Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a psychiatric nurse practitioner who makes $116,000 per year and spends some of her money this week on pepper spray.

Occupation: Psychiatric Nurse Practitioner

Industry: Healthcare

Age: 27

Location: Brooklyn, NY

Salary: $116,000

Net Worth: $41,000 (Savings: $10,000, 401(k): $11,000, Down Payment Savings: $20,000)

Debt: $0

Paycheck Amount (2x/month): $2,410

Pronouns: She/her

Monthly Expenses

Rent: $2,200 for studio in a building that includes gym, bike room, rooftop, and lounge

Internet: $39.99

AT&T: $54.50

Electric/Gas: $73

Spotify + Hulu: $5.99 still on student membership

HBO/Netflix: I use my friends’ and they use my Spotify + Hulu

Donations: $100 (usually to various local mutual aids; last year gave back ~$2,200 including COVID money)

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes. My parents are both first to attend college in their families, back home in East Asia. They work tirelessly to support me financially and I’ll forever be grateful (and paying them back) for that. They expected me to go to college, and ideally grad school. I got about 70% financial aid for both my Bachelor’s and Master’s, 20% from my father, and 10% from working part-time throughout college and grad school.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

We didn’t have any conversations, but my father worked 12 hours a day most of my childhood. He was “absent” in that sense, but it was clear that his idea of “a good father” is to be as financially supportive as possible, which he was. Now that he is close to retirement, he still insists on helping me with a down payment (hence the $20,000) and that this is “the last help” I’m ever going to get. He always has a cute semi-threat that I’m responsible for their retirement life, and I know that I am expected to support them as is our culture. I’m excited, nervous, and proud to return back what they have so graciously provided for me.

What was your first job and why did you get it?

So, I am not a U.S. citizen, but I’ve been here for eight years including college and grad school. For the most part, the only jobs I was allowed to get were on-campus jobs. I worked on campus in college at a campus bookstore, the gym, as a building manager, and as security. I also worked at a domestic violence shelter, a nonprofit mental health org for case management, and a family court for DV victims after college through a work visa.

Did you worry about money growing up?

No. Not at all. And working with patients, clients, and my friends who are from less privileged backgrounds, I’m aware of how privileged I am. It took me a long time to be okay with that privilege and I tried my best to work as much to not feel that guilt, but now, I take it, understand the mechanism of capitalism, try to donate as much as possible, and give back to dismantle it as best as I can.

Do you worry about money now?

Yes, I worry that my studio is HELLA expensive. I had to move in under a week because as soon as I graduated, I got a job in the healthcare system where COVID was rampant and they expected me to start ASAP. So, the most convenient thing for a young Asian woman was a gentrified apartment with doorman in a gentrified neighborhood, so I got this apartment which is half my paycheck. Now that I’m more familiar with the area, I cannot wait to move to a cheaper place so I can give back to my parents more.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I became financially responsible for myself just last year. I was financially dependent on my father for tuition. I still know deep down that I have the luxury of not living paycheck to paycheck and if something were to happen, I can always fly back home and will have my parents’ support.

Do you or have you ever received passive or inherited income? If yes, please explain.

Yes, tuition and down payment.

Day One

6 a.m. — I wake up. 6 a.m. Saturday. Why.

11 a.m. — I lounge in bed, too cold to get out. I listen to an audiobook by Kiese Laymon (my fave author). I finally get up to make coffee with Chobani creamer and eat a huge batata (Asian sweet potatoes — not sure the distinctions but I hate the orange kinds, these are incredible). Finish Succession. Incredibly white but incredibly thrilling in a way. Yes, I’m attracted to Roman.

1 p.m. — I walk around Brooklyn with a colleague and we vent about high-risk patients and lack of support. We both work at a homeless shelter. Our job is essentially to “clear” them with physical and psychiatric illnesses so they can be “shipped out” to more permanent housing. We are pressured to “clear” them to go to hotel pods instead of mental health housing even if they are psychotic. It’s incredibly irresponsible and dangerous and I just won’t do it. The pressure is mostly because they want them gone from this “temporary” shelter, but the waiting list to get into a mental health shelter is months long. We thrift our stress away — I find an incredible Karl Lagerfeld dress for $19 and a green top with gold buttons for $15. If I become a U.S. citizen and can work multiple jobs, I want to go into fashion as a second job! Score! $34

4 p.m. — I work out. I’ve been doing 10,000 steps a day since COVID started and one-hour YouTube workouts (my current fave is Caroline Girvan).

6 p.m. — I have some popcorn, garlic knots, a slice of pizza, and a protein shake with greens. It’s all about the balance.

8 p.m. — I read then do my strict bedtime routine — work out, shower, candle, clean, screens away, and books books books. I read four books at a time (fiction, non-fiction, and audiobooks). Right now, I’m reading The Vanishing Half and Sapiens. (I think The Vanishing Half is a good concept, but not that great…)

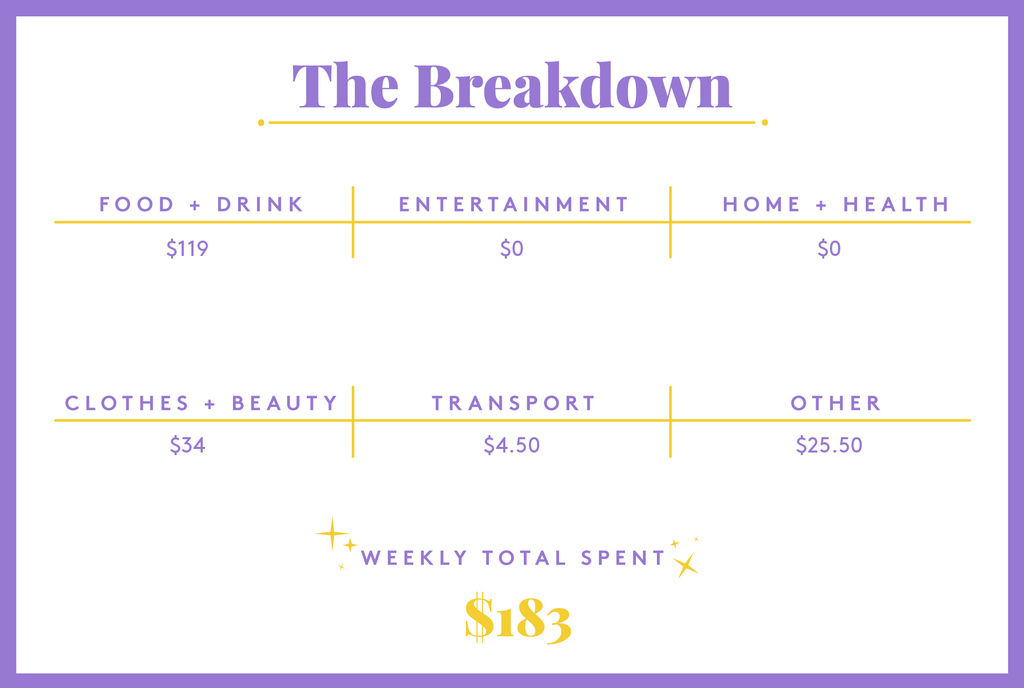

Daily Total: $34

Day Two

6 a.m. — 6 a.m. again. Sunday. Why. I know it’s stress. As a psych NP, I know. Side note: NPs do the exact same thing as physicians (in most states) but make less money. There is also less schooling and therefore less debt. I eat some baked goodies I got from Too Good To Go. Check them out PLEASE — they create less food waste and cheaper food for all of us! I’m obsessed with this app.

11 a.m. — I walk around a nearby park for my 10,000 steps after taking an edible. I stumbled upon peacocks I can see through the cages. I stare for what feels like an eternity. Best high find ever. I also get groceries — peanut butter, cereal, batatas, cheese, broccoli bunch, carrots, eggs, oat milk, coffee creamer, and oregano. I’m mostly vegetarian. I also choose what groceries to get depending on if they’re on sale other than essentials. $76

5 p.m. — I use my InstaPot to make batatas and eat them with a protein bar and some broccoli. Then I proceed to do my bedtime routine except for the workout because today is a rest day.

Daily Total: $76

Day Three

6:30 a.m. — I walk to a further away train (30 minutes) because I want to get in my 10,000 steps but I also love walking. I use the “Fair Fares” program because I was considered below income last year, which cuts down my MetroCard costs by half. I try to swipe others in when I can. I get to work. We are on-site at the clinic 50% of the time and working remotely 50% of the time. $1.50

12 p.m. — I eat an egg wrap I brought from home as well as a protein bar. I see 15 patients today, which is more than my normal and makes me anxious. I recently started taking an SSRI for my anxiety and it has been working wonders even during cloudy days.

5 p.m. — I work out after getting home. Batata time then bedtime routine time. I FaceTime family back home. I miss them dearly and they worry about me and NY COVID rates, but I lie and say I’m fine. Classic Asian let’s-not-worry-our-parents move. I mean… I do feel fine 95% of the time. And that’s pretty freaking high considering what we’re dealing with.

Daily Total: $1.50

Day Four

6 a.m. — Work from home day. I set up my WFH station. I bought most of my furniture through stooping and FB Marketplace (the only reason why I have FB). I shop local for other things and am boycotting Amazon, Target, and Walmart unless absolutely necessary. It’s been tough but also great to get to know a neighborhood. My WFH station functions as a desk and a kitchen cart. It has wheels, so I love how I can shift it and erase any patient memories for my self-care.

12 p.m. — I eat my egg bake sandwich thing and take a lunch walk while checking voicemail. Call a few pharmacies to clear up confusion. Back to work.

5 p.m. — Caroline Girvan time. I take a 10-minute walk around my rooftop to erase the workday from my memory and work out the stress. Then, batatas with Succession. Then I do my bedtime routine. Yes, I know. Repetitive but I need the routine for my mental health! Pop a Zoloft and go to bed.

Daily Total: $0

Day Five

6 a.m. — Coffee. Walk to the shelter. I see seven patients, one of which is actively psychotic and threatening to kill his roommate. I call an ambulance. Crisis hopefully averted. Hope he’s alright.

6 p.m. — I buy pepper spray for my colleague, her mom, and myself. We are all Asian and are becoming more and more threatened by violence against Asian Americans. I am afraid to take the subway a lot. I watch a video on how to use it. Hopefully, I never have to. $25.50

8 p.m. — Same shit, different day.

Daily Total: $25.50

Day Six

7 a.m. — Walk to the train and get to work. I see 11 patients today. No one is in crisis. Amazing. I always tell my patients, we are equals. I may have “medical expertise” but they have their “body expertise” and we are 50-50 collaboration. Without them, there is no me. Fire your healthcare providers if they don’t listen to you. You are entitled to that. The Healthcare system is messed up, but I try my best where I can. $1.50

12 p.m. — I take my lunch walk to a grocery store. I buy lots of Asian goodies, including dried sweet potatoes, instant noodles, and more snacks. I eat another egg wrap for lunch. $31

5 p.m. — Take the train home so I can work out. I work out. Same shit different day. I finish Sapiens. Would recommend. Onto finishing up Obama’s new book. Love him. Love his brain and how it works. $1.50

Daily Total: $34

Day Seven

7 a.m. — Coffee and WFH. I stretch for 10 minutes before sitting down to work. I respond to 14 messages that were left over the past 12 hours.

12 p.m. — I share a banh mi sandwich and some boba with a colleague and take a walk with her. It’s cold but sunny. We vent about upper management as we always do and have a laugh. $12

5 p.m. — I Zoom with a group of friends. I went to an international school, so my friends are global and we finally found the time to all hang out virtually. I feel Zoom burnout and have started to hate virtual chats. They feel like patient visits. But I try and we all have a laugh and congratulate a friend on her pregnancy. Another friend’s sister just got engaged too. I feel old.

7 p.m. — I drink a cup of tea and go on a virtual date. Again, feels like a patient visit. How was your day? How are you? What do you do for fun? MAKE IT STOP. Two virtual meets was a bad idea but the guy is decent. I’m casually looking but also will not settle or be treated rudely. Anyway, the date ends after an hour. I want to destroy all my screens. I put all of them in the cupboard and go to sleep. TGIF, I won’t be looking at any screens for the next 24 hours.

Daily Total: $12

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Philadelphia, PA, On A $54,000 Salary

A Week In St. Paul, MN, On A $58,000 Salary

A Week In Pennsylvania On A $106,000 Salary

from Refinery29 https://ift.tt/3cXiaiL

via IFTTT