Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Are you in Australia? Have you always wanted to write a Money Diary? Now’s your chance! We’re launching Money Diaries Australia and we want to read your diary. Submit your diary here for consideration.

Today: a marketing specialist who makes $50,000 per year and spends some of her money this week on candy corn.

Occupation: Marketing Specialist

Industry: Recruiting

Age: 29

Location: Boston, MA

Salary: $50,000

Net Worth: $18,854.98 (checking and savings, $9,000; retirement and investment accounts, $10,430; car, $13,300 — minus debt)

Debt: $13,875 (car loan, $9,375; student loans, $4,500 — by the end of my three-year grad program I expect this to be just shy of $50,000. Yikes!)

Paycheck Amount (2x/month): $1,578 (The extra $2,000 in my annual salary is from commissions I have received thus far.)

Pronouns: She/her

Monthly Expenses

Rent: $1,595 (I live alone in a studio where I negotiated two months free on a 14-month lease; rent is not prorated. I live in a great area with free, reserved parking which is unheard of in Boston, and I work remotely. Therefore I don’t mind spending a bit more than planned on housing.)

Car Payment: $208.33 (I received 0% APR financing for 48 months and put a large chunk down)

Electric: $45

Internet: $45

Health Insurance: $250

HBO Max: $16.19 (I share the account with my family and mooch off my parent’s Netflix and my sister’s Disney+.)

Auto/Renter’s Insurance: $85.50

Cell Phone: I am still on my family plan

Savings: $200

Travel Savings: $200

Roth IRA: $50

Ellevest: $50

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes. I grew up in a town where the next step for nearly every high schooler was a college degree. I went to school out of state which my parents paid for, and for this, I am extremely lucky. I am currently getting my master’s, which I am paying for myself. I will be taking out loans for all three years.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My dad always stressed the importance of saving and warned us about the pitfalls of credit cards due to his own bad credit when he was young.

What was your first job and why did you get it?

Besides babysitting in high school, my first job was as an unpaid intern for a wedding planner in my college city. I worked a lot of unpaid internships in college, which… I have very strong feelings about. I know I wouldn’t be able to afford them if my parents were not helping me.

Did you worry about money growing up?

Not really. I grew up in an upper-middle-class Massachusetts suburb. My mom was stay-at-home while my dad worked. My dad was unhappy in his job, but it paid well, and my parents very much liked to keep up with the Joneses, which led to some high spending situations in the form of vacations and cars. When I was in college, my dad left his company to start his own business, so they have severely cut down on their spending. As grateful as I am for my childhood, I was quite sheltered and didn’t learn much about finances until after college.

Do you worry about money now?

Yes. I didn’t have much of a budget out of pure ignorance in my early twenties, on top of a low salary in a very expensive city. Luckily, I was able to save a lot of money in the past year. I think after living paycheck to paycheck I may always have that financial anxiety.

At what age did you become financially responsible for yourself and do you have a financial safety net?

When I was 22 and moved to New York. My parents always said if I had trouble with finances they would help me, but I would have to move back home. It is nice having that safety net, with consequences.

Do you or have you ever received passive or inherited income? If yes, please explain.

My parents paid for my college tuition and I lived at my parent’s house for a year plus in 2020-2021, which allowed me to pay off previous debt from my life of bad spending in NYC, build up my emergency and retirement savings, and buy a car. My net worth would be nowhere near where it is now if I didn’t have this opportunity.

Day One

7:30 a.m. — Full disclosure for this diary: I am fully vaxxed, everyone I hang out with is fully vaxxed, and I wear a mask when I am out in the world. Today is a Get Your Shit Together day! To make this a true GYST day, I put on jeans. I’ve been wearing the same seven-year-old Nike shorts all year and honestly, I’m getting tired of it! I have no food in my apartment, so all I make is coffee. I switched to decaf coffee this summer after many years of caffeine-induced anxiety. It’s been a bit of an adjustment, but has been good for my overall mental health.

8 a.m. — I have so much laundry to do this week, so I separate my whites and colors and start a load. It costs $2 per load (so $4 overall) and the laundry is in the basement. I love my apartment. I found it on Craigslist and jumped on it the moment I viewed it virtually. I moved back to Boston after a really hard few years in NYC, ending in a very difficult breakup. It’s been quite the year. But being here now on the other side of it, in this studio, makes me very grateful. One-year-younger-me never would have imagined it. $4

8:30 a.m. — Start work. I work remotely for a recruiting firm and I handle the administration and marketing efforts. The job is really flexible which is perfect because I started my master’s program this month! I spend the morning updating a bunch of client and candidate records on our CRM platform.

11 a.m. — I finish my laundry and make a packet of ramen for lunch because that is all I have. During my lunch break, I head to the store to get chili ingredients. I primarily like to shop at Trader Joe’s because it’s so cheap, but this time I need to go to Hannaford. Regular grocery stores are so much more expensive, it’s painful. I get chili ingredients, yogurt, strawberry popsicles, and microwave popcorn. $38

1 p.m. — While work is slow, I do my class lecture. I’m taking a class online but will be switching to in-person this winter, which I am looking forward to doing. After my life fell apart last year in the form of COVID layoffs, a COVID breakup, and COVID in general, I had a lot of time to figure out what I wanted. I spent months talking to lots of people in the social work field, and realized it’s what I wanted to do and what I would be good at. I decided to get my master’s in social work versus my master’s in counseling because I enjoy the material more, and with an MSW I have more options, such as working in a hospital or private practice, which are two avenues I am currently interested in pursuing. I’m keeping my options open, but I am most interested in working on the individual level with trauma and grief.

3 p.m. — Work break so I quickly clean up my kitchen. The great thing about working remotely is I don’t have to pretend to look busy all the time (was that just me?). The bad thing is I’m always getting distracted by taking care of apartment stuff.

5:30 p.m. — I shut down for the day, go for a short walk around my neighborhood and make chili. It’s delicious, especially covered in Mexican cheese and Fritos which is the only way to eat chili IMHO. I freeze the majority of it to enjoy later and start watching season three of Sex Education. I love this show. I then take a longgggg bath and go to bed around 10:30.

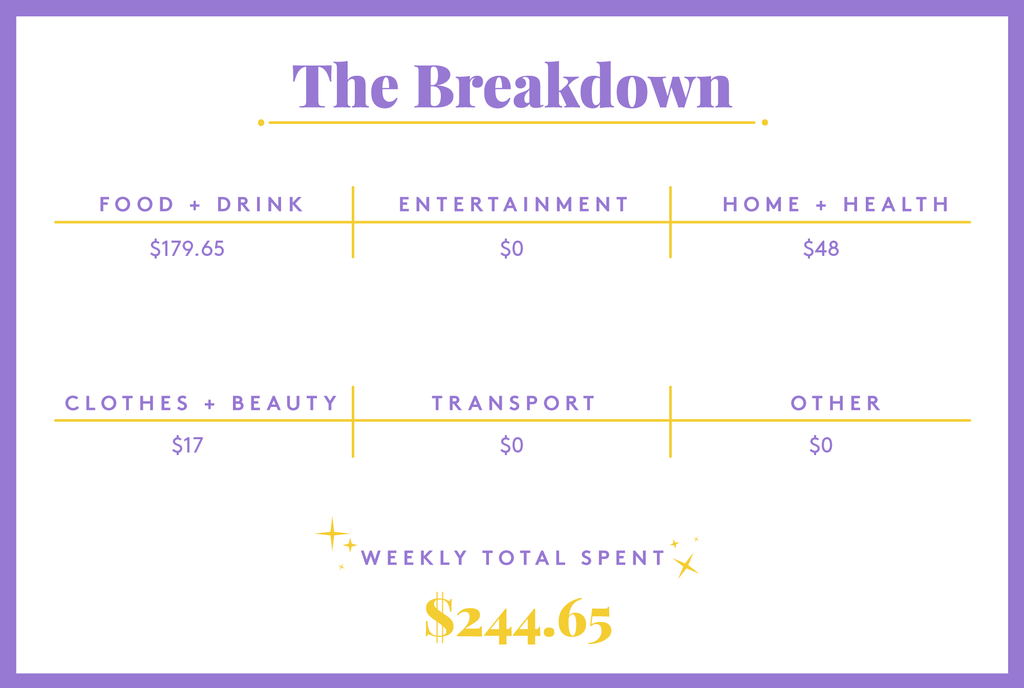

Daily Total: $42

Day Two

7:30 a.m. — Okay. In the before times I used to wake up at 7 and have a full hour of getting ready before commuting. COVID ruined me. I finally wake up and immediately grab my phone (healthy) and read the news in bed. I am so proud of myself for putting on real clothes again! I really do feel more confident about myself??? Maybe this is something??

8 a.m. — I have a Fage strawberry yogurt for breakfast and make iced coffee out of yesterday’s hot coffee. I love Fage but it does not fill me up nearly enough, so by 9:30 I am hungry. Debating eating lunch at 10, but I decide against it.

12 p.m. — Work all morning then head to my wax place to get my brows done. In the before times I used to get my brows waxed once a month… lol. With a 20% tip and a $10 off coupon, my wax is $17. I then go by Chipotle for the first time in a long time and get a carnitas burrito bowl ($9.65). $26.65

5:30 p.m. — After work, I go for another walk, heat up chili for dinner, and take a shower.

7 p.m. — Time for movie club! My high school friends and I started a movie club tradition in quarantine as a way to stay connected. Basically, we all watch whatever not-very-good movie we loved in high school in our respective homes and our text chain goes off about funny things. So far we have mainly stuck to a Zac Efron theme (High School Musical 1, 2, and 3 [don’t judge] and Hairspray) but we also like to branch out. Tonight it’s the Princess Diaries. Gupta? Finish up around 9:30, then spend too much time on my phone until lights out at 10:30.

Daily Total: $26.65

Day Three

7:45 a.m. — Same routine, sleep in a bit this time to really change it up. I make a smoothie but all I have are frozen strawberries and almond milk, so… that’s all it is. I’m not feeling coffee today, so I make some green tea.

9:30 a.m. — While I work I listen to Brene Brown and Esther Perel talk about paradoxical relationships on Brene’s podcast. Long live these two! I also debate going back on the dating apps or not. In early August, I went on a few first dates which was a lot for me! The guys were nice, but nothing came from it. I hate how addicting dating apps are. I’m not against them, but I just can’t find the energy to talk to random men right now. It’s exhausting.

12 p.m. — I heat up the last of my chili and get started on my first grad school paper! I haven’t written a paper in a long time and my college experience didn’t have many of them. I get through a very, very rough draft which I feel good about. I have a few days before it’s due so I think I can get it to a good place.

6 p.m. — After work, I head to meet my friend, D., for dinner. We both went through long-term breakups around the same time and it has been so nice to be with someone who gets it. We both get a margarita and I get chicken enchiladas. We split the bill. My half with tip is $34. I drop her off and drive back home. I journal and watch another episode of Sex Education. If this show existed when I was 17… damn. Instead, I got Twilight. Head to bed around 10:30 after reading some Devotions by Mary Oliver. $34

Daily Total: $34

Day Four

7:30 a.m. — I get an email from Delta that my flight to visit my brother in San Diego in November was changed (has me flying through Seattle??) so I cancel and rebook to a better flight. No cost to me. I have a bunch of points because I have the Delta credit card, so I used those to book the original flight. More yogurt, iced coffee, and water. I am a creature of habit. Get to work. I spend a lot of the morning working on the marketing strategy for our owner’s LinkedIn page.

11 a.m. — Apparently I eat lunch at 11 now. I heat up my leftover enchiladas. Officially getting tired of Mexican food.

12 p.m. — Trader Joe’s run! I also drop off a bunch of clothes that I Marie Kondo’d two weeks ago. I get stuff that will last me for the next few days — orange-peach-mango juice, almond milk, potatoes, broccoli, tomatoes, raspberries, chicken, yogurts, granola, cauliflower gnocchi, kombucha, whole wheat pita chips, hummus, bread, mozz, pomegranate tea, and Smashing S’mores. When I get home I eat some hummus with pita chips. $64

3 p.m. — Work is slow, so you guessed it… paper edits! Such is the life of grad school, I guess. I curse myself for writing the draft WITHOUT inputting references so now I am digging through all of the past month’s lectures trying to find a specific point I made. APA formatting is not fun! I finally find it, make a note to myself to not make that mistake again, and get back to work work.

5:30 p.m. — I go on a long walk after I shut down for the day. Remote work is hard for me in the sense that I could very easily never leave my apartment without realizing it. I have to drag myself out, but once I step outside I already feel better.

6 p.m. — For dinner, I roast cherry tomatoes in olive oil, salt, and pepper, and then pan-fry the cauliflower gnocchi and mix it all together with red chili flakes and a lot of parmesan. I also eat some raspberries. I text my friend, T., to make plans this weekend. After I shower (night shower-er for life!), I watch the last two episodes of The Other Two! Such a funny show. It has me ugly cackling every episode.

10:30 p.m. — I get ready for bed and then I end up awake for a solid hour, stressing about everything under the sun. I hate when this happens. I used to have insomnia issues, but my sleep schedule has gotten much better once I got all the anxiety-inducing things out of my life. Every time I can’t sleep, I get paranoid it’s happening again. I pop a melatonin gummy around 11:30 and fall asleep with weird, vivid dreams.

Daily Total: $64

Day Five

8 a.m. — Aaaand I feel drugged. No real clothes today. My Nike shorts are happy to see me. I make coffee, eat yogurt with granola, and put a load of sheets and towels into the washer ($4). More administrative stuff happening today. We had a couple of candidates accept offers this week which is exciting! For the commissions I mentioned earlier, I make $500 pre-tax per candidate we place. $4

11 a.m. — Officially my new lunchtime! I heat up leftover gnocchi. My new purse comes in so I open it. It was super on sale and is a very pretty dark mulberry color. I am very happy with my purchase even though I feel some post-spend guilt.

12 p.m. — I have my tele-health therapy appointment. Thank god for therapy. This therapist is a new one for me but so far I like her. The therapy search is like dating… don’t settle. My copay is $10. $10

5:30 p.m. — After I finish up work I make a DELISH chicken parm pasta bake with GF pasta, shredded chicken, and homemade tomato sauce I have in the freezer. It is delicious and I give myself a pat on the back. Homemade tomato sauce tastes so much better. D. comes over with a bottle of wine and we hang out with the intention of watching a movie but instead talk for three hours, classic. She leaves around 10:30, then I take a late-night shower and head to bed.

Daily Total: $14

Day Six

9 a.m. — This is my first Saturday in a long time where I get to have a leisurely morning! It feels good. I make iced coffee and use my mini waffle machine to make some Saturday morning waffles. I watch a few episodes of Ted Lasso then get back to my paper. I’ve definitely noticed my television intake has increased since 2020.

1 p.m. — After eating the rest of my chicken parm pasta bake for lunch, I go for a run. Turns out there is a block party going on in my neighborhood with food stalls and DJs so I feel like Frogger as I’m running through this unforeseen crowd. I get home, stretch, talk to both my brother and my best friend, L., on the phone.

6 p.m. — I get ready for an evening and actually put on makeup!! I pick up my friend, T., and drive him back to my apartment. We grab dinner and drinks at a bar nearby. We split cauliflower and I get chicken taquitos. My bill plus tip is $34. T. comes back to my apartment for a drink. I plan to join him and his other friends in Boston proper later, but when he looks up the Uber prices which are around $50 one-way, I promptly bow out with the fear it would be worse later at night. I just cannot justify paying for a car service, and now that I am back in my studio I would much rather take off my makeup and bra. He hangs out for another 30 or so before he heads out to meet up with some other friends. Later he texts me a video of a band playing at an outdoor gig, which gives me FOMO, but then I remember all the money I saved, so I’m okay. $34

Daily Total: $34

Day Seven

9 a.m. — Coffee and yogurt with granola for breakfast while watching more Ted Lasso. I invite T. to hang out, but he’s feeling hungover, so I instead decide to pack a picnic and go to a park! It’s a sparse picnic with a caprese salad minus the basil, because I don’t have any, and water. I drive the 30ish minutes to my hometown and lay out my picnic blanket. My family moved away from my hometown almost ten years ago, so I still get giddy that I can return so easily! I always feel more at peace in the suburbs. It’s absolutely gorgeous out, so I revel in the sunshine with my book downloaded from the Libby app — today it’s The Lying Game by Ruth Ware. I loved her other books, but I’m having trouble getting into this one.

2 p.m. — On the way home from the picnic, I stop by CVS to get toilet paper, toothbrushes, mouthwash, and Halloween candy — including my fave, candy corn ($30). I watch Love on the Spectrum and defrost chicken and mushroom soup I made a couple of weeks ago. $30

6:30 p.m. — I eat the soup for dinner before logging onto my class lecture. After class is over, I do some final paper edits and hit submit! I’m glad to have this assignment over and I have a few more days before the next. I’m still learning how to balance it all, but overall feeling good!

9 p.m. — I finish up my Ted Lasso weekend with the most recent episode, shower, put on a moisturizing sleep face mask, and head to bed early to feel rested for a brand new week. Thanks for joining!

Daily Total: $30

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In North Carolina On A $125,000 Salary

A Week In Boston, MA, On A $450,000 Joint Income

A Week In Seattle, WA, On A $103,000 Salary

from Refinery29 https://ift.tt/3pNeeaW

via IFTTT