Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a software developer who makes $99,972 per year and spends some of their money this week on Dunkin’ drinks.

Occupation: Software Developer

Industry: Artificial Intelligence

Age: 23

Location: Chapel Hill, NC

Salary: $99,972

Net Worth: ~$55,000 ($40,000 in my 401(k), $10,000 in savings (fluctuating throughout the month depending on my direct deposit and expenses), and $3,000 in my HSA. I live with my partner, who makes a bit more money than me, and who doesn’t have student loan debt.)

Debt: $0

Paycheck Amount (2x/month): $2,325

Pronouns: They/them or she/her

Monthly Expenses

Rent: $1,200, which is the rent (including water and sewer) for the two-bed, one-bath I share with my partner. We basically split expenses, but I have a lower credit limit so pay more of the routine bills.

Student Loans: $0 (I paid off $12,000 in student debt and a $14,000 car loan after I finished college in 2019.)

Car Insurance: $80

Renter’s Insurance: $10

News: $25 (I subscribe to two different local newsletters to stay informed, as well as having a Medium membership and two other email lists.)

AAA Membership: $8

Prescription Medication: $40

Pet Medication/Food: $20

Phone Bill: $15 (I have a TracFone.)

Spotify: $15 (I pay for a family plan so that some friends can use it.)

Charitable Contributions: $500 to $750

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

I was expected to go to college, but I was a studious kid so it seemed obvious. My parents promised us that they would contribute the cost of state school towards the university of our choice — my brothers both attended the state college and so graduated with no debt. I received a lot of scholarships but took out about $12,000 in the first two years of school. I graduated early and was an RA the third year, so I didn’t have to take out any loans the third year.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My parents are very upwardly mobile and through career advancement moved from lower middle class when I was a young child to upper middle class by the time I was in high school. That means I was used to a lot of frugality — coupon clipping, thrift shopping, and camping vacations — but we never struggled to afford the necessities and were able to travel frequently. I’m super grateful for all the lessons about how to live well below your means, but now that I have my current job, I’ve been trying to learn where it pays off to splurge a little more.

What was your first job and why did you get it?

Through high school, I tutored to get a bit more spending money. That summer, I worked as a dishwasher and waited tables at a local restaurant, so I could have money for any expenses (textbooks, school supplies, and spending money) at college.

Did you worry about money growing up?

I definitely realized that my family couldn’t afford some of the same things as my friends, but mostly my parents were so creative about it that I never took it to heart. I spent a lot of sleepless nights once I was old enough to think about college, but ultimately I’m glad I chose to attend a private school because it set me up for my software career despite not being much more expensive after scholarships.

Do you worry about money now?

Only about medical bills. In the last year, I’ve started showing signs of a chronic illness, so between extra follow-ups with my GP and some specialist visits, it adds up quickly. It’s been great for my stress levels to not have to mentally tally every single purchase for fear of overdrafting my checking account.

At what age did you become financially responsible for yourself and do you have a financial safety net?

Besides tuition, I started paying for all of my expenses after my second year of college when I was 19. I had an internship in my current city, which meant I had to pay rent and buy all my own groceries for the first time, instead of living in the dining hall and having a meal plan. My partner has more money in savings than I do, which we could dip into if there was a short-term change to our situation. If I were to have a major crisis, I’d probably be able to move back in with my parents, though they’d expect me to chip in for rent and share food costs if I still had any income.

Do you or have you ever received passive or inherited income? If yes, please explain.

Not since I was a kid.

Day One

12 p.m. — I roll out of bed and eat two over-easy eggs with leftover homemade yogurt bread (I love sourdough, but haven’t made the leap to making my own starter). I’m on a self-improvement kick for the new year, so I get dressed, give my dog breakfast, and invite the friends in my pod for a walk at one of the nearby greenways.

2 p.m. — Nobody’s around for the walk, but my partner and I go for about four miles. In order to get out of our pandemic slump, we’re both trying to get out of the house more.

4 p.m. — On the way home, I stop at a neighbor’s house to pick up some shot glasses they were getting rid of on my local Buy Nothing group. I also pick up some Dunkin’ drinks on the way. $11.73

5 p.m. — My skin has been kinda congested lately, so I put on a face mask my friend gave me when they de-stashed last year. I eat last night’s dinner leftovers (black bean hummus and loubia with some toast) for a late lunch, start watching Parks and Rec with my partner on Peacock, and look up outdoor fitness classes. I find a Zumba class nearby that meets Wednesday evenings.

9 p.m. — It’s my partner’s turn to cook dinner — they make fried rice. I empty and re-load the dishwasher and talk to my parents on the phone.

11 p.m. — I dyed my hair before Christmas, but it didn’t come out how I wanted so I ordered a color-depositing conditioner to adjust it. To prime my hair for the dye, I do a bleach wash with some clarifying shampoo. Since I’m already standing in the bathroom, I also dye my eyebrows with Just For Men beard dye (which I read about doing in a Kesha interview back in 2020). I got my brows microbladed last summer, but the combo of the microblading and the dye is what makes them bold enough to really frame my face.

12 a.m. — Finish my shower (I only shampoo my hair once a week, so it takes a little longer than usual), take my meds and vitamins, and watch TikTok for a bit until I fall asleep.

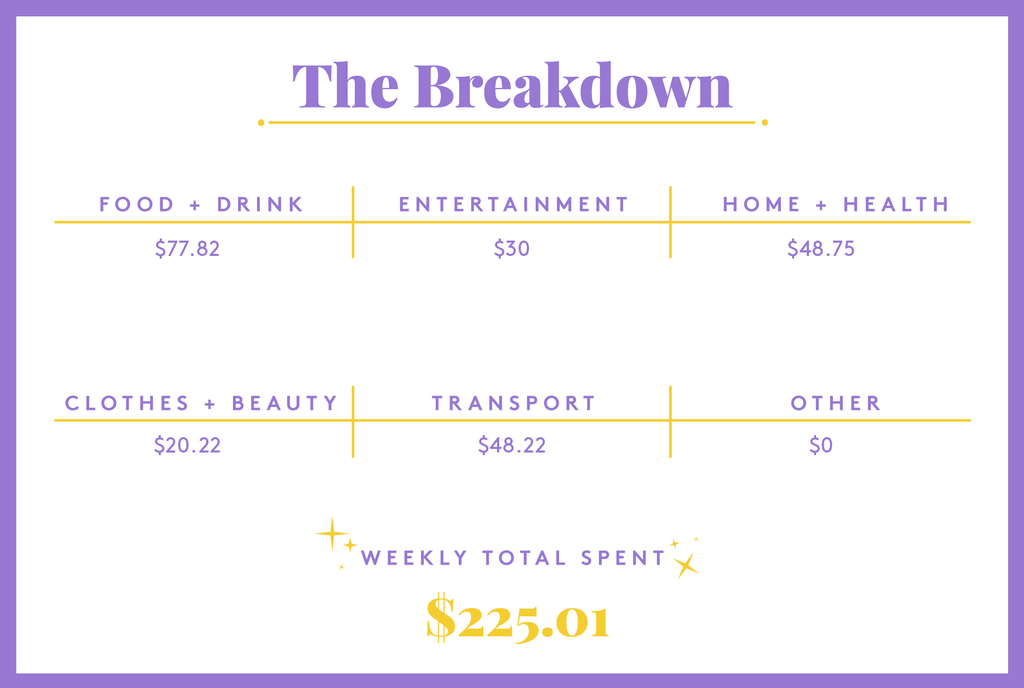

Daily Total: $11.73

Day Two

9 a.m. — I recently moved teams, so I have a new recurring meeting starting this week at 9:45. I manage to get out of bed by 9:30. I eat a banana, update my bullet journal, and check my email and Slack messages.

11 a.m. — Take my dog out, make breakfast (same as yesterday — two over-easy eggs with the rest of the leftover bread), and brew up some green tea with peppermint. While going through my junk mail that got delivered while we were out of town, I see a flyer for fiber internet. I was interested in getting it when we moved, but it wasn’t available then, so I sign up. It’s higher bandwidth and cheaper than my current bill even without all the rebates they’re doing right now (I won’t pay for anything until the first bill comes).

1 p.m. — Heads down. Monday is usually a pretty light workday for me, but I had terrible executive dysfunction on Friday so I have some stuff I’m behind on including working on a portfolio to get promoted, as well as some development work for my new team.

3 p.m. — I heat up some leftover fried rice for lunch and make a protein shake with frozen berry mix and oat milk. Take the dog out again. My new conditioner was delivered!

7 p.m. — Wrap up work for the day. Normally on Mondays, my partner and I work out together, but they ask me to run to CVS to grab some stuff because they’re not feeling well. Besides the stuff they need, I grab them some more skincare (because they’re always running out) and some candy. I also get myself a chocolate bar because I think my period is about to start. $38.75

8 p.m. — My turn to cook dinner! I want boiled potatoes and I sauté some chicken to go with them. While I’m cooking, I eat spinach drizzled with olive oil. I struggle to get enough vegetables, but I find baby spinach pretty tolerable so we usually have some in the fridge for snacking.

9 p.m. — Eat dinner, watch more Parks and Rec.

11 p.m. — Shower and get to bed. I use the new coloring conditioner, but I can’t really tell if it actually dyed my hair at all.

Daily Total: $38.75

Day Three

9 a.m. — I didn’t sleep super well, so my ambitions of getting up early to get a head start on work are dead in the water. I do get up early enough to make myself toast (which I’m eating with leftover hummus) and brew some tea before my first call starts. I don’t usually have a lot of meetings, but today I have a block that runs until noon.

10 a.m. — One meeting ends early enough for me to take the dog out and give her breakfast. I check my email and Slack messages.

12 p.m. — I eat a bowl of skyr with some berries while on a video call with a couple of friends from work, but I don’t stay on long. I grab the extra shot glasses I picked up Sunday and leash up the dog for a walk around the neighborhood. I drop off the glasses and pick up a cork board from another Buy Nothing listing. The round trip is about three miles. I’m really grateful to be living in a walkable town.

2 p.m. — Get back and have spinach and leftover potatoes for lunch. I’m saving the chicken for tonight’s dinner, so I scramble up some turkey sausage and eggs with cheese. I check my emails again and am still feeling kinda fried so instead of diving back into work, I scroll TikTok for a while. Some KF94 masks I ordered last week get delivered, which is great because we’re getting low on stock — the website only allowed me to order packs of 50, so I’m planning on distributing a bunch to our pod and offering the extras to the Buy Nothing group later in the week.

4 p.m. — Meeting ends early. I was hoping to get some more work done, but I’m just feeling run down and instead manage to eat some leftover Christmas candy and lay on the couch.

7 p.m. — My partner still isn’t feeling well, so we both take some Tylenol. After laying on the couch all afternoon, my knees are really starting to hurt. I watch a few episodes of Big Mouth while they take a social call. Then they make rice and frozen potstickers for dinner while we watch Parks and Rec.

11 p.m. — Shower and go to bed. Not as early as I was hoping to do that tonight.

Daily Total: $0

Day Four

9 a.m. — Wake up with my first alarm because my shoulders are hurting. I must have slept on them wrong. Despite waking up early, I have no energy this morning so I just lay in bed reading Twitter for the next hour. I don’t have time to make breakfast before my meeting and just take more Tylenol instead.

11 a.m. — No more meetings today, and I’m craving comfort food, so I make shakshuka for breakfast. It’s a recipe I’ve only made once before, but it comes out great and succeeds in lifting my mood a bit. I also drink some herbal tea with oat milk.

12 p.m. — I’ve been interested in getting a produce box to have more consistent fresh veggies, so I sign up. There’s a coupon to get $25 off, so I add a few extras to the $15 box and only pay the delivery fee. $4.99

2 p.m. — I write some code and send it to my teammate to look over. While I’m waiting for them to get back to me, I clean out my closet and put away the pile of clothes that has accumulated. I find a big bin of stuff to get rid of. I’ll sort through it later this week to figure out what to put up for resale, what to post up on the Buy Nothing group, and what to bulk donate (either through the clothing bins that circulate through the Buy Nothing group, or to a nearby thrift store that works with unhoused people in the community). My big project for this week is to get rid of a desk I bought last summer, but between closing out this task for work and Zumba, I probably won’t have time today.

3 p.m. — A hearty lunch (leftover shakshuka and hummus on toast, plus a berry and oat milk protein shake) and respond to my teammate’s comments. I have some extra time, so I start looking into the background of a related task that I’ll probably be able to start on tomorrow.

5 p.m. — Time to get ready for Zumba! I haven’t worn most of my workout clothes in a while, so it takes me a couple extra minutes to get dressed. The class is about 40 minutes from my apartment, but I manage to arrive a few minutes early to park my car and pay the instructor. The class is great! I’ve never done Zumba before, but I plan on going back next week. $5

8 p.m. — Get home and crash on the couch in front of Project Runway. Do I watch too much TV? For dinner, I make my new favorite ramen upgrade (it has tahini, chili paste, and soy sauce) and eat some leftover chicken while it’s boiling.

11 p.m. — Normal routine — shower and bed.

Daily Total: $9.99

Day Five

9 a.m. — Wake up a bit earlier than normal because my partner has to go to a doctor’s appointment. Instead of using this time for something productive, I’m reminded of a TikTok I saw a couple days ago about hair cutting and decide it’s time for a quick trim. I’ve almost exclusively done my own hair since high school (before that, my mom would cut it, but she had a mishap once after I asked for long layers and ended up with a long bob), and it usually turns out pretty well. I finish up with about two minutes to sign onto my first meeting.

11 a.m. — I actually have to be on camera later, so I do my skincare and put on some makeup. My skincare routine is really boring — I wash with Cetaphil gentle cleanser in the shower, and in the mornings I have a generic toner from Target, then Cetaphil moisturizer and Bio-Oil. I haven’t been a huge makeup wearer since I’ve been in pandemic mode, but I have a basic routine I do on weekdays to help my features read on camera. I also take the dog out and set up the new Wi-Fi. My teammate has made some more comments on the code I’ve been working on, so I make some changes and send them back.

12 p.m. — My partner picks up Bojangles for brunch on the way home from their appointment. I scarf it down just before joining a Toastmasters meeting. I became a member last summer My public speaking skills definitely stand to improve, but I mostly just enjoy attending meetings.

1 p.m. — Toastmasters meeting ends. I finish setting up the Wi-Fi and cancel my previous service. I post everything I’m getting rid of except the clothes to the Buy Nothing group.

4 p.m. — I’m not actively looking for new jobs, but a recruiter from another company reached out to me about a month ago, so I have a half-hour phone call. Then it’s time to walk the dog before it gets too dark out.

8 p.m. — Once I get back, I eat a bowl of skyr with berries and go through my email and Slack messages again. I play some Stardew with my partner.

8 p.m. — My turn to make dinner again — we’re running low on groceries, so I make waffles using whole-grain protein mix.

11 p.m. — Put some more final touches on my haircut before my shower and head to bed. I’m still awake past midnight, so I get a head start on tomorrow’s Wordle.

Daily Total: $0

Day Six

9 a.m. — Wake up before my alarms, for once. My first meeting doesn’t start until 10:30 today, so I lay in bed scrolling through social media for a while before getting up. I check my emails and Slack messages. I’m donating blood this afternoon, so I fill out my Rapid Pass and make sure to drink some extra water.

11 a.m. — Take the dog out. The waffle iron is still left out from last night, so I scrounge in the pantry for baking mix and make garlic cheddar waffles for breakfast. I also have some skyr with berries for a little nutritional value.

12 p.m. — Drink more water, then heads down for a bit. The produce box I ordered gets delivered.

2 p.m. — My blood donation is in about an hour, so I have to head out. I return my old router and modem (a process which, thanks to some weirdly designed parking lots and a miscommunication from the ISP, takes almost 45 minutes), and roll up to my blood donation appointment a bit late.

4 p.m. — Head out from the blood drive after eating some fruit snacks, which are my main motivation to donate blood. On the way home, I hit Plato’s Closet — this week has been pretty cold and I’m realizing most of my actually warm clothes are from college and are at least two sizes smaller than I’d like. I find a pair of jeans for my partner and a cute graphic sweatshirt. I have store credit from some jeans that didn’t fit my partner a few months ago and a coupon. $5.17

5 p.m. — Make it home just in time to join a tabletop RPG session. I’ve never played any RPGs before, but the group ends up having good chemistry and I have an unexpectedly good time. I realize I haven’t had lunch, so during a break in the session, I find almonds, some candy, and an apple. I tip the facilitator because they’re a broke college student and I figure they could use the money. $30

8 p.m. — Session ends, and my partner has gotten food from our favorite Indian takeout place delivered. We watch Parks and Rec while I decompress from the game, which was pretty emotional.

11 p.m. — I’m so tired that we head to bed, way earlier than normal for a Friday.

Daily Total: $35.17

Day Seven

10 a.m. — Wake up without an alarm, but get up quickly. A nearby university’s theater department is having a costume sale, and I told a friend I’d meet them there because they’re working on building a more interesting wardrobe. Partner can’t find their belt and I have to call my pharmacy to pick up a prescription today before I run out, so we end up leaving a full hour later than I had planned. We have brunch plans with our pod, but the restaurant doesn’t serve food that won’t make me sick, so I scarf down some sourdough toast and a blueberry-oat milk protein shake before dashing out the door.

12 p.m. — The costume sale is kinda underwhelming, but we have some time to kill so we walk the dog around campus for a bit. Everyone ends up running so late to brunch that it gets pushed back far enough that I don’t have time to make it before I have to head over to Zumba. I’m still running about 15 minutes early, but I then realize my car needs gas. $48.22

1 p.m. — I’m really getting into Zumba! $5

3 p.m. — On the way home, I need to pick up the prescription I called in — my insurance covers it completely, so I have no copay. We’re supposed to get some potentially icy weather tomorrow, so I pick up a few odds-and-ends groceries to make sure we don’t have to run back out. It’s more expensive than I was expecting — serves me right for shopping hangry. $61.10

4 p.m. — I get home and have cheese, crackers, and hummus for lunch. I also mix up some cappuccino powder with oat milk and caramel. Yum! I’m really tired from all the stress of the morning, so I take a nap on the couch in front of YouTube. It’s very unsatisfying because the apartment is a bit too cold, and I’m laying in a way that hurts my knees.

7 p.m. — I wake up and browse Etsy for a necklace I’ve been thinking about buying. Take a shower in an attempt to warm up.

8 p.m. — I make pizza for dinner! Our last jar of red sauce has mold in it, but we have canned tomato sauce from other recipes that I mix into something passable. I also run out of flour 80% of the way into making the dough, so it isn’t quite right. But I’ve got decent produce from the box, so it actually comes out really well!

9 p.m. — I’ve been looking for a fleece pullover to replace one I’d been keeping at my parents’ house. I find one on Poshmark for really cheap, so I impulse buy it. My partner is on a call, so I eat my pizza in front of Big Mouth. $15.05

12 a.m. — Head to bed.

Daily Total: $129.37

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Boston, MA, On A $75,000 Salary

A Week In San Francisco, CA, On A $115,000 Salary

A Week In Jacksonville, FL, On A $497,000 Income

from Refinery29 https://ift.tt/8OyJRQ6

via IFTTT