Raising children has been especially difficult during the pandemic, as many parents have had to juggle work with childcare, or take care of their children on less income than before. But starting July 15, eligible parents can begin receiving a monthly child tax credit as part of the American Rescue Plan.

For each child under 6, parents can receive $300 per month; for each child under 18, they’ll receive $250 per month. To claim this tax credit, a child will need to have lived with the parent in question for at least half the year, with that parent having provided more than half of the corresponding financial support. There is no limit on the number of children — if you’re an old woman living in a shoe, you can claim the credit for all of your many children with whom you don’t know what to do. Those who file taxes as individuals and had an adjusted gross income of $75,000 and under on your last tax return, those who file as heads of households and made $112,500 and under, and those who file as a couple and made $150,000 and under are eligible for the full tax credit.

About 39 million families could start receiving the tax credit in July. The Tax Policy Center has calculated that most families (about 92%) will receive an average of $4,380 in child tax credits this year, and it’s been estimated that it will cut child poverty in the U.S. by half this year.

The Child Tax Credit is not a new benefit — it was introduced in the Taxpayer Relief Act of 1997 — but the American Rescue Plan modifies it in several unprecedented ways:

• It expands the credit from $2,000 per year to $3,600 per year for children under 6 and $3,000 for children under 18

• Parents can finally claim the credit on their 17-year-old children

• It’s being distributed monthly instead of being deducted from your tax liability and then paid as a lump sum included in your tax refund

• The credit is now “fully refundable.” Previously, if you owed little or no taxes, that meant you wouldn’t actually get $2,000 per child in your tax refund — you would only see the full benefit if you owed over $2,000 in taxes, essentially punishing parents whose incomes were too low. Before the 2021 changes, households in the lowest fifth income bracket received the least amount of child tax credits.

For every $1,000 you make over the above thresholds, your child tax credit will be reduced by $50. But this only applies to the higher 2021 Child Tax Credit amount. For example, if you’re a single parent with a child older than 6, and your income last year was $150,000, the new $3,000 credit would have completely phased out to the old $2,000 amount, but it wouldn’t have fallen below that. If you made over $200,000 as a single parent or over $400,000 as a married couple, however, your child tax credit will start being reduced below $2,000 by $50 per $1,000 in earnings.

If you’ve filed your 2020 tax return (the deadline was yesterday), the IRS will automatically direct deposit or mail the first round of child tax credit payments by July 15, and as close to the 15th of every month after that. Because these monthly payments are technically an advance, the IRS says it will allow people to opt out of receiving them and instead claim it in full when you file your taxes next year.

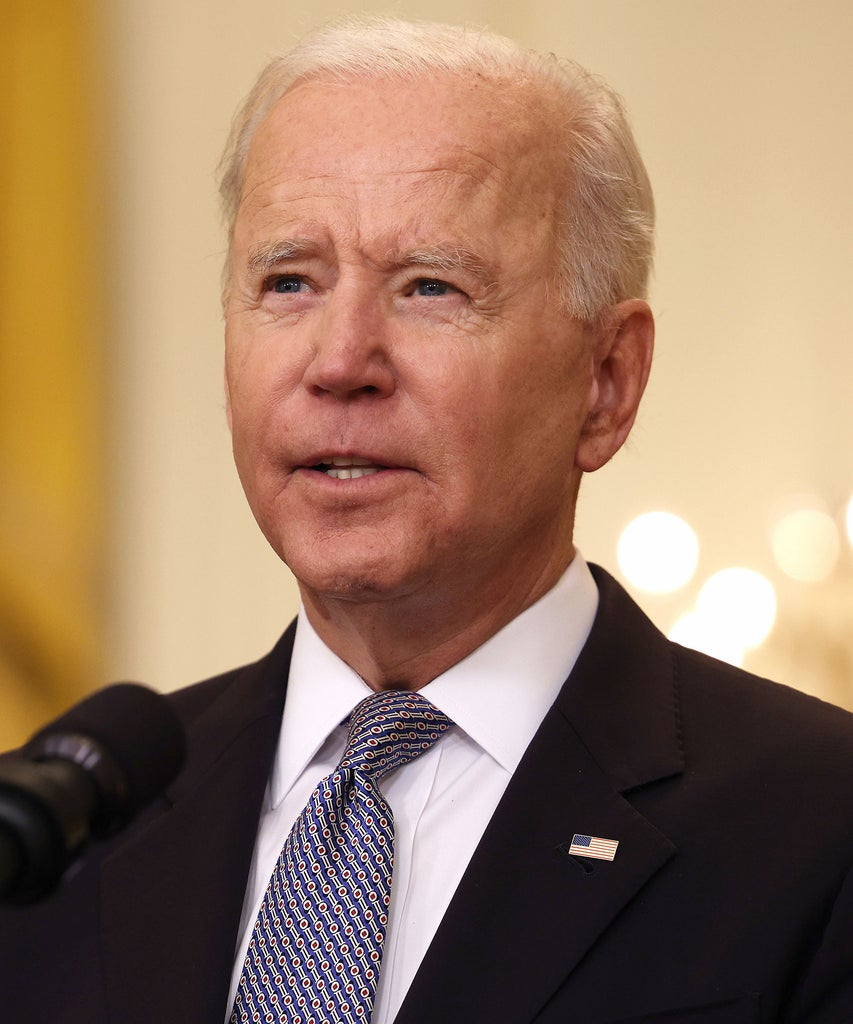

The 2021 Child Tax Credit is currently set to expire next year unless Congress acts to extend it or make it permanent. As of now, President Biden has voiced support for extending the higher amount for the next four years and making the child tax credit fully refundable forever.

Like what you see? How about some more R29 goodness, right here?

Parents Could Get Up To $5,000 With The Next Stimu

How To Create A Financial Plan As A Single Parent

How To Find Yourself Again After Identity Theft

from Refinery29 https://ift.tt/3oAZv0o

via IFTTT