Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: an HR manager who has a joint income of $300,000 per year and spends some of her money this week on a Happy Retirement cake.

Occupation: HR Manager

Industry: Pharmaceutical/Life Sciences

Age: 31

Location: St. Louis, MO

My Salary: $160,000 base + 20% annual bonus tied to performance + 20% of stock vesting every four years. I also currently have a one-time retention bonus with my company. I will receive an extra 35% bonus if I stay with my company through November 2022.

My Husband’s Salary: $140,000 base (He owns his own small business but we try to take out only a reasonable salary amount. This allows him to invest more into the company’s growth.)

Net Worth: ~$900,000 (Cash: $148,000, My 401(k): $204,000, my husband’s 401(k): $181,500, investment account: $12,000, 529: $31,000, house value: $750,000, company stock: $65,000, HSA: $4,500, minus mortgage. Also, my husband owns about 90% of his small business that we think could sell for $15-20 million. This is always a weird thing to try to account for since we don’t actually have any of that money accessible to us today.)

Debt: Mortgage: $492,000

My Paycheck Amount (biweekly): $3,400

My Husband’s Paycheck (biweekly): $3,500

Pronouns: She/her

Monthly Expenses

Mortgage: $3,328.15 (we pay an extra $300 per month towards the principal)

Gym: $35

House Cleaner: $200

Childcare: $1,104

Phone: $27 (I venmo my mom)

Internet: $60

Utilities: $205

Trash: $53

Water: $101

Netflix: $19.99

YouTubeTV: $64.99

YouTube Music: $9.99

Google Storage: $12

Car Insurance: $142.92

Life Insurance: $44.32

Church Donation: $350

529: $1,250

HSA: $313 biweekly

Health Insurance: $226.94 biweekly

401(k): 7% of my paycheck after tax

Annual Expenses:

Amazon: $139

HOA: $675

Wine Club: $1,800

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes; my parents were very adamant that I go to college and they were prepared to help pay for it if need be. Both of my parents came from humble upbringings. My dad’s family had very little income and a lot of debt and my mom went into foster care as a teenager. Both of them put themselves through college using loans and part-time jobs. As a result, the number one thing they wanted to give my sister and me was a good financial start in the real world. Even though my parents were willing to pay for college, I was able to get both an athletic and academic scholarship to cover my bachelor’s degree at a cheap state school. Additionally, I used my employer’s tuition program to pay for most of my master’s degree. Both my husband and I have never had student loans.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My parents instilled in me the value of money and finances early on in my life. One of my earliest memories is from when I was seven and I went to the car dealership with my parents. I broke open my piggy bank and gave the car salesmen $20.36 towards the used Jeep that my dad was buying. My parents made a really big deal about how I was helping to pay for the car (fun fact: I bought myself a Jeep after I finished my master’s degree partially for this reason). When I started making money through random side jobs like babysitting or referring soccer games, my parents would take me to the bank and make me put half of it in a checking account and half in a savings account.

What was your first job and why did you get it?

About six months before I turned 16, my mom made it clear that I needed to get a job, which was hard to do with my sports schedule. She had me apply to every restaurant in town until I found a place that had flexible hours. I had long days where I would go to school, go to practice, and then work the closing shift at the restaurant. I never had time to shower after practice so I was probably a very stinky hostess but no one ever said anything.

Did you worry about money growing up?

For most of my childhood, I was very spoiled. But I think because it didn’t start off that way, I was more appreciative and aware that I was spoiled. My dad was laid off the year I was born so he stayed home and took care of me. He couldn’t find work in the city we were living in so we moved to Kansas City where he found a job in electrical engineering. My mom started out as a nurse and then eventually became a VP, which was a significant jump in income for our family. I remember going on big back-to-school shopping sprees and several family vacations a year; usually one to a beach and one to go skiing. Playing multiple competitive sports was not cheap with club fees, gear, tournaments, etc. Christmas at our house was a huge event where we would open gifts on both Christmas Eve and Christmas Day because my mom couldn’t fit it all under the tree.

Do you worry about money now?

As my husband’s business continues to grow, more and more people ask me why I work. I am really proud of my career. I like the challenge and contributing to our finances. Plus, I am really good at my job. Also, I don’t think any of our friends have any idea how much money I make. I don’t currently worry about money since we have so much cash liquidity, but I always worry about the future because that is just my personality. We use the Mint app to track our financials and to do some budgeting.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I was 22 when I graduated from college and moved to St. Louis to start my first job. I was able to save most of the money from my internship the year before so I had about $10,000 in the bank at that time.

Do you or have you ever received passive or inherited income? If yes, please explain.

I received $7,250 from my parents when they transferred half of their remaining 529 plan over to my daughters. I also received $1,500 when my parents allowed me to keep the proceeds from selling my first car, which they had given to me. My parents also purchased a savings bond for me every Christmas and birthday when I was growing up. I cashed all of those out last year for $2,813.82. My husband receives $50 per month from a trust that his grandparents’ set up. We lost my father-in-law unexpectedly in 2020 and so his mom received a lot of life insurance money that he helps her manage, but he does not receive any of it.

Day One

5 a.m. — Baby K., who is only a few weeks old, wakes up crying. I hold her for a few minutes until she goes back to sleep. I am currently on maternity leave with K. until next month. I am very fortunate to have paid maternity leave for 13 weeks even though it is less than what my prior company had which was 18 weeks. I am a strong believer that the US needs to do more to financially support new parents.

6:15 a.m. — K. wakes up again and I feed her. She is exclusively breastfed. My day starts when hers does so I use this extra morning time to pump. K. takes a nap and I do laundry, shower, and get ready for the day.

7:45 a.m. — Our oldest daughter, B., wakes up. She is almost two and is a very typical toddler. My husband, J., takes B. to daycare most days. I lay out all the stuff he needs to take with him today which includes cookies for the administrative staff and a $50 Amazon gift card for her teacher for Teacher Appreciation Week. I ordered the cookies ahead of time and they are decorated as apples, pencils, and notebooks. They cost $50 for 24 cookies. I tend to spend a lot on decorated cookies for special events like birthdays and holidays.

8:30 a.m. — I feed baby K. again so that we can leave for my church meeting for new moms. I love going to these meetings and connecting with other women that are in a similar phase of life. The women are mostly stay-at-home moms so I only get to join these daytime meetings while I am on maternity leave. The meeting includes a large breakfast. Some of the moms are sharing how their faith has grown or been tested in the past year. I feed K. while listening to the stories.

11:45 a.m. — I stop to get gas on the way home. $56.58

12:45 p.m. — I feed K. I am not hungry for lunch since I ate a big breakfast. I have social exhaustion from the meeting so I watch some TV including Survivor and The Courtship, which I am pretty sure no one has ever heard of, but it is very similar to The Bachelorette but with a regency-era vibe. K. and I snuggle.

3 p.m. — K. wakes up and I feed her. She seems tired still and maybe constipated. She goes back to sleep fairly quickly. My MIL’s fiancé calls me to talk about the surprise party we are planning for her retirement from teaching. We make a quick to-do list together and then I hang up and call a bakery that makes gluten-free cakes. I order a 10 in. custom vanilla cake with lemon buttercream that says “Happy Retirement!” The bakery takes my credit card information over the phone and texts me a receipt. $107.05

3:45 p.m. — I am in week three of a 12-week postpartum ab recovery program called Nancy Anderson Fitness. I fire up the app and see that it is a rest day or an optional low-impact cardio workout. I do the workout because I know I will fall behind this weekend. I eat two protein balls afterward. Next, I start making a key lime pie.

5:55 p.m. — J. and B arrive home. I made tacos for Cinco De Mayo. B. eats half an avocado and asks for more. She says “peeze” and “tank you” and I can’t resist and give her the other half of the avocado. J. realizes that we don’t have any tequila so he runs out to get some. He returns with what he says is a nice bottle for $48.73 and makes us some margaritas. I also give K. a bath. $48.73

8 p.m. — I feed K. and pump a bottle that J. can give her later. While I am feeding her, my mom arrives. She is staying with us for a few days to help out. My mom has been a HUGE help as we have adjusted to being a family of four.

10:10 p.m. — I go to bed. J. gives baby K. her bottle at 10:45, which is part of our routine so that I can go to bed earlier.

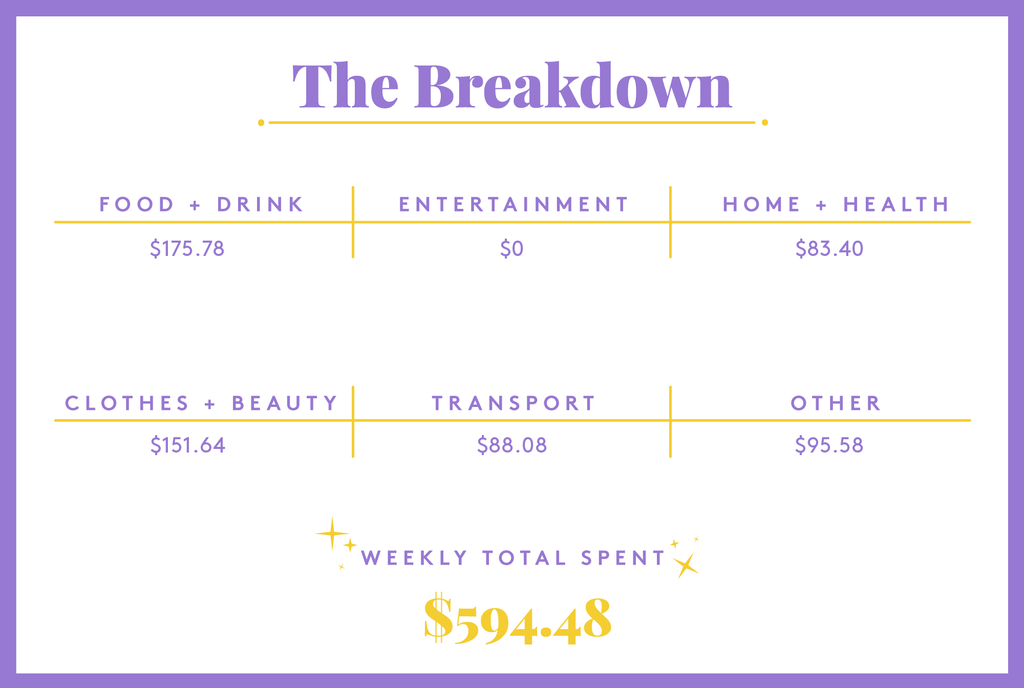

Daily Total: $212.36

Day Two

6:30 a.m. — K. is awake so I feed her. I write a review for some Wayfair porch furniture I recently purchased and they give me a $10 account credit.

7:40 a.m. — My mom wakes B. up and gets her ready for daycare.

8:40 a.m. — My mom returns from daycare drop-off and she uses my office to work from our house. K. eats again. J. sleeps in when my mom is here helping so he leaves for work around this time as well. I am starving. I make half-caf coffee and toast a bagel with onion/chive cream cheese.

10 a.m. — K. is napping so I do my ab workout for the day. I take a quick shower and then sit down to read the fourth Bridgerton book.

11:20 a.m. — I feed K. and then I leave for the dentist. I LOVE going to the dentist. I go to the dentist three times a year because an extra cleaning is only $59. I also schedule J. an appointment.

1:05 p.m. — I get home and my mom leaves immediately to pick up my dad from the train station. I start cooking dinner. I am making chicken and mushrooms in the crockpot. Dinner tonight is fairly simple because my MIL is gluten-free and can’t eat red meat and J.’s grandma is also coming and she doesn’t like anything with a lot of spice. I eat some leftover guacamole and two protein balls while I cook.

2:20 p.m. — I feed K and then pick up B.

4:45 p.m. — I finish making dinner which includes chicken and mushrooms, rice, a strawberry feta salad, rolls, and the key lime pie that I made yesterday.

5:30 p.m. — J. comes home and he has four hanging flower plants for each mom; me, my mom, his mom, and his grandma. He is great and I know all the moms will appreciate his thoughtfulness. $89.40

5:45 p.m. — Dinner time! I feel awesome having made dinner for my family. However, my MIL is late. I am not happy because she is always late and I think it’s rude. J. says we should just eat so we do.

6:50 p.m. — I clear the dishes and then feed K. and put B. to bed.

8:15 p.m. — Both kids are asleep. My MIL and J.’s grandma have left. My parents, J., and I sit in the living room and open some wine.

9:40 p.m. — I pump and go to bed, but truthfully, I sneak upstairs and read two more chapters of Bridgerton.

Daily Total: $89.40

Day Three

3:10 a.m. — I feed K. I get anxious knowing that she isn’t great at going back to sleep after a night feeding.

4 a.m. — K. is up again and J. gets her.

6:40 a.m. —K. is awake again and I feed her. I get my half-caf coffee started. I also need to do dishes right away or my mom will do them for me. I love that she helps, but sometimes it also makes me feel like I am failing if I can’t do it first. The dishwasher is not clean; someone must have opened it after I started it last night so I need to run it again.

8 a.m. — B. is up and my mom gets breakfast started for her. I have another cup of coffee and a toasted bagel with cream cheese. I go wake up J. around 8:20 and I am a little annoyed that he has been sleeping in. I do a quick feed for baby K. before we leave. We usually take B. to swim lessons together on Saturday mornings. J. is getting in the water with her today. I sit on the side and take pictures.

9:50 a.m. — We get home and I realize that B. has peed on me through her swim diaper. Awesome. My dad gives her a bath. My mom and I have spa appointments, so we rush out the door.

10:15 a.m. — My mom gets a massage and I get a facial. Each service is $82, but I have a free facial from a credit, a $10 birthday credit, and I have a $20 referral credit for bringing my mom. The bill ends up being $32 and we tip $15 each off the original price. I put it on my credit card and my mom says she will venmo me $47. $15

12 p.m. — My mom and I pick up Picklemans sandwiches for everyone for lunch. I get an Italian club and BBQ chips. I use my rewards account so I get points for the order. Total bill is $36.81, but she pays.

12:15 p.m. — We get home and J., my dad, and B. are outside playing with sidewalk chalk. I eat a sandwich and feed B. then put her down for a nap.

1 p.m. — I feed K. We are now on day four since she has pooped so I am starting to get worried. I quickly read a Healthline article that says less frequent pooping is okay, but to call your pediatrician if it’s been more than a week.

3:30 p.m. — B. is awake now and K. just pooped!!!!!! I’ve never been more excited about bodily functions. Now that naps are done, we decide to go downtown to walk around after my parents finish their bike ride. We pack some seltzers in the diaper bag because we like to live life on the edge. We stop and get B. ice cream and my mom pays and I don’t even try to fight it. I take my parents to my new favorite shop. They love it and buy a bunch of stuff. I buy two aioli sauces. $20

6 p.m. — We get home and J. heats up the oven. He is making his amazing homemade New York-style pizza for dinner. I take a quick shower and then make Moscow mules. I eat three pieces of pizza and feed K. B. goes right to sleep at 7:30.

8 p.m. — I crack open a Boulevard wheat beer and we all watch a movie.

11 p.m. — I feed K. and then pass out immediately.

Daily Total: $35

Day Four

5:30 a.m. — K. is wide awake so I feed her. I ask J. if he will take over baby duty and I go back to sleep.

8 a.m. — I wake up to J. bringing me coffee and pancakes so I can have breakfast in bed. What a luxury! I get up and get myself ready for church. I get both girls dressed and ready to go. My dad feeds K. a bottle before we leave.

9:30 a.m. — The nursery has been closed since COVID started so we have to sit through the entire service with the kids. My parents do not join us because honestly, they do not like our church and I don’t push them; I think it is important to respect people’s relationship with religion/church. I give B. two coloring books with no-mess magic ink markers and they entertain her for most of the time.

11 a.m. — We get home and I do some tidying up. B. eats lunch.

12 p.m. — J. puts B. down for a nap. I eat leftover strawberry feta salad. My parents return home and they have more gifts including a bunch of kid’s clothes from Target and cupcakes.

1:15 p.m. — Our floors are a mess so I run the Roomba in the main area. We bought a Roomba for Black Friday last year and it was the best purchase ever. I call my grandma and talk to her for about 30 minutes.

2:10 p.m. — B. wakes up and I take her and K. to a local park.

4:15 p.m. — We return home. I eat a cupcake and it is amazing.

5 p.m. — I am craving Thai food so we put in an order. I get Pad Thai. My mom pays. J. and I drive together to pick it up.

6:30 p.m. — I give B. a bath. My mom leaves to take my dad to the train station. I put B. to bed and then I open a bottle of wine.

8:20 p.m. — J. books one night at a state park campsite for a long weekend for $31.50. We are renting an RV for the weekend to try it out and see if we maybe want to buy one for the family. J. really wants to camp more and I don’t like the idea of sleeping on the ground so I think an RV might be a decent compromise. I read on the couch. $31.50

9:30 p.m. — I get B.’s stuff ready for daycare tomorrow, pump a bottle, and go to bed.

Daily Total: $31.50

Day Five

5:10 a.m. — K. is stirring, but not crying. I give her the binky and I try to go back to sleep.

6:20 a.m. — K. is awake and I feed her. I pump like usual. I can hear my mom doing some laundry and emptying the dishwasher and I feel a combination of thankfulness and guilt for not doing it myself.

7:30 a.m. — K. and I nap while J. takes B. to daycare.

8:30 a.m. — K. and I both wake up. I make my half-caf coffee and a bagel with cream cheese.

9:30 a.m. — I decide to do something fun! I work on invites for my MIL’s surprise retirement party. I spend a lot of time on Facebook stalking her friends to make an invite list.

10:30 a.m. — Next up is party planning for B.’s second birthday. I buy an editable graphic instant download on Etsy for $6.18. I use the graphic for the Facebook invite and I will use it for the party as well. $6.18

11:30 p.m. — I feed K. and we go for a short walk. We get the mail and I see we get a property tax letter for our house. It says our house is worth less than it is so that is good news. J. is also slowly working on finishing the basement himself. I want to hire someone so it will get done faster but he wants to do a bunch of custom stuff. I also get a replacement credit card for the second time this year due to fraud.

12:30 p.m. — I do an ab workout and shower while the baby sleeps. I eat leftover Thai food and trail mix for lunch.

1:45 p.m. — I feed K. I do some light cleaning, freeze some breast milk, and sterilize my bottles/pump parts. I usually use Medela quick steam microwave bags to sterilize my equipment quickly, but once a week I also try to get my sterilizer out and clean everything that way as well.

4 p.m. — My mom leaves to go to the gym using my membership. She picks up B. from daycare after.

7 p.m. — The family is eating leftovers because I have a church evening meeting. This is the group that I normally join when I am not on maternity leave. Tonight we are having a “Pizza and Praise” party. I signed up to bring the Shirley Temple mocktails so I am bringing ginger ale, sprite, grenadine, and maraschino cherries (purchased last week at the grocery store).

9:45 p.m. — I get home and feed K. J. and I go to bed at the same time so we get to talk for a little bit which is nice after having my parents with us the past few days.

Daily Total: $6.18

Day Six

3:40 a.m. — I feed K.

6:15 a.m. — I feed K. again. My mom is up so she offers to take her until her first nap. I go back to sleep. My mom also takes B. to daycare. She is amazing.

8:30 a.m. — K. and I both wake up and I feed her. I also really need to pump at this point. I have my normal half-caf coffee. I am committed to having a low-key day today.

10:30 a.m. — Our daycare is trying to raise money for a fancy new playground and I am on the fundraising committee. J. and I have already donated $2,000. For the fundraiser, we buy a juice presser. It is $33.41 including $7.95 for shipping. Isn’t shipping normally included?! $33.41

11:30 a.m. — My mom is leaving so I help her get her bags together and then say goodbye.

12:3o p.m. — I eat leftover strawberry feta salad and two protein balls. I decide to clean up some work emails and watch the latest Town Hall recording. This helps me stay in the loop in prep for my return to work in a few weeks.

2 p.m. — I feed K. I do a low-impact cardio workout and take a shower.

6 p.m. — J. gets home with B. We have one more pizza dough so we are having pizza again and leftover key lime pie.

7:15 p.m. — I feed K. I lose track of time shopping online for retractable deck awnings. Then, I finish my book.

9:30 p.m. — I pump and go to bed.

Daily Total: $33.41

Day Seven

3:10 a.m. — K. is awake and has a poopy diaper so I change her and feed her.

6:30 a.m. — K. is awake so time to feed. I make my half-caf coffee, pump, empty the diaper genies, and take out the trash for trash day. I also start the laundry and dishwasher.

7:45 a.m. — J. is running behind so I get B. dressed and ready for daycare. He leaves to drop her off.

8:50 a.m. — I go to Target. I put together a care package for one of my best friends from college who is having her second baby. I spend $72.98 on her gift including a card, some snacks, face masks/bath bombs, a onesie, a book, and a toy for her toddler. I also get some stuff including two outfits for K., two shirts for me, kid sunscreen, and a card for my aunt. $136.64

10 a.m. — K. is sleeping in the cart so I get myself a grande iced chai latte from the Target Starbucks. I pay $5.28 with a gift card.

11:20 a.m. — I check my email and see that I have a receipt from Apple for $49.99 for the next four weeks of my postpartum ab recovery program. $49.99

12:30 p.m. — I eat leftover chicken, mushrooms, and rice for lunch. A deck awning company calls me based on my online inquiry from last night and sets up an appointment to come by tomorrow to give me a bid.

1:20 p.m. — I feed baby K., do an ab workout, and take a shower. Afterward, I watch an episode of This Is Us.

3 p.m. — J. texts to say we finally got our refund from our 2018 taxes (yes, that was four years ago — his business makes our taxes a nightmare). He deposits $16,189 in our account. We really need to do something with all our cash, but we have a couple of things we are considering right now which is why we are sitting on it (RV, finishing the basement, etc.).

4 p.m. — I don’t have to cook dinner again tonight because a neighbor brought over three different types of homemade soup and they are amazing! I love our neighborhood.

6 p.m. — B. and J. get home. We eat dinner and give the girls baths.

7:30 p.m. — Both girls are asleep and I watch Survivor while J. cuts the grass.

9:30 p.m. — I pump and go to bed.

Daily Total: $186.63

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Fort Wayne, IN, On A $20,000 Salary

A Week In Brooklyn, NY, On A $197,000 Joint Income

A Week In Ann Arbor, MI, On A $72,000 Salary

from Refinery29 https://ift.tt/sDnJOP1

via IFTTT