Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a biz ops manager who makes $240,000 per year and spends some of her money this week on memory foam stuffing for the leather poufs she bought in Morocco last year.

If you’d like to submit your own Money Diary then please do send a bit of information about you and your situation to moneydiary@refinery29.com. We pay $150 for each published diary. Apologies but we’re not able to reply to every email.

Occupation: Biz ops manager

Industry: Tech

Age: 28

Location: The Bay Area

Salary: $240,000 including company stock and bonus.

Assets: $8,500 checking; $161,000 HYSA; $345,000 total investments (401(k): $138,000; Roth IRA: $62,000; company stock: $49,000; brokerage investments: $81,000; treasury bonds: $16,000); $3,500 HSA. My partner, R., and I have a joint account for rent only and separate finances otherwise.

Debt: $0

Paycheck amount (biweekly): $2,200

Pronouns: She/her

Monthly Expenses

Housing costs: $2,100 (my half of rent for a two-bed, two-bath apartment split with R. He pays for utilities and internet).

Loan payments: $0

Max 401(k) & after-tax contributions: $5,000

Company ESPP: $1,800

Pet spend: $100

Gas: $100 (this is my contribution to R.’s car, I don’t own a car myself).

Pet insurance: $25

Health insurance & FSA: $60

Cell phone, Amazon Prime: $0 (covered by parents).

Netflix, YouTube Premium, YouTube TV, Spotify Premium: $0 (covered by R.).

Credit card fees: $150 per month (this is the average per month; in the past couple of years we have been credit card churning and have accumulated over three million points together, which we typically use towards business class international flights or aspirational hotel stays. For example, we went to the Maldives with a business class flight and an overwater villa on points alone).

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes, I was expected to attend college and obtain a bachelor’s degree. My parents immigrated to the US when I was a toddler and spent time and money to obtain master’s degrees themselves. I saw my parents work hard in their 20s and early 30s to further their education and improve their careers to provide a better life for me. Culturally, in an Asian American household, education is very much valued and seen as a strong indicator of future success. My parents always told me that doing well in school and getting into a top-tier college was my top priority and they would find a way to pay for it. I ended up getting into a top 15-ranked private school and was lucky to get some scholarship money that lowered the total cost to only ~$10,000 more a year compared to my public state school. I was very fortunate that my parents paid for most of my tuition and living expenses. As a part of my financial aid package, I did get a work-study job as well as side gigs during the school year and eventually paid internships as an upperclassman. These paid for my summer housing, vacations and general fun money. I also finished classes a quarter early, which saved some expenses. I ended up with about $22,000 in government-sponsored loans, which I paid off completely in 14 months after I graduated with little interest accumulated (it was a goal of mine to pay it off as soon as possible).

Growing up, what kind of conversations did you have about money? Did your parent(s)/guardian(s) educate you about finances?

Growing up, we didn’t have many money conversations — there was emphasis that money was important and shouldn’t go to waste. Generally my parents were frugal with going out to eat, vacations etc. but spent on extracurriculars, lessons, tutoring and college prep for me. They saw those as an investment for my future and I’m grateful now that they always emphasized that I should make the most of those opportunities even though in the moment, I didn’t appreciate the piano lessons or SAT prep I was told to take. My parents didn’t talk specifics on investing, making your money work for you or strategies outside of simple savings. I do think that being immigrants, there was a lot they were learning and figuring out themselves and it’s difficult to teach your kids if you too aren’t sure of the options and risk levels out there.

What was your first job and why did you get it?

My first job was working at McDonald’s during a summer in high school. I got the job as I didn’t have anything else going on and I think my parents thought it would be a good experience. I don’t think I actually made much money from the couple of months I worked as a cashier but looking back it was a good memory as I was pretty introverted as a teenager and this job forced me out of the house.

Did you worry about money growing up?

Generally I did not. I was aware that other kids went to more expensive camps, had the latest fashion and traveled more with their family but I never felt like I lacked money.

Do you worry about money now?

I don’t worry about money now, given that the last couple of years I have been able to increase my net worth and savings substantially. It also helps that I don’t have any debts (including mortgage) and generally my expenses are low, living with a long-term partner. R. and I split rent but he generally pays for more of our other expenses (groceries, household items, dining out, activities) as he earns more. I am able to splurge in areas that I care about (travel and dining out are my biggest expenses outside of rent) while knowing that I am paying myself first and investing a good chunk of my paycheck every month. The rest I spend however I like.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I became financially responsible for myself when I graduated college. I think this became tangible for me when I started paying off my student loans and was responsible for my own daily expenses. At this point I have enough cash savings that I can pay for basic necessities for over a year (probably two) if I were to lose my job. I know that if I needed to, my partner would support my housing, worst-case scenario.

Do you or have you ever received passive or inherited income? If yes, please explain.

When I graduated, my parents provided a down payment for a studio condo and co-signed my mortgage. I’m very fortunate that they were willing to support me in getting my own place. The studio was only about 650 square foot but I lived there for almost five years and I was able to enjoy having a home for myself. The total cost to me monthly (mortgage/HOA) was about the same as if I had rented a studio. I have since sold the studio as I moved cities.

Day One

8 a.m. — It’s Memorial Day and my partner, R., and I have spent the weekend in Los Angeles after driving down from the Bay Area. We go shopping early in the morning to return a shirt R. bought but had instant buyer’s remorse about, as it came out to be much more expensive than he thought it would be. Somehow he didn’t check the price before ringing it up.

11 a.m. — We head to a super trendy and Instagrammable cafe in K-Town. The weather is beautiful and I order a matcha einspänner and frozen mocha for R. and me. We usually would share a coffee but this spot is too cute so I had to get two drinks, even though I knew I would probably end up drinking both. I don’t look at prices closely and end up paying over $16, which seems to be the norm for coffee shops nowadays. I usually don’t buy coffee since I get it for free at work and have a nice espresso machine at home so I don’t feel guilty at all. They didn’t have pastries today but the matcha is fantastic, 10/10. $16.97

1 p.m. — We meet up with a friend for lunch and end up waiting about an hour and 20 minutes for a hole-in-the-wall restaurant (which is super busy given it’s a holiday) but we’re in good company. We fill ourselves up with noodles and dim sum to get ready for the drive back. R. treats our friend and pays for the entire meal. It’s about $75 with tip, which seems very reasonable.

7 p.m. — After hours of traffic driving back from LA to the Bay Area, we stop by McDonald’s to grab a snack as R. is hungry and tired. Our GPS was wildly off on how long it would take to drive back and there were multiple accidents along the way, which slowed us down. I use the app to get a $2 large fries (we love the McDonald’s deals) and R. is excited to see that this McDonald’s has Double Filet-O-Fish, which is rare in the States. Of course he has to get it and we quickly eat in the car before continuing our drive. $9.92

10 p.m. — I’m still hungry after only eating fries but it’s too late to have a full meal. I consider eating the leftovers from lunch but worry that the food has gone bad after spending seven hours in the car. I end up deciding to skip dinner, do a quick scan of my work schedule for tomorrow and go to bed early.

Daily Total: $26.89

Day Two

7 a.m. — I wake up early to start work despite feeling super tired from the weekend travel. Luckily it’s a WFH day and I make a quick latte using my espresso machine and beans I got for free from the office when we had a local roastery come by to promote their store. The coffee really helps me wake up and I get ready for a day of meetings and interviewing a candidate for a new position on our team.

12 p.m. — I eat the leftovers from our lunch in LA and pray to not get food poisoning. I throw out the meat-heavy dishes we got and stick to noodles and vegetables. R. grabs wings and burgers from the restaurant next to our apartment using the Grubhub credits we get through our Amex credit cards.

6 p.m. — I finish up work and spend some time playing with my cat. He’s generally lazy but wants extra attention as we left him at home this weekend. We had R.’s parents check in on him daily but he’s definitely a bit annoyed and more vocal since we were gone for the weekend. I take a long shower to relax from a busy work day and get dinner ready. For dinner I make enoki-wrapped beef with garlic spinach and rice from groceries we had in the fridge and thinly sliced beef I always keep in the freezer. It’s such a time-saver for quick weekday meals.

9 p.m. — I’ve been seeing ads for color analysis sessions on social media and find a local spot nearby. It looks like a fairly new business but the Yelp reviews and Instagram page look good. I make an appointment for R. and me to do a joint session since it’s priced slightly lower if you book for two people ($139 each) and pay a $60 deposit. I spend the rest of the night relaxing with some Netflix in the background. $60

11 p.m. — After a long day, I do my usual nighttime routine (foam cleanser, toner, serum, retinol, hyaluronic serum, moisturizer) and head to bed.

Daily Total: $60

Day Three

7 a.m. — I wake up and get ready to head to the office, checking emails and messages as I do a quick skincare routine and put on makeup. I take my first meeting from home as R. and I typically carpool to work and he wakes up later. We’re lucky our offices are less than 10 minutes apart so he drops me off at work first. On the way, I order a matcha latte for R. from my office barista bar, which is free. Such a great perk! I skipped my morning coffee at home so I get an oat cappuccino for myself.

12 p.m. — After a morning full of meetings, I grab my usual salad from the salad bar in the cafeteria. The salad bar is surprisingly great with a variety of prepared salads, veggies (both grilled and raw), and protein options including my favorite flank steak. My go-to lunch is a steak salad on a bed of spring veggies with roasted brussels sprouts, broccoli and sliced hard-boiled eggs. The best part is that it’s priced by container and not weight so I can pile on the steak and get a huge salad for $3.25. After a quick lunch I grab an iced matcha from the barista bar and continue working. $3.25

4 p.m. — I finish up work and grab a mango spritz from the barista bar before heading out. I take the company shuttle back home, which is $8. I use my commuter benefits card, which my company contributes $130/month to in order to pay for the shuttle. This always covers the cost so I don’t have to pay out of pocket. Today’s route is short and I get home in 25 minutes.

6 p.m. — After finishing up work, I wash dishes from last night and water my plants. I definitely wouldn’t say I have a green thumb but I have managed to keep my three plants alive. As I’m feeling productive and in the mood to finish up chores, I also trim my cat’s nails. Luckily he’s pretty chill with me grabbing his paws and I catch him mid-nap, which is perfect timing to do a quick trim before he fully wakes up. As a reward, I feed him a few of his favorite dried minnow treats afterwards.

8 p.m. — I eat dinner after R. comes back from work. He gets free meals (lunch and dinner) at the office and usually eats there with his team and brings food back so I get free dinner. We typically have enough for lunch the next day as well if we WFH. With this perk, we don’t have to cook much on weekdays. R. joins his evening meetings and I munch on the beef pot roast, broccolini and egg noodles that he brought back while watching travel vlogs on YouTube. I also heat up some homemade soup R.’s mom made and brought over a couple of days ago.

9 p.m. — After dinner I watch one of my favorite shows, Top Chef, and start packing for our staycation tomorrow. We’ve been looking forward to this for a while and have planned to stay at an all-inclusive resort/lodge in Big Sur. We wouldn’t usually take a random weekday off but we used points to book one night at the resort for a really great rate (the cash price is typically $2,000 a night). R. really wanted to experience it and award availability was really slim so we could only get a weekday.

10 p.m. — I pack two outfits, a swimsuit (they have Japanese-style hot springs along with a couple of pools) and my usual toiletries. I also bring my hiking sneakers as we signed up for a guided redwood trees hike (complimentary with our stay). I spend a few minutes debating if I should bring my Dyson straightener since my hair always becomes a frizzy mess after a swim, even with a decent hairdryer. After seeing more space in the one suitcase R. and I are sharing, I end up tossing it in just in case. I make a final list in my Notes app of things to bring tomorrow that I will need to use and spend the rest of the night researching more on the resort and planning out our drive to Big Sur.

Daily Total: $3.25

Day Four

9 a.m. — Today’s the day we’ve been waiting for! I wake up and check my work messages, even though I have the day off. There’s a few questions and tasks that I need to address so I do a bit of work and then finish packing up after going through a quick skincare routine and getting dressed.

10 a.m. — We head out on our road trip to Big Sur. I make a quick latte to go before double-checking that our cat monitors are on and there’s plenty of food and water for him.

11 a.m. — About a third of the way down to Big Sur, R. gets an alert for flight award availability in business class to Tokyo for Christmas. We’re big points churners and have been waiting to book our Christmas trip but of course flights are expensive and award tickets are hard to come by that time of year. R. signed up for a points tracker to get notifications for when good award tickets become available. We pull over and book the flight immediately since there’s only one seat. He spends 75,000 points and $126 in taxes and fees for the one-way business seat. Such a steal! Now we just have to find a flight back…

2 p.m. — After a couple of spots at viewpoints along Highway 1 in Big Sur, we arrive at a popular restaurant known for having a great view. We’ve purposely arrived later for lunch as we heard there’s typically a long wait. Luckily we miss the rush and are quickly seated and order a burger and prime rib French dip to share. They come with a side salad or coleslaw but we end up being pretty disappointed by both the food (R. pays $67 including tip for two sandwiches, essentially) and the view, which honestly is not that great. It definitely doesn’t justify the cost.

3 p.m. — It’s a short drive to our resort, which has amazing views of Big Sur. We park and get shuttled into a golf cart for a short ride to the check-in lobby. Our room is ready early and we’re able to check in, relax and I grab a Diet Coke from the minibar (included).

4 p.m. — We walk to the restaurant on the property as we heard there were complimentary cocktails for happy hour. Upon arriving we see a good number of guests hanging out and treat ourselves to the complimentary gin-based cocktail with a fun bubble that pops and emits smoke. Very Insta-worthy! We are tired from the drive and want to check out the pool and hot tubs before dinner so we change into swimsuits and find a spot near the pool to camp out. Between the infinity hot tub and pool, this is the perfect way to start our stay.

8 p.m. — We head back to the restaurant for dinner (included in our stay) and it’s sunset. The view is gorgeous with the sky a gradient pink and orange. I order a fancy gin and tonic for $23.40 (alcohol is not included) and order two apps (hamachi crudo and grilled octopus), an entree each (seared ribeye and scallop risotto) and dessert (passionfruit mango cheesecake and opera cake). Everything is delicious and perfectly cooked. We’re so, so stuffed afterwards and go to another set of hot tubs to wind down. $23.40

11 p.m. — We get back to our room and somehow we’re feeling a bit hungry even after the three-course dinner. We glance at the room service menu and figure we might as well get a late-night snack since room service is included. R. is tempted by the ribeye steak and I want to try the seared striped bass so we end up ordering both along with grapefruit juice and chocolate chip cookies. We end up eating in bed because being at an all-inclusive just makes you go all out and there’s something so fun about eating a steak in bed. The food is surprisingly really good and the fish is perfectly seared and succulent. We fall asleep quickly soon after.

Daily Total: $23.40

Day Five

6:30 a.m. — My alarm rings at 6:30 a.m. and I instantly regret staying up and the late-night meal. I’m working today and have meetings starting at 7 a.m. I’m interviewing someone for a support role on my team so I scramble to get ready and look presentable. R. wakes up as well and I feel super apologetic for making him get up early but he shrugs it off and leaves for a morning swim. I make a quick coffee using the Nespresso machine in the room and start my meetings.

9 a.m. — I have a quick break from work and I call R. to see what he’s up to. We meet on the way to breakfast and enjoy a meal of mushroom tartine, chorizo breakfast fried rice, French toast, and mimosas to share. This morning, the weather is much hazier and colder than yesterday and we’re grateful for the heat lamps outside as we eat on the patio. We finish up breakfast and I head back to the room for more calls while R. goes on a beekeeping experience. He’s super excited to try on a beekeeper’s suit and handle the hives. It’s an additional $120 but totally worth it for him.

12 p.m. — I finish up my meetings and take my lunch break to go on a guided hike through the gardens. It’s a foraging hike and we try different plants and flowers along the way and learn what to avoid (turns out most plants are poisonous in large amounts). Our guide is super fun and we quickly finish our walk around the property.

1 p.m. — We head back to the restaurant for lunch but are tired from walking the same path so we call a golf cart ride. It’s only a third of a mile but after a few back and forths we just want to eat quickly. For lunch, R. gets the skirt steak churrasco and I get the fish of the day, which is salmon with mashed potatoes. Again, the fish is the highlight — the salmon is perfectly seared and so moist inside, and the cream sauce that comes with it is amazing. We finish our meal with a scoop each of mixed berry and guava sorbet. Our server adds some mixed berries and this is absolutely perfect on a hot afternoon.

3 p.m. — We check out, leave our suitcase and large bags with the front desk and head back to the pool/hot tub area to relax. R. does his sauna/hot tub sequence and I enjoy the view in a cabana. After a couple of hours we realize that the pool is empty — where did everyone go? R. and I had planned to start driving back earlier but once we see that we have the space to ourselves, we decide to hang out for longer and fully take advantage of the time. Back to the hot tub we go.

7 p.m. — We finally start driving back after changing into dry street clothes and getting a final golf cart ride back to our car. It’s sad saying goodbye to the property but we’re super grateful to have had the experience. We drive straight back to our neighborhood and get Chinese takeout since we’re too tired to cook or worry about dinner. I order spicy fish, green beans and noodle soup from a local restaurant for $67.20 in total. The restaurant only accepts cash so I venmo the amount. $67.20

9 p.m. — We get home, feed my cat some treats and I take a quick shower. Finally I settle down to eat our takeout, which turns out to be way too spicy even though I only got medium spice. I only eat a little bit before heading to bed to rest.

Daily Total: $67.20

Day Six

9:30 a.m. — It’s Saturday morning and I wake up super groggy before falling back asleep after seeing that it’s only 9 a.m. An hour later, R. is awake and says that we should get up as we need to leave at 11 a.m. to get lunch with friends before heading up to San Francisco for a friend’s birthday/housewarming party. I scramble to get ready, put on makeup and do my hair as I thought we were leaving later. Luckily, everyone’s running late so we scrap lunch and agree to meet at noon to head up together.

12 p.m. — R. and I drive to our friend’s house to carpool up to San Francisco. It’s a nice drive and we catch up on what’s been going on lately. The housewarming is already going when we arrive and we quickly catch up with old friends and meet new people. The atmosphere is great with a DJ set, desserts and plenty of drinks including signature homemade cocktail mixes. It’s super nice being outside on a large patio on a sunny day.

5 p.m. — People start to leave as many are going to a concert. We head out as well and decide to grab dinner at a popular Japanese noodle shop which specializes in mixed udon noodles. After getting to the restaurant we line up in a long queue outside to get seated but luckily it moves quickly and we only wait 30 minutes to get a table. We each get a noodle dish and we order chicken karaage to share. The food is solid and R. pays for us both (~$45).

7 p.m. — We get home and spend the rest of the night catching up on laptop tasks and I update my to-do list for Sunday and the next week. Sunday is generally our errands day so we take inventory of what we need to do since we were also traveling last weekend. I plan out our meals for the week, which includes taking meat out of the freezer to defrost.

10 p.m. — I’m super tired from a fun (but busy) week and Saturday and get ready for bed early. I go through my usual skincare routine and add on a face mask I got from Japan a few months ago to help recover from all the sun exposure the last couple of days. I always wear sunscreen before going outside but don’t do a great job of reapplying so I’m worried the sun protection wore off since we were outside for hours for days straight, which is pretty unusual for us.

Daily Total: $0

Day Seven

9:30 a.m. — I wake up around 9:30 a.m. on my own but still feel tired so I stay in bed for another hour while browsing social media and YouTube. R. gets up first and I ask him to make me a latte to help me wake up. He brings me the coffee in bed, which gives me the boost I need. While I usually make my coffee myself, R. has more patience to steam the oat milk that I just pour on my espresso so his lattes are way better than mine.

11 a.m. — I get started on a batch of pork, corn and carrot soup — a classic in my household and the perfect comfort dish. I’m feeling bloated after eating out so much in the last week, first in LA and then the indulgent meals at the all-inclusive in Big Sur, so I get ready to make lunch and dinner by prepping veggies. For lunch I use the leftover spicy sauce to boil some thinly sliced beef and add in veggies from the fridge to make it a complete meal.

3 p.m. — Catching up on some laptop work and online errands, I research stuffing for the leather poufs we bought in Morocco last year on vacation and end up spending $32.73 on memory foam stuffing. We got the poufs last fall but haven’t gotten around to filling them as they came with just the leather shell. I hope the memory foam will fill them up nicely and provide additional seating around our living room for when friends come over. $32.73

4 p.m. — R. and I head out to do errands, first going to the car wash as our car got pretty dirty on the two road trips. R. pays $18 for a wash and we end up complaining and going into the washing tunnel again as the first wash didn’t remove the bird poop stains on the windshield. Next we visit our local Korean grocery store and grab produce and restock supplies for the week. Our grocery haul includes spinach, green onions, four kinds of mushrooms, two packs of fresh noodles, ground pork, and frozen tuna onigiri for $37.68. $37.68

7 p.m. — For dinner I make oyakodon, a Japanese comfort dish with chicken, egg and onion simmered in a dashi broth. We eat it with rice and the pork soup I’ve been simmering since 11 a.m. on the side. It’s the perfect healthy, nutritious dinner and I feel much better about my overall diet afterwards. R. cleans up and we finish off the night by unpacking our suitcase and travel bags, doing laundry and picking up packages.

10 p.m. — I get ready for bed with my usual nighttime routine and add in a face steam and retinol. The last thing I do before shutting down is check my work phone for messages, emails and meetings for Monday to get myself ready and have a general sense of my work day.

Daily Total: $70.41

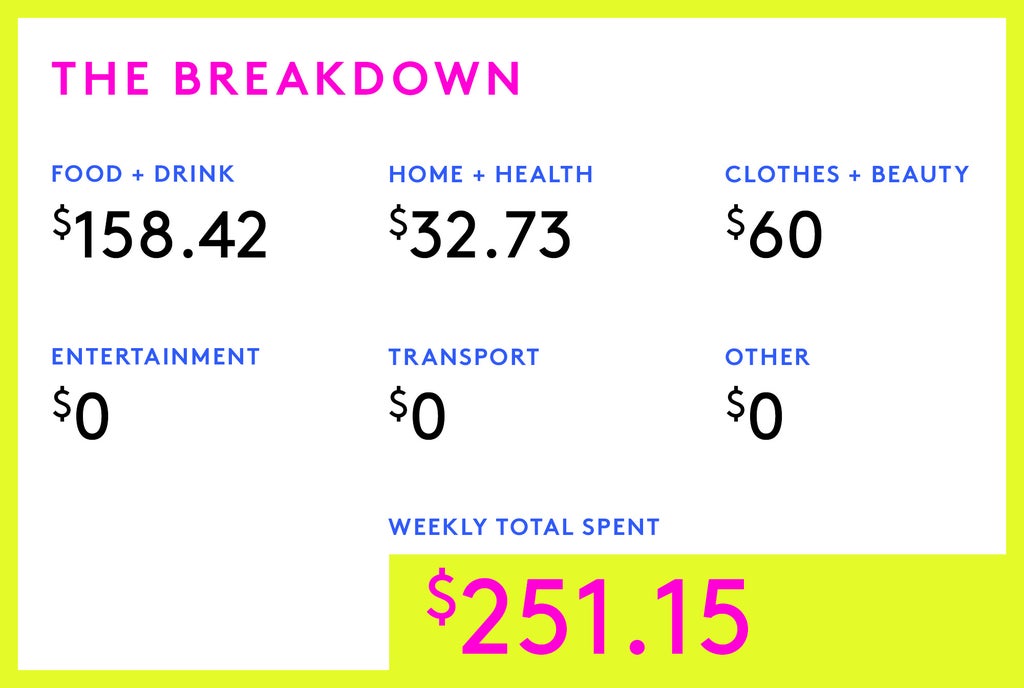

The Breakdown

Weekly Total $$ Spent: $251.15

Food & Drink: $158.42

Entertainment: $0.00

Home & Health: $32.73

Clothes & Beauty $60.00

Transportation $0.00

Other $0.00

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more Money Diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In South Carolina On A $60,000 Salary

A Week In Nashville, TN On A $116,500 Salary

A Week In Philadelphia On A $150,000 Salary

from Refinery29 https://ift.tt/aCcfOmE

via IFTTT