Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a manager who has a $247,760 joint income and who spends some of her money this week on a Saved by the Bell margarita.

Occupation: Manager

Industry: Public policy

Age: 39

Location: Washington, DC

Salary: $132,860

Joint Income/Financial Setup: My husband D.’s gross salary is $114,900. Our combined income is $247,760 (before any deductions). We combine almost everything in joint checking and savings accounts. We each take $125 per pay period for our own spending money. We’ve had our finances combined since we got married.

Assets: Checking: $14,000; savings accounts: $27,000; CD: $4,500; investments – $19,000; retirement (me): $330,000; retirement (D.): $485,000; house: $177,000; car: $18,000.

Debt: House: $297,876; car: $3,000.

Paycheck Amount: Me: $3,267.62 (twice a month); D.: $1,650.45 (weekly).

Pronouns: She/her

Monthly Expenses

Housing Costs: Mortgage: $1,436.19; condo association fees: $1,733.57 (this includes all utilities, parking, taxes, laundry, 24-hour concierge, landscaping, all maintenance, reserve fund, and gym access). We know the amount is quite high, but after owning a house for a few years and absolutely hating the responsibility and upkeep, we decided we are willing to spend more on an association fee and just have everything taken care of for us.

Loan Payments: Car: $251.49

Private School: $2,800 (for our son, F., who is 6). The annual tuition and fees are $48,000. We qualify for financial aid, which brings our total down to $25,000. I had a lot of feelings about sending my child to private school (I did public for my K12 education), but I’ve gotten to the point where I know it was the right decision for F. now and down the road.

Insurance: $231.65 (condo, auto, personal articles, umbrella).

Peloton: $41.34

Internet: $82

Cell Phones: $166.03 (for me and D.; this also includes Apple TV+).

Streaming Services: $40 (Spotify, Netflix, Hulu, Max, Paramount, Peacock, Disney+).

Fidelity: $500 (This is D.’s retirement contribution, since his current job does not have a separate retirement plan).

Dependent HSA: $208.33 per paycheck. We use this to pay for most of summer camp each year, which costs between $6,000 and $7,000 each year.

401(k) Contribution: $332.16 per paycheck.

Health Insurance: $269.37 per paycheck for health, dental, and vision. This covers all of us.

Pet Insurance: $20

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

My parents, and really my entire family, absolutely expected me to go to college. Starting when I was in the 7th grade, my grandparents would buy me hard copies of the US News and World Report College Rankings. I would spend hours pouring over the information. I decided to go to a small, private liberal arts school and graduated with a degree in political science. College (tuition, room and board, some spending money) was completely paid for by my parents and grandparents, and I was so incredibly lucky to graduate without any debt. I was thankful at the time, but did not truly understand how much that would impact my finances in the future. Now that I am approaching 40, I know it was one of the greatest gifts they could have given me.

Growing up, what kind of conversations did you have about money? Did your parent(s) educate you about finances?

My parents discussed money with me regularly when I was growing up and the conversations continue today. I think the fact that I am an only child has a lot to do with this. When you’re an only child, you are often seen as simply a shorter adult in your family. I knew roughly how much my parents made, how they were investing their money, and how they were budgeting. Now that I am older, I am so thankful for those open lines of communication surrounding finances. I know my parents are financially stable as they continue to age. I know where the money is located, and approximately how much is available.

What was your first job and why did you get it?

I started babysitting when I was 13, which, now that I have a child of my own, seems absolutely bananas. When I was a senior in high school, I started working at a local ice cream shop. They let me come back summer after my freshman year of college, too, which was so nice of them. In college, I worked at a local restaurant for three years (during the school year and summers). It was a great job that gave me spending money and allowed me to pay my sorority dues.

Did you worry about money growing up?

When I was going into the 6th grade my mom switched careers and took a huge pay cut. I remember being very aware of this and hearing so many conversations about changes we would need to make. In the end, it all worked out and her salary grew tremendously as her career grew. But those first few years were tense.

Do you worry about money now?

Sometimes yes, sometimes no. Most of my concerns are big picture: Are we being strategic enough with our money (I don’t think we are), are we saving enough for the future, are we being frivolous? Things like that.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I’ve provided additional details below, but honestly, I’m almost 40 and I cannot truly claim to be financially independent. My family is our safety net and it gives me such peace of mind.

Do you or have you ever received passive or inherited income? If yes, please explain.

Yes. When my husband D. and I bought our first house, my parents fronted us my inheritance from my grandfather, approximately $70,000, and then paid themselves back when he passed away a year and a half later. We put this towards our down payment. When we sold that house and bought our condo, they gifted us another $10,000 to put towards our next down payment. When we bought our car in 2020, my parents gifted us $10,000 to put towards it. Each year, my parents gift us $8000 specifically for our son F.’s school tuition. This is all separate from birthday and holiday checks, which total about $3,000. When D. and I got married, my parents paid for our wedding (~$25,000) and his family paid for the rehearsal and other “traditional” expenses that the groom’s family takes on (~$5,000). When my parents pass away (hopefully a very, very long time from now), D. and I will become millionaires through inheritance.

Day One: Friday

6 a.m. — My husband D. and I are snuggling in bed when our son, F. (6 years old), calls out for us. We’re all up now! I make breakfast for F. (toast with peanut butter, apple slices, and yogurt) and make a protein coffee for myself. I’m on Wegovy and can finally stomach coffee again after upping my dosage a few weeks ago. We all sit down while F. eats, and we play a few NYT word games together. F.’s favorites are Wordle and Strands, so we start with those.

7:30 a.m. — While F. gets dressed for school, I fill his water bottle and make sure he has what he needs for Field Day. We watch a few minutes of Wild Kratts then D. drops F. at school (D. comes home after). Once they leave, I get to work on straightening up the condo. Our cleaning lady came yesterday, but there is always something to wipe down or put away. With my ADHD diagnosis, I have embraced the motto of “an object in motion stays in motion”. If I sit down, I’m doomed. Once I’ve cleaned up the condo, I take an Everything Shower, do my skincare, and put on cozy lounge clothes.

9 a.m. — I turn on my computer, check email, make sure things are quiet with work, and then throw in a few loads of laundry. I may be in the minority, but I love communal laundry. The laundry room is right next to our unit and the price is included in our monthly condo fees, so it’s all just very easy. I love being able to do multiple loads at once. I spend a few minutes texting with a friend who is a teacher at my F.’s school and we discuss the best workbooks to do over the summer.

10:30 a.m. — I finished three loads of laundry while keeping an eye on work. I am in a very quiet season right now, which I am loving. My husband drops me off at the dermatologist for my annual skin cancer check, and then he heads to the eye doctor. My appointment goes well and I get the all-clear. I pay a $40 copay when I leave. My husband needs new glasses, so he spends $525 on the exam and new lenses. $565

11:45 a.m. — When I leave my appointment, I walk over to Bluestone Lane and get the Tropical Fresh Smoothie ($13.69 with tip). After I grab my smoothie, I call an Uber and go home ($15.20 with tip). When I get home, I check my email and respond to a Teams message. I call my mom and talk to her for 45 minutes. My parents live a few states away and it is becoming increasingly difficult to be a member of the “sandwich generation”. I just really miss them, and as an only child, I worry about them. $28.89

1 p.m. — D. gets home from his appointment; he stopped at Trader Joe’s to get a few TJ-specific groceries we needed, including roasted garlic and pesto pizza, silver dollar pancakes, orange chicken, and peanut butter crackers ($82.48). I put the groceries away and make myself an open-faced chicken salad sandwich with the fancy bread we bought at Patty O’s in Little Washington last weekend. $82.48

2:30 p.m. — I’ve been rotting (i.e. doom scrolling) and need to pull myself out of it. I review a document for a colleague and provide feedback. Next, I order a prescription cream that my dermatologist recommended earlier today. I review my personal to-do list and decide to finally clean the kitchen ceiling light. We had work done in our condo weeks ago and it’s been super dusty ever since. Once the light is clean, I clean up the rest of the kitchen and put things away. $10

3 p.m. — I call our local toy and bookstore to ask if they have the workbooks I am looking for in stock. I am trying to be a more thoughtful consumer but also must balance real life. They don’t have them, so I go to Amazon and order three workbooks, laundry detergent, and scotch tape. No one tells you before you have kids how much tape they will go through — it’s ridiculous (I don’t even know where it all goes, he just likes taping everything together! It’s weird, but also something I hear from a lot of other parents). I move on to folding all the laundry I did earlier. Luckily it is all towels and sheets and not a million socks. $75.86

3:30 p.m. — While putting away the sheets and towels I take a few minutes to reorganize our linen closet and restock a few things we keep in there. Next, I finish my tablescape (fresh flowers, candlesticks, lemons, and greenery), do a little work, and shut my laptop.

4:30 p.m. — I throw in two more loads of laundry and then get changed and go to the UPS store before picking up F. at school. I need to return two shirts to Old Navy since the sizing was way off. While I am out, I stop and get a lemonade, too. It takes forever for my son to be dismissed, so I clean out the car while I am waiting. $4.68

6 p.m. — We FaceTime with my MIL while F. is having dinner. They chat about his school day and compare answers on the various NYT word games. When F. is done with dinner, he watches a Lego show with D. while I make a black pepper simple syrup for cocktails we are making later this evening. I go through F.’s bookbag quickly to make sure there’s nothing I need to read or sign. Once I’m done, I join F. and D. and watch a show with them.

7 p.m. — We read books and do F.’s bedtime routine. Then, while D. does bedtime, I cut up strawberries for our cocktails and preheat the oven for the garlic and pesto pizza. Once F. is asleep, D. makes cocktails and I open our box from Thrive Market, which is mostly snacks and one box of a sourdough pasta I want to try. Tomorrow is my weekend morning to wake up early with F, so I set out an art project for us to do together.

8 p.m. — D. and I sit on the covered balcony and have dinner. It’s starting to storm, so it’s perfect. We stay out there for a while just talking and hanging out. We come back inside, clean up the kitchen, and watch an episode of The Night Agent on Netflix. While we’re watching television, I give myself a manicure.

9:40 p.m. — D. takes the dog out for his final walk. (Side note: I might not mention every dogwalk here, but I promise he is living his best life with us. Since at least one of us works from home everyday, we don’t have to pay for a dog walker or anything. He spends his days going outside every few hours and sleeping in F.’s bed while D. works at the desk next to him.) I start getting ready for bed. I do my skincare (Biodance Collagen Gel Toner Pads, COSRX Snail Mucin Serum, Innisfree Green Tea Caffeine Bright Eye Serum, Natrium Bio-Lipid lotion). Once I am in bed, I journal for a few minutes, just jotting down the small, good moments of the day before turning out the light and going to sleep.

Daily Total: $766.91

Day Two: Saturday

5:45 a.m. — I wake up and check the time. F. will be up soon, so I scroll for a few minutes and listen for him. At 6 a.m. he wakes up and we start our day.

6:15 a.m. — I make breakfast for F. (mini pancakes, apple slices, yogurt smoothie) and myself (toaster waffle with peanut butter and a protein coffee). We discuss our plans for rock painting and play a few NYT word games. Once we’re done eating, we start our craft project. Another thing no one tells you before having kids is that you’ll be doing art projects before 7 a.m. After our rocks are painted, F. asks if we can put together treat bags for his classmates and give them out on the last day of school. I’m a sucker, so we spend a few minutes on Amazon picking out the bags and a few things to go inside (summer-themed tattoos and bubble wands). $55.09

8 a.m. — D. wakes up and we start getting ready for a day of soccer games. I pack our bag with snacks, sunscreen, bug spray, jerseys, cleats, and a soccer ball. Once that’s done, I quickly fold a load of laundry that I did last night and then get myself dressed (black linen pants from Old Navy, a pink linen tank from Athleta, and gold sandals). We leave a little earlier than we need to so we can stop for coffee (me) and croissants (D. and F.). $15.51

10 a.m. — We get to the soccer game and find other parents to chat with. Making parent friends is so tricky: The kids and parents need to get along, the parents need to have a similar parenting philosophy, and you all have to find and make time to hang out. It’s important to me to build these relationships, so I’m happy to make the effort, but it’s a lot. We watch the game and then the kids play on the playground next to the field.

12:30 p.m. — The second soccer game of the day was canceled due to impending storms, so we decide to trek out to the suburbs to have lunch at Chili’s. The margarita of the month is Saved by the Bell/’90s themed and I really want to try one. It’s the last day of the month, so it’s now or never (it was totally worth it for the nostalgia. The drink itself was fine, but I wouldn’t go out of my way for a Chili’s margarita on a regular basis). We order lunch and take our time, since it has now started pouring rain. It’s not our usual type of restaurant, but those chicken crispers hit the spot. $75.36

5 p.m. — We get home and just hang out for a while. While D. and F. play Mouse Trap, I snuggle with the dog and then take a quick shower. Eventually it’s time for D. to take the dog to meet a potential dog sitter for a trip we have planned later this summer. I stay home with F., make him dinner and record a quick video of him to send to my MIL, then we watch a Savannah Bananas game. The team comes to DC each summer, but tickets are crazy expensive so streaming a game on Disney+ is as close as we are going to get.

7 p.m. — D. and the dog are home just in time for D. to do bedtime, which is F.’s preference. While they do bedtime, I finish the two loads of laundry that I started earlier, put folded laundry away, and do a general pick-up of the condo. Since we ate a larger than usual lunch, I skip making dinner. If D. is hungry, he’ll make a sandwich for himself.

8 p.m. — We sit down to watch Fountain of Youth on Apple TV+. I love movies about treasure hunting and heists. We make it through most of the movie before I call it a night around 9 p.m. I do my skincare routine, journal, and go to sleep.

Daily Total: $145.96

Day Three: Sunday

6 a.m. — F. wakes up and comes looking for D. Sunday is my morning to sleep in, so D. gets up and I fall back asleep.

7:30 a.m. — Now I’m up. I walk out to the living room and find D. and F. playing Connect 4. They tell me they saved me a piece of French toast, so I go find that in the kitchen. We spend the next hour getting ready and packing up the things we want to bring to the winery later.

8:30 a.m. — We’re out the door and on our way to F.’s tennis lesson. We stop for coffee and a breakfast sandwich (me), iced tea (D.), and a croissant (F.). We get to tennis lessons and D. and I (and the dog!) find a bench and spend the next hour just hanging out with each other. We gotta sneak those dates in where we can. $21.84

10 a.m. — Tennis is over, so we head to Wegmans to pick up snacks for the winery. D. and F. go in to pick out snacks and I stay in the car with the dog. They choose an assortment of chips, crackers, and dips. $43.52

11:30 a.m. — We’re not meeting up with our friends until noon, so we stop at Red Truck Bakery for a few treats. Their baked goods are delicious, but they are located about an hour outside of DC, so we try to stop whenever we are out that way. $24.62

6 p.m. — We get home from the winery, give F. a bath and get him ready for bed. Once he’s in bed, I take a quick shower and then refill my water cup with icy water. I decide I’ll deal with unpacking from the winery tomorrow.

7:15 p.m. — After F. is asleep, D. and I sit down to finish watching Fountain of Youth. Afterwards, we discuss logistics for the upcoming week. It’s F.’s last week of school and we leave for vacation next Saturday so there are just a lot of moving pieces. I do my skincare, journal, and go to bed around 9 p.m.

Daily Total: $89.98

Day Four: Monday

4:30 a.m. — I wake up not feeling great. I did my Wegovy shot last night, and it usually makes me feel kind of nauseous. I can’t fall back to sleep, so I scroll for a bit.

6 a.m. — F. wakes up, so now we are all up. I make F. breakfast and myself a protein coffee. We play Wordle and chat.

7 a.m. — I’m still not feeling great, so I go back to bed. D. gets F. dressed and they leave for school.

9 a.m. — I wake up for the second time and I’m feeling much better. I get up, make toast, and log in to work. Everything is quiet, so I read a few work-related newsletters that I subscribe to and check my email. My mom calls and we chat for a few minutes about our weekends.

10:30 a.m. — I have my first meeting of the day with our contracting department. Nothing too exciting is discussed and I walk away with zero action items. As soon as that meeting ends, my manager calls and we chat about a variety of things for a while. After both calls I have 10 minutes until my next meeting, so I set a timer and do a few things around the condo.

12 p.m. — My second meeting is over, so I spend some time drafting summaries of our work over the last few months. I send them to my manager for her review and ask a few other people to send their write-ups to me for inclusion in the final document. I get pulled into a Teams conversation regarding an upcoming webinar, so I share the relevant information I have. When I am done, I turn on My Big Fat Greek Wedding and do a few personal tasks (folding two loads of laundry, putting all of my clean laundry away, and cleaning out my dresser).

1 p.m. — I have a meeting in 30 minutes, so until then I spend some time checking in on my direct reports to ask if they need anything and then get started on making a packing list for our upcoming trip.

2 p.m. — Meeting with my stakeholder is over and I am done with meetings for the day. I throw some chicken in the air fryer for lunch, buy a new deodorant that my dermatologist recommended (Vanicream anti-perspirant/deodorant), finally unpack our delivery from Thrive that I opened on Friday (which leads to restocking and organizing our snack basket), organize a few things I need D. to take with him when he goes out this afternoon, and keep working on my outfit planning/packing list for vacation. $11.25

4 p.m. — Work is still so quiet. D. leaves to get a haircut ($35 with tip — must be nice to be a guy!) and pick up F. from school. I clean up my personal email, review summer reading and math work for F., file a claim with our vision insurance for D.’s appointment last week, and take a shower.

5 p.m. — I make dinner for F. and we all sit down to talk about our days and play NYT word games. After he eats we take the dog out for a long walk and I throw in two loads of laundry.

7 p.m. — F. is asleep. I make birria grilled cheeses for me and D. and we watch an episode of The Night Agent. Afterwards, I put together goodie bags for F.’s classmates, since their end-of-year party is tomorrow. When they’re done, I pack them up along with a few other things that need to go with F. to school tomorrow.

9 p.m. — I’m in bed with my ice water.

Daily Total: $11.25

Day Five: Tuesday

5:45 a.m. — F. wakes up. He’s super excited to see the goodie bags for his friends and he can’t wait to hand them out. D. makes him breakfast and we all sit down to play NYT word games.

6:30 a.m. — I fold the laundry that was done yesterday and then start getting myself ready. I pull my hair back, do skincare, steam my dress, and gather my accessories.

7:30 a.m. — I pack my bag, gather the stuff I packed up last night, and F. and I head out. D. usually does school drop-off, but it makes sense for me to drive today. Once we get to school, I park and walk in with F. and our stuff. I run into a few other class parents and take their stuff too, since I have my handy Versa-Cart. I make my rounds, dropping stuff off where needed. I say bye to F. and his friends and walk back to the car. I decide I want a coffee for my drive to the office, so I grab an iced latte with an extra shot and a breakfast sandwich ($11.54). While I drive to the office, I call my mom and we chat. Once I get to my office’s garage, I pay the parking attendant ($19) and then go to my assigned spot for the day (normally I take the bus/Metro, which is about $5 per day). $30.54

9:30 a.m. — After catching up with a colleague on a few things going on, I finally make it to my desk. I clean up emails that came in overnight/this morning, edit a document my manager reviewed and send the information to the next person in line, and chat with one of my direct reports about their upcoming time out of office.

12 p.m. — I’m done with meetings for the day and hungry. I walk to get lunch ($21.32) and stop at Sephora on my way back to the office. They finally have the Biodance Collagen Toner Pads that I have been looking for so I grab those and The INKEY List Glycolic Acid body stick, which has been all over my FYP (update: It’s okay, but you have to be okay with a slightly sticky feeling on your skin. I only use it at night, so it can sink in while I’m sleeping and then remove any residue in the morning). I redeem some of my points for a $10 discount, so my total comes to $36.04. $57.36

1:30 p.m. — I eat lunch at my desk while I register F. for two fall soccer leagues ($289.32 total for both) and summer tennis lessons ($230). Once registration is complete, I add the game and practice dates to my calendar for all sports. Next, I submit a claim to our health insurance for F.’s speech therapy. The total claim for last month is $825, but we pay each week, so no actual charge today. $519.32

3 p.m. — I send out a few emails to stakeholders and then pack up to leave. I need to get home by 4 p.m. so I can pick up D. at the house and then F. from school. I get home around 3:45 p.m., get changed into running shorts and a T-shirt, and we leave to get F. Once we pick him up, we drive to the burbs for soccer practice.

5 p.m. — We get to soccer practice and F. joins his team while D. and I stand on the sidelines with friends and chat.

6:30 p.m. — We’re home from soccer and go immediately into F.’s bedtime routine (bath, pajamas, story). Once he’s asleep, I make chicken sandwiches for me and D. and we watch the first episode of Conan O’Brien Must Go.

9 p.m. — I get into bed and have a feeling it’s not going to be a great night of sleep (spoiler alert: I was right).

Daily Total: $607.22

Day Six: Wednesday

2:30 a.m. — I wake up and try to fall back asleep for an hour before giving up and allowing myself to scroll for a bit. I finally drift off to sleep around 4 a.m.

6 a.m. — We’re all up for the day. F. has breakfast and afterwards he wants to do a few of the math worksheets that are part of his school’s summer work. Once he’s done, we watch a show, and get ready for his last day of school.

8 a.m. — D. takes F. to his last day of school and I make myself breakfast and log on to my work computer. I clean up emails and make sure my calendar is blocked for the day.

11 a.m. — I take a quick shower, get ready, and go over to F.’s school for closing day activities. Once the celebration is over, F. and I leave and go get lunch, as well as a sandwich to bring home to D. While we are at lunch, we run into a few friends from school, so the kids run around with ice cream cones for a while. $62.34

1:30 p.m. — F. and I are finally home. I log back in to work and see that I won an award for a project I recently completed. It comes with a gift card, so I buy a navy-blue body suit, a bathing suit, a set of summer pajamas, a workout tank, and a set of rechargeable battery-operated lightbulbs for two antique lamps. Afterwards, I update a few documents that I am responsible for maintaining, check in with my grand boss regarding a call he has next week that I won’t be around for, and work on personnel-related documents.

3 p.m. — Since D. was able to work all morning, his afternoon is free. He and F. play with monster trucks and then F. and I go outside to play catch. I wear my over-the-head bug net (the mosquitoes and nats are so annoying in DC) and feel ridiculous, but it works so well. It’s really nice being on the cusp of 40 and not caring at all about what people may think of my ridiculous head gear.

5 p.m. — Tonight’s soccer practice is canceled, so we all watch Inside Out on our balcony while F. has dinner. Once it’s over, it’s time to move on to our bedtime routine.

7 p.m. — F. is asleep. Neither of us are particularly hungry since we both had a larger-than-usual lunch, so I skip making dinner. D. does some work, and we watch another episode of The Night Agent. We decide that D. will get up with F. tomorrow morning and I will do Friday morning. I put out a wooden car building and painting set for them to do in the morning.

9 p.m. — Skincare, journal, bed.

Daily Total: $62.34

Day Seven: Thursday

6 a.m. — First day of summer vacation and F. is up. D. gets up with him and I go back to sleep.

8 a.m. — I’m up now. D. and I discuss our meeting schedules for the day so we can ensure coverage for each other. D. and F. run to the grocery store to get a few things we need until we leave town on Saturday and I get ready for the day. $42.35

9:30 a.m. — D. and F. get home. F. gets changed into the outfit I have laid out (it’s the same outfit he wore for the first day of Kindergarten) and we go outside to take “last day of school” pictures. I bought a cute sign from Etsy a few weeks ago, so he holds that, and we get some really good photos. I take a few in the same place I took baby pictures in 2020, and all the feelings come rushing back.

12 p.m. — F. has been playing while D. and I have a few meetings, but things are quiet now. F. and I drive to a pie shop in Arlington that I’ve been wanting to check out. I have been craving key lime pie for a few weeks, so this is my chance. I get a slice of that, D. gets a slice of coconut, and F. gets the “lunch lady bar” with oats, peanut butter, and chocolate frosting. Everything is incredible! We will definitely be back. $21.57

1 p.m. — While I was out, my boss messaged me asking to chat about a few work things, so I let her know I am back in front of my computer. We chat for about 90 minutes regarding various work issues.

3 p.m. — F. and I work on a new Lego set for most of the afternoon. We thought it would be a good activity for the two days in between school ending and leaving for vacation, but he’s done in about two hours. Oh well!

7 p.m. — F. is asleep and I am making chicken sandwiches (again!) for dinner. We didn’t do a big grocery shopping trip this week since we’re going out of town, and now we are scraping together meals.

9 p.m. — Skincare, journal, bed.

Daily Total: $63.92

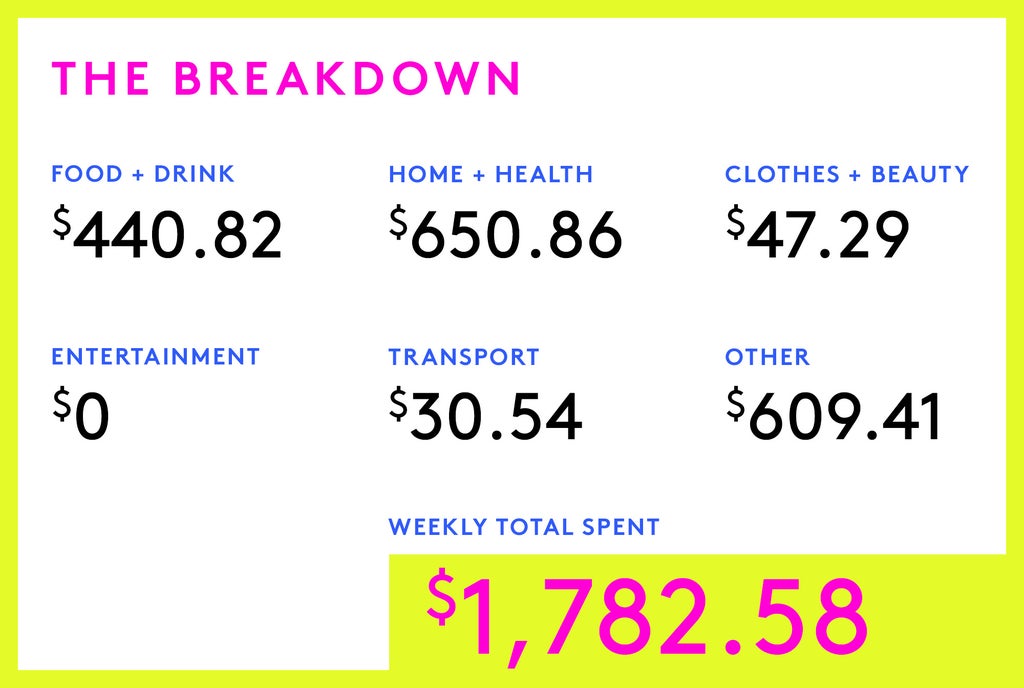

The Breakdown

Conclusion

“Seeing all of the ‘little treats’ compiled in one place makes me realize they’re not so much treats as regular everyday occurrences. We really need to scale back in that area. We haven’t updated our budget in a long time, and this is inspiring me to do so. Since writing this diary, D. and I have both received raises. My raise was a little less than 5% and D.’s was approximately 13%. In terms of dollars, both raises together will add about $1,000 per month (net) to our income. We have a date scheduled for later this month to finally sit down and re-do our budget.”

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more Money Diaries, click here.

We’ve updated our Money Diaries submission process: You can now submit your Money Diary via our online form or by sending us a bit of information about you and your financial situation to moneydiary@refinery29.com. We pay $150 for each published diary. Apologies but we’re not able to reply to every email.

Prior to submitting your Money Diary, please read and consider Refinery29’s Terms of Use and Privacy Policy. Submission of your Money Diary does not guarantee publication by Refinery29. Should your Money Diary be selected for publication, Refinery29 may, in its sole discretion, elect to pay you a fee, subject to such further terms and conditions as Refinery29 may deem necessary. Money Diaries that are not published are not entitled to receive any payment. Refinery29 will not remove Money Diaries once published. By submitting your Money Diary to Refinery29, you agree to abide and be bound by the applicable Terms of Use and Privacy Policy linked above. All submissions need to be original to the author (i.e., no AI contributions).

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In New York On A $75,000 Salary

A Week In Seattle On A $354,000 Household Income

A Week In Providence, RI On $120,000

from Refinery29 https://ift.tt/hFzVDKT

via IFTTT