Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a design director who makes $140,000 per year and spends some of her money this week on a cashmere sweater.

Occupation: Design Director

Industry: Textiles

Age: 31

Location: Brooklyn, NY

Salary: $140,000

Net Worth: ~$148,000 (retirement: $90,105 and savings: $58,153, no debt. I am married and have a partner outside my marriage. My marriage has separate finances aside from a small shared savings account ($`1,000) that we created after our wedding to use for taxes, joint gifts, etc. My husband and I split utilities, bills, groceries, and general expenses, with each of us responsible for our own personal expenses. My other partner and I also have separate finances and we alternate who pays for dates. For transparency, my husband makes $85,000, and my other partner makes ~$80,000.)

Debt: $0

Paycheck Amount (biweekly): $3,156

Pronouns: She/her

Monthly Expenses

Rent: $1,262.50 for my half of a two-bedroom, my husband pays the other half

ClassPass: $25

Spotify: $6.50 (my half, split with my husband)

Internet: $25 (my half, split with my husband)

Cell Phone: $0 (on a family plan, thanks dad)

Streaming Services: $0 (various friends and family pay for this)

401(k): 6% of my paycheck

Medical/Dental: $95, deducted from my paycheck

Purple Carrot: $119 (my half, split with my husband)

Annual Expenses

Renters’/Property Insurance: $300.70

Website: $180

Zipcar: $116.04

Roth IRA: $6,000 (I max it out every year)

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

My parents both have master’s degrees and there was an expectation I would earn at least a bachelor’s degree. I did not fully grasp that alternative options existed until I was well into high school. My extended family wanted me to be a doctor or a lawyer, but I went the creative route into art and design. I was determined to disprove the “starving artist” idea and impress upon traditional minds that creatives can be successful. I am currently working on a master’s degree part-time that is not in a creative field that I will be finishing within the year. My education has been entirely funded through the generosity of my parents and merit scholarships, plus my employer is paying for almost all of my master’s program.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My parents taught me how to balance a checkbook, what a traditional IRA vs. a Roth IRA was, and to never carry a credit card balance, but not much more. I taught myself how to do my taxes, dabble in the stock market, and budget.

What was your first job and why did you get it?

My first job growing up was teaching swim lessons at my local pool. My first job in my field was interning at a clothing company during college. That internship was incredibly toxic and traumatizing due to harassment and toxic masculinity.

Did you worry about money growing up?

I grew up with an unwarranted scarcity mindset due to absent parenting (which was caused by a combination of addiction and medical issues). In a lot of ways, I had older-child responsibility syndrome and took on the emotional burdens of my parents. I felt incredibly stressed when money was tight in my family and it has led to financial triggers in my current life — hence (some) of the generational trauma tax.

Do you worry about money now?

My inner child carries financial concerns forward into adulthood, manifesting in some marital issues and my obsessive budgeting. I am grateful for my current salary to alleviate some of that fear, but I feel a need to increase my salary to increase my cushion should disaster strike. I’m working on this in therapy.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I stopped accepting financial support (aside from my therapy and cell phone bills) from my parents when I accepted my first NYC salary in 2016, at the age of 25, about a year and a half after I graduated college.

Do you or have you ever received passive or inherited income? If yes, please explain.

Only through education paid for by my parents.

Day One

10 a.m. — Good morning! I’m traveling for work currently and my company offered to hire a car service so we can go look at textiles at the shops in this city (fully expensed by the company). Before the car gets here, I grab some breakfast. I get coffee and a vegan tartelette, along with a sandwich for later. Then I hop in the car. $12

12:15 p.m. — I stop at my first destination and spend some time perusing their assortment, taking pictures of merchandise, and selecting samples to purchase for comparative reference, spending $115.85. I then walk across the street to my next stop, making two more purchases totaling $97.12 and $98.54 respectively. I’m finding some great stuff and am enjoying the solo time after the better part of a week spent with family. ($311.51 expensed)

12:45 p.m. — I drop my bags in the car and get driven around the corner to my next stop. I cruise through the store, buying one thing and taking lots of pictures before heading on to my next destination. I eat my sandwich saved from breakfast along the way. ($45.25 expensed)

2:15 p.m. — I am driven to my next destination and only find gifts to purchase. While the store is fun to look at and browse, there is nothing tangible of work benefit so I move on quickly. I do get a gift for a friend. $38.25

4:15 p.m. — I stop into two more stores but make no purchases after my phone dies. I had arranged with the driver to meet me at a certain time and location but he doesn’t show up. I wait half an hour before giving up and walking/metro-ing (with a prepaid card) halfway across town back to my hotel. I make contact with the driver and ask him to leave my bags at the concierge and send me a link so I can pay him for the hours worked, but I am fuming about the lost time and am extremely frustrated. I vent to my partner, fully acknowledging the privilege I have to even be in this position. He is sympathetic to my ire, letting me run out of steam before reminding me I still have another day to enjoy of my trip. I text my husband for a picture of my dog to cheer me up as well. I send $271.62 to the driver for his hours (I’ll expense this).

6:30 p.m. — I’m in a city near where my parents live so I Uber to dinner with my parents (my mom pays for the Uber). My parents pick up the bill as this trip was partially a birthday trip. I metro back to the hotel with my prepaid card. I end the day stuffing my suitcases full while catching up on the SVU episodes I missed while traveling. Olivia Benson captures my attention, keeping me up later than intended.

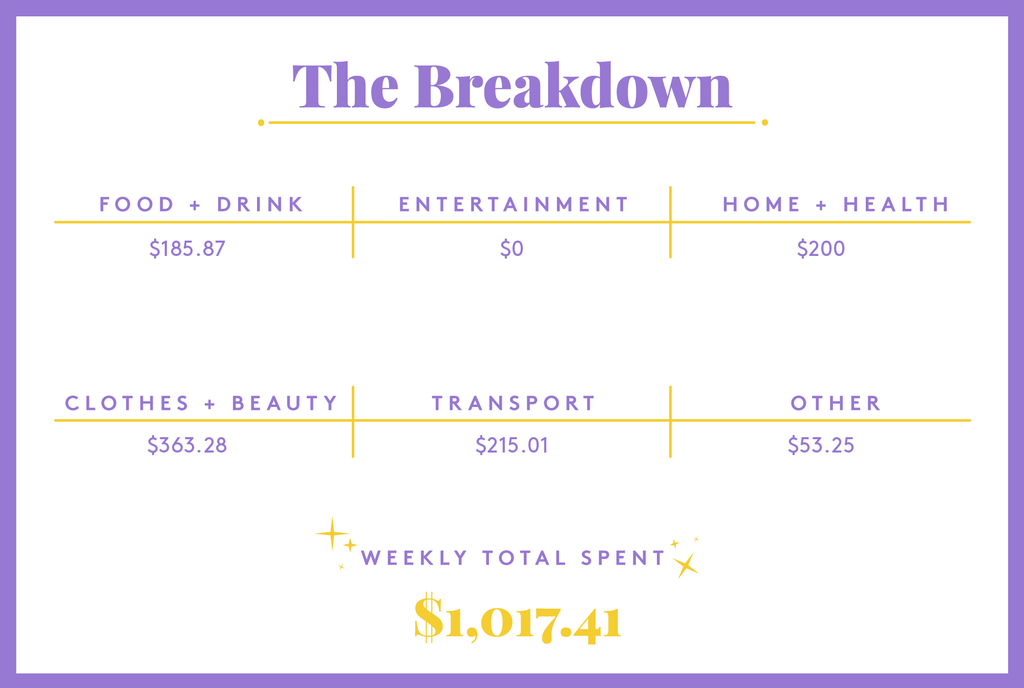

Daily Total: $50.25

Day Two

10:45 a.m. — I start the day with another tartelette, a croissant, and a coffee, and snag a sandwich for lunch later. Once I’m fed and coffee’d, I wander about the city in search of fun before my flight this afternoon. I am eager to reset after yesterday’s taxi fiasco. $15

1:15 p.m. — I wander through the picturesque streets, stopping to look at window displays and visit shops. I find something to my taste — a responsibly sourced cashmere sweater. It’s cozy and deliciously soft, but I worry my bags are overpacked as it is. I decide to either wear it on the plane or shove it in the suitcase. This sweater will be mine! I leave the store and snack on my sandwich saved from breakfast before heading back to the hotel to decompress before leaving for my flight later this afternoon. $245.25

3:45 p.m. — I take an Uber to the airport. My checked bag garners an overweight fee ($98.54), and I shrug it off, as work will cover that expense — half the suitcase is products for my team to reference. I cover the cab fare. $48.46

5:15 p.m. — I get various snacks for the plane ride. Once on the plane, I catch up on grad school reading as well as fanfiction for House of the Dragon, passing the hours until we land. $23

10:35 p.m. — I call a Lyft once I’m back in New York. I’m so excited to see my husband and dog. Our reunion is sleepy and I curl up in bed to watch House of the Dragon before passing out. I send a sleepy selfie to my partner letting him know I landed. $94.33

Daily Total: $426.04

Day Three

7:45 a.m. — I wake up bright and early with a scarce six hours of sleep, roll out of bed, and make my way to the office for an 8:30 a.m. call with our international team. I use Apple Pay for the subway fare into the office ($2.75), and I buy a bad croissant at the cafe next door with cash ($3.50). $6.25

12:15 p.m. — I pick up a salad bowl for lunch ($11.50). I eat at my desk between back-to-back meetings and desperately try to make a dent in the inbox. I then run out for a quick doctor’s appointment and my regular STI screening during lunchtime ($25). $36.50

7:15 p.m. — At home after work, I have hours of group-project meetings and class ahead of me and am nearly dead on my feet. While in class, I remember I have a credit at Reformation and use it to buy myself a skirt I have been eyeing for a while, covering the remaining balance with my credit card. It will go great with the sweater I purchased on my trip. My husband cooks a Purple Carrot meal while I am in class. I pass out almost immediately once my last Zoom call is over, forgetting to call my partner to catch up on the last few days. He forgives me and we have plans to see each other later this week. $46.93

Daily Total: $89.68

Day Four

6 a.m. — I wake up to get some gym time in but my neck hurts from the flight, so I skip the gym and tackle my inbox instead. My husband brings me a bagel around 8.

3 p.m. — I eat lunch (leftovers) while bouncing between meetings. There are projects that got dropped in my absence that require creative problem-solving to get back on track, although some will miss crucial deadlines. I do my best to course correct. During a break between meetings, I scroll on Instagram and see that a polyamorous content creator I follow needs financial help. I have followed them for years so I look at their GoFundMe but cannot remember my password. I Venmo them and make a mental note to figure out my password at another time to give again should they need it. I also do my 50 minutes of therapy, which my folks cover (I call it generational trauma tax). $15

7:15 p.m. — I call my partner and catch up for almost two hours. It’s my husband’s turn for takeout, and he orders us pho and a banh mi for dinner while I dive into work on a term project deliverable due at the end of the week.

Daily Total: $15

Day Five

7:45 a.m. — I scramble out of bed late for another early meeting with the global team. I get ready as quickly as I can then head to work. I tap onto the subway and grab a breakfast of champions at the office: two fun-size Snickers and a Diet Coke. $2.75

12 p.m. — Back-to-back meetings means I skip lunch and just eat some dark chocolate while I work.

3:15 p.m. — I leave work early for a doctor’s appointment ($2.75, subway). While at the doctor’s, I buy new orthotic inserts ($175). Afterward, I walk home. $177.75

6 p.m. — I eat leftover pho before diving into homework, project meetings, and class until bedtime.

Daily Total: $180.50

Day Six

7 a.m. — I get up and eat toast with vegan butter for breakfast.

12:30 p.m. — We don’t have a lot of food left in the apartment so I order bao buns and sushi on Seamless for lunch. Yum. $23.79

7 p.m. — My partner is getting married in two weeks (it’s a green card marriage for his future wife that he is being compensated for). I ask him what to wear and he says something tight and black. Not my usual wedding vibe, but I decide the sexy widow aesthetic works for the situation and the winter nuptials. I order a sheer black bolero to layer over my tight black dress, boots, and stockings. Saucy. $71.10

8 p.m. — I am spending most of the upcoming weekend with my partner so I head over there with a packed bag. Once I’m there, we order vegan Chinese food. He is going through a period of many changes, so I am happy to treat him to dinner for the night. I’m looking forward to spending the weekend snuggling and catching up after two weeks apart. $57.59

9 p.m. — I check my bank account before bed and see a toll from a recent trip to Canada deducted automatically. $29.45

Daily Total: $181.93

Day Seven

11:30 a.m. — My partner and I wake up and enjoy a lazy morning in bed. Then we swing by a vegan bakery/cafe and grab a sleepy brunch. I order first while he grabs a table outside and then we switch. My partner then drives us to pick up some gourmet ice cream. $22.07

6 p.m. — I swing by home to drop off and pick up a few things and say hi to my husband and pets. Then I hop on the subway to meet up with a partner I am breaking things off with. The last few weeks have made me realize I am over capacity, and unfortunately, I need to de-escalate this particular relationship to make space in my life. He treats me to vegan ice cream and is beyond understanding and compassionate. The conversation is emotional for us both, but we part ways amicably and plan to stay in touch after a break period. $2.75

7:30 p.m. — I stop into a wine store to pick up a birthday/housewarming gift for a friend who is throwing a party a few blocks away. I’m excited to celebrate my friend and also mentally shift gears away from the challenging conversation I just had. $17.42

10 p.m. — I Lyft back to my partner’s apartment after the party, joining him for a cozy night in bed. We are three months into an intense new dynamic and every minute feels valuable. I will part ways with him tomorrow when I meet up with friends for brunch, but I cherish the moments together in the meantime. $31.77

Daily Total: $74.01

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

from Refinery29 https://ift.tt/yxPDqmh

via IFTTT