Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: an administrative assistant working in Government who has a joint income of $190,000 and spends some of her money this week on Warby Parker glasses.

Occupation: Administrative Assistant

Industry: Government

Age: 31

Location: Irvine, CA

My Salary: $58,000

My Partner’s Salary: $132,000

Net Worth: -$89,879 (This is what we’re working with thanks to my two college degrees with a third one in progress. This number is mine and my partner’s total debt, minus our joint savings and checking accounts, my 457 deferred compensation plan, and my partner’s 401(k). As a government employee, I am a member of CalPers and will receive a pension calculated from my years of service and highest paid salary, so I don’t have a traditional 401(k) and am not counting my pension as part of our assets.)

Debt: $140,000, mainly from my student loans.

My Paycheck Amount (2x/month): $1,555

My Partner’s Paycheck Amount (2x/month): $3,300 (partner’s)

Pronouns: She/her/ella

Monthly Expenses

Rent: $3,295 (My partner and I share a two-bedroom, two-bathroom apartment that we recently moved into, and it was definitely a splurge for us. The apartment company had a move-in special so we ended up getting $9,000 off in the form of two and a half rent-free months, so we actually pay right around $2,800 a month. We really love our place, mainly because of the floor-to-ceiling windows in our living room and dining area that give us amazing natural light at all times. Our quality of life has improved so much since moving here.)

Car Payments: $838

Student Loans: $0 (currently in deferment since I am in grad school)

Utilities: ~$60

Internet: $75

iCloud Storage: $0.99

Car Insurance: $440 (this includes coverage for both of our cars and my partner’s dad’s car)

Cell Phone: $359 (we pay for my partner’s dad’s phone service as well)

Charitable Donations: $65 (Grl Collective, Black Lives Matter, Border Angels)

Peacock: $4.99

Netflix: $13.99

Fubo: $75

Hulu: $11.99

Spotify Premium: $0 thanks to my sis

Wix: $28 (I have a website for my bakery side-hustle that is more side, less hustle these days. But I pay the monthly fee to maintain the domain so no one can steal it and the mailbox.)

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Hell. Yes. My dad only completed a few college courses and never got a degree. My mom immigrated to CA from Mexico when she was a teenager, and she started working and taking English classes right away. It was always understood that college was the path for myself and my sisters and that they wanted more for us than what they had. My parents never even entertained the idea of community college first, it was always understood that we would all go straight to four-year universities. My parents took out parent-plus loans for my sisters and myself, and we also took out loans to pay for our tuition balance after scholarships and financial aid had been applied.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

Money was discussed in our household but not in an educational sense. My parents were very open about their financial struggles and the fact that we were not well off. They chose to put my two sisters and me in a private Christian school for our entire lives so they had to pay monthly tuition for all of us. Money was always tight and we knew that, but things like budgets, savings accounts, interest on debt, etc. were never discussed in an educational way.

What was your first job and why did you get it?

My first job was at age 14 as a childcare worker at my church. I wanted to get a job as soon as I was old enough to work so that I could pay for my own things I wanted (clothes, going out with friends, etc). In high school, I often felt embarrassed being out with friends and having no money to spend. My parents couldn’t usually give me money for things like movies or eating out, so working afforded me that freedom to have money to spend however I wanted.

Did you worry about money growing up?

I worried a lot about money, probably more than was normal for a kid. I was always concerned about where we would live, having clothes that fit, and being able to pay for school expenses like supplies and field trips.

Do you worry about money now?

I do, but not as much as I did when I was younger honestly. I think about money more than I worry about money if that makes sense. My partner and I are always budgeting, paying down debt, putting money towards saving, and planning for our future. We have plans to have a small wedding, buy a home, and want to continue to travel once the pandemic is over, so we are very aware of our money and spend a lot of time discussing our plans and budget.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I was on my own financially at age 18 once I started college and moved into the dorms. I had to work for any expenses and racked up credit card debt buying textbooks and other necessities that came with living on my own. Once I graduated from college, I moved back in with my parents for a few years and lived there rent-free. I would say I became completely financially independent at 27 when I moved in with my partner. We don’t have a financial safety net; if one of us loses our job, our savings is really all we have to fall back on.

Do you or have you ever received passive or inherited income? If yes, please explain.

No, but this sounds pretty cool. I am definitely interested in inheriting some money.

Day One

5:30 a.m. — My first alarm goes off and miraculously, I don’t hit snooze. I roll my corgi-mix pooch off my legs and push her onto the other side of the bed so I can actually get up. I immediately brush my teeth because I can’t stand morning breath even for 10 seconds, then give some extra love and cuddles to my two pups who are now both snuggled up next to my partner. I spend the next 20 minutes cleaning up the kitchen. I realize we are out of paper towels, so I clear all the dishes but can’t wipe down the counter, leaving it a hot mess. I hear my partner, K.’s, alarm going off, and once she wakes up, I ask her if she can stop by the store today for some essentials. She mumbles yes and falls back asleep instantly. Lucky bitch.

6:25 a.m. — I am out the door surprisingly early, which means I can stop for some breakfast. I make the 40-minute commute to my job in L.A., listening to a Harry Potter audiobook on the way, and do a mobile order for curbside pickup at the Starbucks near my work. I order a hot vanilla latte, a butter croissant, and an “earth” cake pop. Really, this just means the cake pop has blue frosting with white and green sprinkles on it, but I don’t even care because it’s cute and I want to eat it. I use a 50-star reward for the cake pop. $7

7:32 a.m. — I sit down at my desk and read the 17 emails in my inbox. I have a busy Monday morning getting work done, but after four years, my job is pretty much second nature to me and I find it to be less than stimulating. Conversations with work friends sustain me.

11:30 a.m. — I take a fifteen-minute break and order five drawer organizers online from The Container Store. These are going to be used for our junk drawer in the kitchen because it is so full of shit that I can barely get it open right now. It costs $33.55 and I can pick it up through curbside service in a few days. $33.55

1:30 p.m. — It’s finally lunchtime and I am craving a Chinese chicken salad from a teriyaki place down the street. I place my order online so I can spend the briefest amount of time possible in the restaurant. While my order is being prepared, I head to the post office to return my Warby Parker eyeglasses home-try-on that I got last week. I pick up my salad and spend $12.92. I eat the earth cake pop for dessert and it’s delish. $12.92

4:30 p.m. — K. is off work and calls me to tell me she is craving comfort food and really doesn’t want to go to the store. Her job is fast-paced and high stress, even without an added pandemic. I offer to do a Target drive-up order instead, and she agrees and then heads to Panda Express, which apparently is comfort food to her. We’ve been together for almost four years now and I am still learning new things about her. Wild. She gets a family feast so we can have leftovers for a few days. $31.50

5:35 p.m. — Off work, and as soon as I get into my car, I turn on Audible and continue listening to Harry Potter and the Prisoner of Azkaban. J.K. Rowling is now a known TERF and I refuse to support her work monetarily in any way. That being said, I purchased the entire Harry Potter series on Audible over four years ago because the Jim Dale narration is amazing and I am forever obsessed. So don’t come for me, please. I arrive at Target and park in a designated drive-up parking spot. Drive-up ordering at Target is the literal best, especially during a global pandemic since I am trying to limit my exposure to other people as much as possible. I get a 15-pound bag of Blue dog food and pee pads for the pups, a two-pack of paper towels, apple juice (because sometimes I have the palate of a three-year-old), lactose-free milk, chai latte concentrate, and diet green tea for K. We clearly like our beverages. I use a $25 gift card that I got for Christmas and pay the remaining balance. $45.60

6:55 p.m. — Home! I am greeted by two happy pups who immediately grab my shoes and run off with them, tails wagging. They are the cutest animals alive and I will fight anyone who tells me otherwise. I serve myself some orange chicken, kung pao chicken, chicken breast, and green beans (can you tell we like chicken?), chow mein, and steamed rice from Panda Express and K. puts on Gilmore Girls for me while I eat. She’s such a selfless queen because she really hates this show. I spend the rest of the night studying for an analyst performance test that I am taking at the end of the week while watching season thirteen of Ru Paul’s Drag Race with K. We both gag over Gottmik and Olivia Lux.

9:45 p.m. — My head hurts from studying so I am ready to call it a night. I do my nighttime routine — remove makeup with makeup remover towel from Grove Co (obsessed, you just dampen the towel and it takes off every trace of makeup), rose water facial toner, Oxygen Serum + HOCL from Lumion, and texture smoothing cream from cocokind. I use a few drops of Haitian black castor oil from Kreyol Essence on my eyebrows (grow little babies, growww), then take two women’s multivitamin gummies, 20 mg of Lexapro for my anxiety, and birth control for a hormonal imbalance issue. Teeth get brushed and flossed before I crawl into bed next to K. and do a brain-dump on my laptop until 10:20 p.m. Then it’s cuddles and giggles until we both fall asleep.

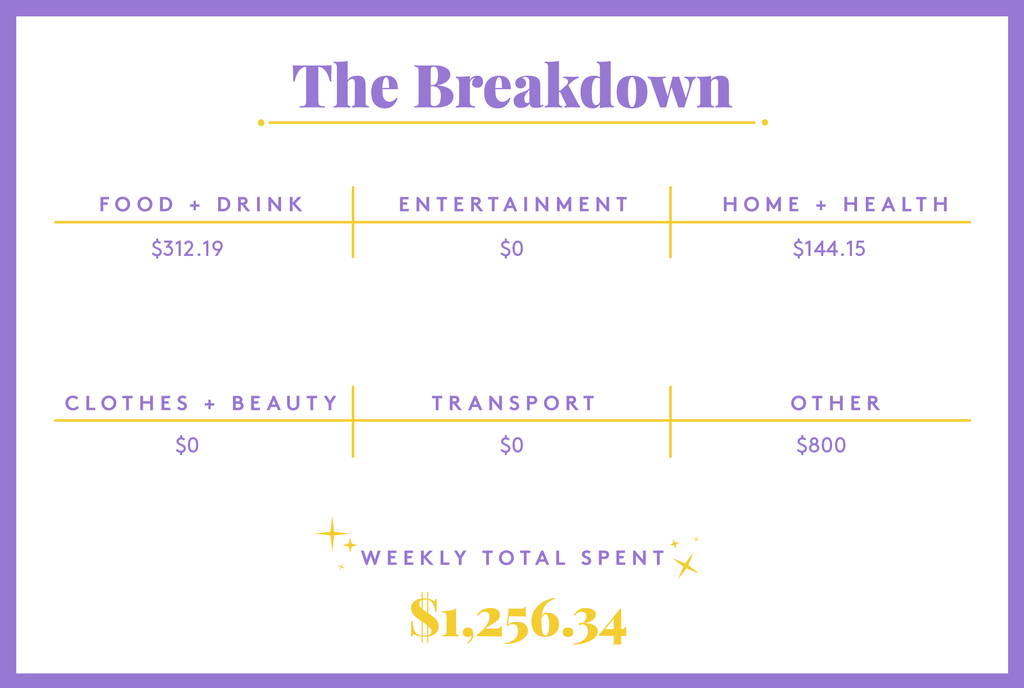

Daily Total: $130.57

Day Two

5:30 a.m. — Snooze. Snooze. Snooze.

6:14 a.m. — I crawl out of bed and realize how late it is. Brush teeth, shower, steam my clothes for work, and change. I wipe down the counters now that we have paper towels and lift all the living room shades so the pups can get their vitamin D while K. and I are at work. I make an iced chai latte with chai tea concentrate and milk and grab a chocolate chip oatmeal walnut cookie before heading out the door with K. Once or twice a year, we miraculously leave our apartment at the exact same time for work in the morning, and it’s actually really nice not having to walk to the parking garage alone.

7:21 a.m. — I arrive at work with nine minutes to do my makeup in the car. I keep it simple with Olay 7-in-1 day cream, CoverGirl brow pencil, Rimmel London eyeliner, and Maybelline colossal mascara. I’m clearly a drugstore makeup influencer.

1 p.m. — I take my lunch break and pick up a sandwich from a tiny mom-and-pop deli across the street from my work. I decide to walk there for some exercise, but when I get outside, it is way too cold (63 degrees in SoCal is frigid), so I drive instead. I order their new Italian sandwich, a bag of BBQ chips, and macaroni salad. I leave a tip and spend $14.16. The deli owner usually makes my sandwich and he is always very friendly and in the best mood. Like, singing while he works type of mood. Today is no different, and it makes me feel hopeful that good days (days without pandemic deaths and violent Capitol riots) will come again. $14.16

6:30 p.m. — I get home and munch on an apple while I heat up dinner for myself. K. gets home way earlier than I do since she has no commute, so she’s already eaten Panda Express leftovers doused in sriracha, which is truly her ride-or-die condiment. The pups get fed while I eat and we talk about our days at work.

7 p.m. — Our Christmas trees are still up. Yes, trees. There’s a big one in the living room and a small one in the main bedroom. It’s finally time to get rid of them before they spontaneously burst into flames. Living in an apartment, that means carrying them allll the way to the elevator and taking them down to the ground floor’s main dumpsters. K. and I are sweating balls by the time we are done and have scratches all over our arms.

8 p.m. — I clean up pine needles for the next hour. I’m one of those people who loves, no adores, cleaning so this makes me really happy. It is just so satisfying to see all those needles disappear! K. is more than willing to let me go all out while she lays in bed scrolling on her phone. I sweep, vacuum, and Swiffer the entire apartment, then take a ridiculously long shower.

9:30 p.m. — Study time for my analyst exam. I’m trying to get a job as a personnel analyst for a school district in Orange County, and this test is step two in the very long process. The exam is pass or fail, so I have to pass in order to advance to the next step, which makes studying an absolute must. Getting this job would also mean using my degrees, so prayers goin’ up to Lizzo, Dan Levy, and the Duke of Hastings that this works out!

10:30 p.m. — Nighttime routine then time for bed. Ya girl is exhausted.

Daily Total: $14.16

Day Three

7:25 a.m. — It’s a work from home day so I get an extra hour and a half of blissful sleep. I wake up literally five minutes before I need to log in to my desktop and spend the morning working on the couch and binging Derry Girls. It’s charming and hilarious and makes me want to visit Ireland even more.

10:20 a.m. — I toast a piece of my favorite cracked wheat sourdough bread from Trader Joe’s and add cream cheese. I eat an apple, some roasted pumpkin seeds with Tajin, and a handful of Hershey Santa hat kisses leftover from my Christmas stocking. #balance

2 p.m. — Lunch is a bowl of homemade pozole, courtesy of mi mama. She makes it once a year around Christmas and this particular batch is fire. I top it with shredded cabbage and eat a tostada with sour cream and queso fresco on the side.

5:15 p.m. — K. and I are in the process of becoming foster parents and we have our final in-home review with our social worker at the end of the month. That means our pups need to be better trained and not so damn barky and aggressive whenever someone dares to come into our (i.e. their) apartment. We have a private, in-home training session with a local dog trainer, and it goes so well that we decide to purchase a maintenance package of five sessions. $800

6:15 p.m. — K. heats up leftover chicken pad thai that I made on Sunday and the last of the Panda Express from Monday for her dinner. We don’t waste food and we like to eat, can ya dig it? I finish Derry Girls while she eats.

7 p.m. — I’m hungry and decide to Doordash Cheesecake Factory. They have a promo going on where you can get a free slice of cheesecake if you spend $30. Schwing. I order the farfalle with roasted chicken and garlic, french fries with a side of ranch, and a lemonade. I also order the 30th-anniversary cheesecake. With fees and tip, I pay $40.10. $40.10

7:45 p.m. — Food is heah! (Please read that in the voice of Pauly D from Jersey Shore, when he would announce “cabs are heah!” to the housemates who were always still getting dressed for the club.) I eat all the fries and bomb-ass ranch, the brown bread, and three bites of my cheesecake before I’m full. Thanks, carbs. I save the pasta for tomorrow and spend the rest of the night reading I’m Still Here: Black Dignity in a World Made for Whiteness by Austin Channing Brown. 10/10 would recommend.

10 p.m. — I shower and wash my hair, which means it’s product time. I have naturally curly hair and have to use a few things to keep it maintained. I start with a custom hair oil from Prose that smells insanely good followed by their curl cream. I use an invisible volumizer to give it…volume and air dry creme from Kristin Ess to reduce frizz. I do my nighttime routine then get into bed alone. K. is still awake and the pups won’t leave her side, so I decide to put on a whale sounds playlist on Spotify. Whale sounds put me to sleep and I’m knocked out within 20 minutes.

Daily Total: $840.10

Day Four

6:13 a.m. — I’m up and rushing thanks to my perpetual snoozing. I’m out the door at 6:52 a.m. and have to speed the entire way to get to my job on time. I arrive at 7:33 and see that my boss is just getting out of her car. We pretend not to see each other, and I’m really okay with that.

9:45 a.m. — Thanks to the previously mentioned Warby Parker eyeglasses home try on, I’ve decided to purchase the Carlton frames in Sequoia, and I pay extra to upgrade the lenses to be blue-light filtering and high-index, which basically just means thinner. I’ve been wearing glasses since the third grade, so my vision is absolutely terrible. Without the high-index upgrade, I’d be stuck with super thick lenses that would distort my eye size and give me serious Urkel vibes. I drop $175 for the glasses, but my insurance will reimburse me $110 (Thanks, EyeMed). $65

1:30 p.m. — Lunch is Urban Plates. I order a grilled steak plate with mashed potatoes and salad. The steak is sadly overcooked, but that’s my fault because I forgot to specify how I wanted it (medium-rare, obvi.) But the mashed potatoes give.me.life, so all is well. $16.15

6:20 p.m. — I’m home from work and open the fridge to find that K. has eaten the Cheesecake Factory pasta. She’s lucky I love her enough to forgive this transgression. I’m not super hungry yet and tomorrow is my day off, so I decide to stay up late and make pizza. The dough takes almost three hours to make, so if I start now, I can have a late dinner. I combine bread flour, yeast, salt, and room temperature water in my mixer until a ball of dough forms. I let it rest for 10 minutes, then turn the mixer back on and let it knead the dough for 10 more minutes. Once it’s done, I cover the bowl with beeswax wrap and let it rest on the counter for two hours.

7 p.m. — After a three-week break, grad school is back in session for me. I spend a few hours reading and writing two discussions on ethics in the public sector. As much as I find writing class discussions annoying, I enjoy learning and reading my textbook.

9 p.m. — The dough is ready to be made into pizza. I grease a baking sheet with butter and plop (yes, you must plop) the dough out onto the pan, using my hands to press and stretch the dough out evenly to the pan edges. I let it rest for another 30 minutes, then add marinara sauce, shredded mozzarella cheese, and top with thinly sliced mushrooms. It’s my ideal pizza! I bake it at 500 degrees for 14 minutes until it is crispy and melty. I eat it with a romaine salad mix and ranch dressing.

10 p.m. — I watch The Office on Peacock and am v annoyed at the ads. I’m still pissed it left Netflix.

12:30 a.m. — Night time routine and lights out.

Daily Total: $81.15

Day Five

8 a.m. — It’s test day and that means I am anxious AF, which explains why I am up so early on my day off. I make myself coffee (Ethiopian blend from Trader Joes) with hazelnut creamer and sit down on the couch to get in a few more hours of studying.

12:50 p.m. — I leave the house for my test and make the 20-minute drive to the school district headquarters. This is the first test I have taken in-person during the pandemic, and I am hoping there aren’t too many people in the same room. Test anxiety + pandemic anxiety is such a bad combination.

3:30 p.m. — Test is done! There was only one person in each row and everyone wore masks, thankfully. I feel really good about it so hopefully, I get to move on to the next step which is a rater panel interview.

7 p.m. — K. and I are having a COVID date night, which means we are cooking dinner together and playing board games. We make carne asada tacos, Mexi rice, and fresh salsa. We play chess (our current obsession since finishing The Queen’s Gambit), Copenhagen, and Rummikub. We’re both very competitive, especially with each other, but I’m the only one who tends to be a sore loser. Sorry K.! She beats me at every. single. game. and I pout.

11 p.m. — K. heads to bed and I stay up watching an old season of The Great British Baking Show. I swoon over Kim Joy’s cute-ass fox cake! I start falling asleep on the couch and am so tired that I skip my full nighttime routine and fall into bed.

Daily Total: $0

Day Six

9 a.m. — K.’s mom is coming over later today and will be spending the night. K. spends the morning cleaning up, washing linens, and prepping the guest room for her while I go shopping at Target and Ralphs for much-needed supplies (toilet paper, paper towels, hair products, deodorant, wet dog food, cereal, bread, Cheez-Its, carne asada, milk, sour cream, avocados, salad, and a lot more stuff that magically found its way into my cart). I spend $114.88 at Target and $67.51 at Ralphs. $182.39

2:30 p.m. — K.’s mom arrives and comes bearing belated Christmas gifts. She gives me a wallet, slippers, a sweater, and a lunch bag with bamboo utensils and a reusable water bottle. Since my own mom is not supportive of my relationship and won’t even acknowledge K.’s existence, it feels really nice to have K.’s mom care about me. Her coming over, wanting to hang out, and being a part of our lives is lovely.

11:30 p.m. — After a night of hanging out, drinking, playing games, eating tacos, introducing K.’s mom to TikTok, and watching RuPaul’s Drag Race, it’s time for bed. Nighttime routine and cuddles with K. and the pups.

Daily Total: $182.39

Day Seven

8 a.m. — K. wakes me up because her mom is already awake and I’m SO tired but crawl out of bed.

8:30 a.m. — I make pancakes while K. and her mom watch football. They are in the same fantasy league and both genuinely love the sport, which still completely baffles me to this day.

11:30 a.m. — K.’s mom heads home, and we lay down together and talk for a while. K. falls asleep and I do the dishes and go over a cake recipe I plan on baking tomorrow. I place an online order through Michaels for a few different types of sprinkles and pay. $7.97

3:45 p.m. — K. wakes up from her nap and we do some laundry and binge Bling Empire on Netflix. You don’t realize what rich really is until you see someone shut down Rodeo Drive to host a private Lunar New Year celebration for their friends.

7 p.m. — Dinner is pasta and turkey meatballs from Trader Joe’s. I make a red sauce using crushed tomatoes, tomato sauce, fresh onion and garlic, basil, salt, pepper, and a dash of heavy cream.

9 p.m. — Nighttime routine and bed. Cue the whale sounds playlist.

Daily Total: $7.97

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In San Luis Obispo, CA, On A $65,000 Salary

A Week In Central Valley, CA On A $216,100 Income

A Week In Billings, MT, On A $85,000 Joint Income

from Refinery29 https://ift.tt/2ZyaagE

via IFTTT