Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a project manager who has a joint salary of $224,000 per year and spends some of her money this week on Dunkin’ Original Blend Whole Bean Coffee.

If you’d like to submit your own Money Diary, you can do so via our online form. We pay $150 for each published diary. Apologies but we’re not able to reply to every email.

Occupation: Project manager

Industry: Healthcare

Age: 34

Location: Salt Lake City, UT

Salary: $224,000 (joint)

Assets: 401(k): $90,400; Roth IRA: $14,000; stocks: $15,600; bonds: $2,800; home value: $545,000; car values: $24,000; HYSA: $53,000; checking account: $11,100. After we got married earlier this year, we combined finances but we did not commingle any assets we brought into the marriage. We now put everything into our joint checking account and each have a “fun money” budget that we can spend or save as we please on personal items that don’t fall within our regular budget categories.

Debt: $505,000 (mortgage); $78,000 (student loans).

Paycheck amount (every two weeks): $4,787 (after all deductions).

Pronouns: She/her

Monthly Expenses

Housing costs: Mortgage principal and interest: $2,583; taxes and insurance: $421; utilities: ~$220.

Loan payments: $589 for student loans (this goes up in October to $800+).

Pet wellness plan and insurance plan: $133

Wax subscription: $50

Phones: $85 (for two lines).

Home security system: $32

Internet: $50

Spotify: $18.26

Apple Fitness: $10.73

Car wash membership: $49.99

Life and disability insurance: $132

Car insurance: $83.33

Savings: ~$900 (plus any leftover budgeted money).

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

My parents expected all of their kids to go to college and they paid for most of my undergraduate degree. I took out some student loans to help. My husband was also expected to get a degree. He lived at home during his undergrad and then took out loans for his master’s.

Growing up, what kind of conversations did you have about money? Did your parent(s)/guardian(s) educate you about finances?

My parents didn’t educate me about finances or budgeting at all. I would overhear them fighting at times but money was not something they were willing to discuss with us. My husband had a different experience. His parents had to start over when they immigrated here, and as a family they seem to have a healthier approach to money.

What was your first job and why did you get it?

I got a job as a retail cashier when I was 16. I didn’t receive an allowance, though my parents would give me money if I asked for it for something specific. I hated asking though, so I got a job.

Did you worry about money growing up?

Yes, I think the lack of transparency from my parents combined with overhearing fights was very stressful for me as a kid. I saw my parents work very hard but I would also see my mom spend a lot, which I knew caused fights. So I stressed.

Do you worry about money now?

For the first time I can say, not really. We have about nine months of an emergency fund in our HYSA, and we speak openly about finances as a couple. We have agreed that anything we save beyond the nine-month emergency fund will go toward home improvements, vacations and a new car in a couple of years. We aren’t quite maxing out our 401(k) contributions but we’re pretty damn close. My biggest concern right now is the economic climate and potential job loss depleting our savings.

At what age did you become financially responsible for yourself and do you have a financial safety net?

During college I worked to cover part of my living costs. My parents contributed as well. After I graduated, I took on all of my expenses. My husband and I have really great parents and they would help us out if we were in a bind.

Do you or have you ever received passive or inherited income? If yes, please explain.

Neither of us has inherited anything, though we did get married this year and received $25,000 in gifts from family and friends.

Day One

5:30 a.m. — Our dog, C., wakes me up for the third time this morning. We went to see Slash last night and the stress of being home alone for a few hours triggered his IBD. My husband, S., convinces him to come back to bed since he’s not produced anything on the two walks I’ve taken him on this morning. We all go back to sleep.

7:30 a.m. — S. wakes me up to make sure I have another alarm set since he is leaving for work. I set one for 8:30 a.m. and go back to sleep.

8:30 a.m. — I walk C., who does manage to go to the bathroom again. We return home, exhausted, and I start work. I can’t remember how we used to manage his IBD before I worked remotely. C. snores on his couch in my office.

5 p.m. — Work today was a bit of a tired blur. I’m tempted to get takeout for dinner but decide to surprise S. with a home-cooked dinner instead. I make us chicken with roasted carrots and potatoes. We’re trying to curb our restaurant spending so that we can work to max out our retirement contributions. It has been harder than I thought to resist the siren call of Uber Eats.

Daily Total: $0

Day Two

7 a.m. — I wake up as S. is getting ready for work. C. and I cuddle while I perv on S. as he changes. I scroll on my phone after he leaves and then head out to take C. on his morning walk. Our mail guy has been studiously ignoring an outgoing letter I have posted at our mailbox. It’s a million degrees out every day so I can’t blame him for not wanting to carry any extra weight (he’s a walking carrier). C. and I walk across the neighborhood to a blue mailbox so I can mail it.

10:30 a.m. — I notice a group text come through, it’s an invitation to our good friend’s bachelorette weekend in New Mexico in a few months. Unfortunately, I am supposed to be driving to Portland for a different trip during those dates.

4 p.m. — Because I work remotely, I have to charge anything I print to a local FedEx office. I am running a review tomorrow and send over a copy of the deck to have on hand in case I have any technical issues. $4.47 (expensed).

4:15 p.m. — I notice when grabbing the FedEx transaction from my card for reimbursement that our HelloFresh subscription was charged today. We received a “come back” offer and I’m taking full advantage until the discounts end. $62.42

6:15 p.m. — S. comes home and I let him know that we might be hosting my sibling, D., for the night. Their dog, B., is having a medical emergency and they live a bit far from any vet hospitals. I skip my yoga class in case I need to help them. It’s S.’ turn to cook and he makes us chicken taco bowls. When D. lets me know they’re driving home tonight, I switch focus to the New Mexico bachelorette. Ultimately, I decide I’ll stay two nights and leave early to get back to Salt Lake so that I can still drive to Portland on time. Thank god for airline miles or I wouldn’t be able to go; taxes are a mere $11.20. $11.20

Daily Total: $73.62

Day Three

5:15 a.m. — C. has been up a few times over the night, to get water, loudly rub his face on the carpet etc. I wake up at 5:15 a.m. to him softly growling at me to wake me up. He has had IBD for years so I do a quick gauge as to whether he actually needs to go out or just would like to, and then tell him to get back in bed. He doesn’t fight me, which means he is fine to wait for his usual morning walk.

7 a.m. — S. wakes me up and tells me there’s a worldwide issue with Microsoft and blue screens of death. I ping a coworker in IT to see if they think that our offices will be affected. He doesn’t think so. I’m glad to know work won’t be on fire today. C. gives me a ton of side-eye for not taking him out earlier.

10 a.m. — I fight the urge to get a latte while on my errand to FedEx. We went a bit ham on our restaurant expenditure at the beginning of this month celebrating my birthday and going on a weekend getaway, and I’m determined to remain within our new, untested $500 restaurant budget. While making myself a sad little cup of drip coffee at home, I realize that we are low on groceries and place an order ($76.38). The rest of the morning passes quickly. I sit in on some presentations, some of which are painfully boring so I send my boss, who doesn’t have social media, screen recordings of videos making fun of corporate shenanigans, which she loves. $76.38

12 p.m. — My mom calls to let me know that D.’s dog, B., is not doing well. B. and D. used to live with me and C., and B. and I have a close bond because D. worked nights. B. may have advanced cancer and the vet is making it sound like the prognosis is not good. I am devastated. He is the biggest, most lovable goober. We have to wait until later in the day to learn if the cancer will be treatable. He’s been dropping weight for a month but the vet kept sending him home and telling D. to try harder to get him to eat. I’m angry. I have to pull myself together for this review in an hour. B. is only five. This is so not right and so unfair. I cuddle C. on the couch and cry. Right before my mom called, I ordered matching metallic plates and party hats from Target for a birthday get-together tomorrow ($15.02). Now I don’t want to do anything. $15.02

4:30 p.m. — I’ve made it through the afternoon and there is light on the horizon. D. just texted to let us know that B.’s cancer is probably treatable. It’s lymphoma and if it’s not the most aggressive type, he could have years left. He is getting all the snoot kisses when I see him next. I’m feeling hopeful and go out to get my drive-up orders at Target and the grocery store. S. and I spend a quiet evening at home.

Daily Total: $91.40

Day Four

10:15 a.m. — I wake up, confused. We all slept in, including C. C. only lets this happen about once a year. I think we’re all tired from this most recent IBD flare-up and the emotional rollercoaster that has been B.’s diagnosis this week. We make brunch at home and I spend hours trying to figure out how to make a proper espresso on our espresso machine. I feel like I’m back in chemistry class, a subject where I barely managed a B-. I only take a break to talk to my best friend when she calls.

2 p.m. — Much cussing later, I head to a local bakery to pick up a cake I ordered for the birthday party tonight. It doesn’t look anything like what I ordered (an ombre frosting look) but compared to what other bakeries are charging these days for custom frosting jobs, I don’t feel like I can complain ($49.44). I take the cake home and cover the sides in sprinkle swirls. It ends up looking pretty cute! $49.44

7 p.m. — We spend the evening celebrating a friend’s birthday at a dueling piano bar downtown. On the drive up, S. takes some photos of the new fire burning in the foothills above downtown. We can see some of the flames in the smoke cloud and a helicopter fighting the blaze. At the bar, there is a $5 cover per person ($10.78 with tax). $10.78

7:30 p.m. — The cake is delicious and the music is good. S. and I spend $97.56 on cocktails and food throughout the night after tip. Parking ends up being $15 for four hours. $112.56

Daily Total: $172.78

Day Five

8 a.m. — S. and I are pretty tired after our night out so we decide to skip the heat of the farmers’ market to chill at home.

12 p.m. — C. and I end up taking a long nap on the couch and I wake up to S. telling me that Joe Biden dropped out of the presidential race. Now I feel wide awake. We watch Hasan Piker’s coverage on Twitch while we cook lunch: sesame tofu and snap pea stir-fry. I play TimeGuessr for a bit as we watch.

6 p.m. — Despite the Friday grocery order, we are still short on food for lunches and the upcoming holiday. We head to a local grocery chain, Macey’s, to pick up some deli food for dinner and food for grilling on Pioneer Day (better known in our household as Pie & Beer Day). While we’re there, I buy a bag of different beans to try in the espresso machine, in case the quality of our beans is standing in the way of our homemade latte dreams. There’s nothing like shopping in a local chain to really feel the increase in grocery prices, good lord. $201.70

6 p.m. — And then we immediately spend $10.75 more because we realize that the cashier forgot to ring up our firewood bundles for an upcoming camping trip. $10.75

8 p.m. — S. and I spend some time going through our pantry as we put groceries away. We’ve consciously reduced food waste a lot over the past year and a half but we still find a couple of expired bags of nuts and dried fruits that need to be tossed. I’m not sure how long these items are good past the sell-by date but I’ve had enough bouts of food poisoning to be paranoid. I check our card after the groceries/cleanup is over and see that our monthly car wash subscription ($49.99), our Spotify subscription ($18.26) and my Apple Fitness+ subscription ($10.73) have all been charged today. I had no idea that Spotify increased prices again this month. Cool.

Daily Total: $212.45

Day Six

8:55 a.m. — I strategically take C. on a longer walk a little later this morning: S. has a life insurance physical scheduled for this morning at our house and C. occasionally decides that strangers are foes, not friends. We see quail bobbing around. Why are they so cute? There is a mated pair of mallards that comes to live in our neighborhood each spring and I’ve been missing their antics. The quail are a nice consolation prize. I guess I’m a bird enthusiast now.

5:50 p.m. — It was a busy work day and I hustle to the post office before it closes to ship a Poshmark sale. I’ll make $48 off this dress sale. I time this errand so that I can swing by a friend’s house to drop off some dessert trays I borrowed. She recently returned from a long trip in Switzerland and we taste-test chocolate as she catches me up on her life. We end up talking about our aging parents and how hard it can be to set healthy boundaries with them. We don’t come up with any definitive solutions to loving parents who probably need therapy but the chocolate and company are lovely.

8:30 p.m. — I get home late and S. asks if I can use my family’s Amazon account to order him a guitar stand ($8.59). I stay up late reading The Royal We on my library app. One way I decompress when stressed is to read chick lit. $8.59

Daily Total: $8.59

Day Seven

8 a.m. — I have an early nail appointment. On the drive over I see more quail being adorable. I hardly wear makeup or style my hair beyond letting it be natural but I always bend my schedule to my nail artist’s schedule. I’ve been seeing her for three years and so every month it feels more like a friend catchup. We end up talking about budgeting and money as well as filling each other in on our respective friends and families. Salt Lake City has a nickname, “Small Lake City,” and it feels true because after I started seeing her, I learned that we know a lot of the same people. I ask her to make my nails “Taylor Swift” short because S. tried to teach me basic guitar chords the other night but my long nails made it nearly impossible to play ($70 after tip). $70

10 a.m. — Between meetings, I contemplate my espresso machine. Will changing the beans really do it? S.’ parents use Dunkin’ beans, something that has always baffled me. When we were at the store the other night, I bought a bag of the original blend beans they grind to use in their cezve. I fill the hopper with the Dunkin’ beans and follow the rest of the steps. I shit you not, a beautiful double shot of espresso comes out. I send S. a victory text and take my oat milk latte back to my office, saluting a spider that has taken up residence by our front door with my mug as I pass. I’ve already texted S. its location and asked him if he can relocate it later.

3:45 p.m. — D. texts me. I wait to read it until the meeting I’m in is over. I’m glad I waited. B.’s results show that he has T-cell lymphoma and at best he can live six months with chemo. D. has some tough choices to make balancing end-of-life care and quality of life. I’m not sure yet how I need to process this information. I’m not angry today, just sad. I let D. know how much I love them both and sit with my feelings a bit before work tasks come through. Back to it, I suppose.

6 p.m. — I am working late when S. gets home and he assesses our leftover situation and debates ordering Indian food for delivery. I remind him that we have $96 left in our restaurant budget for the month and plans for this weekend. He makes a microwave meal instead to avoid eating the leftover tofu stir-fry (I love it, so more for me!). I take a break from work to join him on a call with his parents and update them on everything that is going on.

7:50 p.m. — Apple Wallet notifies me of a card transaction — it’s our pet insurance for C. that I insist on keeping in case he ever gets cancer, and it’s gone up by $13 this month (included in monthly expenses). Timely. I decide I’m done with work and dog cancer thoughts for the night and go to hang out with S. and C. in the living room, where S. serenades us on his guitar.

Daily Total: $70

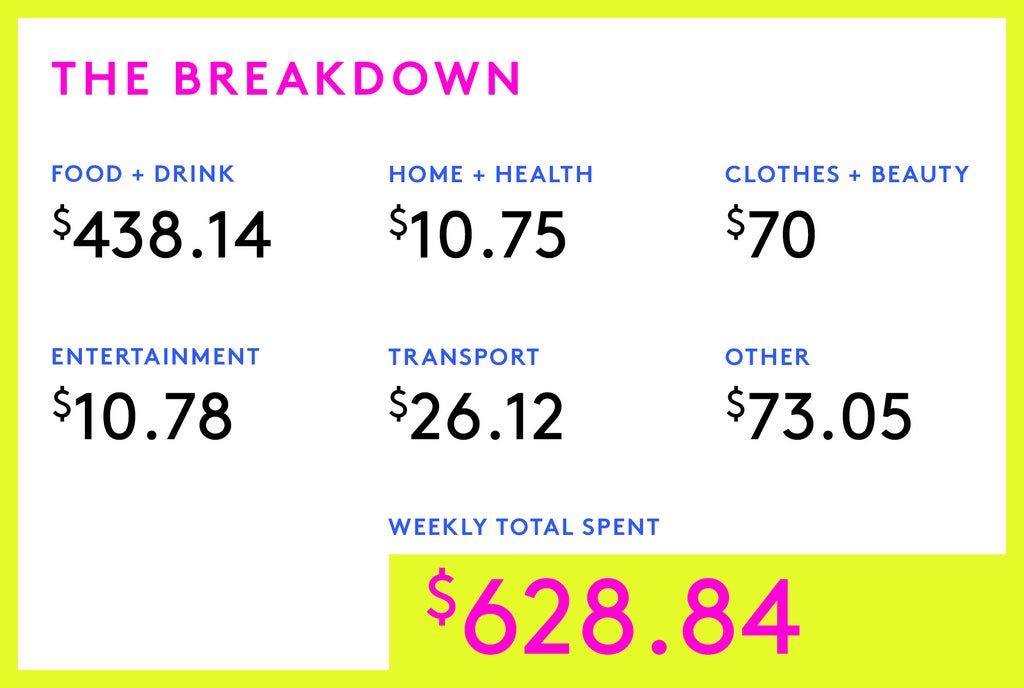

The Breakdown

Weekly Total $$ Spent: $628.84

Food & Drink: $438.14

Entertainment: $10.78

Home & Health: $10.75

Clothes & Beauty $70.00

Transportation $26.12

Other $73.05

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more Money Diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Pittsburgh, PA On An $80,000 Salary

A Week In New York On A $204,000 Salary

A Week In Montreal On A $95,000 Salary

from Refinery29 https://ift.tt/2gnd5q3

via IFTTT