Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a bartender who makes $56,000 per year and who spends some of her money this week on a clay tool kit.

If you’d like to submit your own Money Diary, you can do so via our online form. We pay $150 for each published diary. Apologies but we’re not able to reply to every email.

Occupation: Bartender

Industry: Hospitality

Age: 28

Location: Morristown, NJ (North Jersey)

Salary: $56,000

Assets: Checking: $2,023; savings: $2,091; Roth IRAs: $29,898; non-retirement investments: $40,437

Debt: Credit card: $2,324; student loan: $36,214

Paycheck Amount (Weekly): Average $1,150

Pronouns: She/her

Monthly Expenses

Housing Costs: $921, I live in a three-bedroom house that is rented to myself, my sister, and our roommate. We’re all around the same age.

Loan Payments: My debt payments are an estimated $520 (13% of my income). My student loans are in deferment for the moment.

Car insurance: $136.33

Medical, Dental, Vision Insurance: $115 (I get this through the state marketplace).

Gas & Electric: Around $80 for my third of utilities.

Phone: $31.43

Savings: Estimated $600 (15% of income).

Internet: $20 for my third.

Gym: $33

Roth IRA Contributions: $536

Non-Retirement Contributions: $200

Contract/Freelance Business Expenses: $46

Entertainment & Streaming: $33

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes, there was an expectation to attend higher education. My mom had an associate’s degree. My dad earned vocational certificates. Education was a priority in my family. I earned a bachelor’s degree in accounting in Boston. This was paid for with financial aid, grants, and student loans. I soon after earned a master in business administration with a focus in marketing, paid for with financial aid, student loans, and some of my own money I earned while I was going through school.

Growing up, what kind of conversations did you have about money? Did your parent(s)/guardian(s) educate you about finances?

I remember being really young, before working age, and wanting to buy a T-shirt at Target. I asked my dad if I could get it. He reminded me that I had money from my birthday I could use to spend on myself. At the time, this money message was an empowering one for me. If I had money, I could use it on whatever I wanted. But I also understand this memory as my parents only being able to cover necessities for the family, and anything extra wouldn’t fit in the bigger money picture. Most of what I learned about money from my parents was observing how they handled money, the way they talked about it, and the way they stressed about it; lessons were never through direct conversation. Money was something earned, spent on bills, and saved if you had it to save. I’ve inferred that we weren’t well off, but we could survive and live a little outside our means. My parents fought and worried about money but there were also gifts at Christmas and birthdays. I picked up the story that you had to be well educated to get a job in something like accounting or finance that offered job security. Otherwise, it seemed, you struggled for money in a bad job with a bad boss. My current financial knowledge has been self-taught within the past few years by listening to podcasts, reading books, and through trial and error. It can be terrifying to save, invest, and put money away when you feel you aren’t even making much; however, even the smallest amounts add up to be a lot. Money decisions become more comfortable to make. I have a loose budget. I allocate specific percentages of my income by each paycheck. My income is variable and these percentages are helpful to auto-save, auto-invest, and set up systems for myself to keep my finances under control. I’m learning more about the role money plays in my life and how finances add to my quality of life.

What was your first job and why did you get it?

I worked at a sandwich shop as soon as I turned 15. I worked there whenever I had the time until I got my first post-graduate job: during the school year, after sports and the time in between sports seasons, during winter and summer break. It was my second home. I even worked on Saturdays when I became an accountant until the busy season hit. My parents wanted us to work and earn money, but also I wanted to work and earn money. My parents required my siblings and I to work during the summer, but I was the one who wanted to work any chance I got.

Did you worry about money growing up?

I did worry about money. I took saving very seriously. Every once in a while, I would spend money at the mall on clothes or concert tickets. I wanted to be the child my parents didn’t have to worry about. They were both seriously ill in my teenage years and it felt important to afford my own life, to take one less worry off their plate. My mom ended up passing away during my senior year of high school. And my dad ended up passing away when I was in college. I’ve come to recognize people’s parents and family can be an extension of your own finances and financial wellbeing, and not having that anymore felt terrifying when I was 21 years old and still makes me uneasy now.

Do you worry about money now?

I worry more about my career than money, even though they go together. Living throughout my twenties, I’ve experienced a lot of ups and downs in my finances and job exploration. I believe I’m more than capable of getting through difficult personal financial times and I’m confident that I’m being responsible with investing for my retirement. But sometimes my worry turns into panicking about my earning potential and what my long-term goals are with money and career. My biggest worry surrounds finding the balance between being responsible by investing for long-term goals and experiencing the most out of life in the present. I’ve cycled through moments of letting my savings dwindle in order to live my life in the present and then having periods of restricting myself from spending at all. I want to find the right balance that prepares me for the future but also maximizes my happiness right now.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I’d say I was partially financially responsible for myself when I was 16 or 17 years old. This was around the time when my mom was sick and passed away. If I wanted something, I had to buy it. Then I was pretty much paying for all of my expenses by the time I left for college. I’ve been officially on my own since we sold our family house after my dad’s passing. I’m realizing that this inherited income is the reason my long-term investments are where they are today.

Do you or have you ever received passive or inherited income? If yes, please explain.

I have received inherited income. When my dad passed away, his finances were put into an estate account and his retirement portfolio was divided between my siblings and me. The estate was used for our general bills living in our house until we all graduated college. Almost immediately after our graduations, we sold our family home and all moved out. The amount from the estate, retirement account, and sale of the house probably totaled around $110,000 of inherited income. I paid off my undergraduate student loans in full: $26,000. I put $12,000 towards opening and investing in my first Roth IRA. I put $10,000 down on a new car. I moved my inherited retirement account into my non-retirement investment account: $30,000. Retirement portfolio early withdrawal fees and taxes paid on it as income: $15,000. The remaining $17,000 I can’t specifically account for has likely been used over years on the following: 1) moving costs for three big moves 2) paying off the rest of my car ($10,000) 3) a three-week road trip I took to visit eight national parks on the west coast 4) taking risks at entrepreneurship 5) emergency expenses like medical costs and periods of unemployment.

Day One: Friday

7:35 a.m. — I wake up and roll out of bed. I’ve been getting over a cold so I almost have to have DayQuil before I do anything else. I brush my teeth and wash my face, cleanse and moisturize. I drive my sister to work, which I’ve done for the past year (longer, in fact), since she moved back from a city where she didn’t have a car. My sister moved into my apartment in the fall. She works near a Trader Joe’s, so a lot of times I’ll stop at the grocery store on my way home. Today, I stopped for vegetables, bagels, coffee creamer and ramen for meal prep and breakfast. $27.08

8:45 a.m. — I arrive home and make myself breakfast: two fried eggs and a bagel with cream cheese. I brew fresh-ground coffee with creamer, and sit down to read. I sometimes put cozy jazz ambiance videos on YouTube. I’m reading The Rachel Incident by Caroline O’Donoghue. I picked this up at the library after looking up book recommendations similar to Writers and Lovers by Lily King.

10 a.m. — I make a snack out of an apple and orange and sit down with my headphones to draw a few designs for trinket trays and other crafts I want to make out of air dry clay I purchased recently. I watch a YouTube video on best tips to make these trays and realize I need tools to help make them look nice. I order a kit online to make my trays with clay. I use my sketchbook to make designs while I waited to start them. $27.70

1 p.m. — It’s payday for me every Friday. I usually sit down for a “money date” to do income allocations in a basic Excel sheet. I do this most weeks. I took home $939 after taxes. January is slow for most restaurants in town, but November and December were great months. This is what I do with it: 15% of my paycheck is automatically deposited into my savings account. I also have a weekly automatic investment and distribution to my Roth IRA on payday, $134.60. I manually transfer 2% of my paycheck to my “spending money” account: $23. I’ll take 13% of my check to pay towards debt. I pay $122 towards my credit card. Even if I’m not perfect with them, my money dates give me peace of mind that I’m doing enough to hit these numbers.

3 p.m. — I make lunch from the ramen I bought in the morning and chicken teriyaki I had in the fridge. I pack a pasta salad for dinner for work. I throw on a Tala black bodysuit and thrifted black jeans. Tala, a sustainable activewear company, is my favorite brand — I decided this year I wouldn’t buy clothing unless it was Tala. They’re the pieces that I gravitate towards the most and they last years. I put on a little bit of makeup. I use a lot of clean brands: Tower 28 tinted moisturizer and its cream contour. I use Ilia multi-stick for blush, Thrive Cosmetics brown tubing mascara and a Kosa’s eyeshadow palette. Fridays are days I like to dress up and put on makeup. It’s my way of making working on the weekends fun.

4 p.m. — My shift starts. I’m working at our downstairs bar tonight which means I’m closing. We’re a pool house for the bar, and if I close I have more hours in the pool and will earn a higher percentage of tips. It doesn’t matter too much during busy seasons but every dollar counts now when it’s slow. Tonight, you could tell that business was starting to pick up again. Guests have spent the beginning of the year sober, saving money, or dieting and then from Valentine’s Day onwards, they come back out. Around 9:30 p.m., we are allowed to order food and eat. I brought my pasta salad, so have that. We finish cleaning the bar after doing last call. At 2 a.m., I drive home, do my nightly routine, and go to bed.

Daily Total: $54.78

Day Two: Saturday

10:30 a.m. — I sleep in. When I wake up, I make coffee and breakfast: two fried eggs and a bagel.

12 p.m. — I hang out for a bit in the living room with my sister and my other roommate. I read more of The Rachel Incident. I put on my headphones and play Bad Bunny’s new album, DtMF. I’ve been practicing Spanish for a few months now. I’m going to Costa Rica in March for a surf trip and I want to improve before I fly out by listening to music, journaling in Spanish, and reading my favorite book translated to Spanish. I take out my clay once my headphones are on. I open all my supplies and lay everything out on the table. I roll out the clay and use a candle topper to trace two circular trays for jewelry or little trinkets. I spend a while scoring and connecting clay to make an edge and smoothing out each piece with slip. Once I’m finished, leave them out on wax paper to finish drying before I can paint them.

3 p.m. — I have time to get my nails done — and I need to. I typically try to make it to four weeks before I go again. With bartending, you’re constantly washing shakers and bar tools and it’s nice to have a manicure to sort of protect my nails from breaking. I call and make an appointment for a little later in the afternoon. At 3 p.m., I drive to the nail salon but stop at the bank to withdraw cash for my nails and gas (I get a $3 discount if I pay for my gel manicure in cash). I chose a pale pink sparkly color. My gel manicure with tip is $45. $45

6 p.m. — My sister and I are driving into New York for Emo Night Brooklyn. Emo Night is like a DJ set but for emo and punk music. On our way there, I stop at the gas station and fill my tank with the cash I withdrew when I got my nails done ($40). There are a handful of tolls going into the city for the NJ Turnspike, Holland Tunnel and NYC Congestion Pricing ($31.36 using E-ZPass). I park near the venue at a lot that ends up being $40. $111.36

9 p.m. — Emo Night starts! They have members of bands come out to play their own music or their favorite music from the genre. Derek DiScanio and Tony Diaz from State Champs, John from The Maine, and Kellin Quinn from Sleeping with Sirens were there. They played a lot of punk songs from the early 2000s and 2010s. We sang and danced and chatted with people. It was really fun! I ended up buying a T-shirt from the merch stand during the show ($38.05), as well as a non-alcoholic cocktail during the show ($15.47). $53.52

1 a.m. — We leave to drive home, stopping on the way to get waters and electrolyte drinks. $25

Daily Total: $234.88

Day Three: Sunday

10 a.m. — I wake up and drink my electrolyte drink. I make coffee and hang out on the couch. I put on music again to make more clay creations. My smaller jewelry tray is almost fully dry but it’s taking longer for the bigger one to dry. Today I make two little square trays that I hope can be matching stamp design trays of a key and locket. They turn out better looking than my first trays.

12 p.m. — I get ready to leave for a get-together but have work later, so I pack a black shirt, leggings, and my black Vans for work. Two of my friends got engaged last week while they were on their annual vacation! Her fiancé invited friends and family to come over to surprise her and celebrate the engagement. I head over for some drinks and food before I have to go to work. While we are there, my friend and I talk about this comedian that we love watching videos of. It turns out he’ll be in New York in a few weeks, so we buy resale tickets. I leave the party at 3:30 p.m to head to work. $108.17

4 p.m. — My shift starts. One of my friends is wearing a Devil’s sweatshirt and I make a note to make him a clay tray with the logo on it. A little later in the shift, all employees are allowed to get food. I didn’t pack dinner so I order a harvest salad with chicken. It’s nice that at this restaurant, my coworkers and I can take turns going to the bar basement to eat. Sometimes in other places, all you can do is scarf down food fast and get back to work. We get a 50% discount so it ends up being $12.80. Sundays are slower. The kitchen closes earlier and there are usually fewer people out so we can do the last call and start breaking down the bar earlier. I clock out around 11 p.m. and head home to go to bed. $12.80

Daily Total: $120.97

Day Four: Monday

7:35 a.m. — I wake up and go through my routine before I drive my sister to work. I pick up eggs and tissues at Trader Joe’s on the way home. $7.75

9 a.m. — I make myself breakfast and coffee and sit down to do some freelance work. I work with a creative arts non-profit, assisting with their poetry and prose publication and other web development tasks. My big projects are putting together books from their workshops, which will bring in $500 each for me. I’m curious about building more income by doing work like this for others. I definitely feel the stigma of bartending and working in the service industry. I often field questions like “Are you a student? What do you do when you’re not here?” from guests. I almost feel a little defensive. I’ve gotten more comfortable just being a bartender as I’ve still been able to meet my needs and live a good life. Yet I still think I need to find something else. Maybe this is what I do in the meantime until I can answer the question of what that something else is.

11 a.m. — The restaurant I’m working at now has a 401(k) option for employees that meet a certain number of hours. After three months being there, I’m now eligible to enroll, so I sit down to do so. I fill out my contribution allocations based on what I’ve read about what to invest your money in. My restaurant will match up to 4% and I choose to allocate 6% of my pre-tax income. This will start in two pay periods.

12:30 p.m. — I sit down to write more and snack on an apple and orange. I have been getting back into The Artist’s Way by Julia Cameron. I write some poetry and explore some of my goals for 2025. A lot of what I want to do surrounds travel, writing, and pitching to do social media management for restaurants in the area. After being in my head for a while, I like to be in my body. I drive to the gym to walk on the treadmill for 45 minutes. I’m taking it easy after recovering from the flu. I love to play solitaire when I warm up, then fast walk while listening and reading the lyrics to Bad Bunny’s album.

2 p.m. — After cooling down at the gym, I drive home and shower. I make an easy lunch with Trader Joe’s chicken tenders, fries and Brussels sprouts I have in the freezer. I relax a little bit before getting ready to go to work.

4 p.m. — My shift starts. Monday happy hours are pretty steady because we have half-off all drinks and starters, but most people leave after happy hour is over. Our staff plays hangman to pass some time. Even though I brought food today, I order the special Cuban BBQ flatbread when we can order food. I really should not buy food at work, but I save a little more than half for lunch tomorrow. I’m done with work at 10:30 p.m. and drive home to go to bed. $9.60

Daily Total: $17.35

Day Five: Tuesday

7:35 a.m. — I wake up, go through my routine, and drive my sister to work. When I get back home, I make coffee and breakfast for myself. I sit down to write and go over the things I wrote from yesterday’s writing. I read it’s good to keep a journal in your target language so I translate my journal into Spanish and rewrite it. I make a list of phrases and words I use a lot and rewrite the translations.

10 a.m. — I’m kind of tired today so I mainly just relax on the couch with my cozy jazz ambiance videos from YouTube on the TV.

12:30 p.m. — After resting all morning, I change and head to the gym to walk on the treadmill again. I set my time goal on an hour, incline at eight and speed at three. I put my punk-pop playlist on. Today is my day off so I can spend a little more time at the gym walking and stretching after. When I’m done, I drive home to shower. I make lunch from the leftover flatbread I bought at work last night.

4 p.m. — I sit down to write for a little bit after I’m fresh out of the shower. When I’m done, I slowly start cleaning my room and the living area. I throw my laundry into the washer. I practice Spanish through Mango Languages. Fun fact: Check your local library to see if they offer free Mango Language subscriptions if you sign up with your library card. I have the app on my phone and it’s really good for learning through repetition. When my clothes are done, I hang my clothes that can’t go in the dryer. I make ramen and chicken for dinner and throw cookies from Trader Joe’s into the oven. I make myself peppermint tea while they bake.

8 p.m. — I worked a little bit on the book I’m making before putting on The Storied Life of A.J. Fickery on Netflix on the living room TV. I benefit from my roommates having subscription services. When it’s over, I do my nightly routine and go to bed.

Daily Total: $0

Day Six: Wednesday

7:35 a.m. — I wake up and roll out of bed quickly to make coffee. I’m working a double shift today — lunch and dinner — so I won’t have a lot of time to myself this morning. I get ready for work, throwing on an all-black Tala outfit of leggings, a tank top, and sweatshirt. I roll on compression socks, which help a lot when I’m on my feet all day. I have my coffee as my sister finishes getting ready and then drive her to work.

9:30 a.m. — When I get back, I make two eggs with breakfast ham and shredded cheese for breakfast. I pack food for work: an apple, an orange, my prepped pasta salad, breaded chicken cutlets, and a protein shake. My shift starts at 10 a.m. I have to set up the whole bar. Since it’s slow this season, I’m the only bartender on until 2 p.m. I picked up this shift to make some extra money this week. I’m hoping to pick up more this week, too.

3 p.m. — Lunch was decently busy today. I was thinking about ordering our special pesto turkey sandwich with prosciutto, mozzarella, tomato, arugula and pesto mayo! I have my protein shake instead. I finished up my lunch shift around this time. We have a happy hour party starting at the upstairs bar. At 4 p.m., the night-shift bartenders all start arriving. My role for the night shift is at the upstairs bar so I collect my stuff and head upstairs. I have the option to take a break but it looks like a slow night which means I’ll probably be cut early. I don’t take my break.

7 p.m. — The happy hour party finishes and we close the upstairs bar for the night as there probably won’t be tables sat upstairs. We clean the bar and put everything away. I drive home and change. I have my pasta salad and chicken for dinner and put on Ronny Chieng’s comedy special, “Love to Hate It.” Once the special is over, I put my headphones on and play with my clay. I’ve got about six pieces drying at the moment — I’m going to start painting them soon. I clean up and go to bed around 11 p.m.

Daily Total: $0

Day Seven: Thursday

7:35 a.m. — I wake up and drive my sister to work. I end up picking up another double today. When I get back from dropping my sister off, I make coffee and eggs for breakfast. I also made myself a yogurt parfait with granola, chocolate chips and banana slices. I change into leggings and a black T-shirt before heading into work at 10 a.m.

12 p.m. — Lunch is slower today. Since I picked up these shifts at the last minute, I didn’t pack lunch. I buy the turkey sandwich special. It was really good and just what I needed! The night shift bartenders arrive at 4 p.m. again. Thursday night is when the restaurant gets busier for the weekend crowds. We have a 30-person party in the dining room, so the restaurant and bar starts filling up quickly. This is nice since I didn’t make a lot at lunch. $9.60

9 p.m. — Since I’m working a double, I’m the first person to get cut. I clean one of the bar wells as my side work. I’m meeting a friend in town for a drink. I can get what’s called a “shifty” — a free drink after I clock out from my shift at work. I have a glass of prosecco before meeting up with my friend at a restaurant nearby. I’ve gotten to know the staff at this restaurant and love visiting them when I have time. My friend and I hang out for a bit with a drink catching up. Our drinks are on the house, but we tip $10 cash each. I head home and make myself dinner with breaded chicken cutlets, fresh mozzarella and sliced tomatoes. I read a little bit before getting ready for bed. $10

Daily Total: $19.60

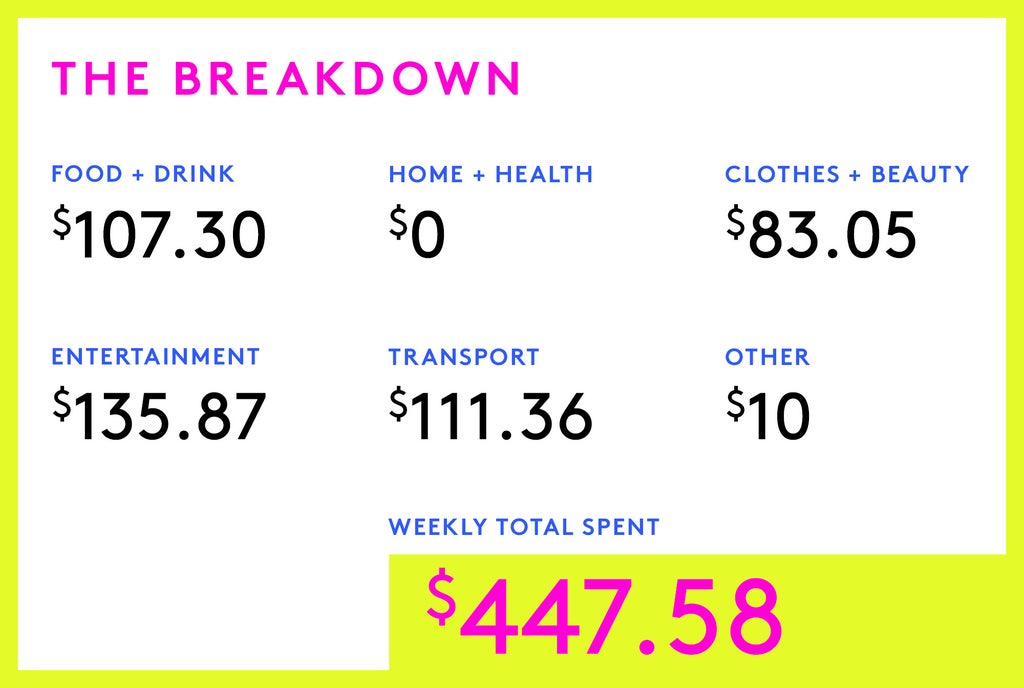

The Breakdown

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more Money Diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Charlottesville, VA On $350,000 Joint

A Week In Los Angeles On A $45,000 Salary

A Week In New York On A $81,000 Salary

from Refinery29 https://ift.tt/uiZa9dR

via IFTTT