts me through a tough workout and I leave sweaty. I stop at home to change and head to the office. $30 (copay)

11:30 a.m. — I get through some writing for a grant report. I didn’t have anything at home for lunch so I message my boss to see if she wants sushi. We go pick it up and eat during our 1:1 time. I get a snow mountain roll combo with miso soup. $19.17 for my portion. $19.17

2:30 p.m. — Someone is giving away a lavender bush they got from a neighboring non-profit. It’s deer resistant so I take it!

5:30 p.m. — My last call at work with a client ran late but she was very appreciative. Traffic succcckkkkkks on the way home. We make frozen Detroit-style pizza for dinner and watch Top Chef. M. falls asleep while cuddling.

7:30 p.m. — B. got a haircut today and I joked about a combover so I order him some Rogaine on Amazon. I also add some teeth whitening pens to the order for me. It is covered by a gift card and some CC points ($45). Yay!

9:40 p.m. — I’m too tired to finish Summer House (I am a new fan) so I head to bed. I forget my PT exercises and skincare.

Daily Total: $49.17

Day Two

6:15 a.m. — M. is up and so am I. She is sad when B. leaves today so I get her up and moving. She is mostly cooperative. I do skincare, makeup, take Adderall and allergy meds. M. gets oat milk and I get a Kind Thins bar for the car.

8 a.m. — Right on time for a specialist appointment with maternal fetal medicine. I have had two second-trimester miscarriages (one three months ago, hence the medical debt) and they are doing an ultrasound to understand my uterine shape.

9:10 a.m. — I have a septate uterus! This is somewhat good news and explains a lot of the challenges I have had with pregnancies. I will need to have surgery to remove the tissue in the middle of my uterus, but I am happy to have some explanation and answer to what is going on. I ask the doctor if it’s possible to be done in the next six weeks because that is when my benefit year ends. I already hit my deductible when I delivered in January. I call B., my sister, and my mom to share the news. When I get home I make scrambled eggs and coffee and start working.

12:30 p.m. — I leave for “lunch” which is actually food testing. I do this occasionally. It usually only takes 30 minutes and I get a small gift card after. I use the money on groceries. Today was cereal and my mouth hurts.

3:25 p.m. — I am not super hungry, but munch on popcorn and a Happy Viking triple chocolate protein shake. B. calls and we discuss getting fast food for dinner to make life easy and because we have no groceries. He is going to pick up M. right away because of construction traffic.

4:45 p.m. — I change and head to Orangetheory for a class. It’s pretty tough with some inclines but a good workout overall. After my workout, B.’s dad and cousin are over because they are working on my sister-in-law’s bathroom nearby. They head to the hardware store and B. picks up dinner from Arby’s, which he pays for.

7:45 p.m. — M. is down. I am very tired after showering so B. and I watch one ghost show and then I go to bed by 9 p.m.

Daily Total: $0

Day Three

6:04 a.m. — M. wakes up. I coax her back to bed and she sleeps for another 90 minutes.

8:41 a.m. — I wake up (B. woke up earlier with M.). Saturdays is for gymnastics class so I make M. and me the last of our eggs and some toast before we get ready and leave.

11:15 a.m. — After gymnastics, I take M. and we head over to my friend’s house nearby. My friend has a toddler and a newborn. The kids play a little and we help them pot some seedlings. M. is shy but they play outside in the cold for a bit.

1 p.m. — I pick up some matzo ball soup I ordered from a local “soup lady.” She has a small business and posts what she is making weekly. It’s $16 for a quart but I paid her the other week. I eat that for lunch and make M. a PB&J which she eats none of. My sister comes over and we all (B. included) head out to the mall. I stop to get gas, too. $44.95

3:15 p.m. — We hit several stores and I get some sweat shorts from H&M ($21.28) and T-shirts, athletic pants, and a Paw Patrol shirt for M. at Old Navy ($114.43). I might take the athletic pants back because they are $35 and I think I could thrift some. Undecided. We go to Target, too, and B. buys M. some new tennis shoes and me some vitamins, along with Pokémon cards for himself. $135.71

5 p.m. — That time again. We are really, really out of groceries so I make M. and I some Kraft mac and cheese. B. can fend for himself.

8:15 p.m. — M. is in bed so I head to a bar to meet up for a coworker’s birthday. It’s awkward because I don’t know many people but she likes to karaoke. I get two drinks throughout the night and pay for my coworkers, too ($15.50). I have never done karaoke before but I sign up for one song. After singing Goodbye Earl by The Chicks, I drink a glass of water and head out. $15.50

11:30 p.m. — Take my makeup off, put on Beekman 1802 Vitamin C serum, an eye cream, and moisturizer and pass out.

Daily Total: $196.16

Day Four

6:04 a.m. — M. won’t go back to sleep and it’s my turn to wake up with her. We play NYT games on my phone and she plays with her puzzles for a bit. I try to fall back asleep on the couch but she isn’t having it.

8:45 a.m. — B. is up. I make pancakes for everyone.

9:50 a.m. — M. and I are out the door late (after a small tantrum) to meet up with a friend and her kids at a nearby park. It’s pretty cold but it doesn’t faze the kids too much. M. won’t get in her car seat when it’s time to leave so I wrestle her in.

1 p.m. — B. leaves to pick up Taco Bell with M. My mother-in-law arrives. She came to help watch M. so we can go to the grocery store and then go help B.’s dad with the bathroom. I try the new Cantina Crispy Chicken Cheese Taco and it’s yummy.

2:30 p.m. — B. and I head to the grocery store for a big shop. We usually take M. with us but we knew we needed a lot and my MIL was planning to come anyway. We get so many things but among them eggs, bread, hotdogs, cottage cheese, feta, turnips, dill, bananas, soy sauce, relish, chili powder, cat food, cat litter, strawberries, buttermilk, deer repellant spray, Windex, toilet cleaner, new toothbrushes for M. and more ($289.81). We also hit the car wash for a wash and vacuum ($10). $299.81

4:12 p.m. — When we get back home, M. is watching a movie. We put everything away and finish the movie and say goodbye to my MIL. M. only wants cottage cheese, a banana, and carrots for dinner. I make a quiche with sweet potatoes, kale, onion, and feta as dinner and meal prep. I feel better eating something healthy for the first time all weekend.

7:23 p.m. — M. falls asleep on the couch and I FaceTime my dad back. We talk about my results from Friday and about M.

10:01 p.m. — I take a shower, do my skincare and forget to do my PT exercises. I scroll in bed until I am sleepy, then put on Always Sunny in Philadelphia to fall asleep to.

Daily Total: $299.81

Day Five

5:45 a.m. — My bladder wakes me up. I use the restroom and then can’t fall back asleep. I do the NYT puzzles before really getting up.

7:30 a.m. — I get M. and me ready, brush teeth, take meds, get changed, put on some makeup. I make a coffee, start the dishwasher and take M. to daycare.

8:10 a.m. — I am going to a non-profit store at 9 a.m. near my house so I return home and eat some Mini Wheats before getting my work stuff together and leaving,

10:12 a.m. — In the office and start work. Everyone is in the office on Mondays so it’s busy and loud. There is also some construction going on behind my desk. I eat some leftover quiche in a nearby meeting room.

4 p.m. — I finish leading a meeting about Evicted and Poverty, By America by Matthew Desmond. It was a good conversation regarding problems that we see with clients and ways to help affect change. I return some calls and finish the day.

5:30 p.m. — B. and M. are home and I start the grill for burgers. I make a cheddar broccoli pasta thing on the side knowing M. won’t try a burger. She doesn’t. After dinner, I give her a bath and she practices her swimming kicks. B. does teeth brushing and I read her books and pat her back to bed.

8:41 p.m. — The cat puked on the jute rug again. I really regret buying this rug less than a year ago. Also the cat never pukes on the hardwoods, only the rugs. I search for affordable machine washable rugs and order one off Walmart’s website with a rug pad. $109.15

9:49 p.m. — I peel myself off the couch to get ready for bed. I do my PT exercises and watch Always Sunny to fall asleep.

Daily Total: $109.15

Day Six

6:30 a.m. — Oucchhhh. My back really hurts today. M. woke at like 6 a.m. I try to do some pelvic tilts to help my back but nothing works. M. and I get ready and I put a heating pad in my bag. I make a coffee and head out.

8:20 a.m. — I heat up my quiche for breakfast. I listen in on a webinar about strategic planning.

11:30 a.m. — The webinar is over. I eat leftover matzo ball soup at my desk. I get an email that the CSA I signed up for starts in two weeks — yay! It’s an urban farm near my home and I am excited to support them and get fresh veggies and herbs.

4:30 p.m. — Out the door after a late-afternoon emergency. An employee that I work with had their power shut off. I do what I can and tell her I will check in later to see if her power was able to get put back on. I grab everything because tomorrow is work from home.

5:01 p.m. — M.’s weekly swim class. She loves going. B. picked her up and said that she fell asleep in the car. She is doing great at floating on her back and going under the water.

7:12 p.m. — Speed is the most important part of dinner tonight so M. eats some dino nuggets, a banana, and naan dippers. I eat some sourdough multigrain with ricotta and honey. B. makes something in the air fryer. I read books to M. and brush her teeth. B. has back-patting duties.

9:30 p.m. — After my PT exercises, I eat some Mini Wheats. B and I watch a few episodes of The Traitors (UK) before bed.

Daily Total: $0

Day Seven

6:30 a.m. — I wake up to M. coughing. Cue the Mom Sickness Panic. No fever and her cough goes away as she gets ready. She seems good enough to go to daycare. (Update: She was fine, must have been spring allergies.) I drop her off and head home for work.

10:30 a.m. — I make eggs over-easy on toast before a work call. I chat with a navigator at an organization like ours about some tools we use.

11:12 a.m. — My sister calls to talk about our days. We talk three or four times a day on WFH days and one or two times when I am in the office. We talk about the new episodes of Vanderpump Rules and The Valley. We also talk about the workout at Orangetheory for today.

3 p.m. — I work on a grant report in the afternoon and do some dishes and laundry. B. calls on his way home. I start some rice in the rice cooker for dinner, too.

5:10 p.m. — I make a Boursin-broccoli-rice thing for dinner. M. is not impressed and gets peanut butter on bread instead. B. suffers through. I think it’s great! Dang picky eaters.

6:15 p.m. — I am starting not to feel great. My tummy hurts and I just generally feel unwell. I call my sister to tell her I am going to cancel my workout. She is sad but will be fine without me. I am sad to lose a class but it is what it is.

7:30 p.m. — After helping B. put M. down, I go between the couch and the toilet. I do my PT exercises and shower before bed.

Daily Total: $0

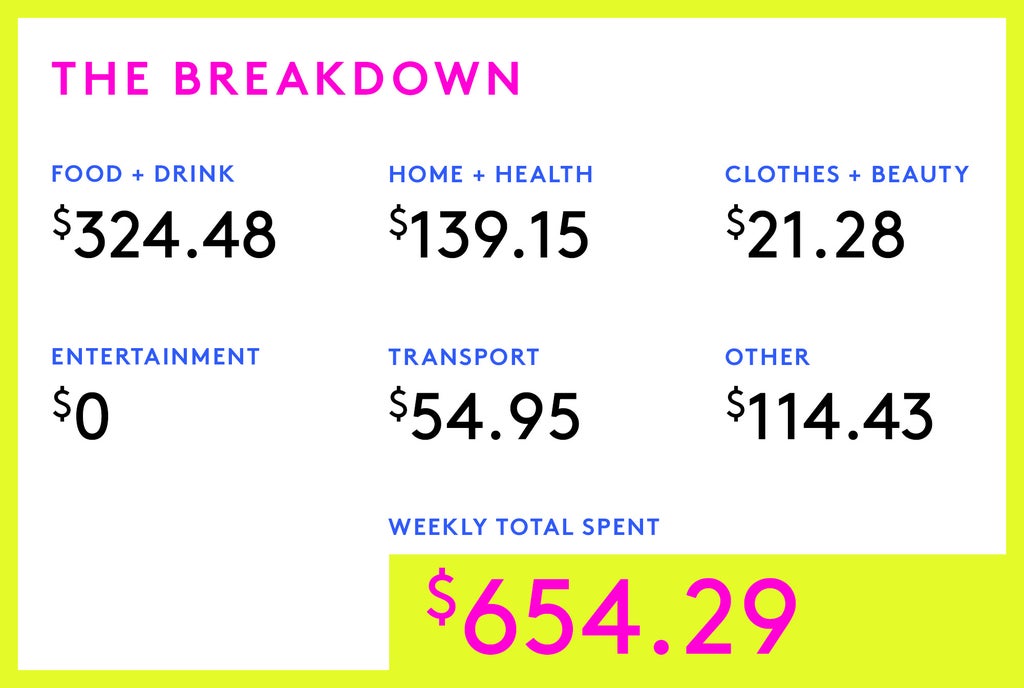

The Breakdown

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more Money Diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Huntsville On A $321,000 Joint Salary

A Week In Philadelphia, PA On A $73,500 Salary

A Week In Chicago On A $108,150 Salary

from Refinery29 https://ift.tt/x5CqIif

via IFTTT