Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Are you someone who retired early, in their 30s or 40s? Or do you wonder how the hell some people manage to retire so early when it feels like you’ll have to be working forever? We want to hear your thoughts here for an upcoming Refinery29 story.

Today: a program manager who makes $58,000 per year and spends some of her money this week on tree-free paper towels.

Occupation: Program Manager

Industry: Nonprofit

Age: 25

Location: St. Paul, MN

Salary: $58,000

Net Worth: ~$61,600 (Savings: $15,000 (depleted a bit after a $12,000 down payment on a house this past summer), FT Employment Retirement: $14,223 (25% is invested in a sustainable investment fund and the other 75% is in a target retirement date fund), PT Employment Retirement Account: $4,175 (This is all employer contributions), home equity: $15,000 (house is worth $170,000), car: $6,000 (I own it fully), travel fund: $2,643, home repair savings: $437 (I just started this one), wedding savings: $4,150. My partner and I have a joint account for joint savings, but the rest of our finances are separate.)

Debt: $155,000 left of my mortgage

Paycheck Amount (2x/month ): $1,620

Pronouns: She/her

Monthly Expenses

Mortgage: $1,110 I live with one roommate, B., who pays me $650 per month (this includes her share of monthly expenses listed below)

Loans: $0

Internet: $65

Security System: $15

Spotify: $16.06 (I pay for a family plan that my mom, dad, and brother use) Amazon: I share with my family (my parents pay)

Hulu: I use my brother’s account

Gym: canceled due to COVID (was $38)

Virtual Dance Classes: $40

Wedding Fund: $200 (My partner, L., and I each contribute $200 per month, we aren’t officially engaged but we know we want to get married and weddings are hella expensive so we’re trying to get a head start)

Travel Fund: L. and I usually contribute $100 per month but it’s paused right now because we had saved for a trip to Spain but didn’t go due to COVID.

House Emergency Fund: $150 (I recently started this because I have had to dip into my savings for house repairs. I’d rather have a separate pool of money)

Appliance Insurance: $45

Health Insurance: $0 (I am currently on my parent’s health insurance and it’s the same price for them whether I am on it or not, so they don’t charge me. At the end of the month, when I turn 26, I will switch to the high deductible plan offered by my employer that will cost about $60 per month.)

Cell Phone: $50 sent to my dad

Donations: $10 to the ACLU, $20 to Black Visions Collective

Car insurance: $440 every six months

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

My parents always expected me to go to college and they saved for both my brother and me to help us do so. As a college student, I did not fully appreciate their support and many years of planning that made this possible. I know I am very privileged to have had so much help paying for my college. In the rest of my Money Diary, I think you’ll be able to see how that help has already influenced my financial stability and ability to obtain wealth. I’ve worked hard, but this is also a story of how generational wealth works. I had about $25,000 of student debt after attending a private college. I paid that debt off in three years by moving back in with my parents for two years after graduating and working two jobs consistently. The most significant reason I am debt-free is because my parents contributed a total of $30,000 to my college education. I also took college-level classes in high school and was able to graduate from college in three years. I was also an RA for my last two years of college, so I did not pay for housing.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

We didn’t talk a lot about our family’s money growing up. We were fairly frugal in everyday life, often buying on sale and such, but we had a nice house and went on family vacations. My parents did frequently talk to me about managing the money I was earning/receiving from them. Now, I call my parents with financial questions and asked them a lot of questions when buying my first house.

What was your first job and why did you get it?

When I was 14, I started working as an assistant dance teacher a couple of hours a week. I got paid in class credits and it helped my parents with the astronomical cost of dance. I continued to do that job until I graduated high school. I also got a job at a local sporting goods store at 16. I typically worked about eight hours a week. This job was really just for extra spending money.

Did you worry about money growing up?

My family was financially very comfortable while I was growing up. I never worried about money, with one exception for a brief period of time when my dad lost his job. The most significant expense was that my parents paid for many hours of dance lessons for me every week.

Do you worry about money now?

I was unexpectedly laid off from my first job out of college and I do worry about losing my income like that again. Other than that, I am privileged to not worry very much about money.

At what age did you become financially responsible for yourself and do you have a financial safety net?

When I turned 16, my parents wanted to instill financial responsibility in me, so they started a new system: they gave me $150 per month and I was now responsible for all of my day-to-day expenses (they still paid for my dance classes and dance costume fees). I paid for my own gas, car repairs, toiletries, school supplies, clothes, going to the movies with friends, etc. I do think this system taught me to budget and manage my money well from a young age. I quickly learned to buy store-brand items and to skip the expensive movie theater popcorn sometimes. It was also very safe. I realize that many people have to learn these skills in a stressful way out of necessity. I always knew I had a safety net and I know I still do with my parents and my large extended family.

Do you or have you ever received passive or inherited income? If yes, please explain.

Aside from the $150 per month I received as a teenager, I haven’t received any passive income.

Day One

8 a.m. — Woo it’s Friday! I wake up begrudgingly because I stayed up until 2 a.m. reading Such A Fun Age. Mornings are hard for me in general. After my very basic morning routine of throwing on leggings and a turtleneck, washing my face, brushing my teeth, putting contacts in, and piling my hair up on top of my head with a scrunchie, I reheat some leftover quinoa, add brown sugar, cinnamon, and blueberries. I make myself some of the nice coffee I bought from a local co-op last week. It’s more expensive than what I typically buy ($13 for a bag), but it’s really the little things getting me through COVID times. Time for work (from home)!

12 p.m. — Three Zoom meetings in a row and I’m ready for a break. I take stock of the leftovers in my fridge and dump the last of the leftover quinoa, some cooked sweet potato slices, and some seasoned tofu from dinner last night into a pan. I add spring mix and pour lemon vinaigrette salad dressing over the top. Not bad for an impromptu meal. I realize I have an almost overdue bill for my appliance insurance and write out a check for $45 (monthly expenses). I bought my first house six months ago and many of the appliances are o.l.d. Like so old they almost have a vintage cool look now. I like the peace of mind and predictable expense the insurance provides, plus these dinosaur appliances are also really well made so who knows if they’ll ever actually need to be replaced.

3 p.m. — It’s officially work from the couch o’clock. I make tea and snack on some plain greek yogurt with honey and blueberries.

4:30 p.m. — I head over to my friend, D.’s, house. She is collecting period products for a local youth shelter for her birthday. I pick up some tampons, pads, and liners on the way. I also bring her my last bottle of homemade orange, grapefruit, vanilla-infused wine. We chat outside for a few minutes with masks, but it’s pretty cold so it doesn’t last long. It’s still good to see her in real life. $16.74

5 p.m. — I stop to do a contactless pick up of some cute vintage cabinet knobs I saw listed on Facebook marketplace ($2). I am obsessed with Facebook marketplace for furniture, decor, home improvement tools, etc. I love a good deal and buying used so it’s a win-win. $2

6 p.m. — I start cooking some wild rice as my roommate, B., arrives home. She says she is ordering some tacos for pick up and asks if I want some. Twenty minutes earlier, I definitely would have taken her up on it, but I opt to finish making a rice bowl instead. B. and I were introduced through a mutual friend when we were both looking for new housing two years ago. We lived together in an apartment with a third roommate for two years before I bought this house. B. is a great roommate, so I was glad when she wanted to move in with me! I know I am too extroverted to enjoy living alone and sharing costs makes it much more manageable to afford my mortgage and utilities. It also gives me some extra money to work on home repairs and improvements.

7:30 p.m. — I hop on a Zoom call with two of my closest friends (from college) who are in different states. COVID has actually allowed us to connect more since we are all more tech-savvy now and there aren’t in-person friend gatherings getting in the way. We do yoga together and then proceed to our planned activity of the night — simultaneously making flourless chocolate cake. I open a bottle of red wine for the occasion. The cake is amazing and we have a thorough catch-up.

1 a.m. — I get ready for bed after a burst of energy inspired me to clean my room. I almost always have energy at night like this.

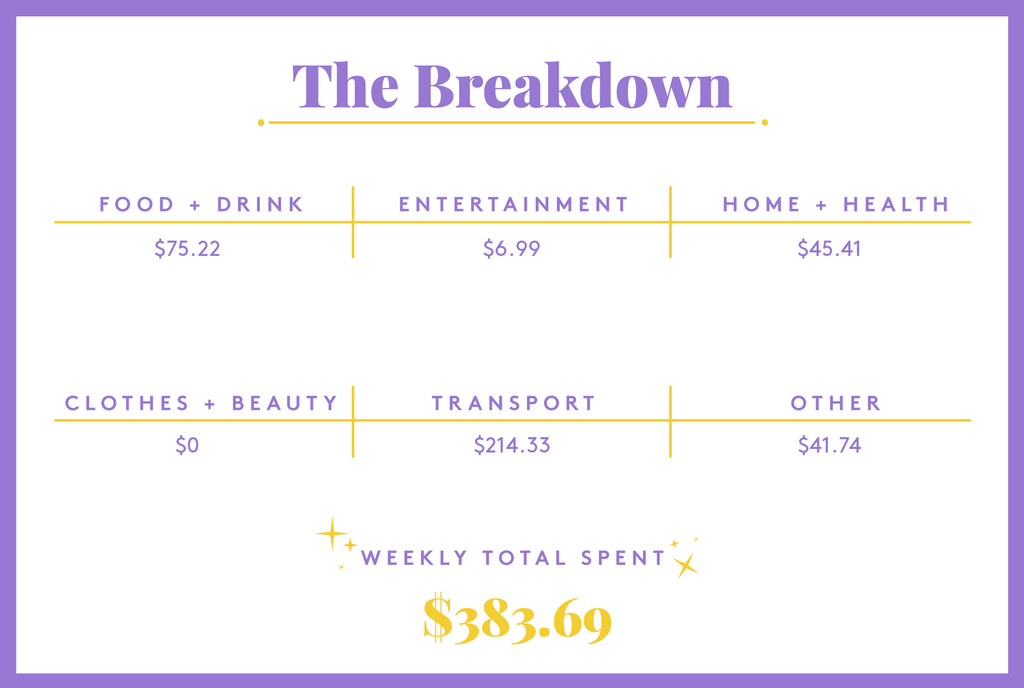

Daily Total: $18.74

Day Two

7:30 a.m. — My alarm goes off. Usually, I like to sleep in on weekends, but I have a second job teaching dance and I am helping out with choreography this morning. I make coffee and grab a bag of homemade trail mix on my way out the door.

11:30 a.m. — It feels nice to have been awake and moving my body for a couple of hours already. I hop in the car and call my partner, L. He lives an hour and a half away and we call our relationship an “inconvenient distant relationship.” I am going to his house today so I fill up my car ($31.81) and hit the road. $31.81

1 p.m. — I arrive at L.’s and am feeling very creative from this morning’s choreography session. I spend another hour working on some material for my classes this week. I eat some of the egg bake L. made this morning. He’s a great cook and isn’t afraid of slow-to-cook meals where I am kind of impatient.

5 p.m. — We’re hungry and it’s just starting to snow so we order pizza for pick up ($17.25 plus a $5 tip). We have a tradition of pizza and wine nights so we stop to pick up a bottle of wine too ($12). L. pays for both of these things. We have a very informal system of taking turns paying for things.

6 p.m. — We get a little wine drunk and have several spirited and random conversations. Later we rent MLK/FBI on Amazon Prime (I pay). It’s interesting but we’re both tired and call it a night around midnight. $6.99

Daily Total: $38.80

Day Three

6:30 a.m. — L. wakes up because he likes mornings. Luckily, he has mostly given up trying to convert me to his morning ways. At 9, I roll out of bed, grab coffee, and join L. on the couch. We finish watching the last bit of the documentary and eat leftover egg bake.

11 a.m. — The fresh snow has inspired us to go out cross-country skiing. We both recently got our own pairs (L.’s as a birthday gift from me and mine from Facebook marketplace for $40). It’s turning out to be a great pandemic hobby. We pack up our gear and…. my car won’t start. I knew I was on the verge of needing a new battery and we’re supposed to have below zero temps next week. Luckily, an auto parts store a couple of blocks away has the battery I need and the new one is in within 30 minutes. $182.52

12 p.m. — Skiing is back on! We drive about 20 minutes to a county park with trails that are free to ski. The sun is shining and it is quite busy. Luckily there is plenty of space.

2:30 p.m. — I feel so good after moving my body and getting some sun. It feels like I never see the light of day in the winter sometimes. L. and I decide to both head back to my house, but we have to drive separately because of our work schedules this week. I stop for a chai latte with almond milk, a coffee for L., and a doughnut on the way. $8.22

4:30 p.m. — We have definitely not eaten enough today, so we make some vegan chicken nuggets in the oven as a pre-dinner. I mix together sriracha and honey to create my favorite dipping sauce combo. I mostly eat vegetarian — partially because I just don’t really like the taste of meat and also for environmental reasons.

7 p.m. — I shovel the sidewalk and do some cleaning while listening to The Splendid Table podcast. L. roasts some squash for dinner and I take over after getting inspired by the podcast. I have some lefse (a thin, potato-based tortilla-like Swedish food) frozen and leftover from Christmas and I decide to try to make it work with the squash. I make a greek yogurt thyme sauce and pile the lefse with the squash, tomatoes, spring mix, walnuts, and pickled onions. It’s pretty good, though it’s not quite the same as my holiday favorite of lefse slathered in butter and sugar.

11 p.m. — I continue my cleaning spree while L. reads a book. We shower and crawl into bed. L. really does help me go to bed at a reasonable time.

Daily Total: $190.74

Day Four

8 a.m. — I wake up worried that I have to move my car (by 8 a.m.) to not get towed when the snowplow comes through. Luckily, L. has already moved our cars. I do my morning “routine” quickly and get ready for a 9 a.m.. meeting. L. has made eggs, toast, and coffee (bless him) and is working from my place today.

12 p.m. — I sauté some onions and a yellow pepper and add in some leftover roasted squash and wild rice. L. makes a yummy yogurt sauce. I also eat some of the leftover flourless chocolate cake and it’s sooo good.

2 p.m. — We decide to get out of the house for a quick walk at a nearby park. We enjoy walking around the area and discover a brewery we didn’t know existed. We aren’t going out to eat inside restaurants right now, even though it has recently become allowed again, so I add it to a list on my phone of places to try later or when we can comfortably sit outside again. We make some microwave popcorn when we get back home.

4:30 p.m. — Done with job #1 for the day. I send B. a quick apology text for leaving the kitchen a disaster and make some tea to take with me as I’m running out the door.

5:30 p.m. — I teach dance at this time on Mondays and Tuesdays. We are recently back to in-person classes after a shutdown. Class sizes are small, distanced, and we all wear masks. It feels relatively safe and it is one million times better than teaching dance over Zoom.

9 p.m. — Usually I snack between classes while teaching but now I don’t really like to remove my mask aside from quick sips of water. I inhale a Lemon Lara bar on my drive home and listen to the local public radio station to catch up on news. I’m still hungry when I get home so I eat a bowl of cereal. I know this isn’t the most nutritious dinner, but I’m exhausted and this is the reality on these long workdays. I catch up with B. who is a freelance writer as a second job and is writing at the kitchen table (we switch off in the nice office chair — it’s mine during the day and hers at night). Then I force myself to clean up the day’s worth of mess in the kitchen, even though I am very tempted to just leave it for tomorrow.

12 a.m. — I stretch for a few minutes and call L. to say goodnight before passing out

Daily Total: $0

Day Five

8 a.m. — I wake up to B. getting ready for work (she has to go into the office again after several work-from-home months). I have a killer tension headache so I shut off my alarm and pull my blanket over my head.

9 a.m. — Okay, I really have to get up now. I take a quick steaming hot shower and drink some water to try to diffuse my tense neck and shoulders. I have a three-hour meeting that I have to rally for. I make a huge cup of coffee, throw on a button-up shirt, some joggers, and blue light glasses, and hop on the Zoom call with wet hair. My workplace (a medium-sized nonprofit) has been very flexible and supportive throughout COVID. I work with almost all women which I think is a huge win. It’s not uncommon for someone to join a meeting with a toddler on their lap and we have gotten extra self-care days in response to both COVID and after George Floyd’s murder this past summer, in addition to our generous PTO policy. I know I’m lucky to have a workplace that recognizes that we’re human (and that I can still work from home).

11 a.m. — I make two pieces of toast with honey during a meeting break and I realize we’re almost out of paper towels and dish soap. I have a New Years’ resolution to use less plastic and paper for household chores. I’ve started using Grove to order household supplies since I haven’t been able to find a local store that carries a full range of environmentally friendly household products. I add recycled plastic trash bags, tree-free paper towels, plastic-free hand soap and dish soap refills, and a pack of two walnut dish sponges. I decide to try out their reusable “paper towel” product to hopefully cut down on paper towel usage. Shipping is free because I got a free year membership when they were doing a promotion. $37.70

1 p.m. — I remember the chicken enchiladas that I froze last week (thank you past self) and put them in the oven to cook for lunch. While scrolling on Facebook I see that one of my friends who is a middle school teacher in a low-income area is raising money for technology for his students to use at home for distance learning. Though I think it is ridiculous that he has to pull from his friends and family to fund the educational needs of his students, I chip in $25 because that’s a systemic issue that can’t be solved today. $25

3 p.m. — I make a smoothie with plain greek yogurt, frozen raspberries, almond milk, and orange juice as a snack along with some 88% dark chocolate (my fave). I’ve been super productive so far this afternoon and I’m hoping to keep up the momentum.

4:30 p.m. — I change and leave for my second night of teaching this week. The beginnings of my weeks are always hectic like this. I was trying to avoid the afternoon caffeine, but I am feeling myself get sleepy during the drive, and that isn’t going to fly, so I stop at Caribou and order a mocha with almond milk. $4.23

10 p.m. — I get home and chop up a pineapple, which I eat most of along with some cashews and hot Cheetos.

1 a.m. — Oops, time for bed! I stayed up talking and laughing with B. (thanks 5 p.m. caffeine for the second wind).

Daily Total: $66.93

Day Six

8:30 a.m. — Get dressed in a classic work from home blazer and sweatpants combo. Eggs, toast, coffee, emails.

1 p.m. — I make a pesto grilled cheese on sourdough, tomato soup, and a salad. Yum!

6:30 p.m. — Ah! Where has the day gone. I’m still working when I realize my weekly Spanish class is about to start, like right now. I hop on the Zoom link and try to switch my brain over. I’m sick of staring at a computer, but the teacher is so nice and engaging that I’m glad I didn’t skip it. I’ve been *very* gradually learning Spanish over the past three years. I like being a student, but man, learning a language as an adult is hard. I eat some cashews and fruit leather as a snack during the class.

8 p.m. — I cannot sit a minute longer. I put a cardio dance video on and then do 20 minutes of yoga. Afterward, B. saves me by offering up some of the curry lentil shepherd’s pie that she made. It’s delicious and also prevents a grocery store run for one more day.

9 p.m. — I bake banana bread and banana chocolate chip muffins to use up some of the bananas in the freezer and the last of my flour, sugar, and butter. While cleaning the kitchen, I accidentally destroy a measuring spoon in the garbage disposal. This is the second time I’ve done this since the kitchen remodel where I added a dishwasher and disposal, so I look for a sink stopper that will fit the opening online. I find one for $5.71 on Amazon. L. and I did the remodel ourselves this past fall, aside from the electrical and plumbing work for about $2,500. I found a perfectly good dishwasher free on, you guessed it, Facebook marketplace! $5.71

10 p.m. — I take a bath with Epsom salts while reading; a favorite unwinding activity. I just started reading the Stonewall Reader. I call L. and we talk for about an hour before we go to bed around midnight. I miss him!

Daily Total: $5.71

Day Seven

8 a.m. — I wake up to a call from my cousin/best friend who is driving home from working the night shift as a nurse. We catch up for half an hour while I eat breakfast (coffee and banana bread). After I hang up with her, I make a to-do list for work and dive in.

12:30 p.m. — My dad and I have our standing scheduled lunch phone call. We talk about recent layoffs at my work and how I’m now managing an additional person with the restructure. We also talk about politics (a favorite topic). We don’t agree on several things, but we’re able to have productive conversations. I appreciate his openness to hearing my points of view and sometimes changing his mind. While we talk, I make mac and cheese and sprinkle breadcrumbs and sriracha on the top. Grocery shopping will happen tonight, I promise!

2:30 p.m. — Tea and banana muffin break! I schedule a gyno appointment and luckily snag one before the end of the month when I get kicked off of my parents’ health insurance when I turn 26. Their insurance is much better coverage and cheaper than the high deductible plan my work offers, so I’ve stayed on as long as possible. I send a message to my doctor asking if it’s possible to get a new IUD at this visit (even though I technically can have my current one for another year) because I know it will be much cheaper to do it on my current plan. Fingers crossed and also our healthcare system is ridiculous.

6 p.m. — I join a virtual meeting for a volunteer committee I’m on. I put it on my headphones and simultaneously make dinner (farro, spring mix, feta, bell peppers, chickpeas, and tomatoes with balsamic dressing).

7:30 p.m. — I finally make it to the grocery store. I mostly shop at Aldi because it’s cheap. Sometimes I shop at the local food co-op if I need a specialty ingredient. Those are definitely two different ends of the spectrum of grocery options and pricing. I buy two cans of chickpeas, two cans of black beans, eggs, goat cheese, pretzel sticks, broccoli cheddar soup, a box of macaroni, frozen corn, frozen veggie blend, a frozen pizza, cashews, cereal, a cucumber, bananas, clementines, radishes, jalapeños, bell peppers, English muffins, flour, sugar, butter, baking soda, and antibacterial hand wipes. $62.77

9 p.m. — I’ve been meaning to clean my floors all week so I wash the main level floors (all wood) and vacuum the rugs. I clean off the kitchen table/office which gets so messy every week after so many hours of use.

11 p.m. — I call L. and we talk until 12:30. We get to see each other tomorrow — yay! (I’m always excited to see him, but it’s even more exciting now when he’s one of the two people I see.)

Daily Total: $62.77

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Raleigh, NC, On A $132,000 Salary

A Week In Sonoma County, CA On A $17,000 Salary

A Week In Long Beach, CA, On A $58,000 Salary

from Refinery29 https://ift.tt/3d3xGZ9

via IFTTT